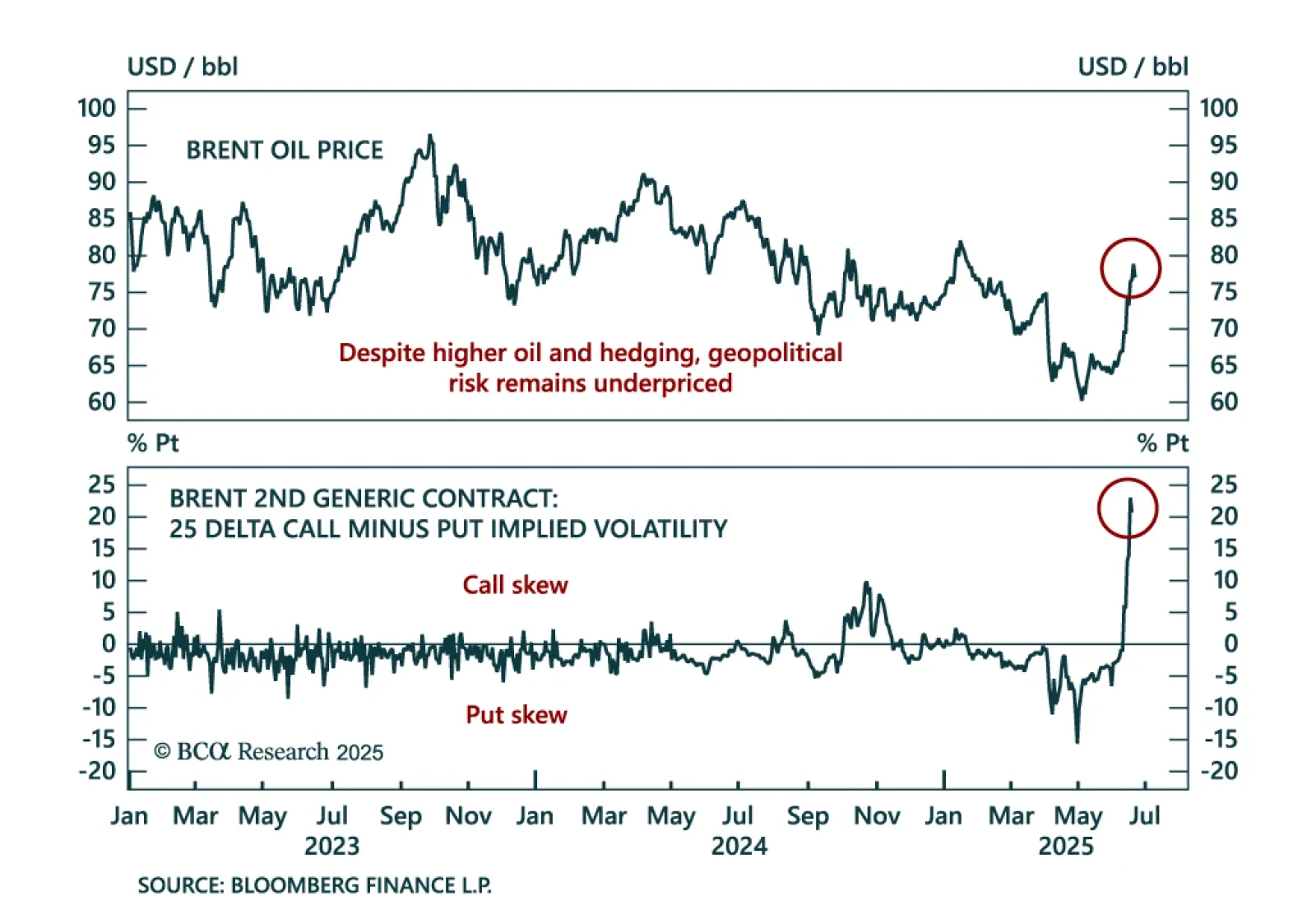

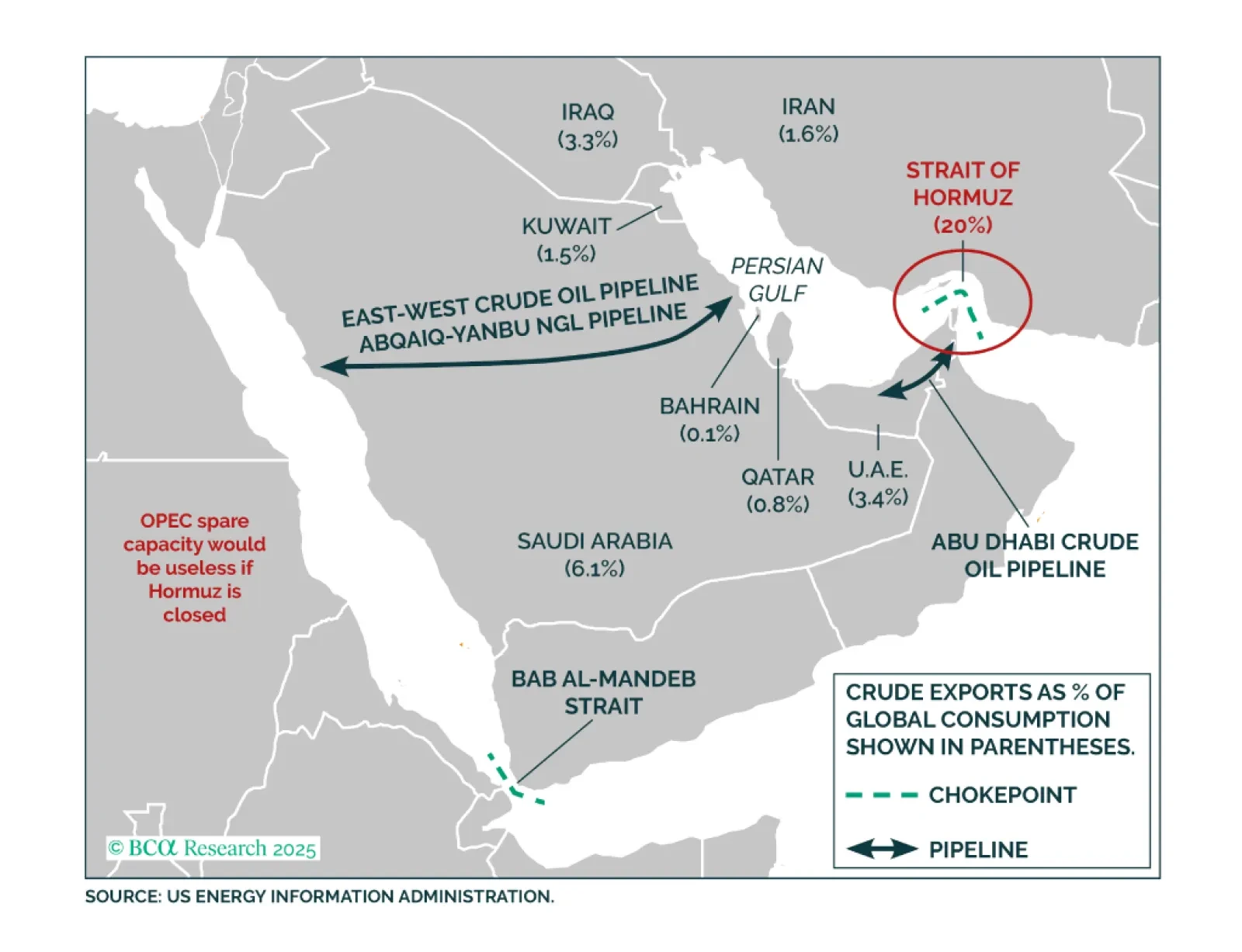

Elevated market complacency contrasts with high geopolitical risk as oil disruption remains a key threat. Middle East tensions escalated over the weekend after the US struck Iran’s nuclear capabilities, yet markets have reacted…

