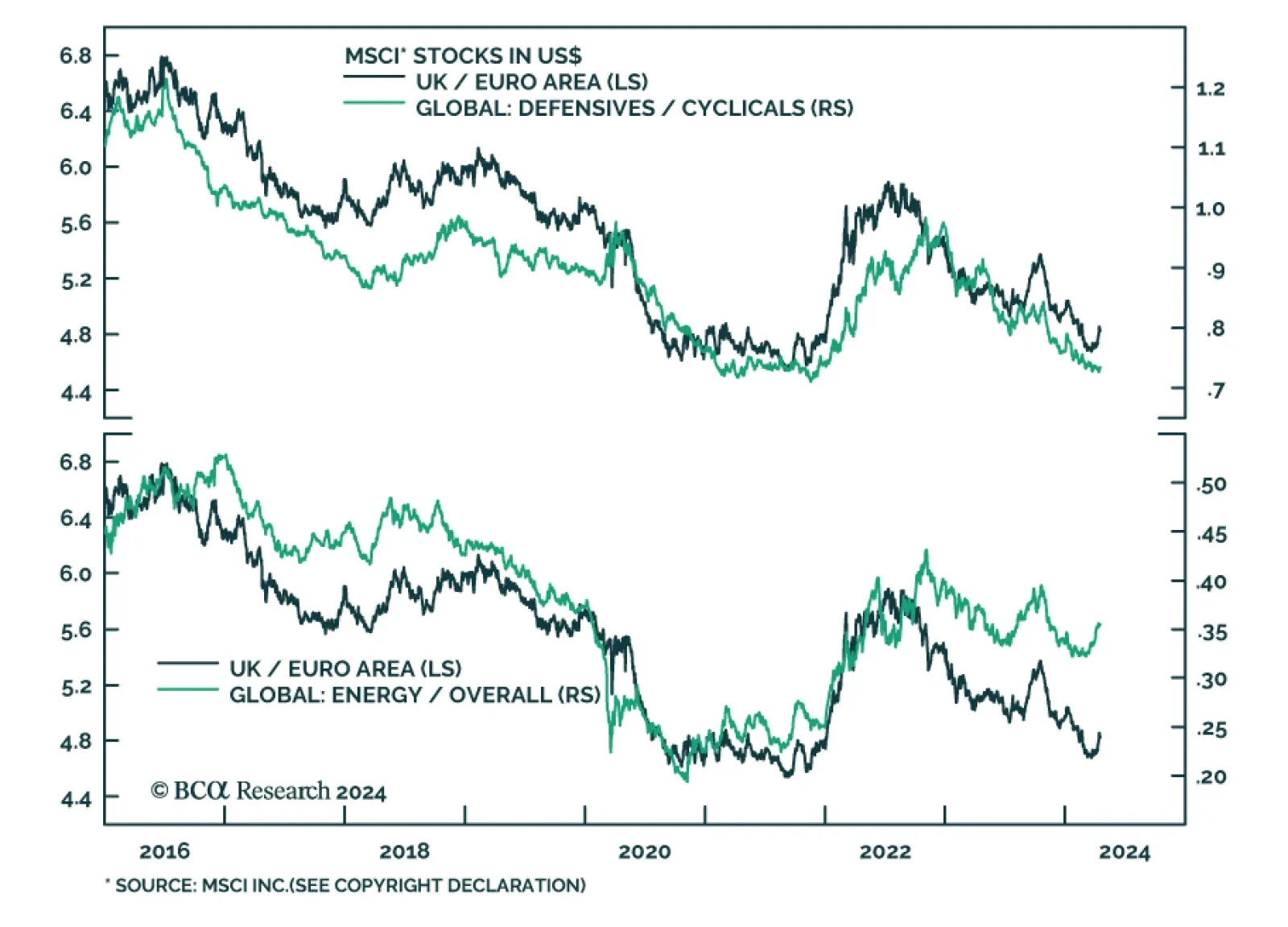

UK stocks posted one of the largest positive abnormal returns (z-score) among the major financial markets we tracked in March. The MSCI UK index has gained 2% relative to Eurozone stocks since late February. However, the…

