Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

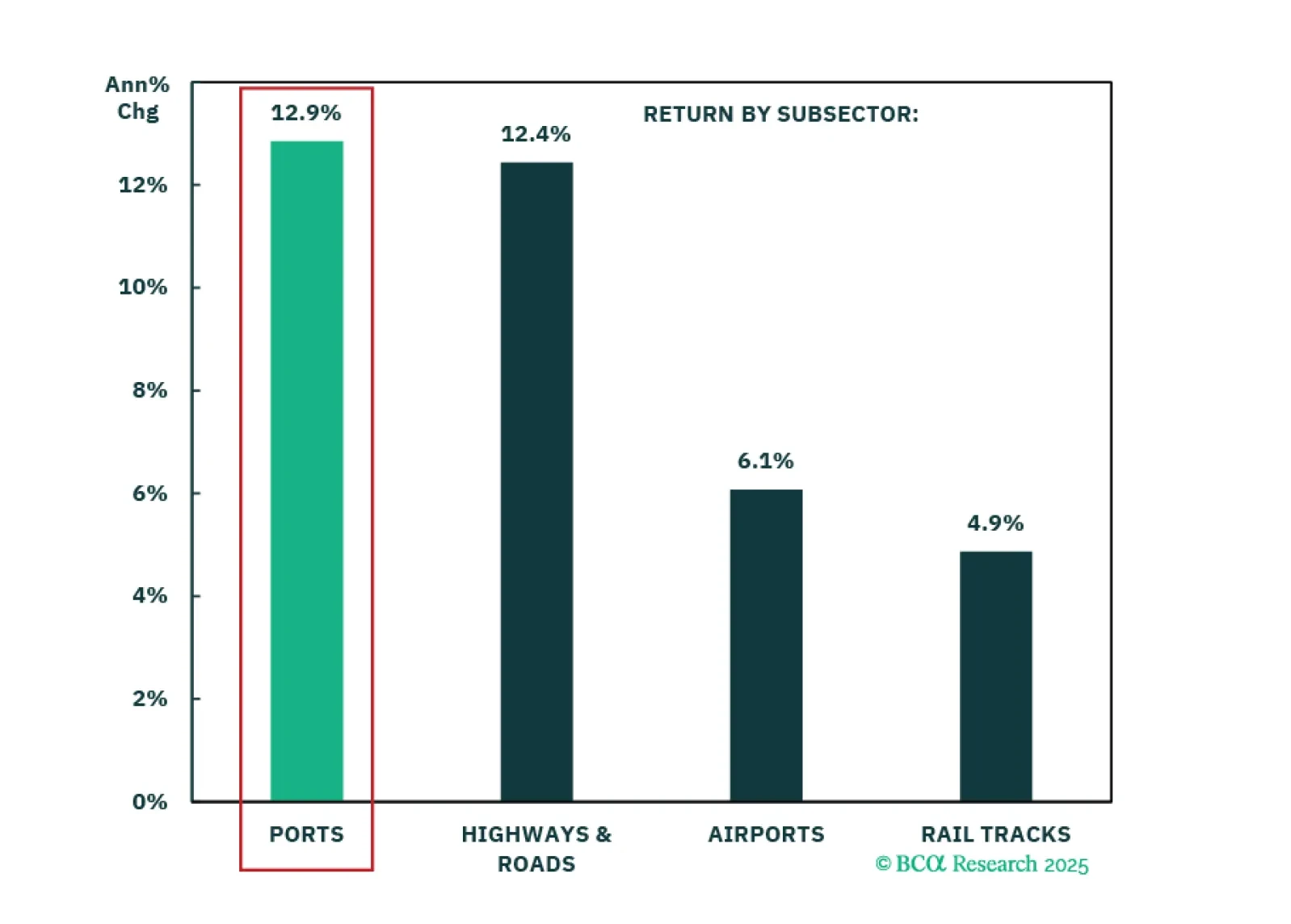

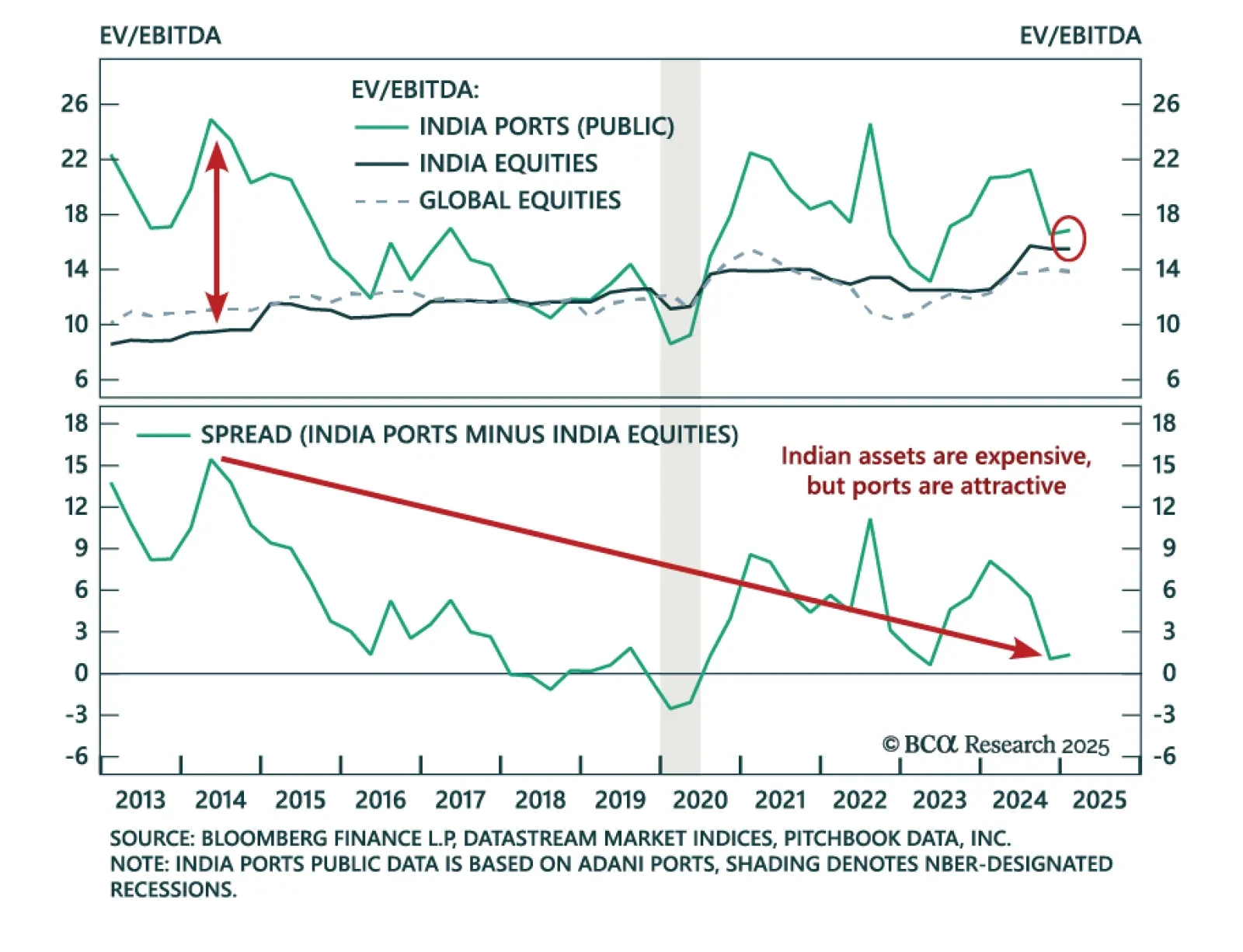

Our Private Markets & Alternatives strategists recommend shifting exposure within Port Infrastructure to India as re-globalization reshapes trade flows. The US will remain a trade leader, but tensions with China and the…

The US will continue to lead global trade, but the past winners from China-US tensions face decline. Reglobalization is underway. India Port Infrastructure will be a long-term winner.

