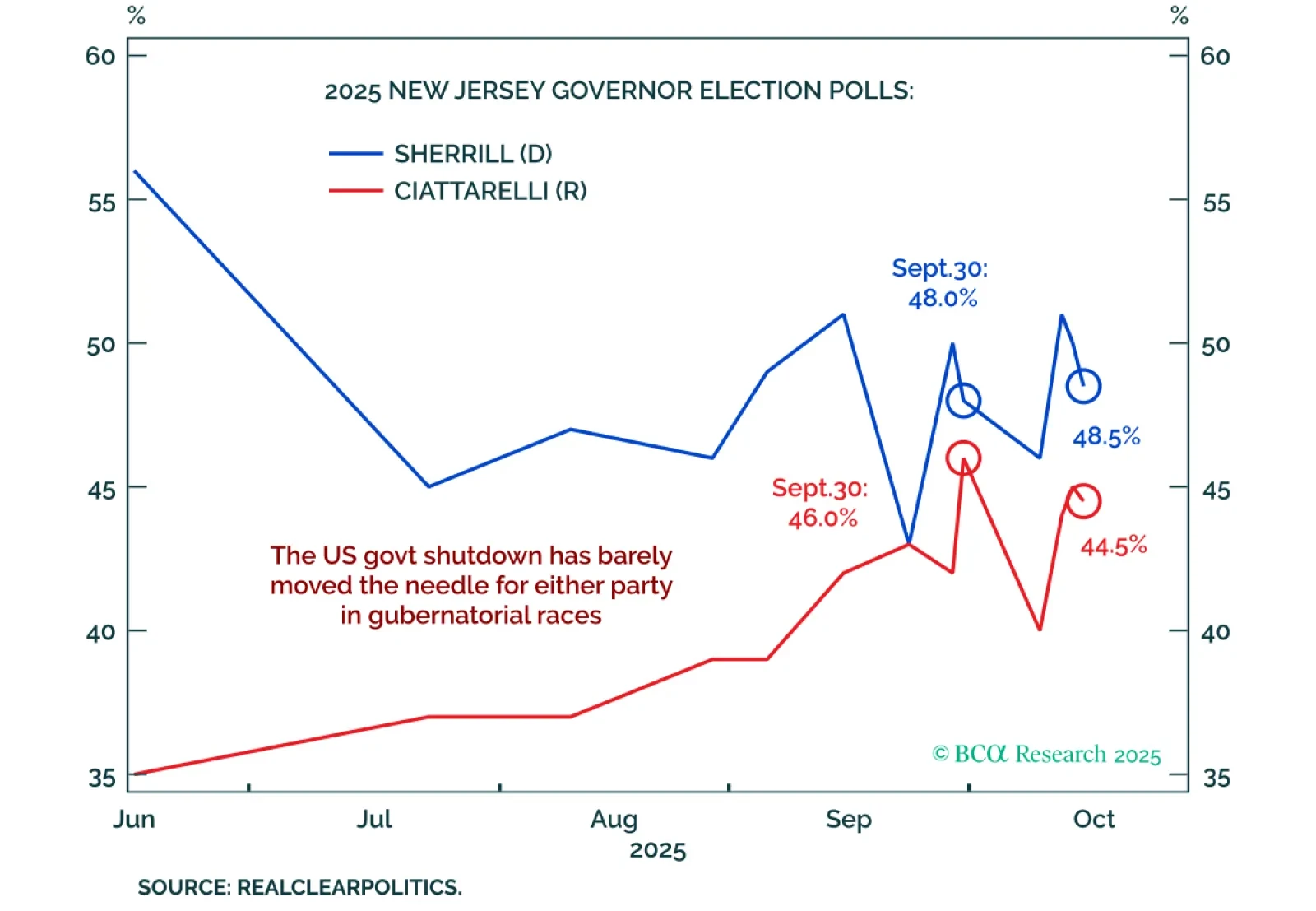

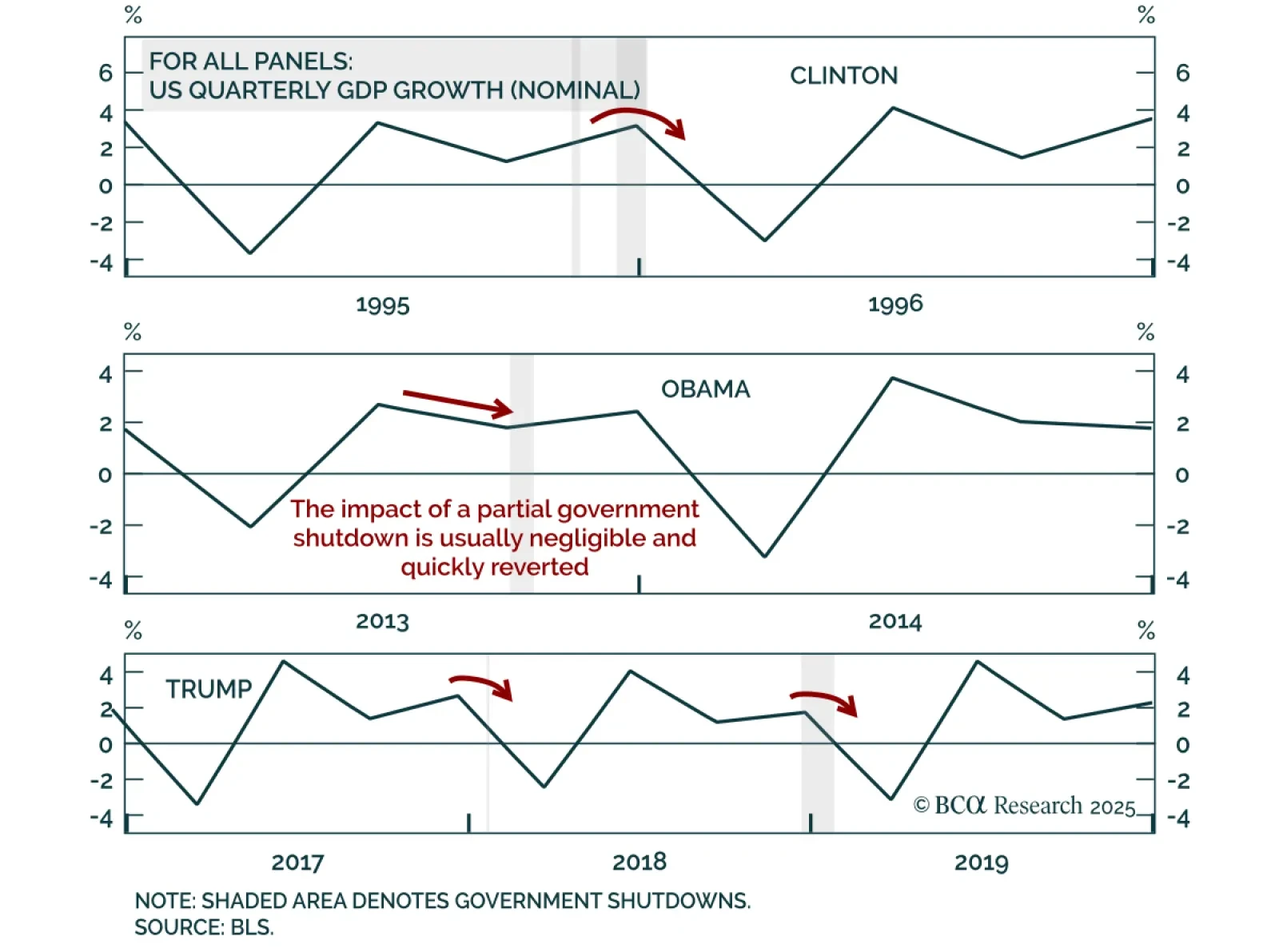

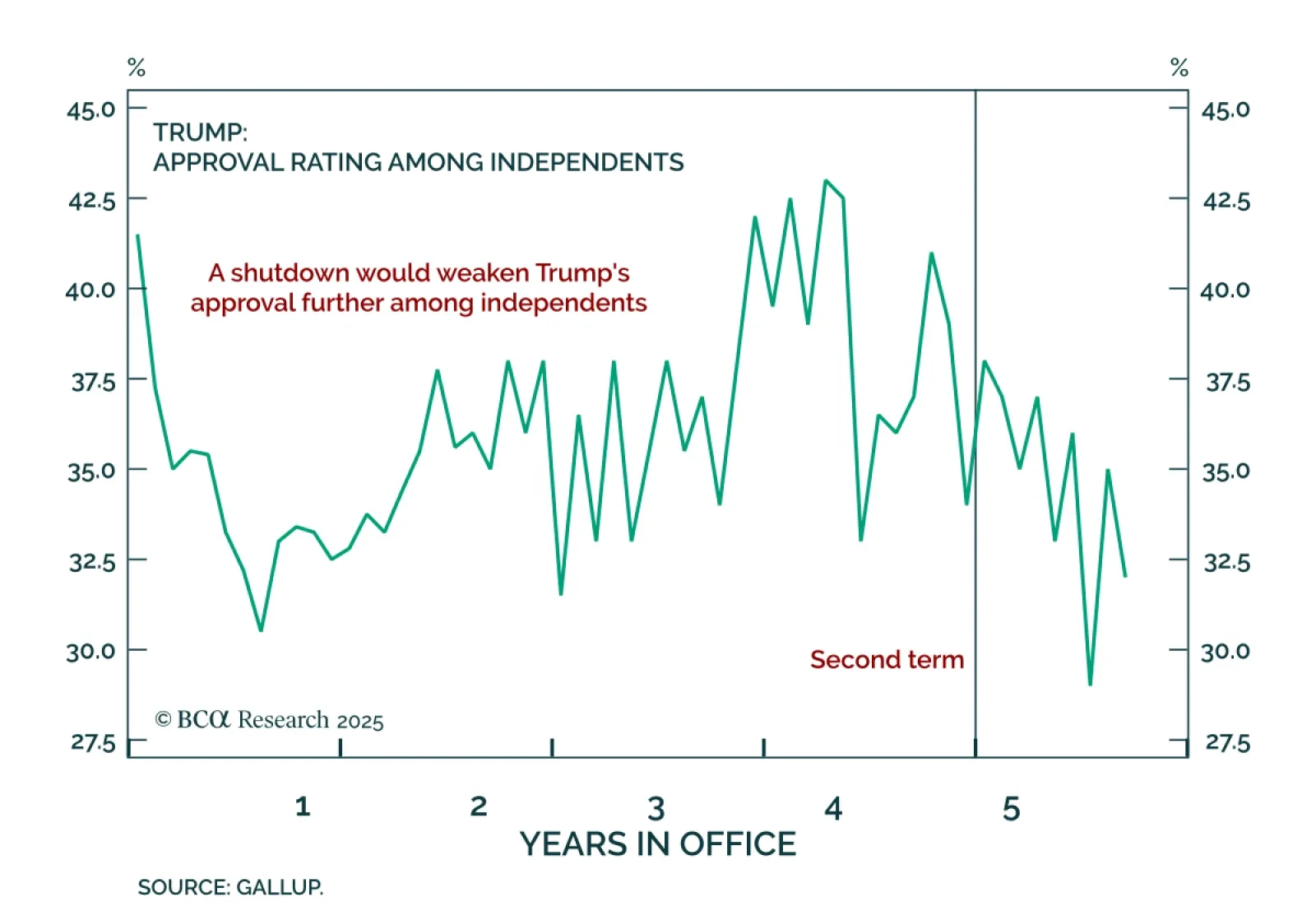

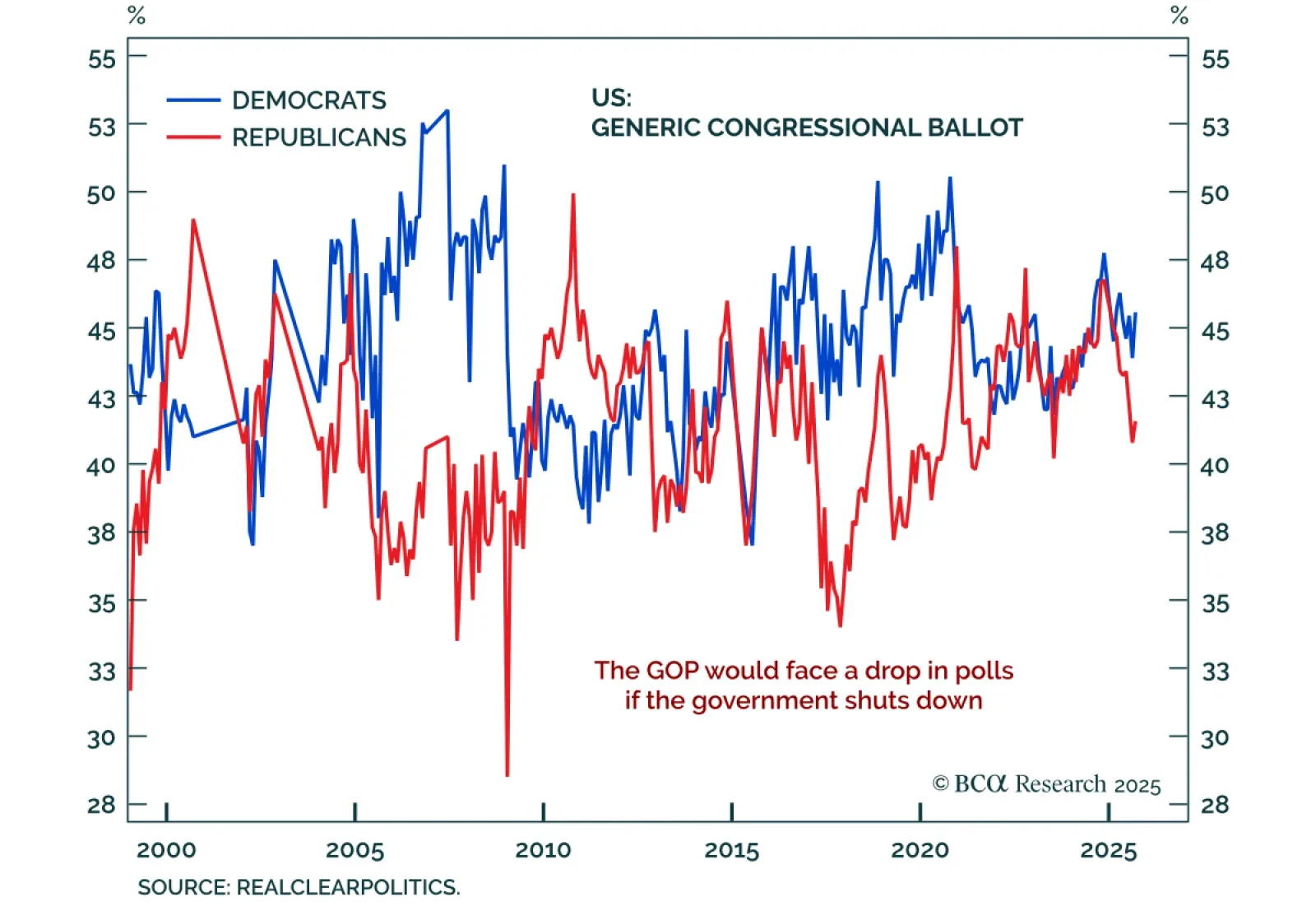

The shutdown can continue into November; only when the off-year elections and/or national opinion polls put more pressure on one or both parties will compromise start to come together to reopen the government. The US federal…

Our US and Geopolitical strategists see 50% odds of a shutdown that lasts beyond three weeks. Investors continue to wonder whether the US federal government shutdown will last long enough, or involve large enough layoffs, to affect…

The October 1 partial US government shutdown risks denting near-term GDP and sentiment but should present a buying opportunity if it triggers equity weakness. The US federal government partly shutdown on October 1 after the…

President Trump said a partial federal government shutdown is "probably likely" late in the afternoon on September 30. Senators have until midnight to pass a continuing resolution already passed by the House that would keep the…

Will the US federal government shutdown on October 1? Congressional leaders are meeting with President Trump in the White House as we go to press. If eight Democratic senators do not vote with Republicans to pass a no-frills "…

