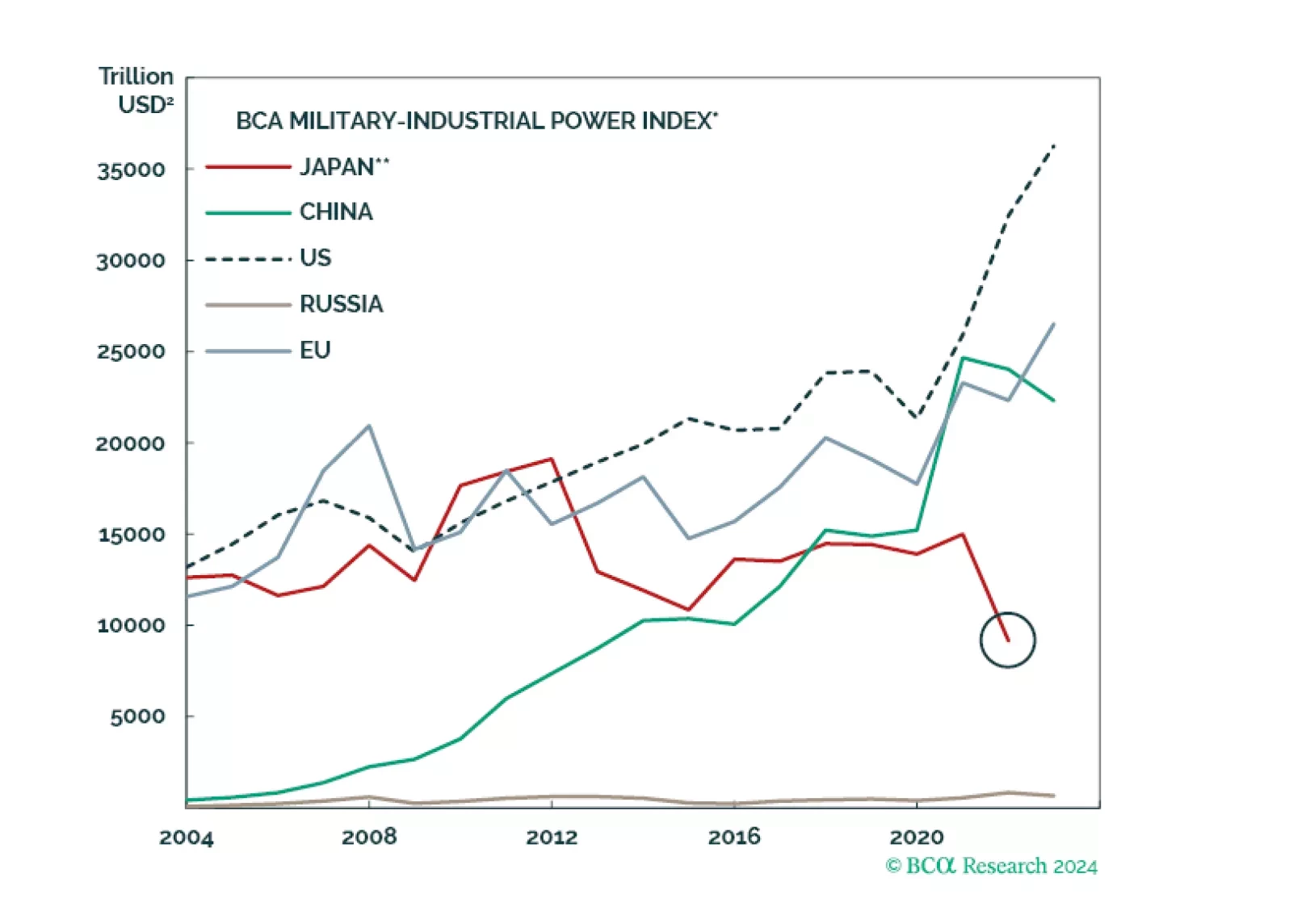

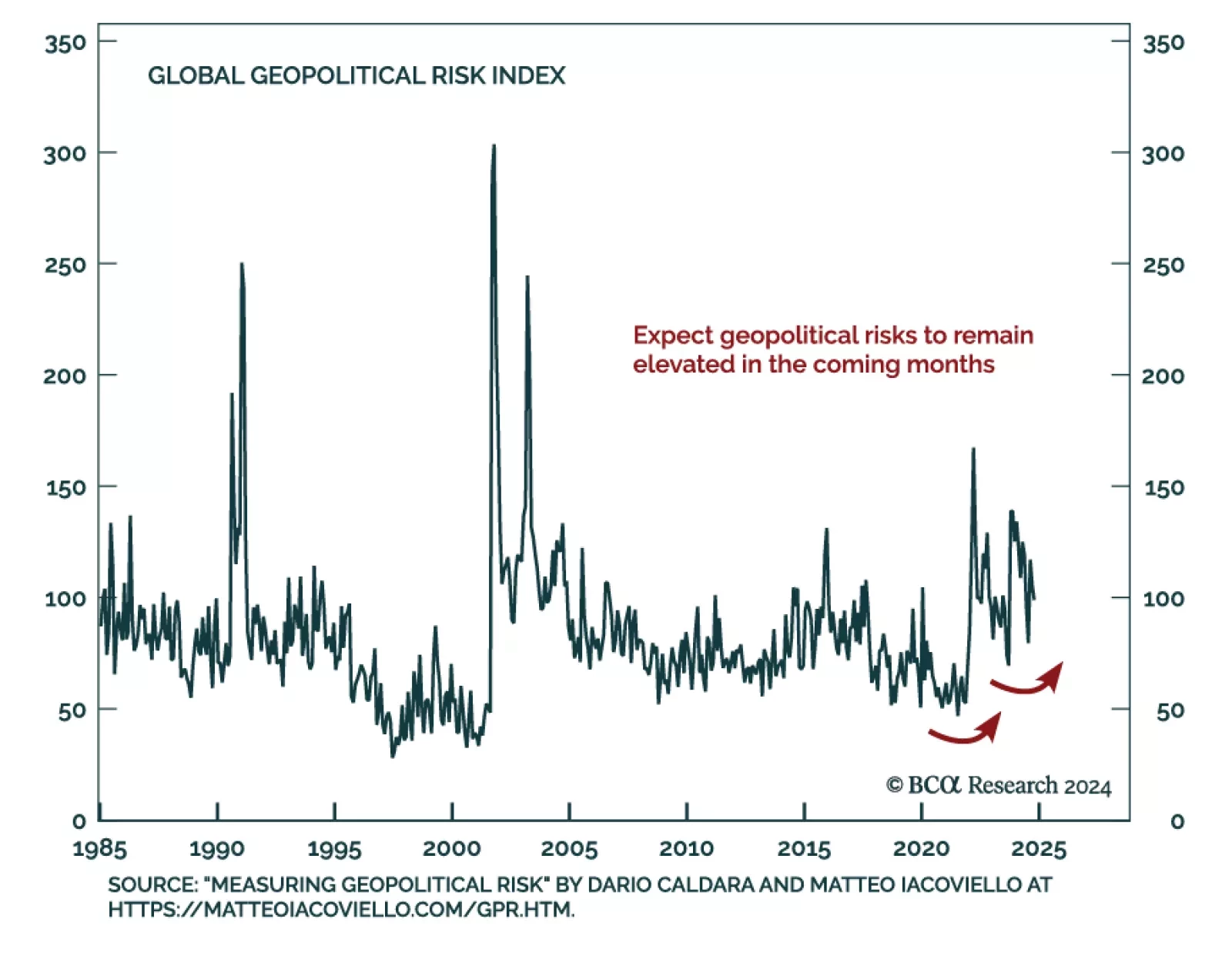

With cross-asset price action mainly revolving