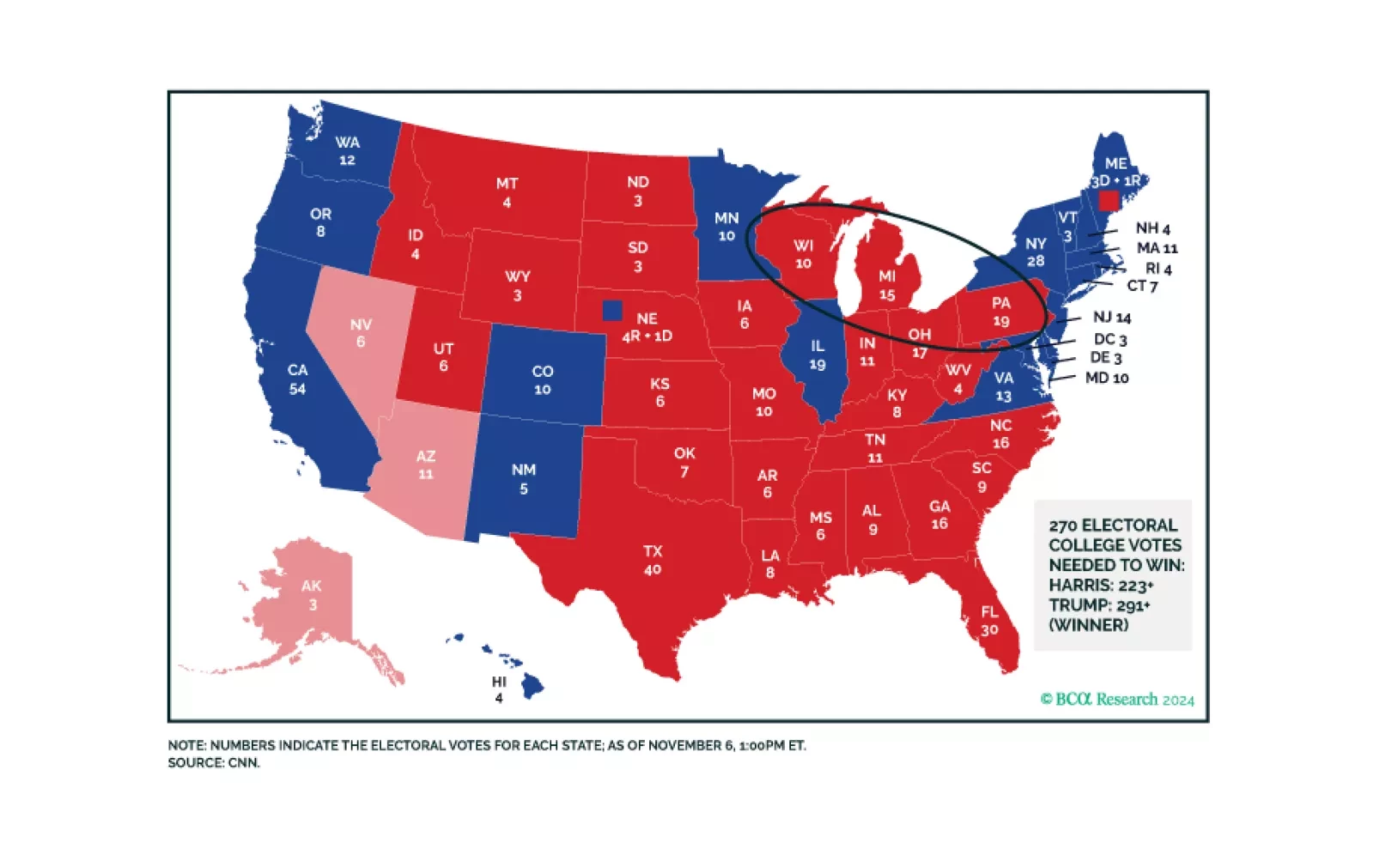

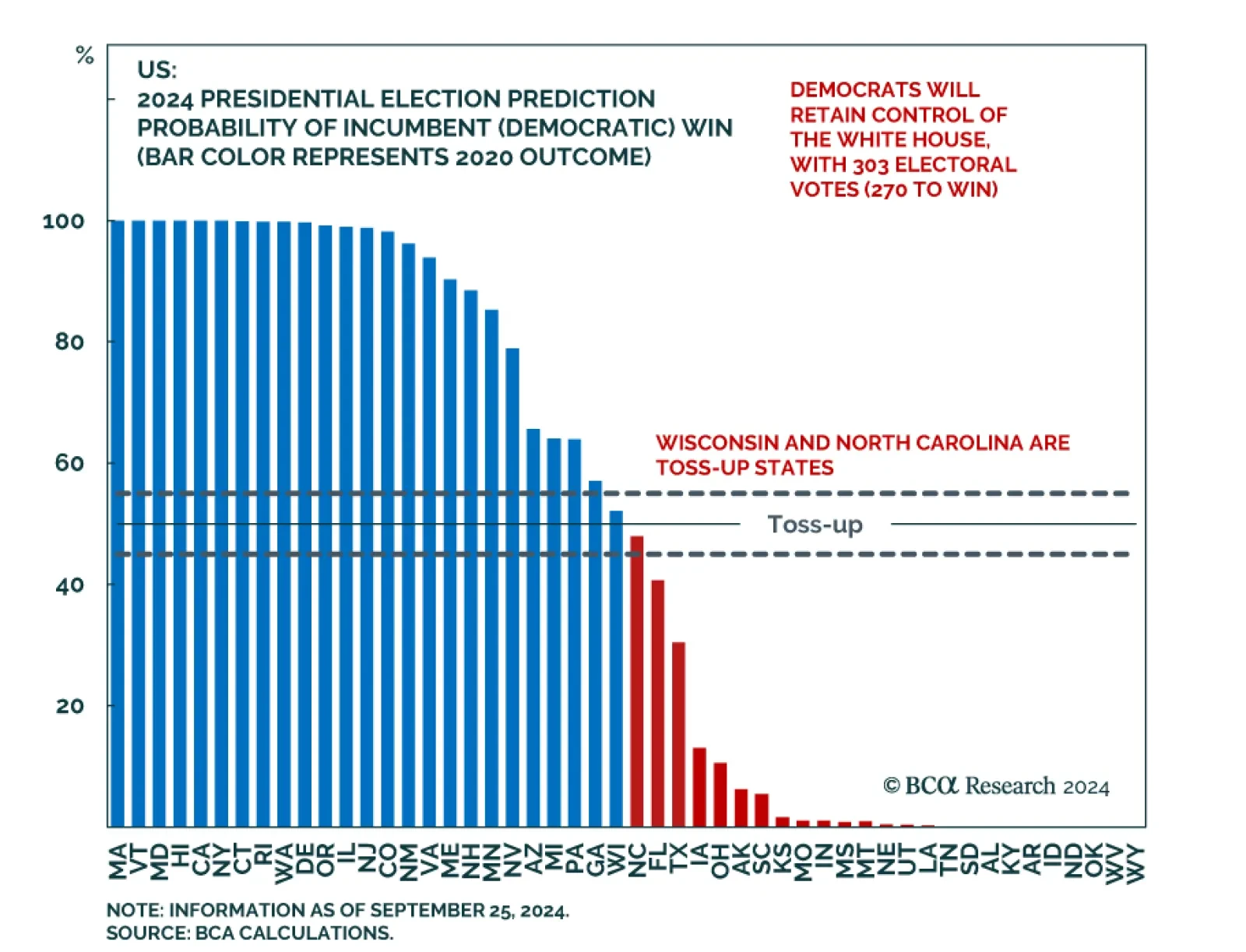

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

