This new scenario could trigger a deeper selloff in global equity and credit markets if investors begin to price in a larger and more prolonged hit to economic growth and corporate profits from the U.S. tariffs. This would…

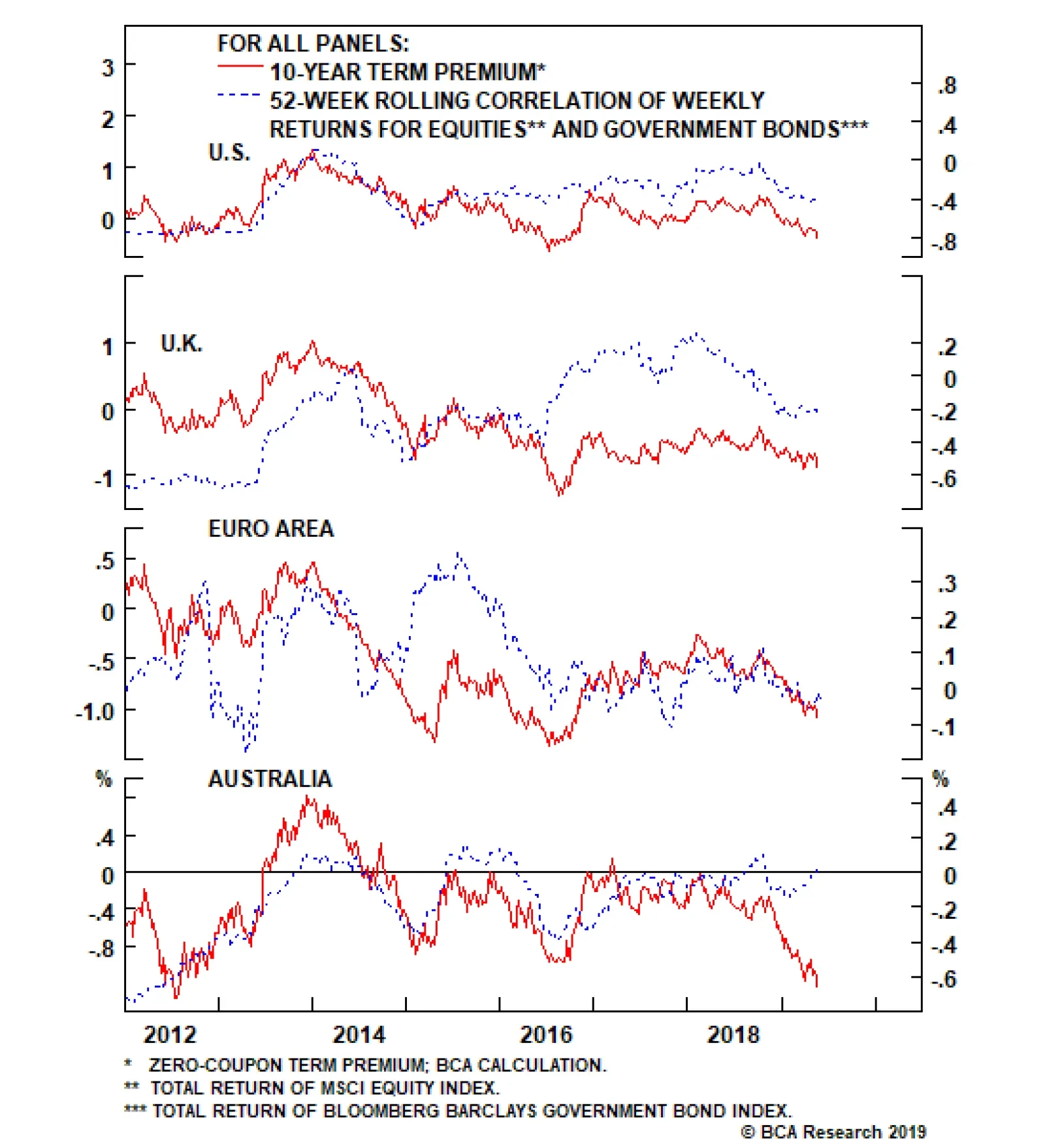

This suggests that the risk-aversion bid for U.S. Treasuries will result in an even more deeply negative U.S. term premium and lower bond yields. Already, we are seeing such increasingly negative correlations between returns…

