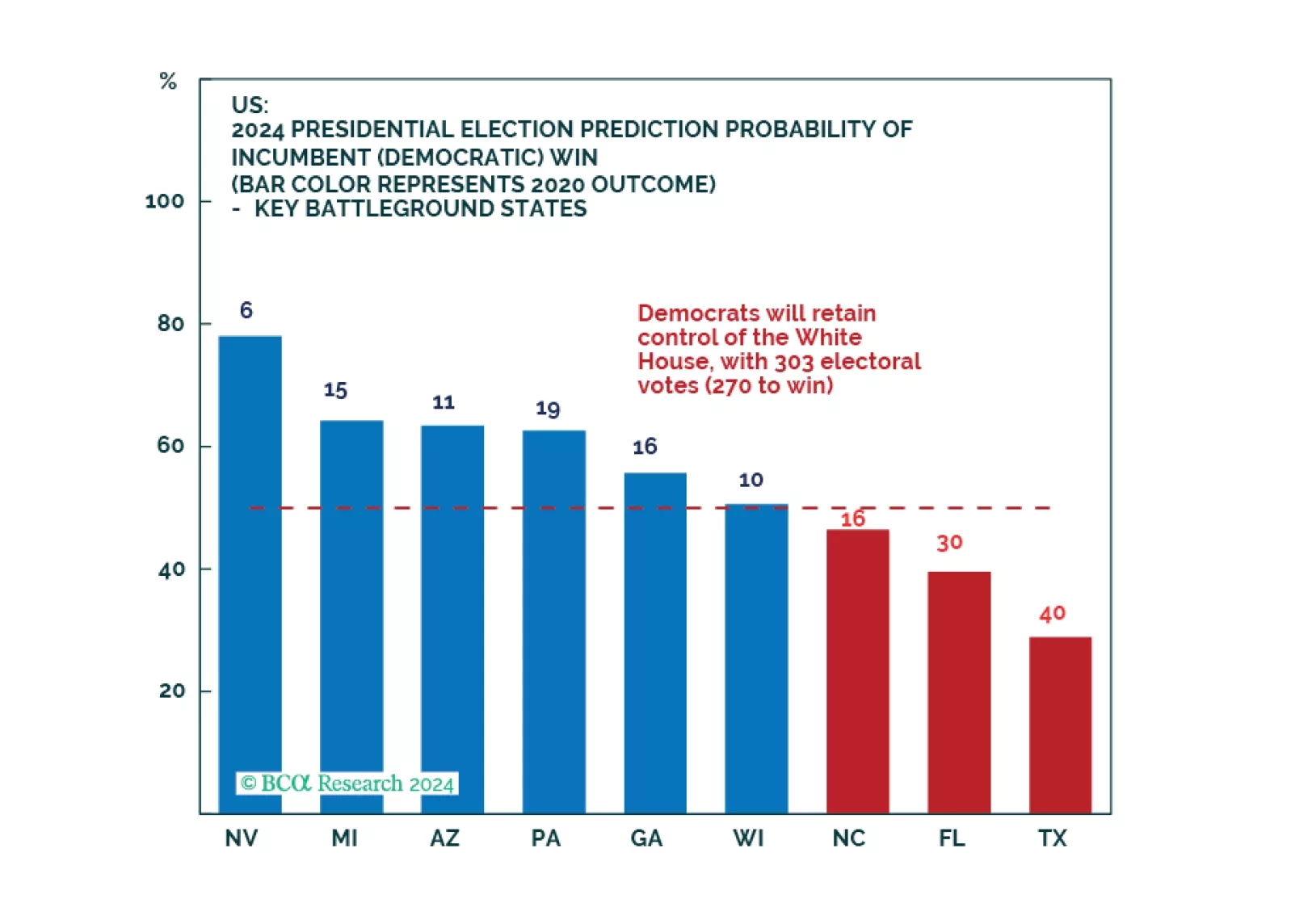

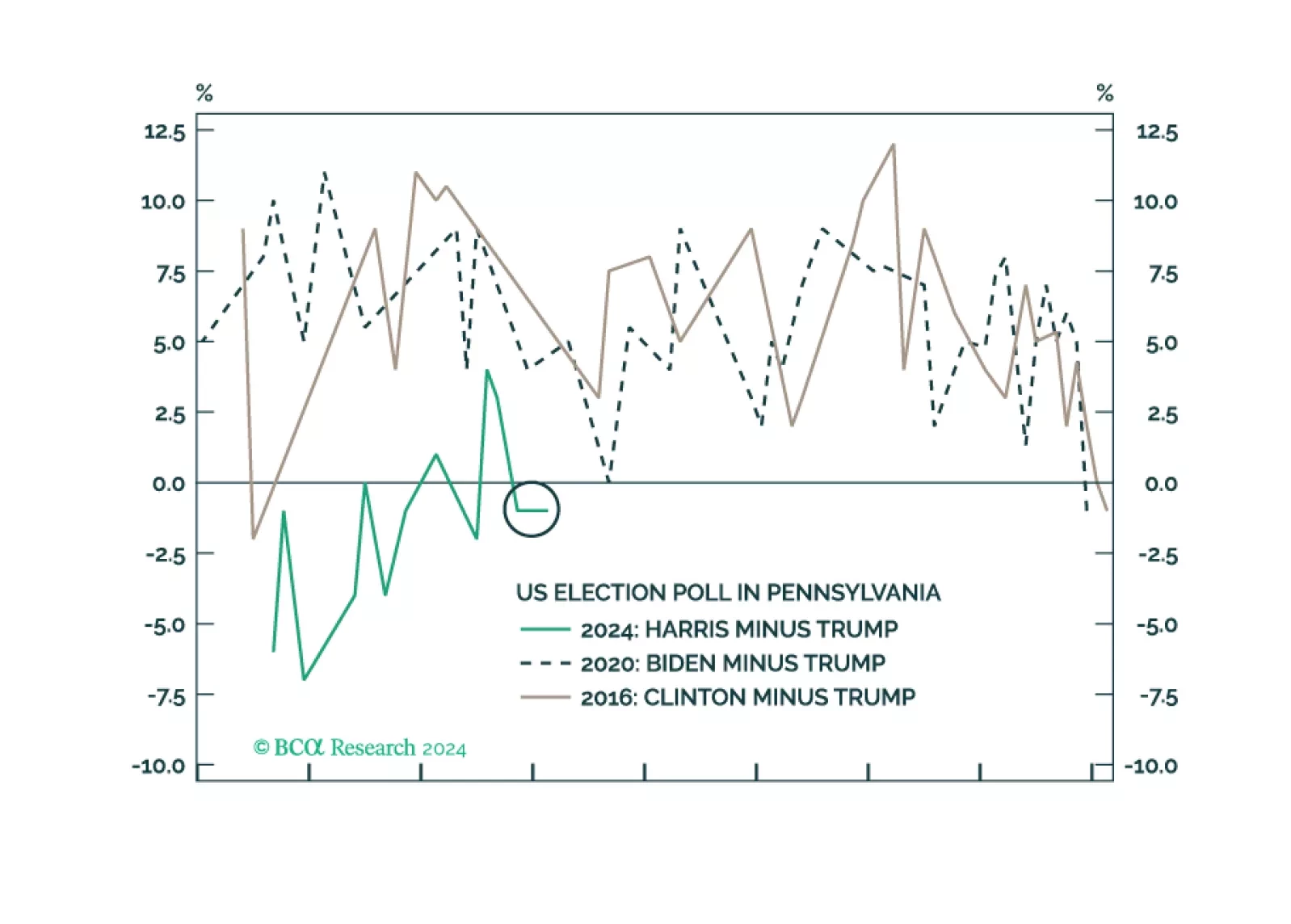

Democrats will not win a full sweep and implement drastic new tax hikes. However, our quant model still favors