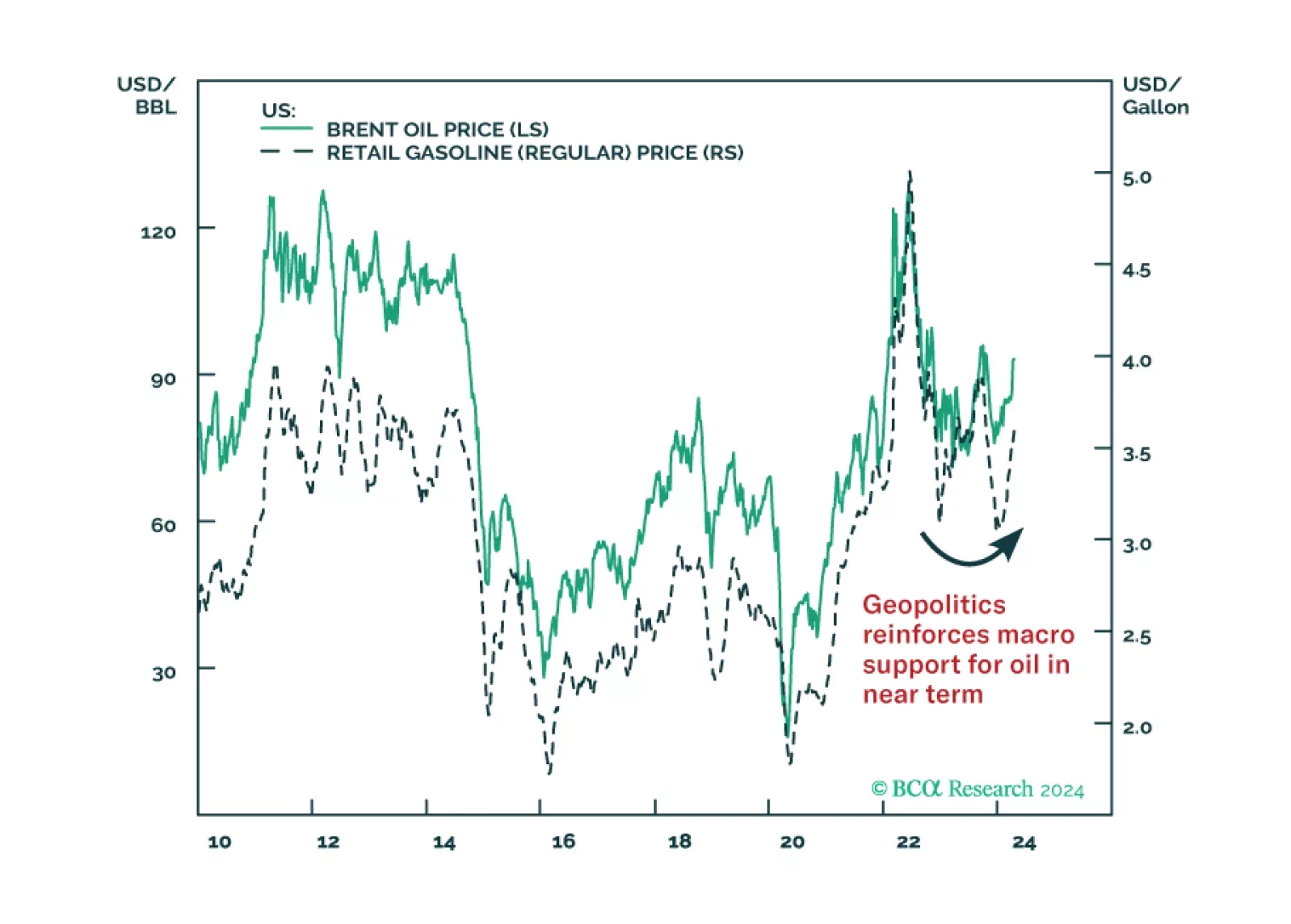

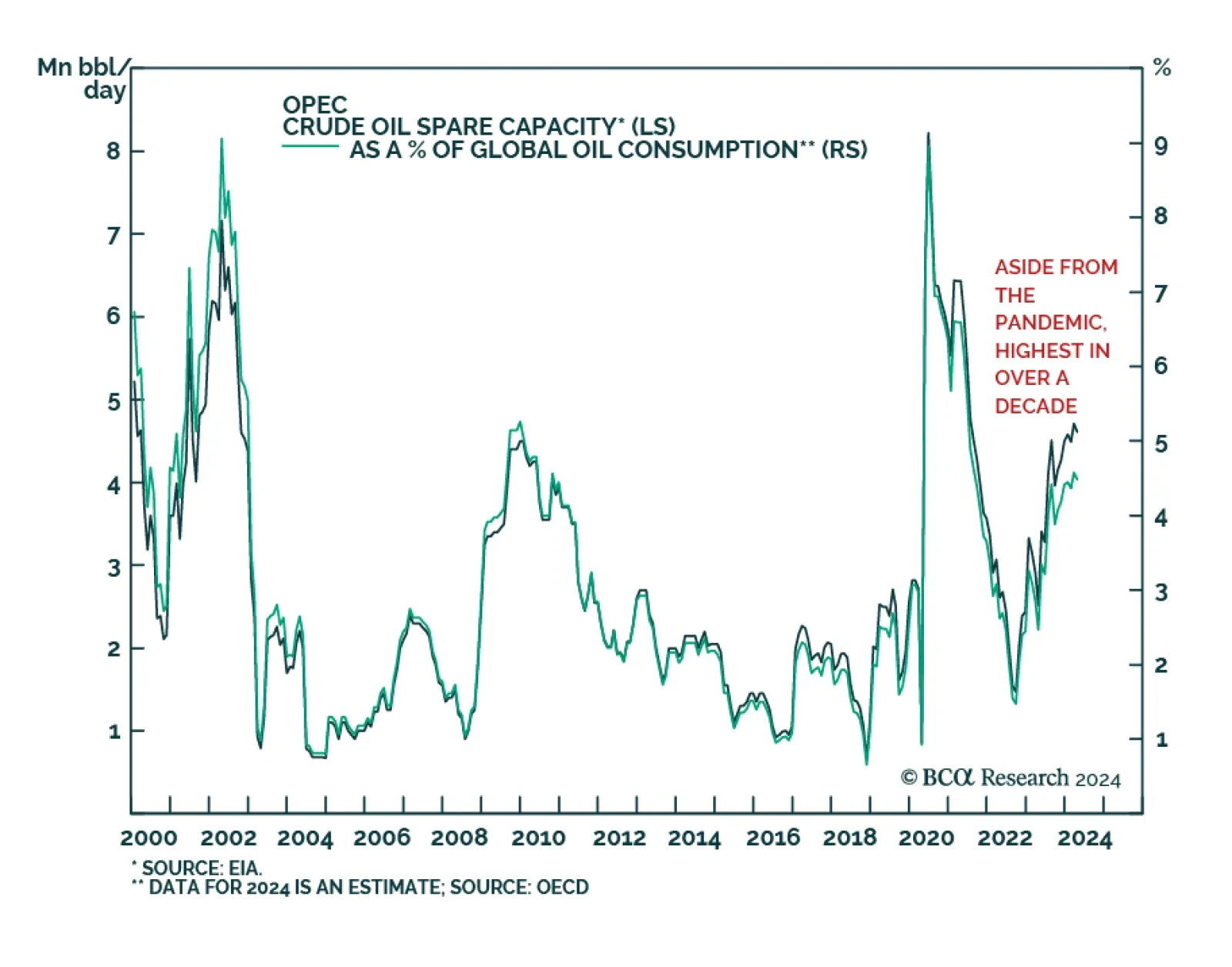

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

