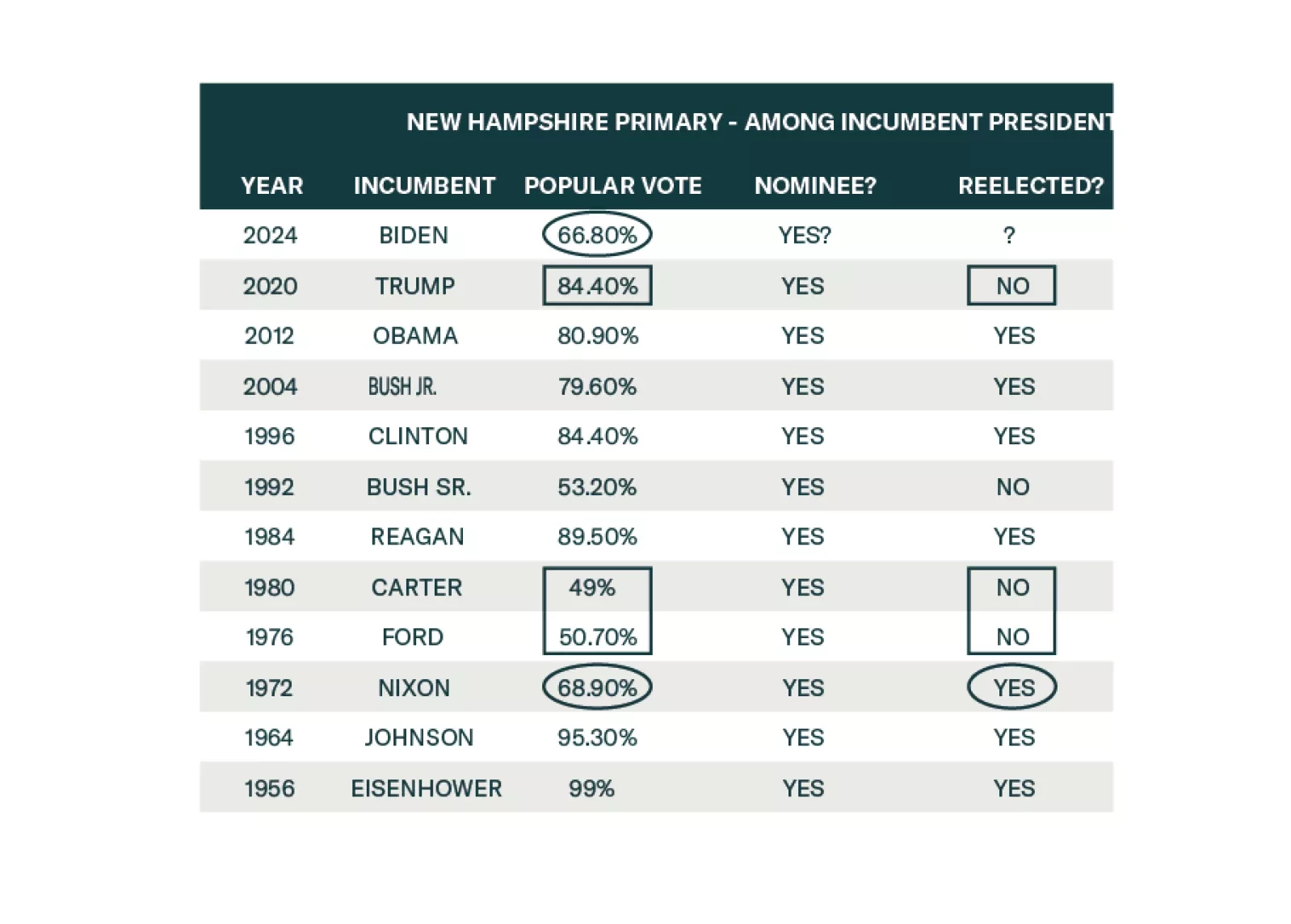

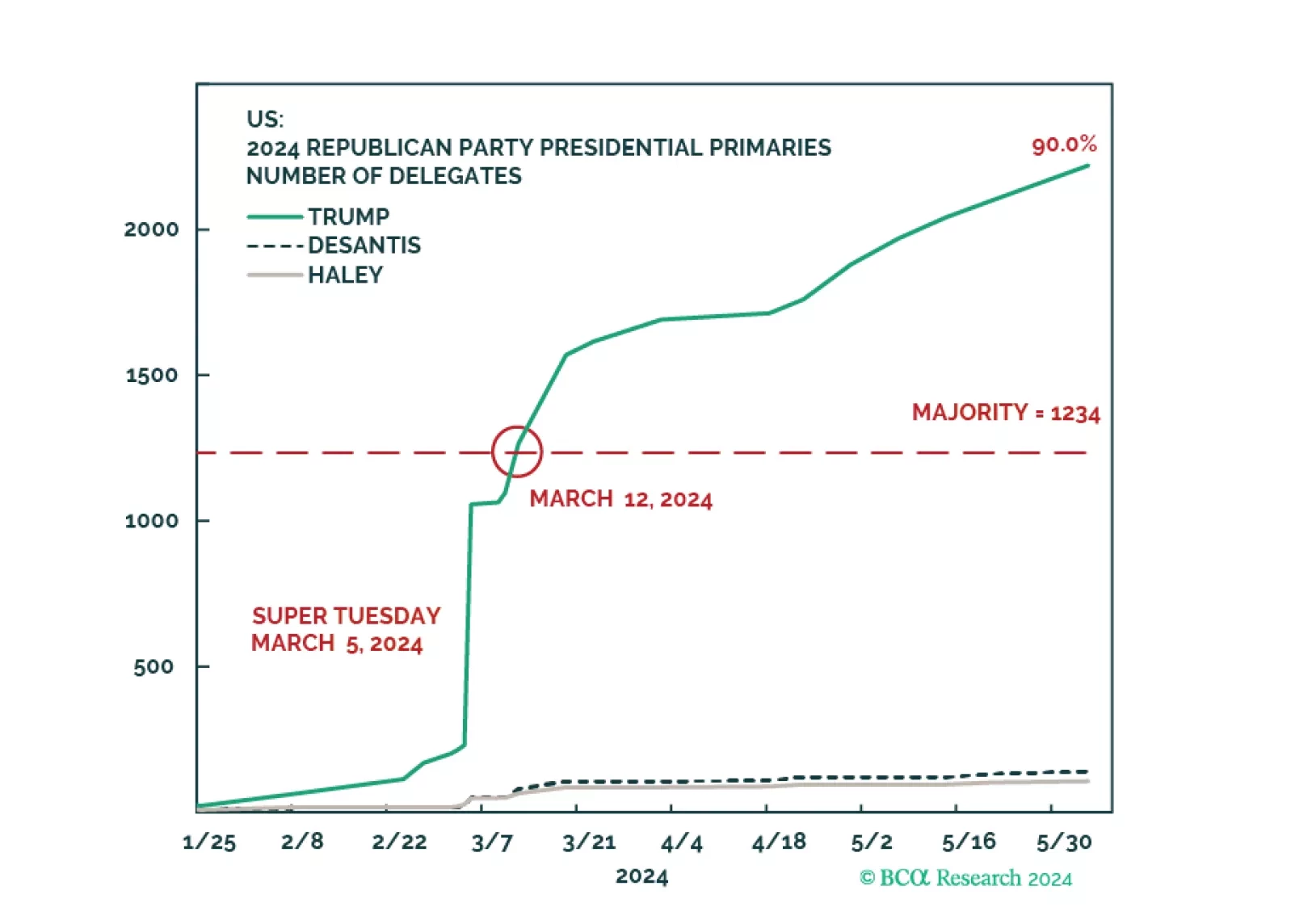