around the Trump trade since the election, Tuesday’s headlines surrounding Russia and Ukraine brought investors’ attention back abroad. As predicted by our Geopolitical…

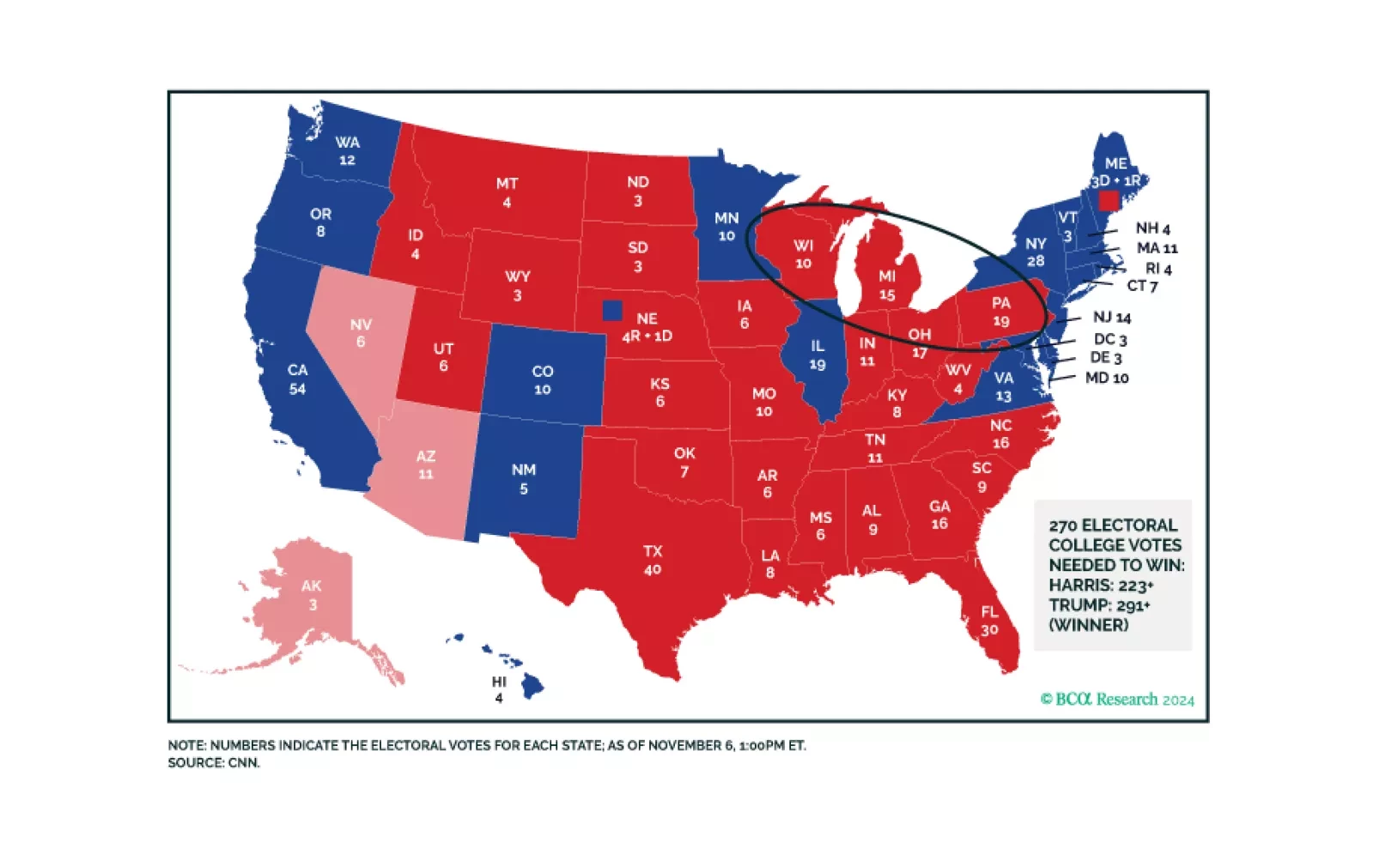

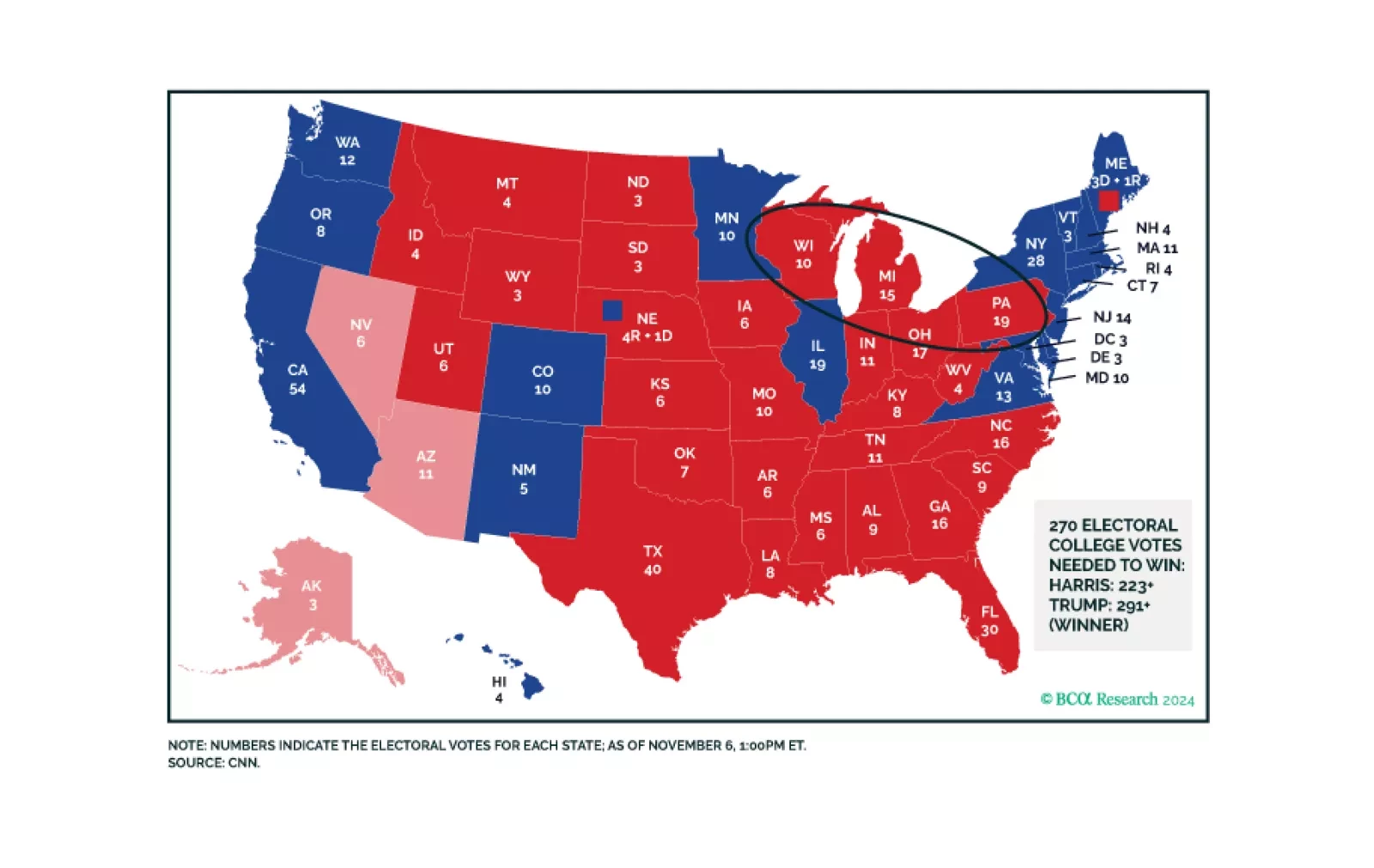