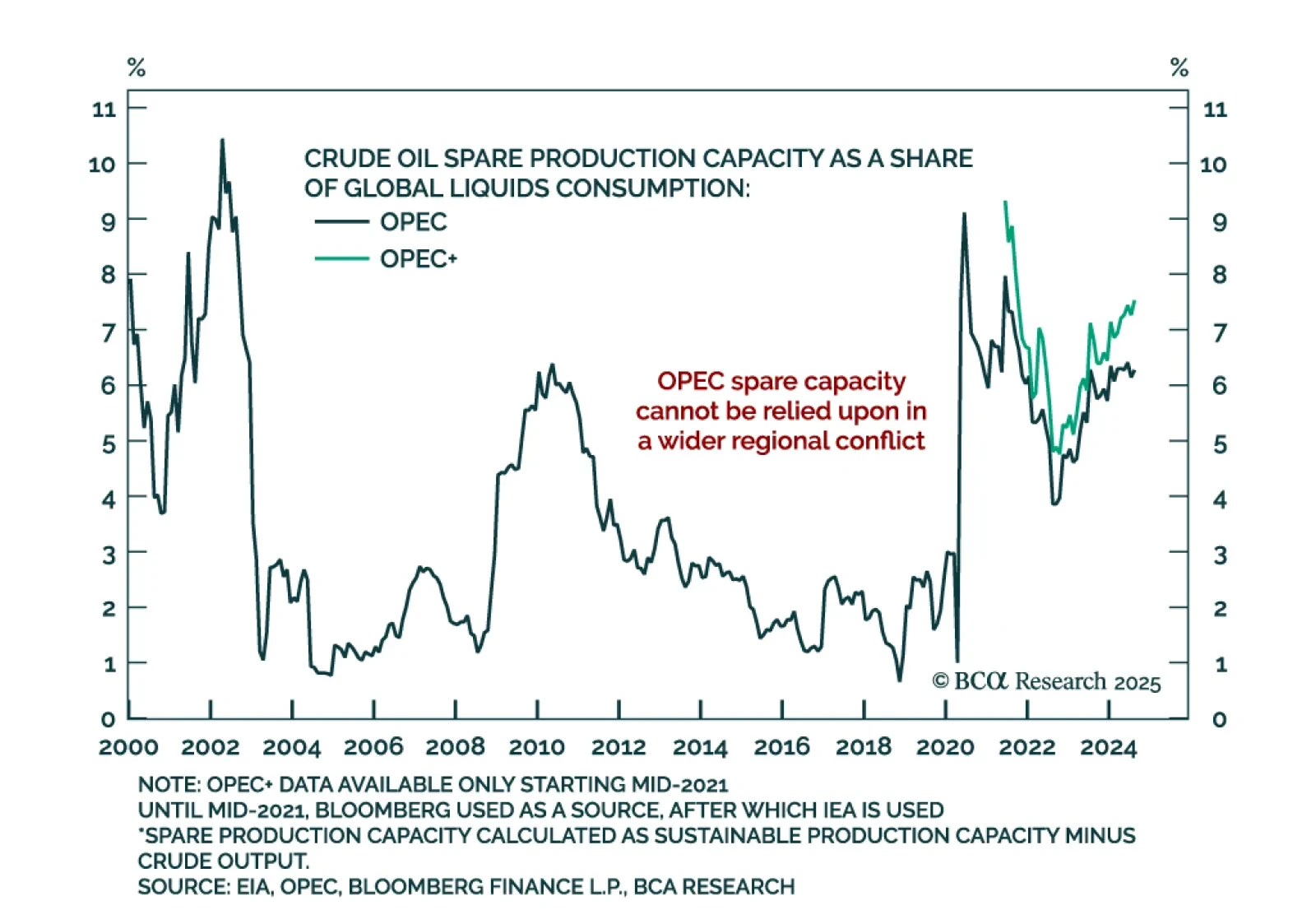

Our Commodity strategists see rising geopolitical risks as a catalyst for gold outperformance and caution that oil markets are underpricing the threat of a supply shock. The intensifying conflict between Israel and Iran has raised…

