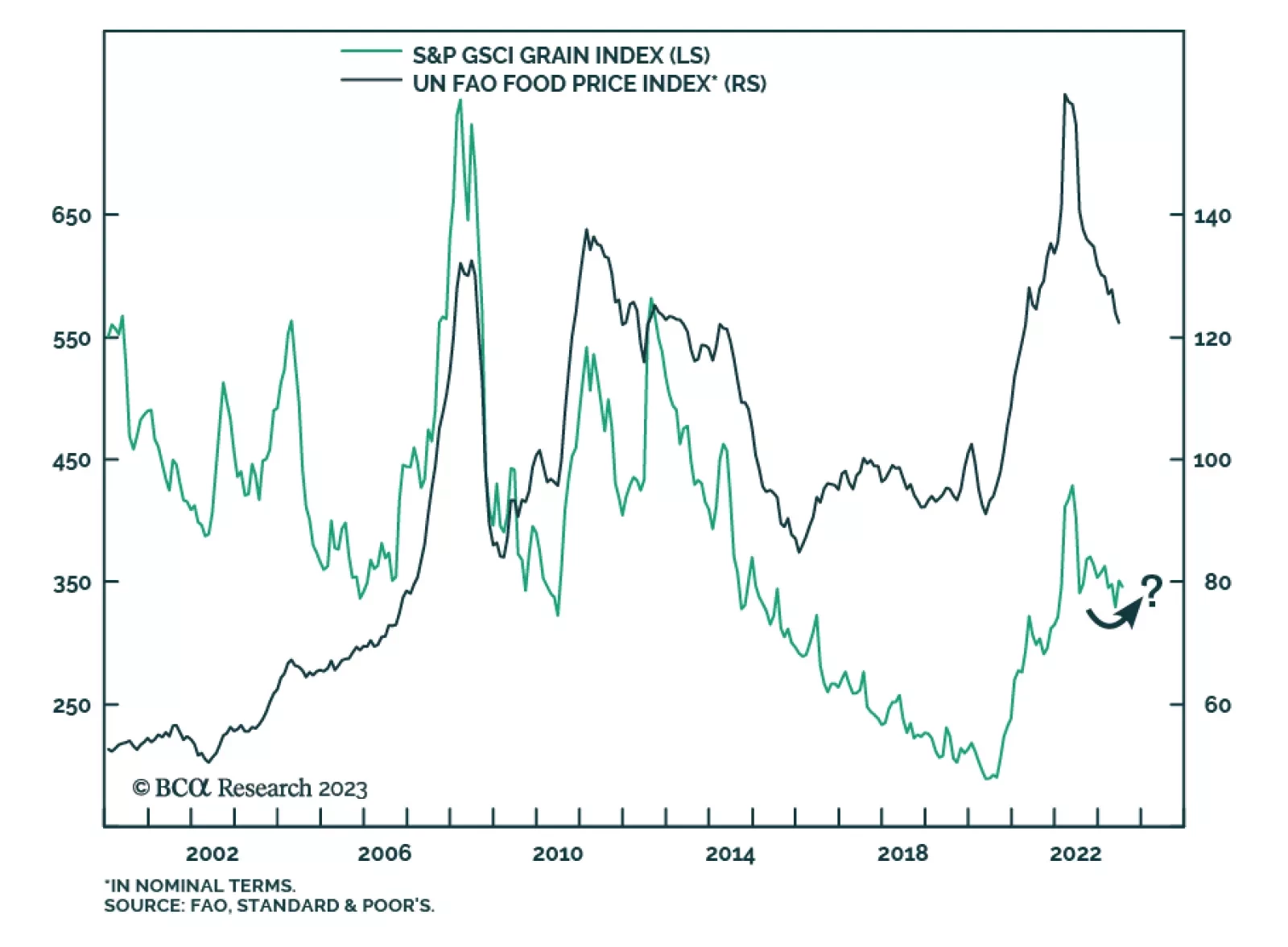

Wheat and corn prices have surged by 16% and 11%, respectively since Russia refused to renew the Black Sea Grain Initiative after it expired on July 17. The deal, which was negotiated with Turkey and the UN, allowed shipments of…

