Investors should bet against the global rally in risk assets and maintain a defensive positioning until recession risks verifiably abate.

Prefer government bonds over stocks, defensive sectors over cyclicals, and large caps over small caps. Favor North America over other markets. Favor emerging markets like Southeast Asia and Latin America over Greater China, Turkey,…

Our best calls of the year were long defensives over cyclicals, short Russia and emerging Europe, long aerospace/defense, short Greater China, and long Latin America. Our worst call of the year was long cyber security stocks.

The S&P 500 is down by 17% year to date, while our portfolio is up 15%. US political analysis is essential for investors but it is best done by geopolitical method rather than Washington punditry.

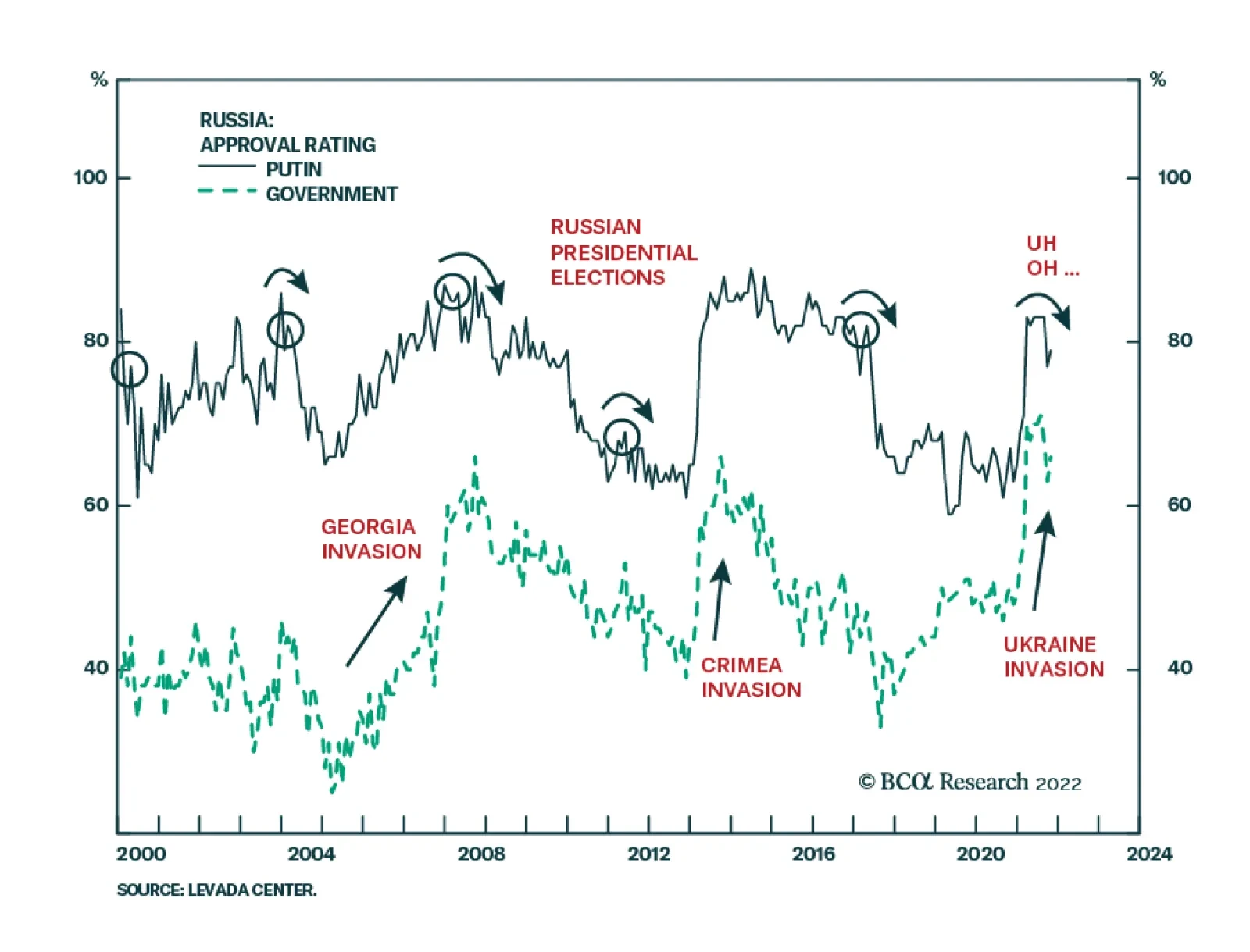

According to BCA Research’s Geopolitical Strategy service, Russia’s presidential election of March 2024 will put pressure on Vladimir Putin to negotiate a ceasefire before that time. Putin faces his fifth…