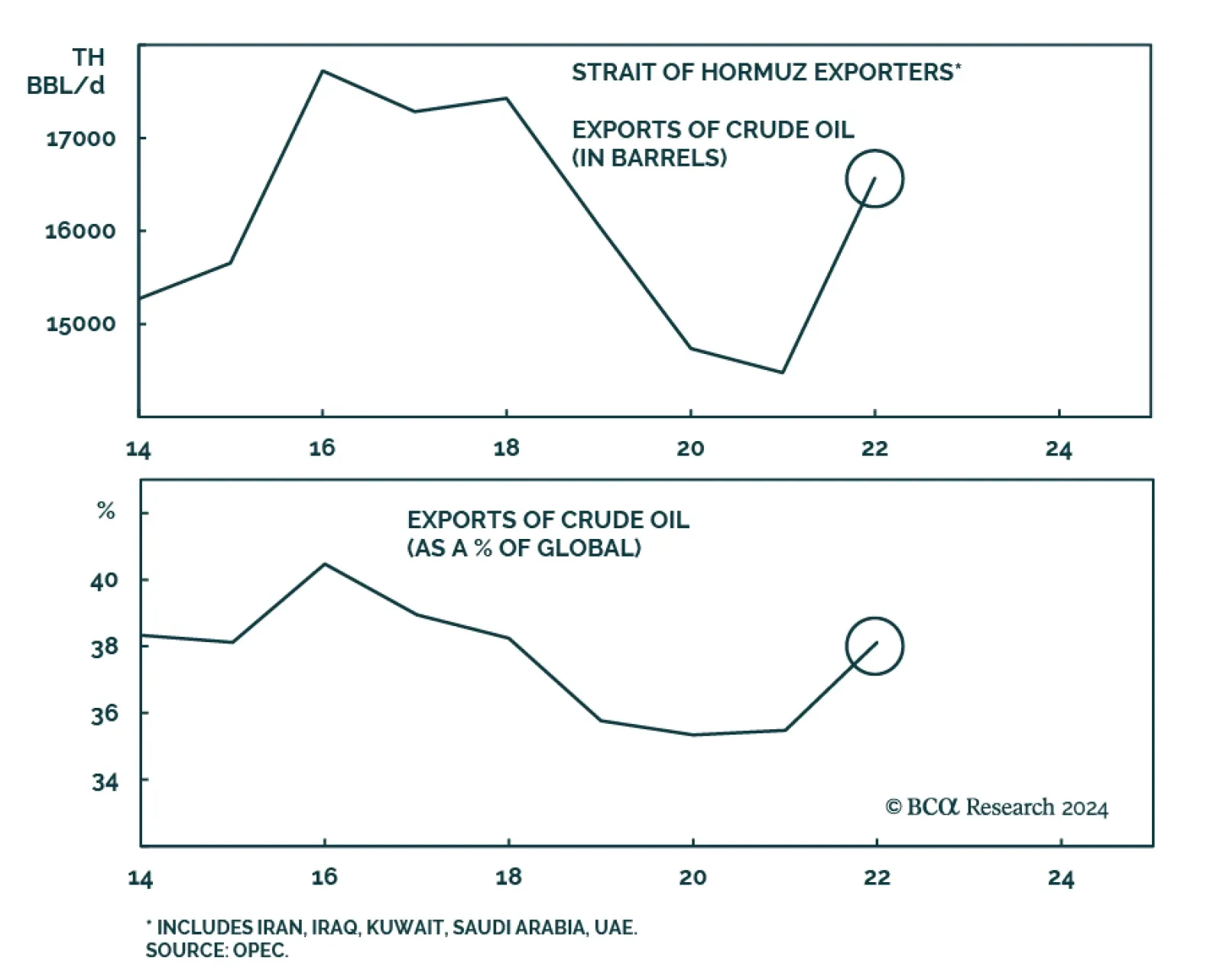

Financial markets appear unphased by the increase in Mideast tensions that occurred with Iran’s retaliatory attack on Israel over the weekend. Most notably, crude oil prices declined on Monday, suggesting that investors are…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

