According to BCA Research’s US Political Strategy service, the important election takeaway for investment strategy comes from the Senate. The Senate is highly likely to fall to Republicans. They are nearly certain to win…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

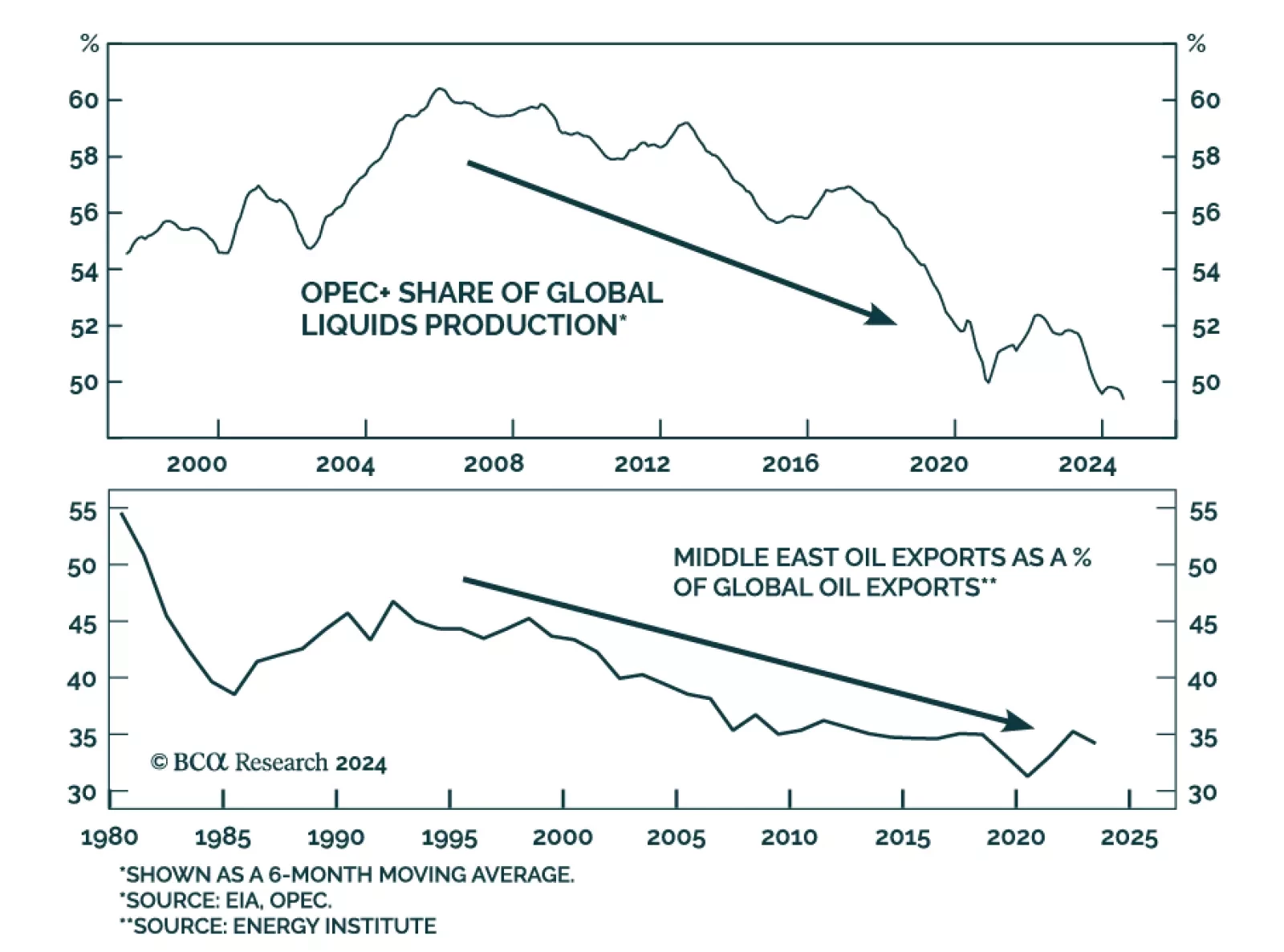

Western policymakers are pursuing three capital “T” Truths: China is evil, climate change is a major risk, and Russia is… also evil. Pursuing all three priorities at the same time presents a version of the classic “impossible trinity…