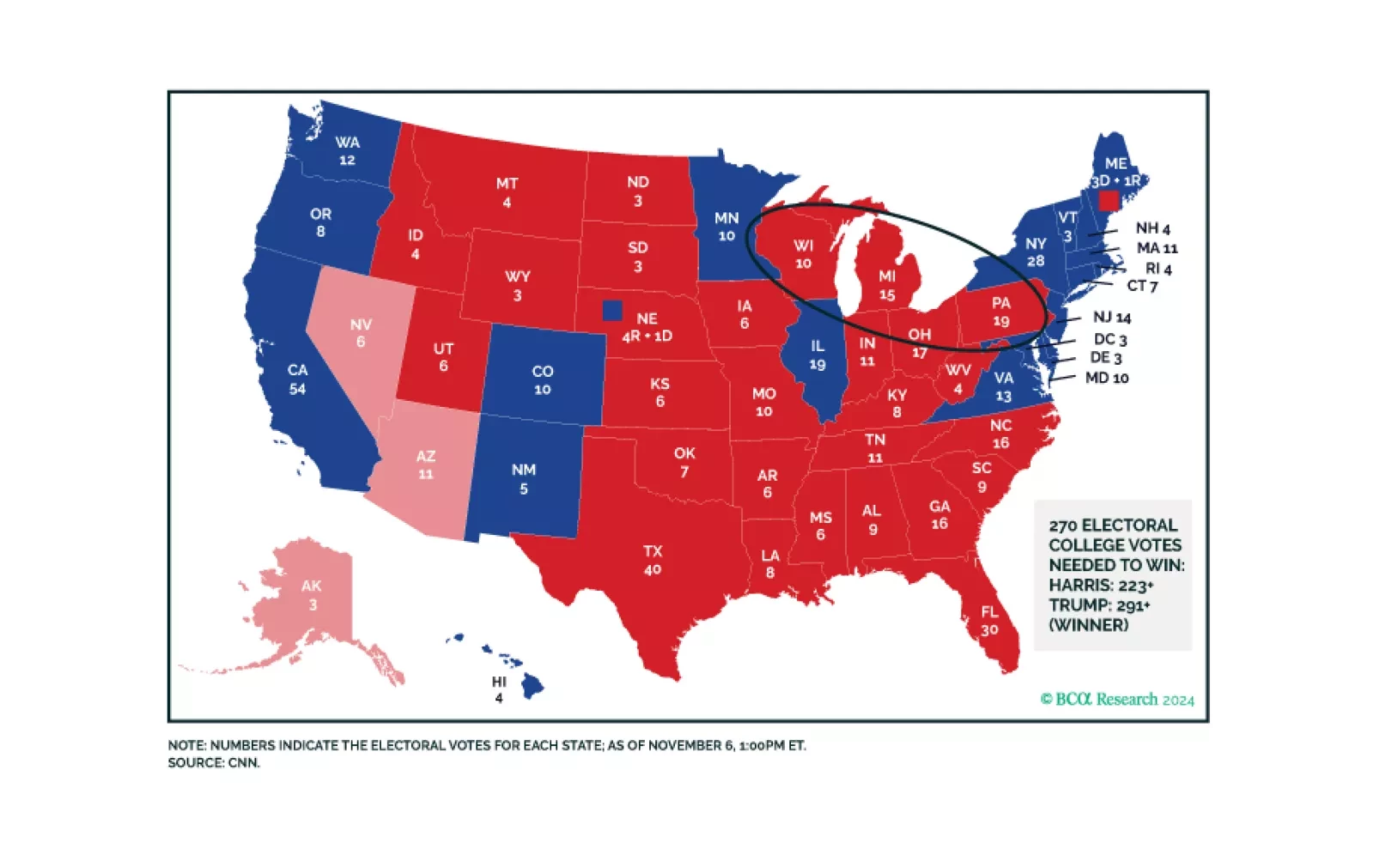

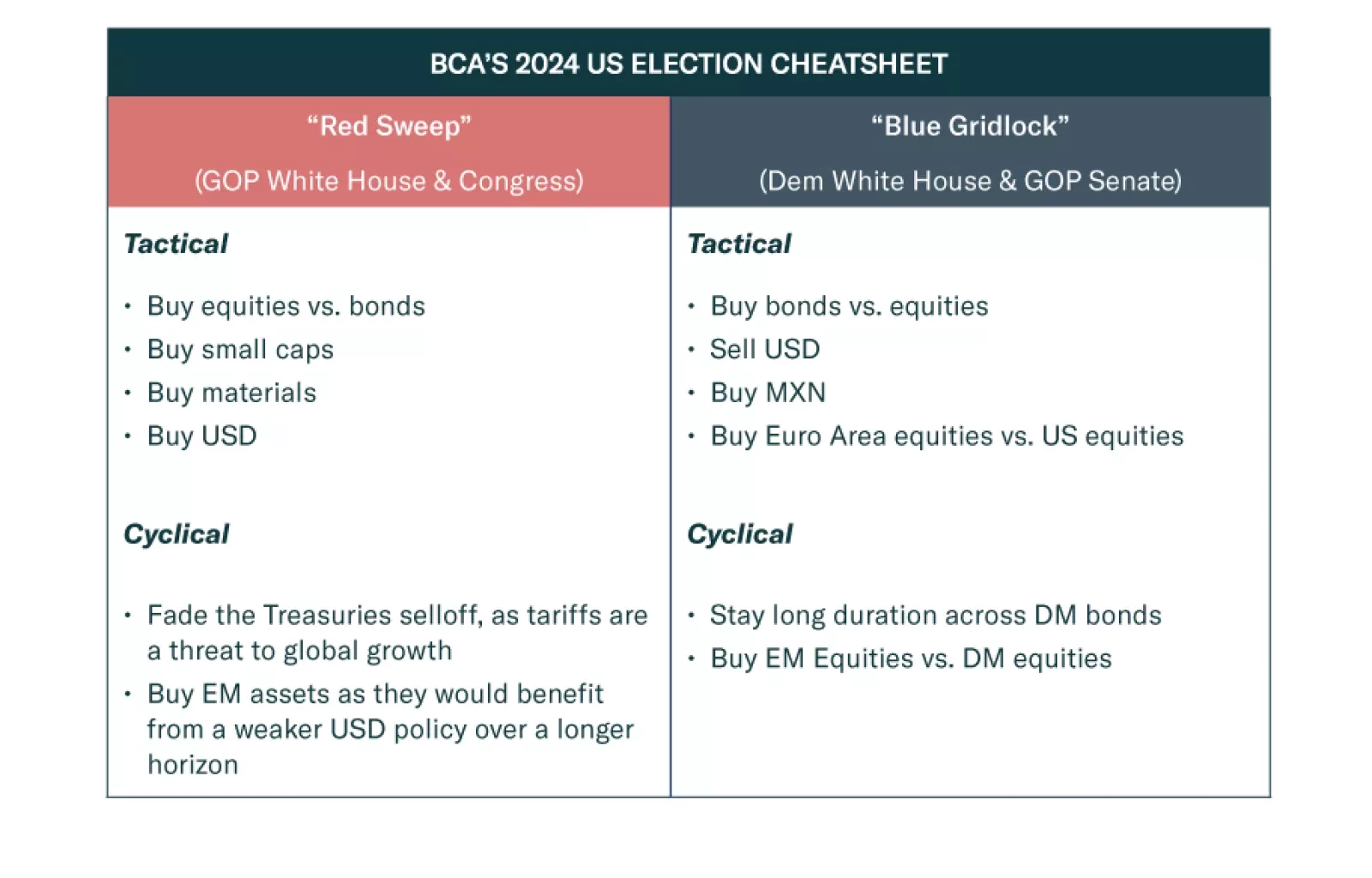

The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

