President Donald Trump was unhappy with the Federal Reserve’s somewhat hawkish interest rate cut on July 31. Chairman Jerome Powell emphasized that the cut should not be seen as the launch of a “lengthy rate cutting…

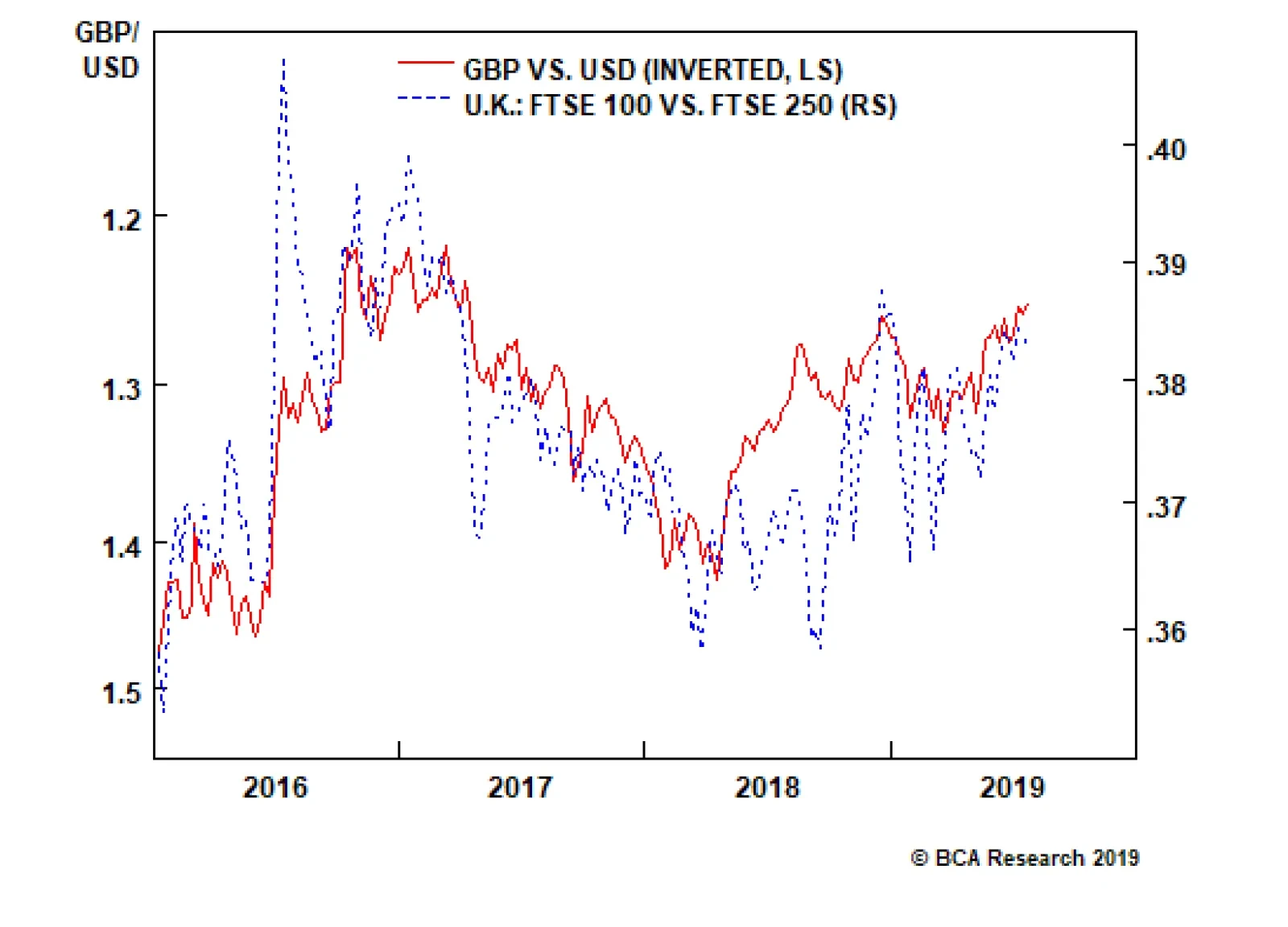

Highlights So What? Prime Minister Boris Johnson’s threat to take the U.K. out of the EU without a withdrawal deal in place is a substantial 21% risk. Why? The odds of a no-deal exit could range from today’s 21% to around…

