Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

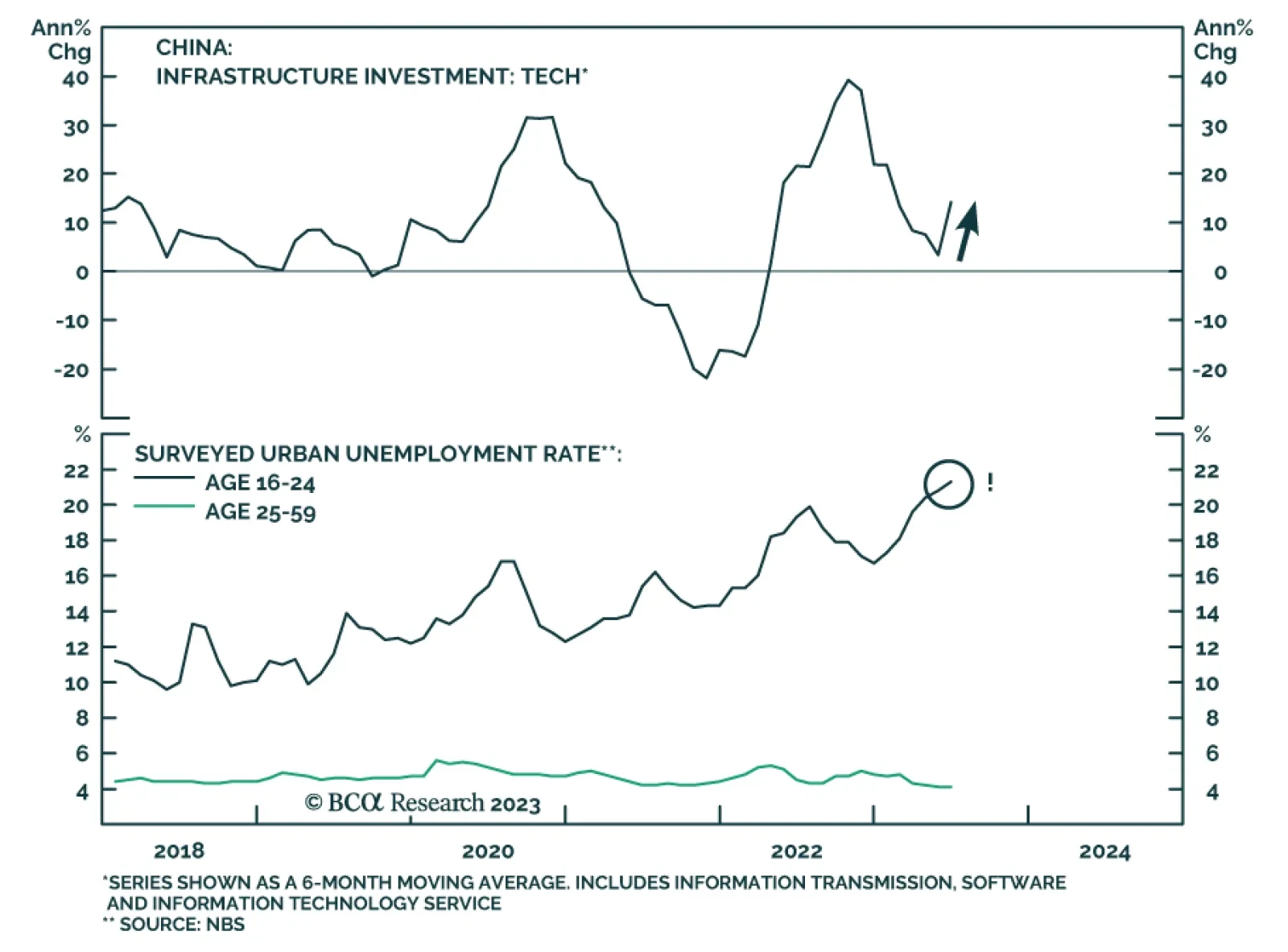

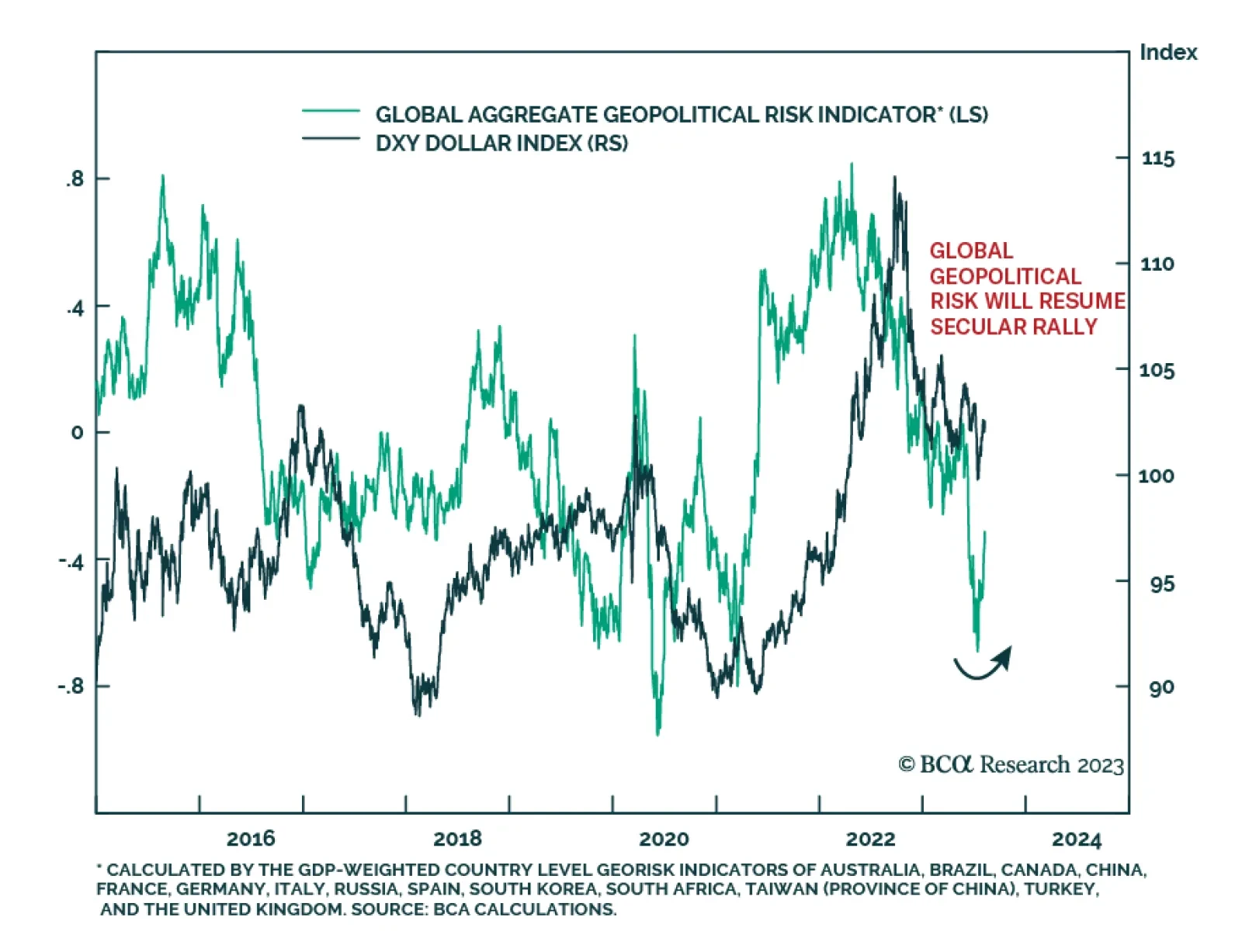

According to BCA Research’s Geopolitical Strategy service, investors should stay overweight low-beta assets. Geopolitical risk is likely to stay elevated in Asia Pacific in the coming months. Mainland China faces debt-…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

