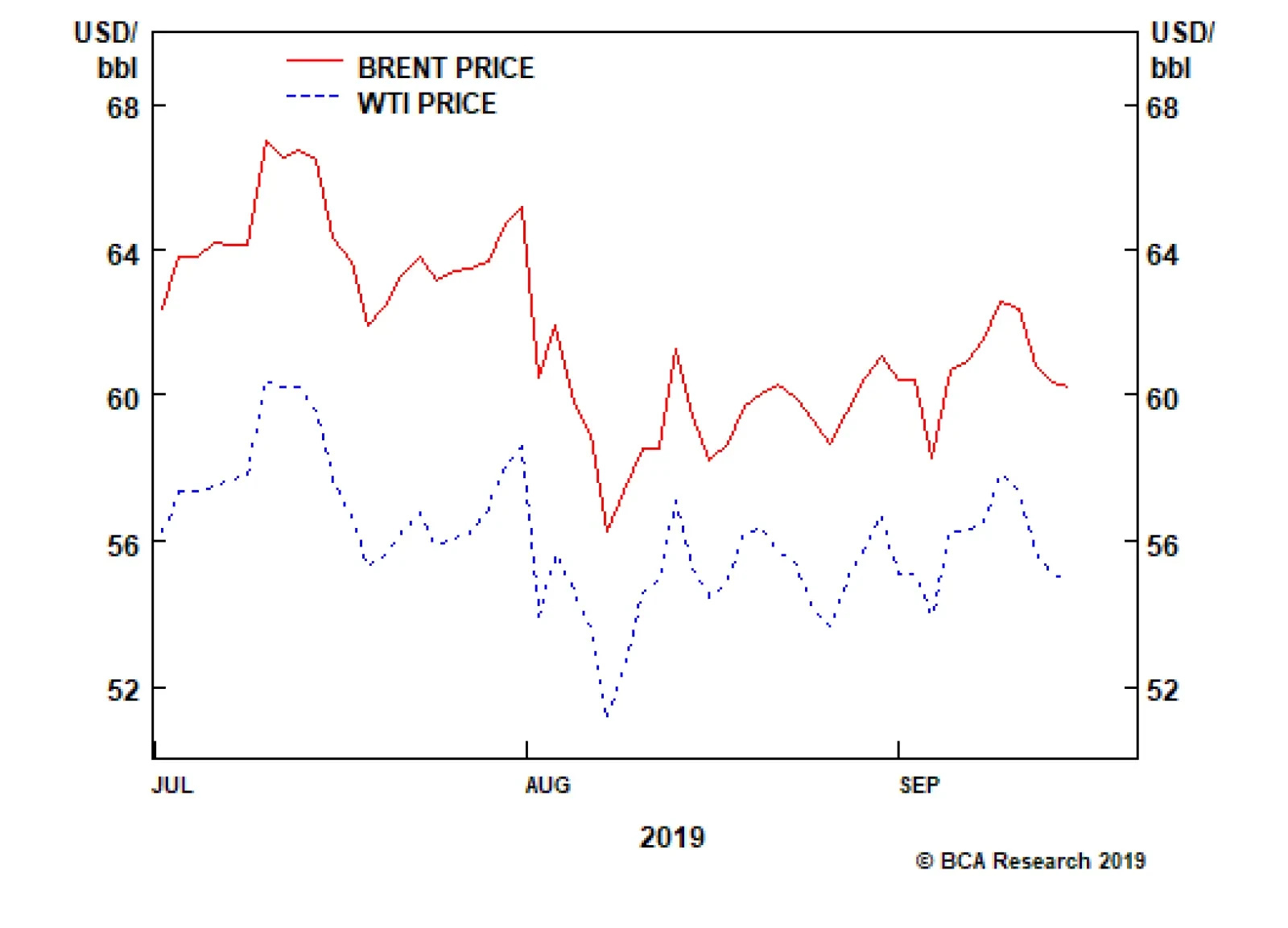

Following drone attacks on critical oil infrastructure in the Kingdom of Saudi Arabia (KSA) over the weekend, which removed ~ 5.7mm b/d of output, the U.S. is likely to conduct a limited retaliatory strike. In addition, the U.S. will…