The thawing of Asia’s frozen post-WWII conflicts is a paradigm shift with significant long-term consequences for investors. The fundamental drivers are as follows: China’s rise is not peaceful: President Xi Jinping…

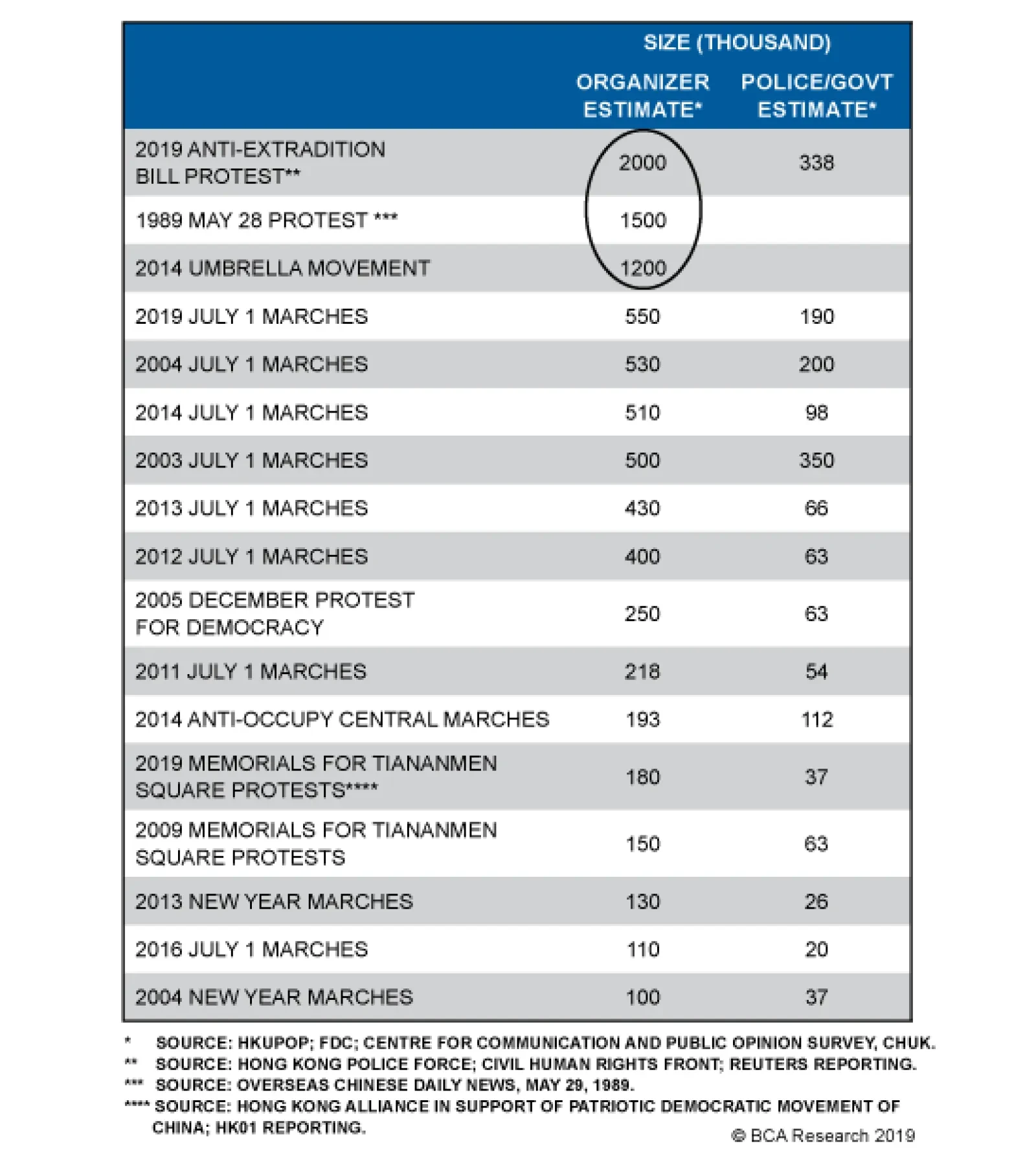

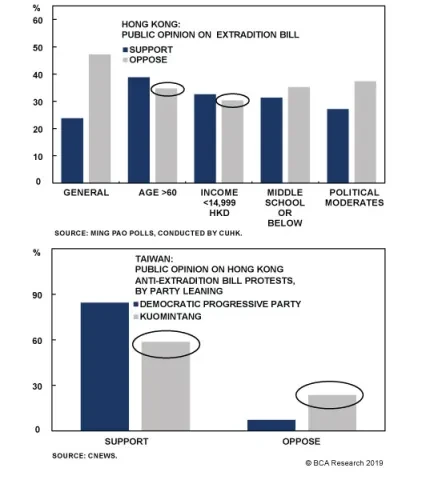

Even the groups that are least sympathetic to the protesters – political moderates, the elderly, low-income groups, and the least educated – are more or less divided over the controversial extradition bill that…