The snap election which took place on Sunday resulted in a political deadlock in Spain. No single party has won enough seats to form a government. More importantly, both the left-wing bloc and the right-bloc fell short of the 176-…

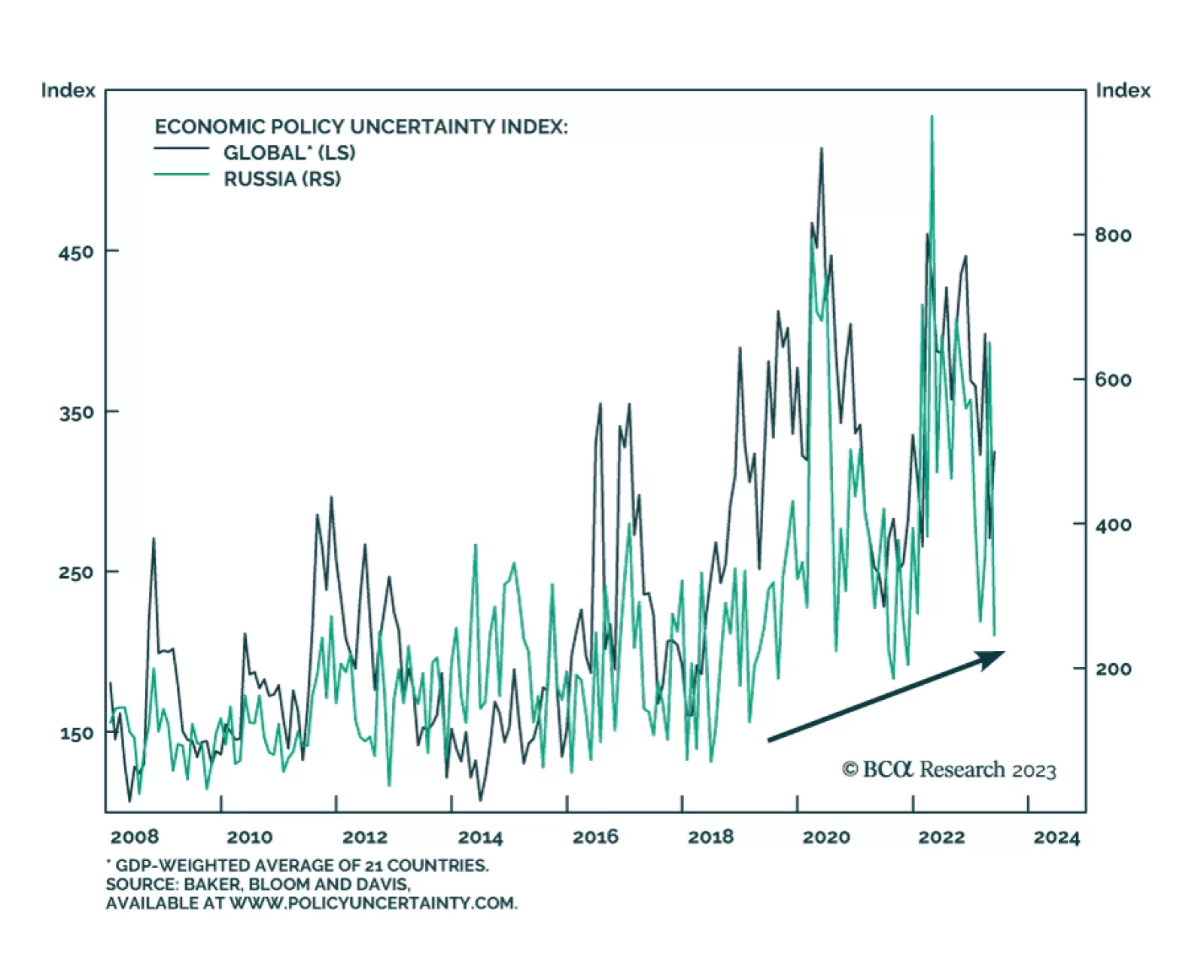

The looming risk of an economic downturn, geopolitical risk and inconsistent government policy are feeding commodity markets with volatility, additional to the market specific uncertainty-generating factors. Amidst heightened event-…