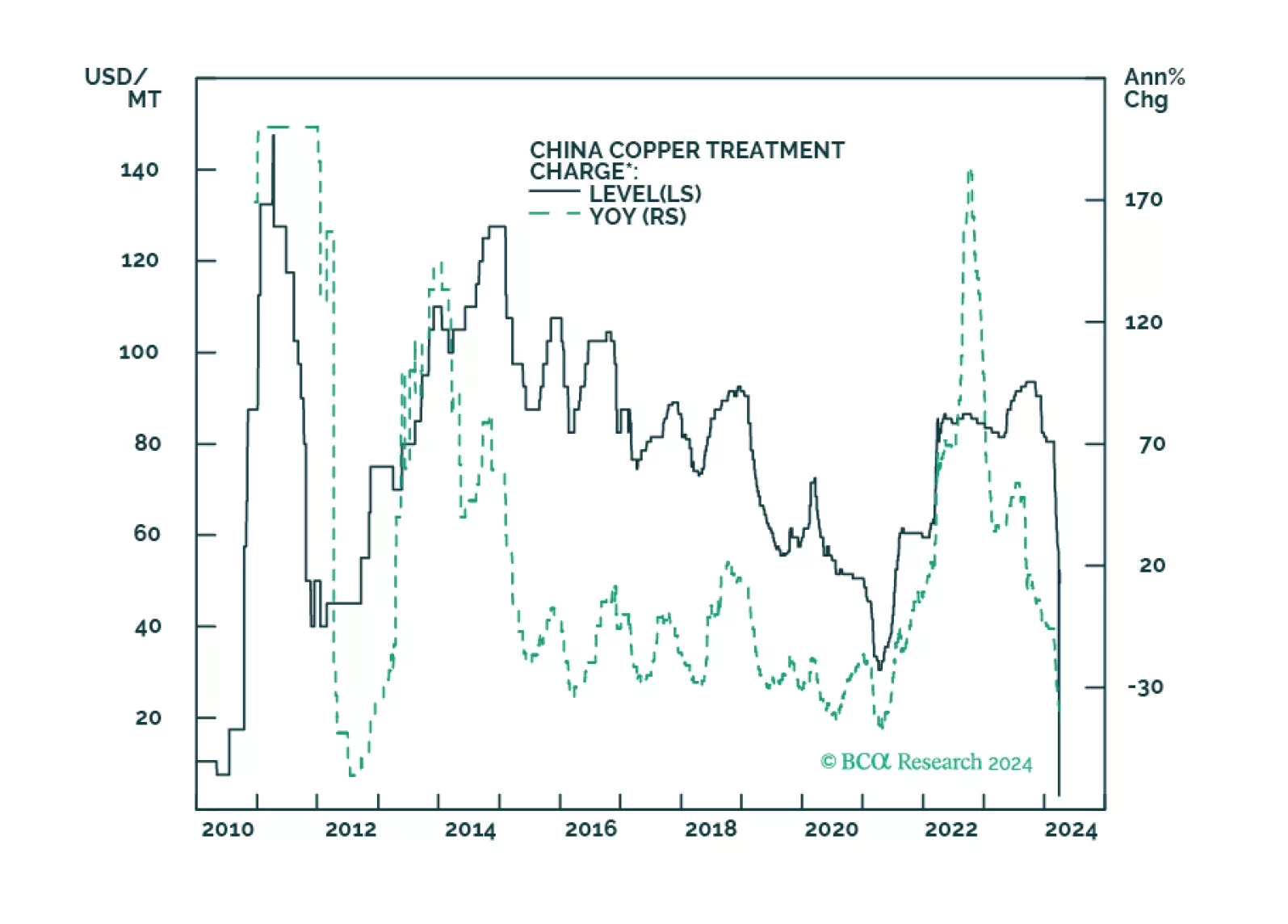

Copper markets are fast approaching a price breakout, as Chinese smelters scramble to find ore to meet increasing refined-copper demand in the wake of a global manufacturing rebound. We are holding fast to our expectation of $4.50/lb…

Oil prices surged over the past two days on the back of heightened geopolitical risks to supply following increased tensions in the Middle East. Both Iran’s Supreme Leader Ayatollah Ali Khamenei and President Ebrahim Raisi…