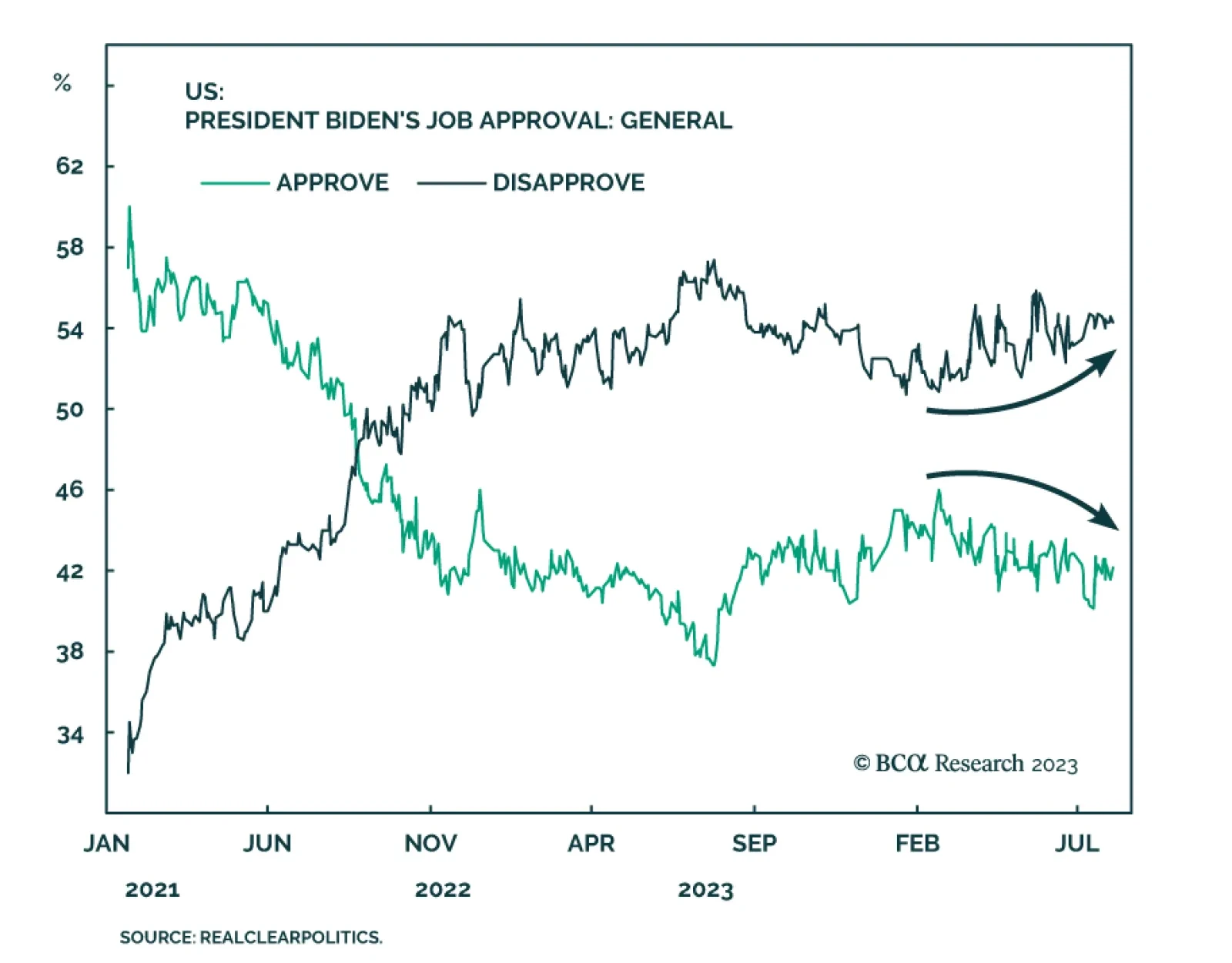

President Joe Biden’s approval rating trended down from a peak in February this year of 45.8% to the current level of 42.1%. Meanwhile his disapproval rating rose from a trough of 50.9% to its current 54.3%. The negative…

