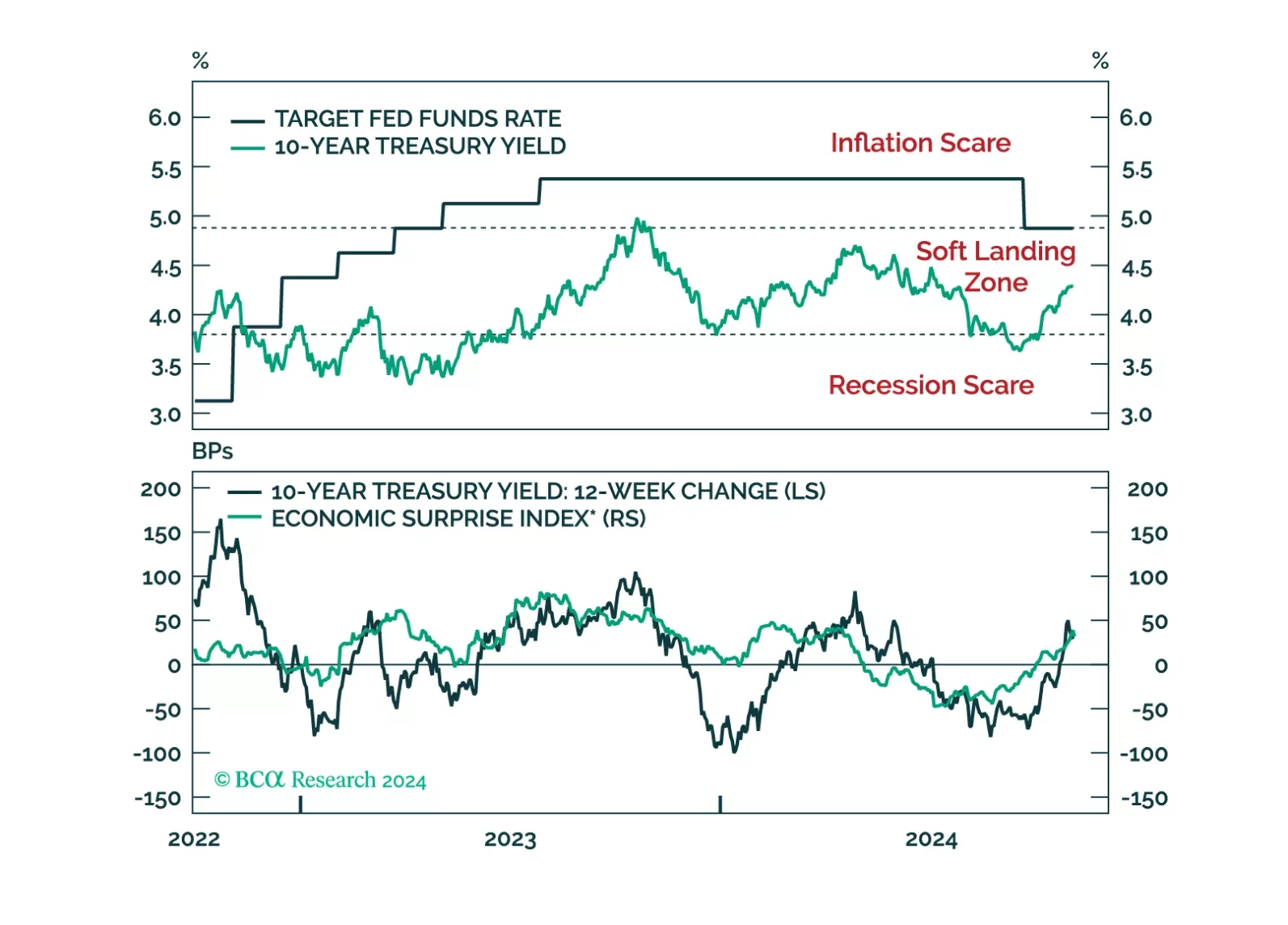

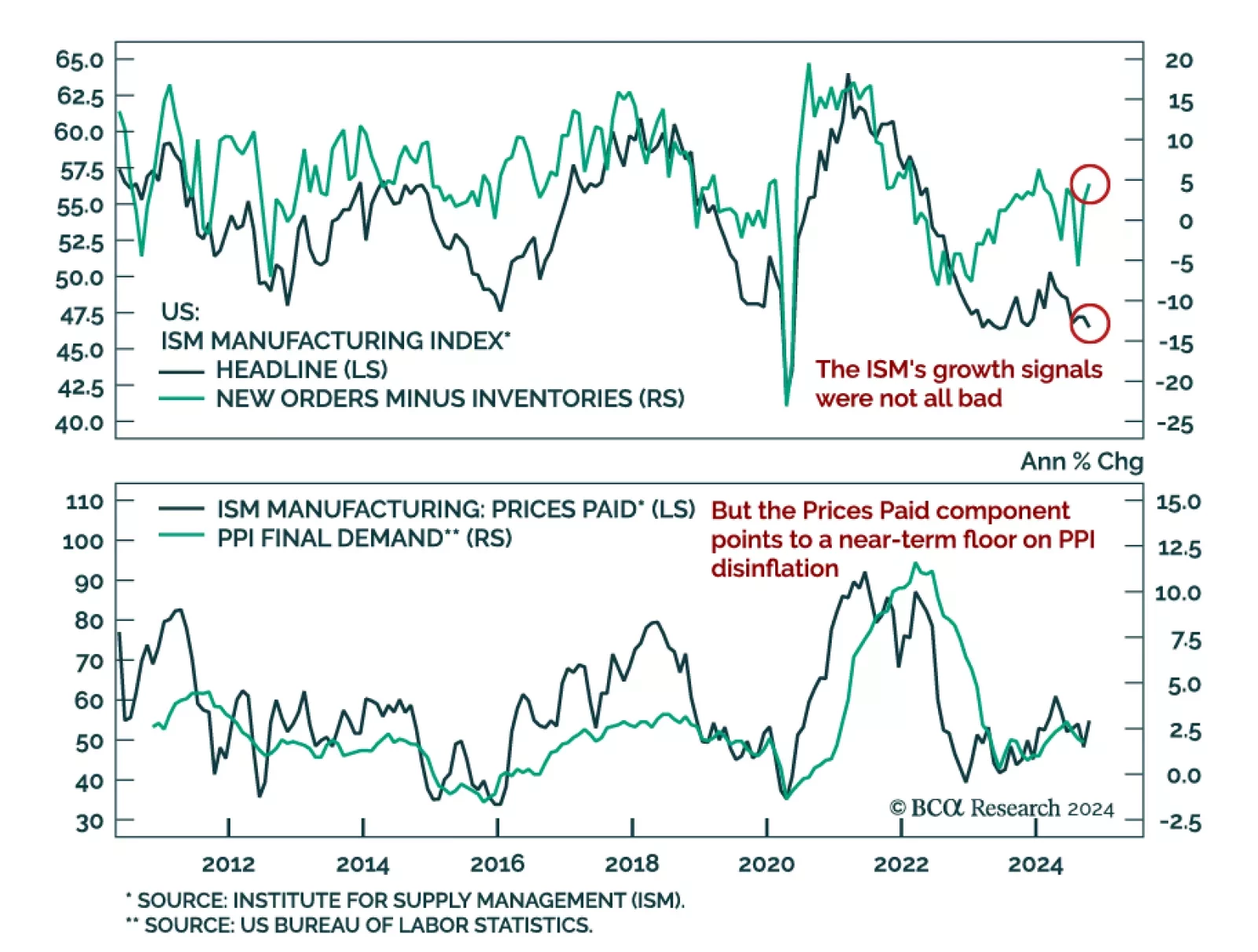

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

A reaction to this morning’s employment report and a preview of the potential bond market implications of next week’s US election and FOMC meeting.

