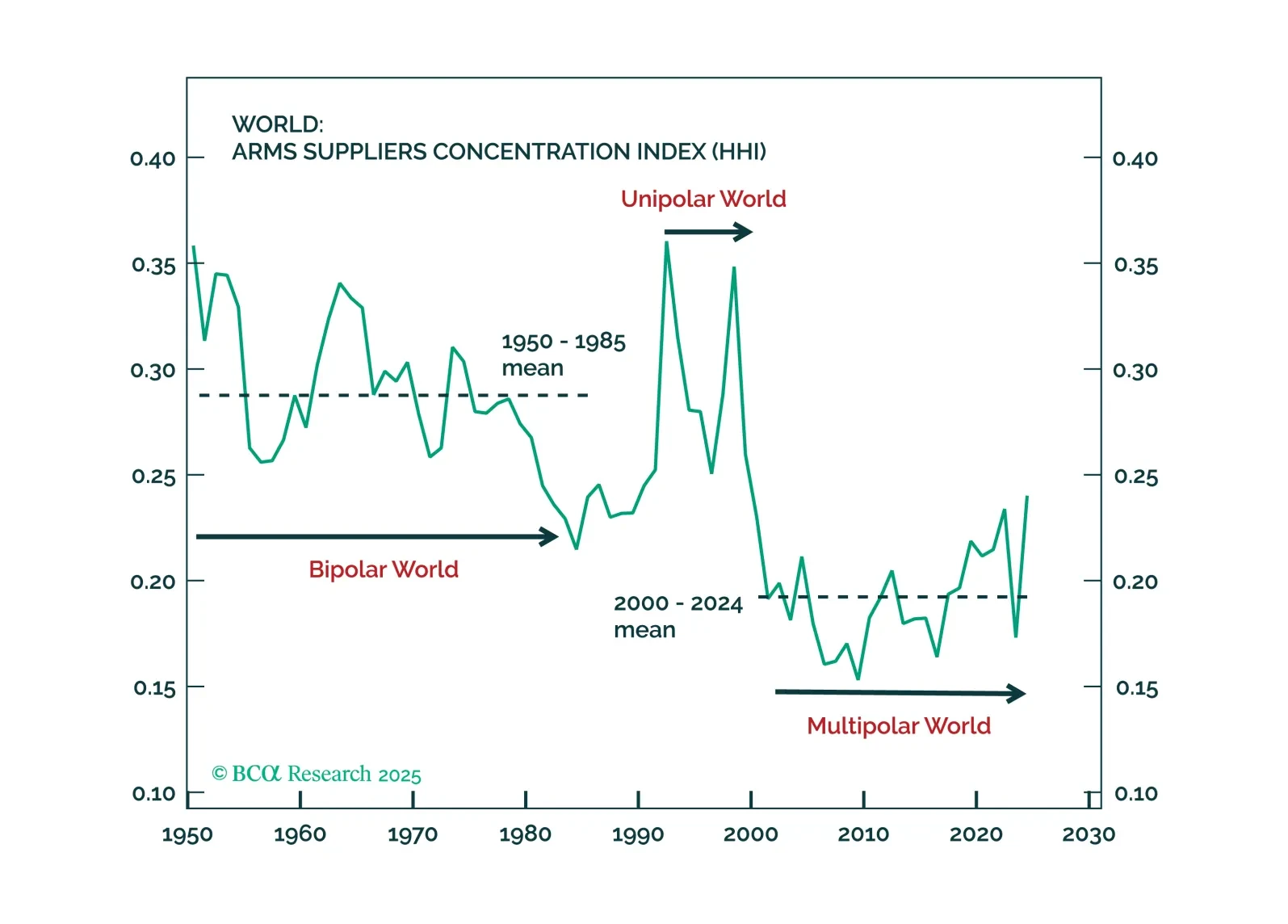

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…

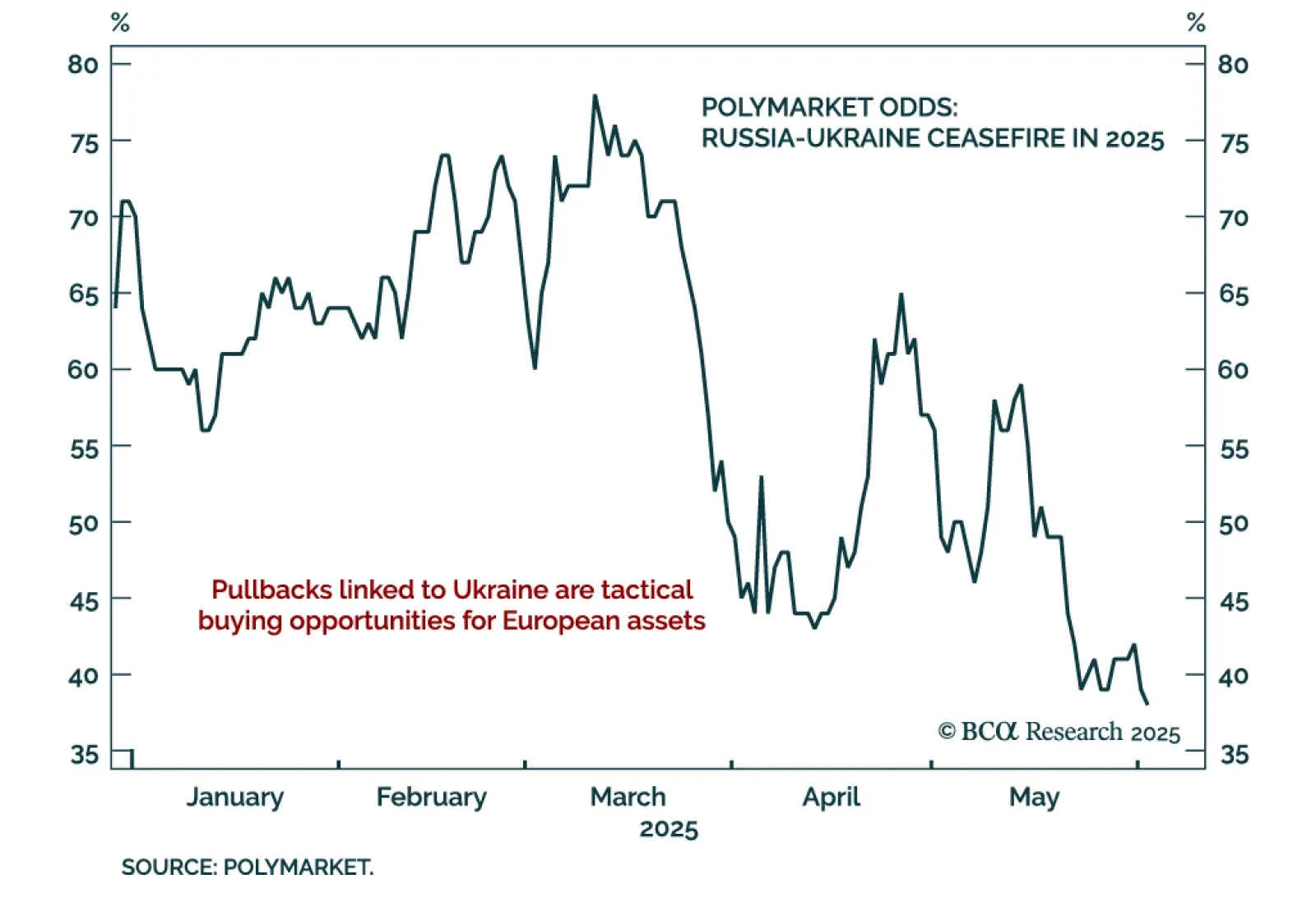

