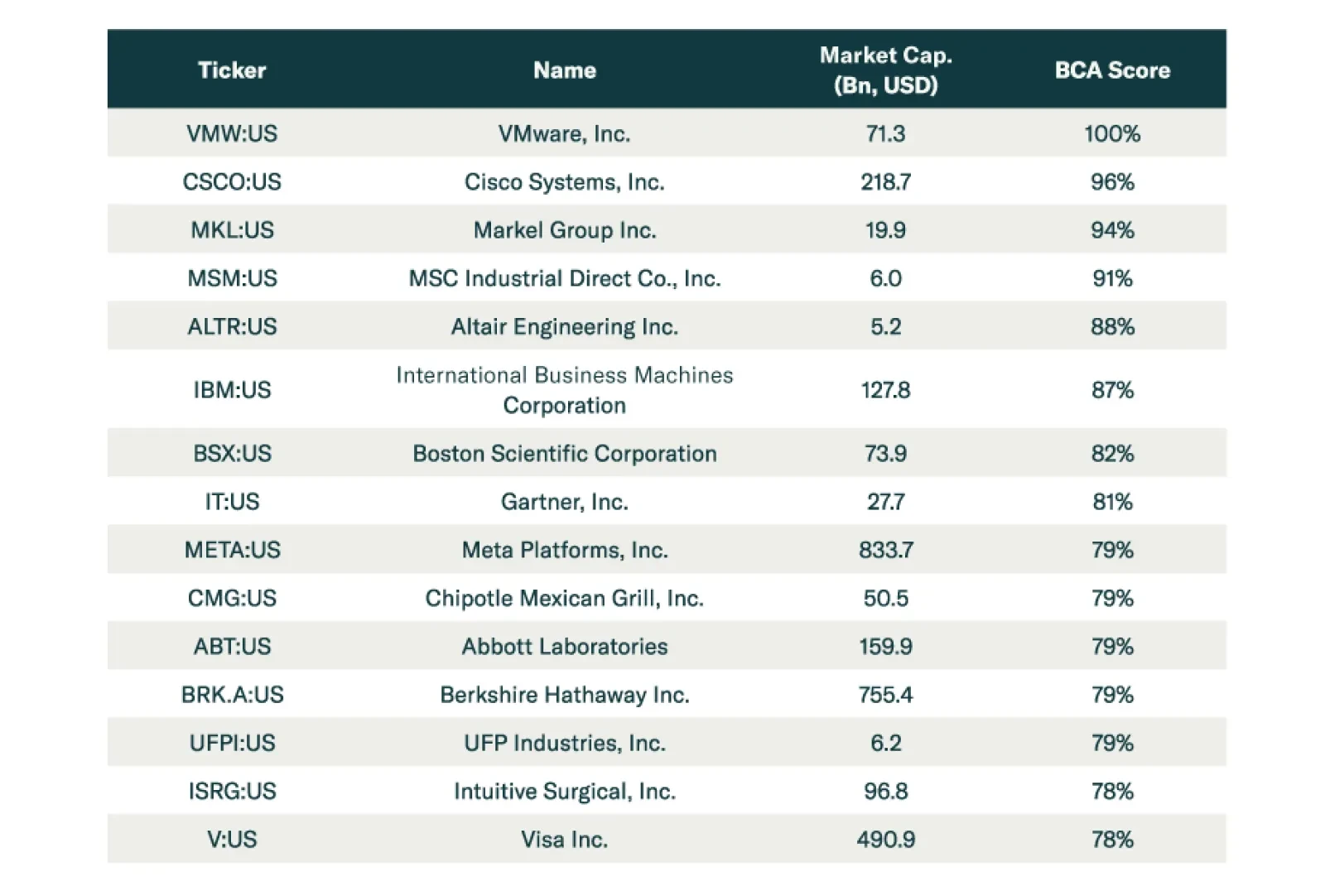

In a recent report, BCA Research’s Equity Analyzer service proposes two strategies to help investors navigate the conflict in the Middle East. The first strategy uses the “Macro Sensitivities” filter on…