them to win the White House and just upgraded their odds. While we expect equity volatility around the election, investors…

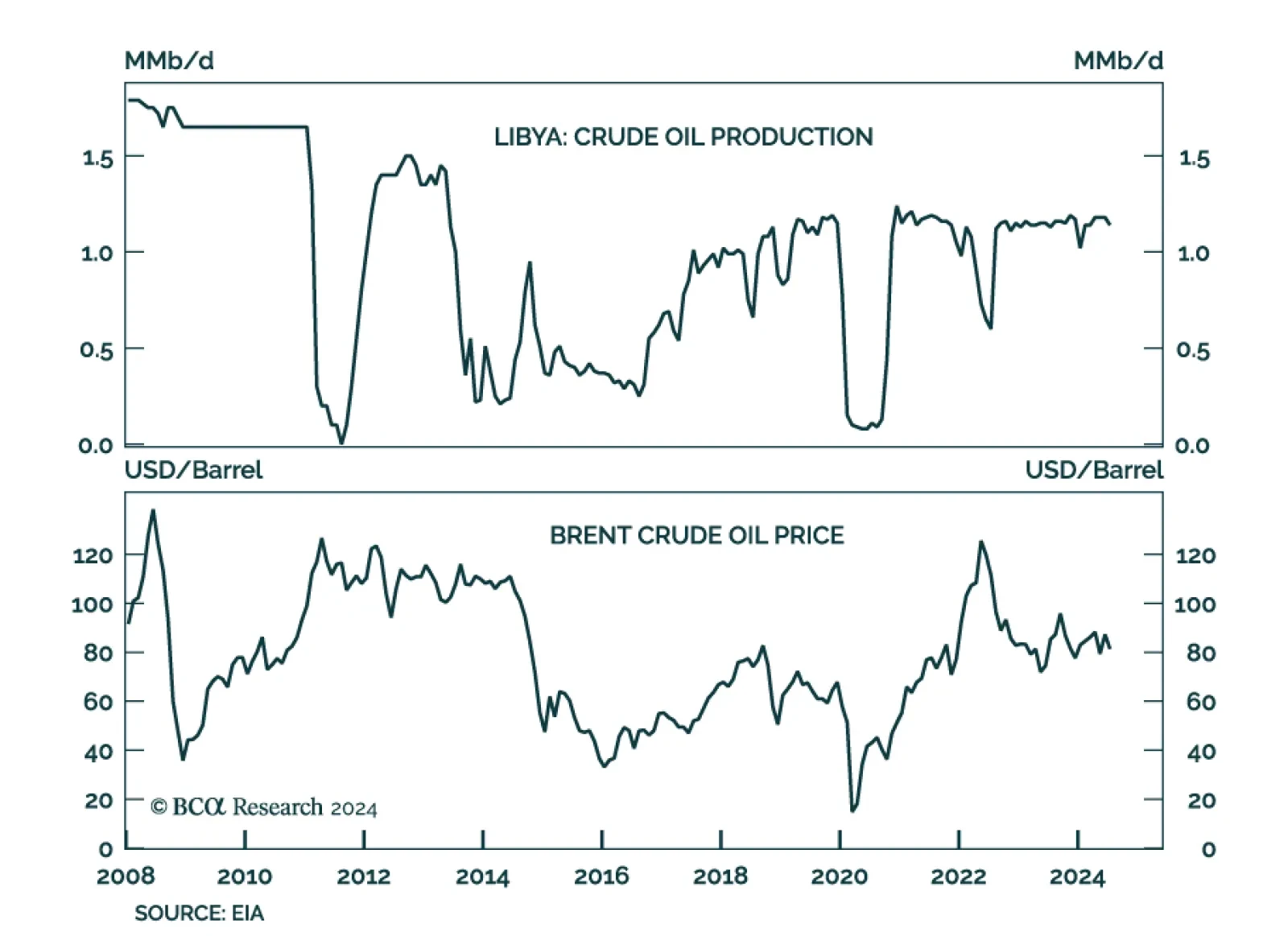

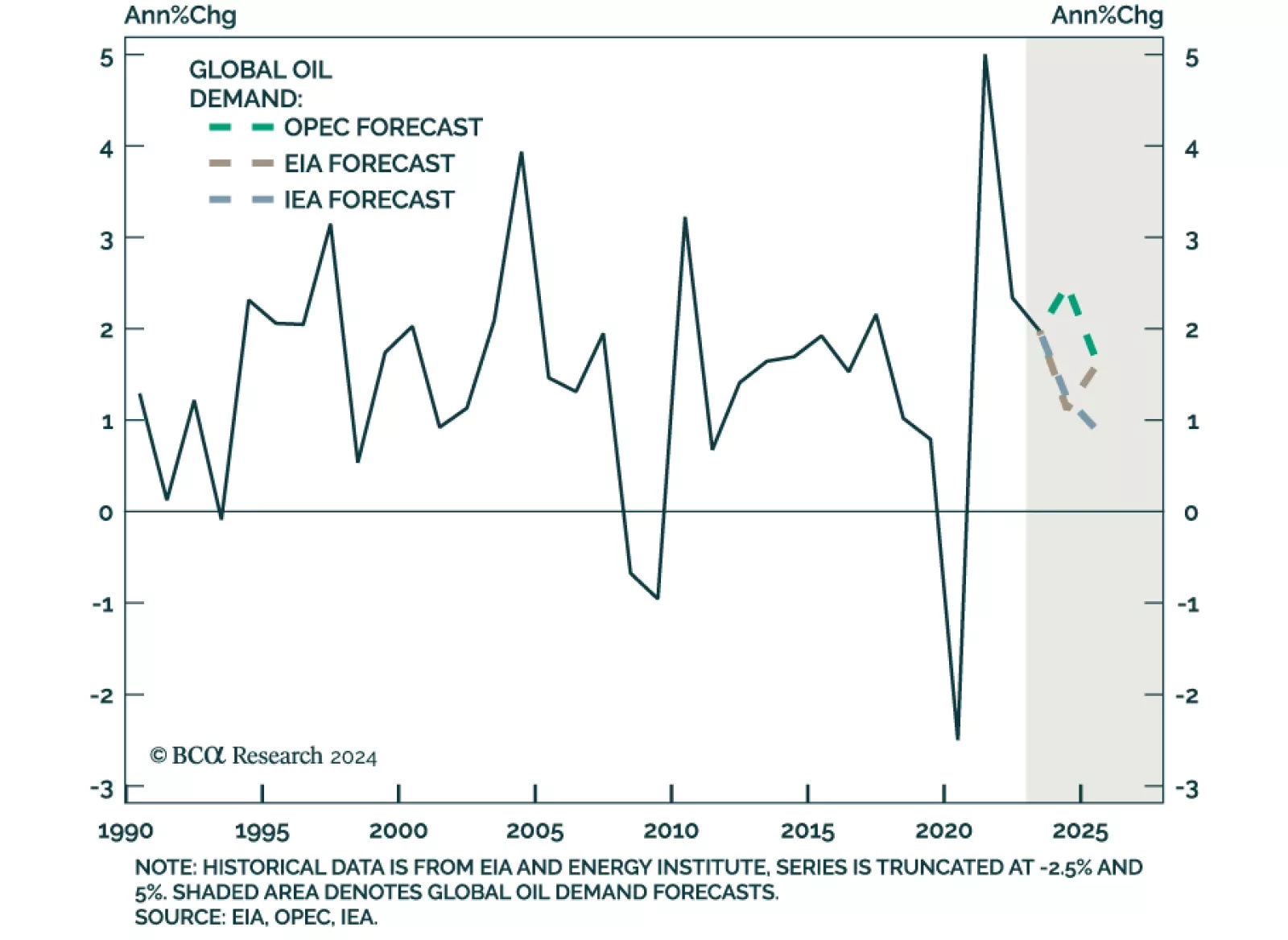