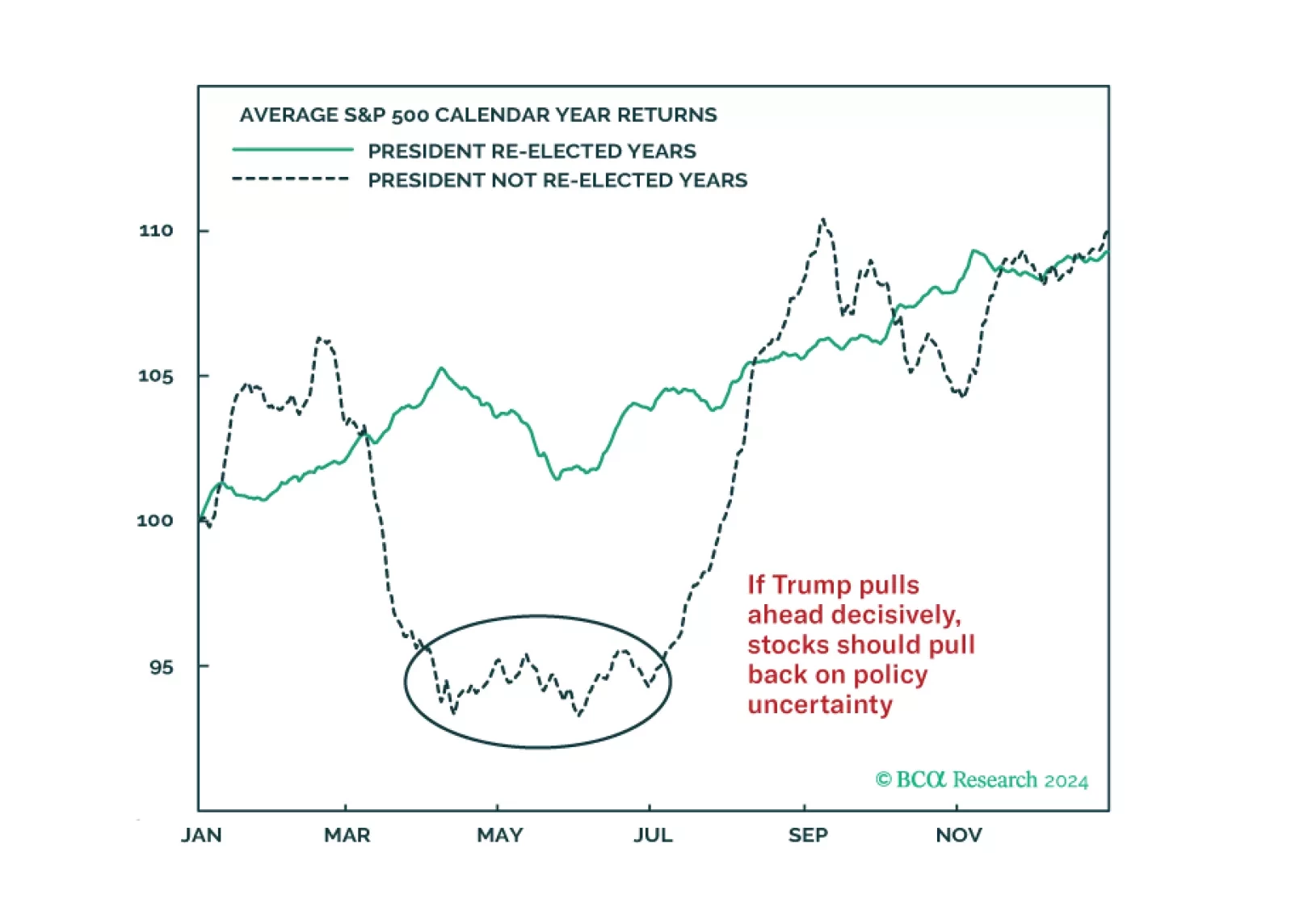

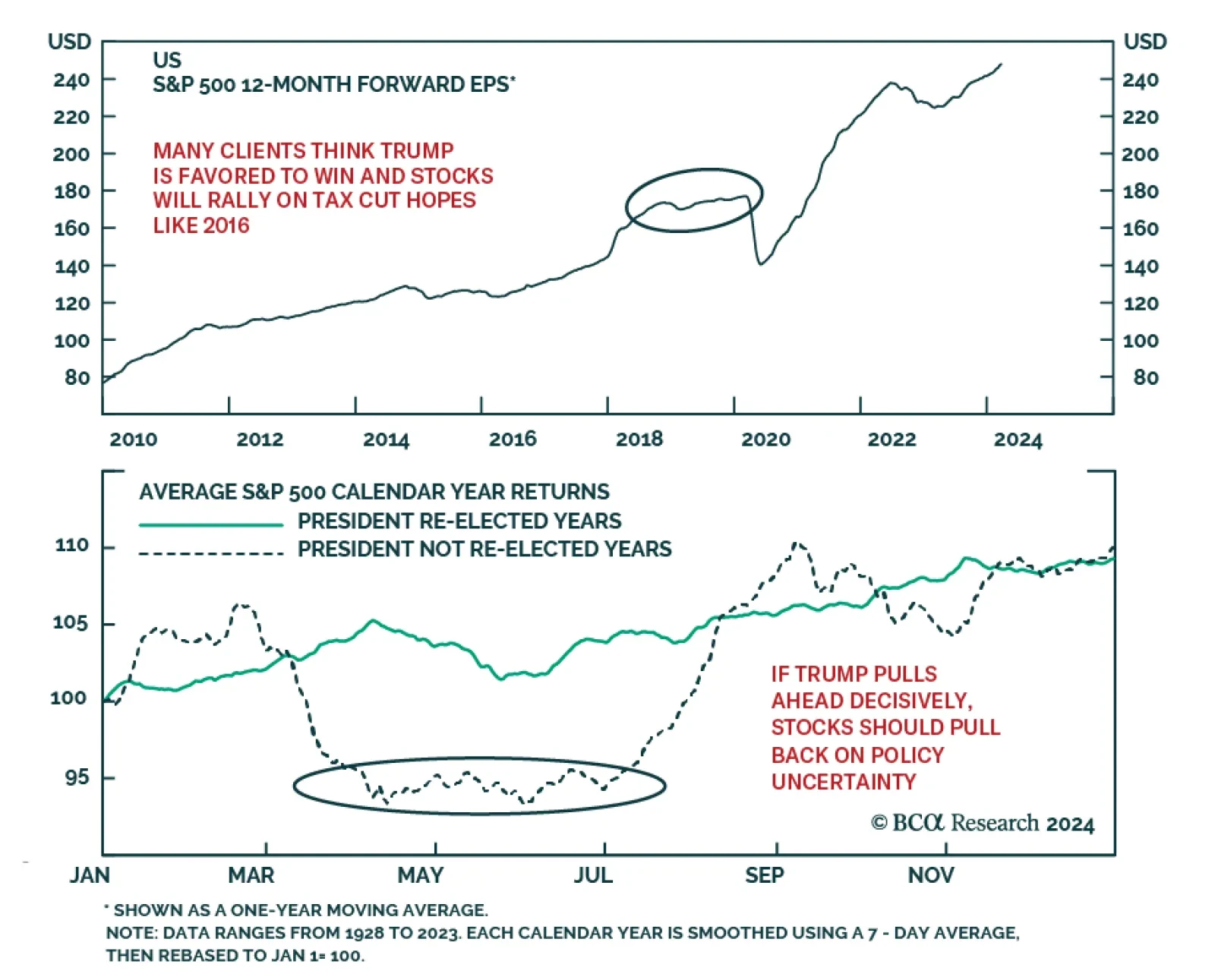

According to BCA Research’s Geopolitical Strategy service, Trump’s agenda is structurally inflationary and would eventually be needed to be discounted by markets, if he wins. Most retail investors – and many…

