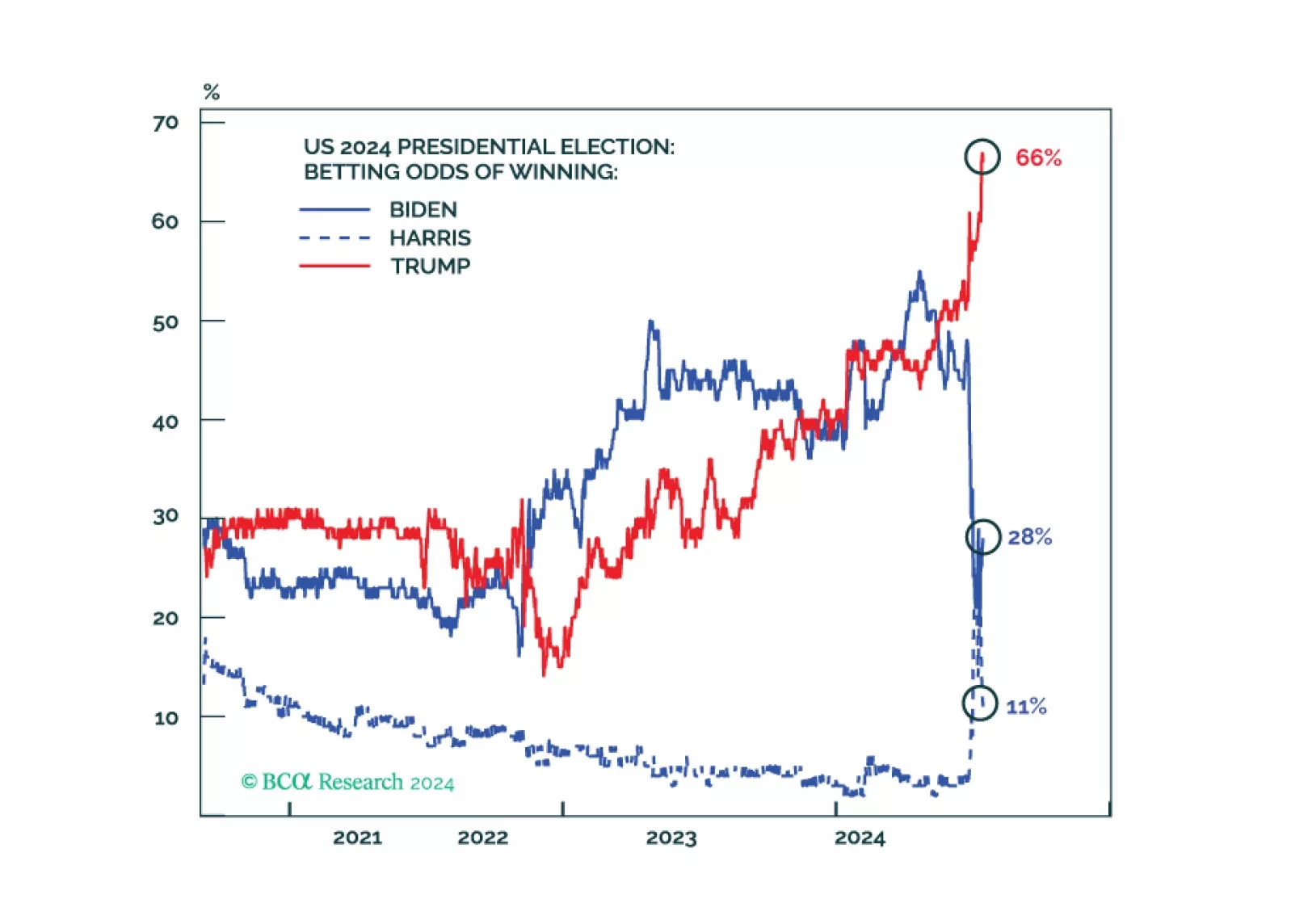

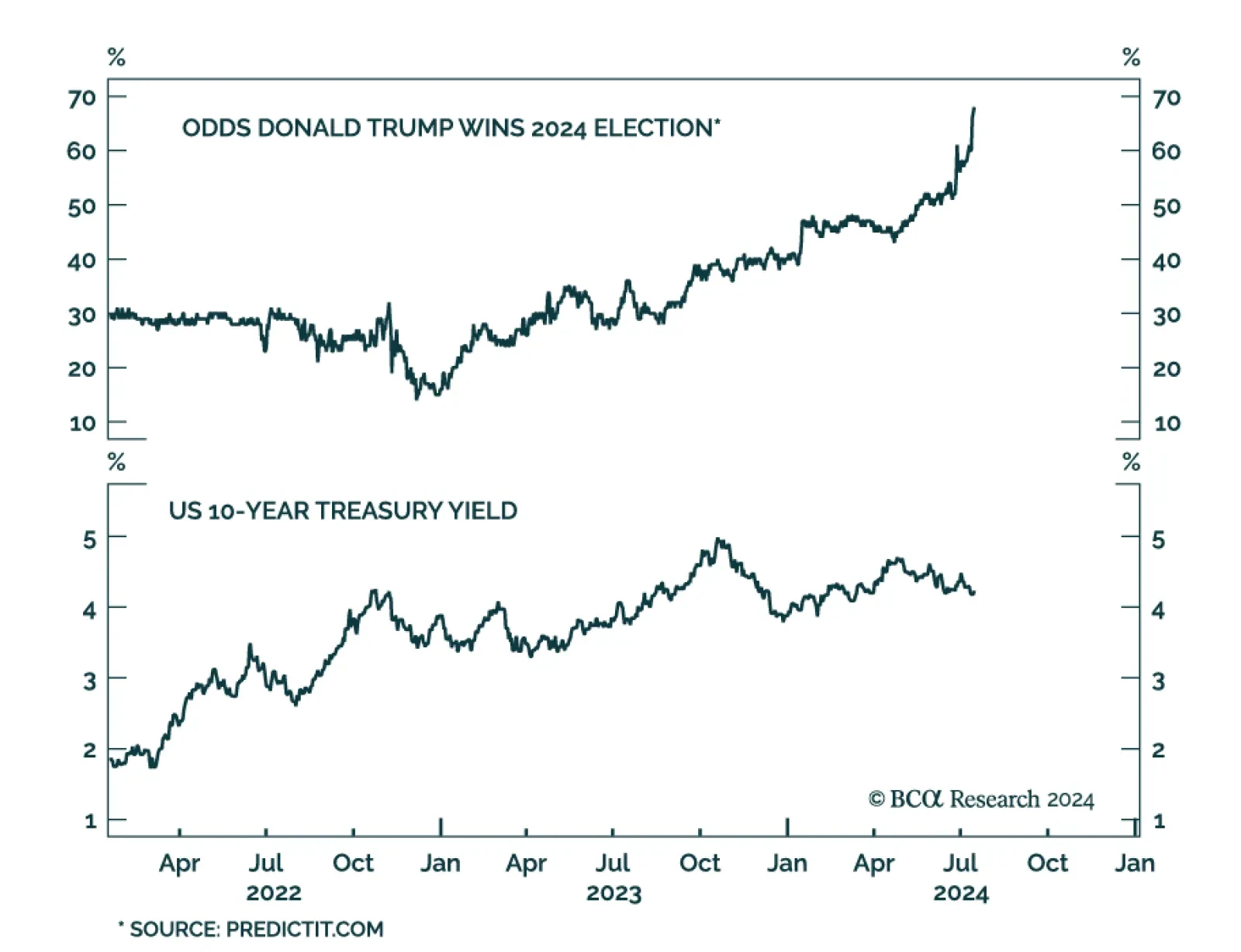

On Monday morning, both election betting markets and financial markets reacted to the attempted assassination of Donald Trump that occurred over the weekend. Predictably, the betting odds that Trump will win the presidency in…

GeoMacro’s monthly Beta Report will typically perform deep dives into the most pressing macro topics of the moment. For its debut, however, it turns the microscope on its own process, explaining the team’s framework…