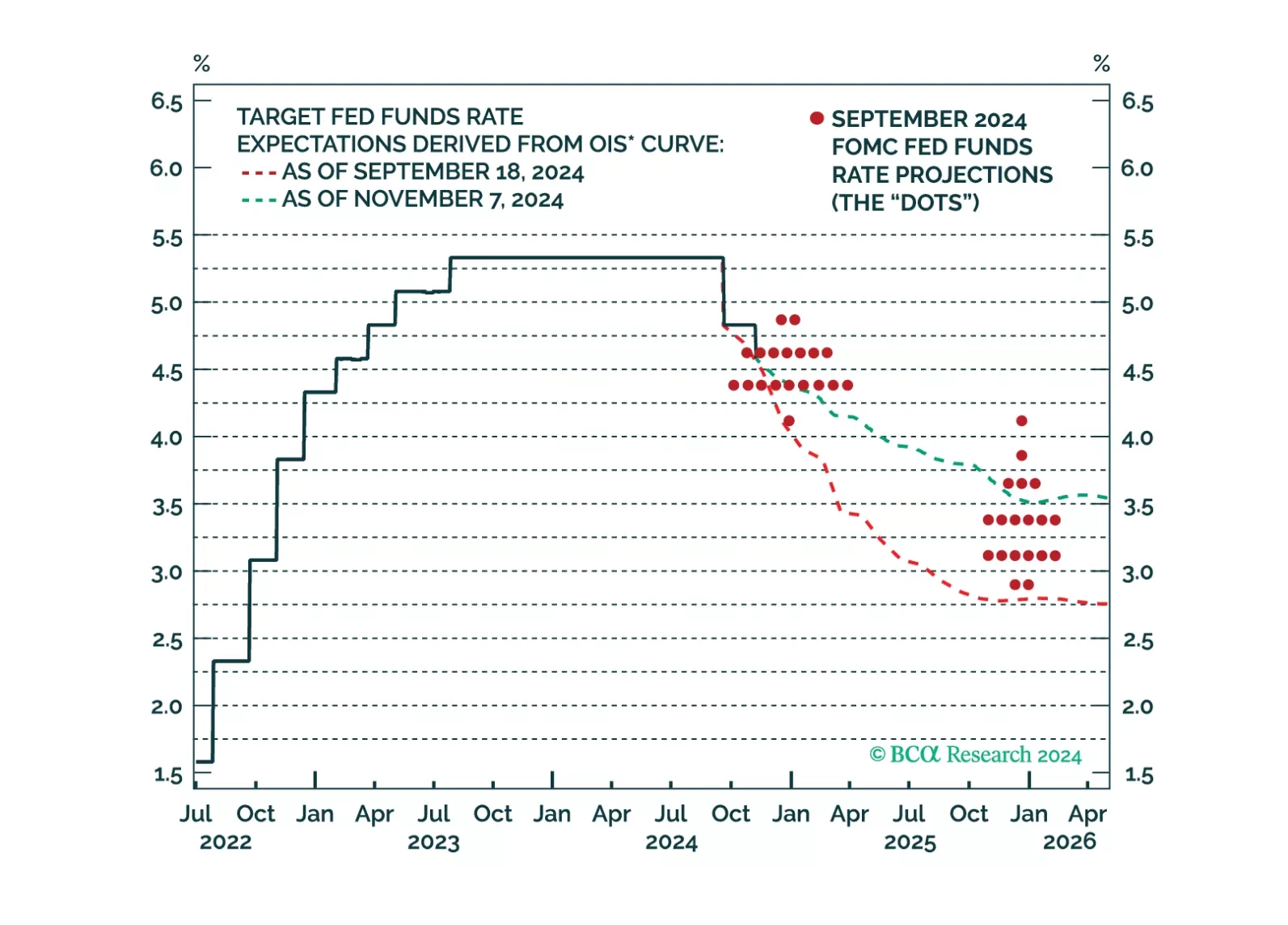

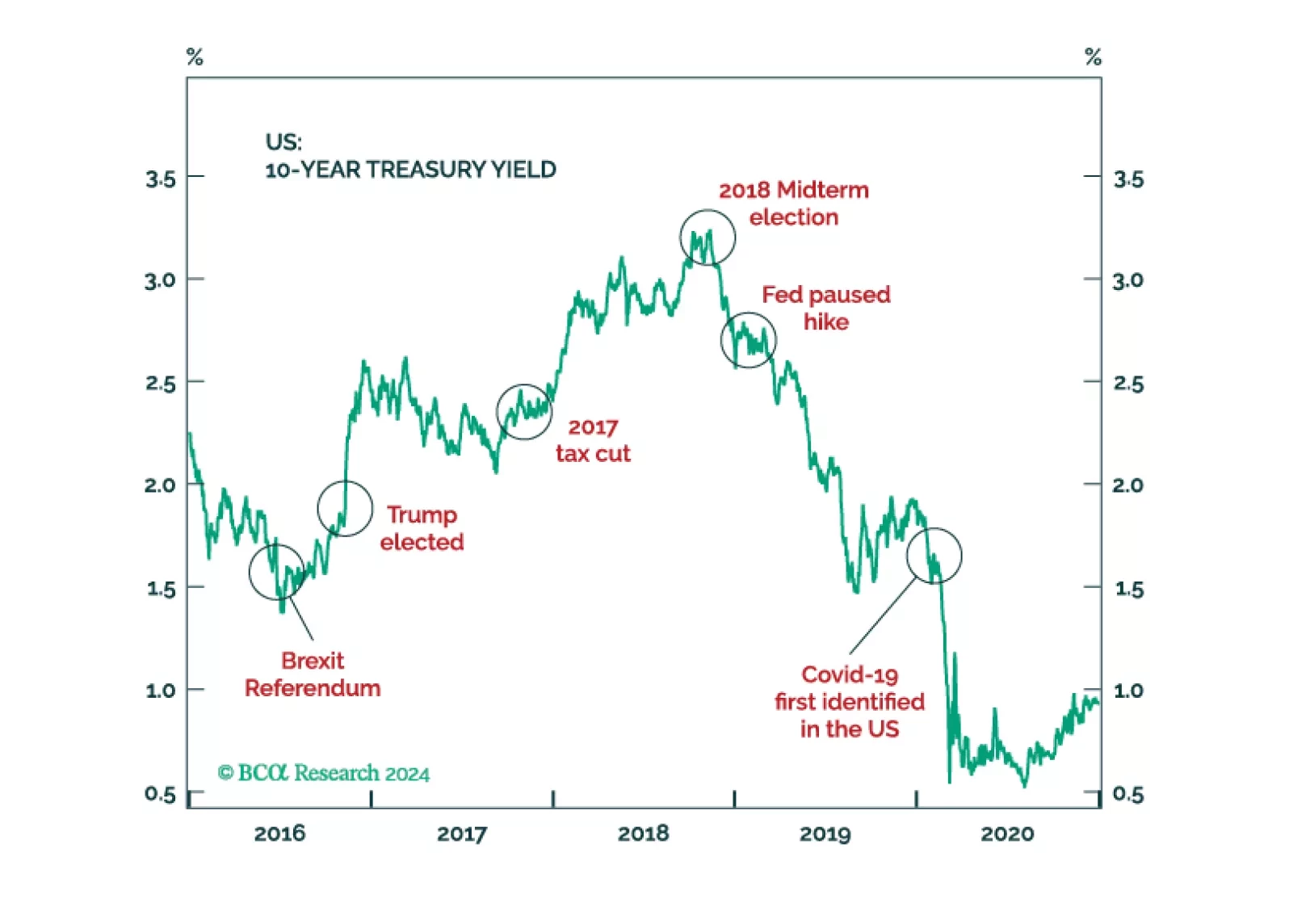

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