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

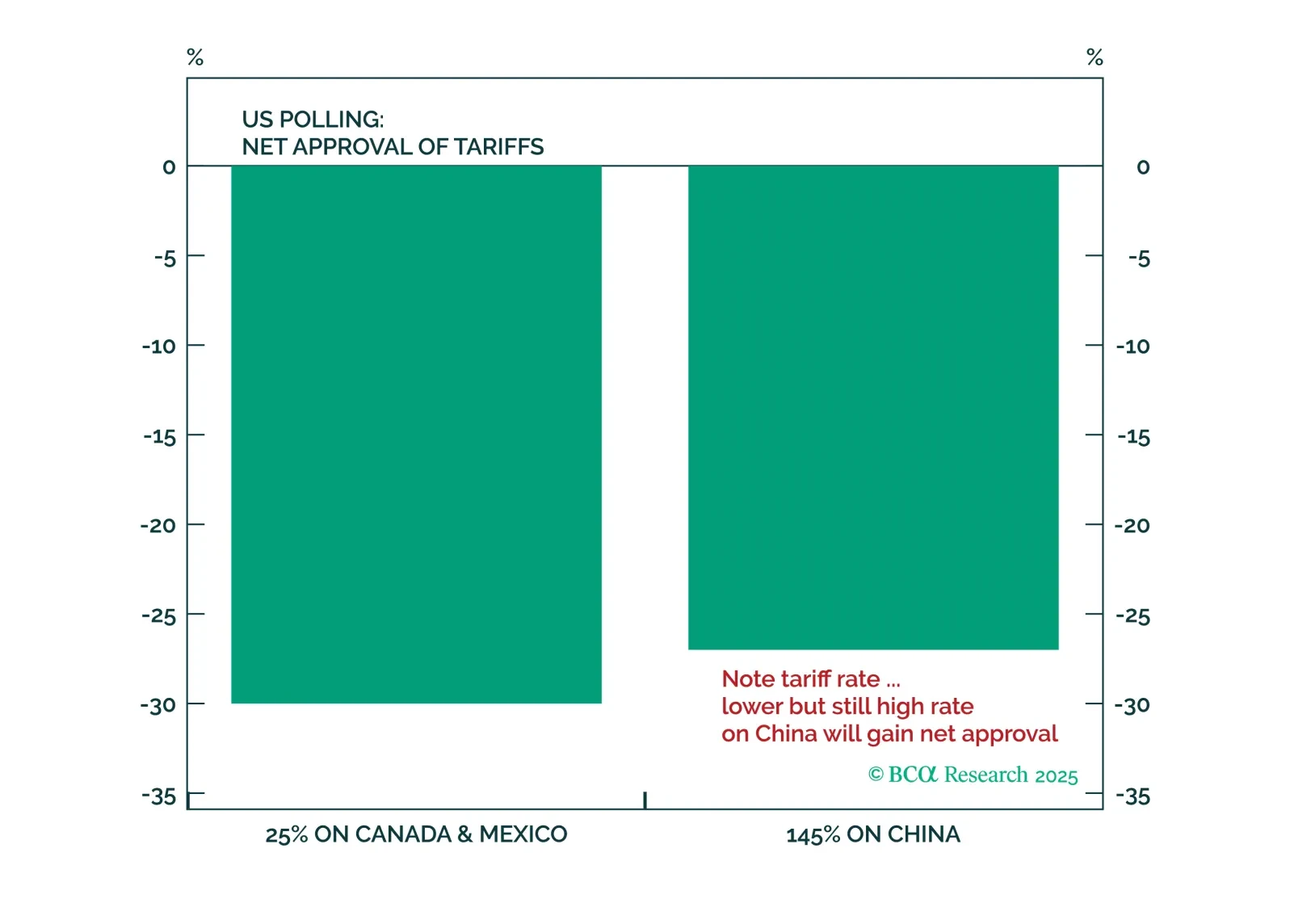

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…