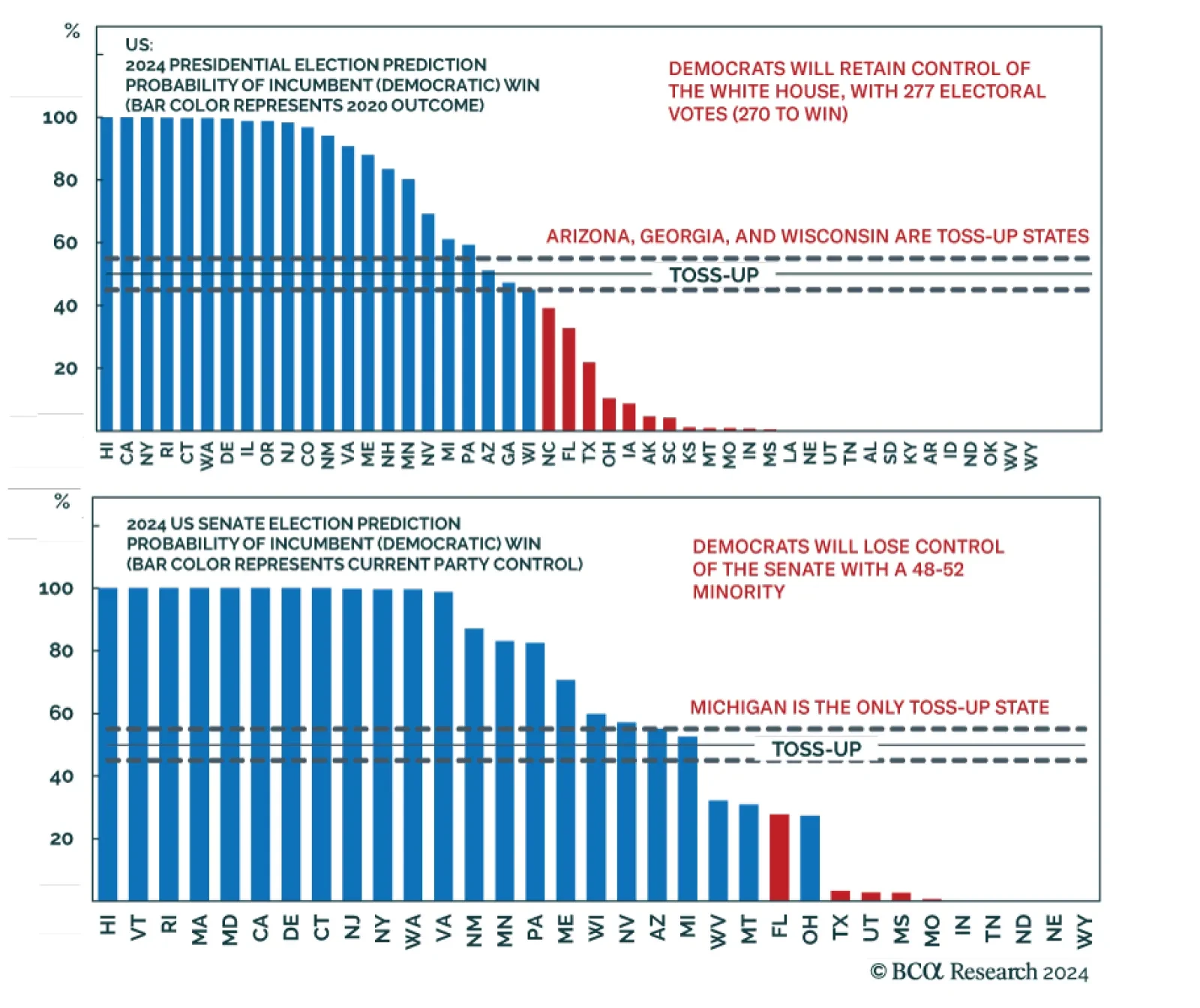

The US primary election is effectively over. The Biden-Trump rematch – our base case since 2022 – is all but set in stone. Only a health issue or freak incident could change that now.