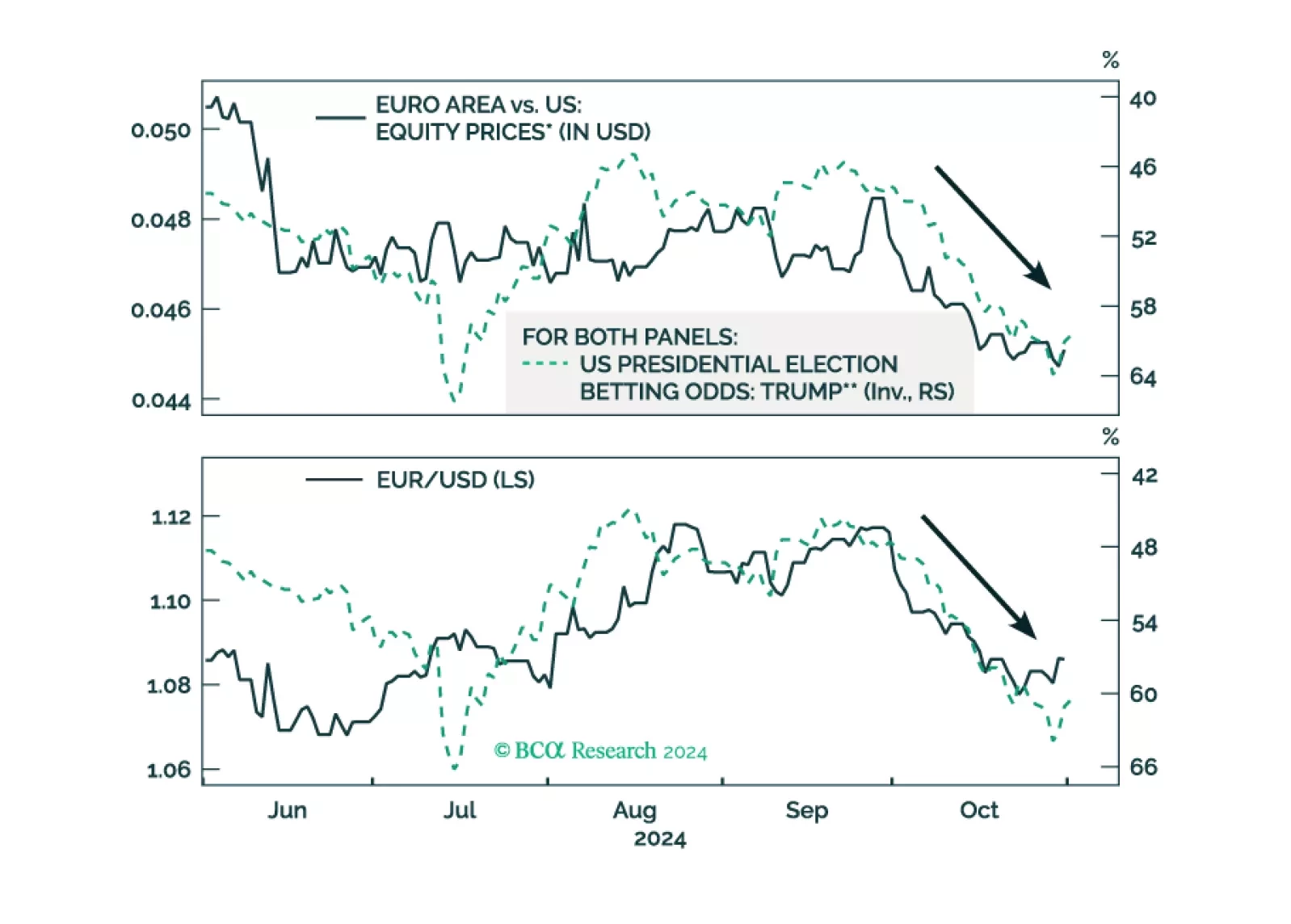

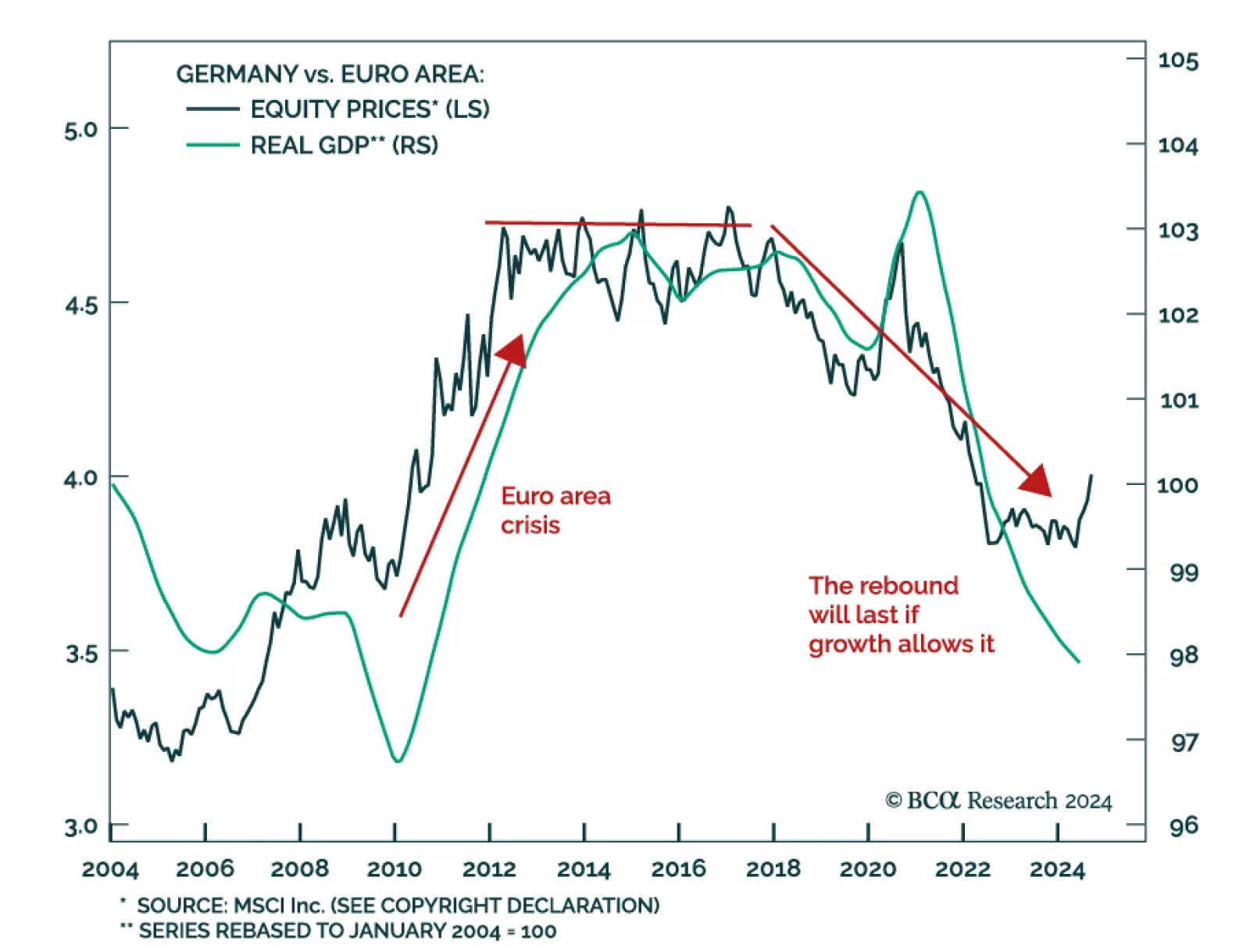

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