The macro backdrop is hardly encouraging: global export volumes are contracting and a huge spike in global policy uncertainty is providing additional support to the dollar. Any further rebound in the greenback will pile…

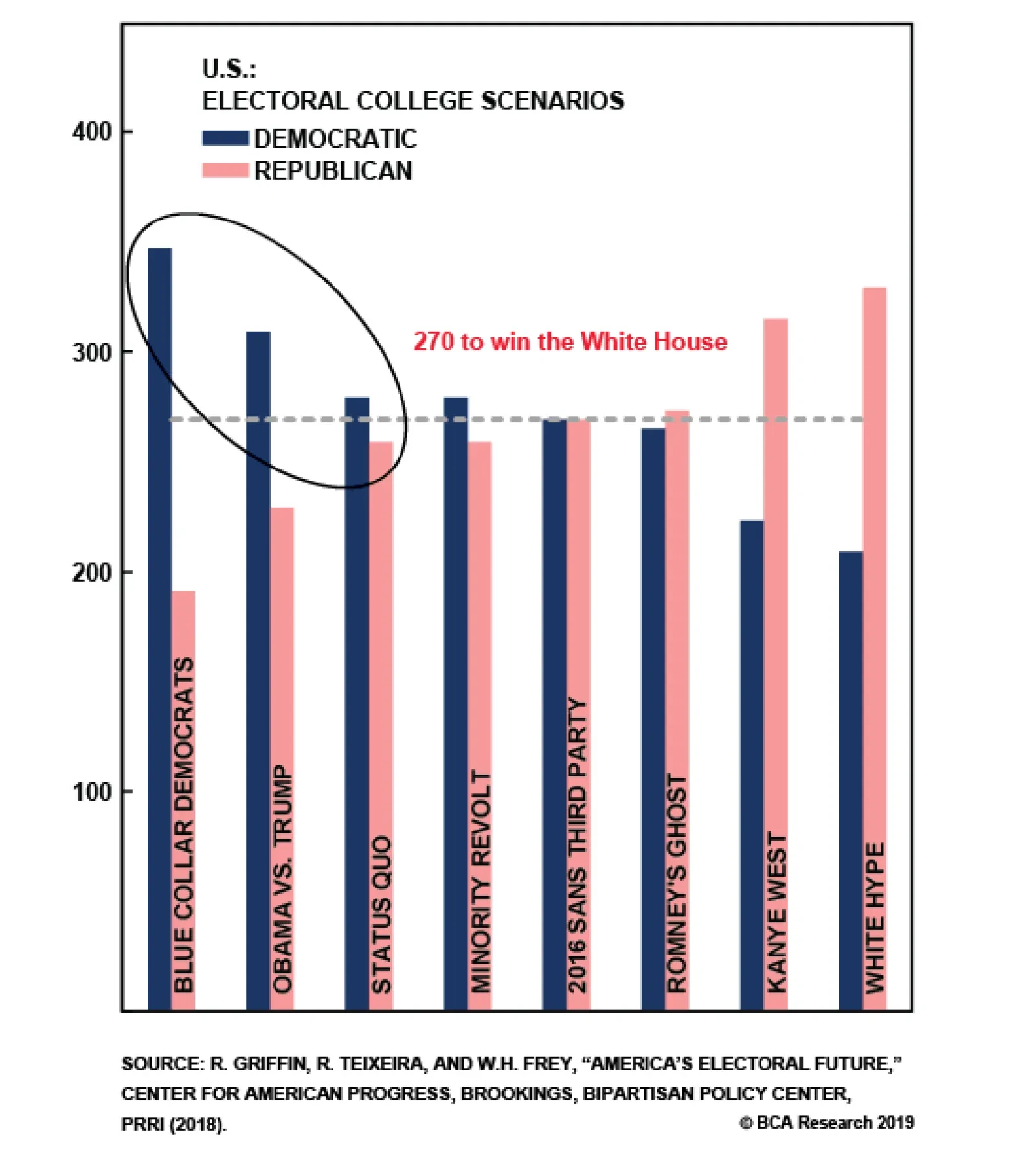

Biden, who is still enjoying a very sizable bump to his polling a month after formally announcing his candidacy, is a direct threat to Trump’s electoral strategy of maximizing white blue-collar turnout and support,…