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

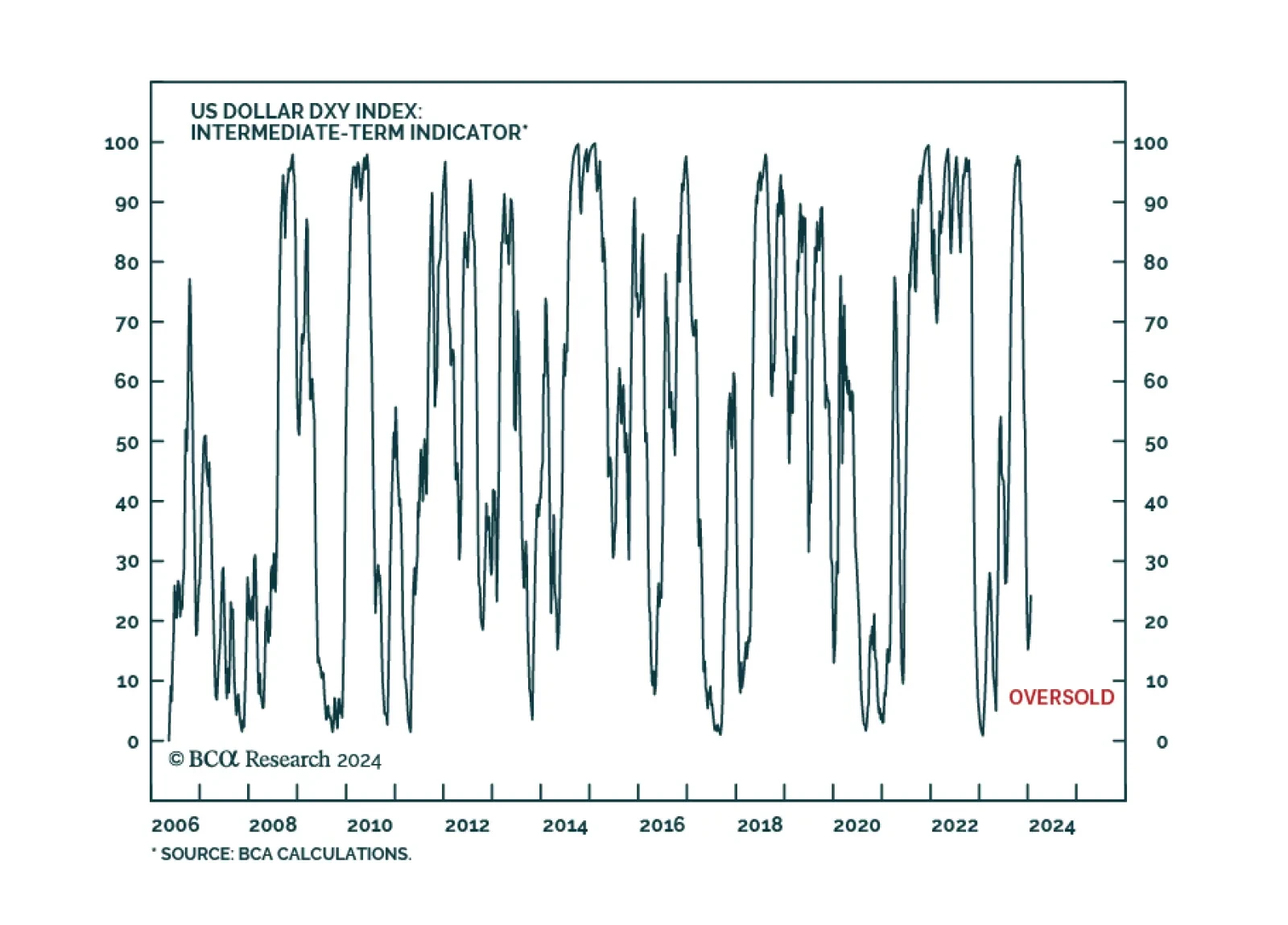

The US dollar has started the year on a strong note with the DXY gaining 2.6% since it bottomed on December 27. Multiple forces are behind this appreciation. Investors have been scaling back their expectations of Fed rate hikes…

