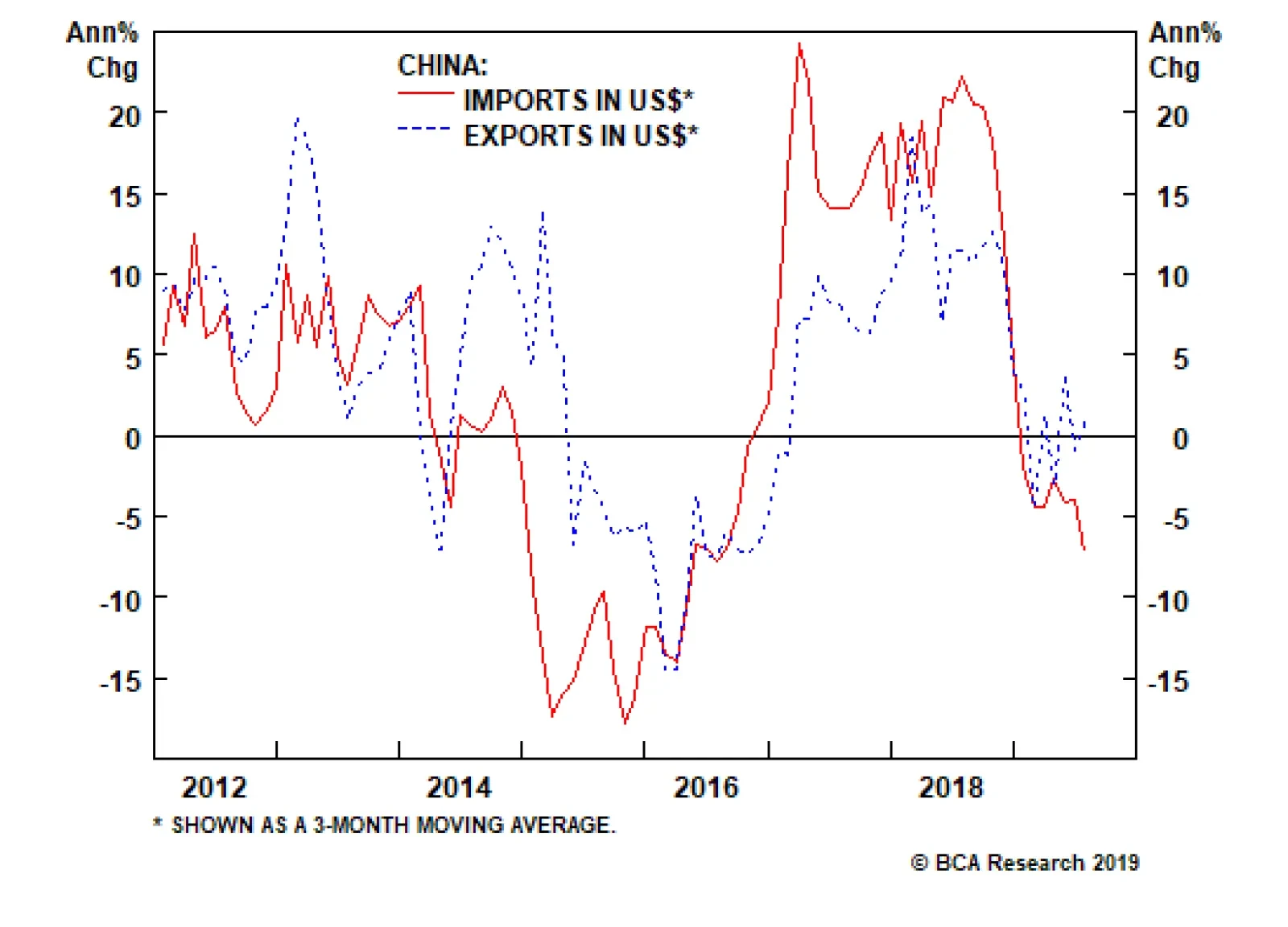

The media and many investors seem to be solely focused on the impact of U.S. tariffs against imports from China. Yet, these tariffs have not been the primary cause of the ongoing global manufacturing and trade recessions. The…