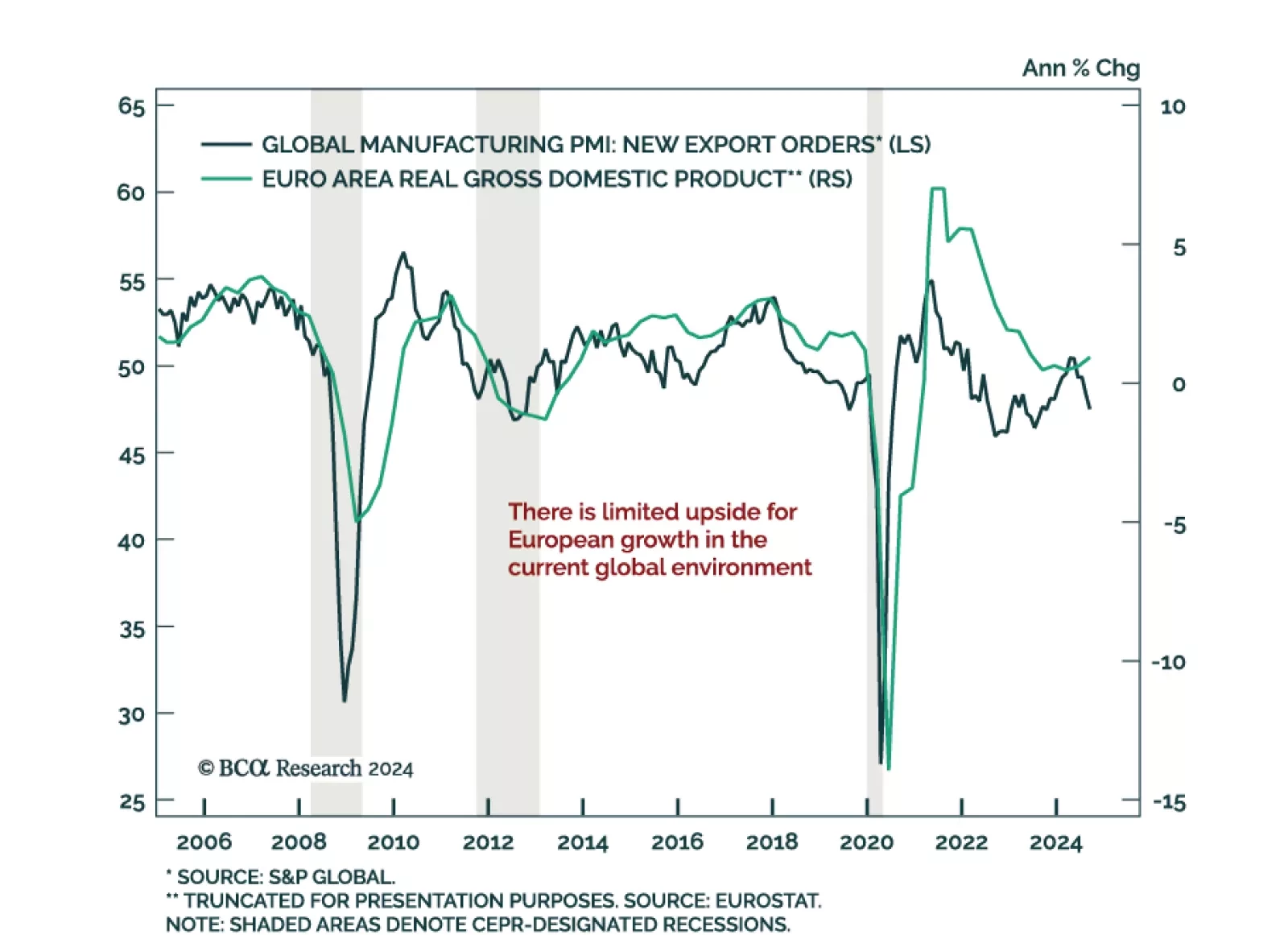

Flash Q3 GDP estimates for the Euro Area beat expectations, accelerating to 0.4% quarterly growth from 0.2% last quarter. The momentum was spread across major countries, except for Italy. Meanwhile, the European Commission’…

