Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

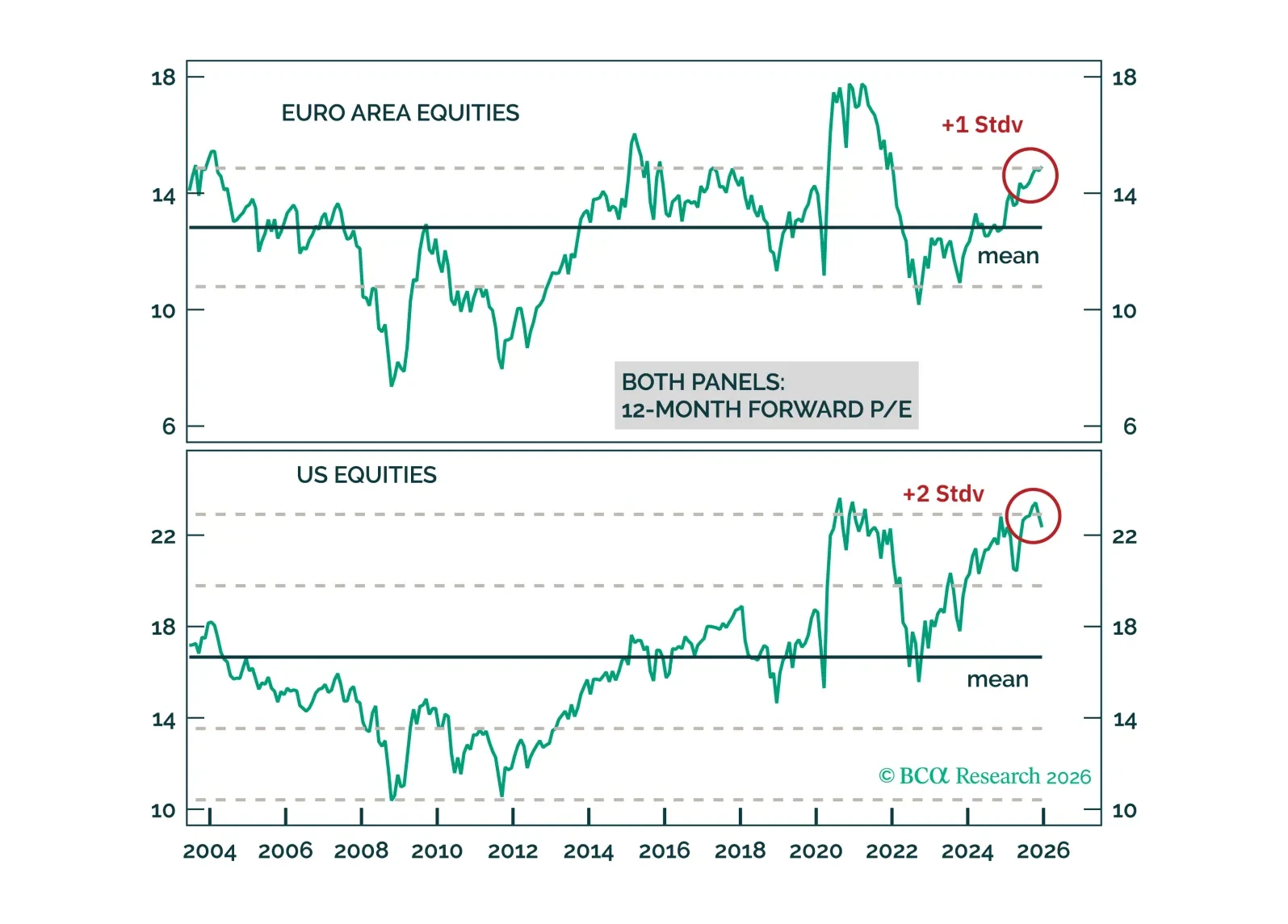

Our top five "Black Swan" risks this year are familiar but all too realistic in the current climate. Investors should stay overweight US equities and EM-ex-China until some hurdles are cleared.

