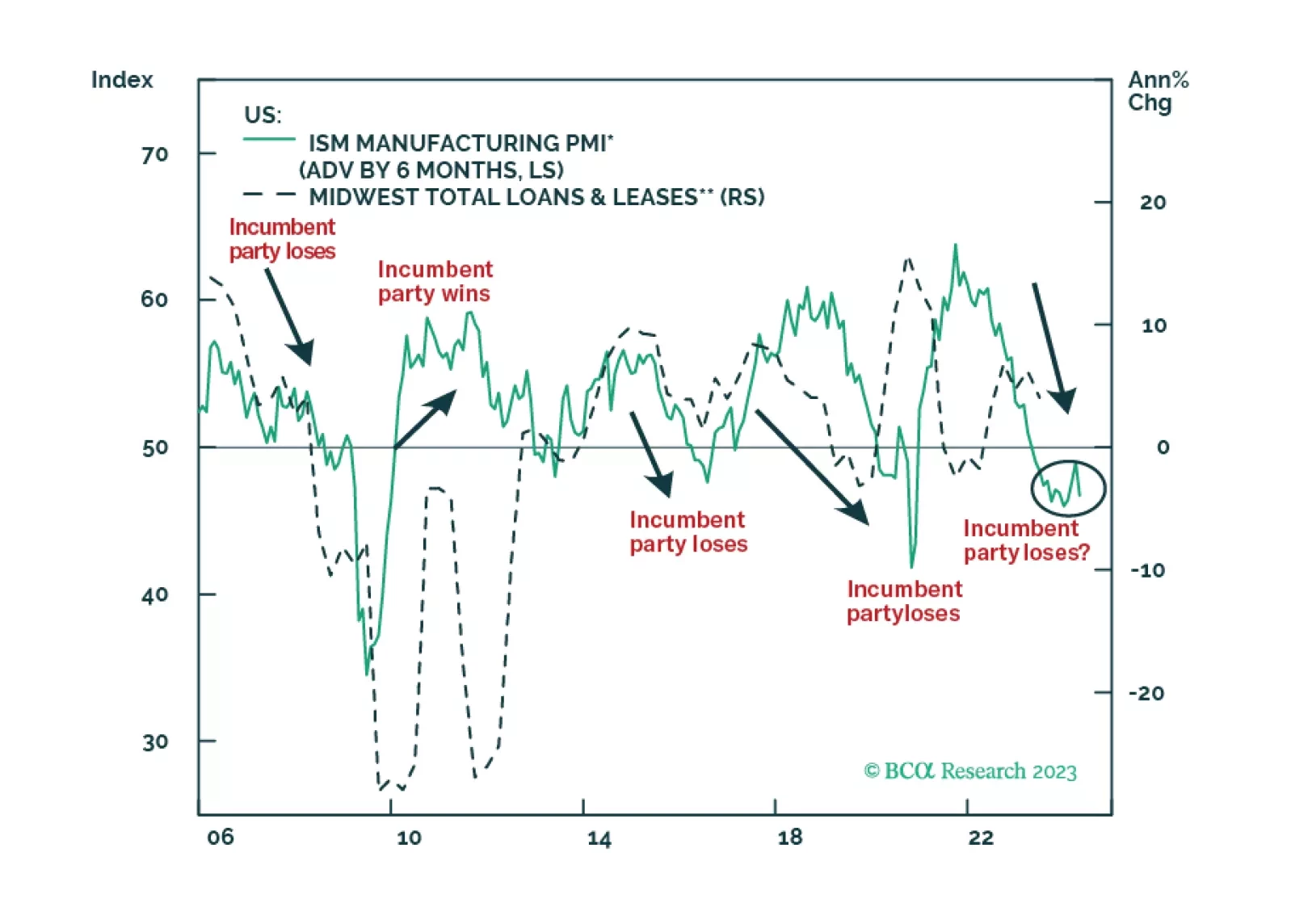

President Joe Biden’s average approval rating fell to 39.9% on December 3, while his disapproval rating rose to 55.4%. This polling is extremely dangerous for the president. He lags former President Donald Trump by 2% in…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.