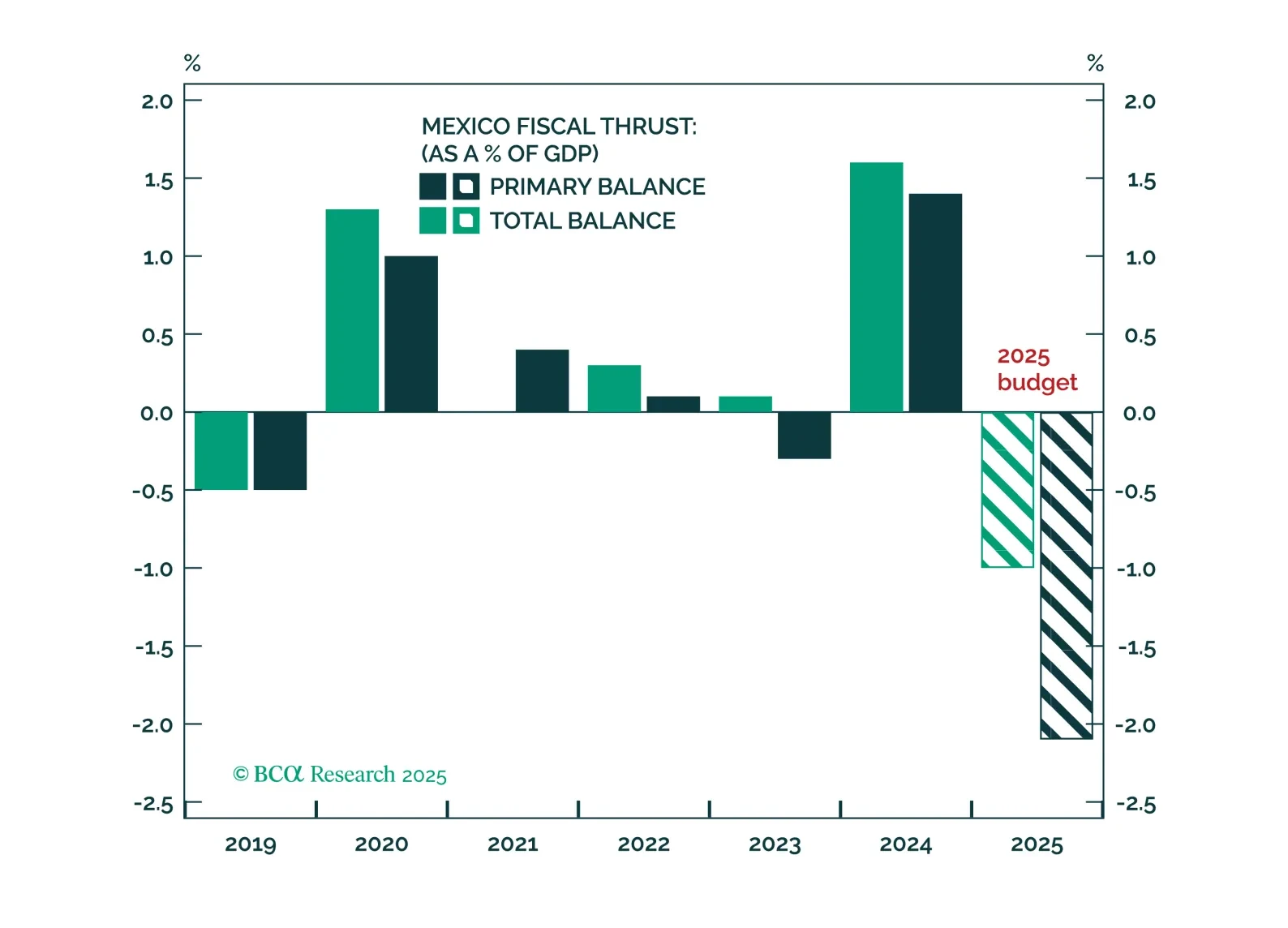

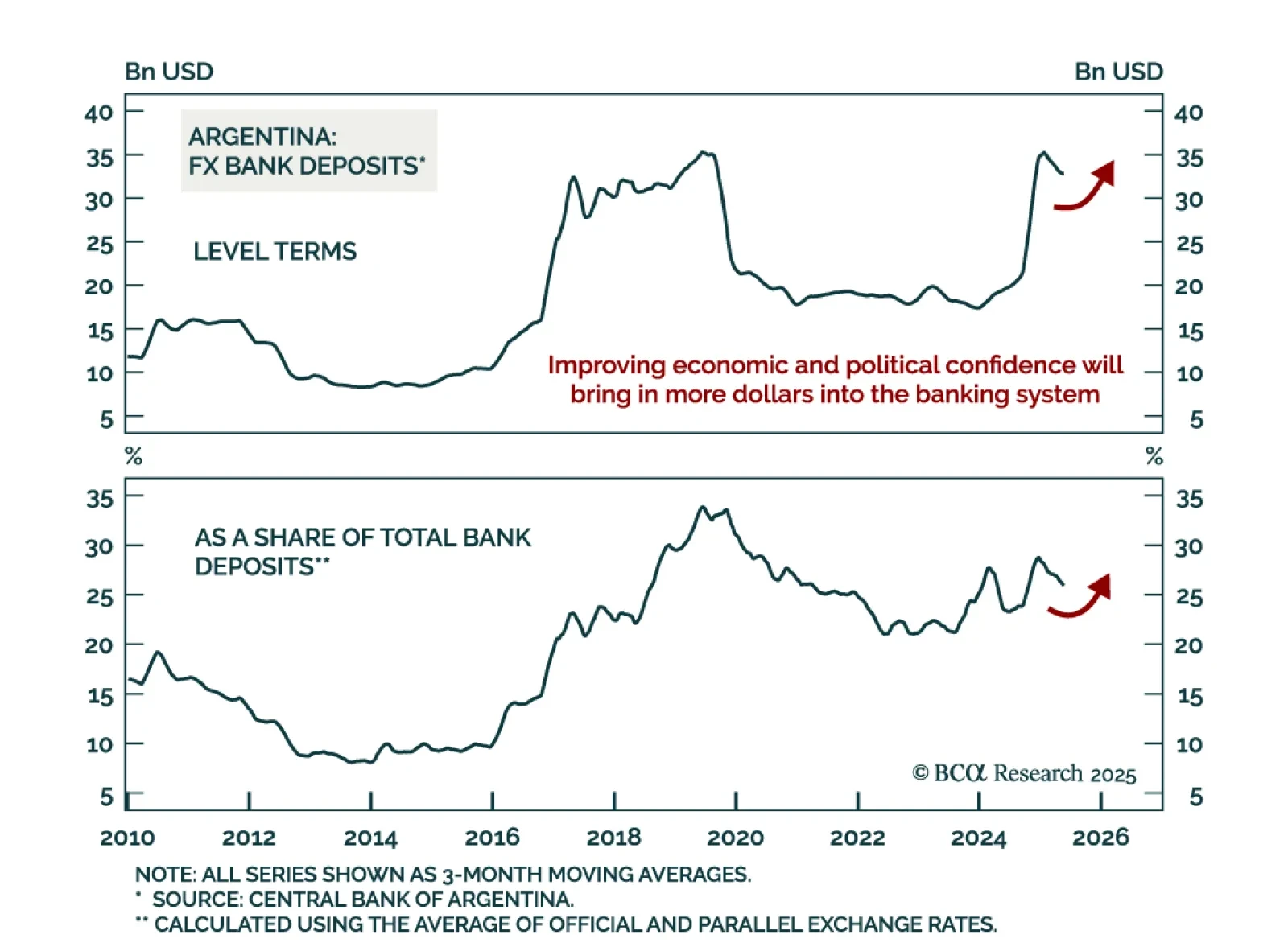

The latest political developments in Argentina increase the odds of further liberalizing reforms and solidify the economy’s structural upside. First, the libertarian governing party came out on top in Buenos Aires’ legislative…