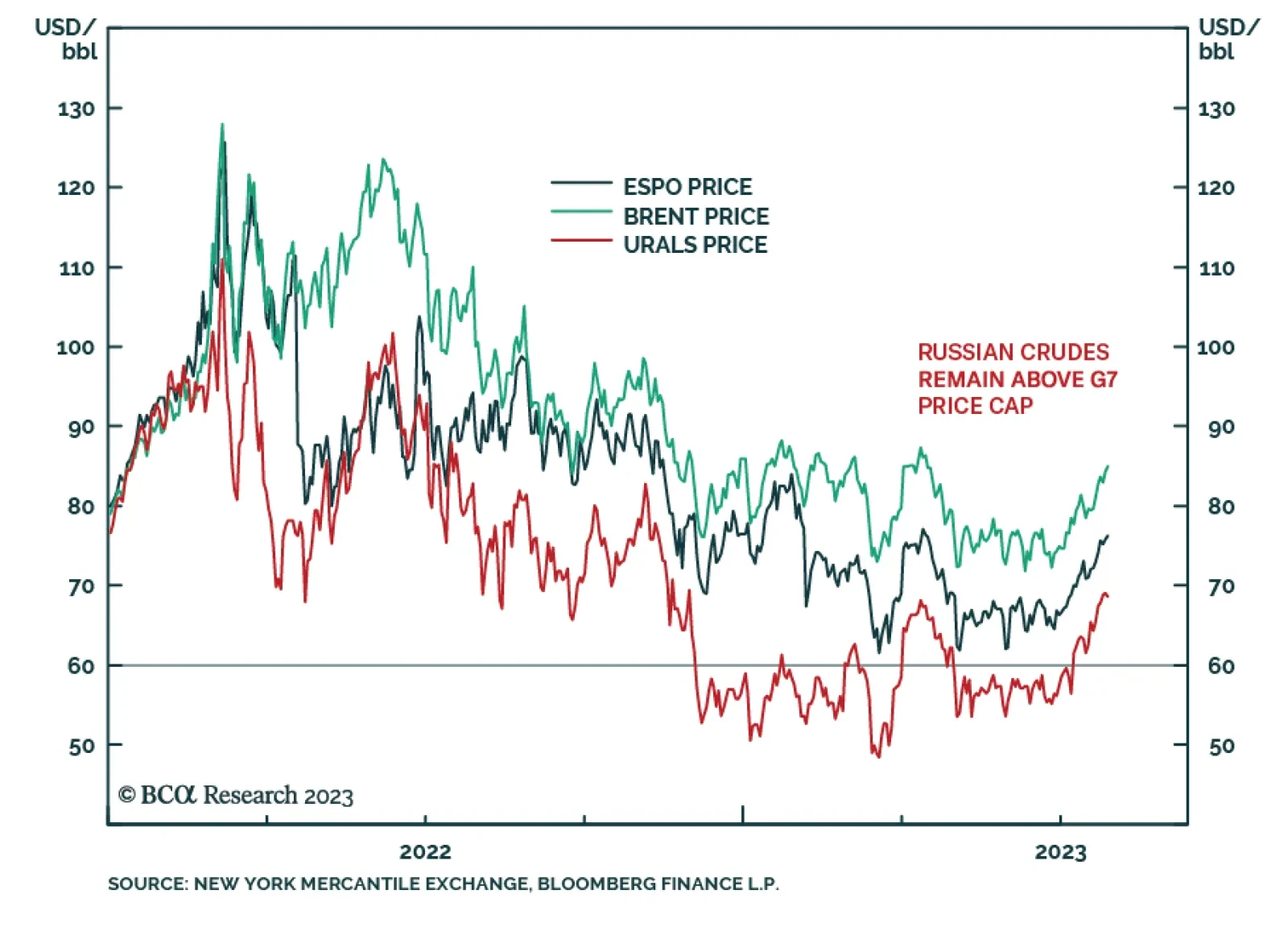

According to BCA Research’s Commodity & Energy Strategy and Geopolitical Strategy services, Russia is likely to cut oil production to pressure the West as a part of its war effort. This cut would push oil prices to…