According to BCA Research’s Commodity & Energy Strategy service, oil markets are caught in a tug-of-war that has kept oil prices in a trading range since H2 2023. Bearish demand concerns are enforcing an upper limit on…

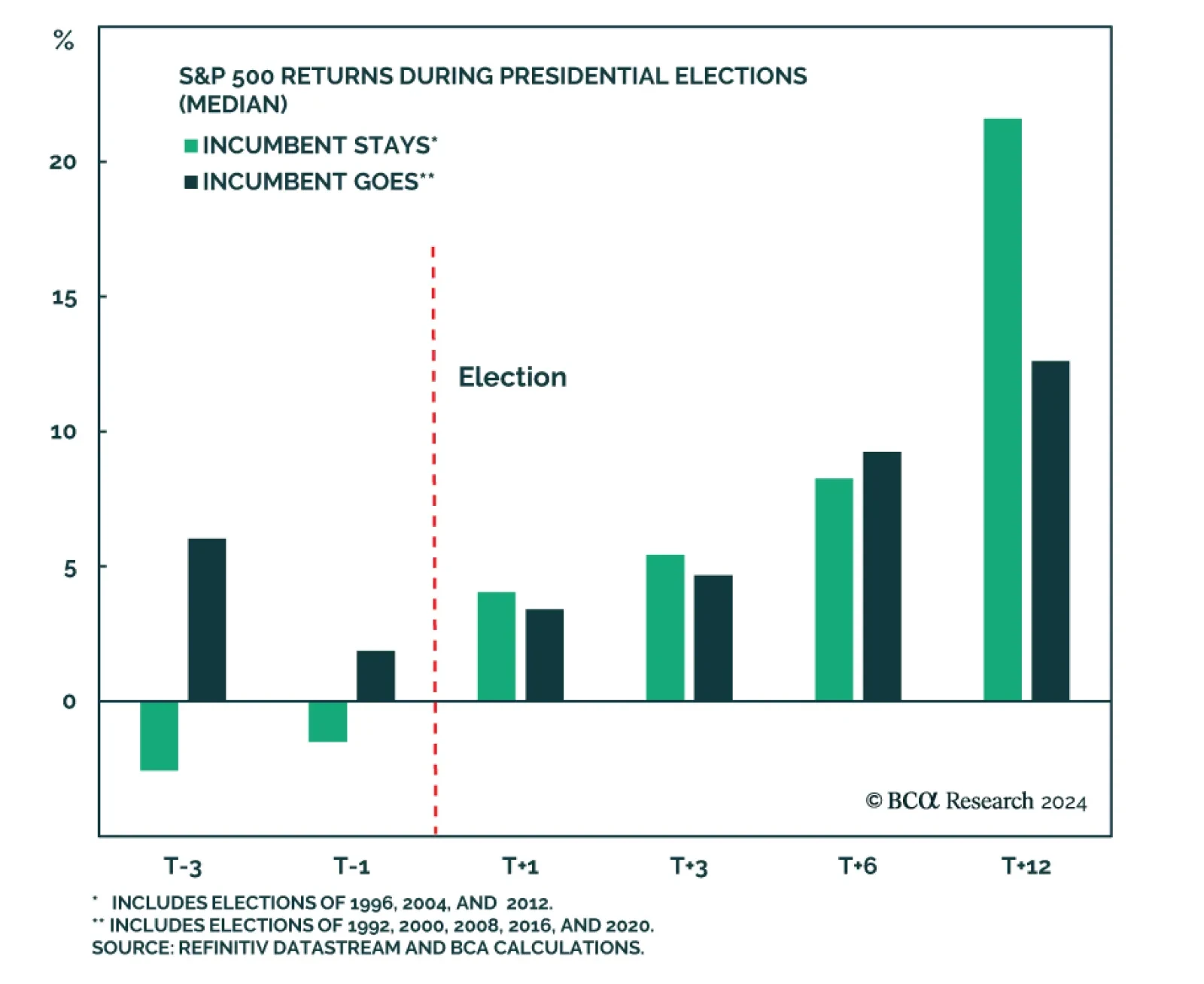

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

According to BCA Research’s Geopolitical Strategy service, the