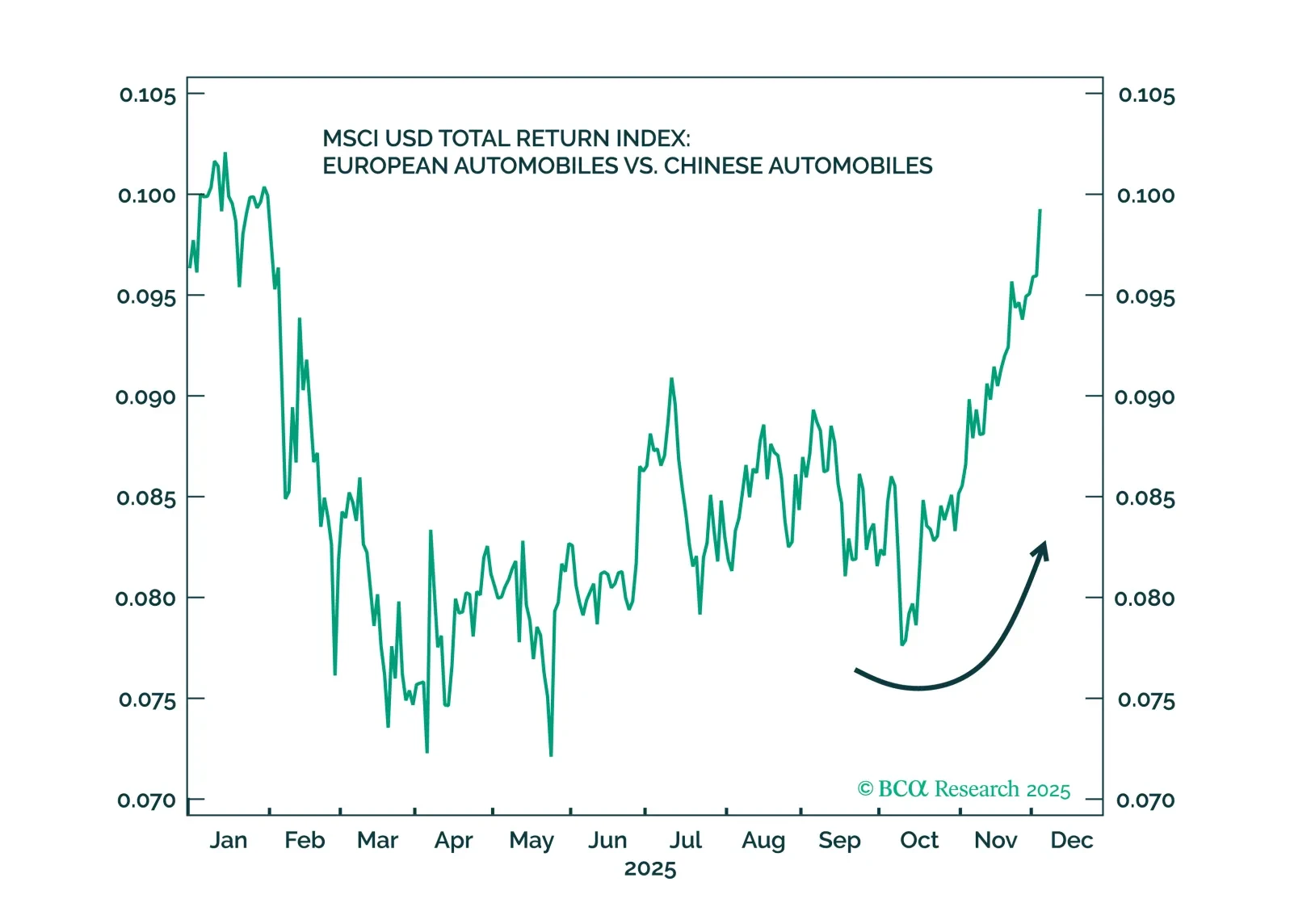

Europe is in a geopolitical sweet spot. Exaggerated fears of Russian military aggression and abandonment by the United States, as well as increased competition from China, create a geopolitical imperative to stimulate, reflate, and…