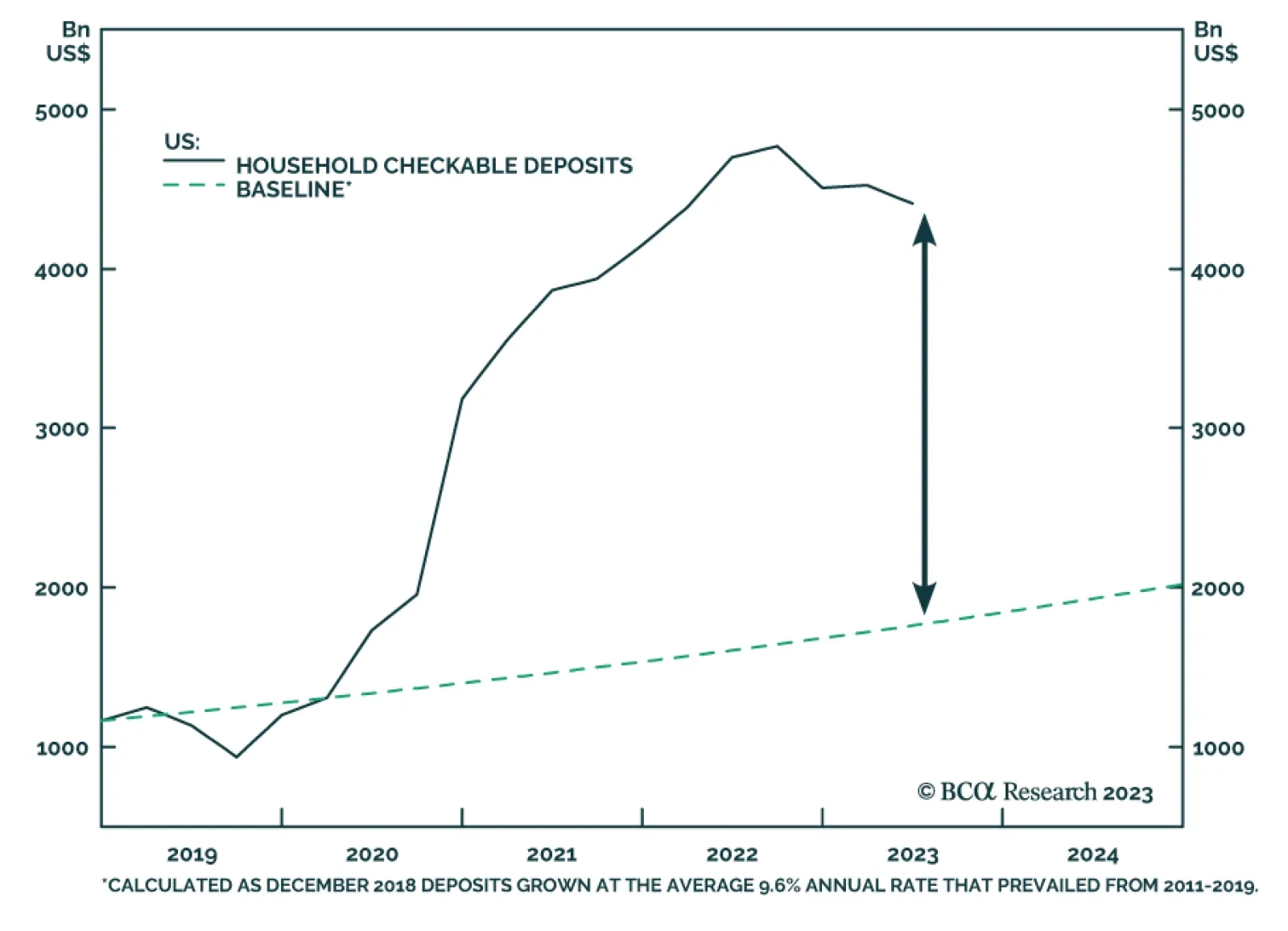

BCA Research’s US Investment Strategy service studied the SIFIs’ earnings calls for insights into borrower performance, lender willingness, liquidity and the actions and intentions of households and businesses.…