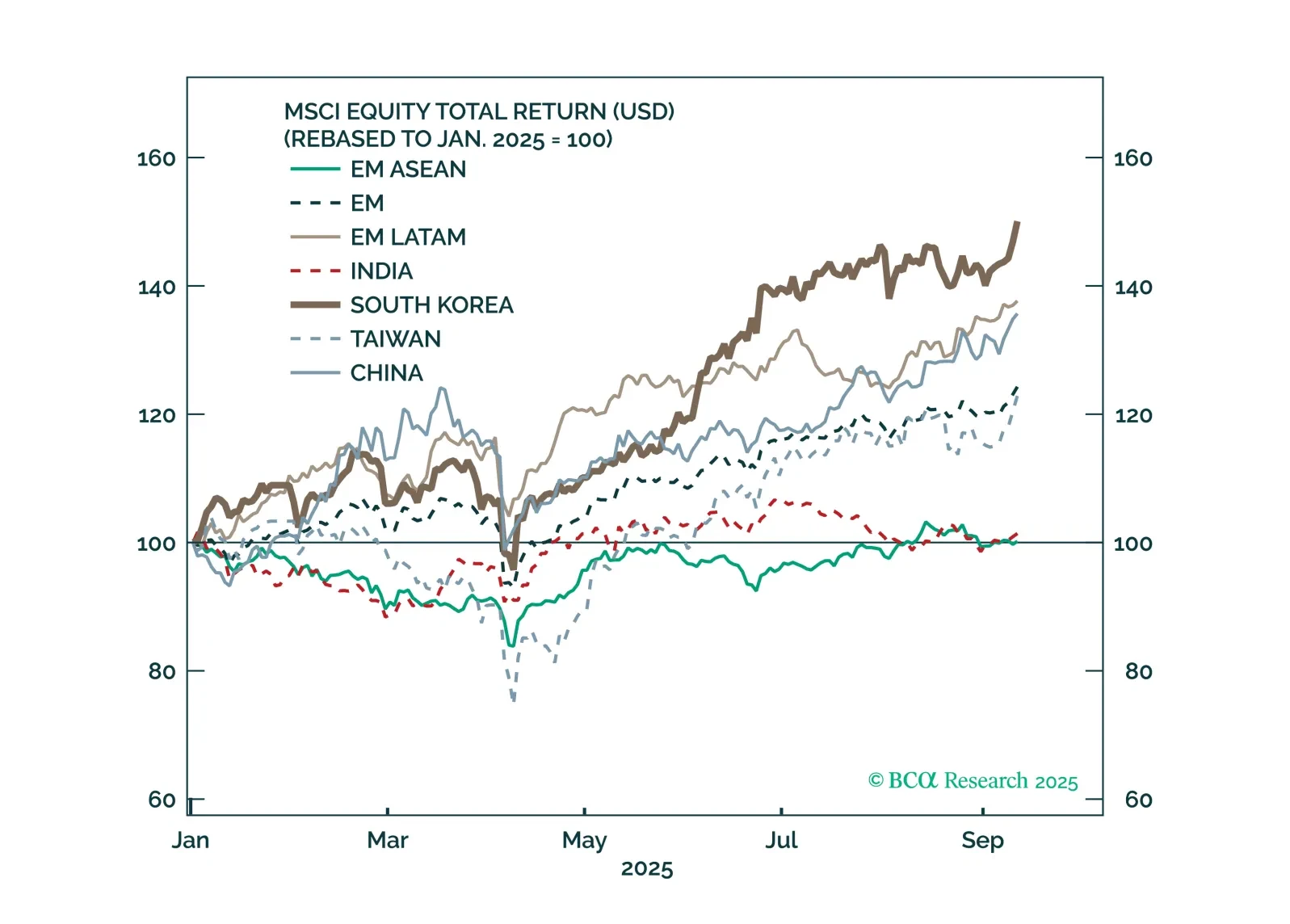

Political instability across Asia is colliding with the trade war fallout, forcing Southeast Asian economies to ease monetary and fiscal policy, while pushing the Bank of Japan in the opposite direction.