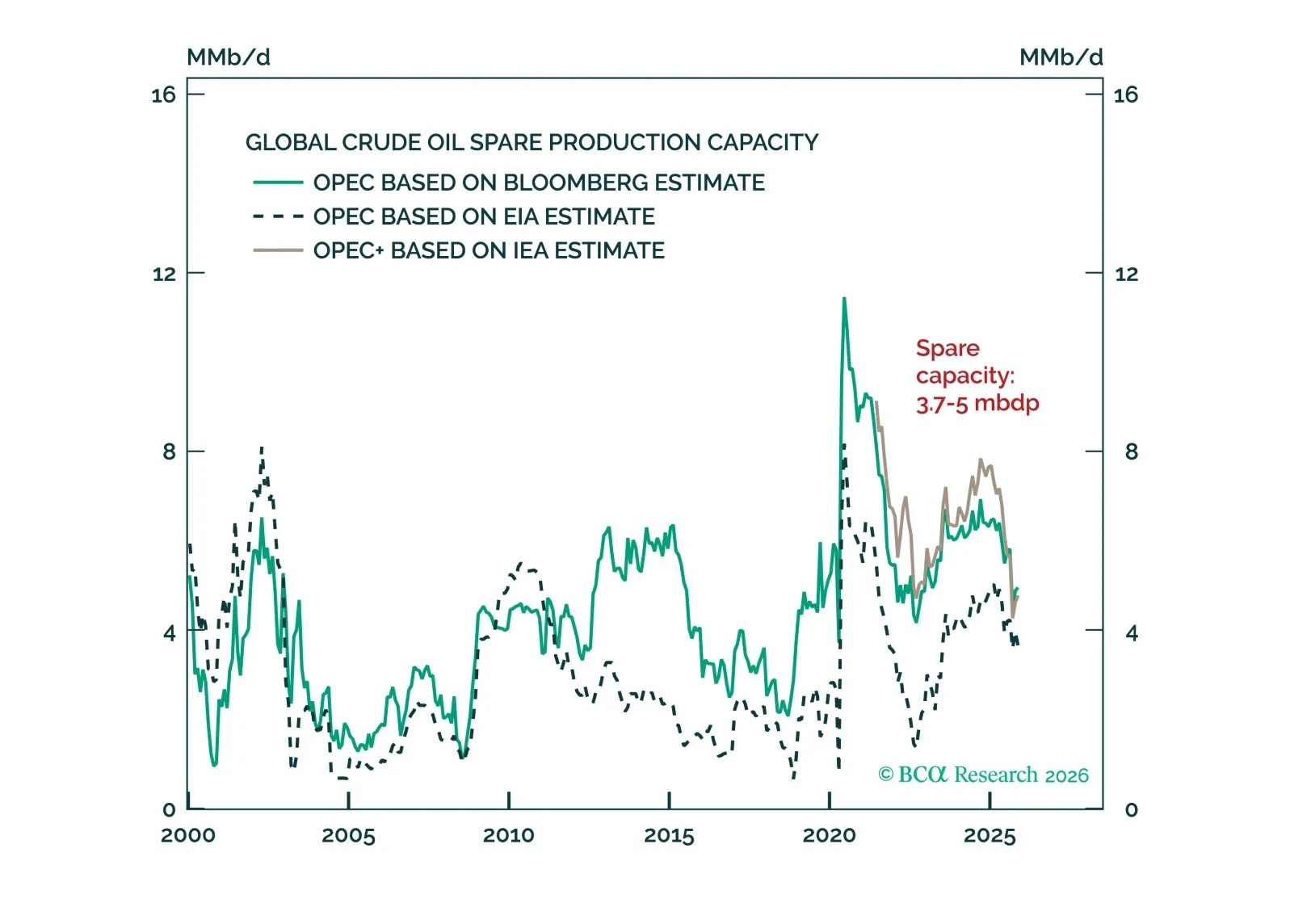

Venezuelan crude output is unlikely to alter the global oil market outlook for this year. However, US control of Venezuelan crude is a risk to Canadian oil sands producers and Canadian oil prices. Go long US oil refiners/short…