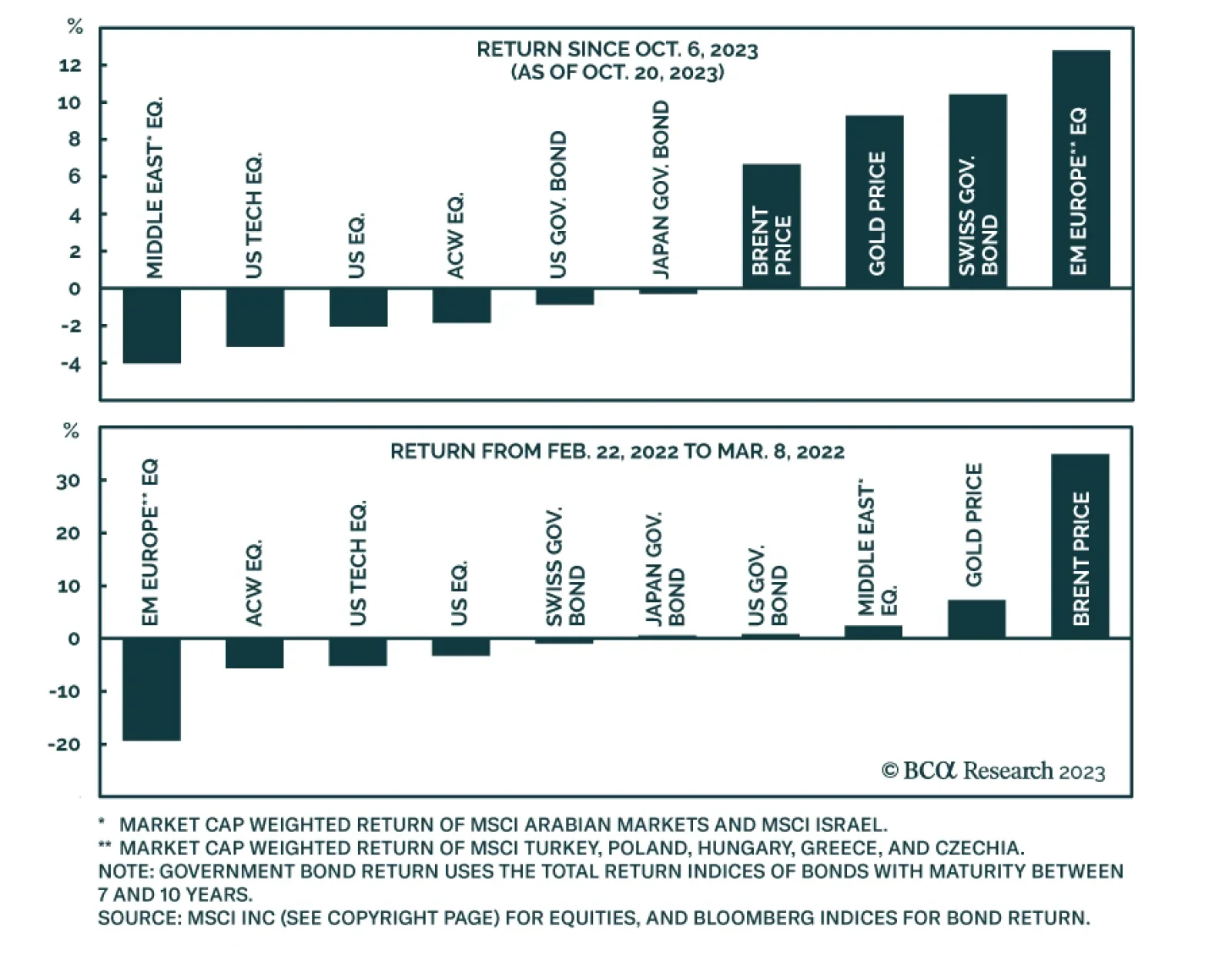

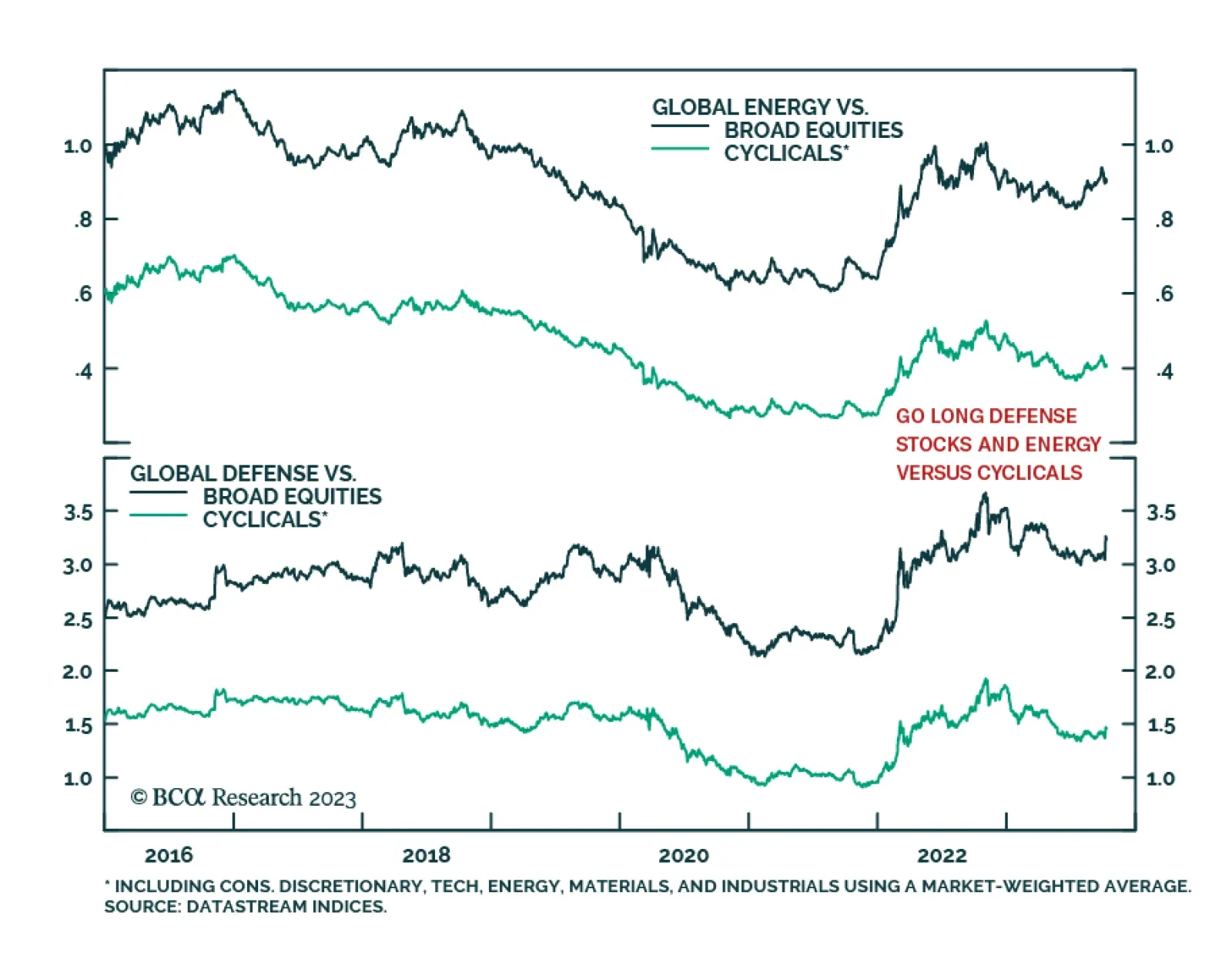

Geopolitical risk is returning to the market after a hiatus for most of 2023. Global investors are now realizing what our geopolitical strategists have argued all year: that the rise in geopolitical risk is a secular trend…