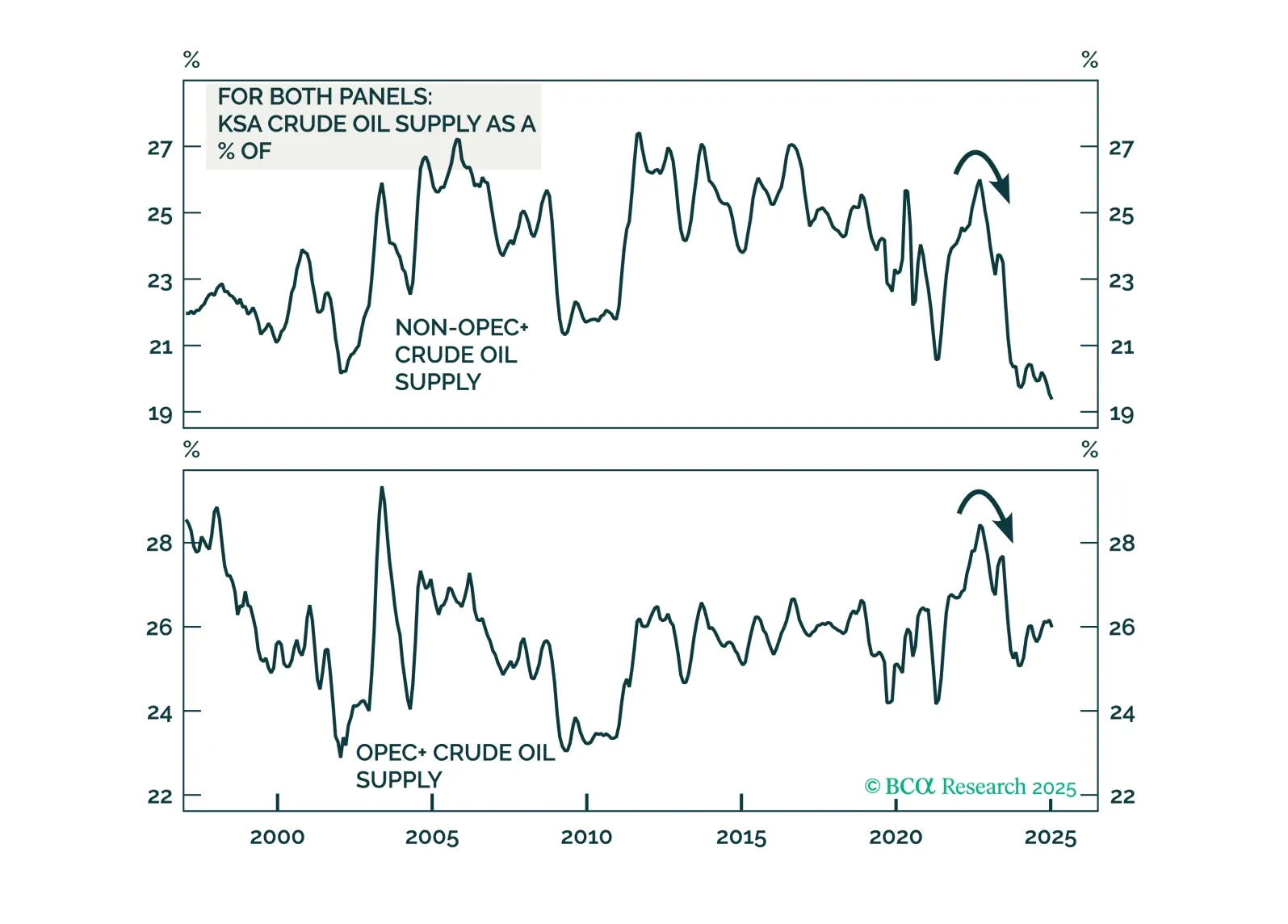

OPEC+ recently announced another outsized oil production hike, tripling its planned June output increase to 411k b/d for the second consecutive month. Our take on why KSA is boosting crude output at a time of heightened downside…