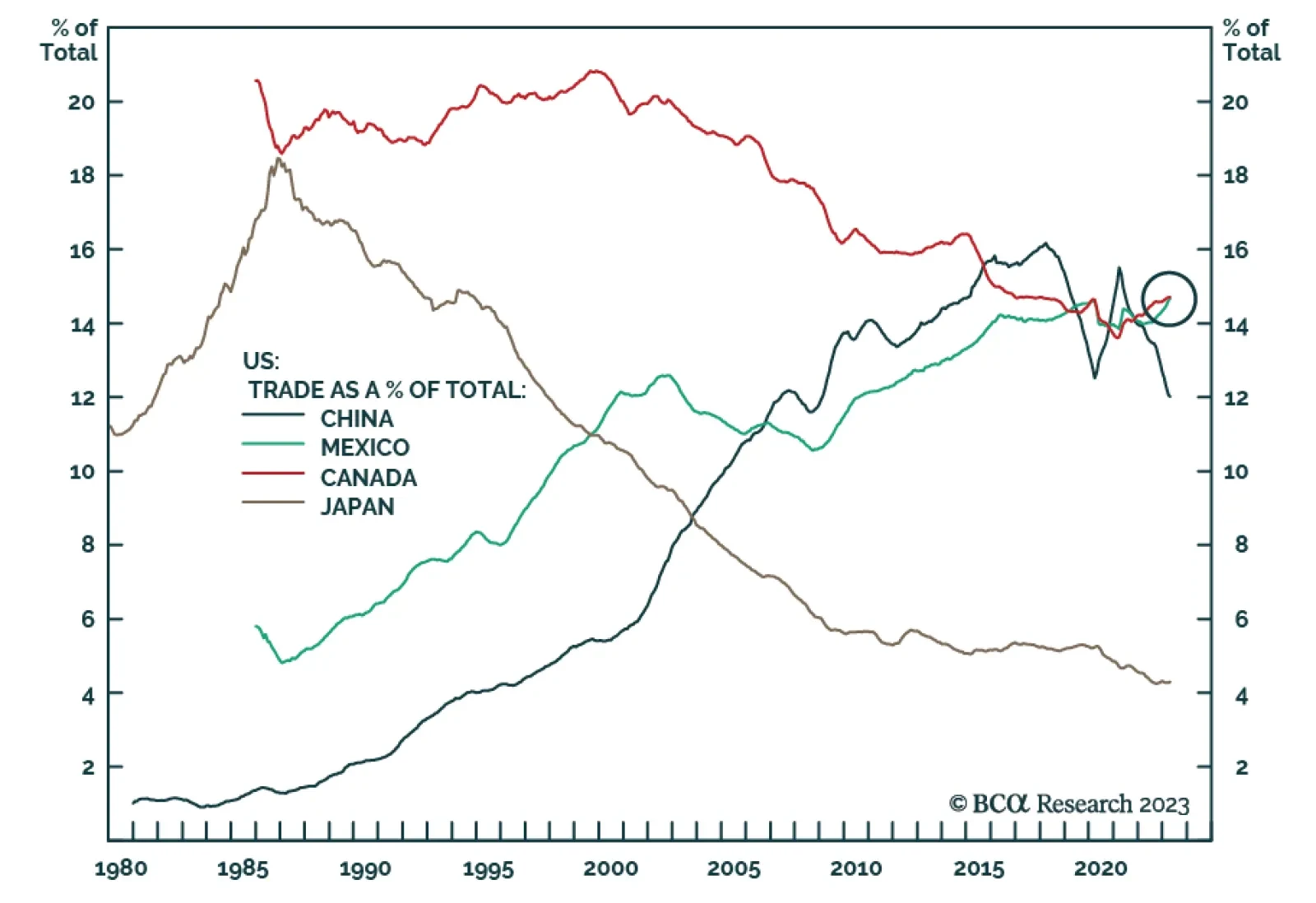

China’s slowdown confirms BCA’s Geopolitical Strategists’ view that persisting structural challenges would cause China’s economic reopening to disappoint (see The Numbers). In this context, Canada and…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