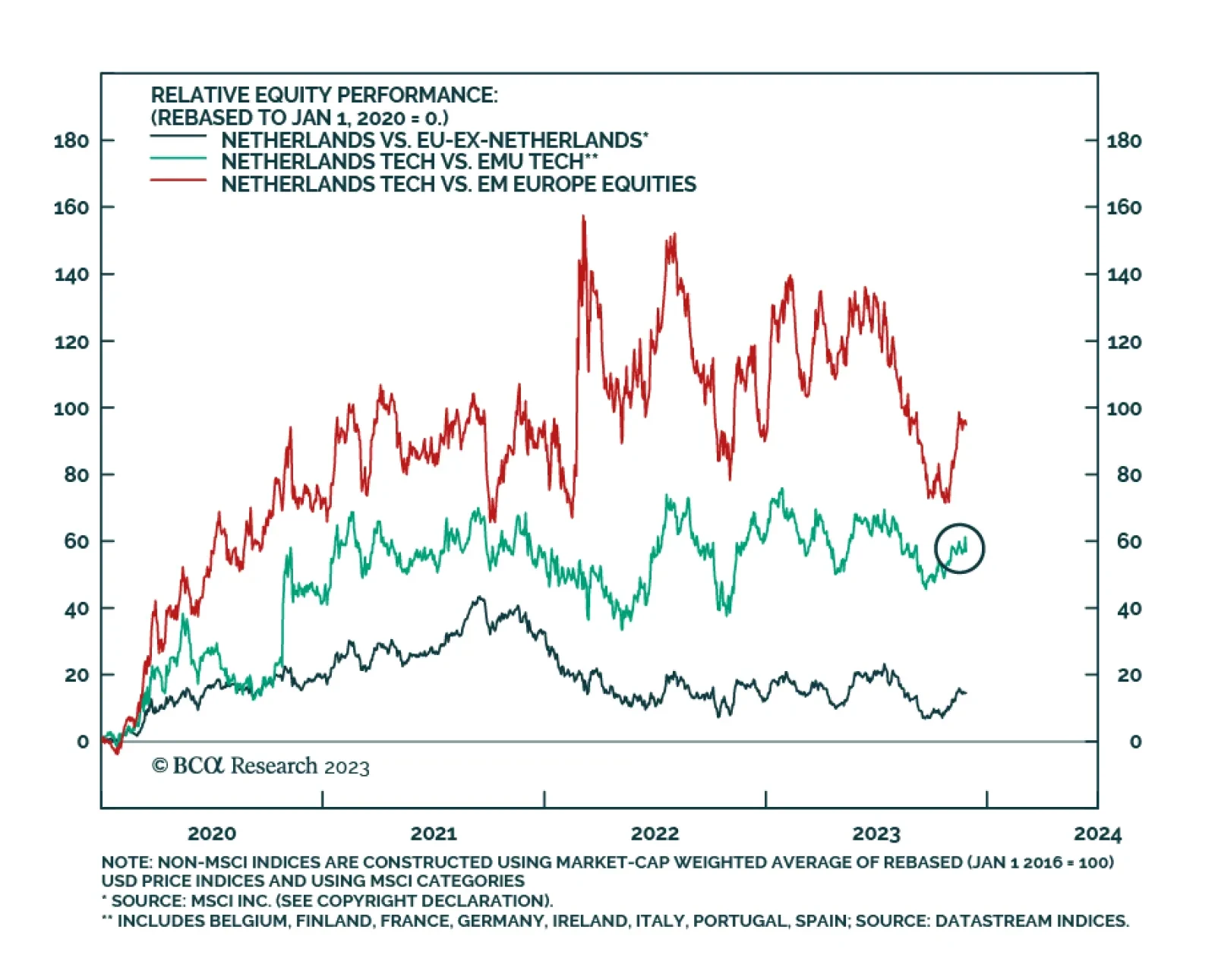

According to BCA Research's Geopolitical Strategy service, coalition politics will prevent radical policy changes in