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

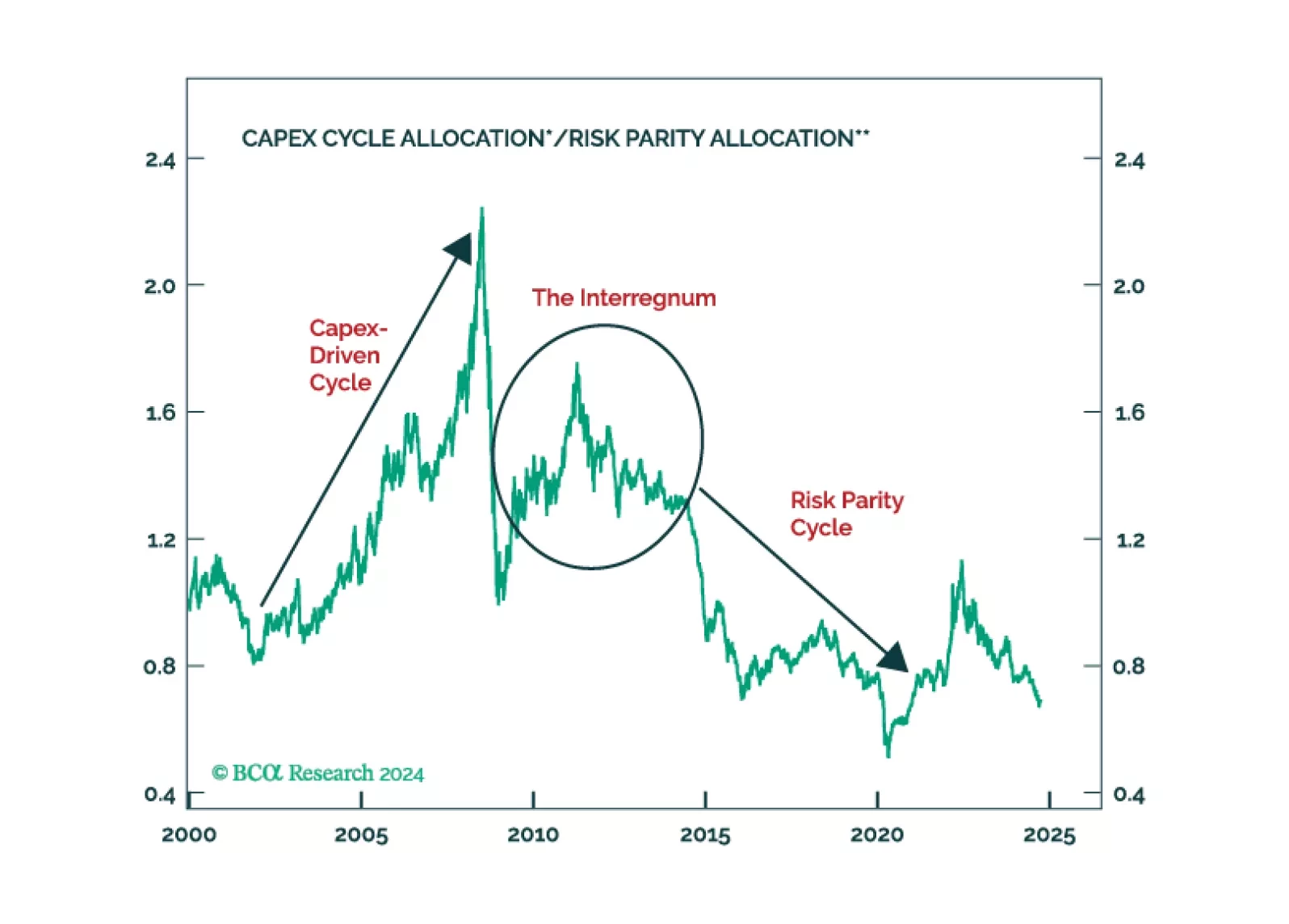

But the big macro…

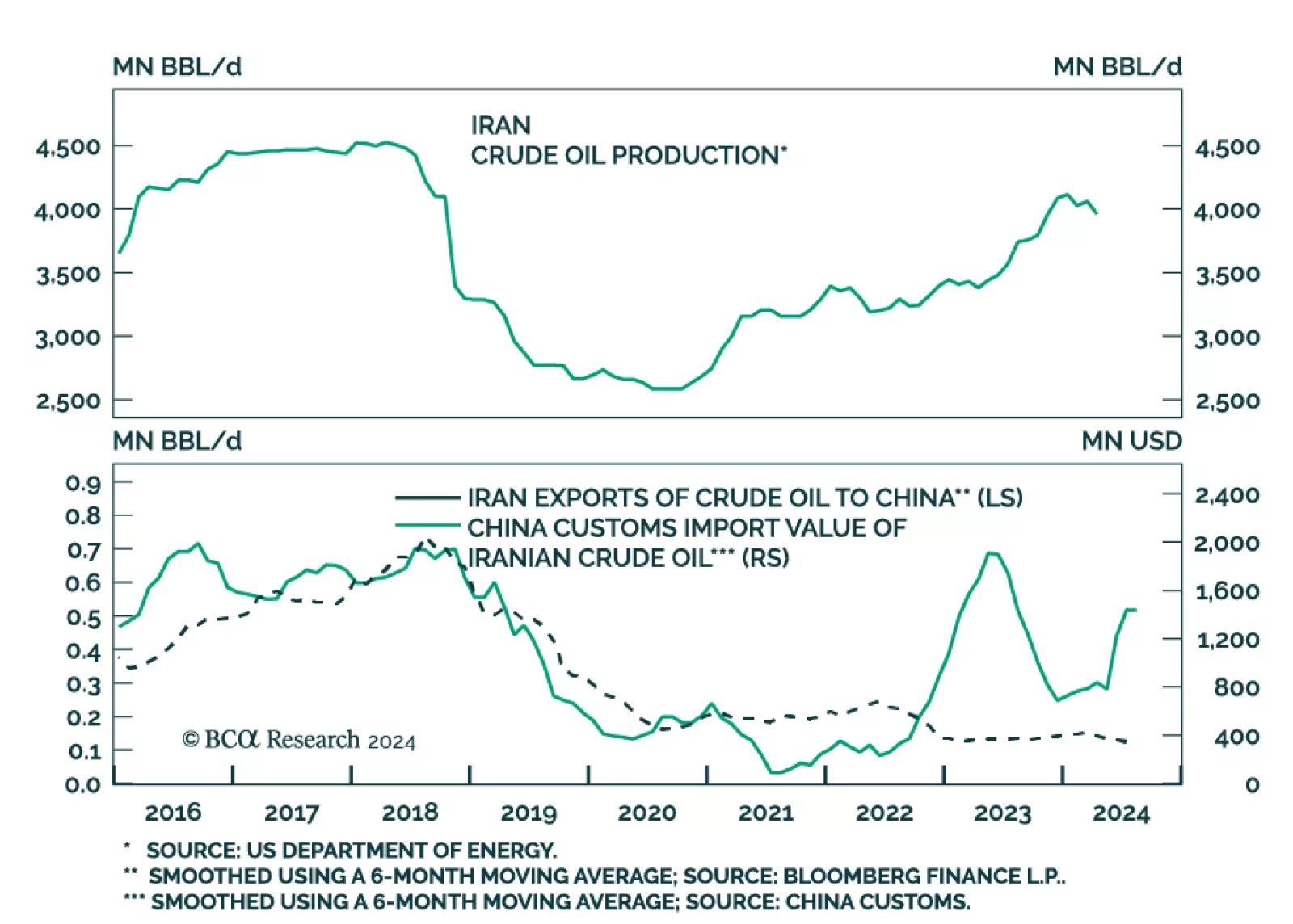

According to BCA Research’s Geopolitical Strategy service, the Biden administration’s outreach to Iran will fail. The war in the Middle East has expanded as our colleagues predicted: Israel attacked Lebanon. Now…