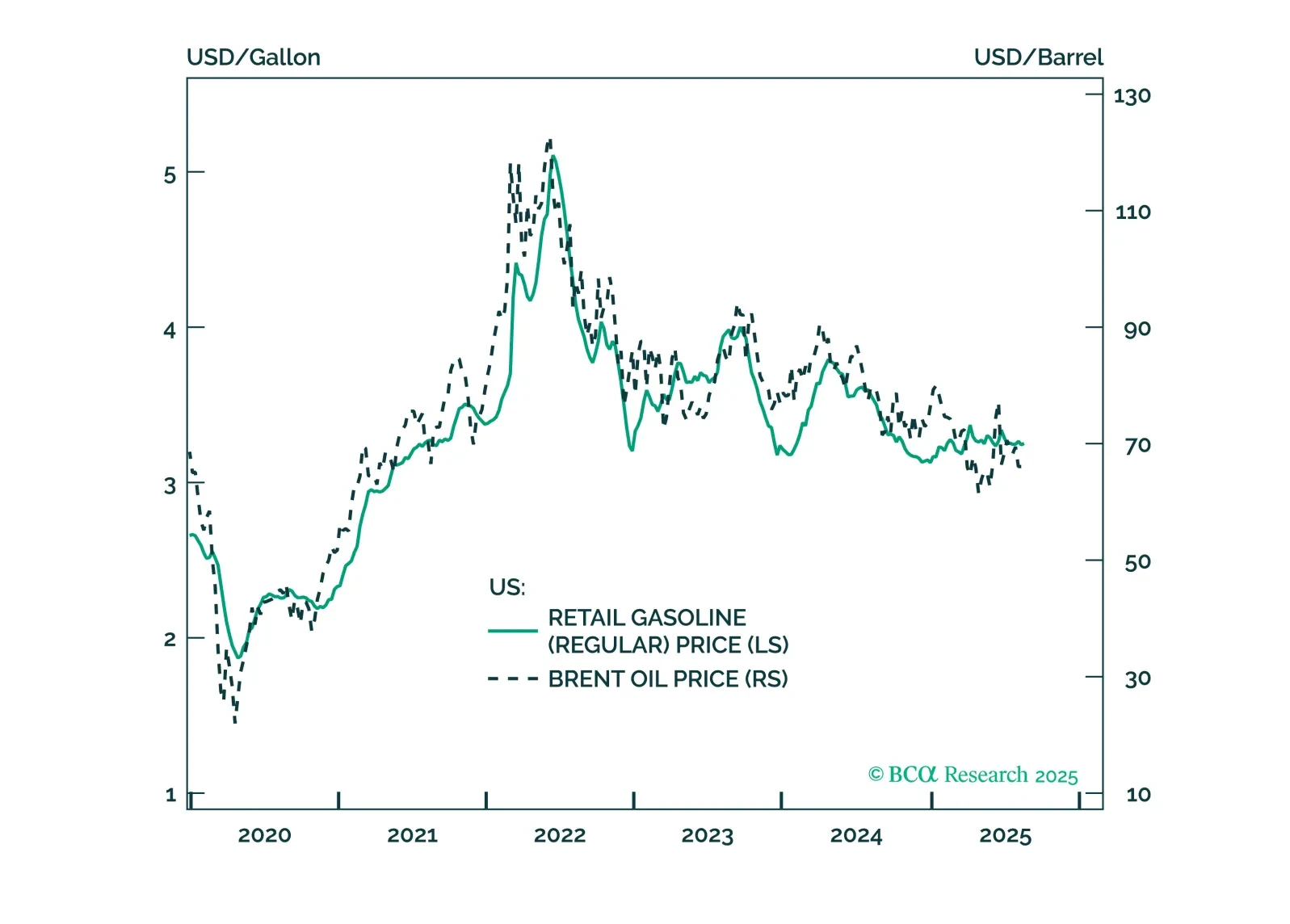

The media is missing the big picture: the war is already contained. The falling oil price confirms that. We fully expect cold feet and volatility incidents in the very near term but there is only a 5% chance of Russia triggering a…

