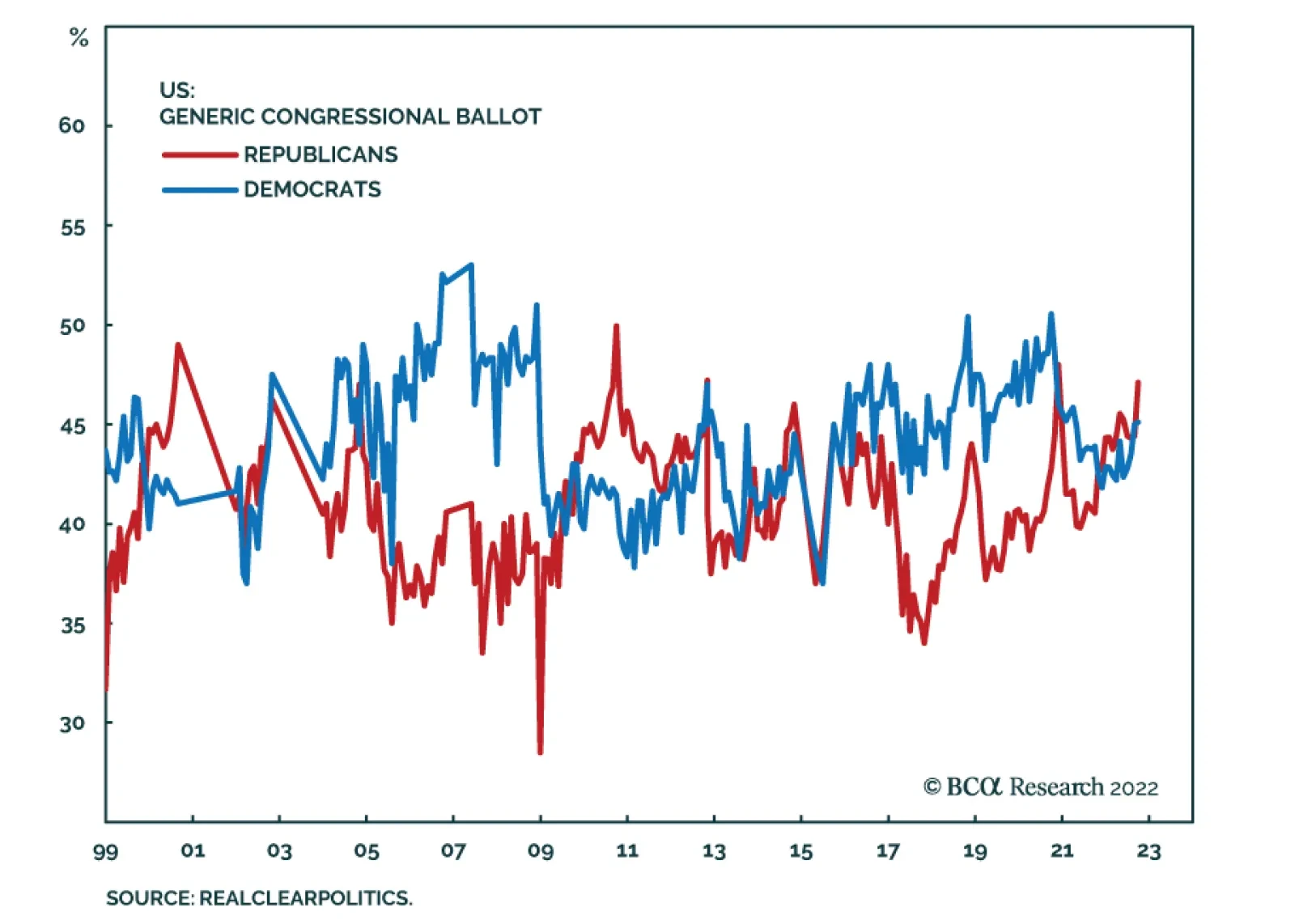

According to BCA Research’s US Political Strategy service, if Republicans only take the House, US policy will be more dysfunctional than if they take the entire Congress. US opinion polls are breaking in favor of…

The midterm election will bring some relief from US policy uncertainty. But this relief will be short-lived unless Republicans win the Senate, which is still too close to call. Global policy uncertainty and geopolitical risk will…

Stay defensive at least until the US midterm election is over. Gridlock is disinflationary in 2023 and hence marginally positive for US equities. But any relief rally will be short-lived as recession risks are very high.