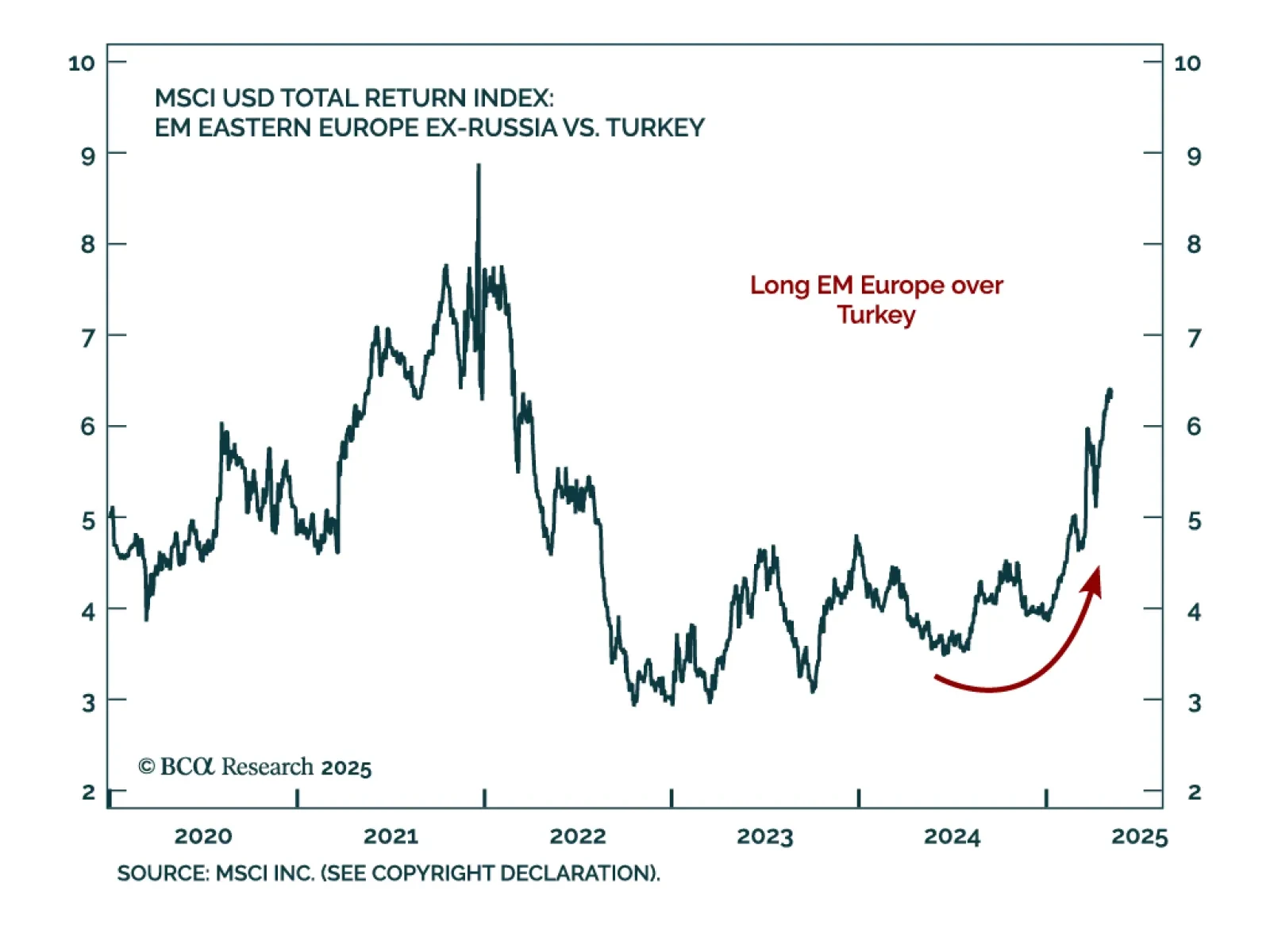

Our Geopolitical strategists recommend underweighting Turkish assets. Erdogan’s weakening rule, rising social unrest, and eroding governance are deepening Turkey’s macro deterioration. Inflation will stay sticky as odds of new…