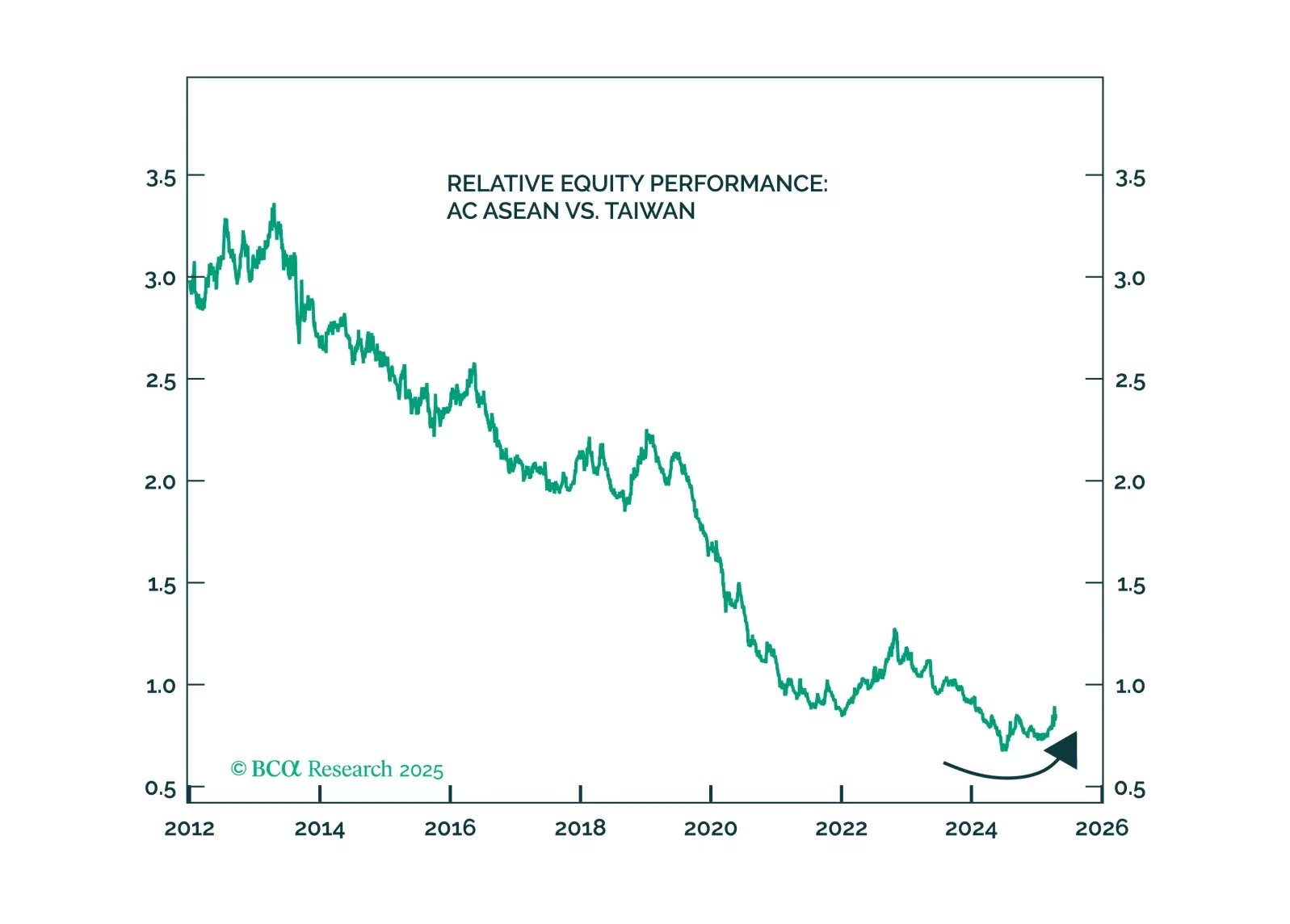

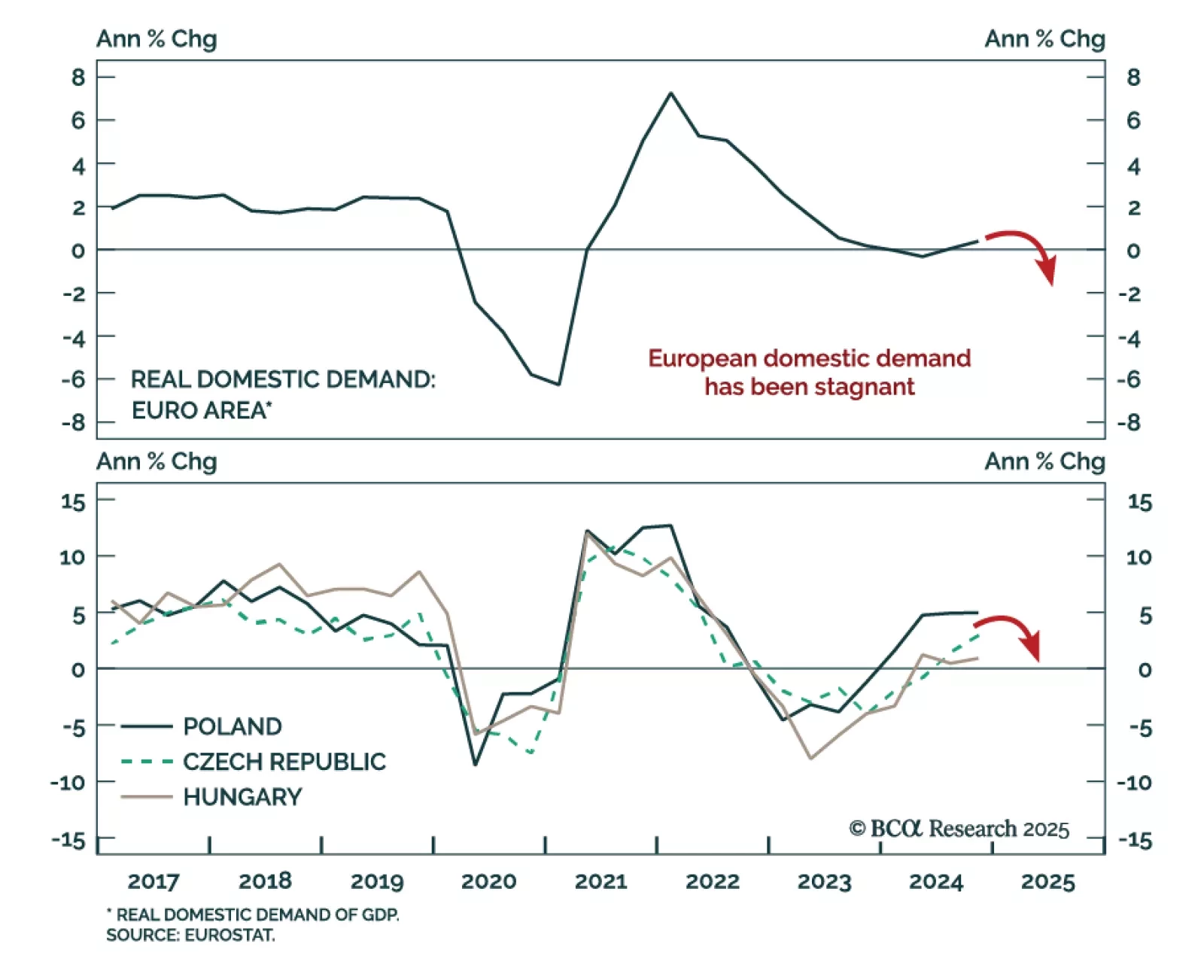

Our EM strategists recommend upgrading CE3 assets within EM portfolios, as a structural shift in the global currency regime is underway. They expect the greenback to depreciate against the euro amid a global downturn, supporting…