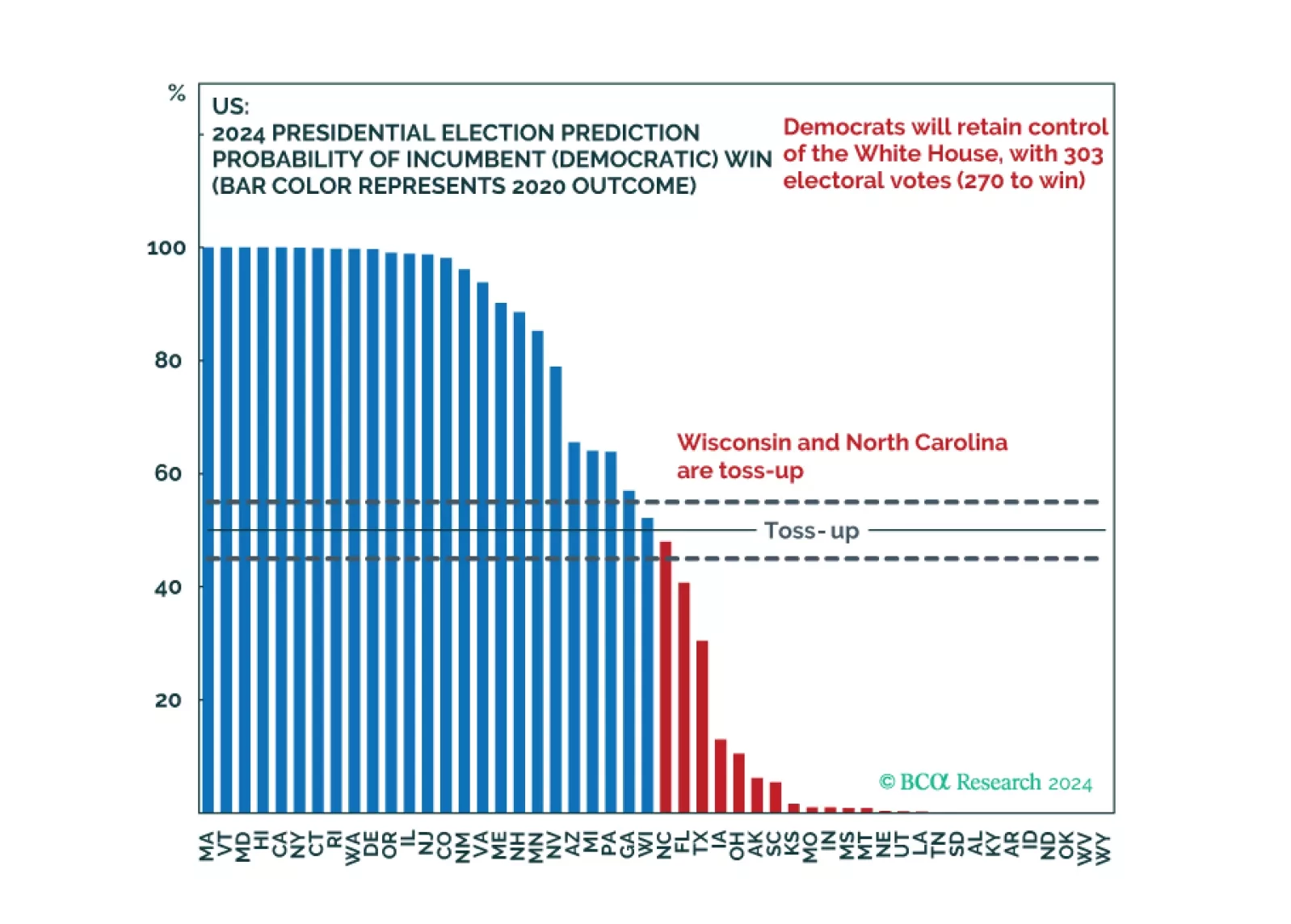

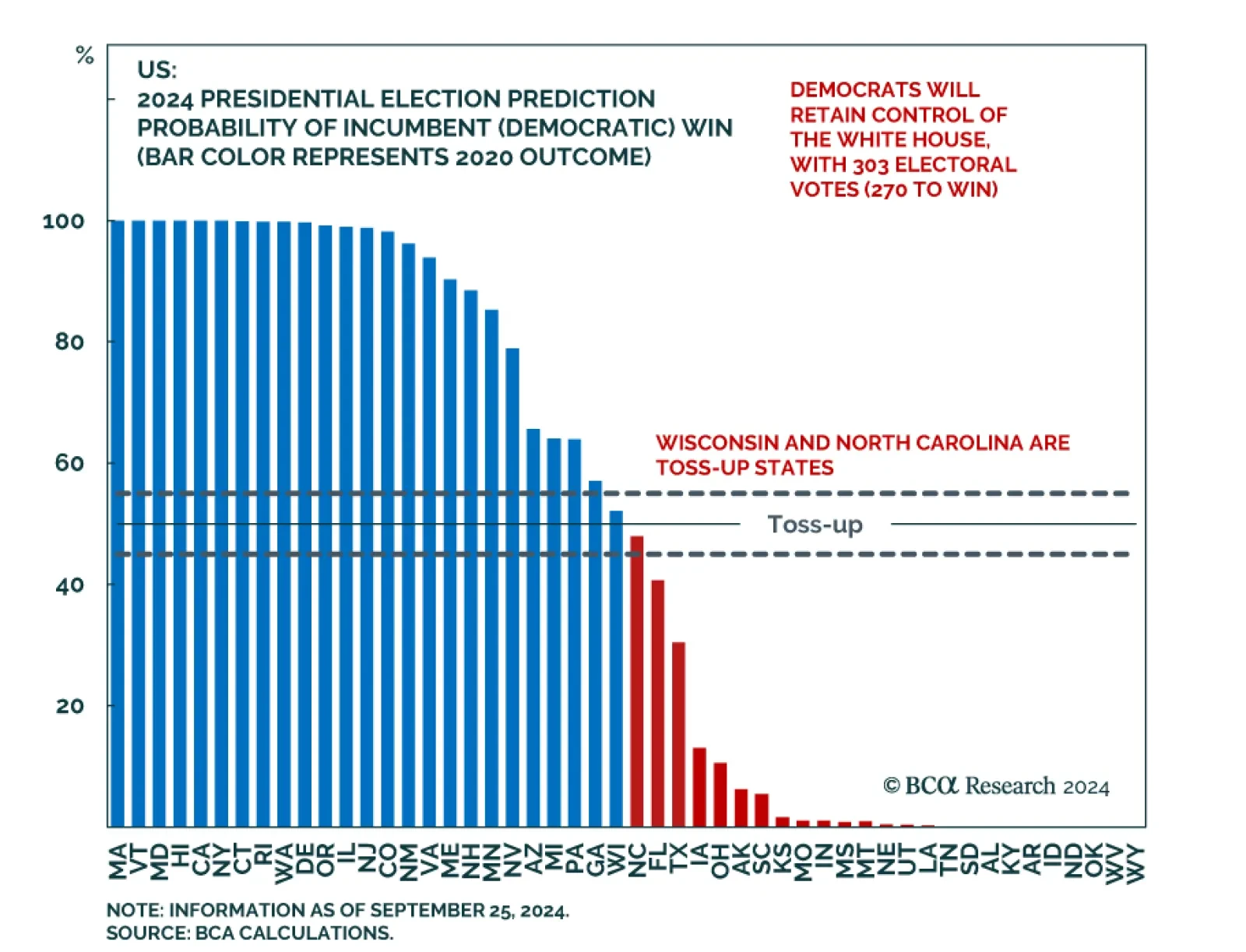

Our quant model shows Democrats winning the election at a 56% probability, with 303 electoral college votes. But swing state economies are slowing and Democrats’ odds in Michigan fell. Trump can win with Georgia, Michigan, plus one…