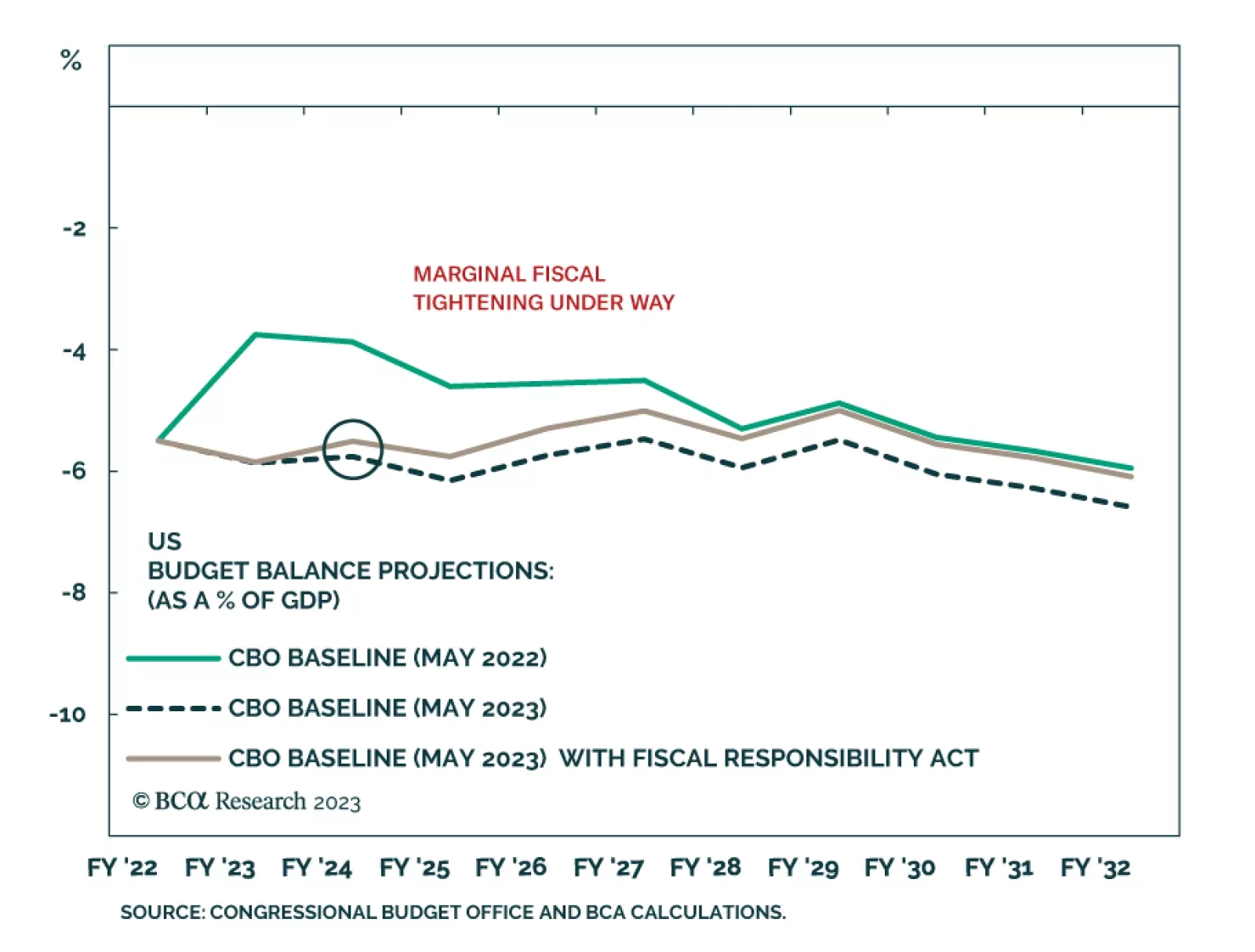

According to BCA Research’s US Political Strategy service, US fiscal policy is marginally negative for the economy and marginally increases the odds of recession in 2023-24. It is not a positive catalyst for equities in the…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

