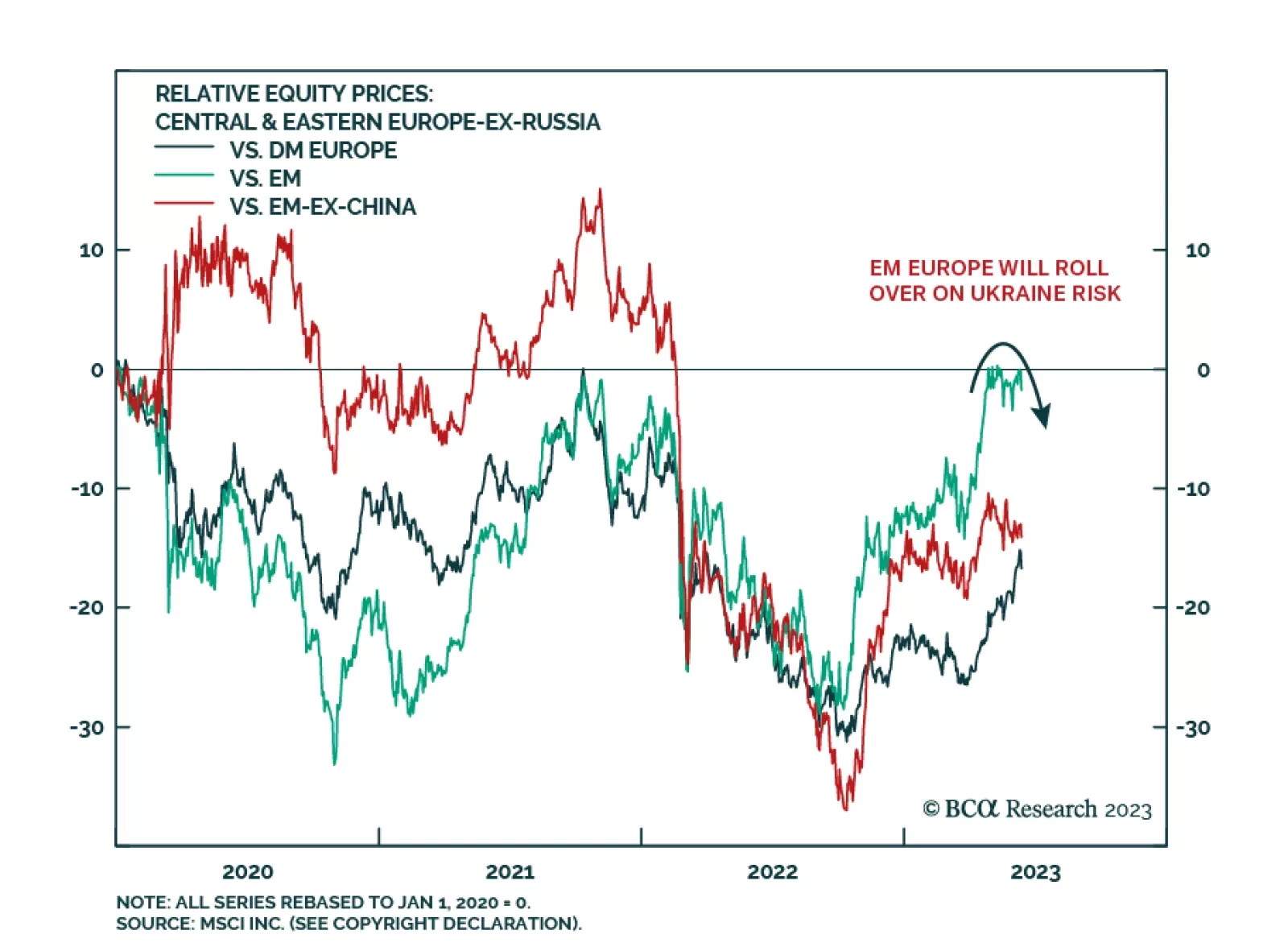

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

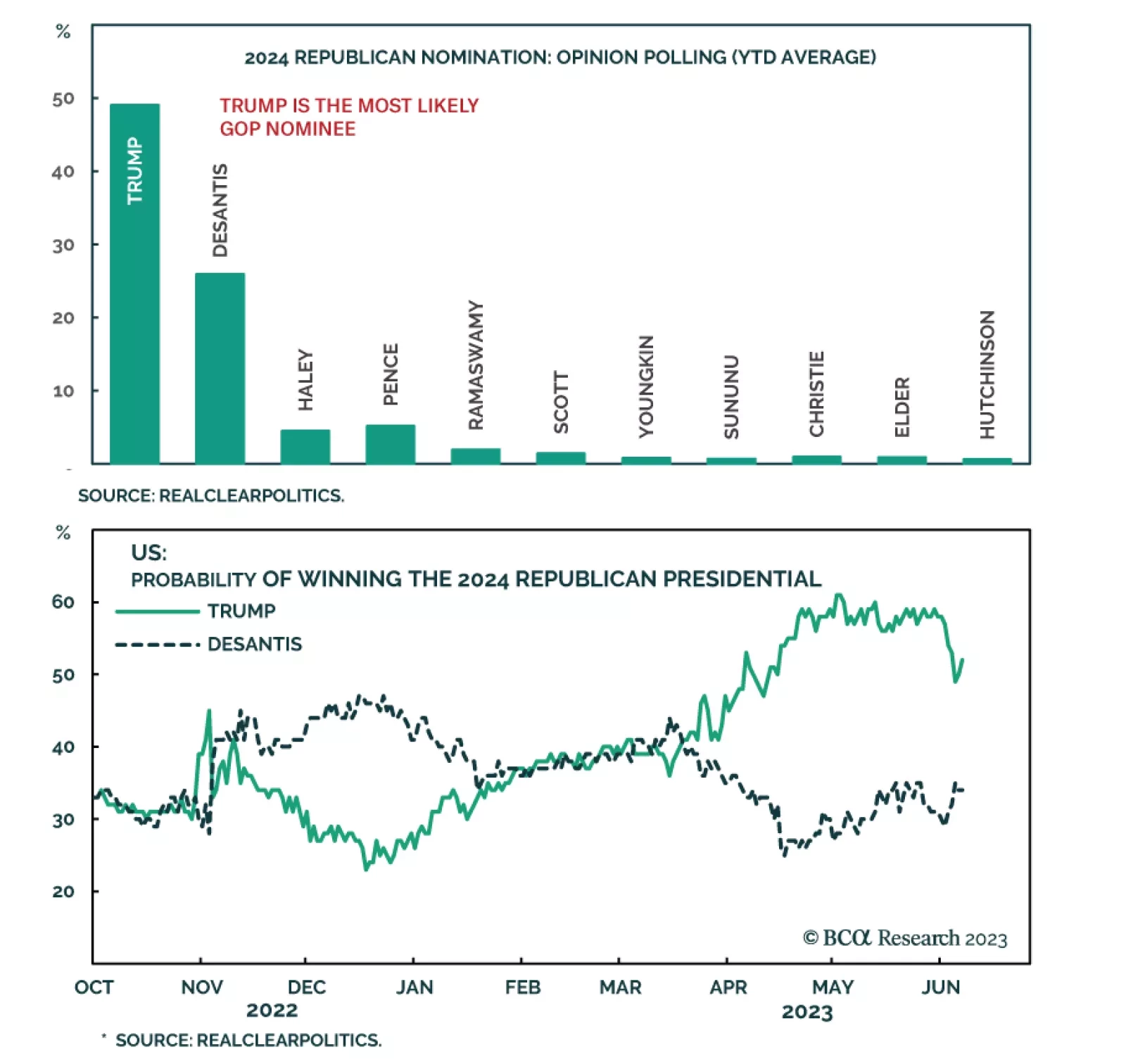

According to BCA Research’s US Political Strategy service, if Trump is imprisoned, the odds of Republican policy enactment will rise, not fall, on the margin. If he is not imprisoned, then the opposite will occur. Prior…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

Slowing manufacturing PMI indices globally indicate the slowdown in economic activity will persist. Manufacturing demand for commodities will also soften, weighing on industrial commodity prices. Geopolitical tensions and the race to…

