Democrats remain favored for reelection in 2024, which implies gridlock and policy status quo in 2025. That is not negative for stocks in the near term. However, economic, political, and geopolitical risks will escalate from here,…

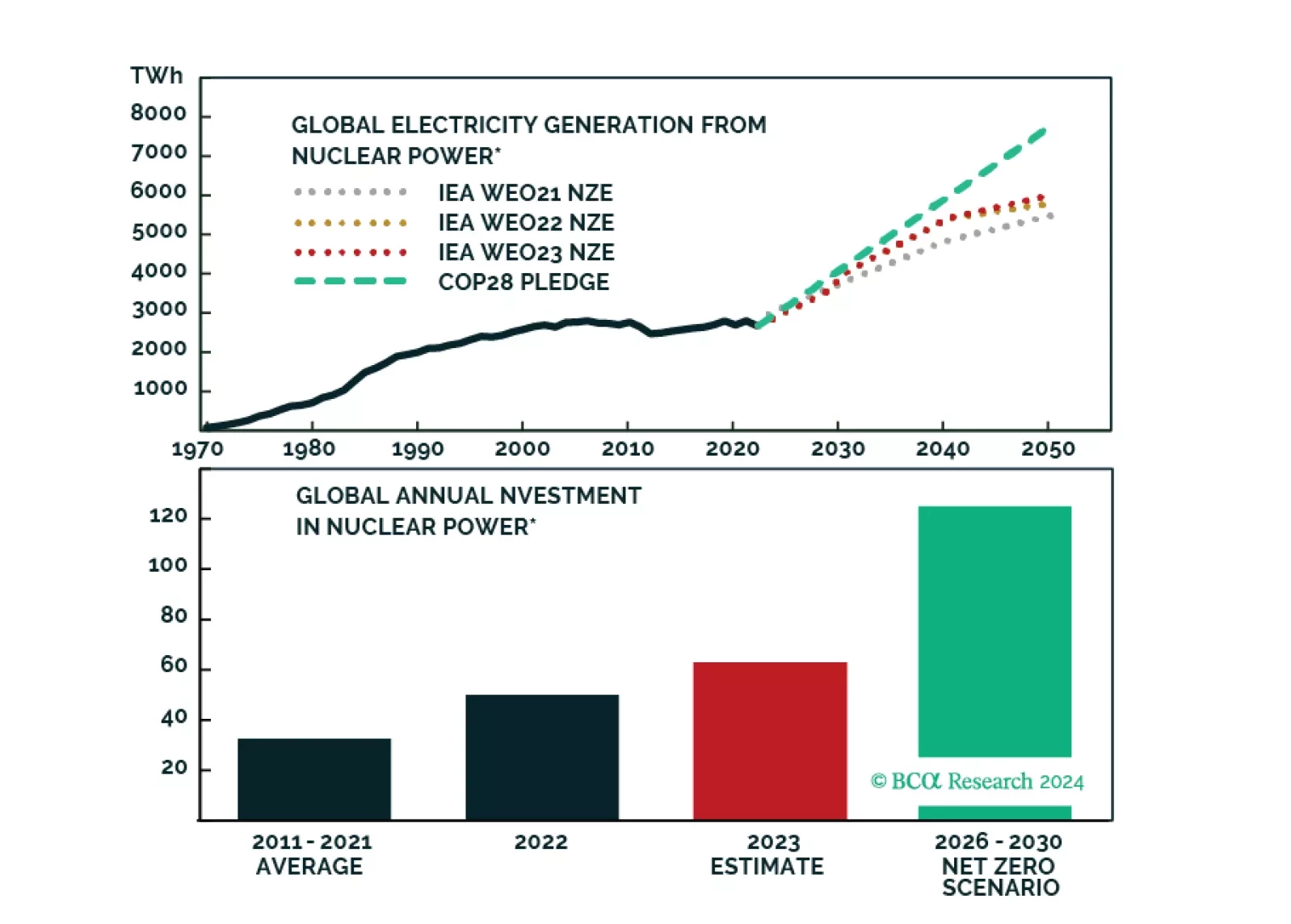