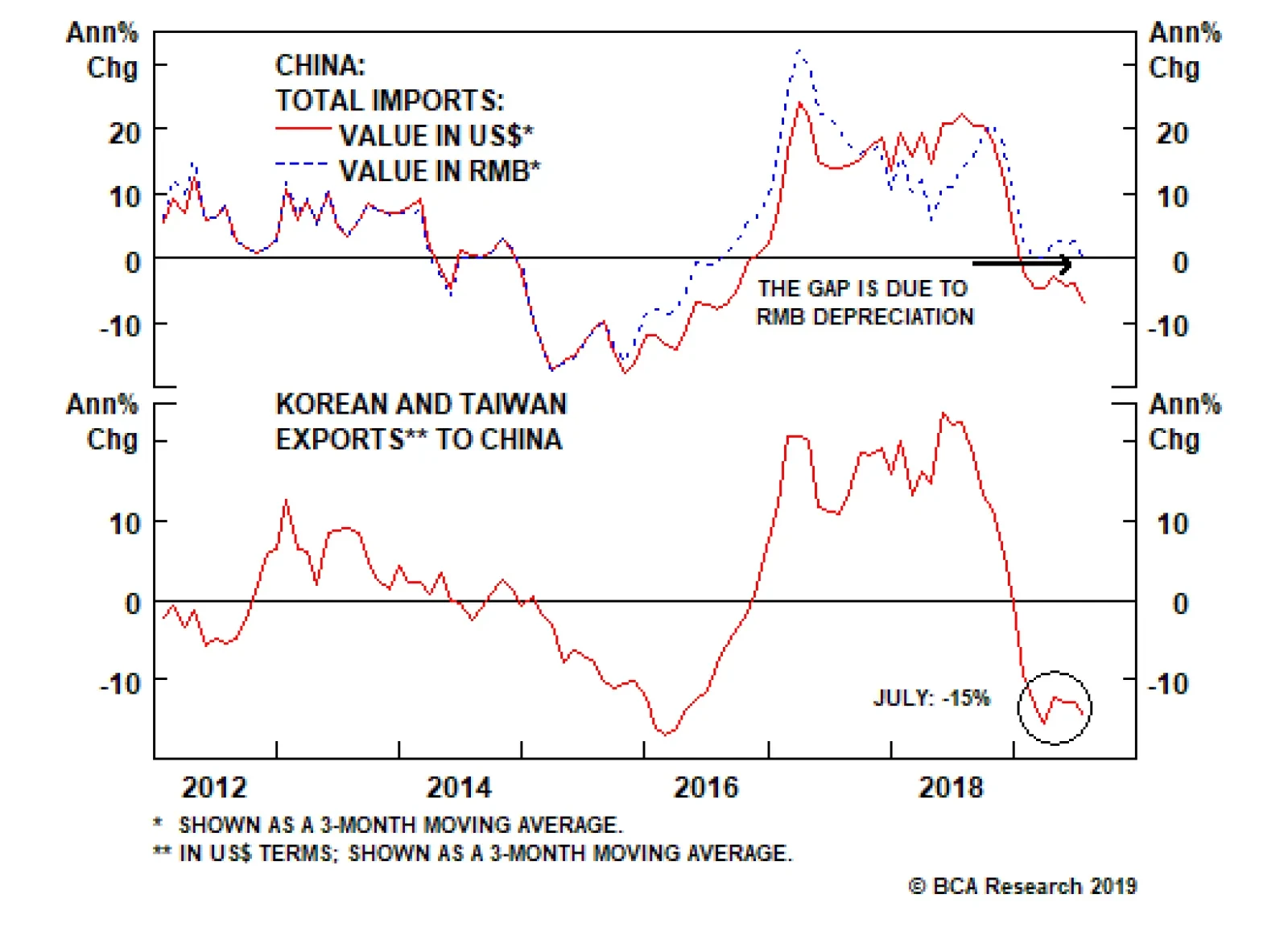

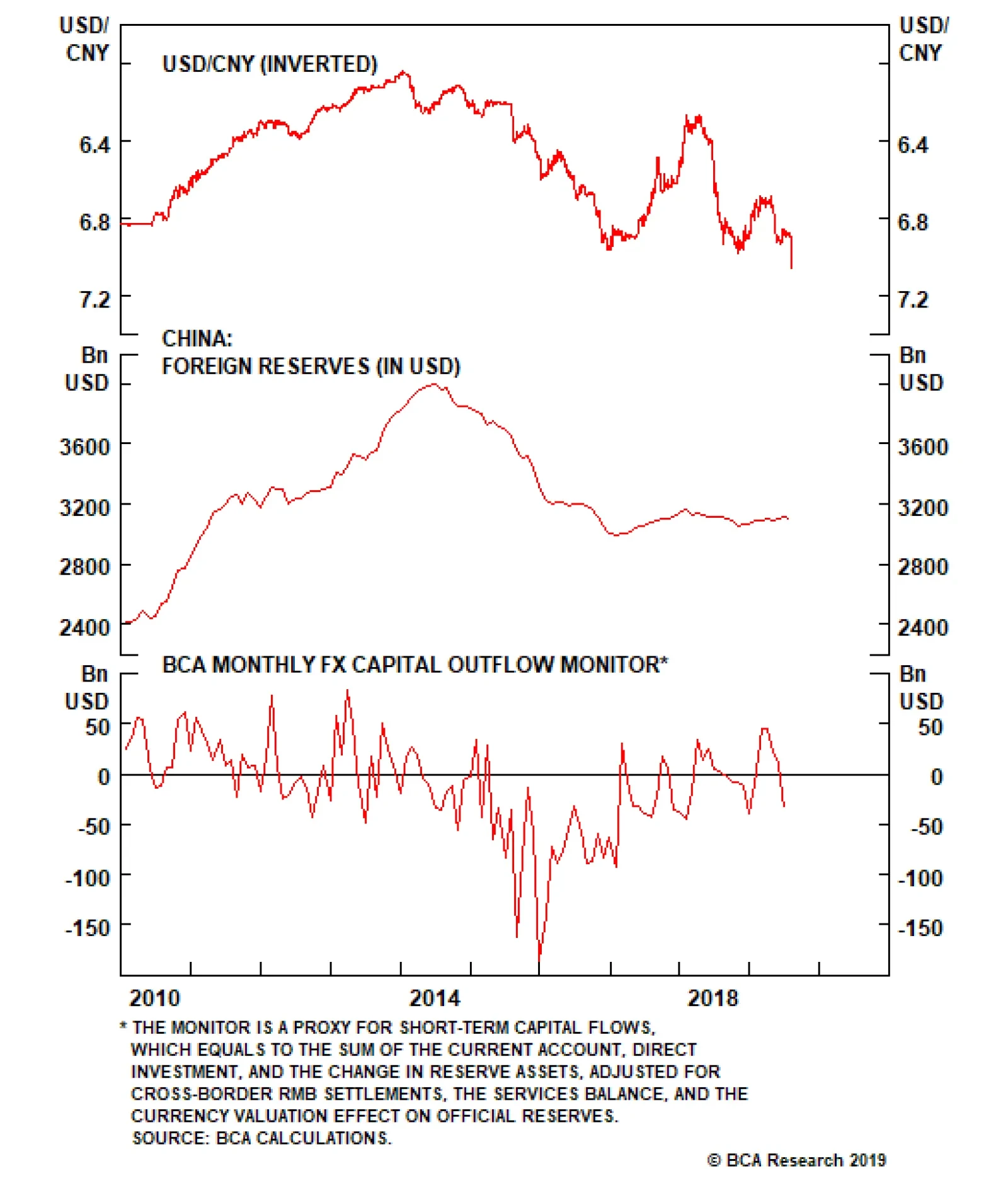

The recent RMB depreciation will likely intensify the Chinese import contraction, as the same amount of yuan will buy less goods priced in U.S. dollars. Since the majority of goods and commodities procured by mainland companies…

Highlights Economic data suggest the current business cycle in China has not yet reached a bottom. Stimulus measures have not been forceful enough to fully offset a slowing domestic economy and weakening global demand. With possibly…

Highlights Duration: Hawkish trade policy will continue to weigh on bond yields for at least the next few months, but a rebound in global economic growth should take hold before the end of the year. Ultimately, a growth rebound will…

This Monday we published a Special Report by Matt Gertken, Chief Geopolitical Strategist where Matt takes a dive into implications of the U.S.-Iran hot and U.S.-China cold wars. What follows is a snipped of the investment…