While the Conservatives and the U.K. have a new leader, as far as Brexit is concerned, plus ça change plus c’est la même chose. A new leader does not change the tight parliamentary arithmetic in which the…

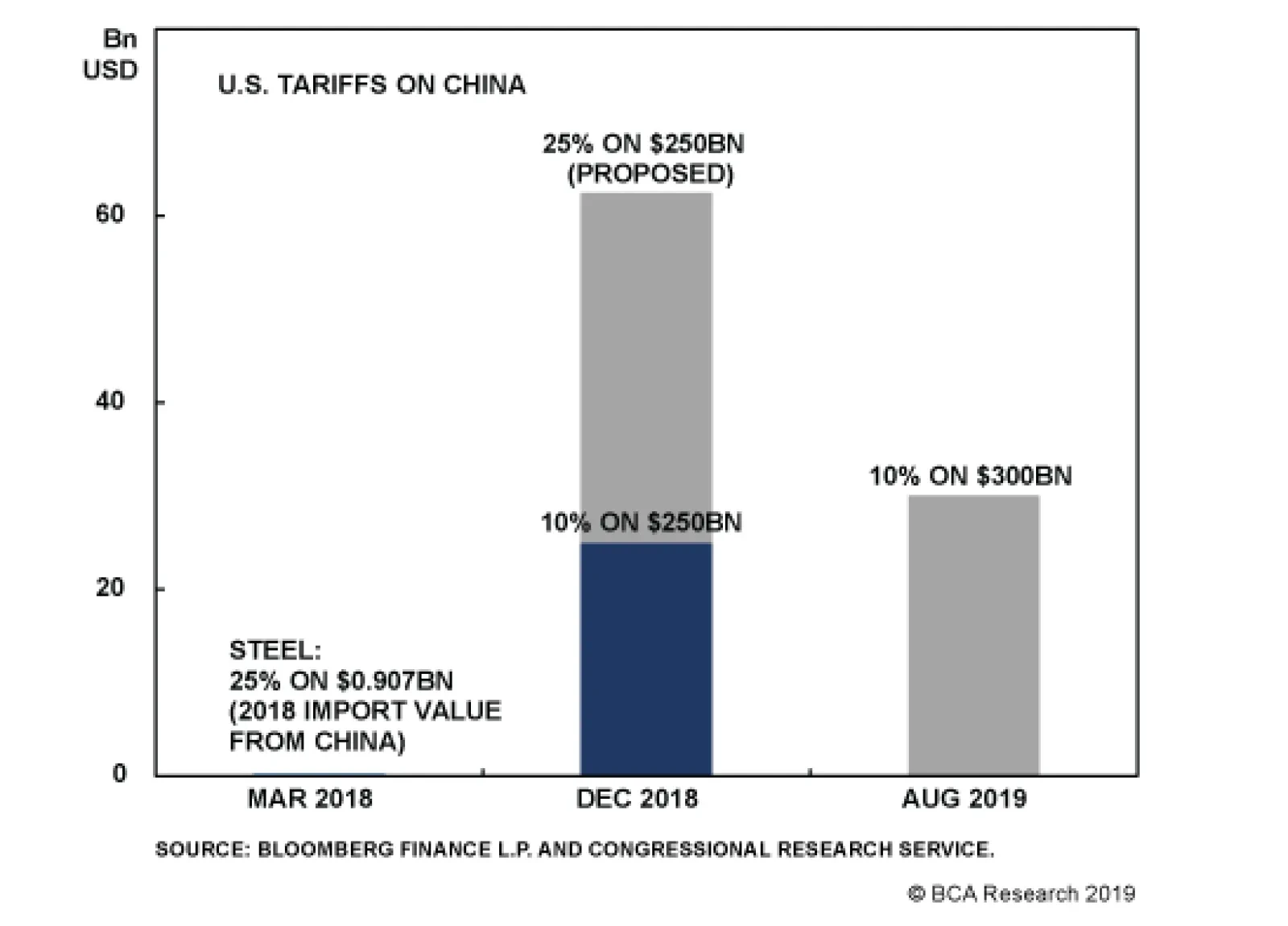

Highlights So What? Key geopolitical risks remain unresolved and most of the improvements are transitory. Maintain a cautious tactical stance toward risk assets. Why? U.S.-China relations remain the preeminent geopolitical risk to…

