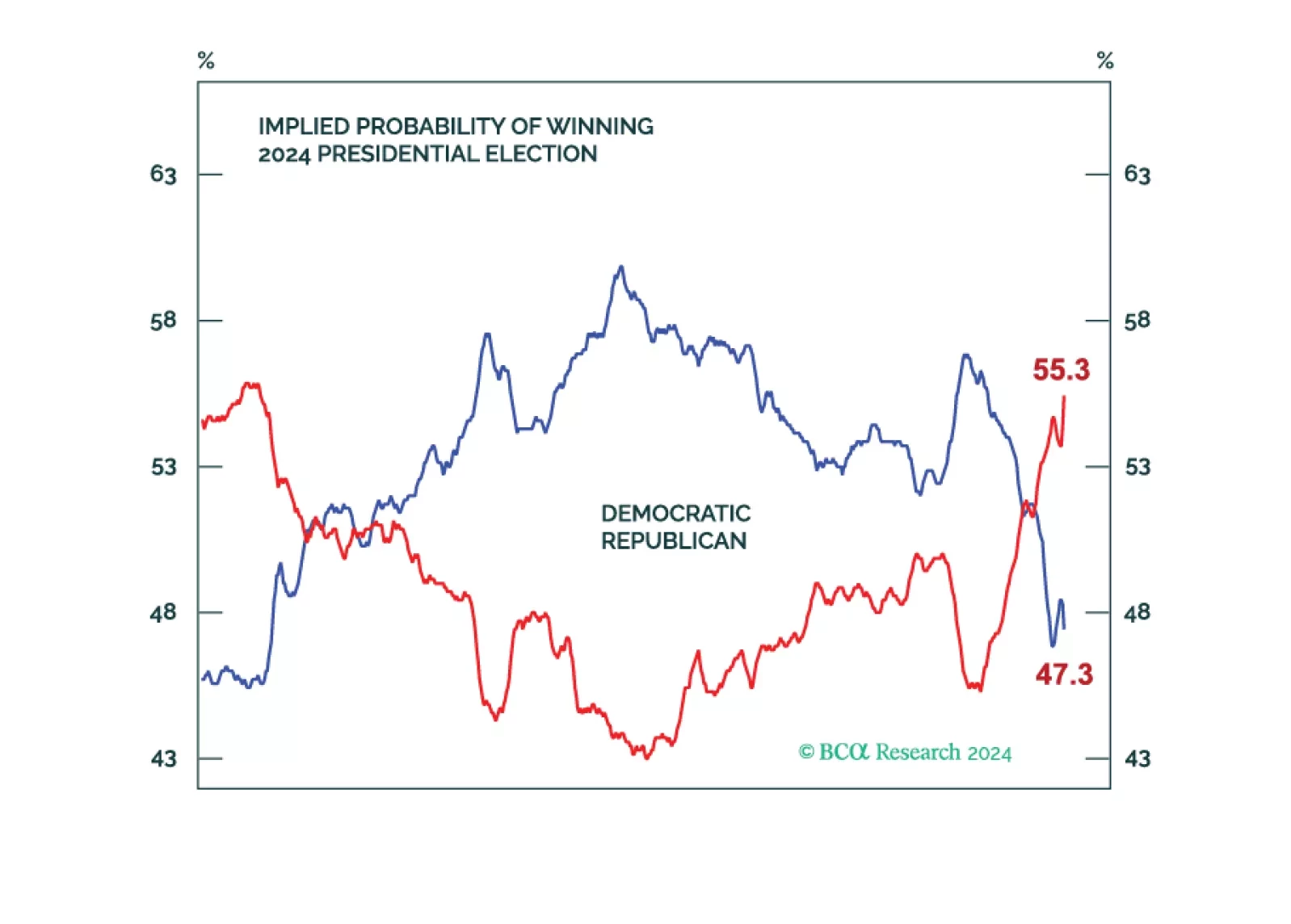

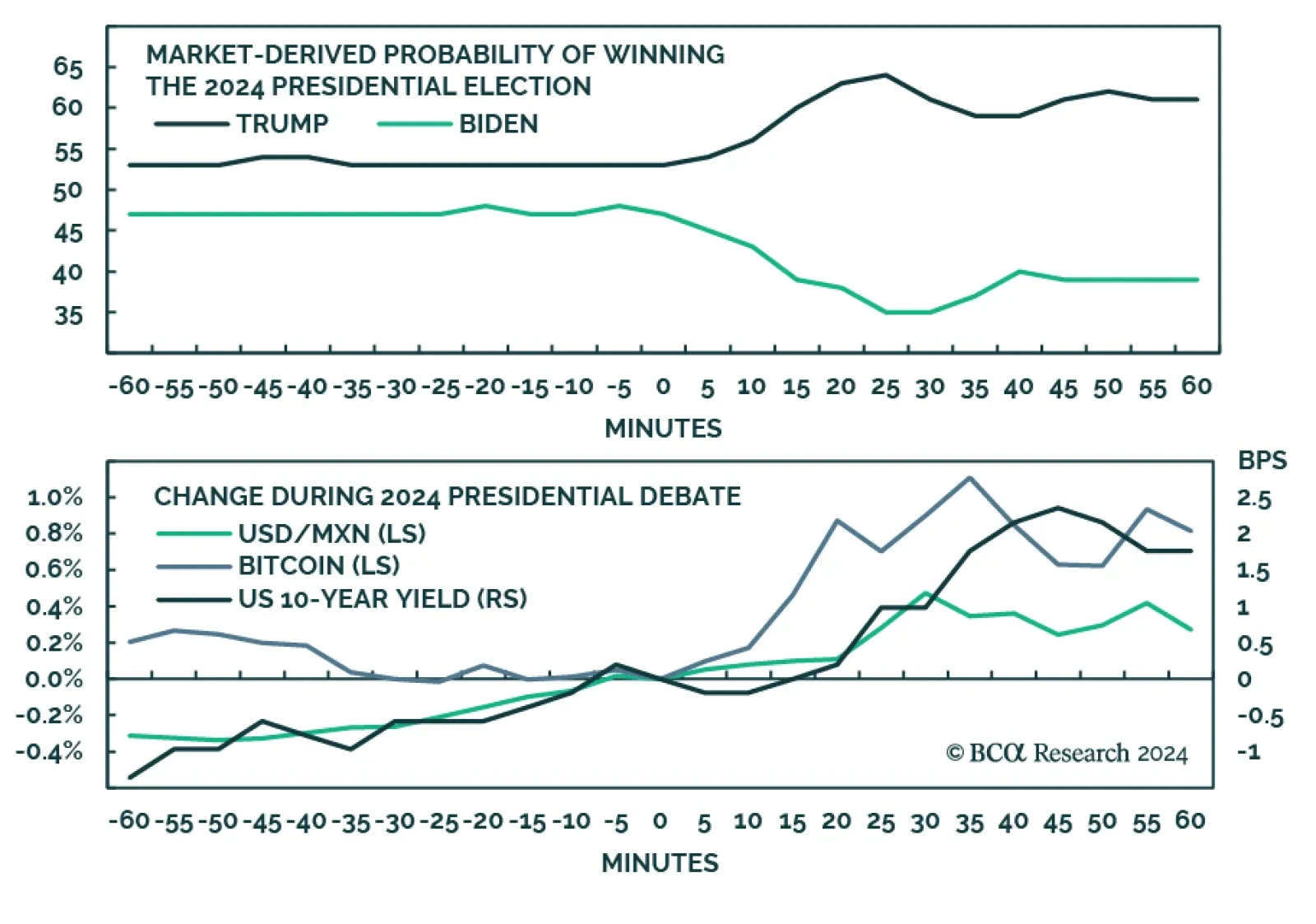

The first US presidential debate was held on Thursday. Betting markets were very quick to crown former president Trump the winner. Meanwhile, Biden’s chances to win fell off a cliff. The likelihood that he will not be the…