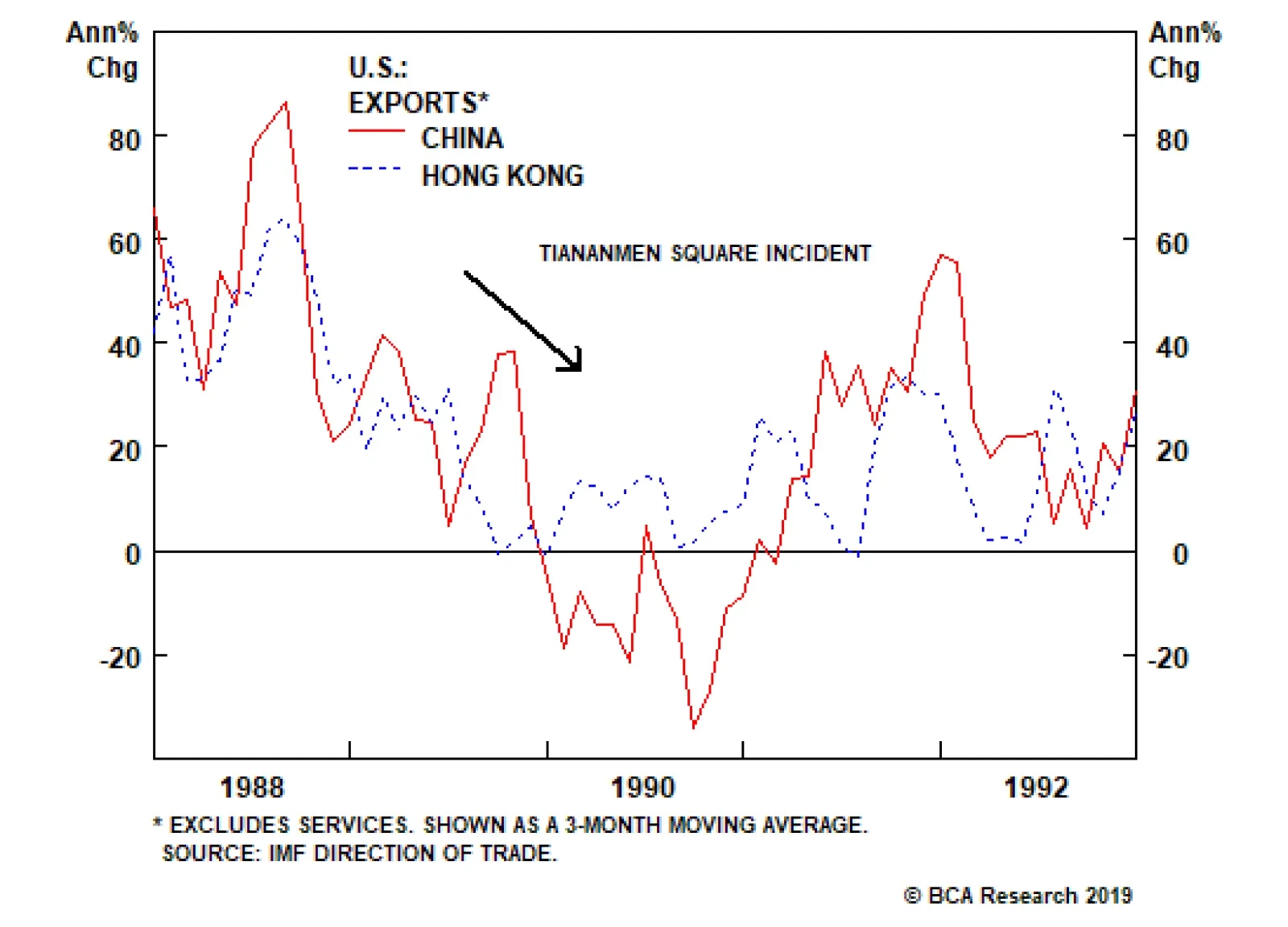

For the Chinese, it is not just a matter of losing access to the vast U.S. market. It’s also about losing access to vital technologies that China needs to further its ambitions in everything from robotics, to AI, to…