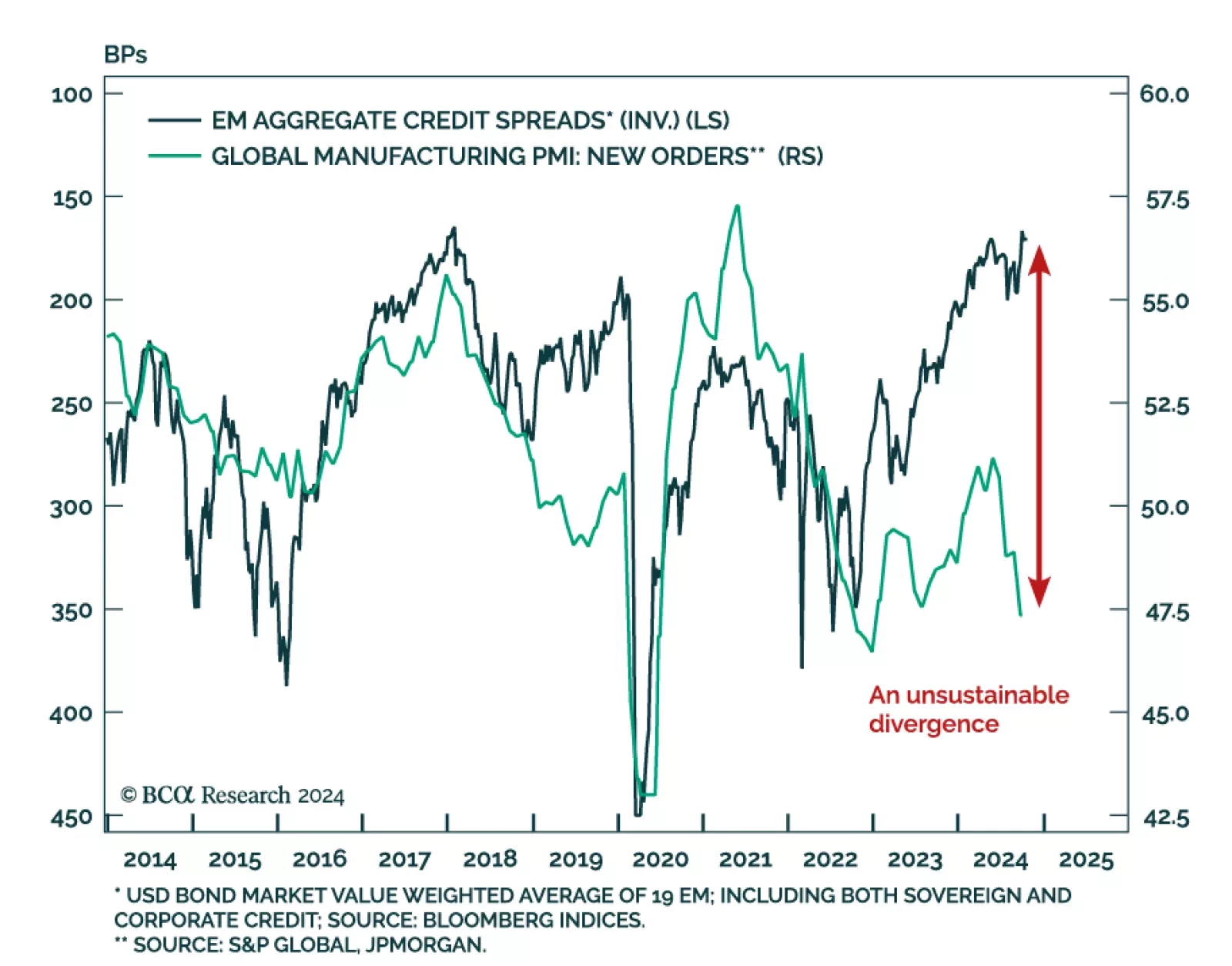

EM credit markets have recently defied the selloffs in EM equities, currencies, local