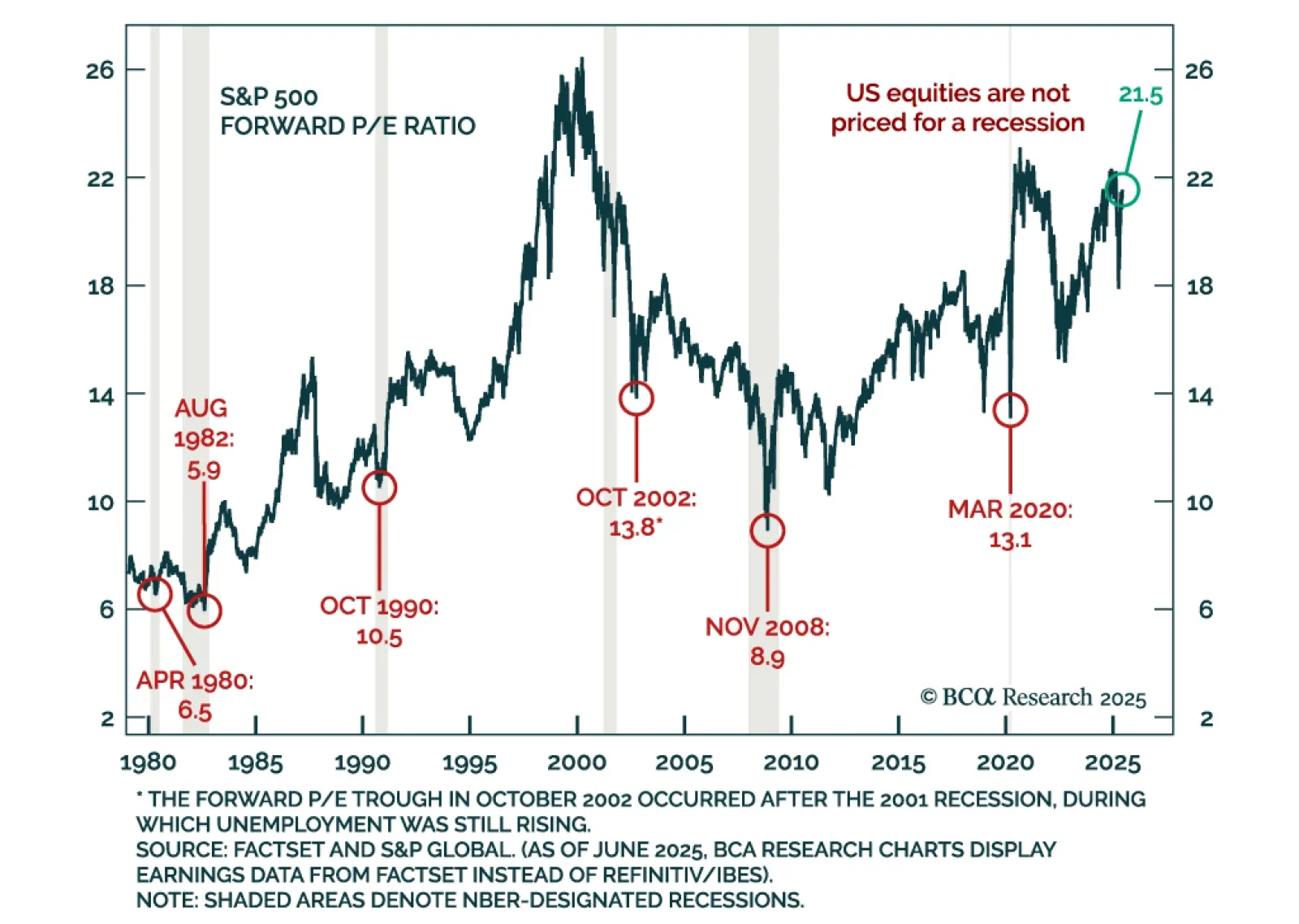

Geopolitical risks and fragile margins reinforce a defensive allocation stance, as oil shocks and high US equity valuations pose growing downside risks. At this month’s Views Meeting, our strategists discussed the potential fallout…