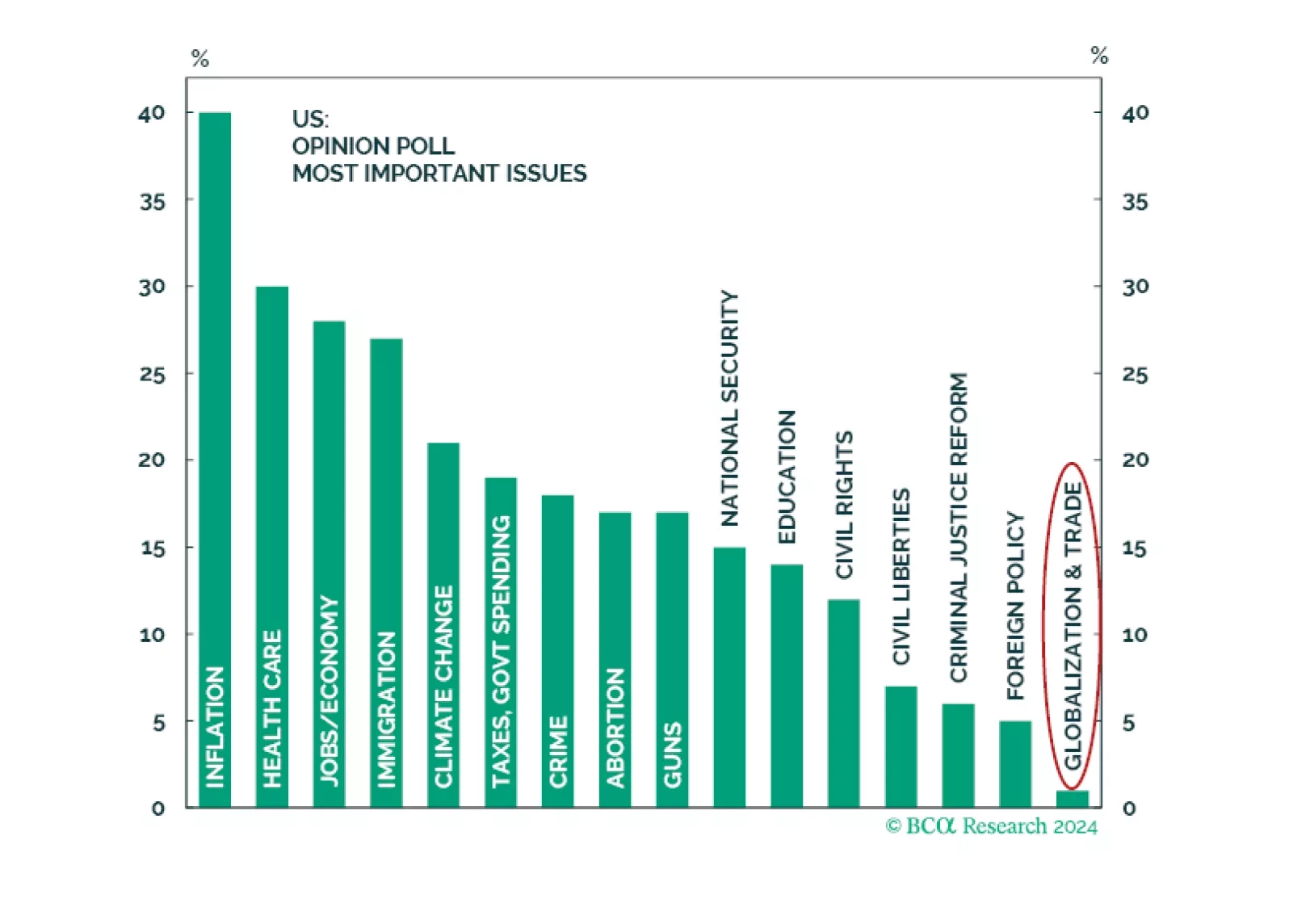

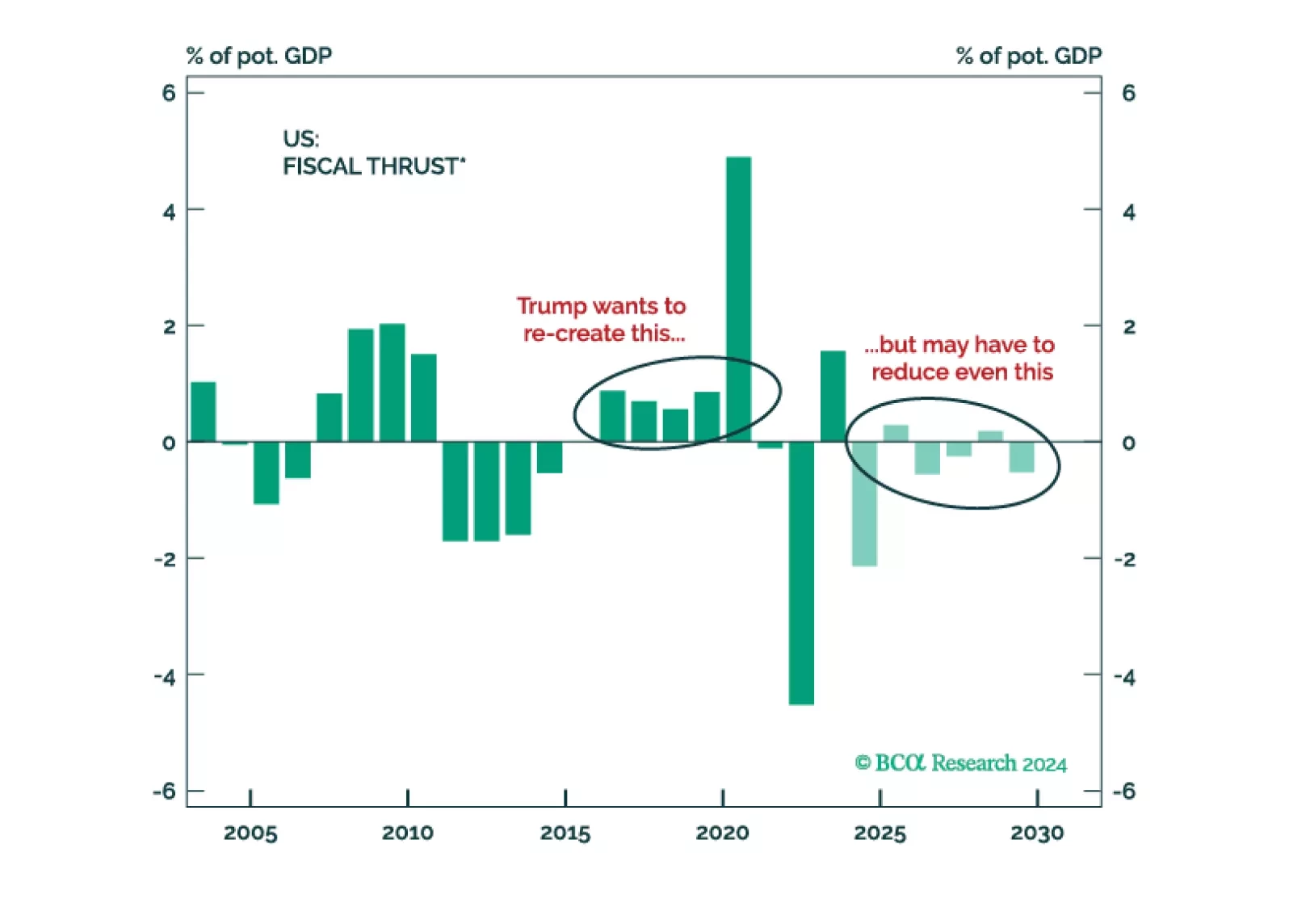

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

As markets settle into waiting mode for the US election, we provide a concise but not exhaustive cheatsheet for what to expect as the results come out. Our US & Geopolitical strategists’ two most likely outcomes are a…