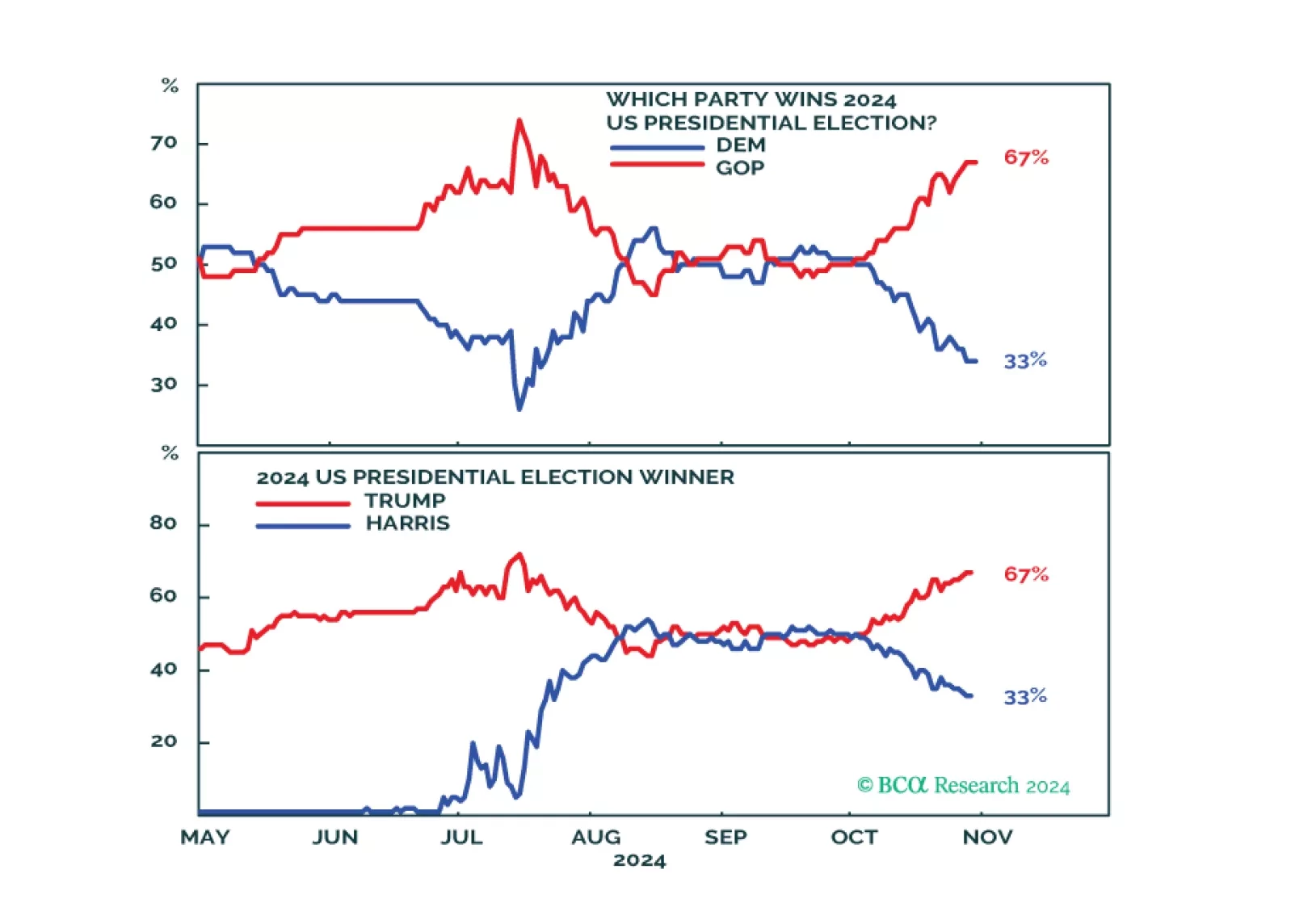

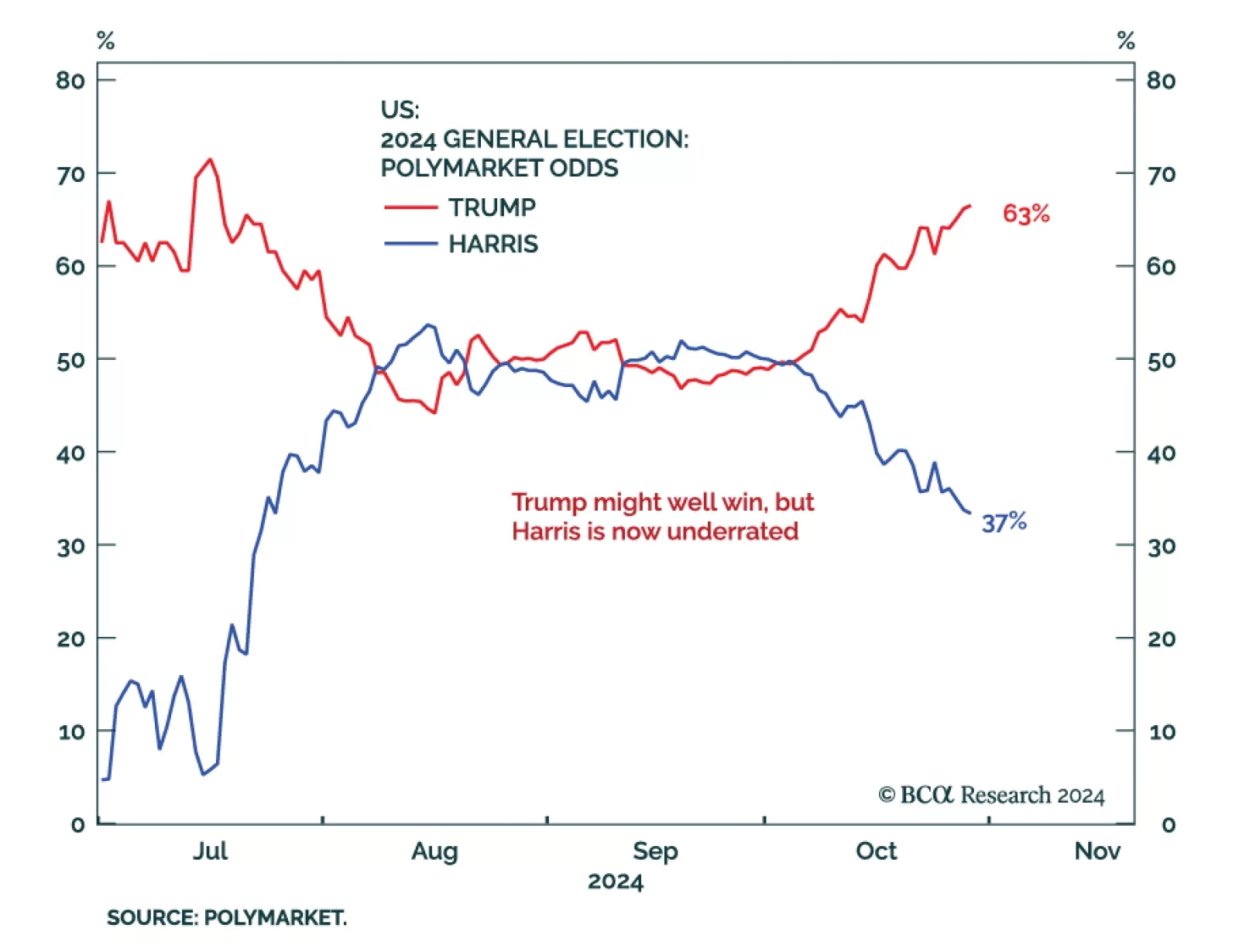

Trump may be favored, but Harris is now underrated. The Senate is highly likely to go Republican – Harris would be gridlocked if she pulled off a victory. If Trump wins it will be a full sweep. Expect volatility in the short term.