According to BCA Research’s US Political Strategy service, Republicans are favored in the Senate, so if they win the White House they will control all of Congress. This is the critical asymmetry of the election since a…

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

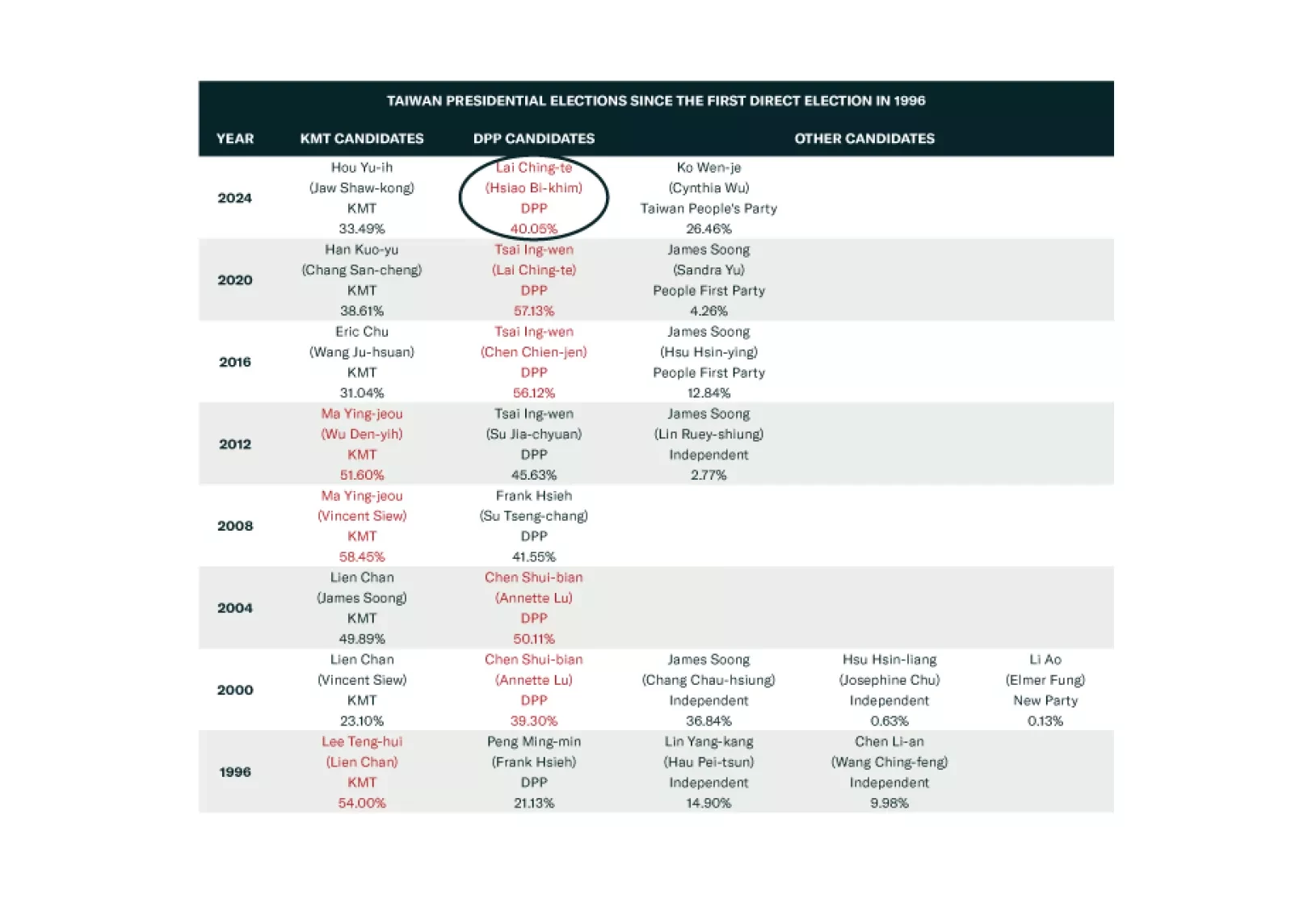