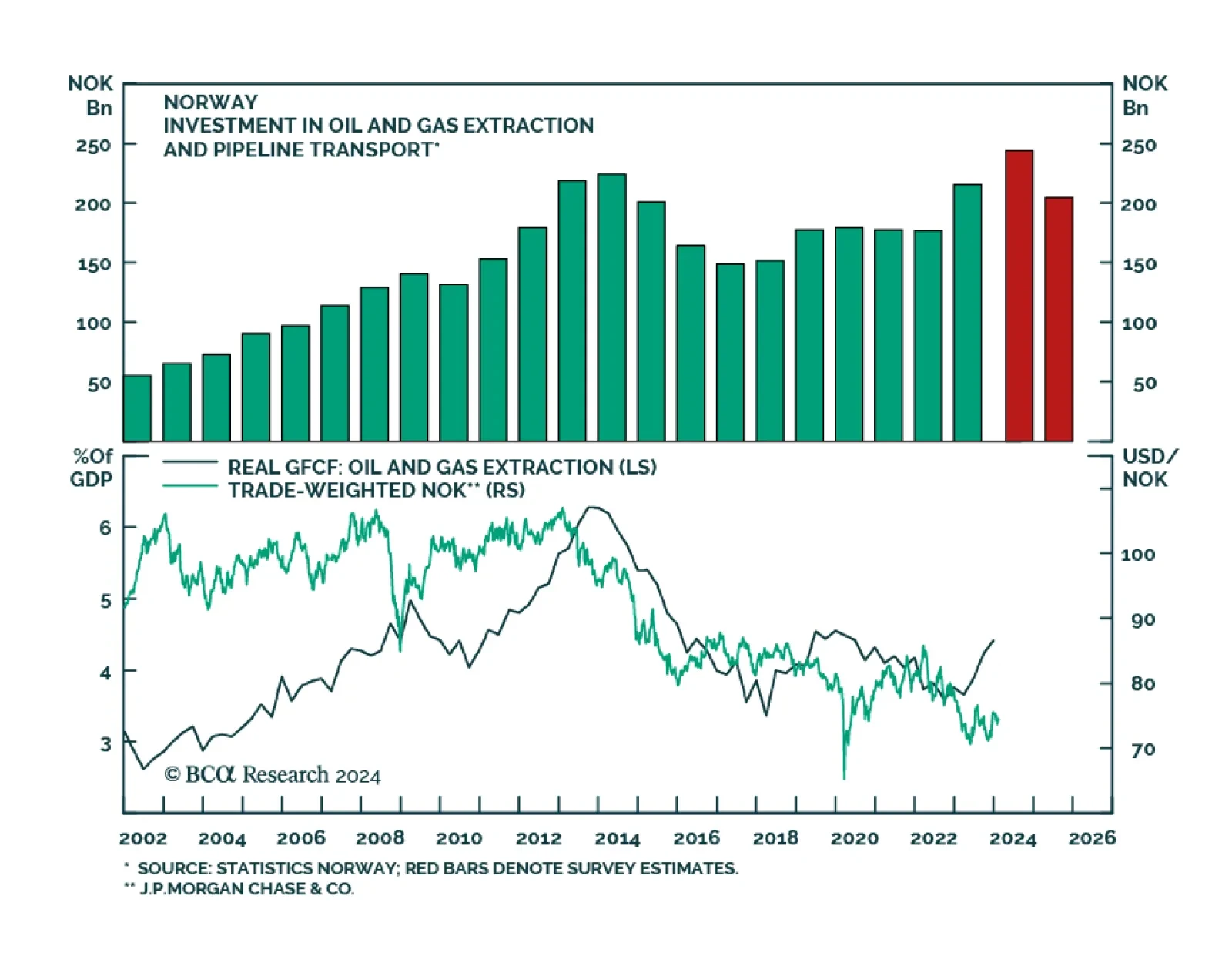

Energy security is a focus of many governments, especially since the onset of the Russia-Ukraine conflict. One producer that is benefitting from diversification away from Russian oil and gas is Norway. This is buffeting the trade…