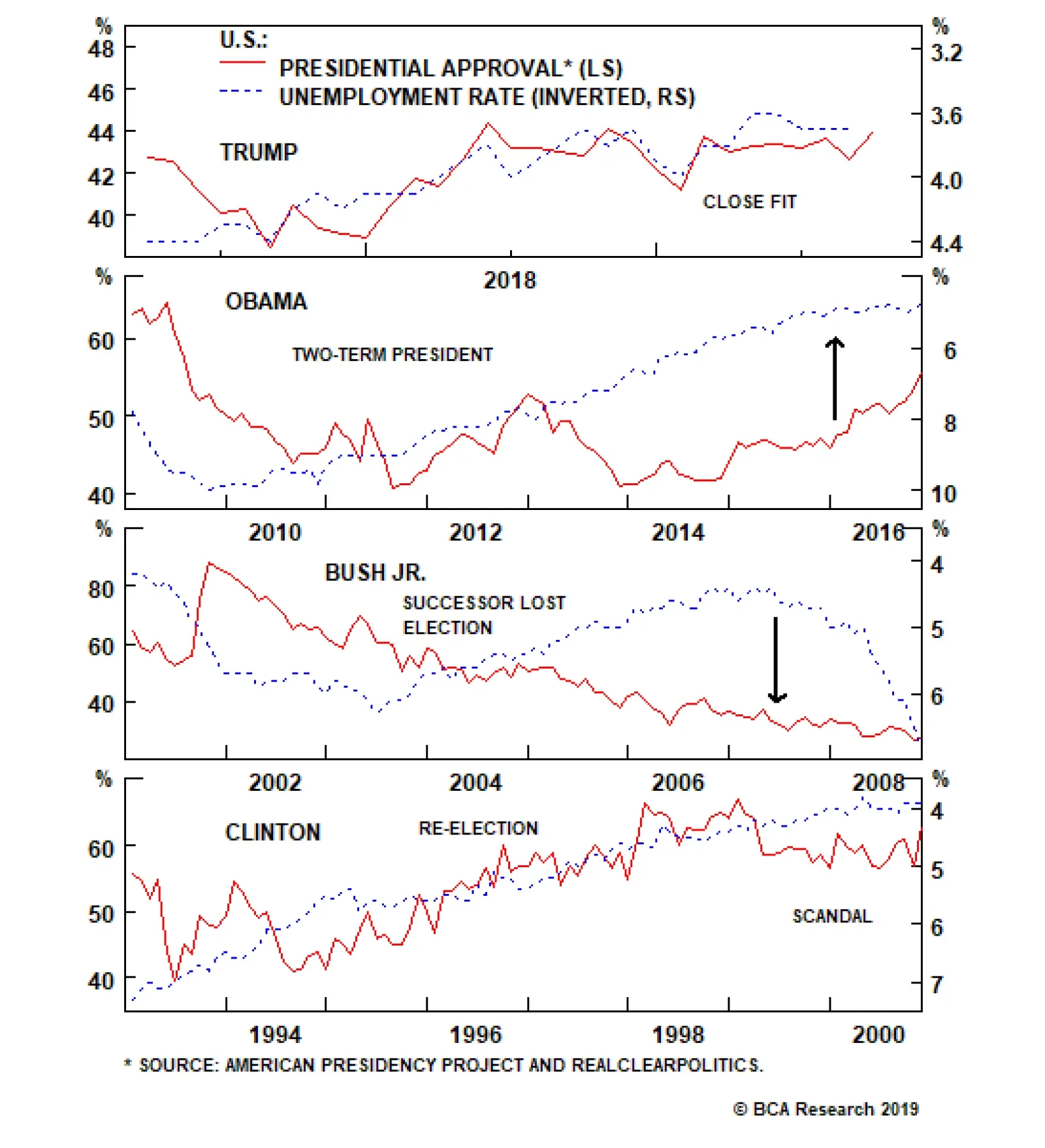

Weak economic data is alarming for a sitting president. Following a drop in business sentiment and investment, consumer sentiment is now suffering. Manufacturing – the sector Trump was ostensibly elected to defend –…

The U.S. and China are now officially easing tensions. Trump has delayed the October 1 tariff hike (from 25% to 30% on $250 billion worth of goods), while China has issued waivers for tariffs and promised to increase purchases of…

Highlights We remain bullish on global equities and spread product but acknowledge a variety of risks to our thesis. One such risk involves a scenario where a weaker U.S. economy hurts President Trump’s re-election prospects,…

Highlights Trump is now clearly retreating from policies that harm the economy and reduce his reelection chances. Geopolitical risks are abating for the first time since May – a boon for financial markets amid global policy…