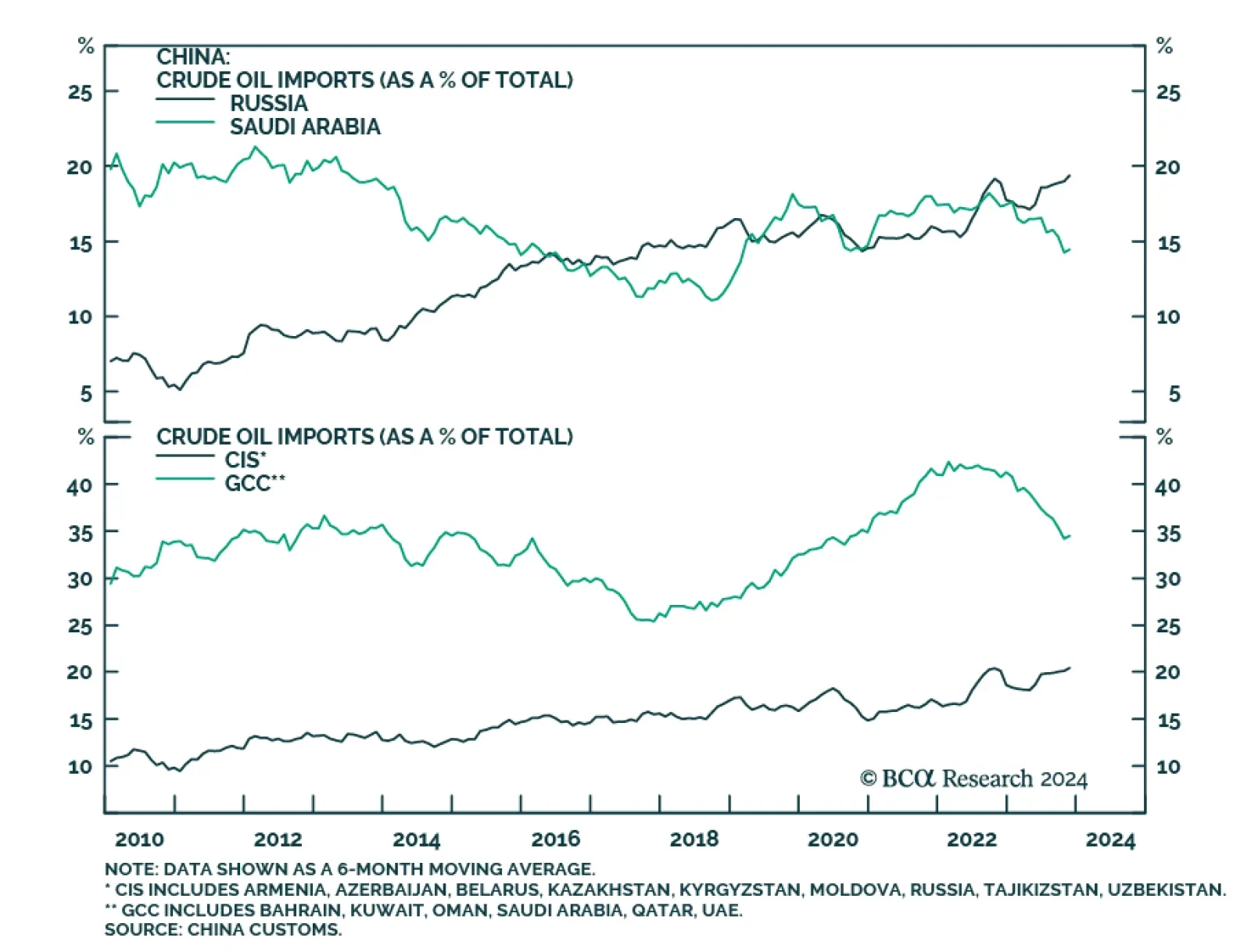

China will increase economic and military pressure on Taiwan but there is no basis for immediate full-scale war. That is the takeaway from the Taiwanese election on January 13, which returned the nominally pro-independence…

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.