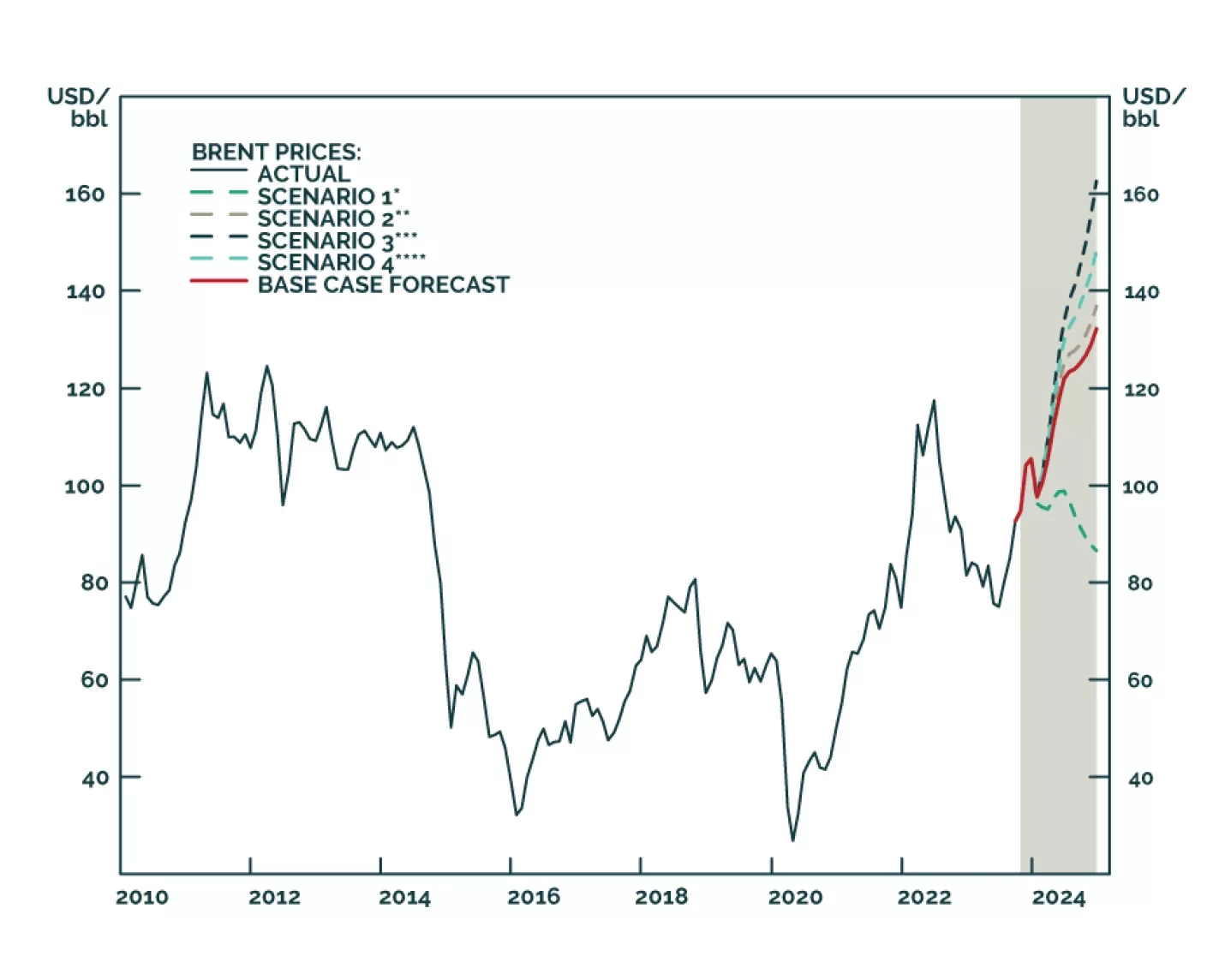

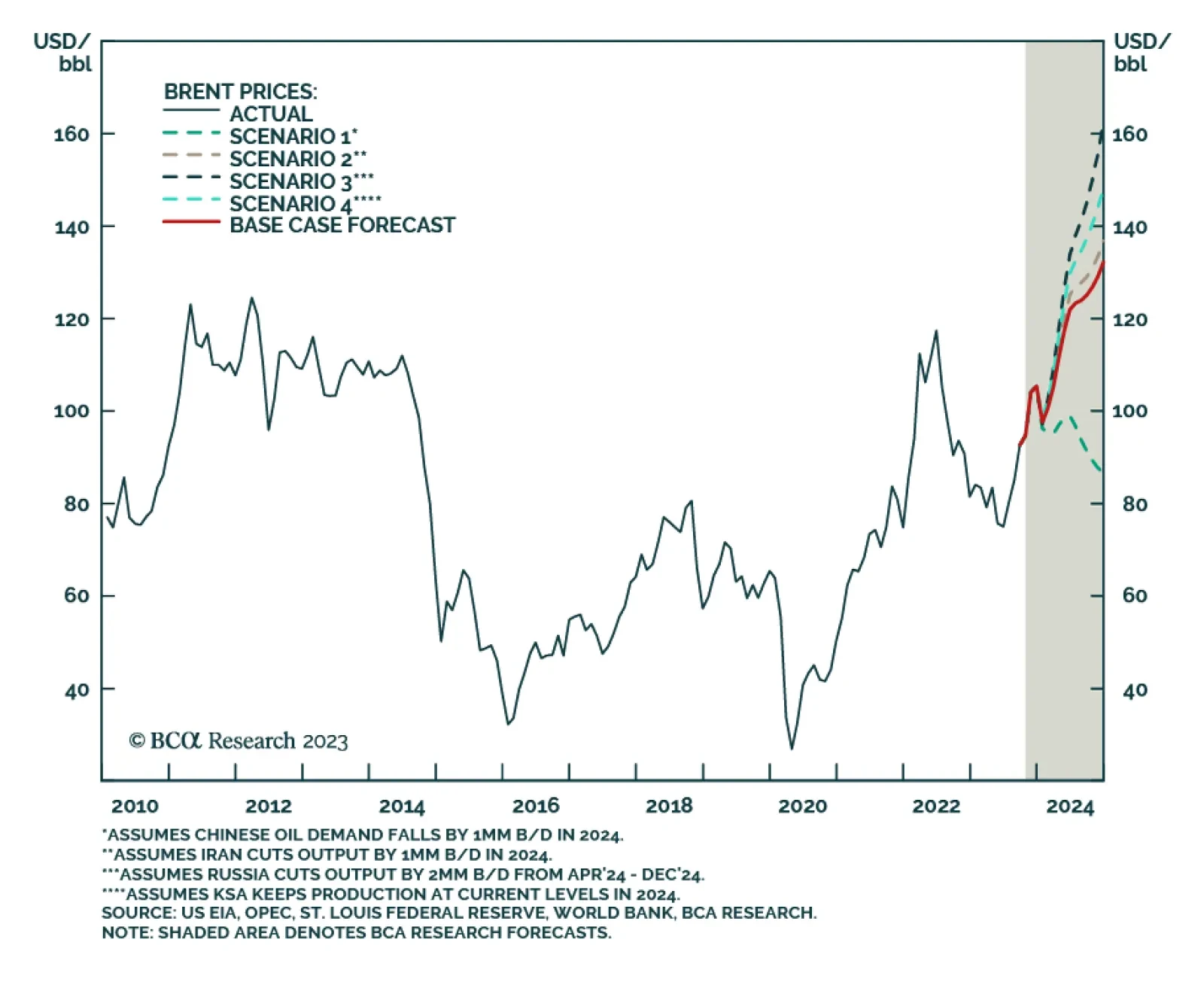

Our Commodity & Energy Strategy colleagues (CES) left their 2024 Brent crude oil price forecast unchanged at $118/bbl. This is not because nothing’s changed in the market. Rather, higher levels of…