Highlights Currency markets continue to fight a tug of war between weak incoming data but easier financial conditions. Our thesis remains that the path of least resistance for the dollar is down, but the rising specter of global…

Highlights So What? Markets remain complacent about U.S.-China trade. Why? The U.S. has escalated the trade war by threatening sanctions on key Chinese tech firms. Chinese President Xi Jinping is preparing his domestic audience for…

Highlights The risk premium in crude oil prices is rising again, as policy risk – and the potential for large policy-driven errors – increases (Chart of the Week).1 This is not being fully reflected in options markets, where…

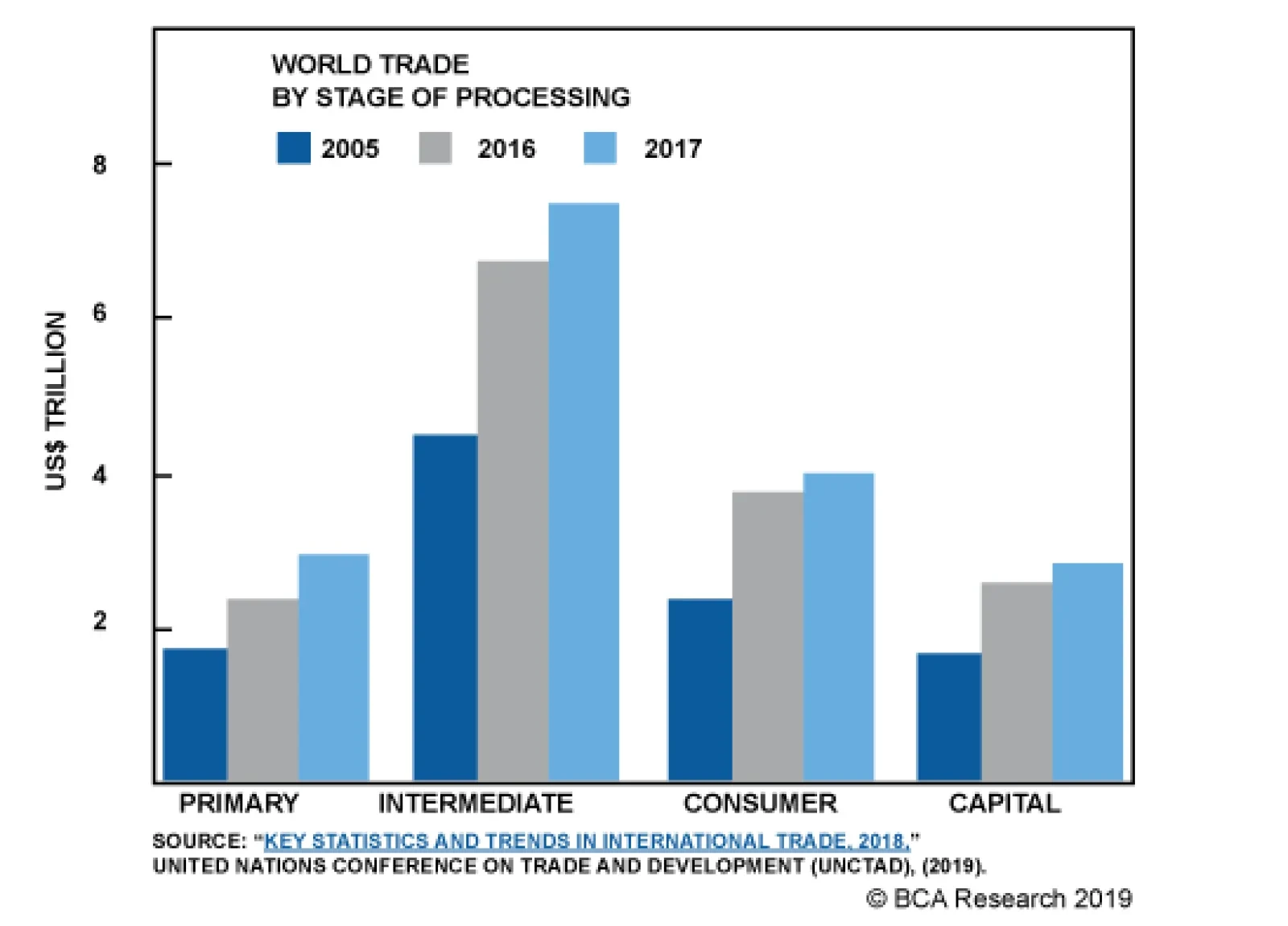

There are at least five reasons for the true cost of a trade war being higher than expected. A trade war would degrade the value of the existing stock of human and physical capital. This would result in lower potential GDP. It…