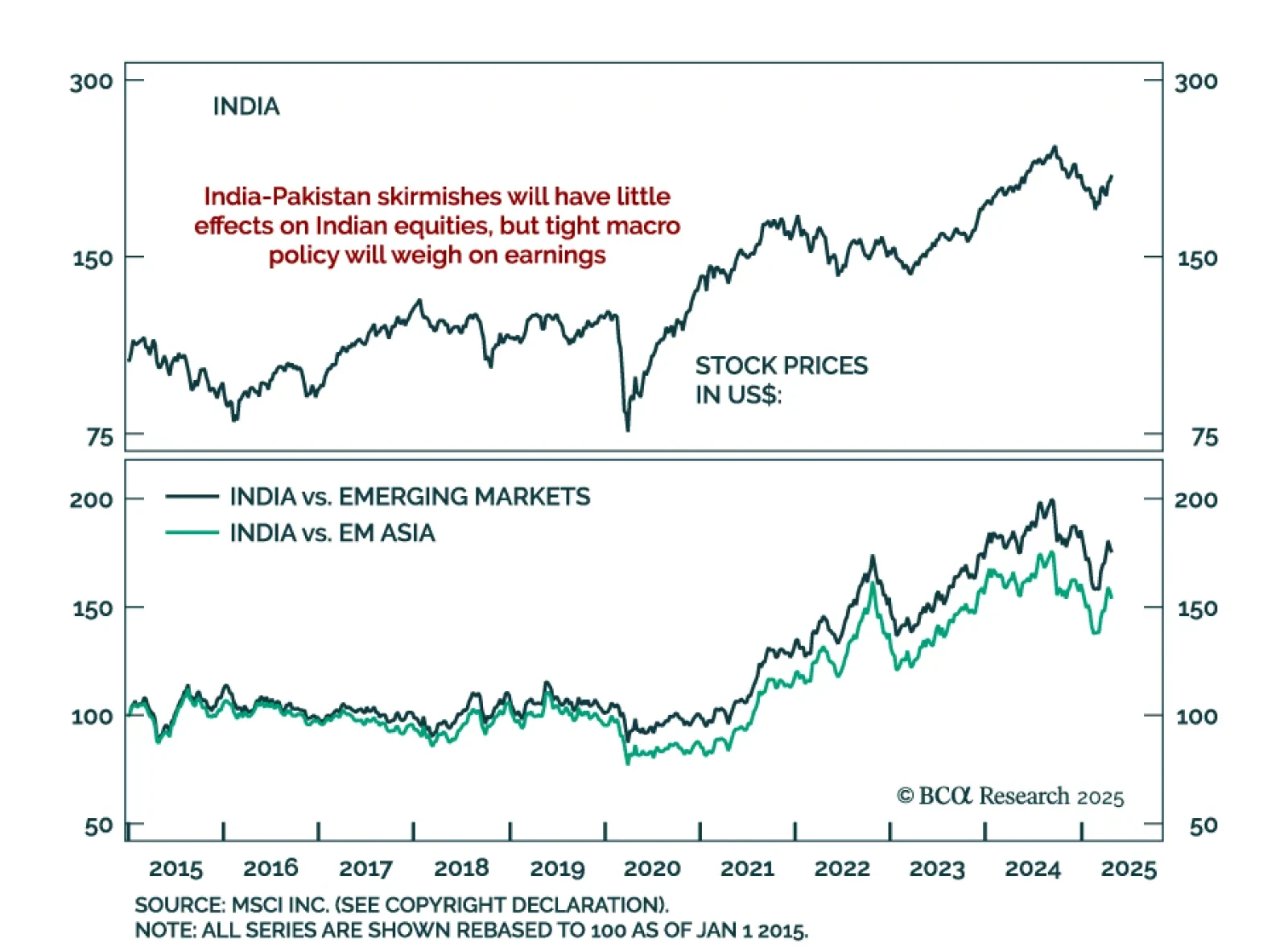

Indian equities remain resilient despite rising India-Pakistan tensions, but BCA’s EM strategists stay underweight India while favoring local-currency bonds. The latest flare-up follows Indian retaliation to last month’s terrorist…