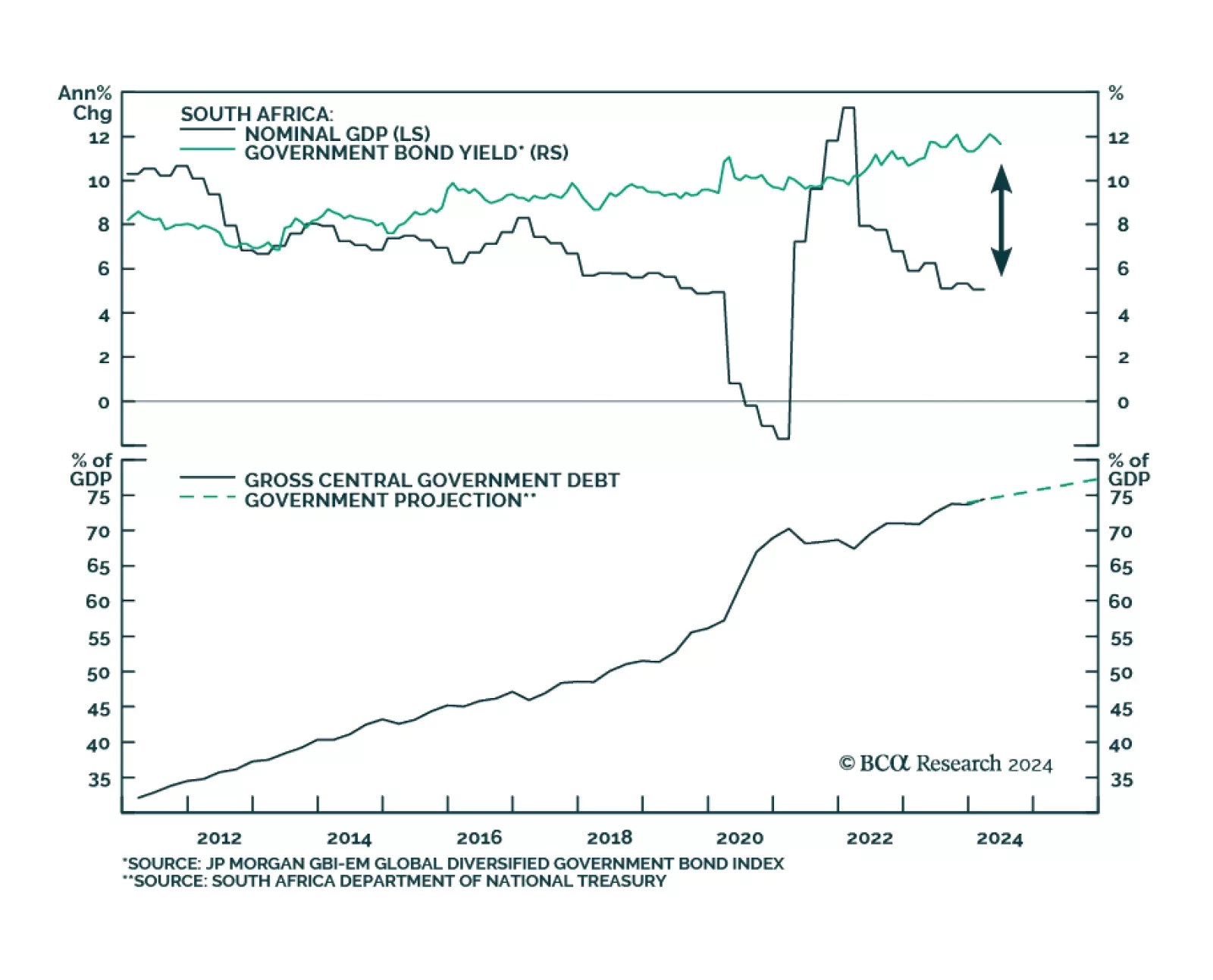

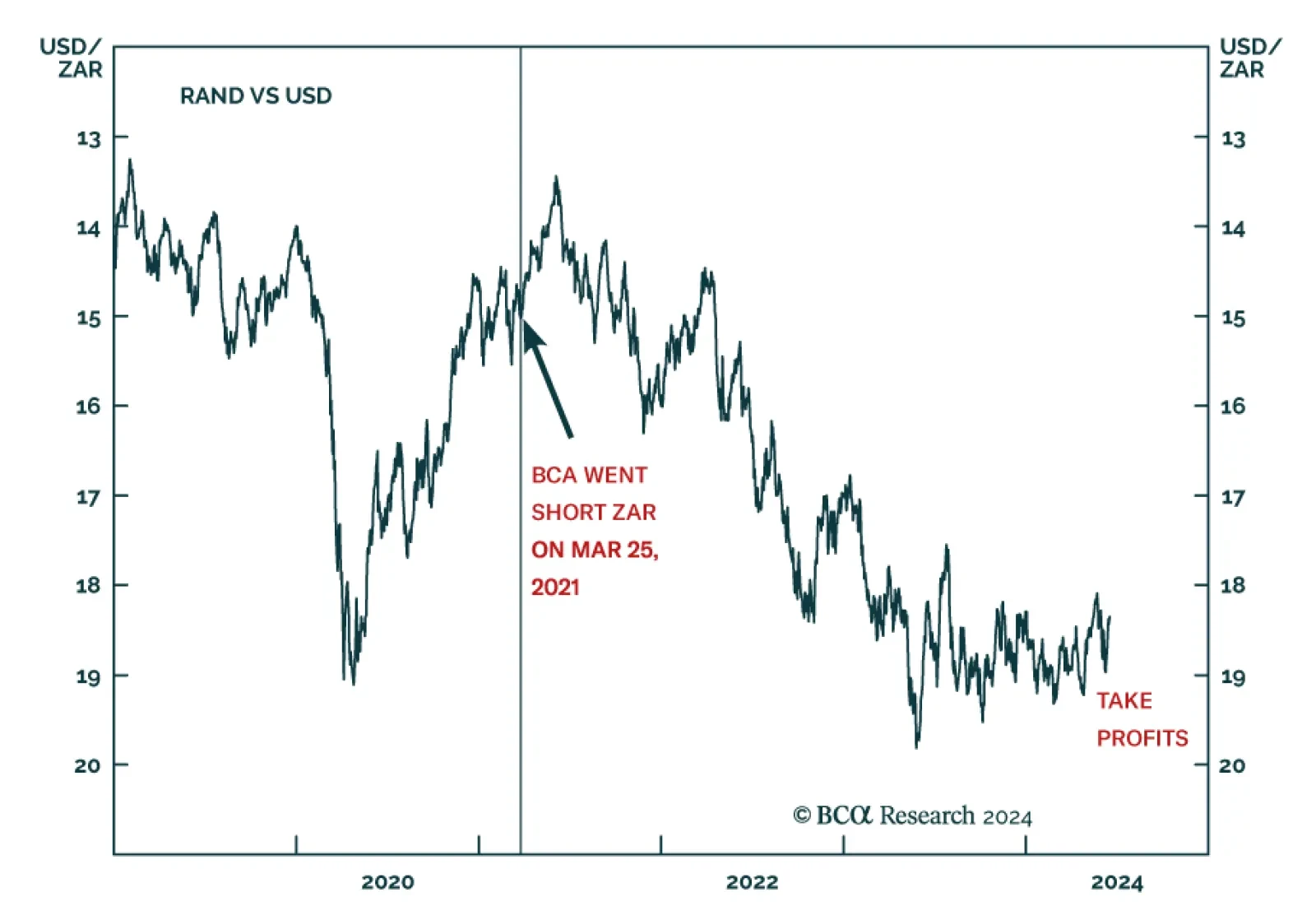

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

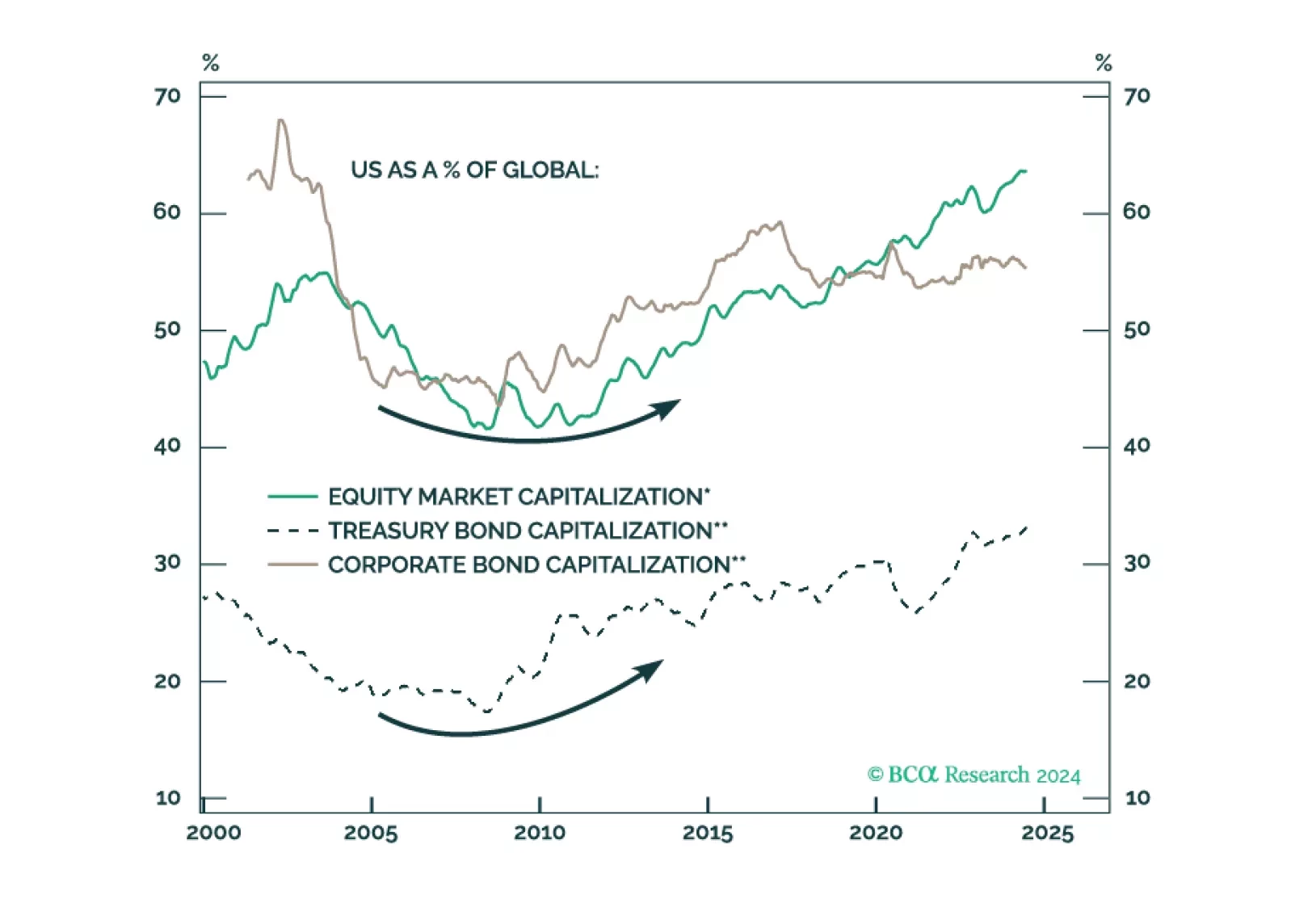