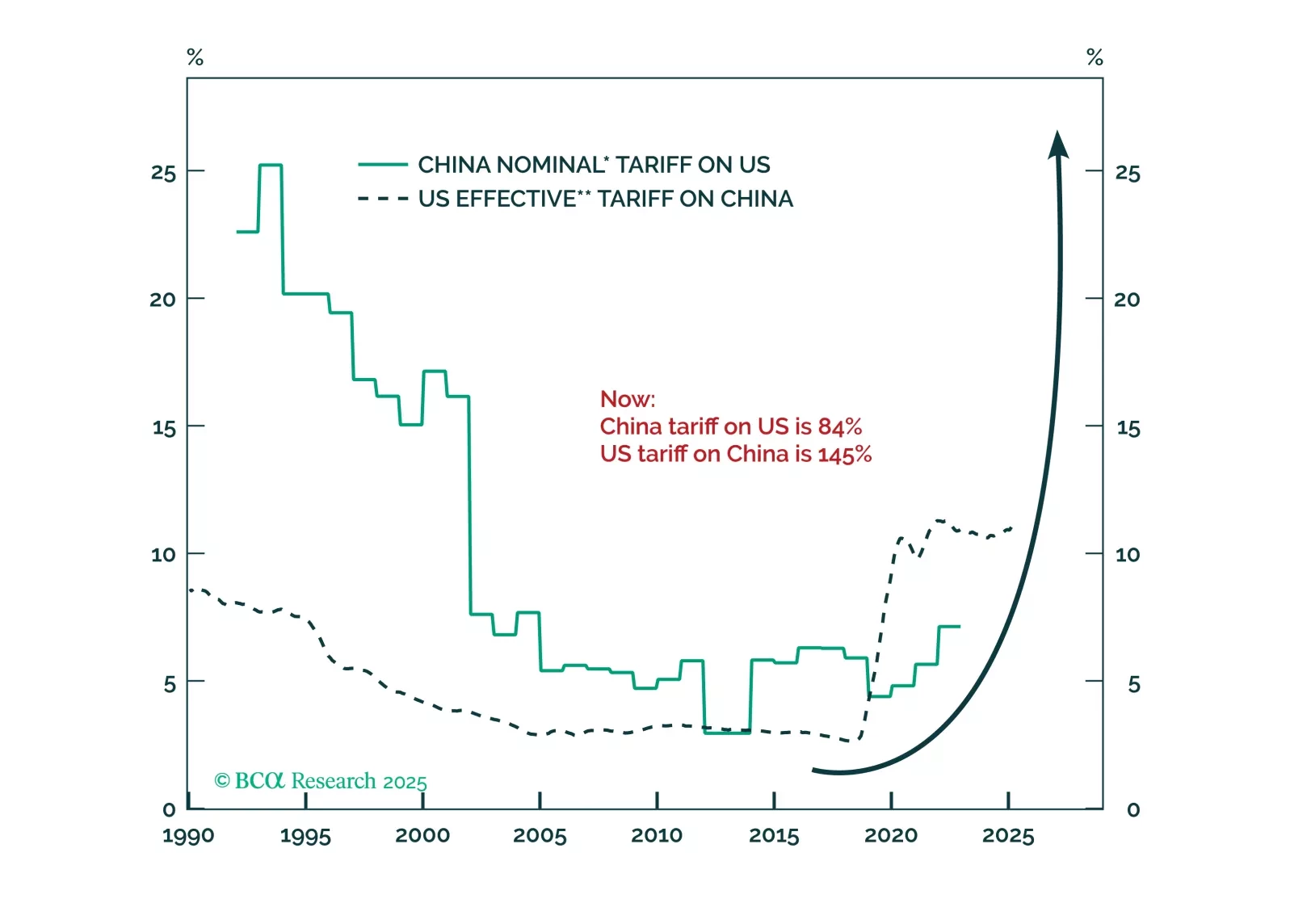

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