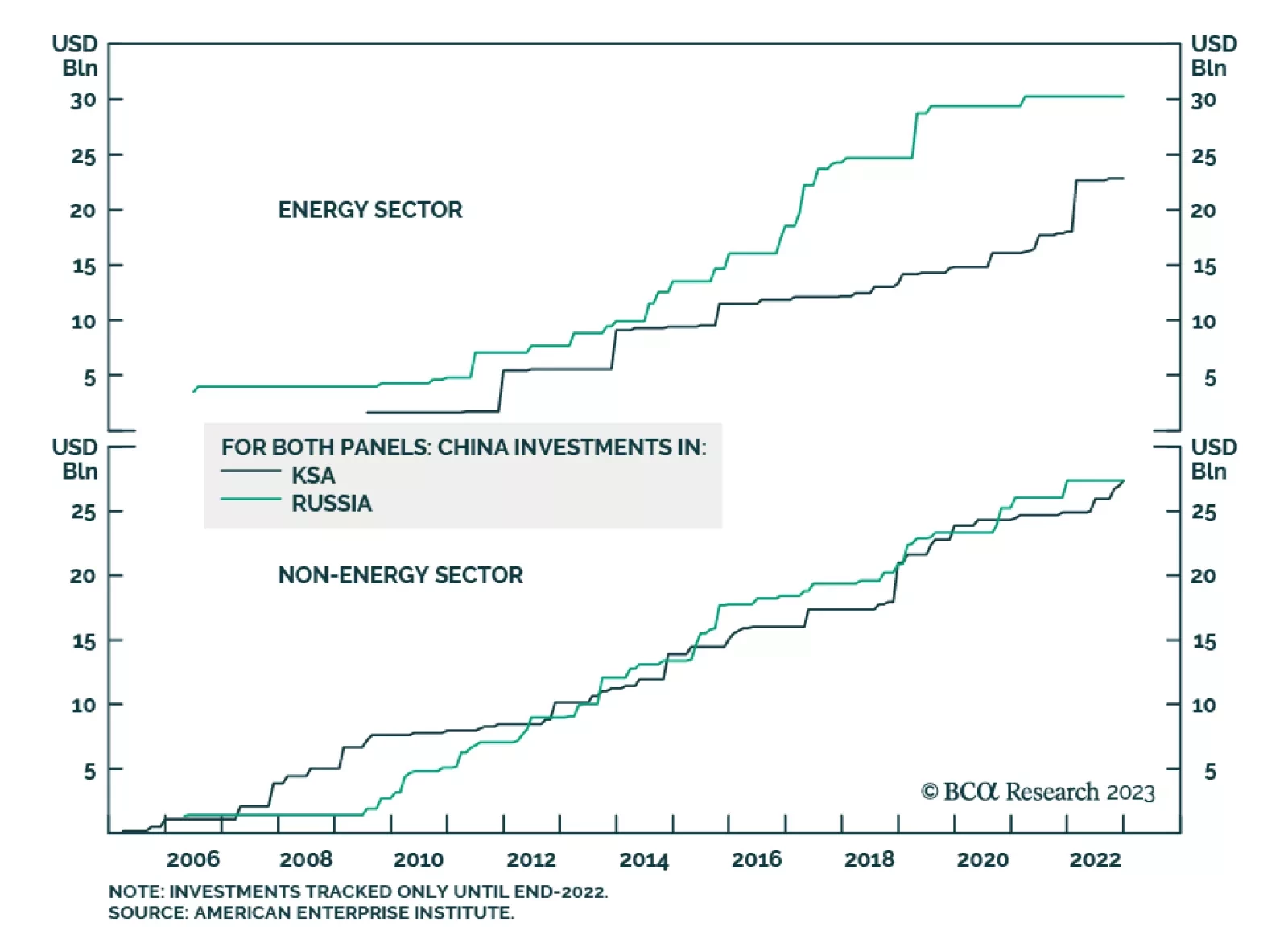

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

Our Geopolitical Strategy service cautions investors of Russian instability, which will likely push up the global equity risk premium in the next few months. After some developments during the weekend, Vladimir Putin and his…