logic of pursuing one’s interest against US interests in the final hours of the election mostly applies to states that will suffer a significant loss to…

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

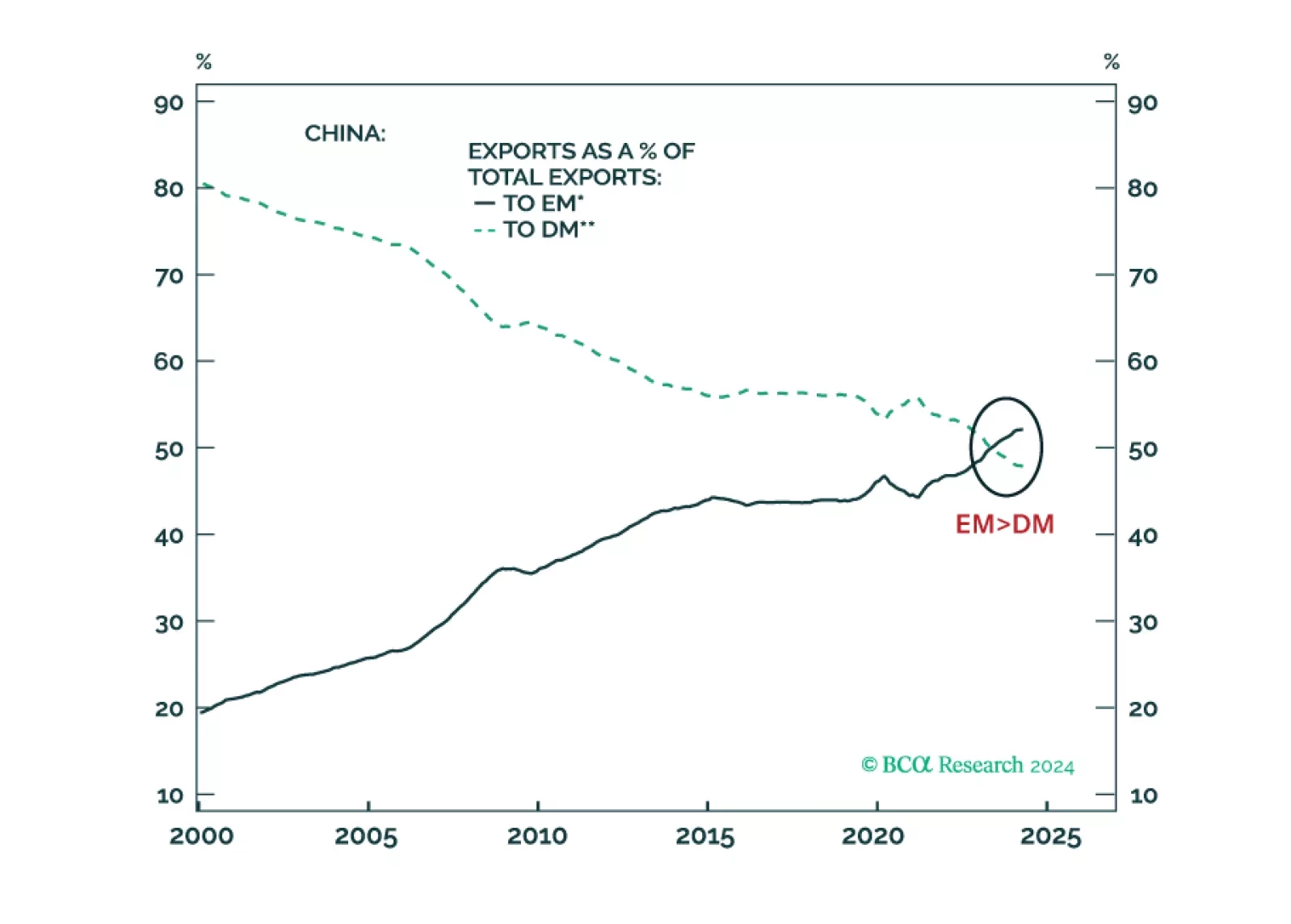

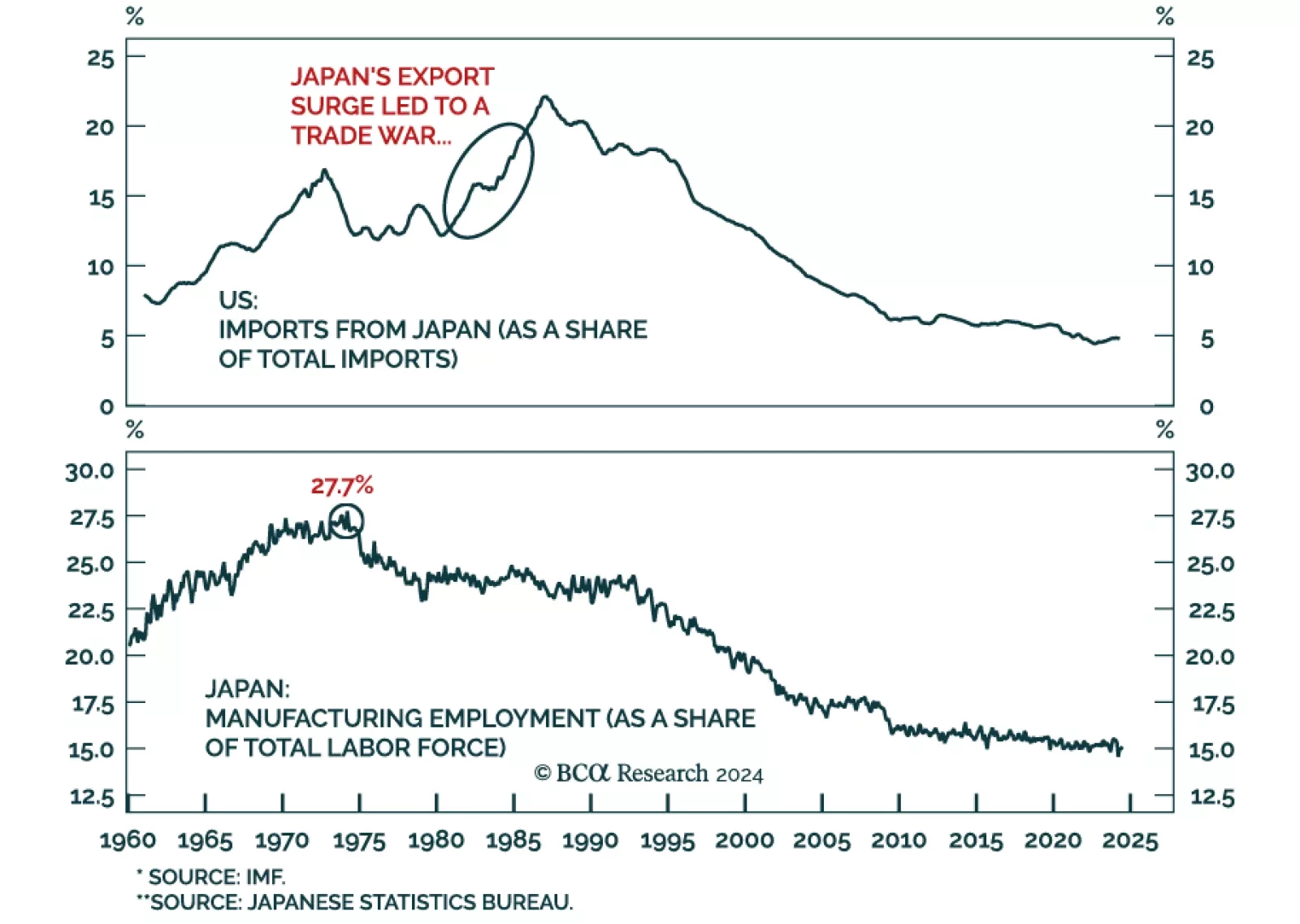

According to BCA Research’s GeoMacro Strategy service, while the idea that Donald Trump