The first week of January is always the most difficult for investment strategists. The annual outlook is usually penned in early December. Ours went to your inbox on December 2, perhaps too early to get a read on the next 12 (really 13!)…

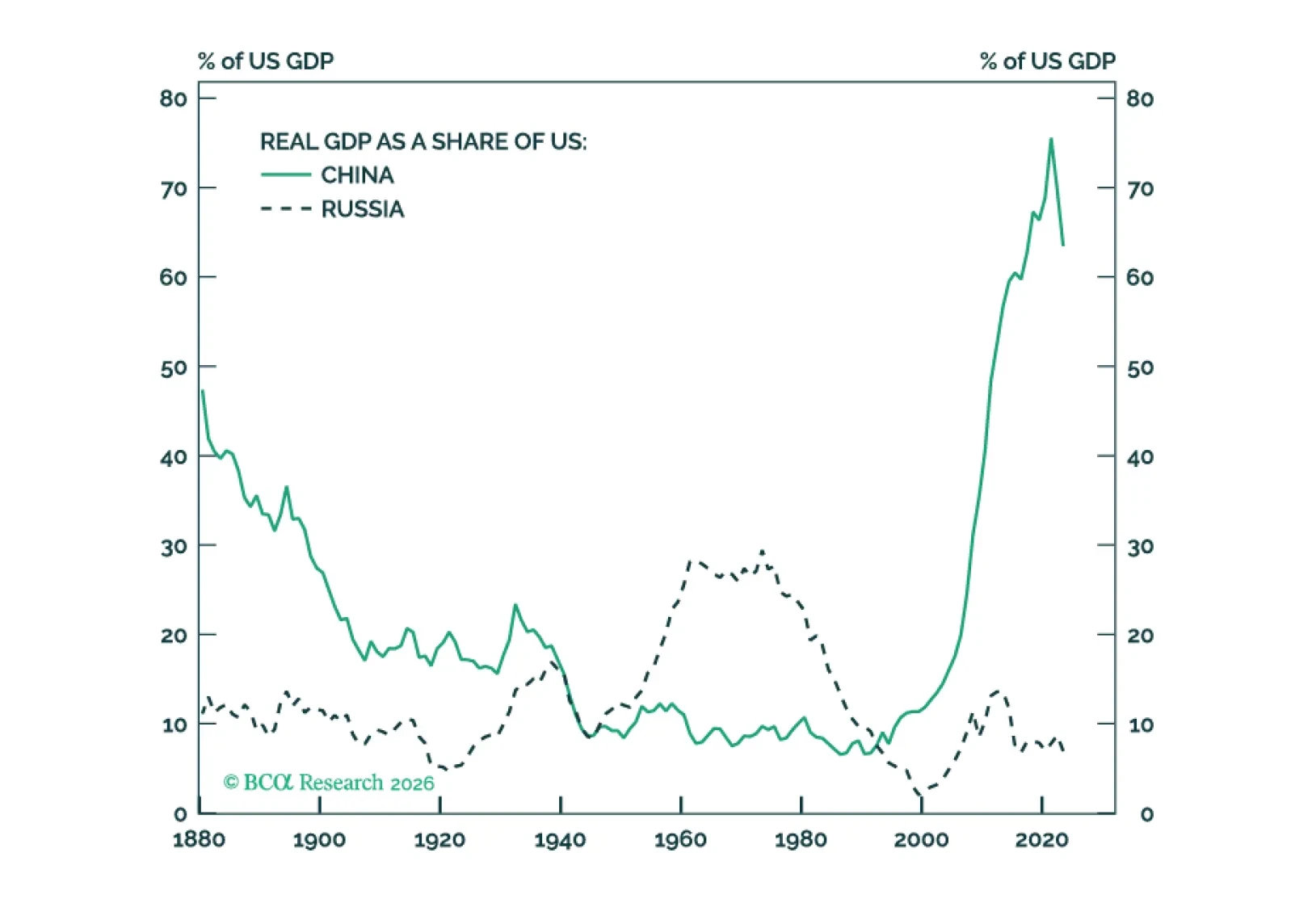

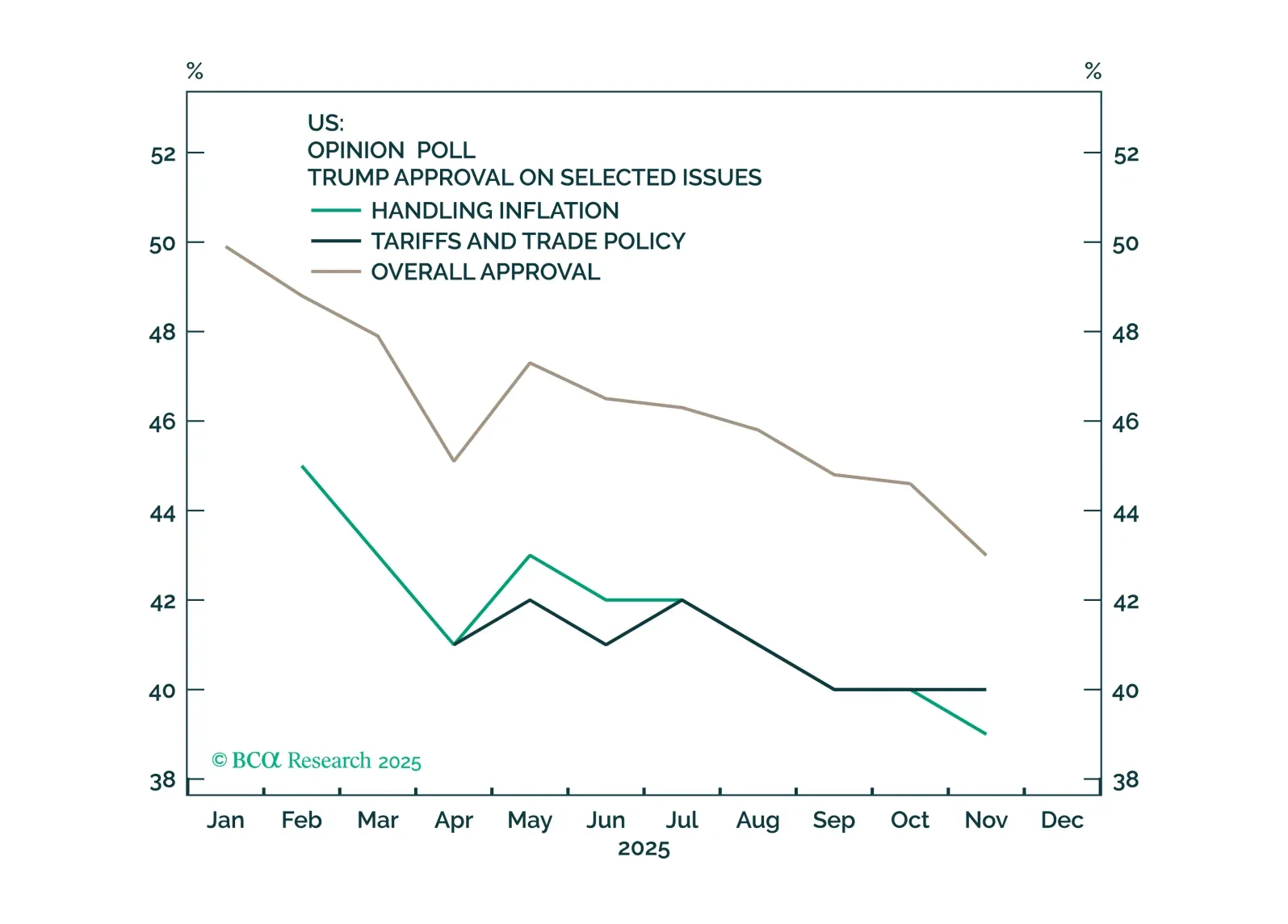

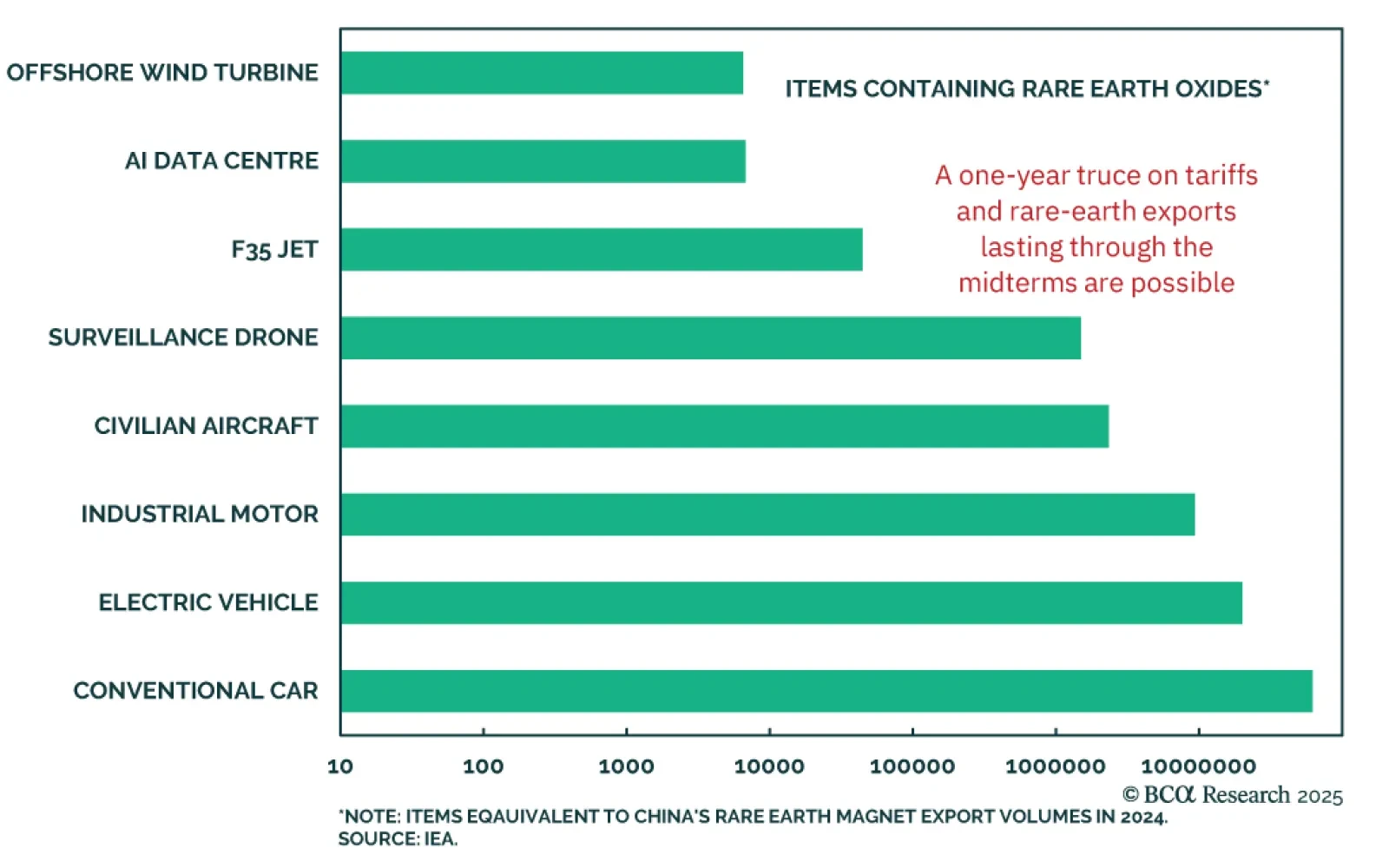

2026 will see geopolitical risk move sideways globally as the US pursues a ceasefire in the proxy war with Russia and a tariff truce with China ahead of midterm elections that will produce gridlock.

We got Trump's tariff shock and backtracking correct and predicted Israel's attack on Iran. But we missed the China rally — and there is still no Ukraine ceasefire.