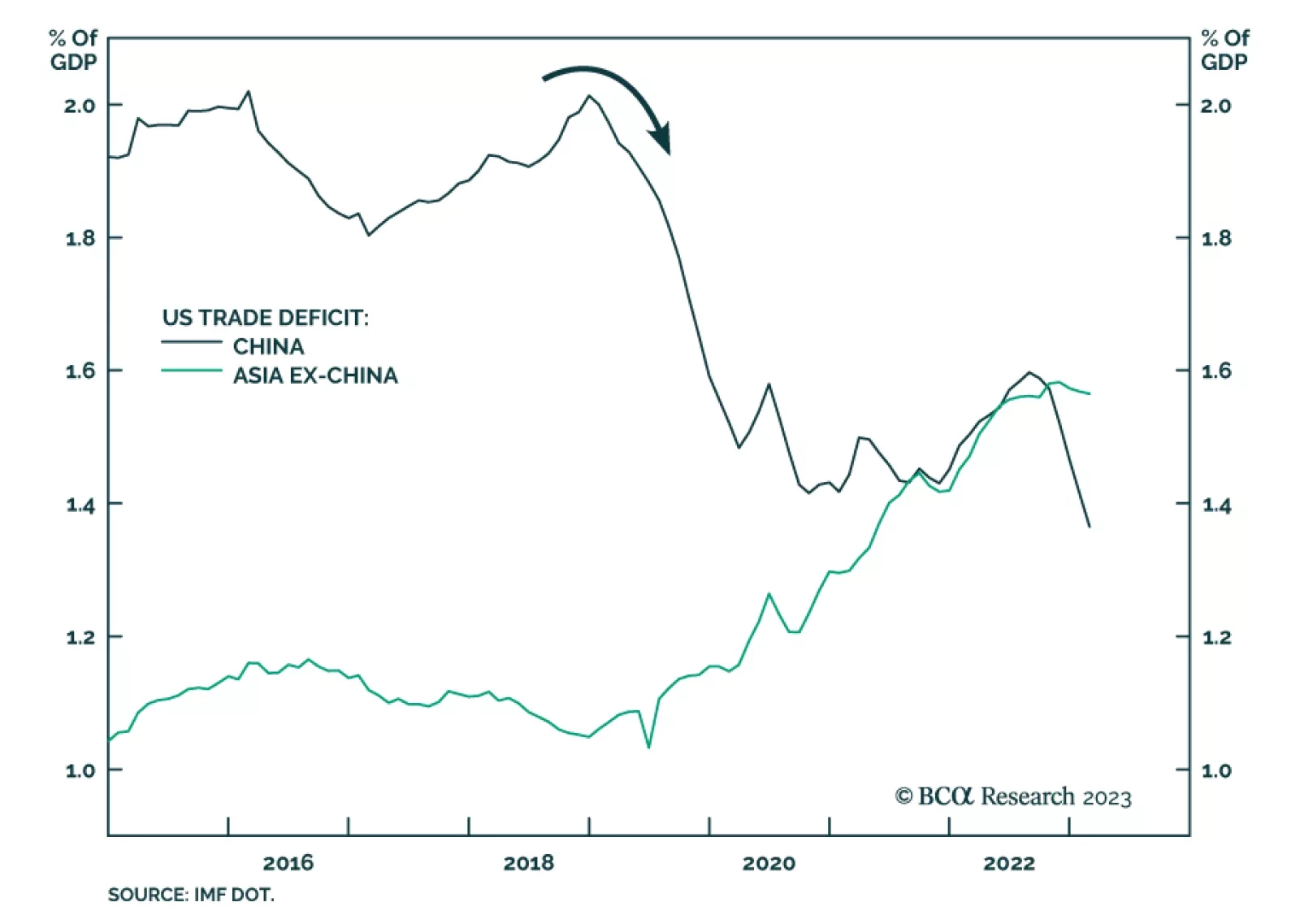

The Biden administration reached out to China to try to reduce tensions over the month of May, attracting interest from the investment community, though our Geopolitical Strategists believe the US and China cannot agree to a…

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…