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

Our US Political Strategy colleagues now see 55% odds of a Trump victory, with odds of a Republican sweep at 47%. As odds of a contested election are rising, they built on their 2020 work to provide answers for next week’s…

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

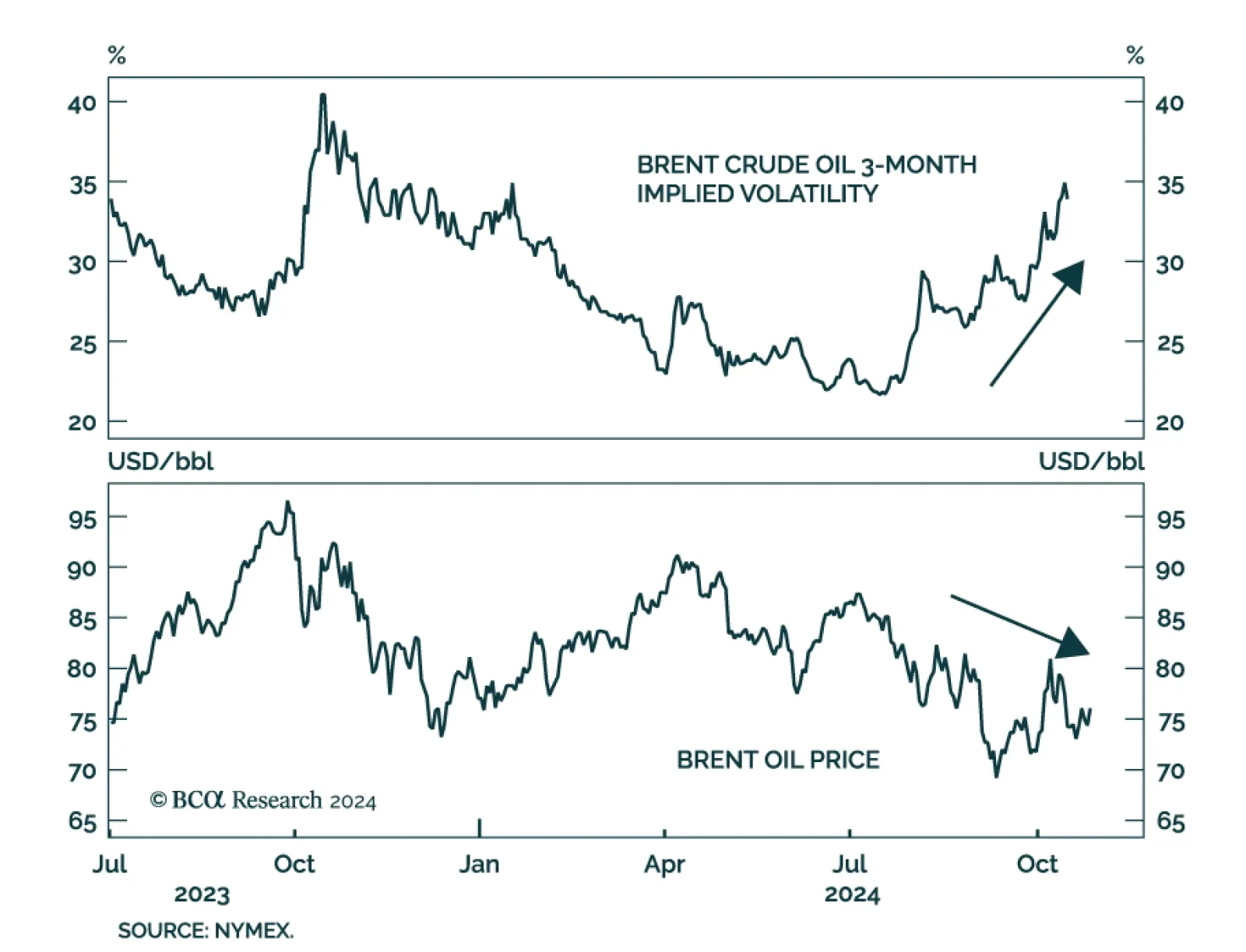

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…