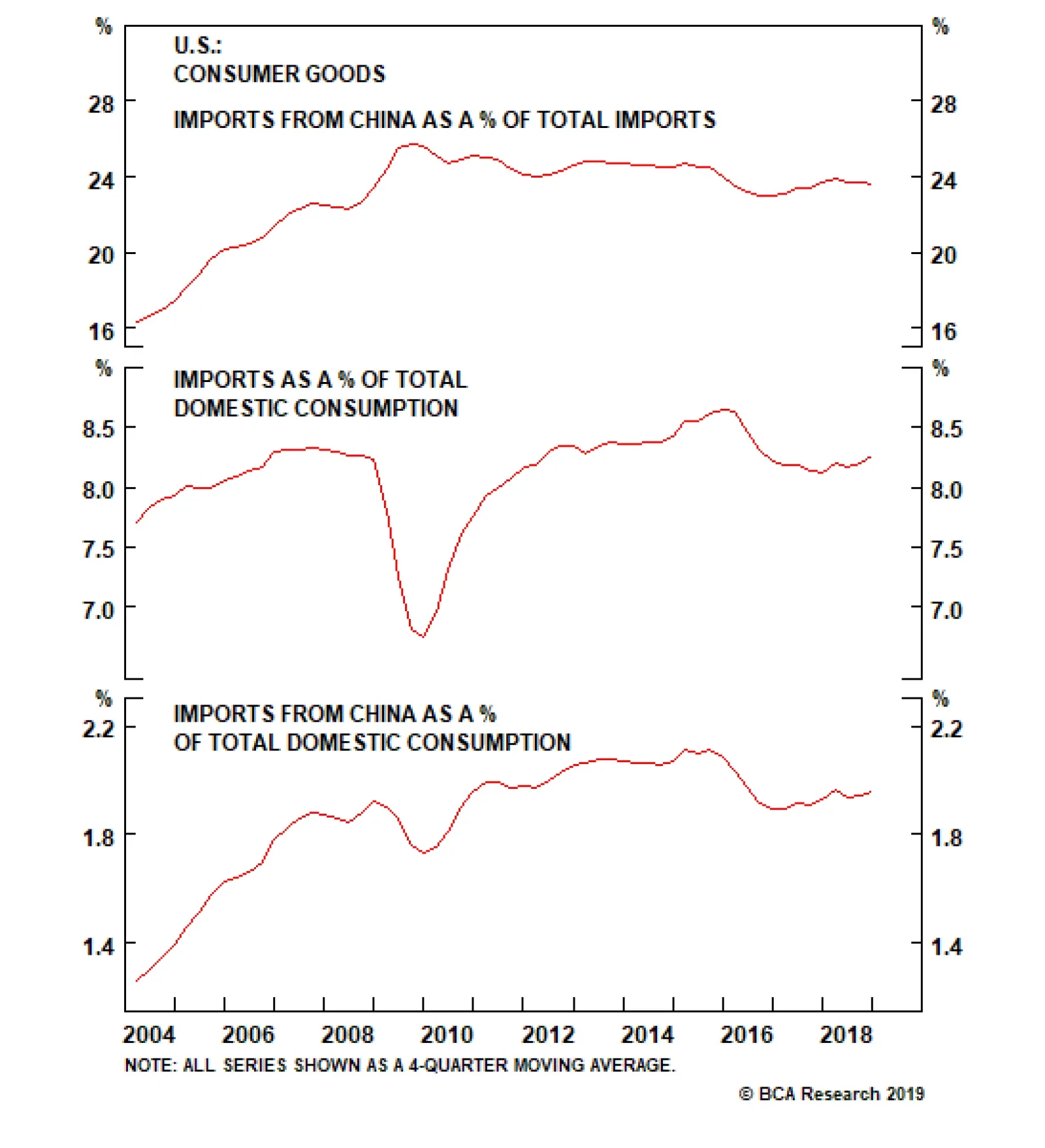

With all U.S. imports from China affected, price rises will percolate upward through all tradable industries and consumer goods. Two points are worth noting: The domestic value-add of Chinese exports to the U.S. is not as…