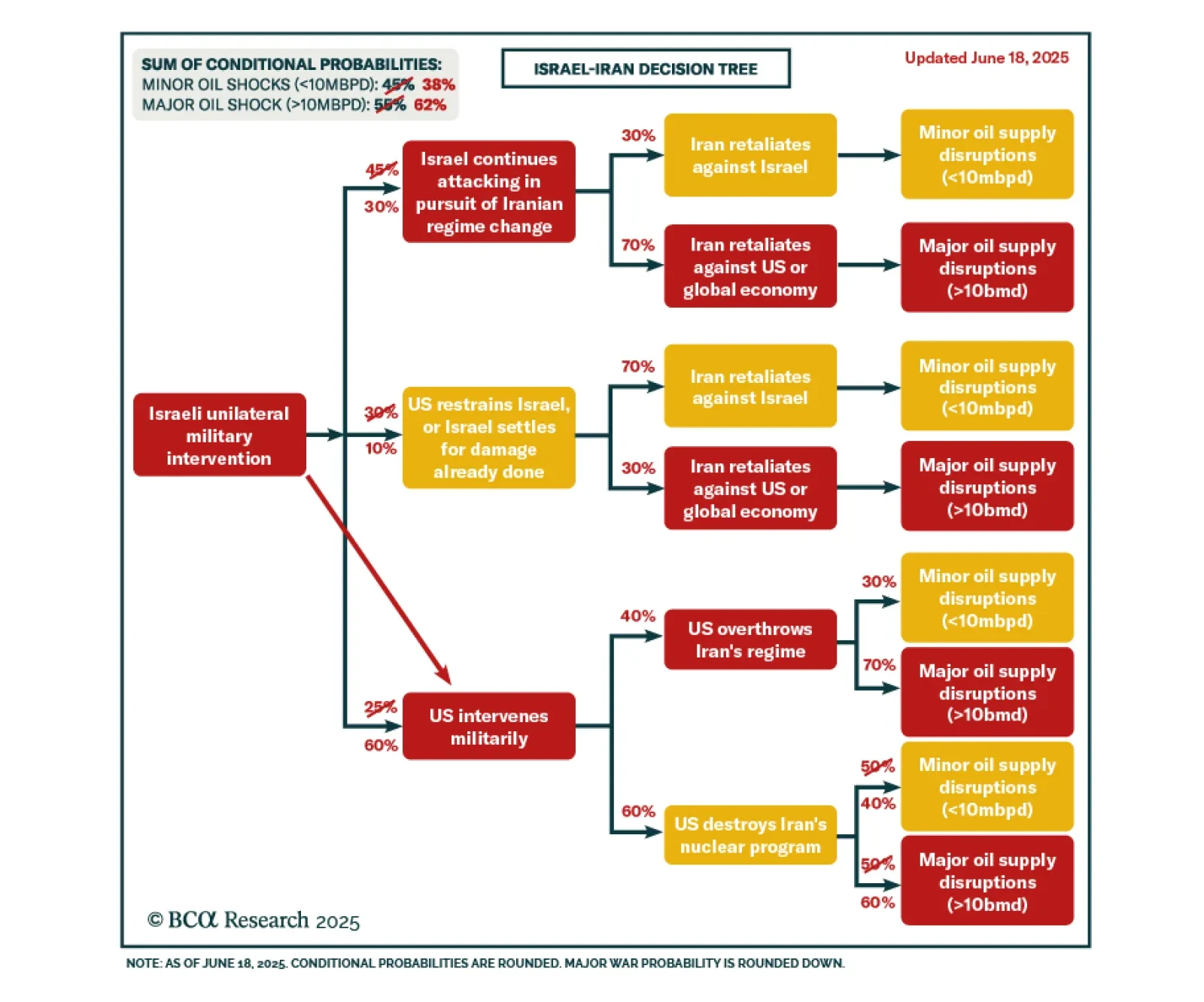

Our Geopolitical strategists expect US involvement in Israel’s military campaign against Iran, raising near-term risks to oil supply and market stability. Iran is likely to retaliate by targeting regional oil production and transport…