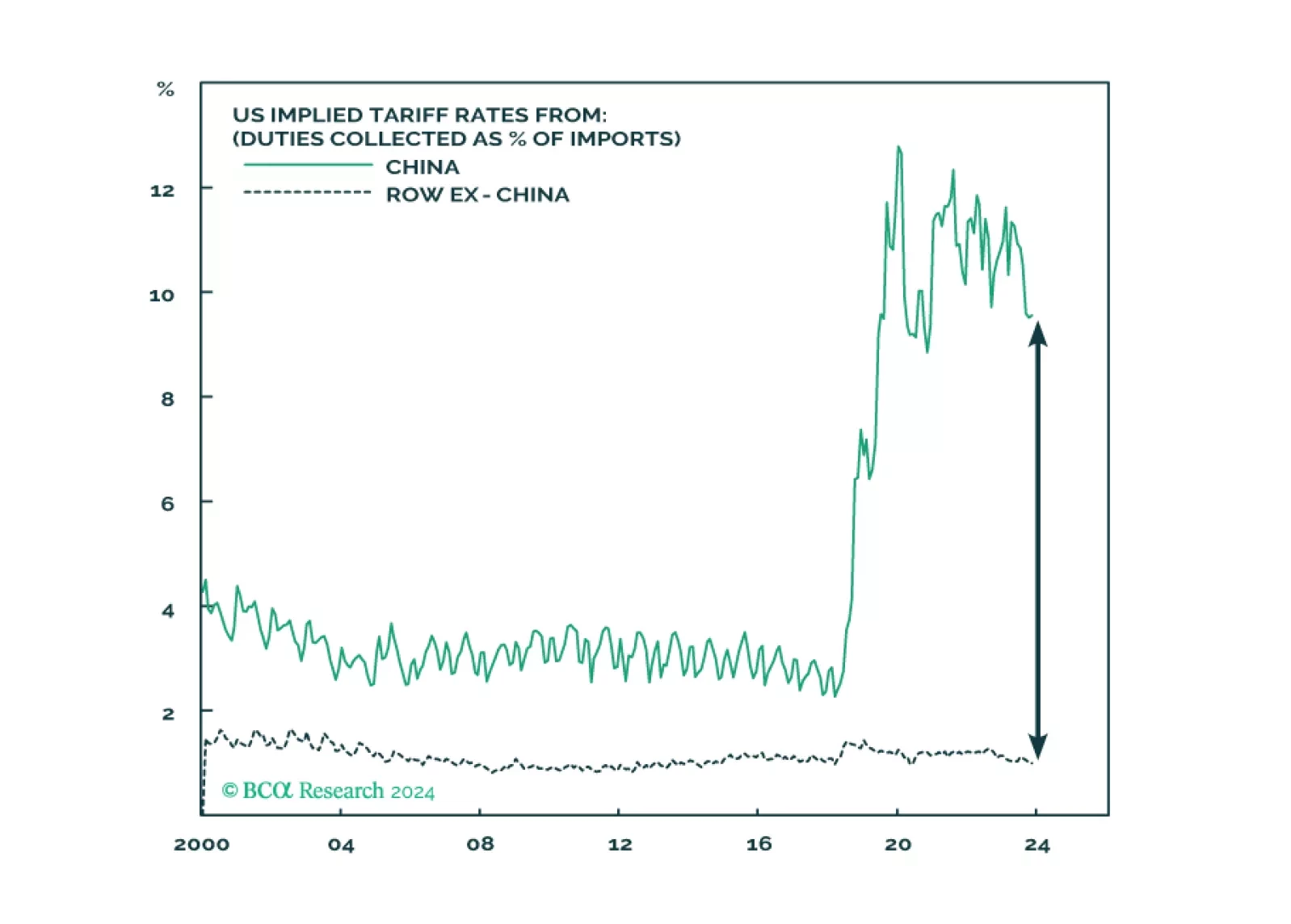

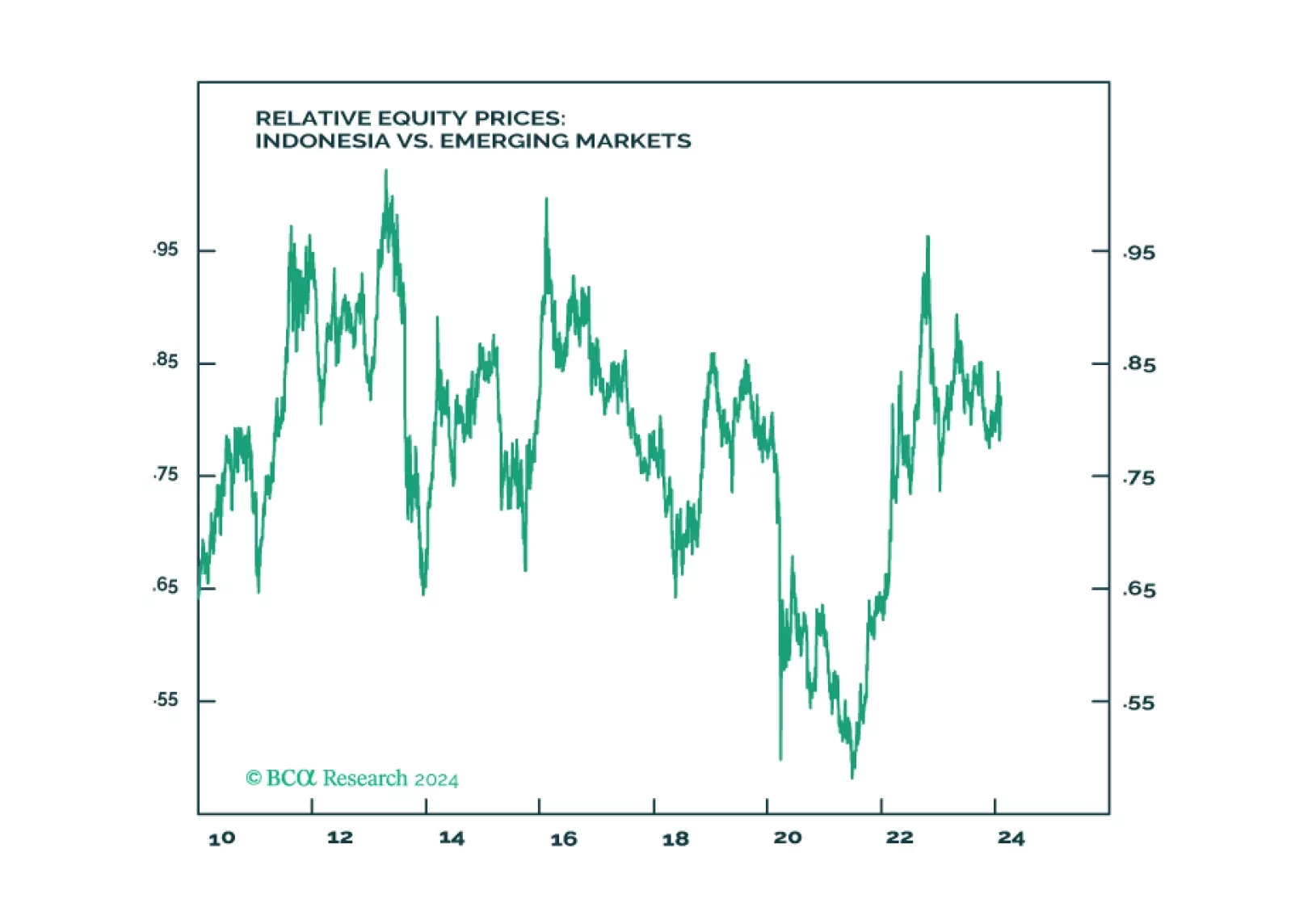

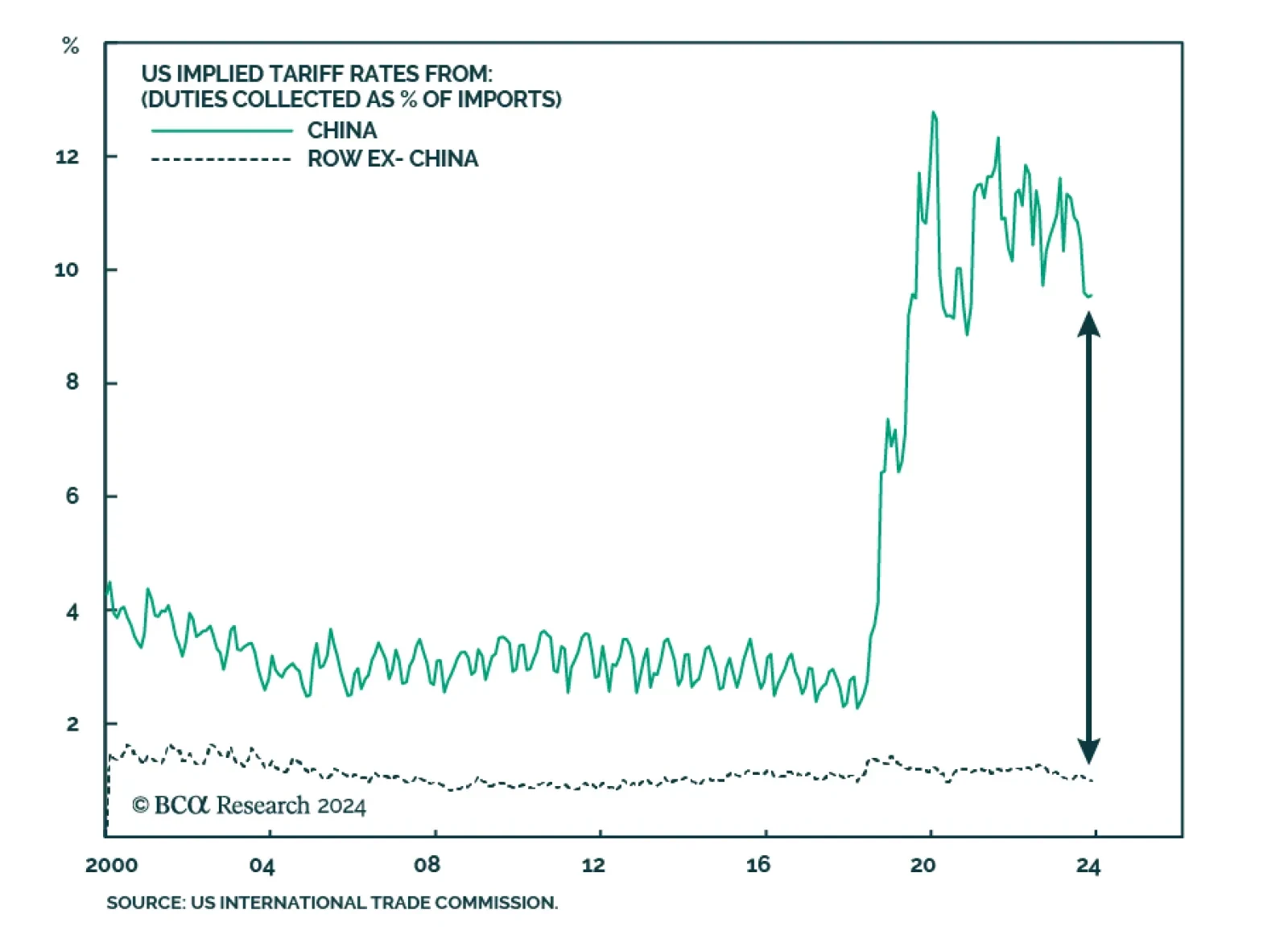

The Chinese economy continues to face deflationary pressures, reducing the odds that any intervention-driven rebound in equities will be sustained. In addition, our Geopolitical strategists have argued that US-China relations…

Since the pursuit of a nuclear deterrent makes it inevitable that the US and Israel will oppose Iran in the coming years, Iran must seize the initiative today. It cannot afford to assume that the Democratic Party will stay in…