Highlights As central banks continue to push on a string for 2 percent inflation, it will underpin the valuation of equities and other risk-assets. So long as the global 10-year bond yield remains well below 2.5 percent, equity market…

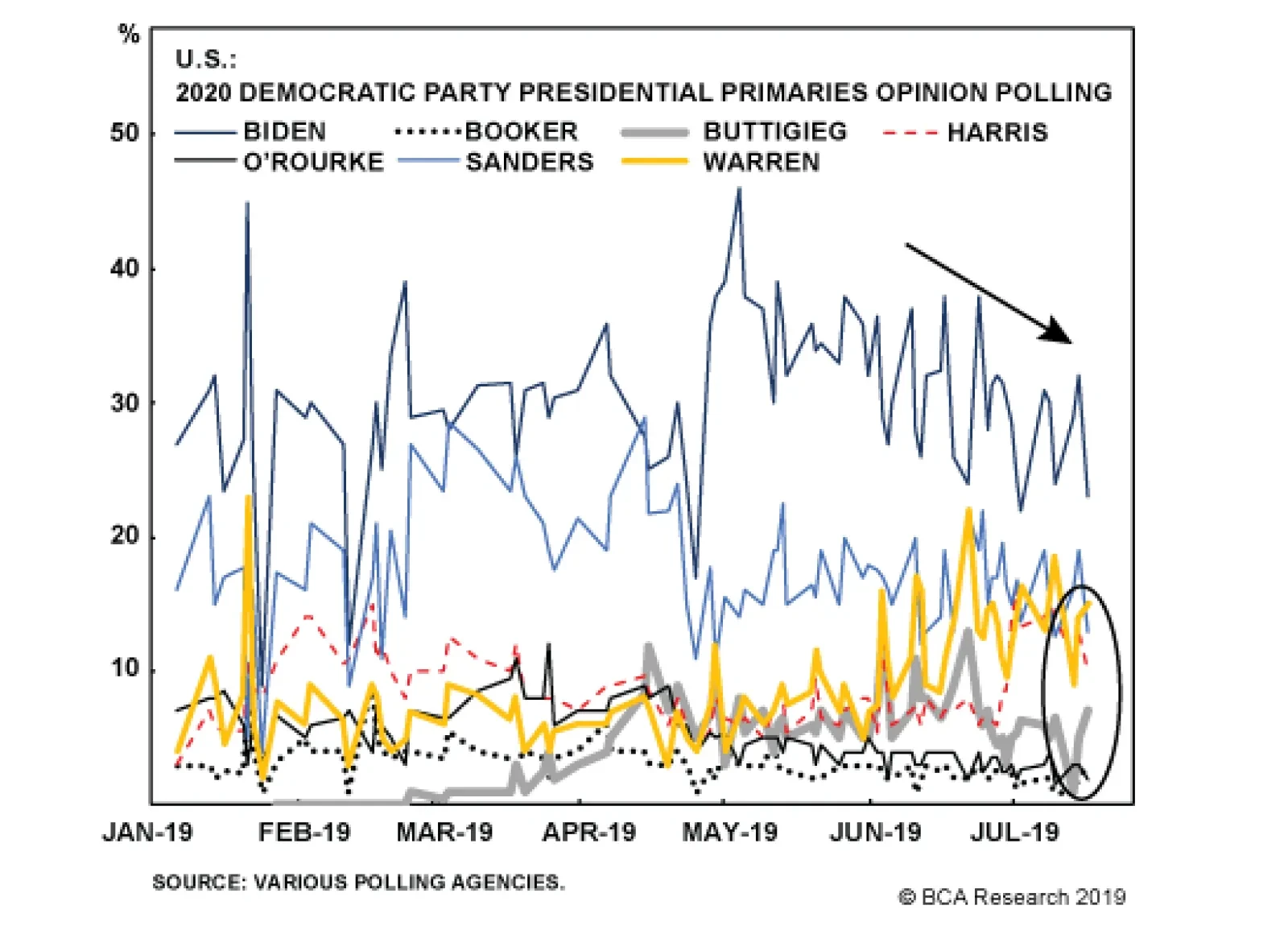

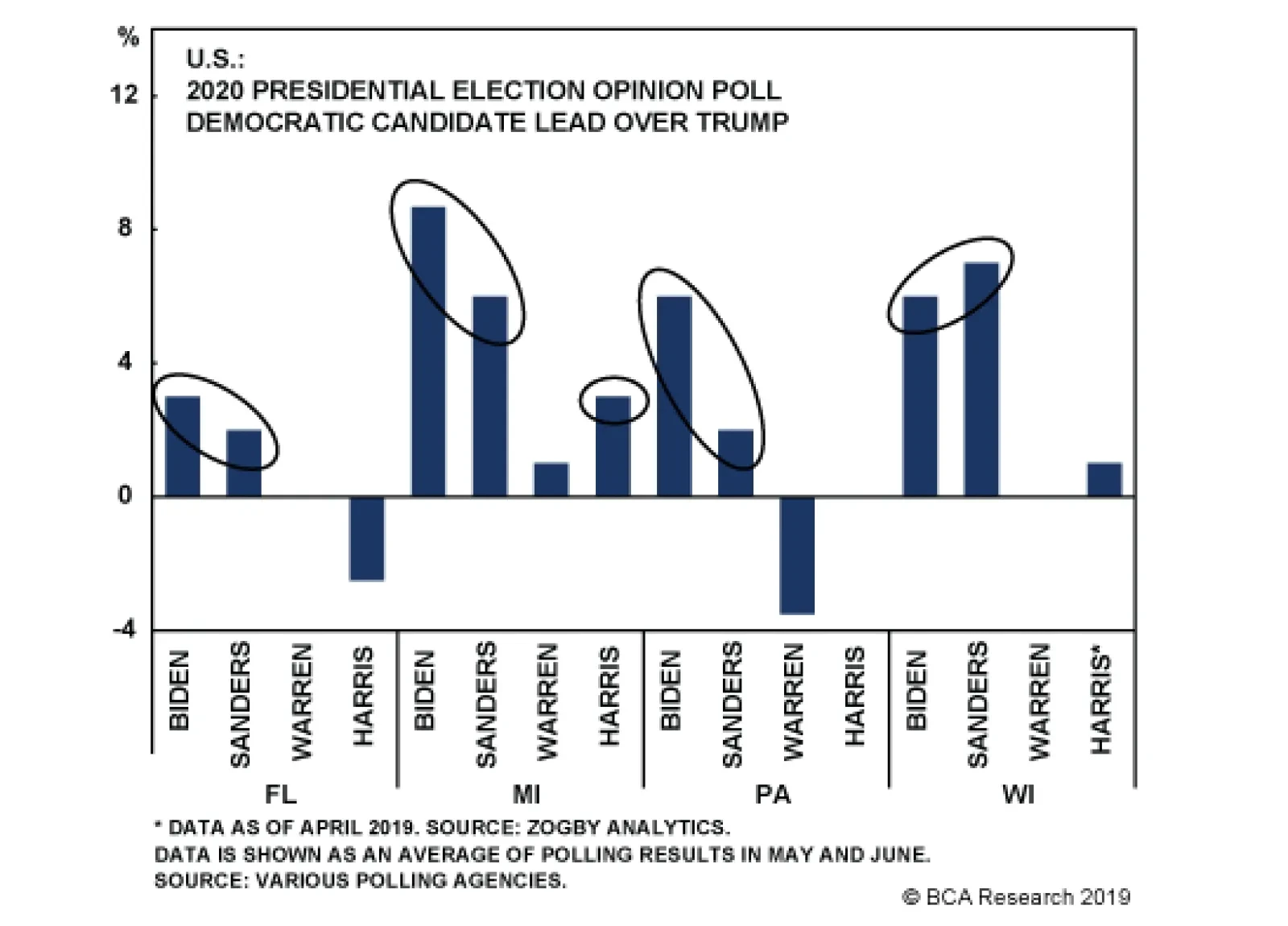

The risks are to the downside because the market is at all-time highs and Democratic proposals include raising taxes on corporations and re-regulating the economy. Whether you accept our 55% odds of Trump reelection, the race…

Most of the major progressive candidates are electable – they have a popular and electoral path to the White House – as revealed by their successful head-to-head polling against Trump in battleground state opinion…

Highlights So What? U.S. policy uncertainty adds to a slew of geopolitical reasons to remain tactically cautious on risk assets. Why? U.S. fiscal policy should ultimately bring market-positive developments – though the budget…