Marko Papic, a pioneer in using geopolitics as an essential component of investment strategy, has returned to BCA, where he founded Geopolitical Strategy, the world’s first dedicated investment consultancy focused on…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

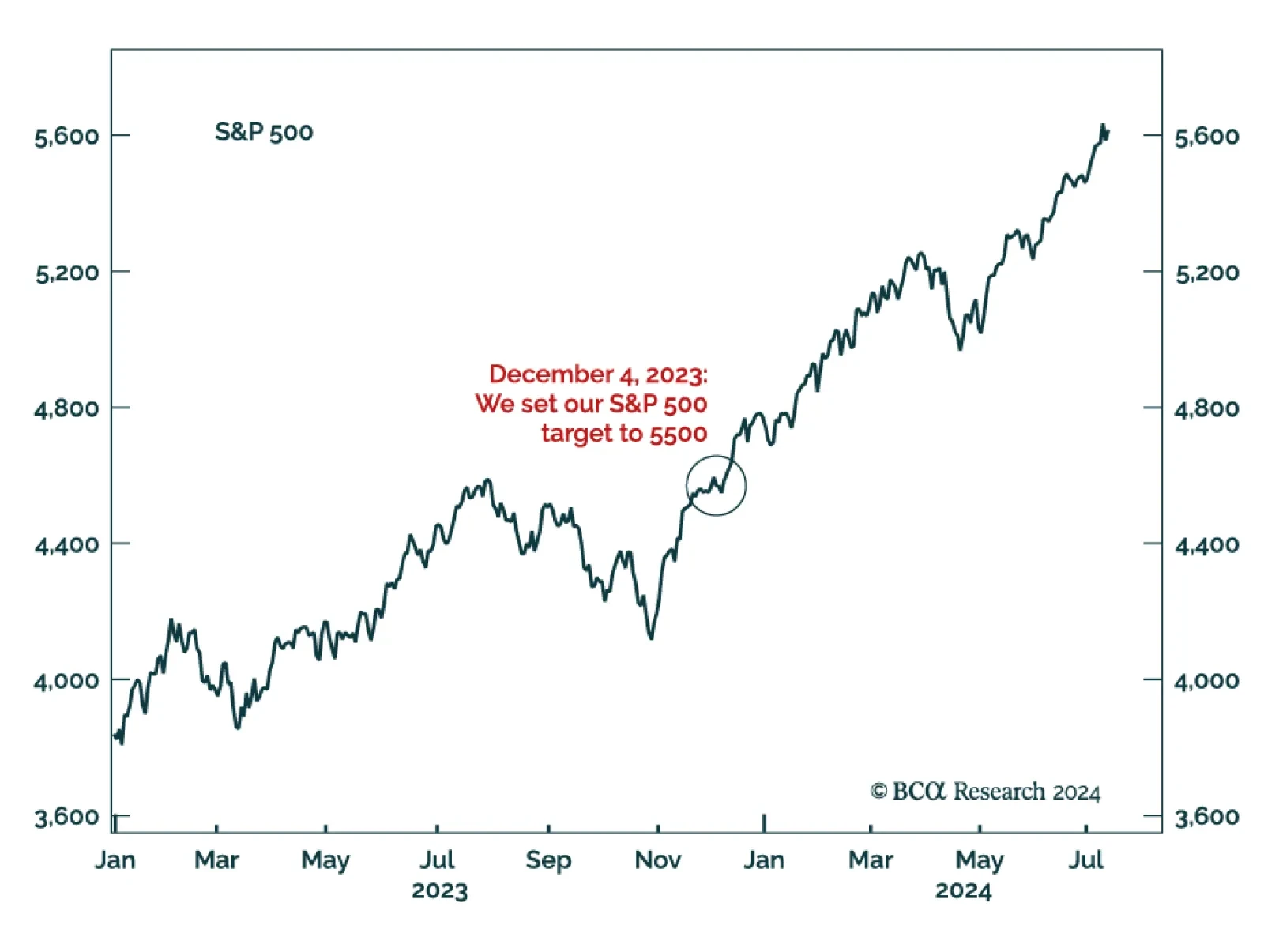