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

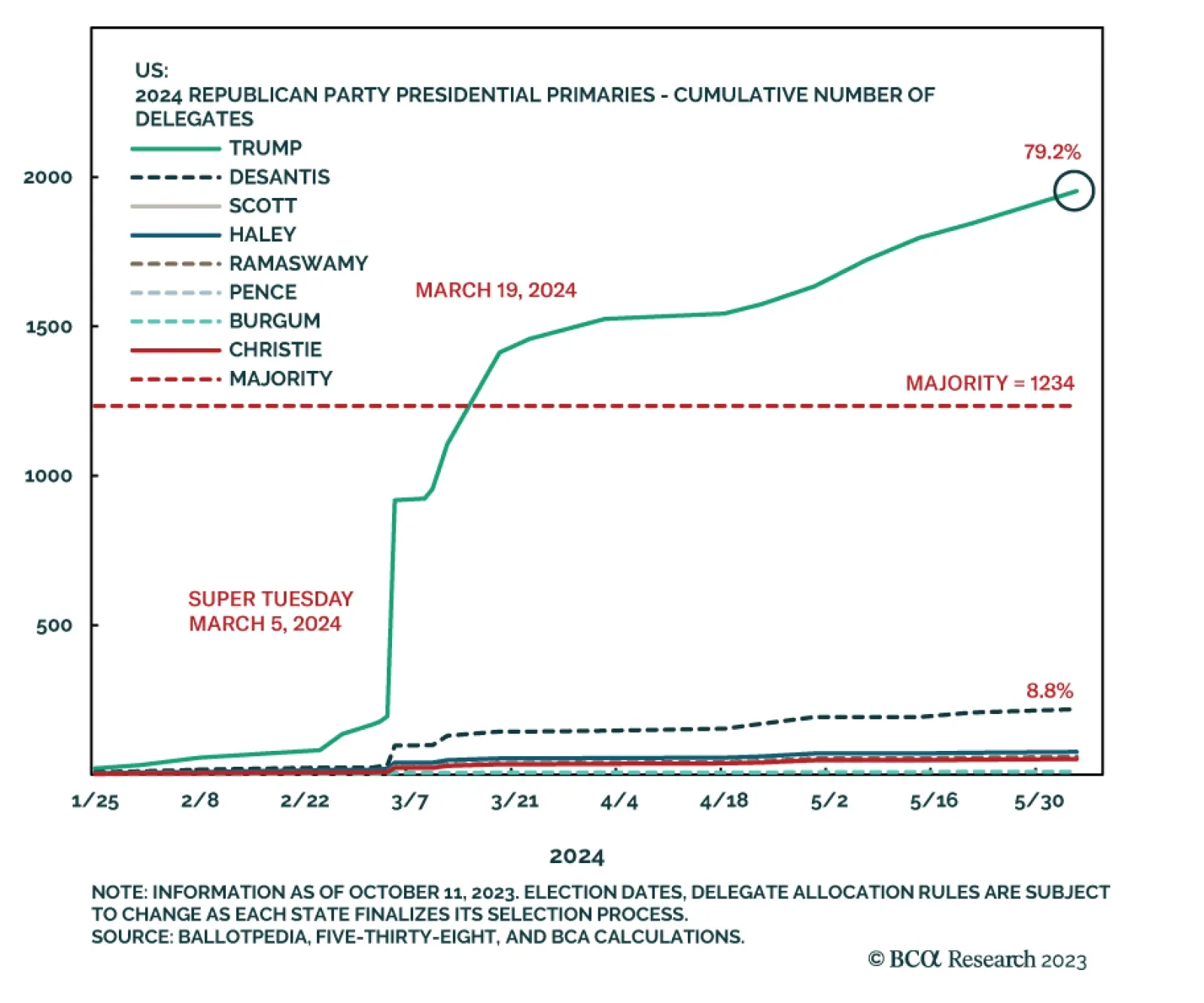

According to BCA Research’s US Political Strategy service, Trump is lined up to win the Republican presidential nomination by March 19, 2024. The takeaway is greater risk of party change, higher US and global policy…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

According to BCA Research’s Geopolitical Strategy service, Israel’s retaliation against Hamas has a 70% chance of expanding beyond Gaza in some form over the coming 12 months. The team’s scenarios and…