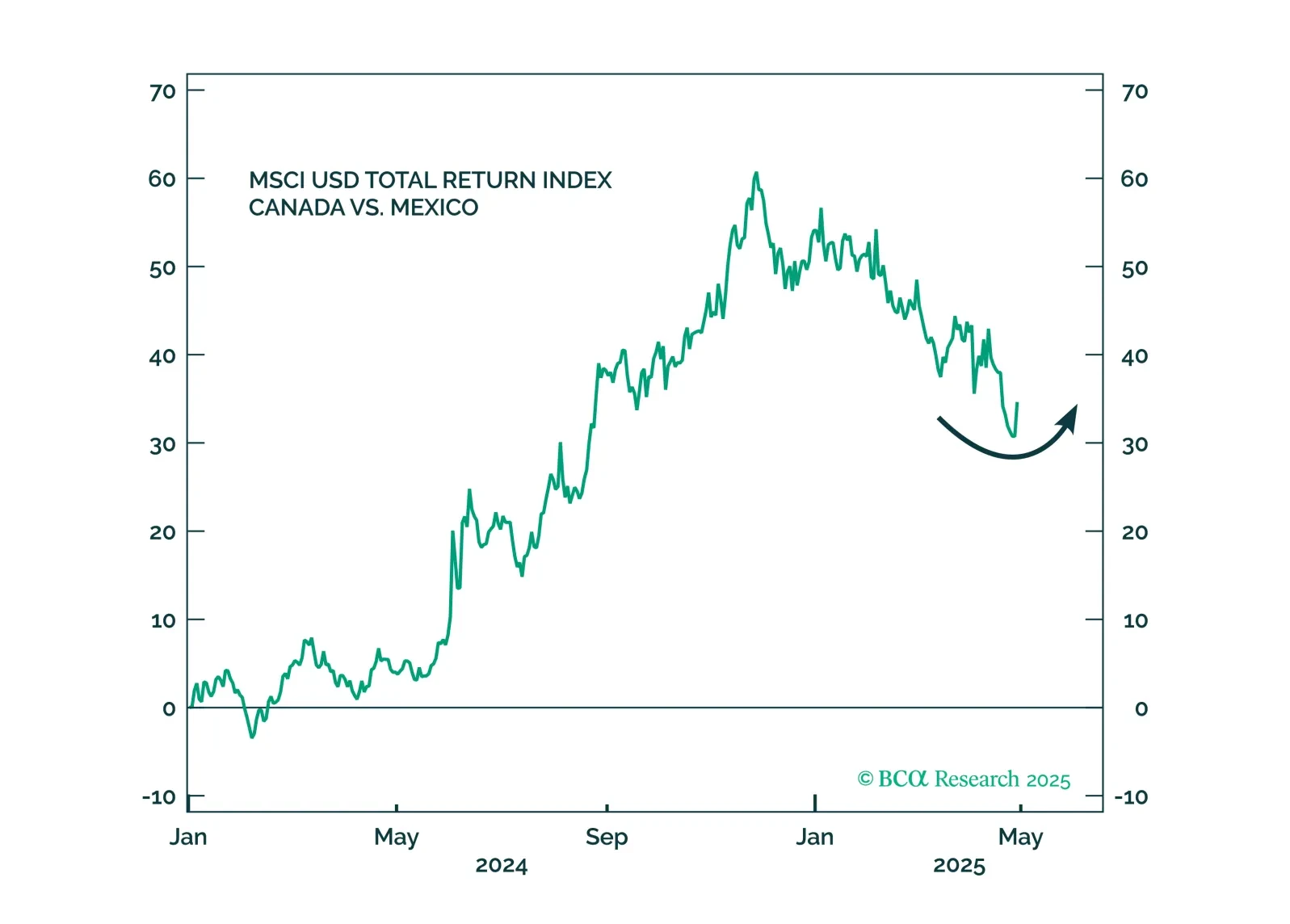

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