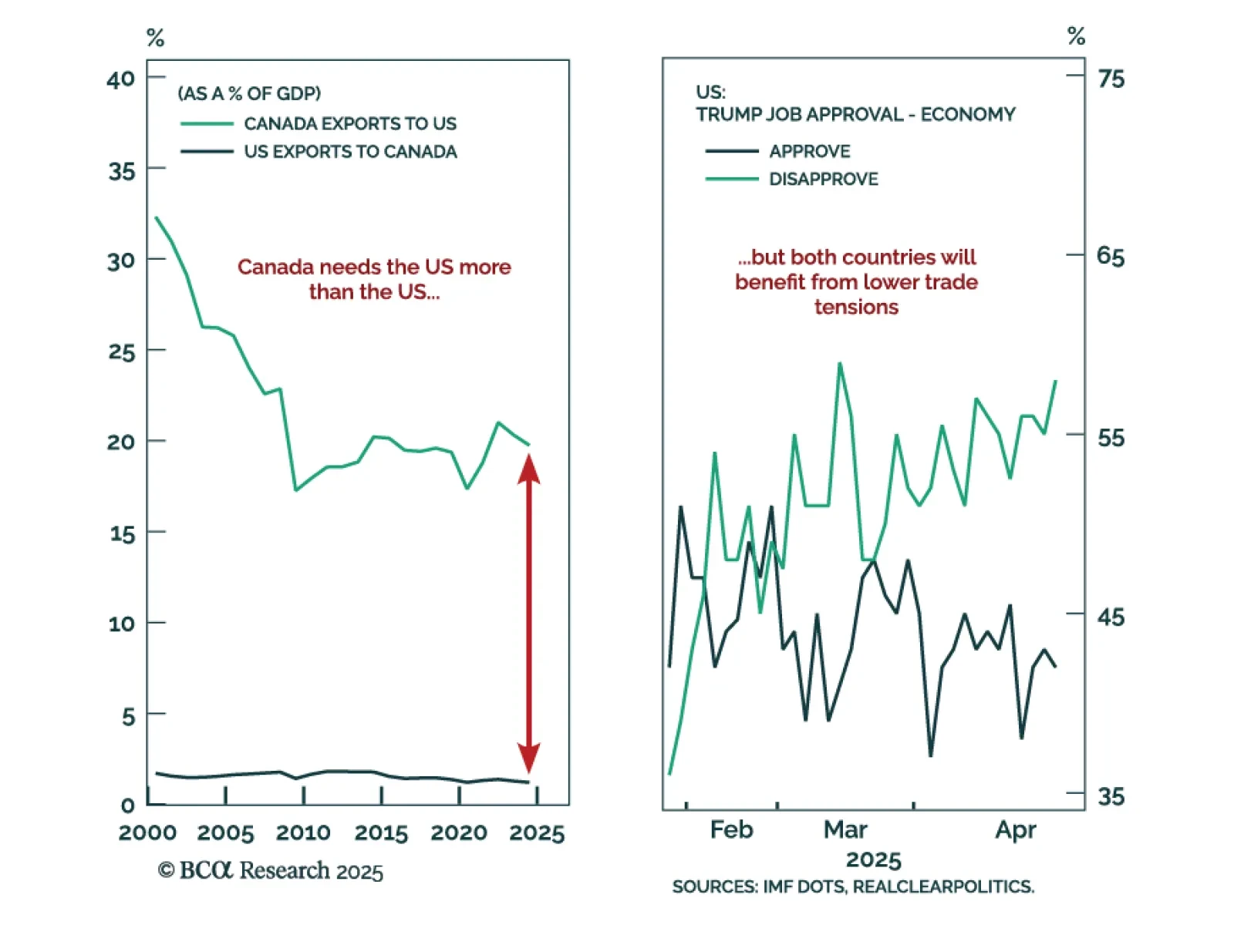

The Carney-Trump summit signals an early shift toward trade de-escalation, creating a tactical tailwind for risk assets. President Trump referred to the Canada-US relationship as a “wonderful marriage.” Moreover, both leaders…