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

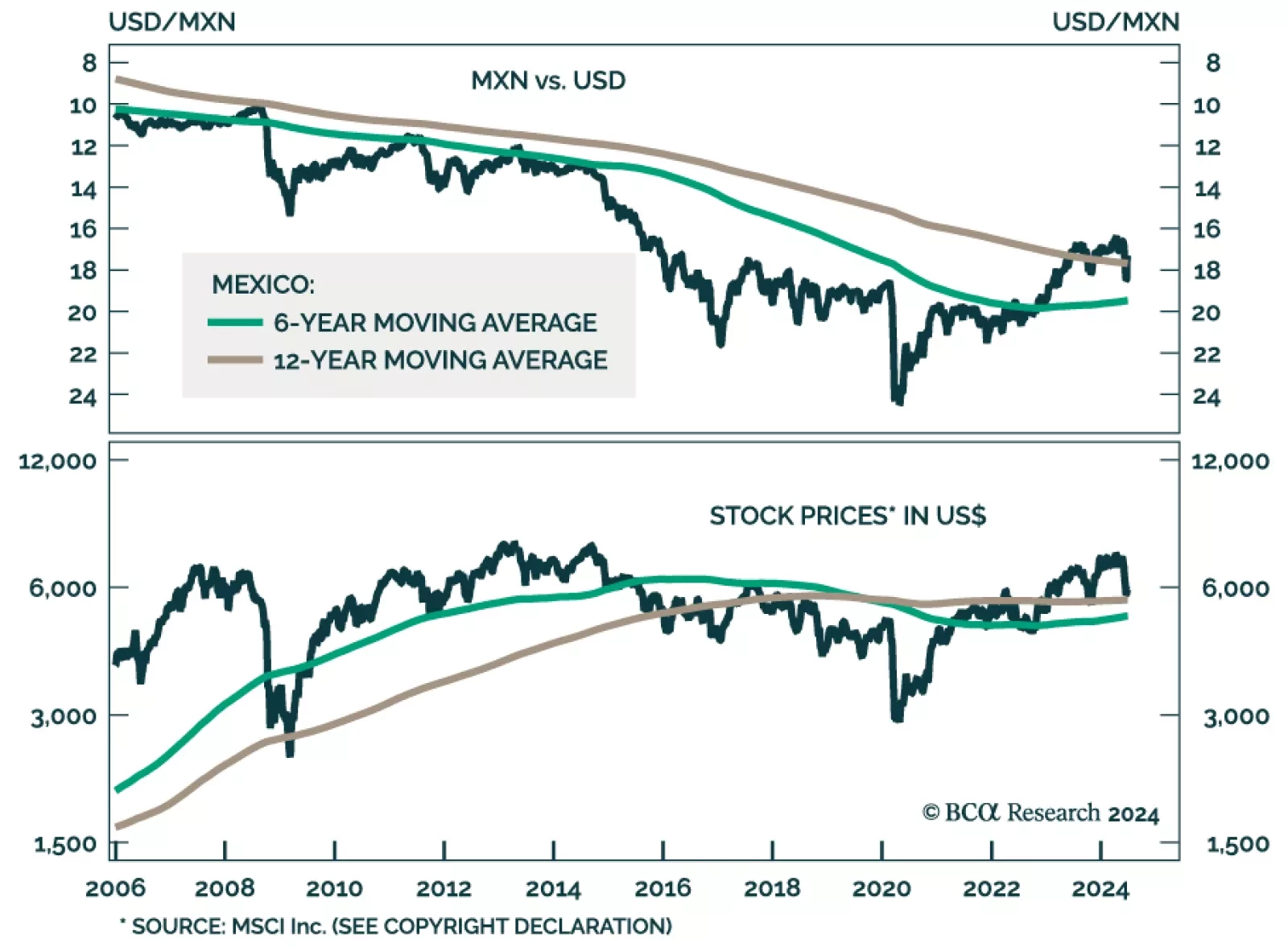

Mexico has gone from investor darling to massive underperformer within the EM space in the past month. In the eyes of our Emerging Markets Strategy team, the near-term outlook for Mexican risk assets remains poor in absolute…