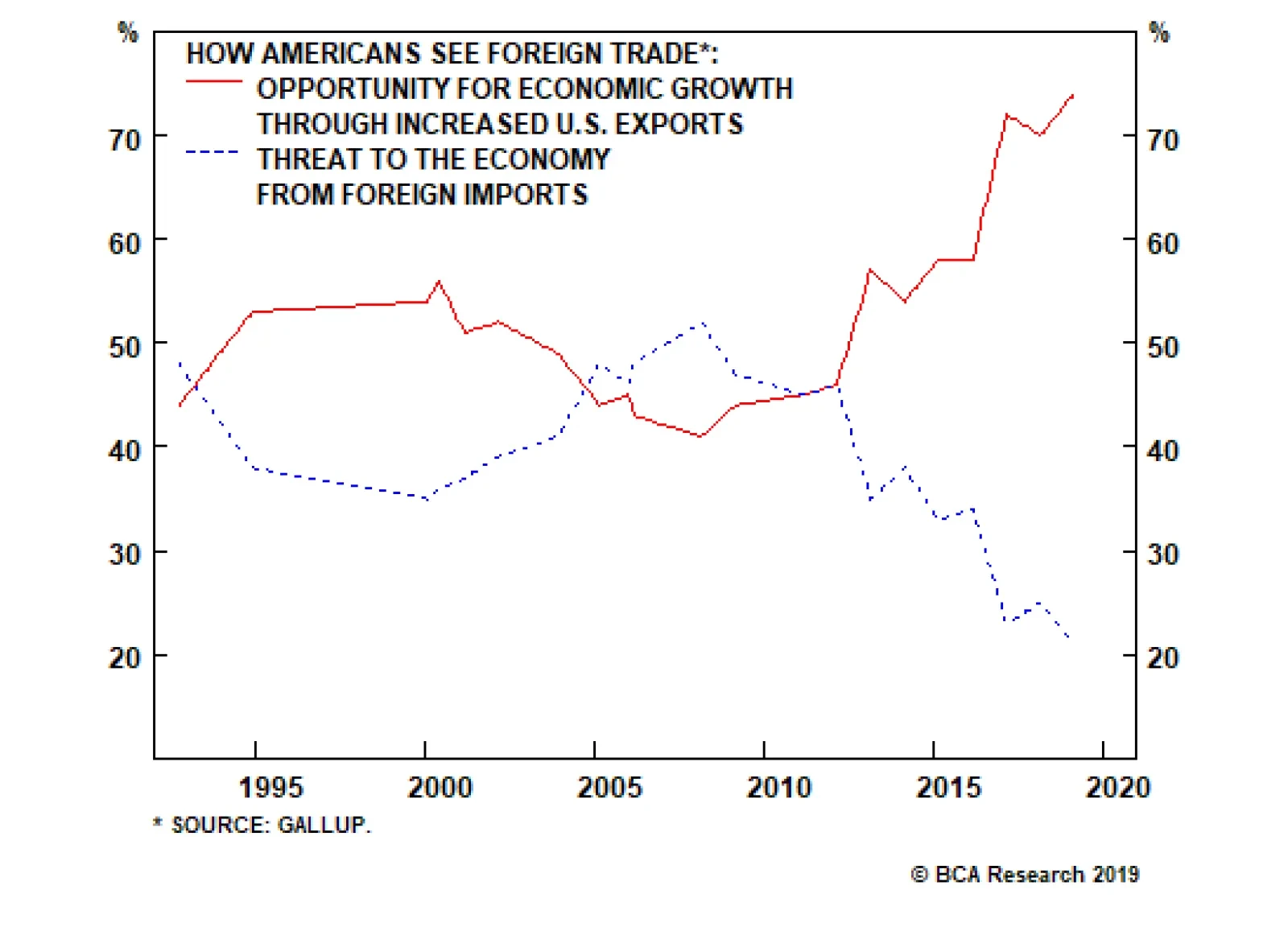

Neither the U.S. nor China would gain from a prolonged trade war. This does not mean that a “World War I” scenario, where all parties end up severely worse off from their actions, can be completely excluded. However,…

While the U.S. threatens to cut off Chinese tech companies like Huawei, Beijing has signaled that countermeasures would include an embargo on U.S. imports of rare earth elements and products. When China implemented a partial rare…