currency bonds, and commodities. According to our Emerging Markets Strategy colleagues, such a decoupling is unusual. A potential Trump re-…

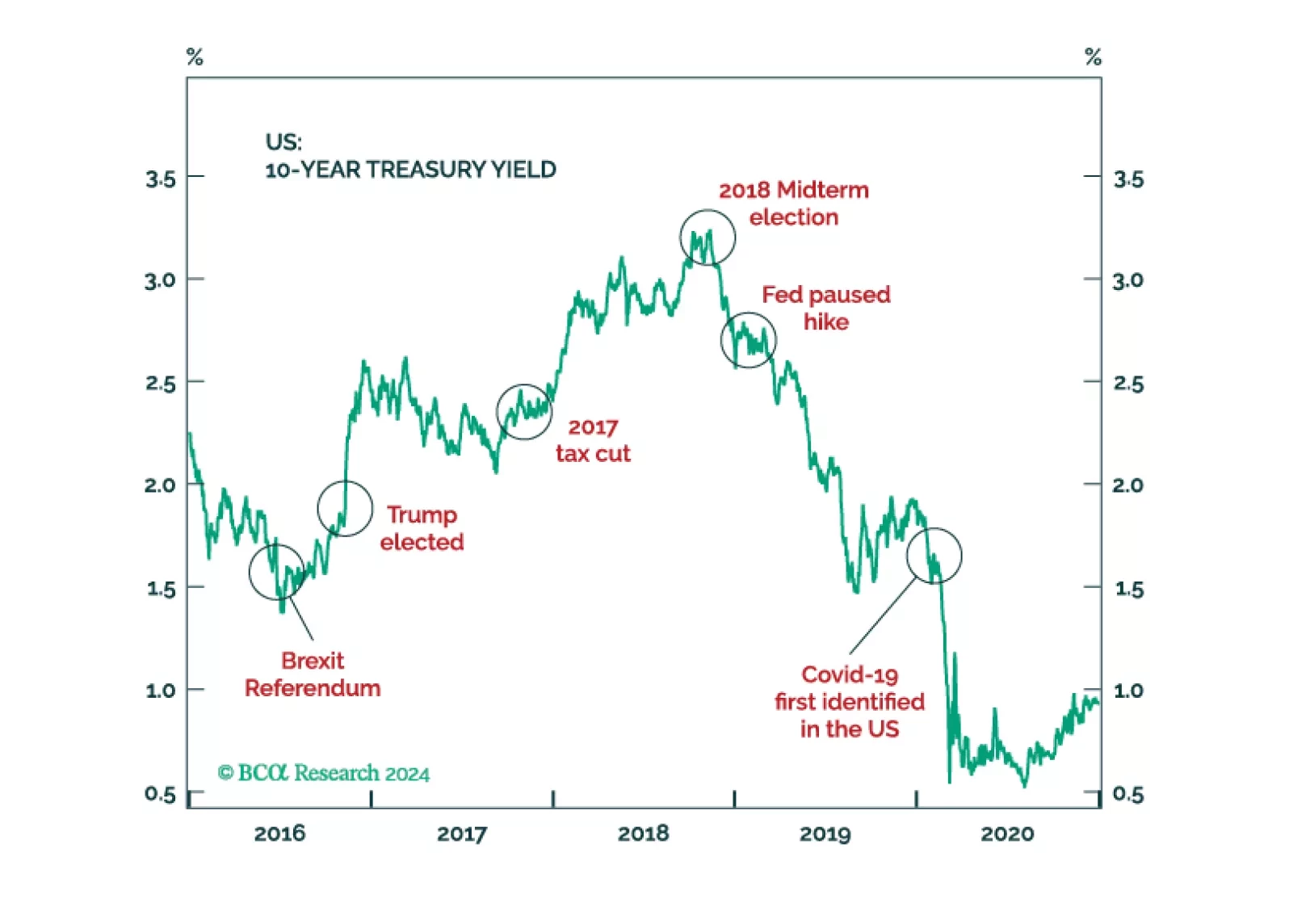

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

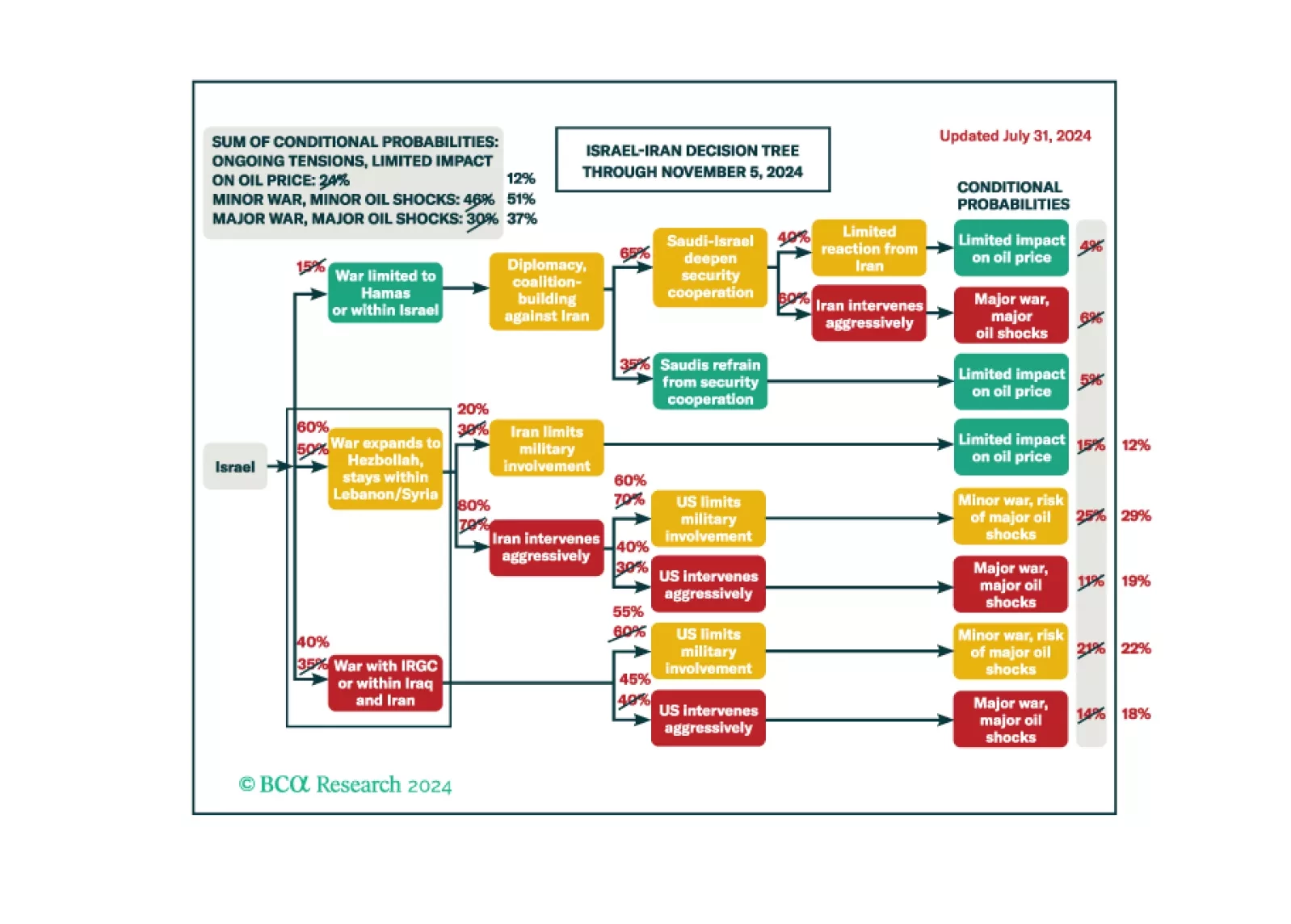