The Fed says that to get back to 2 percent inflation, the US unemployment rate must increase by ‘just’ 0.6 percent through 2023-24. All well and good you might think, except that the Fed is forecasting something that has been…

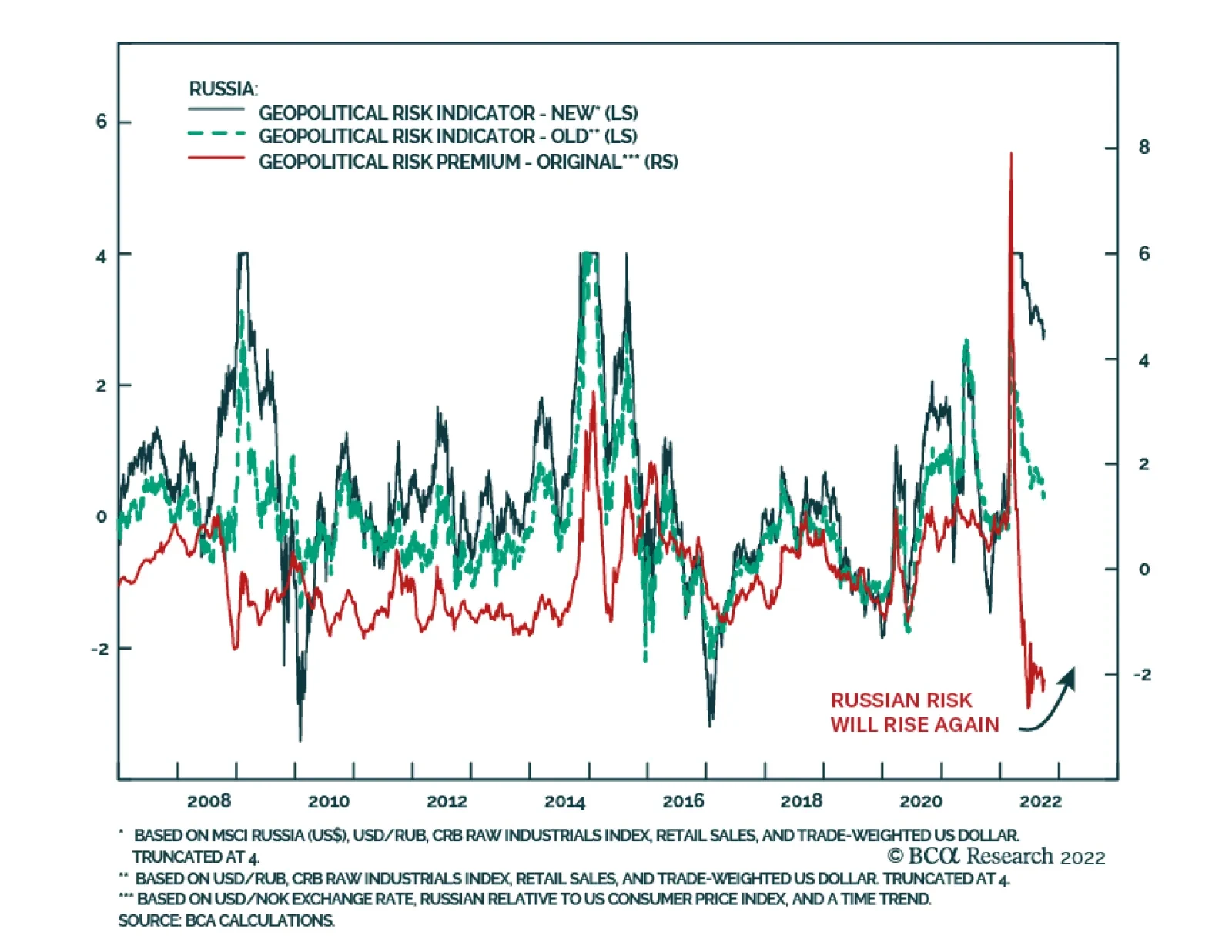

BCA Research’s Geopolitical Strategy service expects Russia’s conflict with the West to escalate and trigger more bad news for risky assets this fall. The “balance of terror” is a variation on…

Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…

In Section I, we note that the Fed’s new interest rate projections show that US monetary policy is set to rise soon into restrictive territory even relative to what we consider to be the neutral rate of interest, and to a level that…