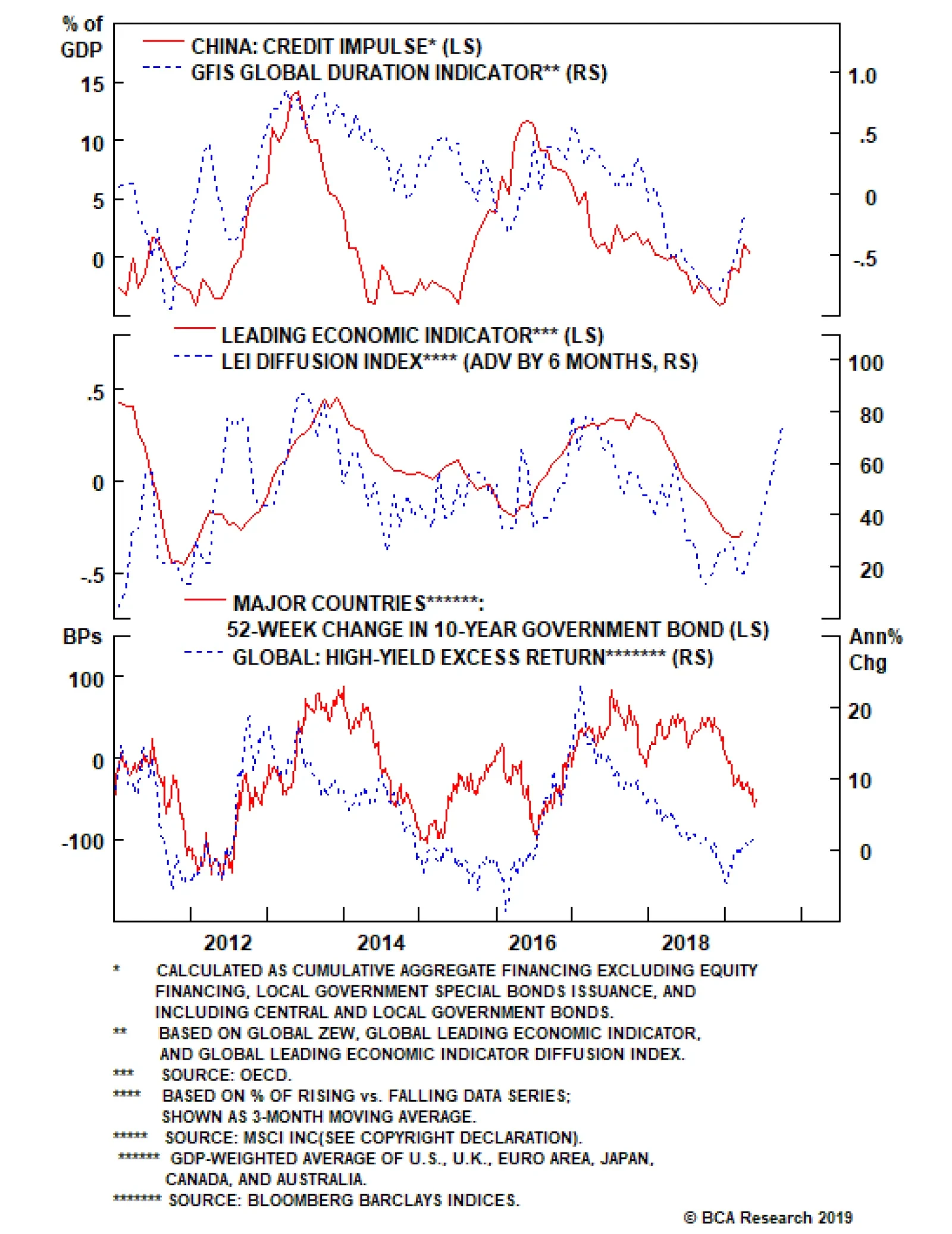

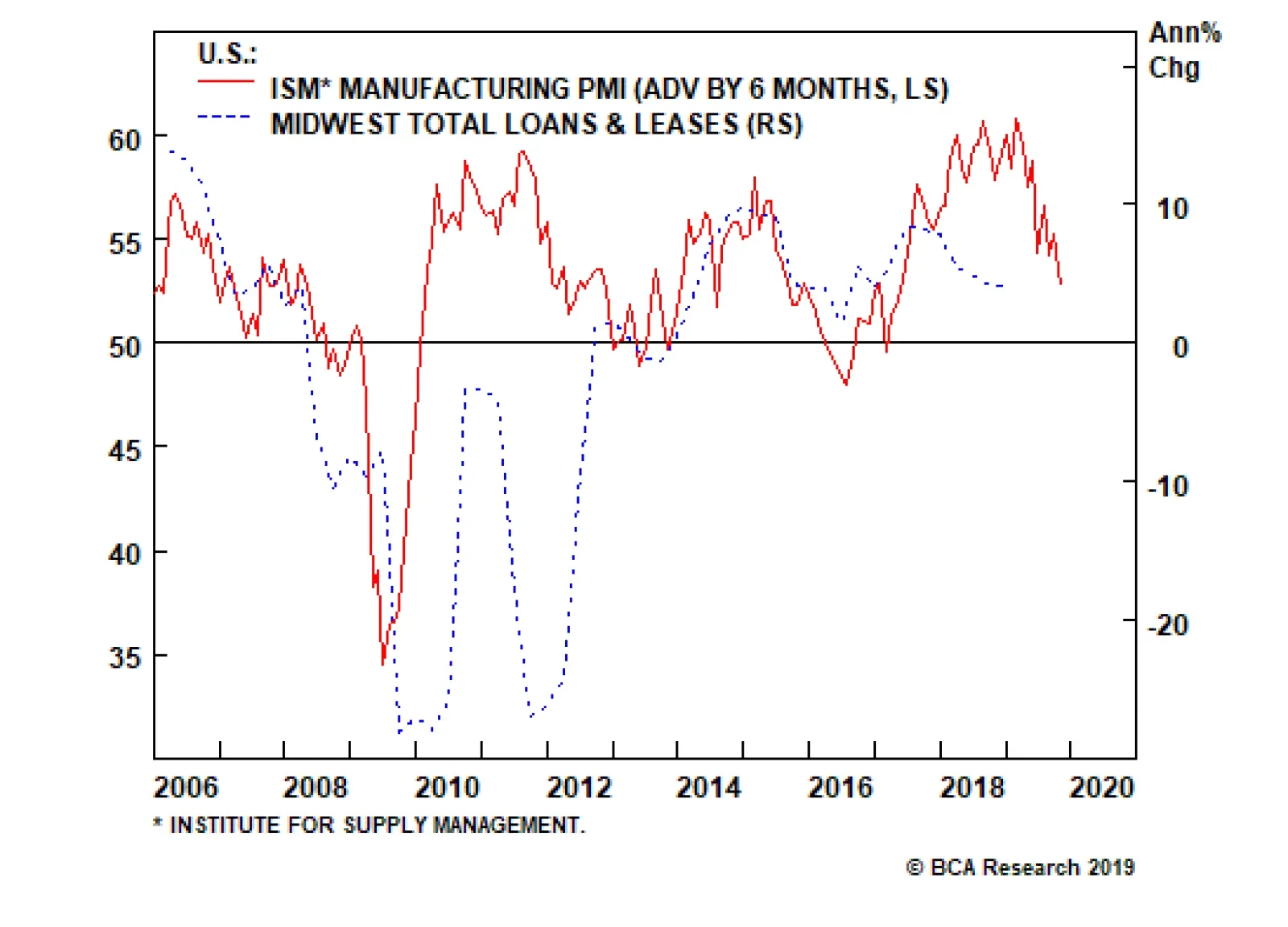

Highlights Duration: We see current bond market behavior as very similar to mid-2016, when heightened political uncertainty obscured the economy’s true strength and kept bond yields lower for longer than was justified by the…