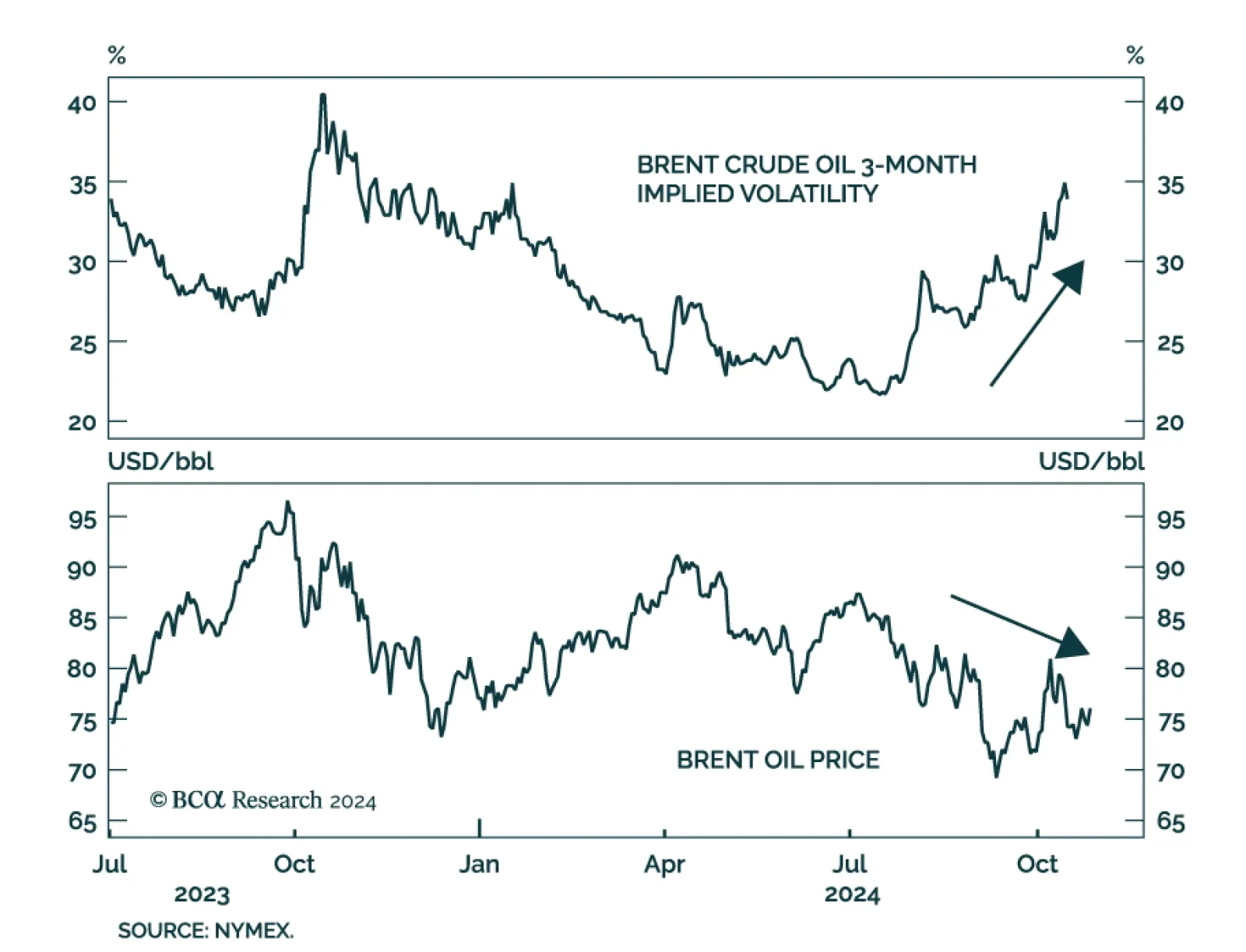

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