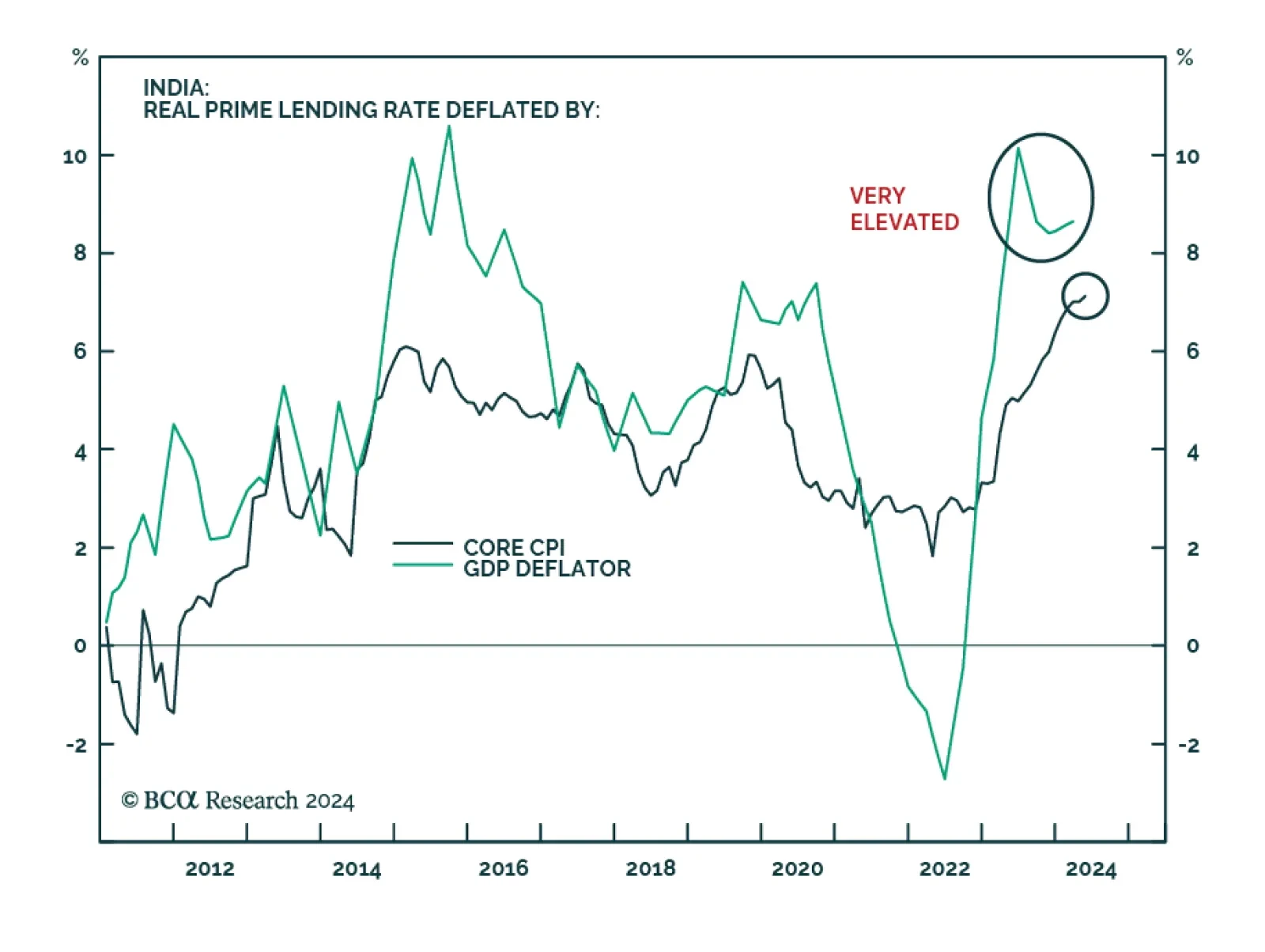

BCA Research’s Emerging Markets Strategy team posits that the BJP's loss of majority in India’s parliament could be a blessing in disguise for India. The new BJP-led coalition with the National Democratic…

According to BCA Research’s Geopolitical Strategy service, the South African election presents a window of opportunity for productivity-boosting structural reforms, such as privatization, to coincide with monetary and…