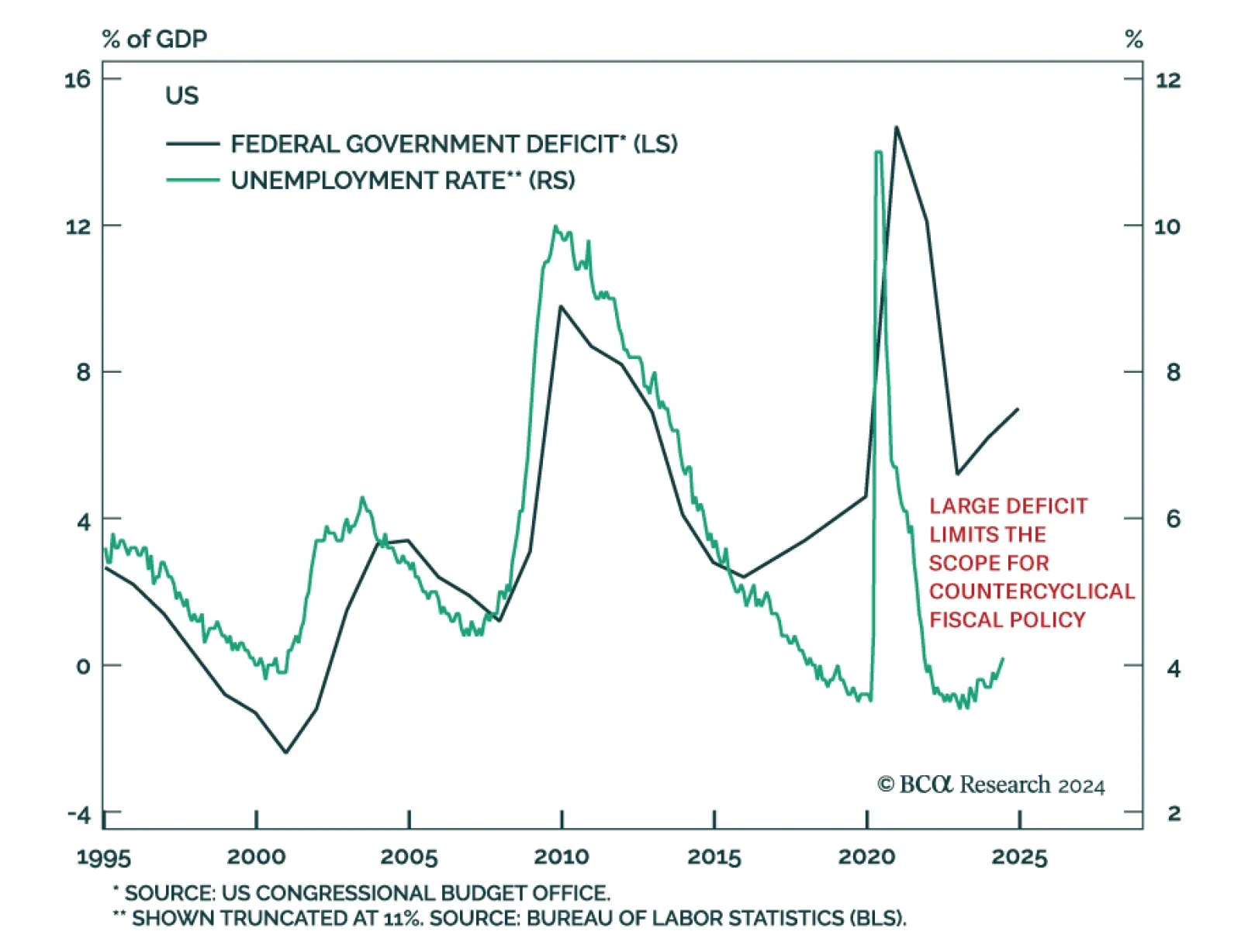

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

According to BCA Research’s Global Investment Strategy service, investors are overstating the degree to which bond yields will rise under a Trump presidency. For one thing, the team expects the US to fall into recession…