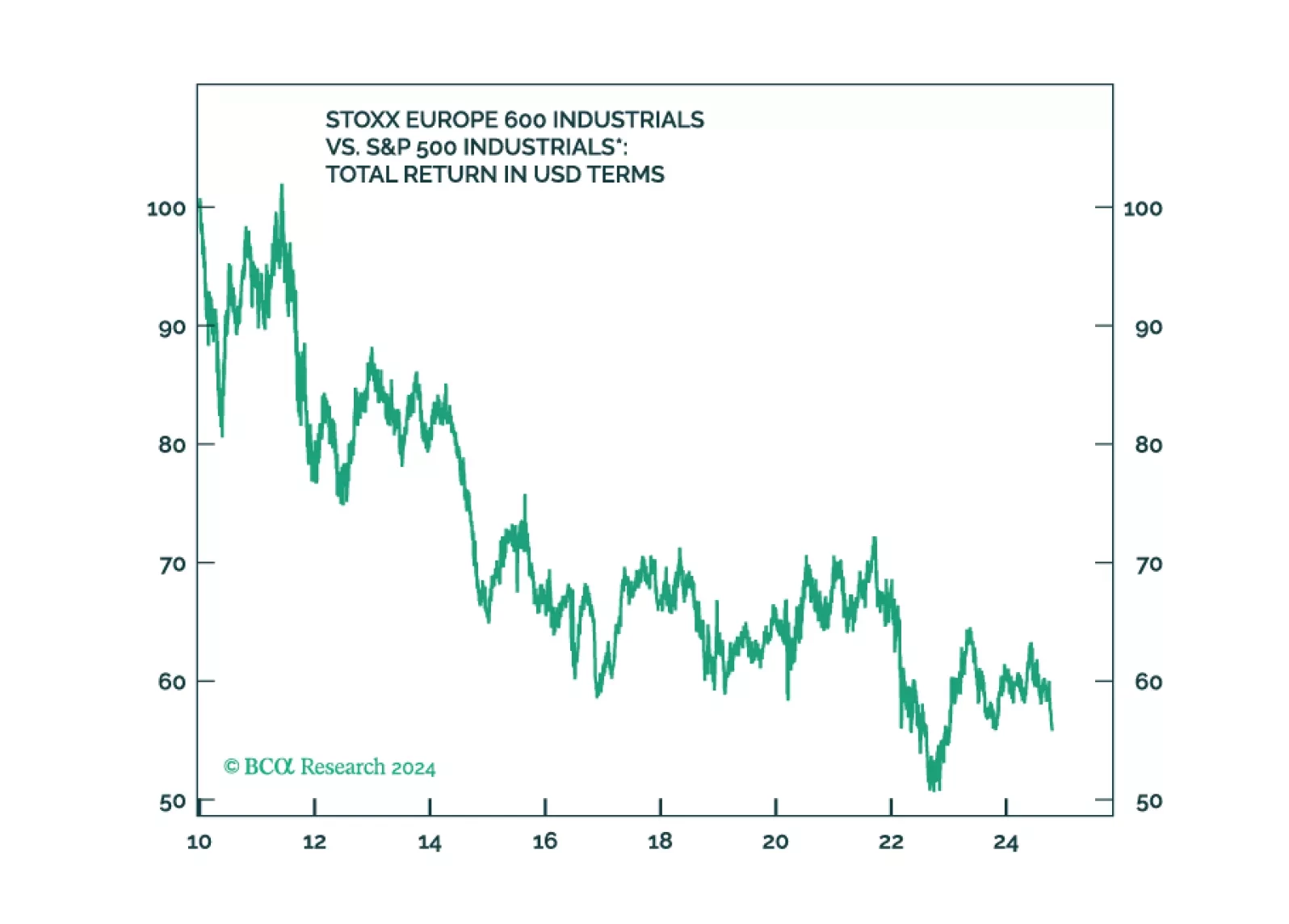

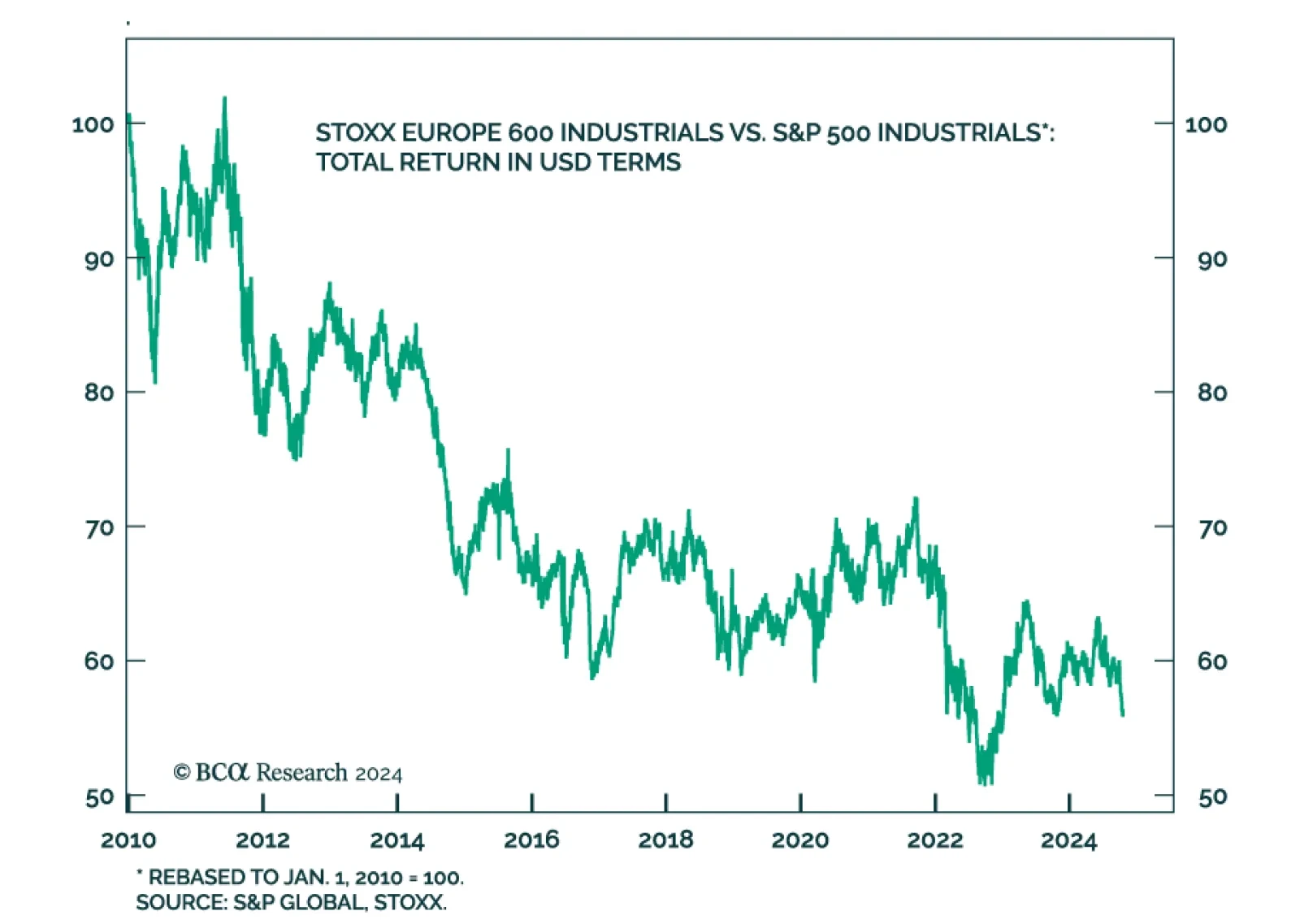

Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…

The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

According to BCA Research’s US Political Strategy service, the important election takeaway for investment strategy comes from the Senate. The Senate is highly likely to fall to Republicans. They are nearly certain to win…