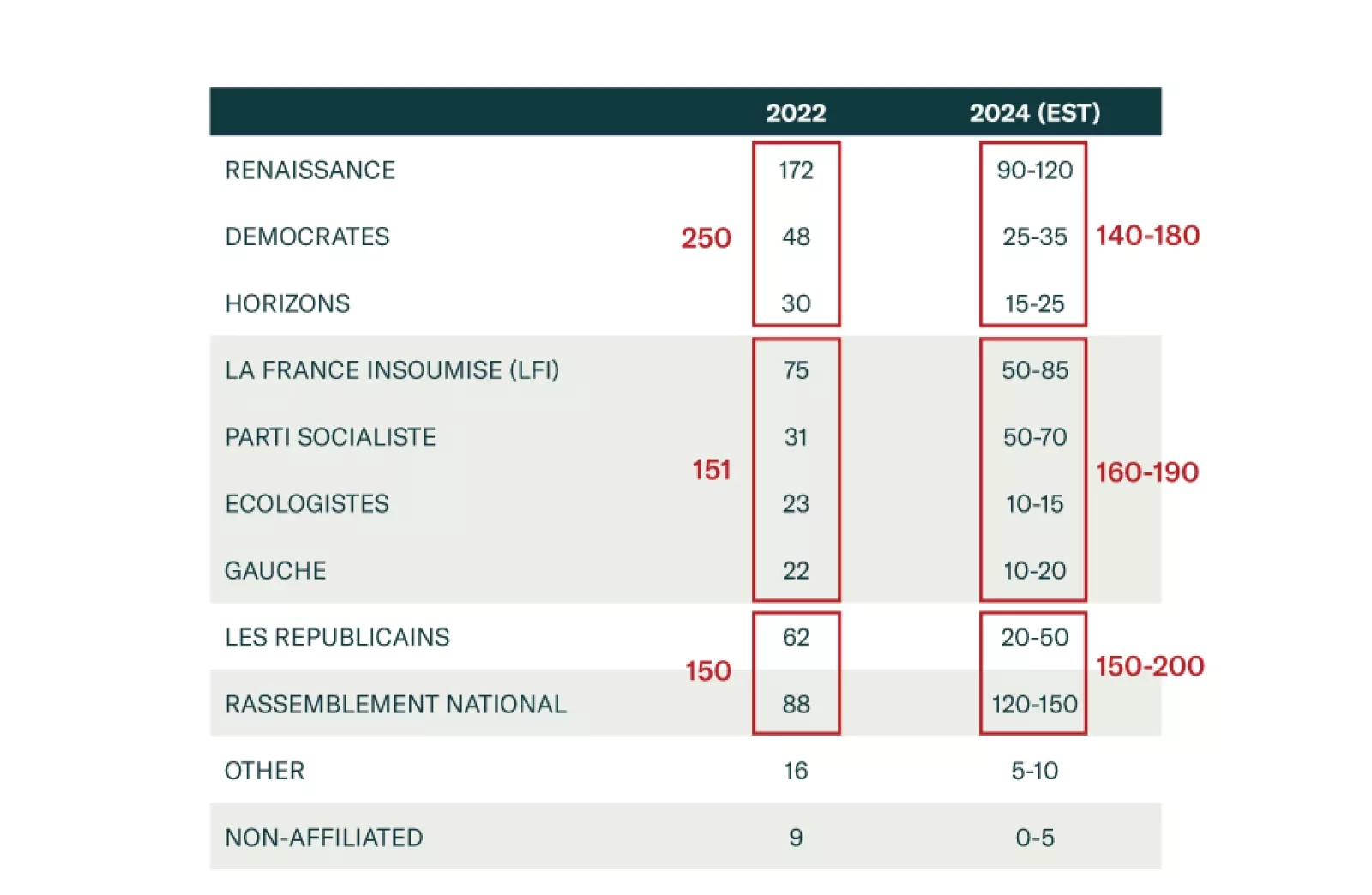

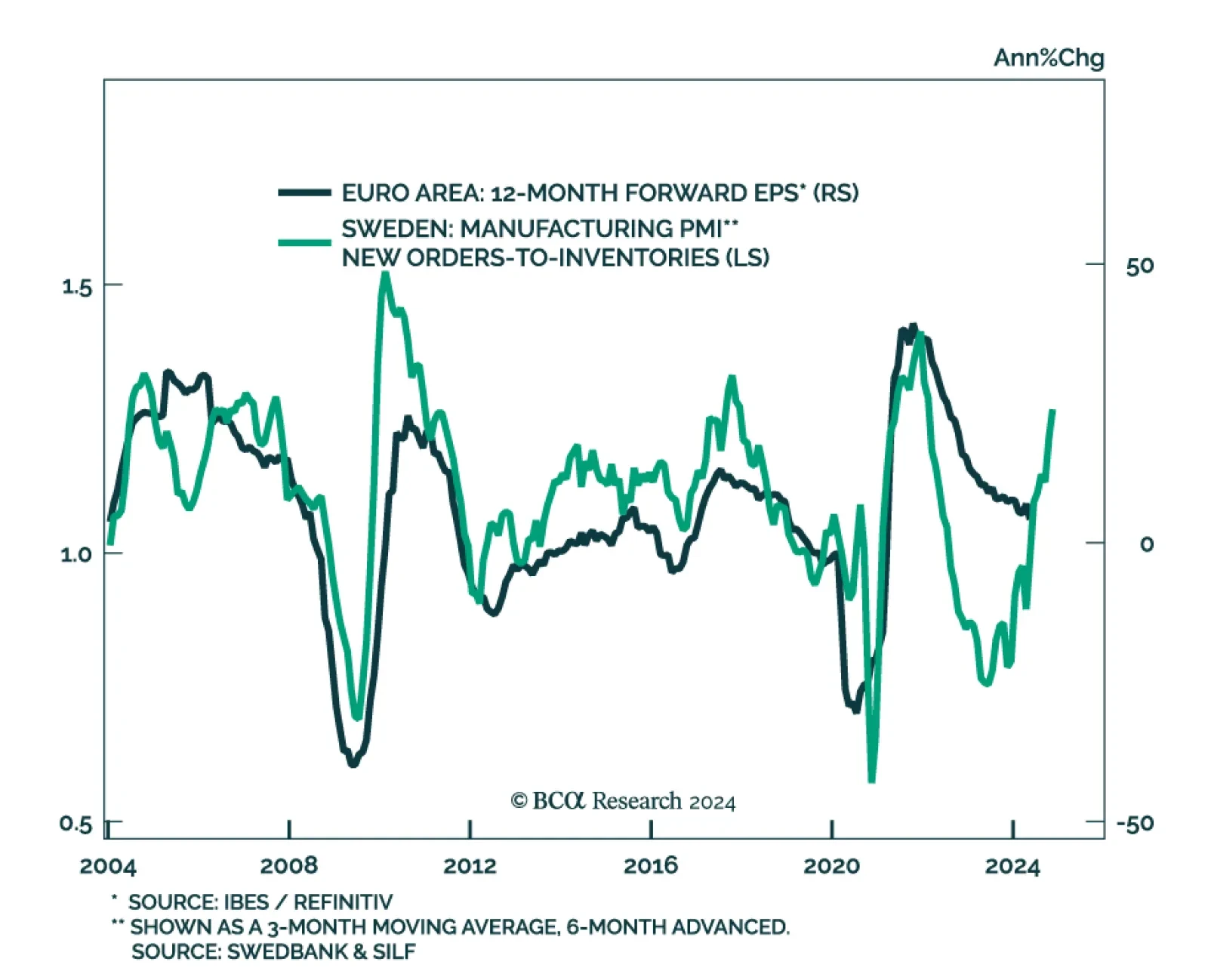

Eurozone equities sold off 7% from their June 6 highs, according to MSCI indices. The surprise French legislative elections and renewed fears of populism and European Union exits are spooking investors. Yet, our European…

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?