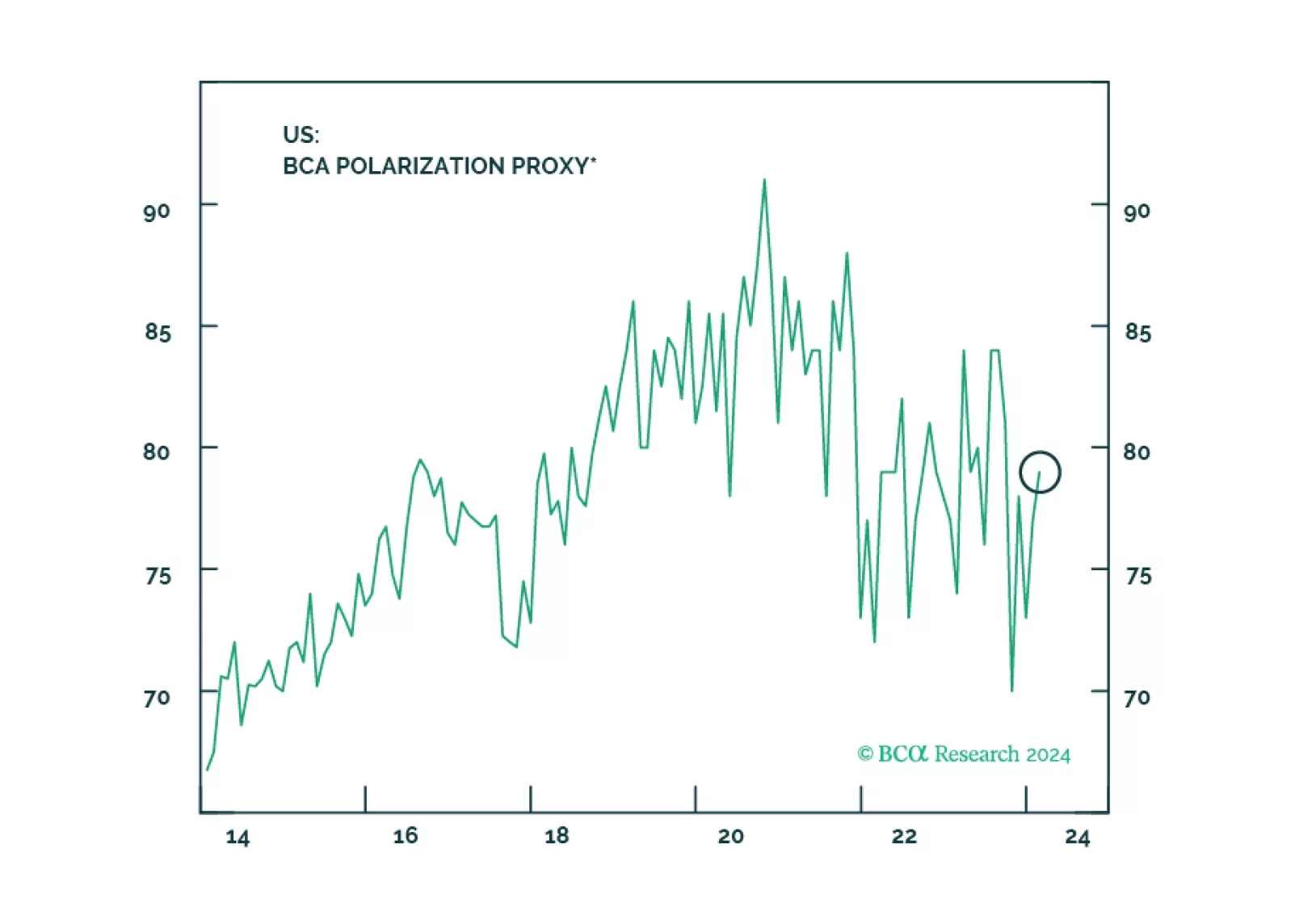

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

According to BCA Research’s US Political Strategy service, Biden’s domestic political actions are limited and in combination with the overbought and overpriced US equity market, Biden’s desperation, and the need…

The US Presidential election is eight months away. In this report, we will be looking at what is left of President Biden’s political capital and his room for actions in the next few months which may include market-negative actions…