would allow China to build factories in the US does not mesh with the contemporary media narrative, it would fit the historical track…

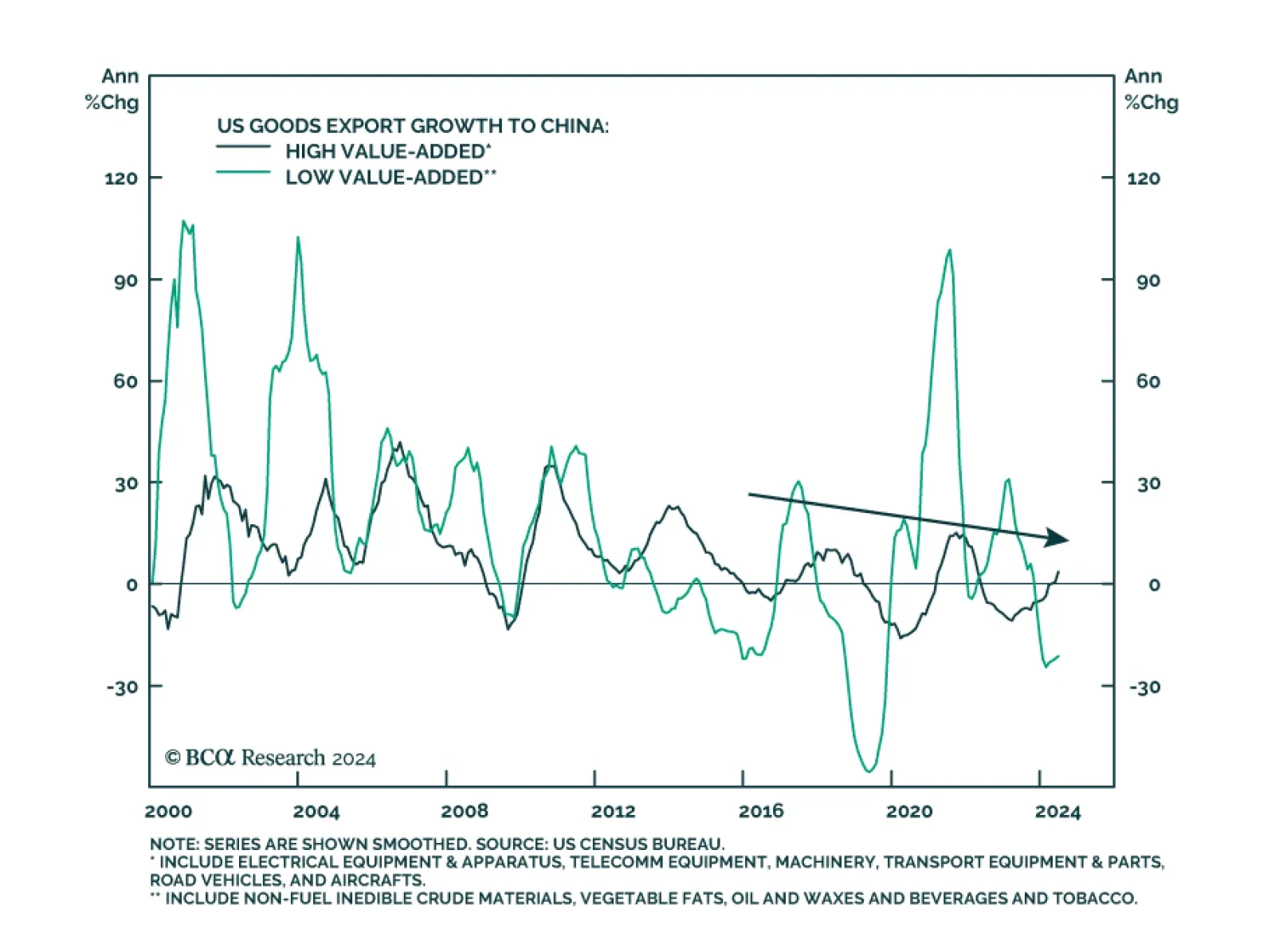

According to BCA Research’s Geopolitical Strategy service, US policy will have an impact on China’s willingness to adopt a preemptively hawkish foreign policy. But the US is in the middle of a chaotic election that…