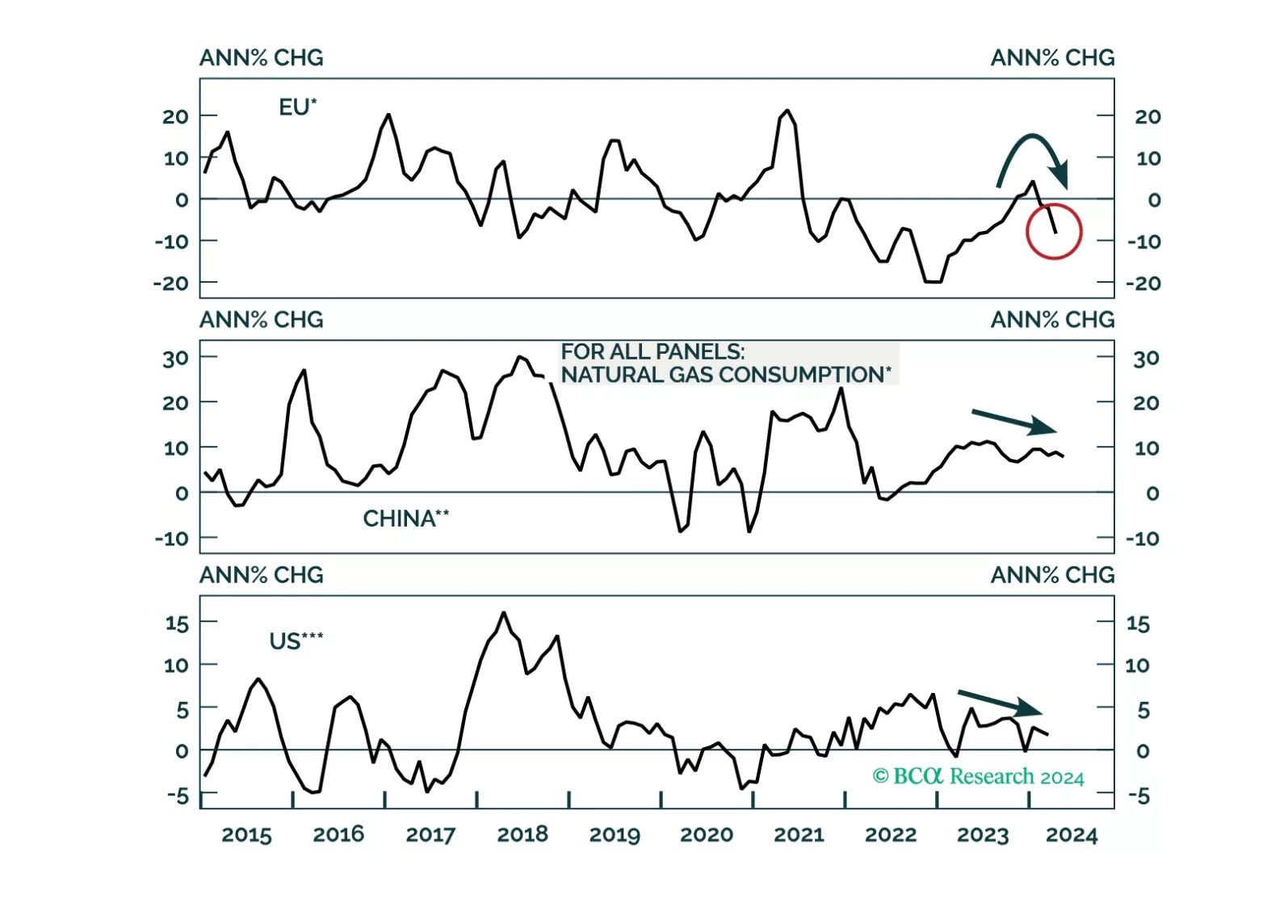

A global economic downturn will be a headwind for natgas prices over the cyclical horizon. Thereafter, LNG capacity additions will help keep the market in balance into the end of the decade. That said, Europe’s increased dependence…