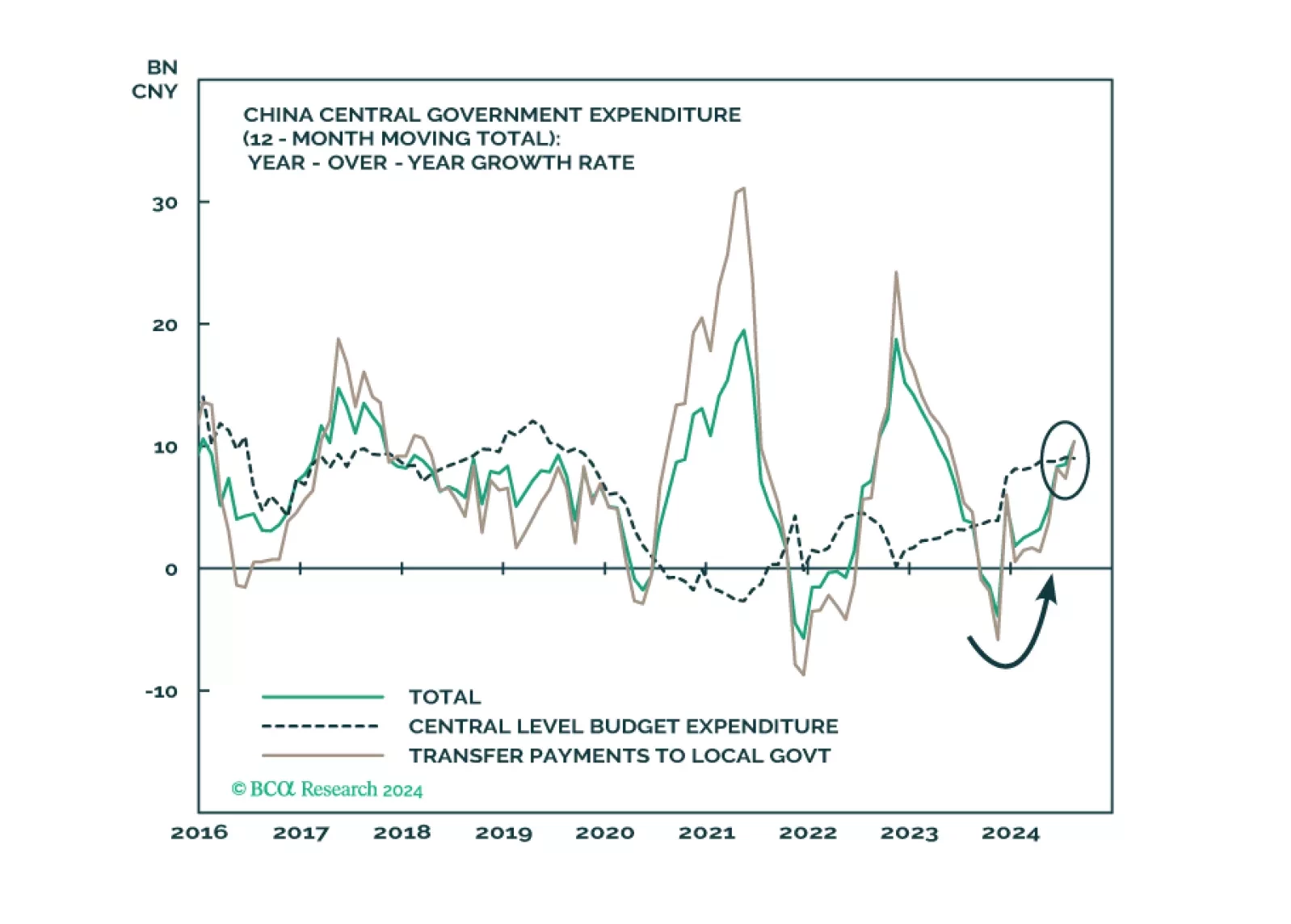

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

BCA Research’s Geopolitical Strategy service introduced a Global Political Capital Index. Investors should favor countries with newly elected government, small government size, and ample room to cut policy rate. Ideally,…