Our US Political Strategy team recommends staying long the US dollar, as Trump’s peak political capital drives near-term policy volatility and renewed support for US assets. Market optimism is underpinned by AI enthusiasm and…

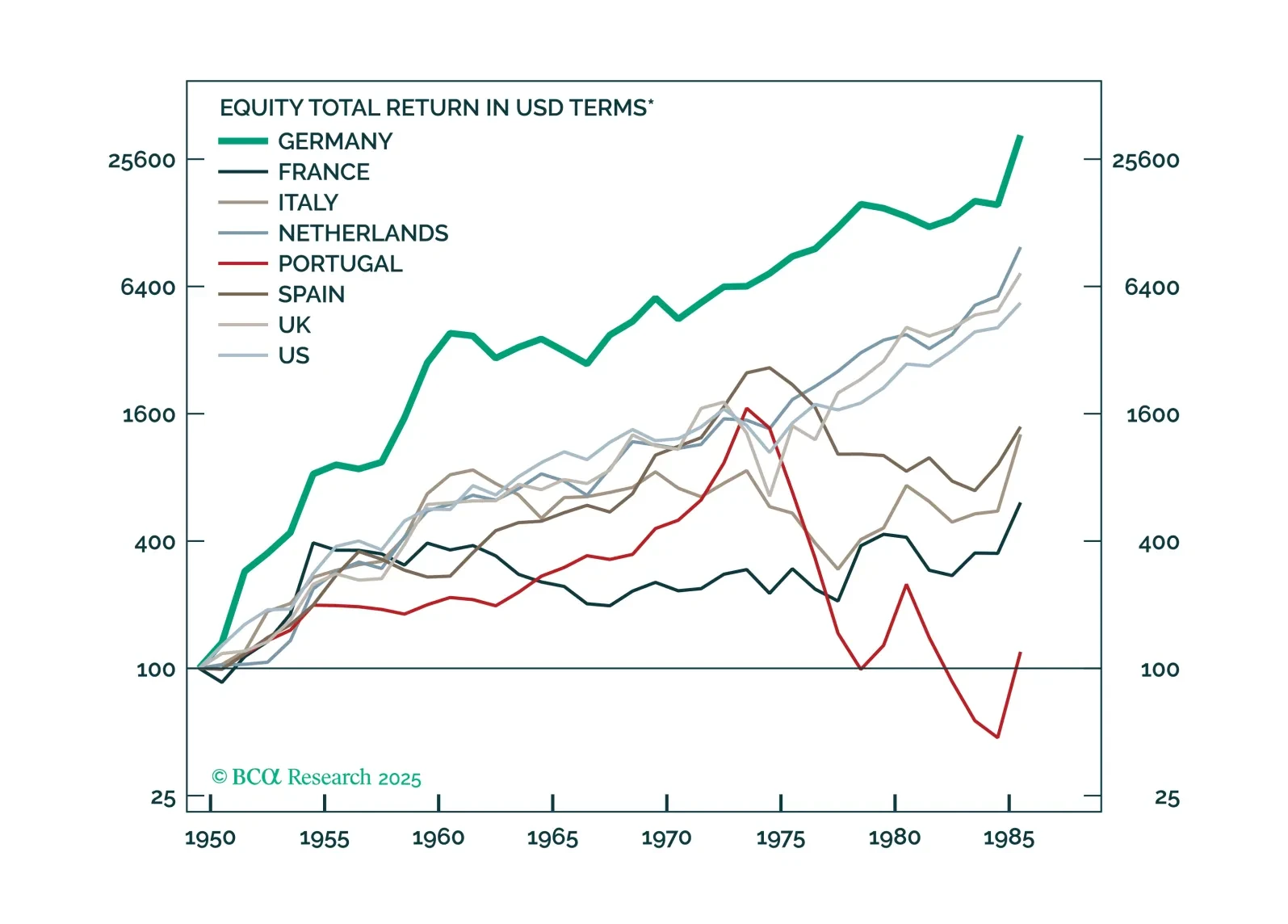

In our Beta report, we introduce a new framework for thinking about long-term investing in a multipolar world: The Garrison State. Investors need to shed their outdated view that geopolitical risks are... a risk. History teaches…