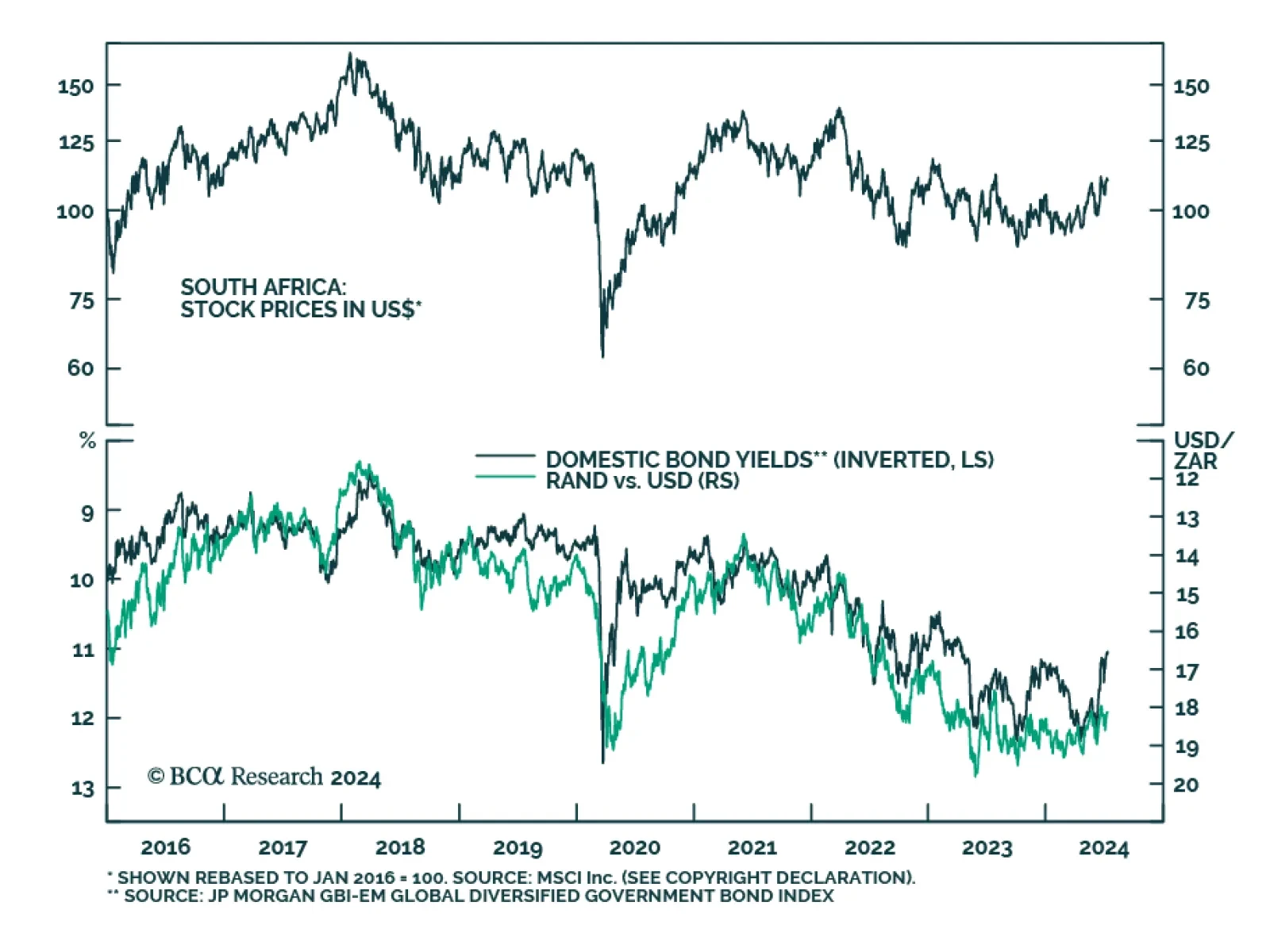

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

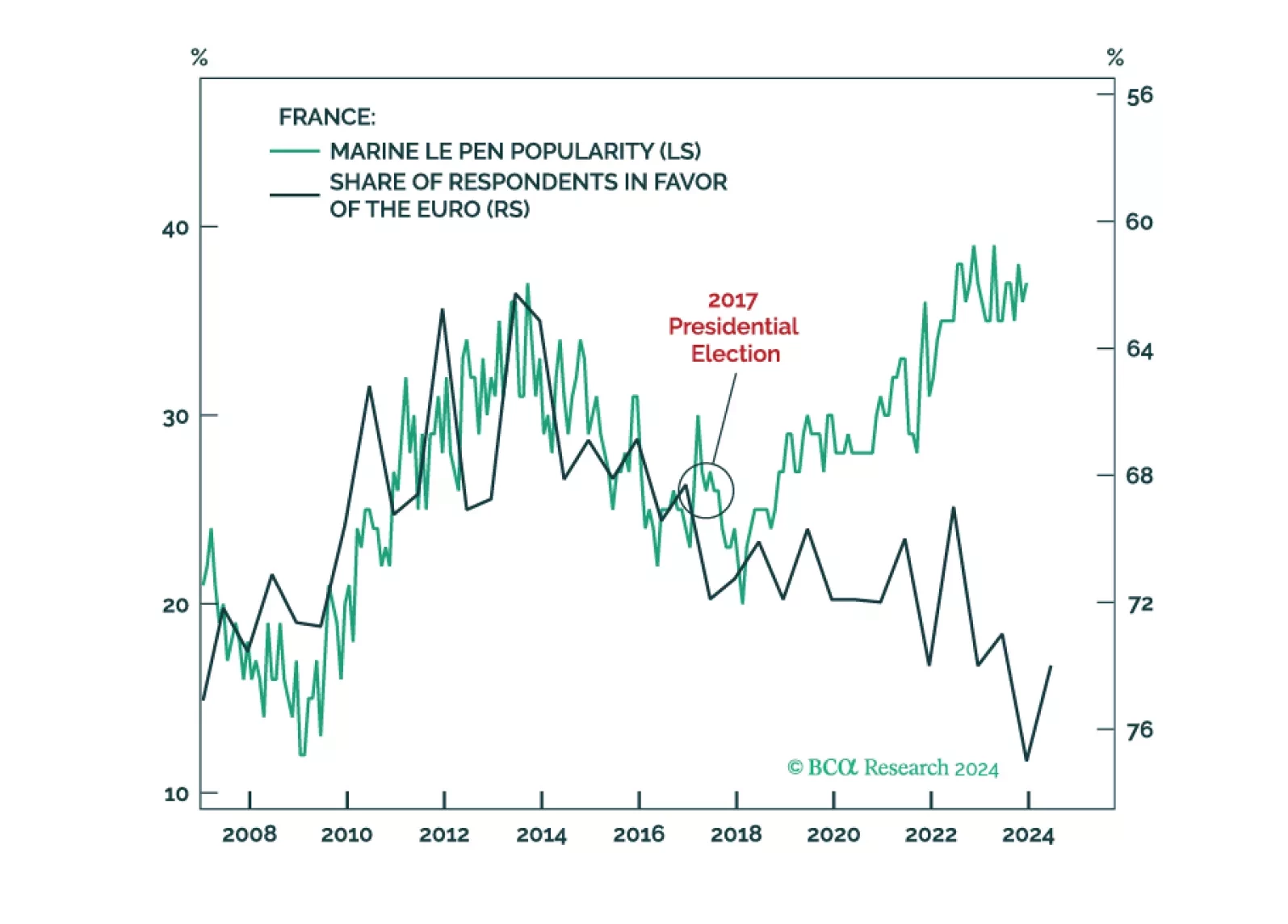

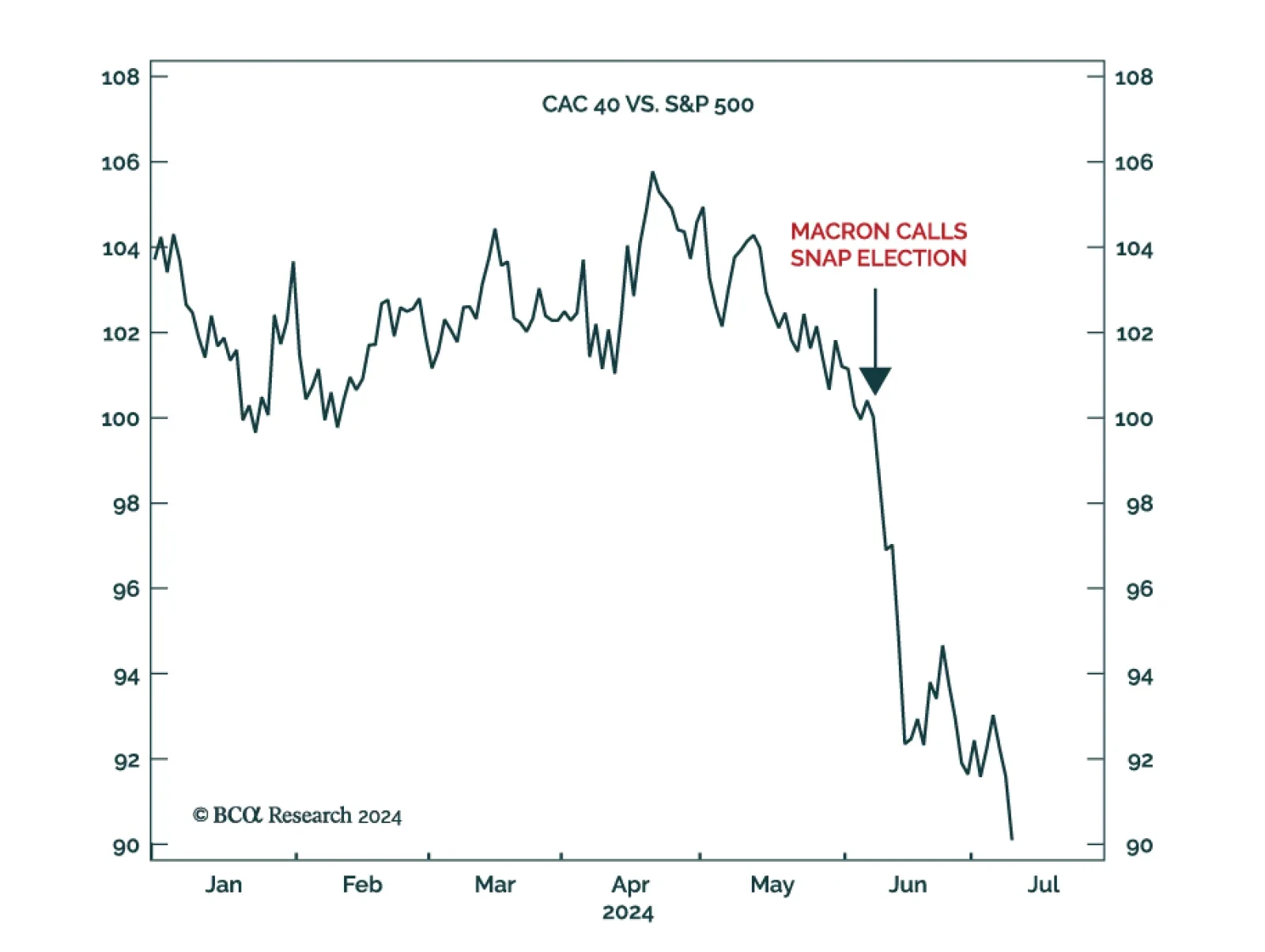

According to BCA Research’s Counterpoint service, the sharp underperformance of the French stock market over political uncertainty is irrational, given the CAC 40’s limited exposure to French domestic economics and…

Investors in European sovereign bonds should find solace that continental voters are not turning away from support for EU integration. As such, populist parties are not really that “far” left or right. And as long as they want to…