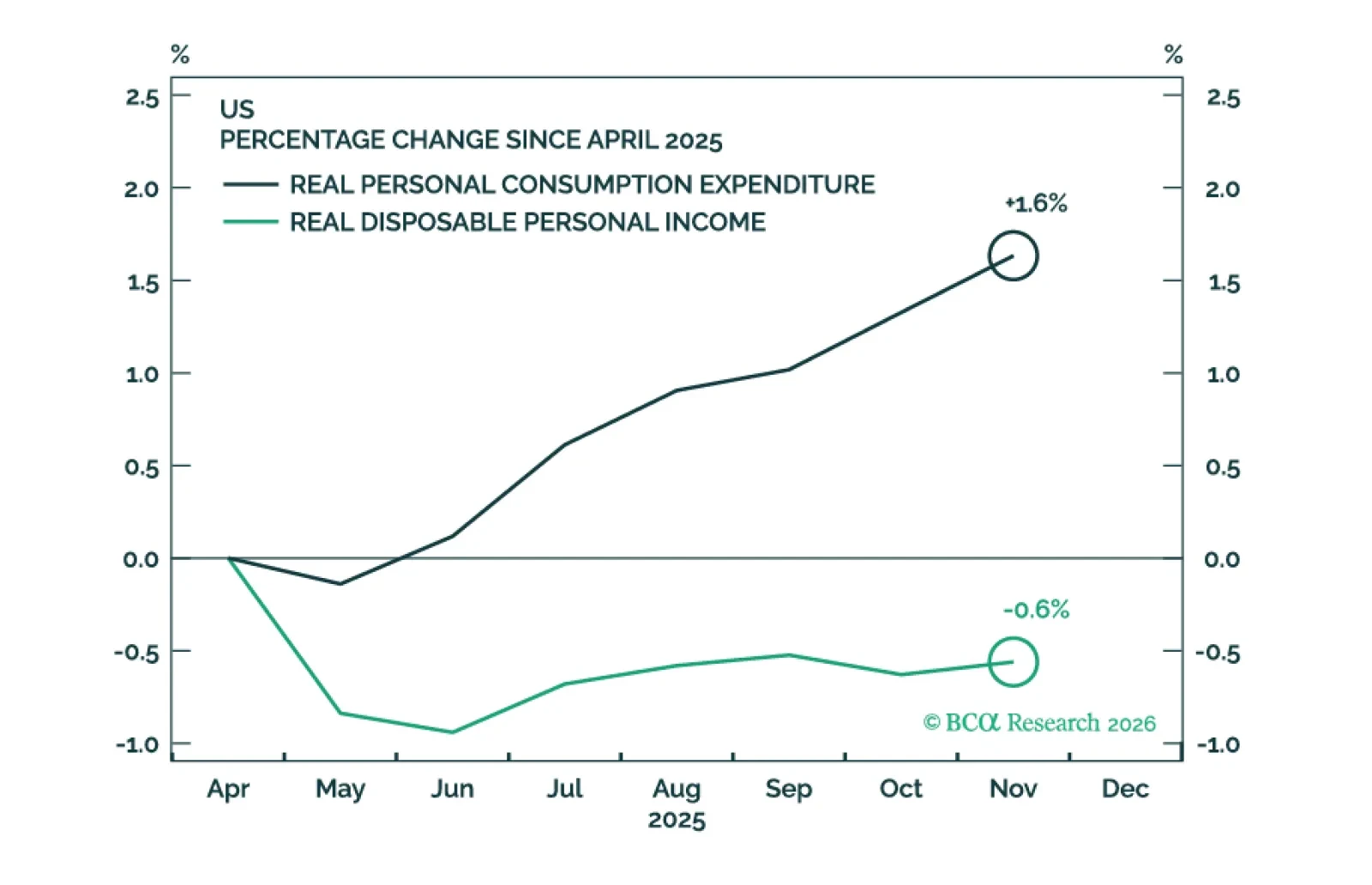

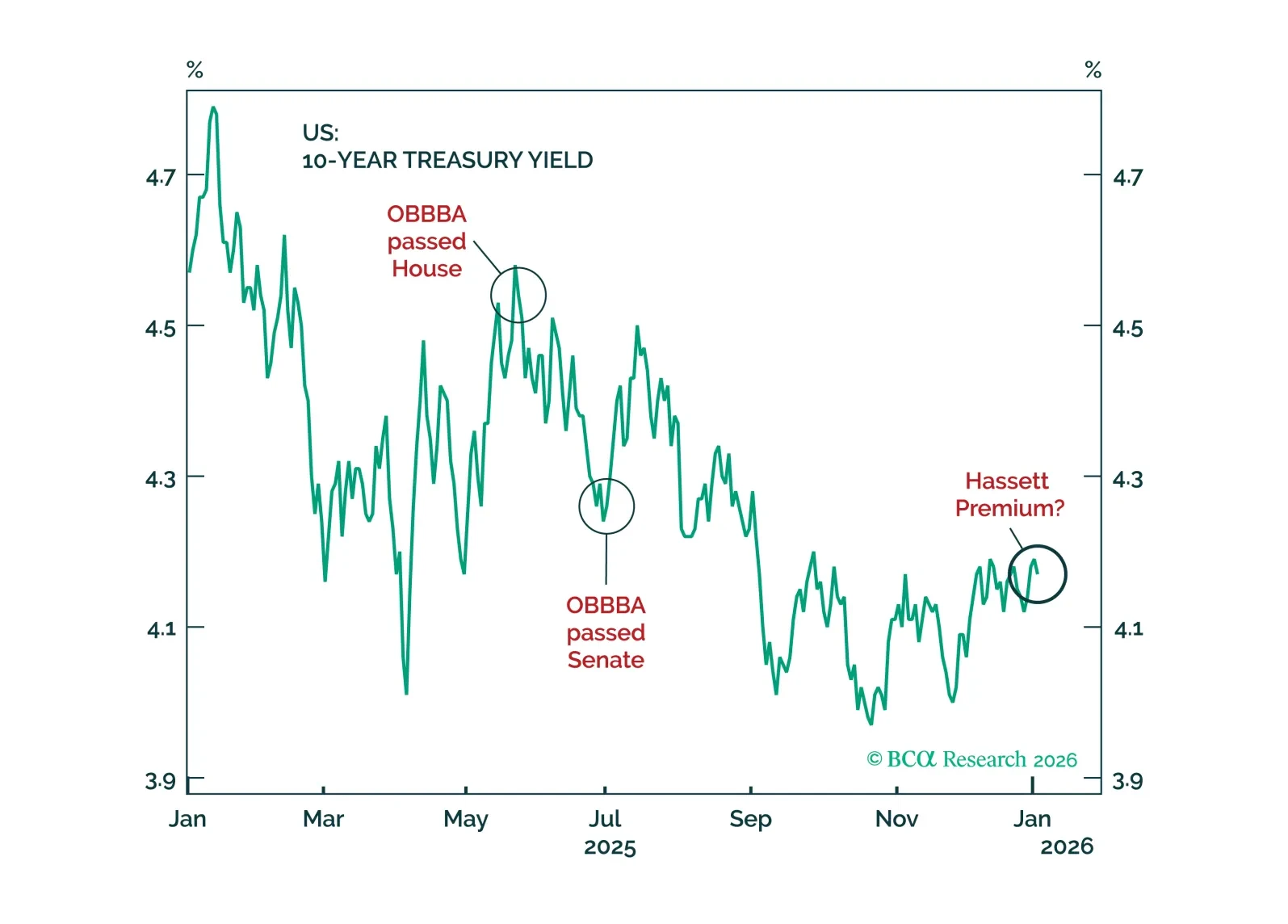

On purely macroeconomic terms, the US economy appears to be heading towards a recession. But the whole point of our framework – GeoMacro – is to forecast the interplay between politics, geopolitics, and macro. The White House is…

The US and China appear to be moving toward a trade deal, though it remains unclear whether the goal is simply damage control or a genuine expansion of market access. Presidents Trump and Xi are scheduled to meet on October 30 in…