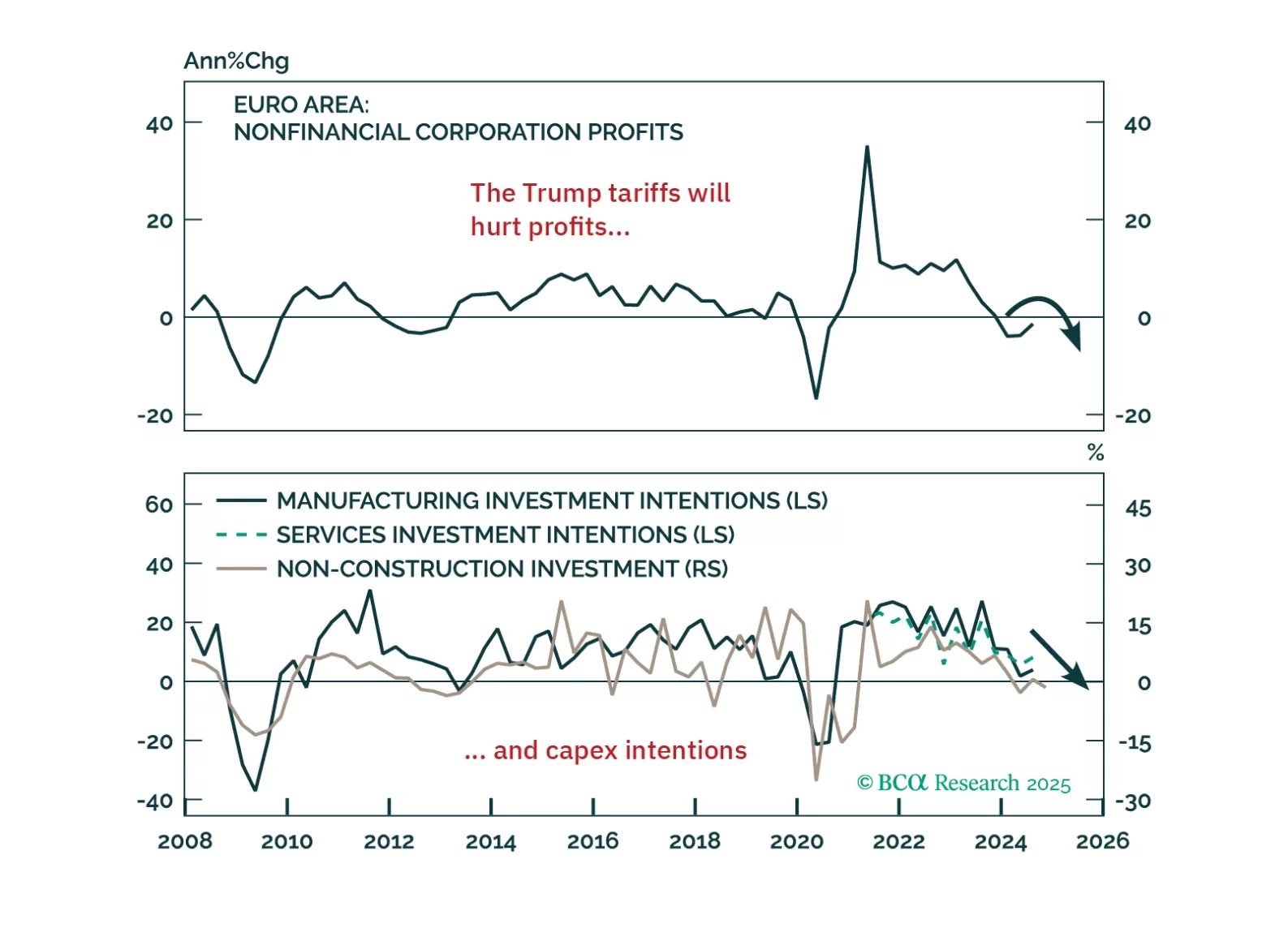

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…