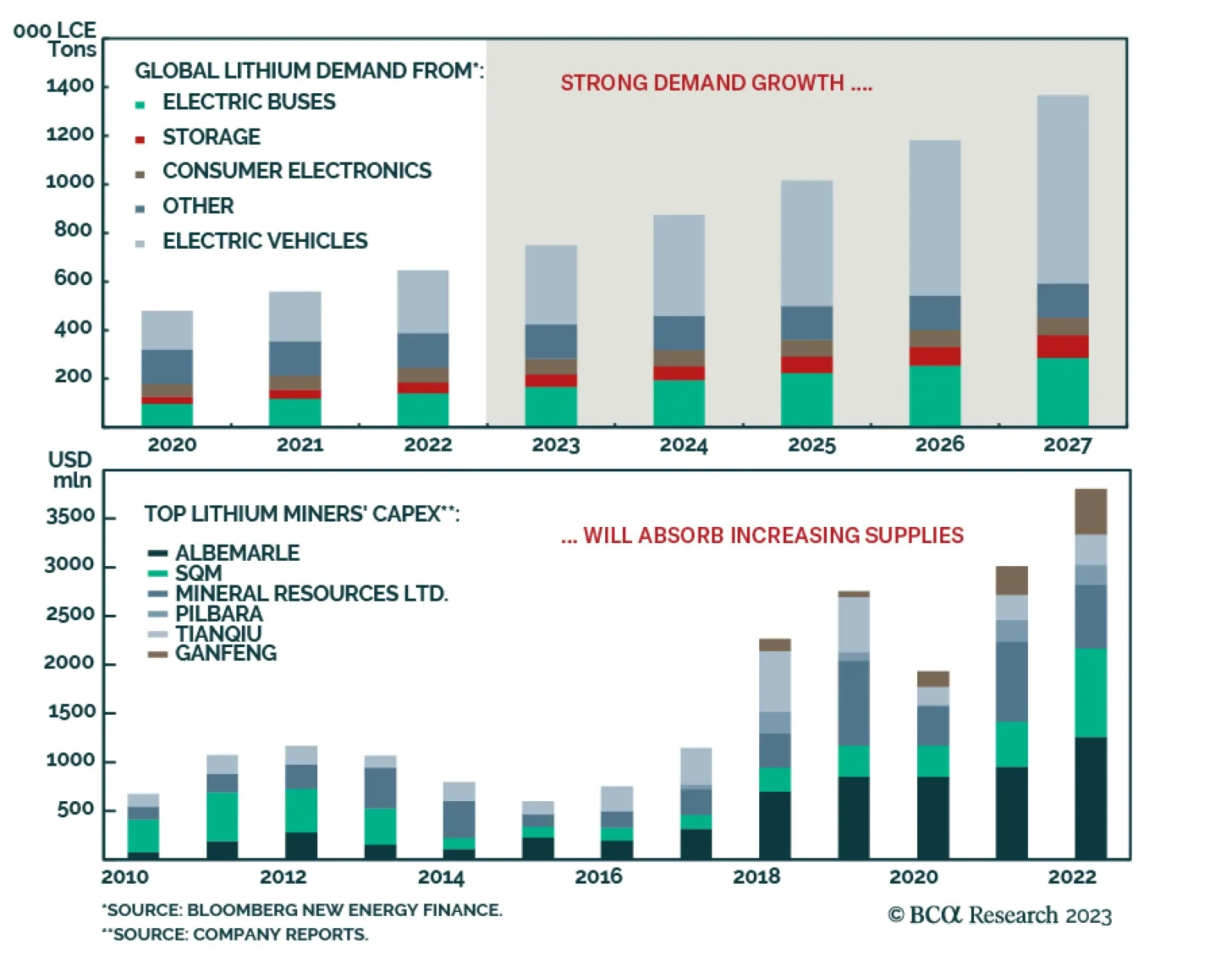

BCA Research’s Commodity & Energy Strategy service expects steady demand for EVs will be able to absorb increasing lithium supplies in the short-to-medium term. The team is getting long the LIT ETF at tonight’s…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…