the Netherlands. The Dutch elections saw a shift to new and opposition parties as the team…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

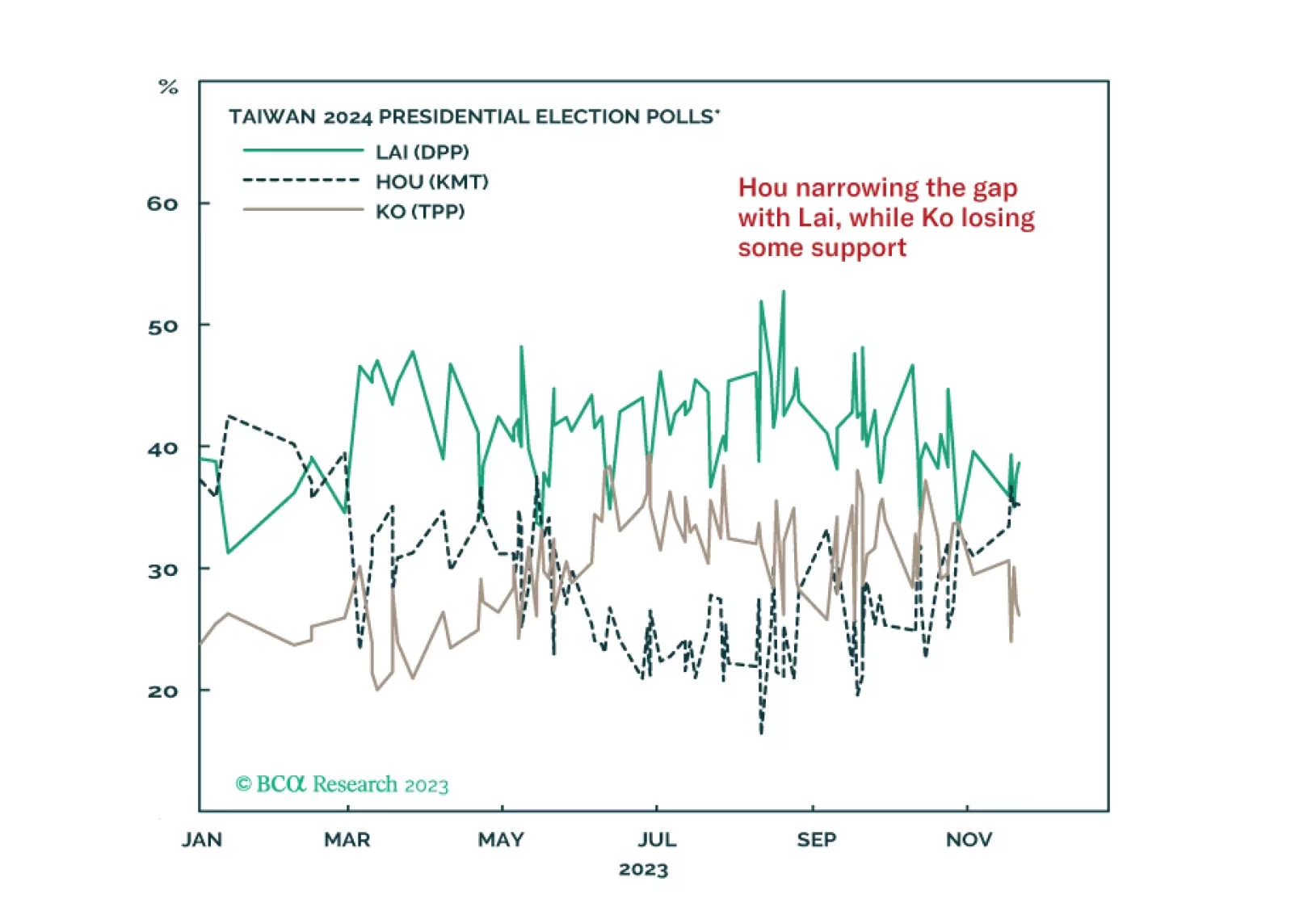

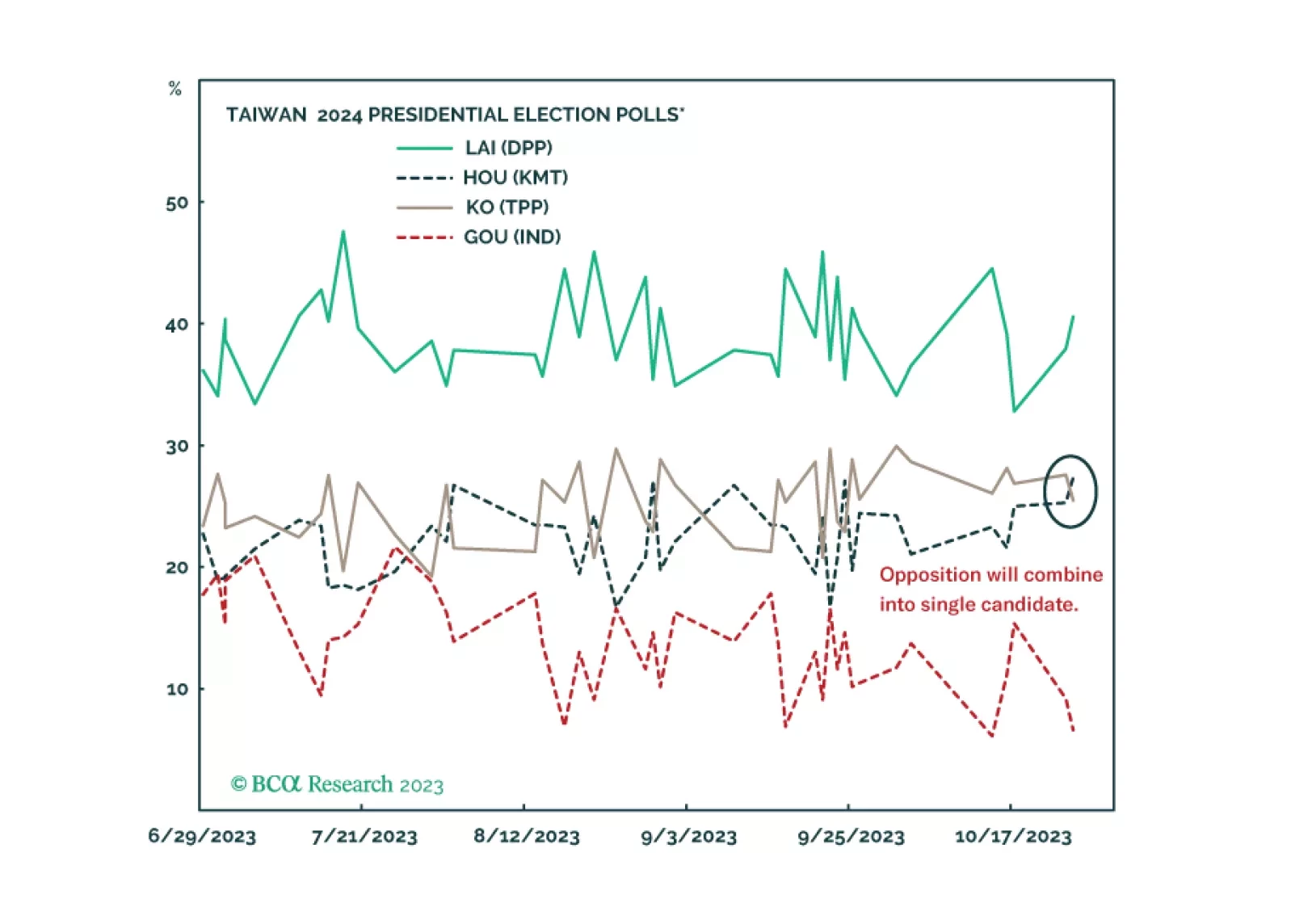

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

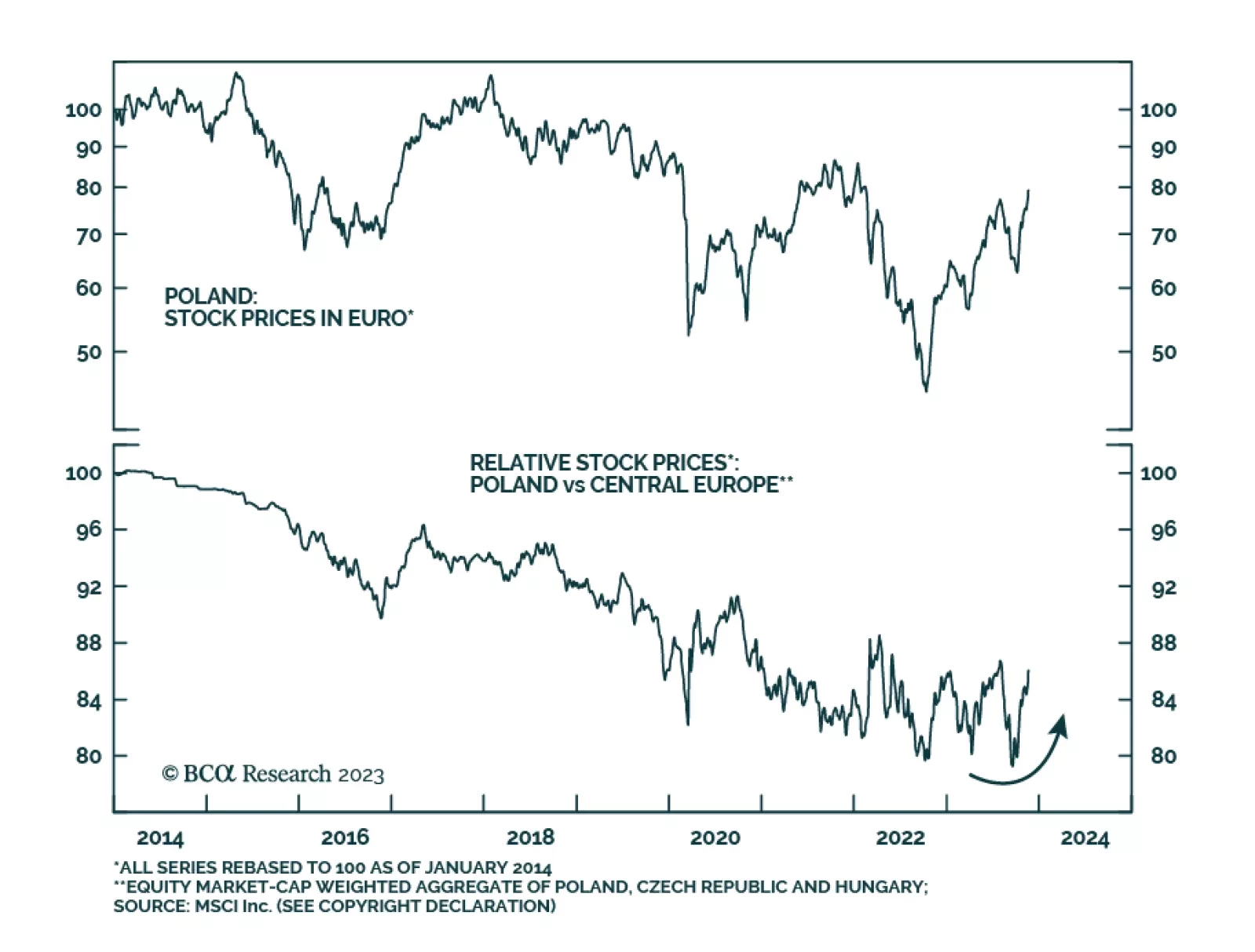

