Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

In this week’s report, we look at the current de-dollarization discussion within the context of the USD’s near-term cyclical outlook, and whether it warrants a bullish or bearish stance.

No, the secular rise in geopolitical risk has not peaked. EU-China trade ties underscore the multipolar context, but this multipolarity is unbalanced, as the US has not reached a new equilibrium with its rivals. While the second…

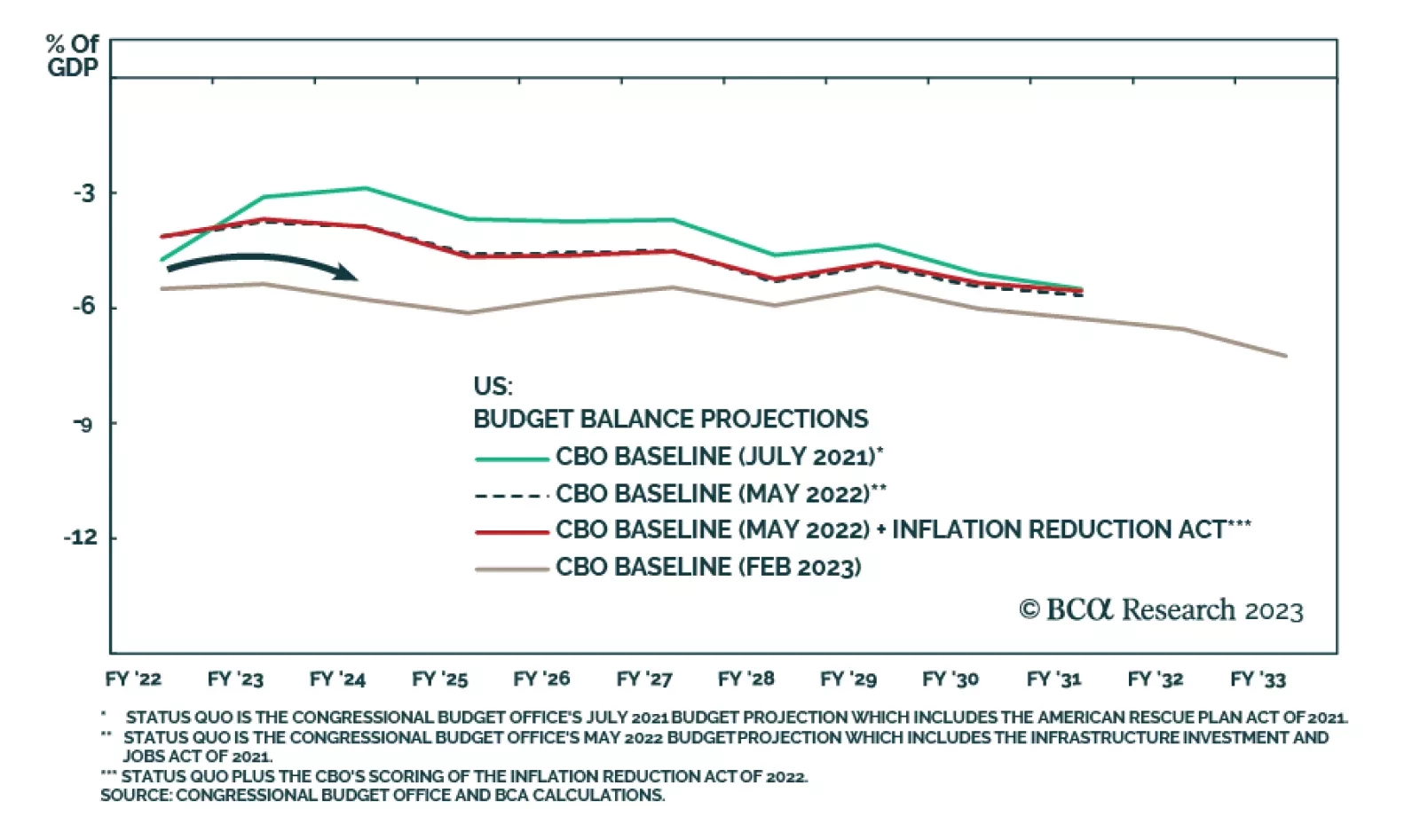

According to BCA Research’s US Political Strategy service, congressional gridlock is a bigger problem now that financial instability has emerged. The two political parties are evenly divided in Congress and public…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

Stay defensive in the second quarter. We can see a narrow window for risky assets to outperform but we recommend investors stay wary amid high rates, supply risks, extreme uncertainty, peak polarization, and structurally rising…

US financial instability reinforces our bearish investment outlook by weighing on economic growth and corporate earnings while also increasing US policy uncertainty and geopolitical risk.