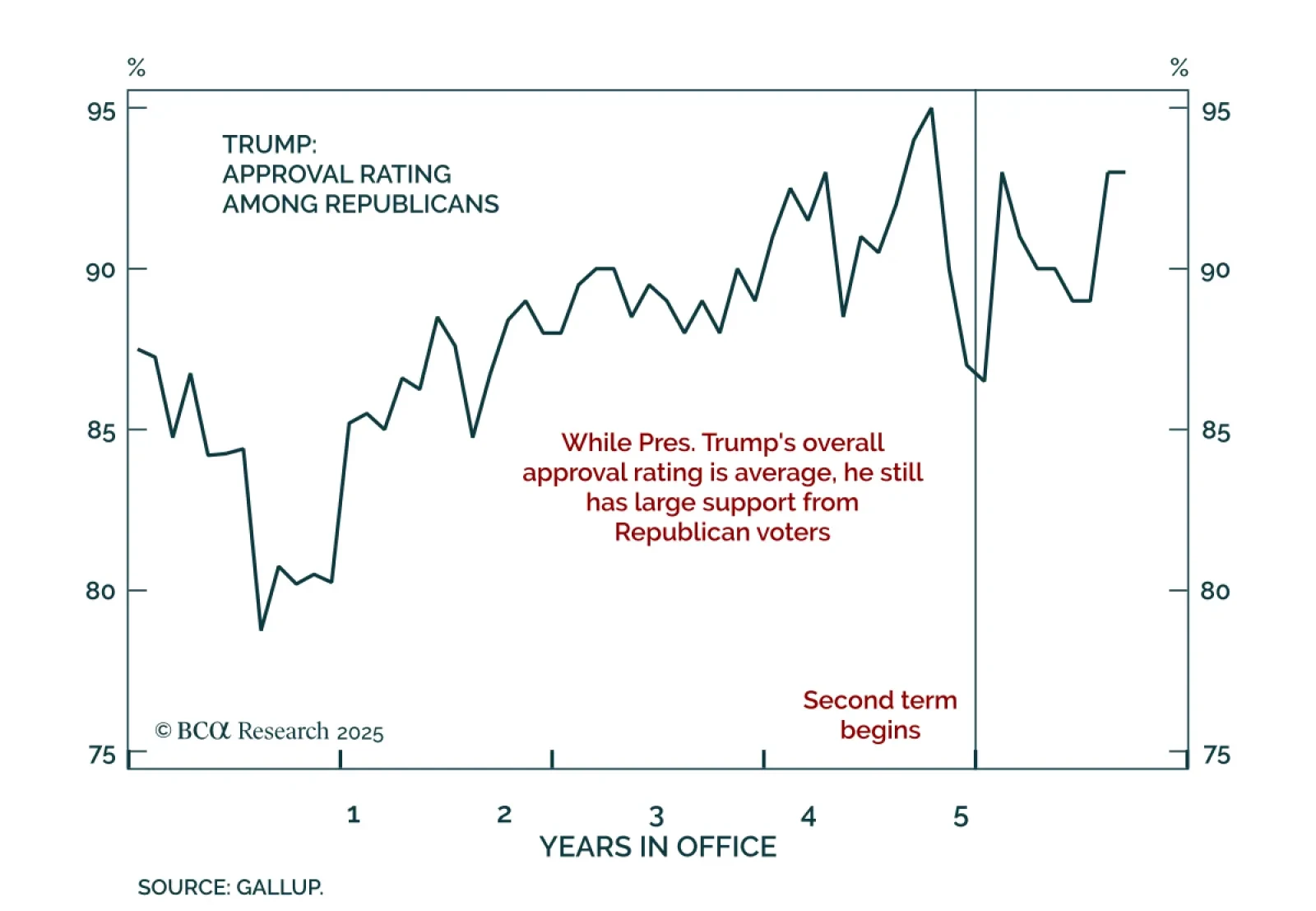

BCA’s US Political strategists warn that Russia presents an immediate market risk, with near-term pullbacks offering potential buying opportunities. President Trump is pivoting toward ceasefires and trade deals, supported by approval…