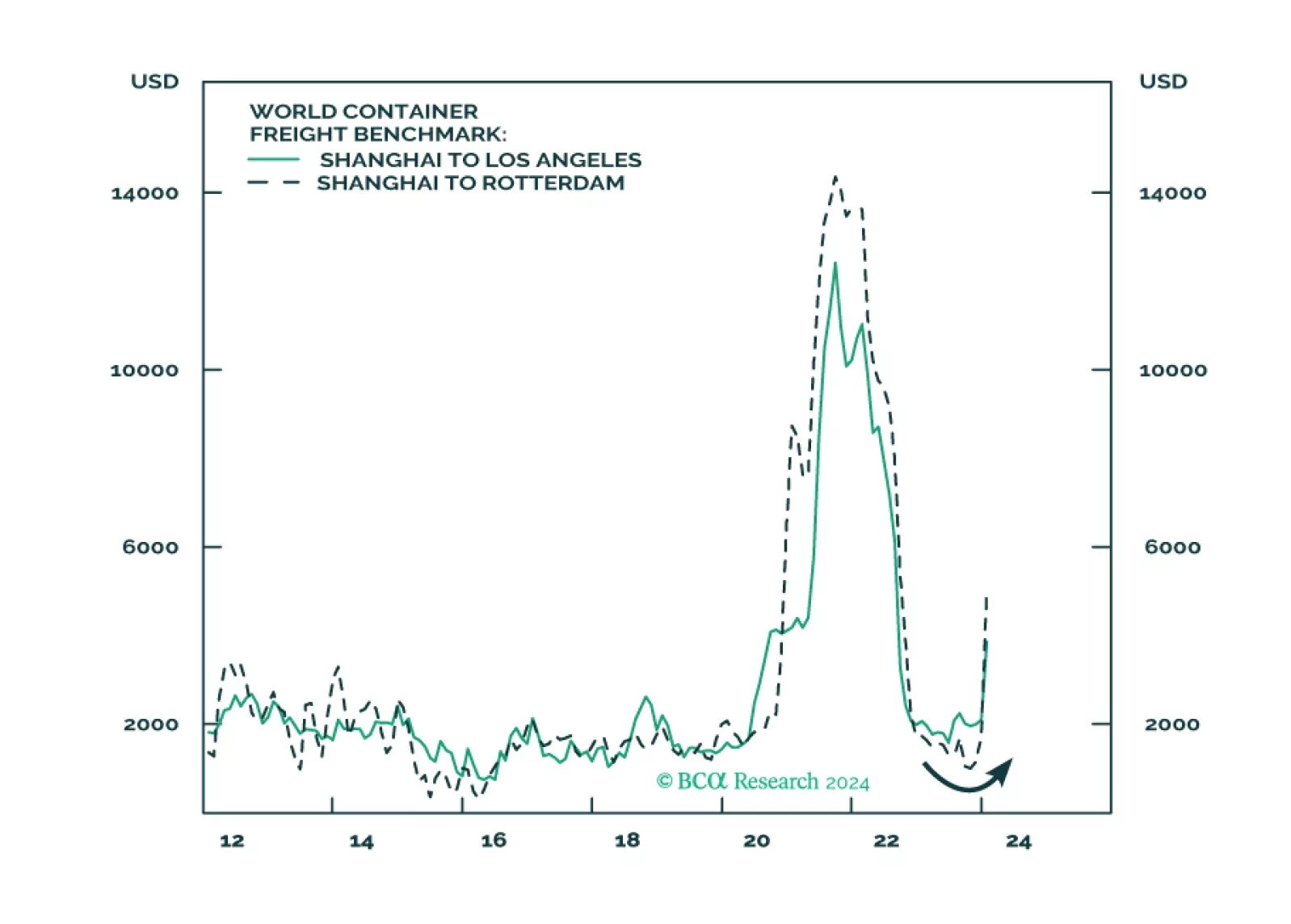

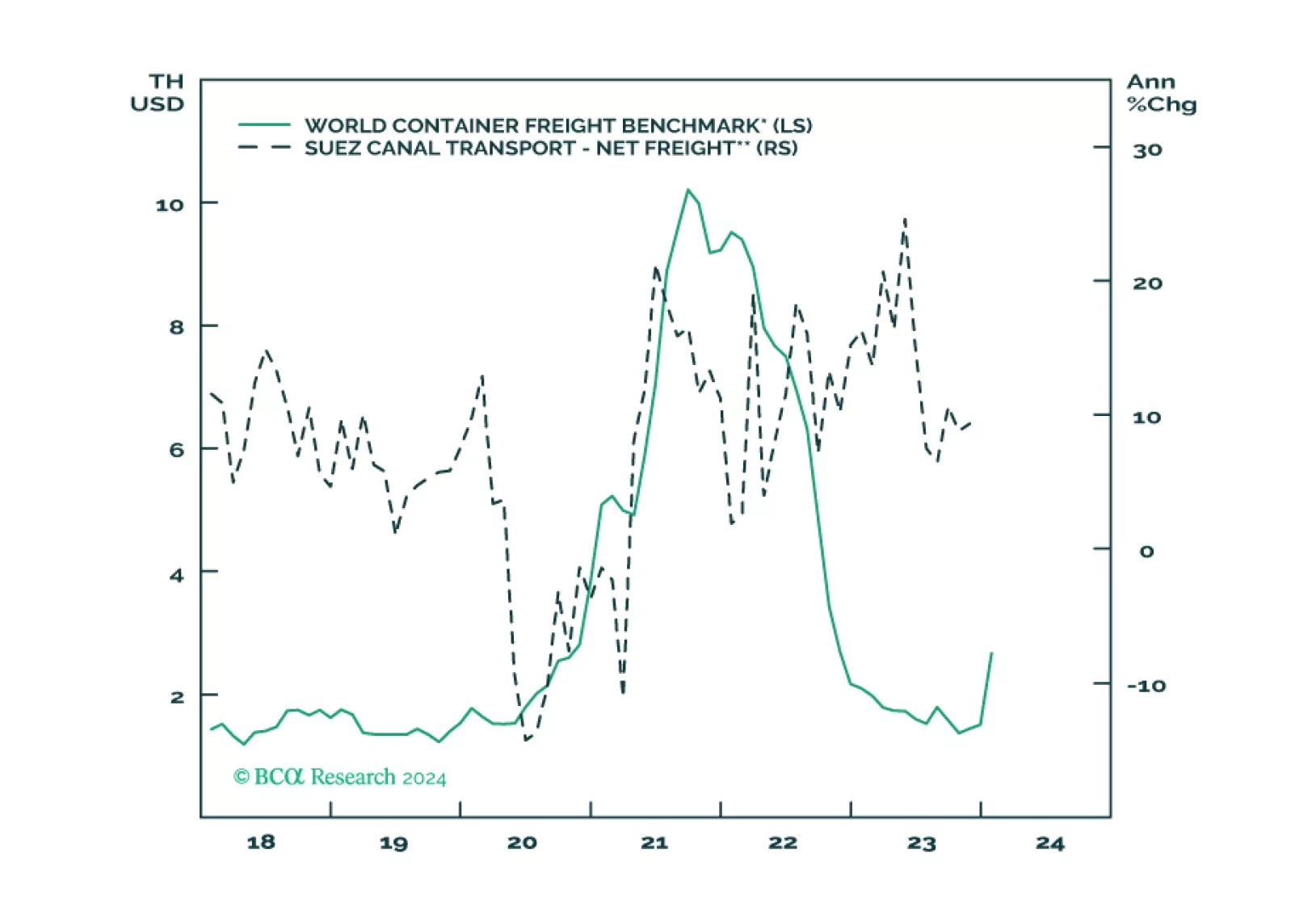

In this brief Insight we examine the expanding Middle East conflict and update the situation in the Taiwan Strait on the eve of elections. The Houthis are a distraction and China is not likely to invade Taiwan in the near term, but…