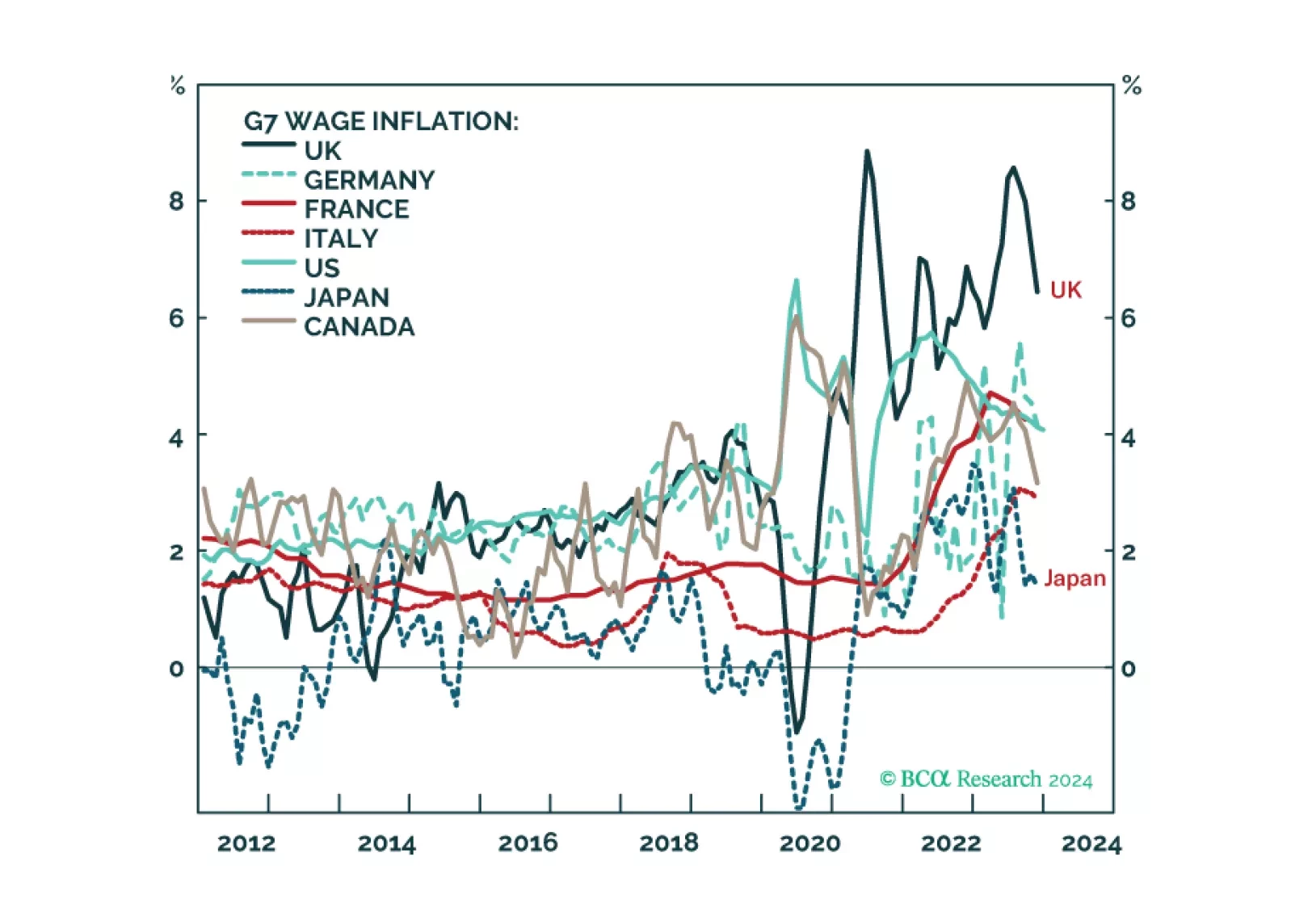

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…

According to BCA Research’s Geopolitical Strategy service there is more downside than upside for stocks and yields. Every year the team chooses their top five low-probability, high-impact events that could roil markets.…