In the recently held Polish general elections, the ruling Law & Justice Party (PiS) lost power. Chances are that a coalition led by the Civic Platform party will form a government next month. The new coalition ran on a pro…

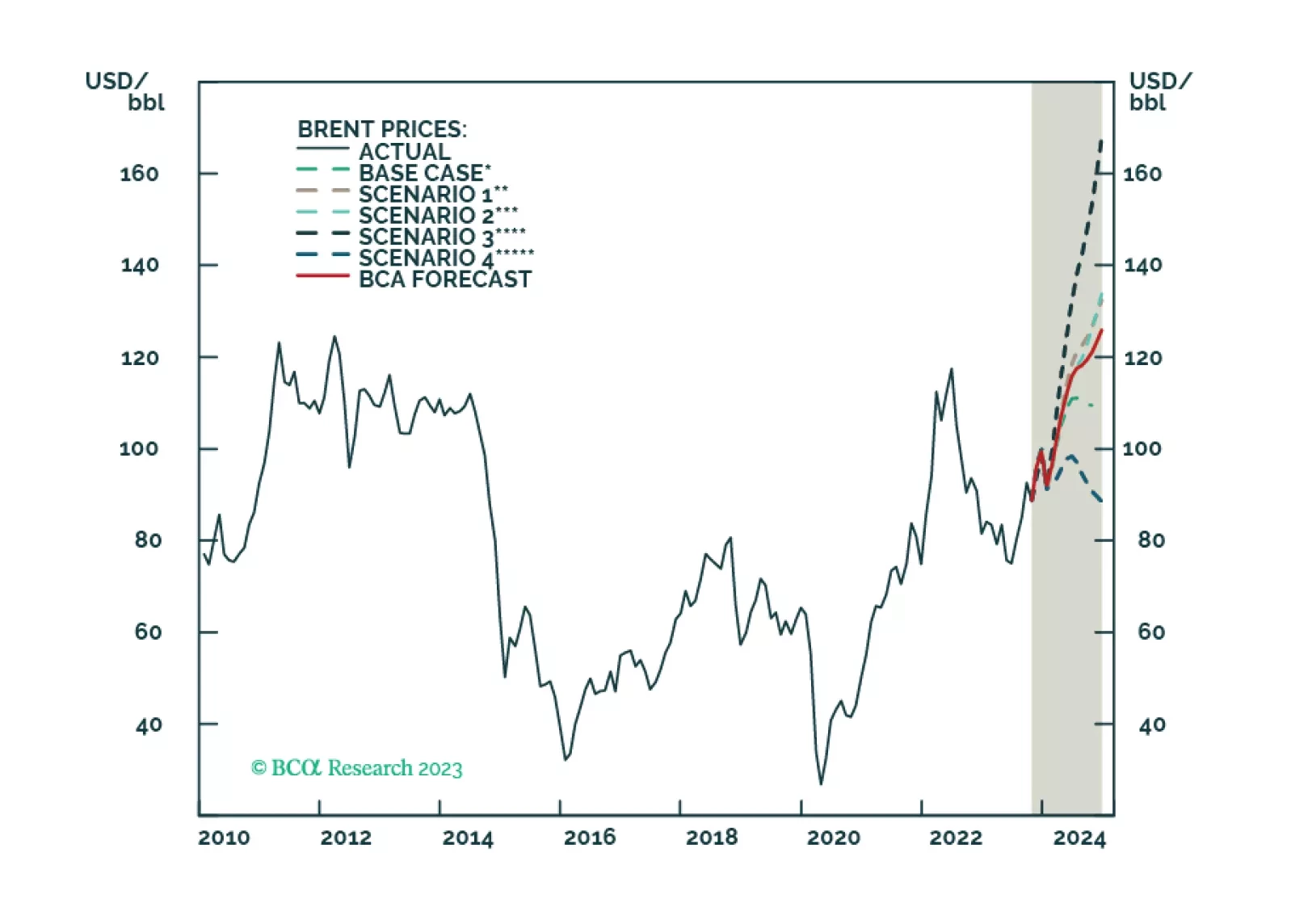

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…