Highlights Global bond yields have closely tracked the trajectory of global growth. While the global economy remains fragile, some positive signs are emerging: Our global leading economic indicator has moved off its lows; global…

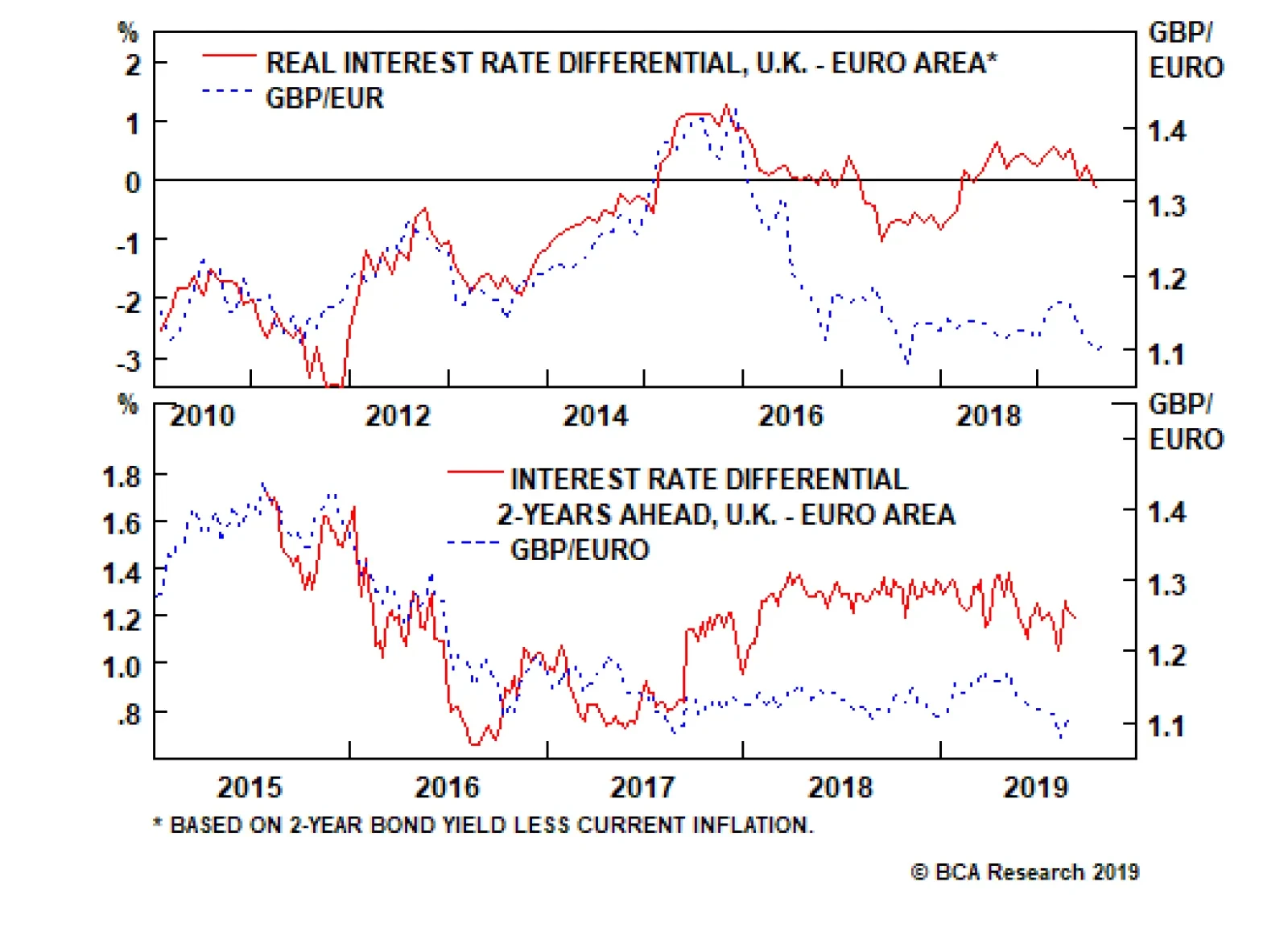

The only way out of the impasse is to change the parliamentary arithmetic via a snap general election. The trouble is that the outcome of such an election is near impossible to predict. This is because the U.K.’s first past…

Highlights An inevitable and imminent U.K. general election will be one of the most unpredictable and ‘non-linear’ elections ever. This non-linearity makes it difficult to take a high-conviction view on sterling’s…