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

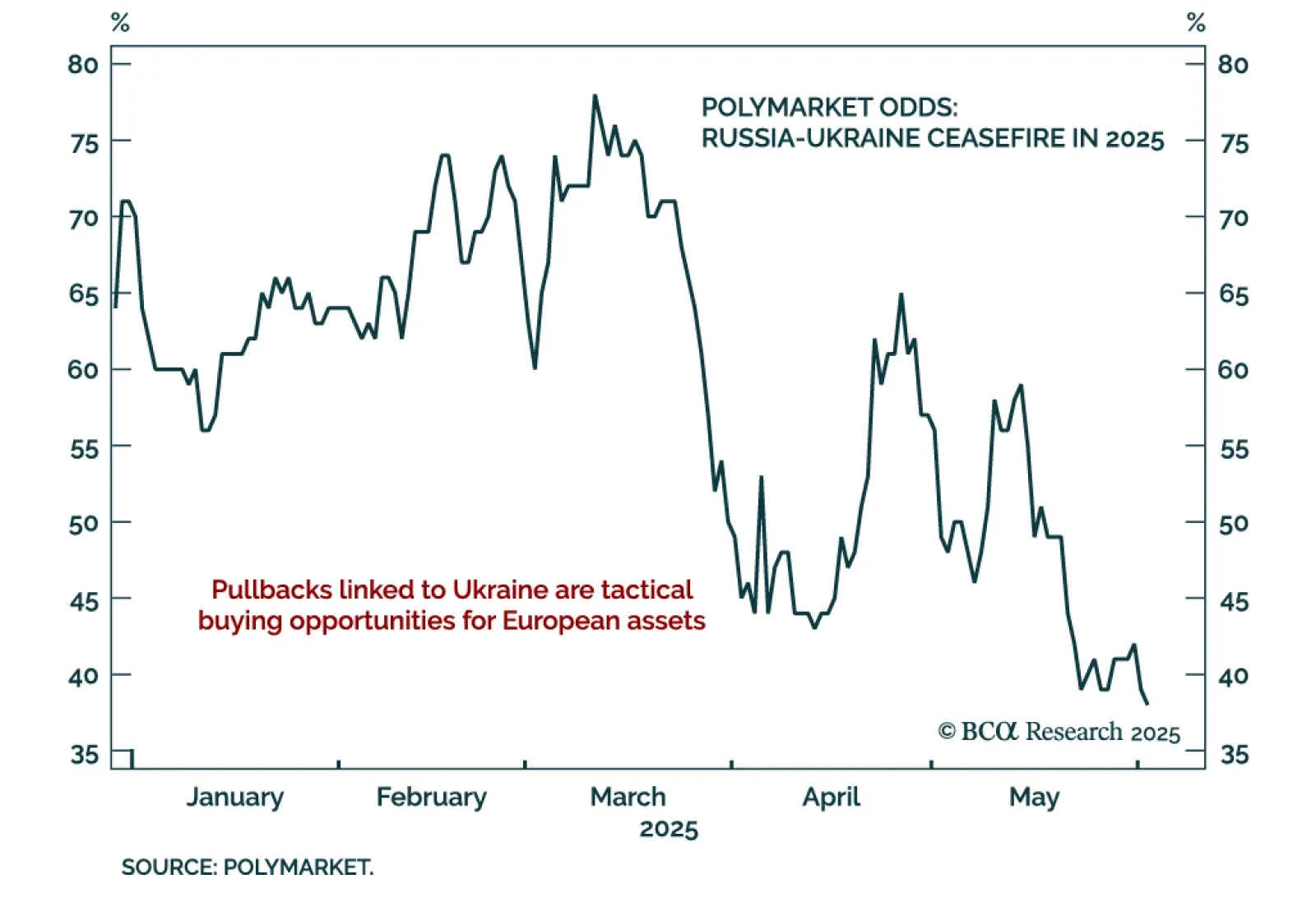

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

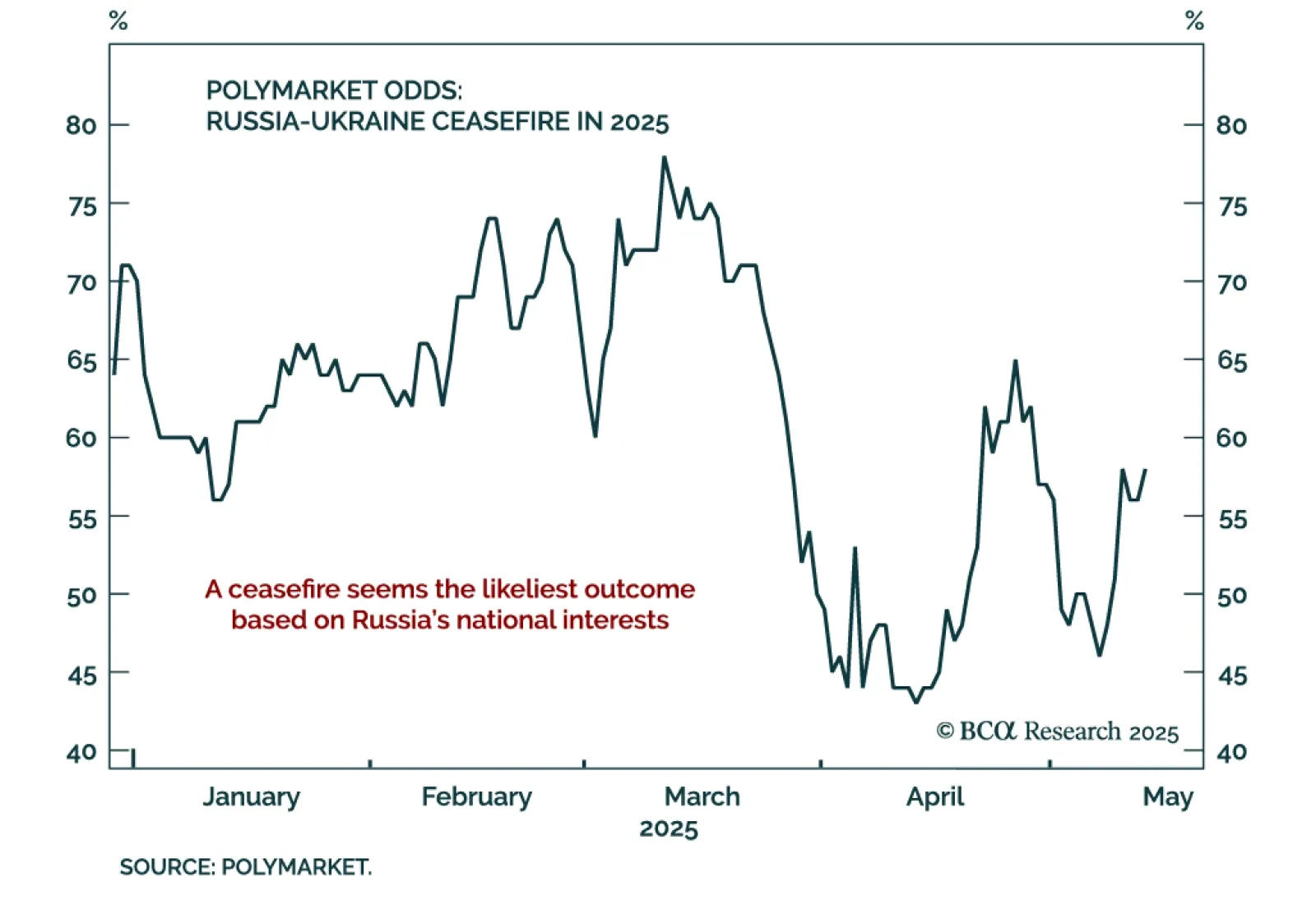

Our Geopolitical strategists expect a Ukraine ceasefire as Russia’s economic weakness compels Putin to shift focus from war to domestic stability. The likely outcome is not peace, but a frozen conflict that enables Russia to…

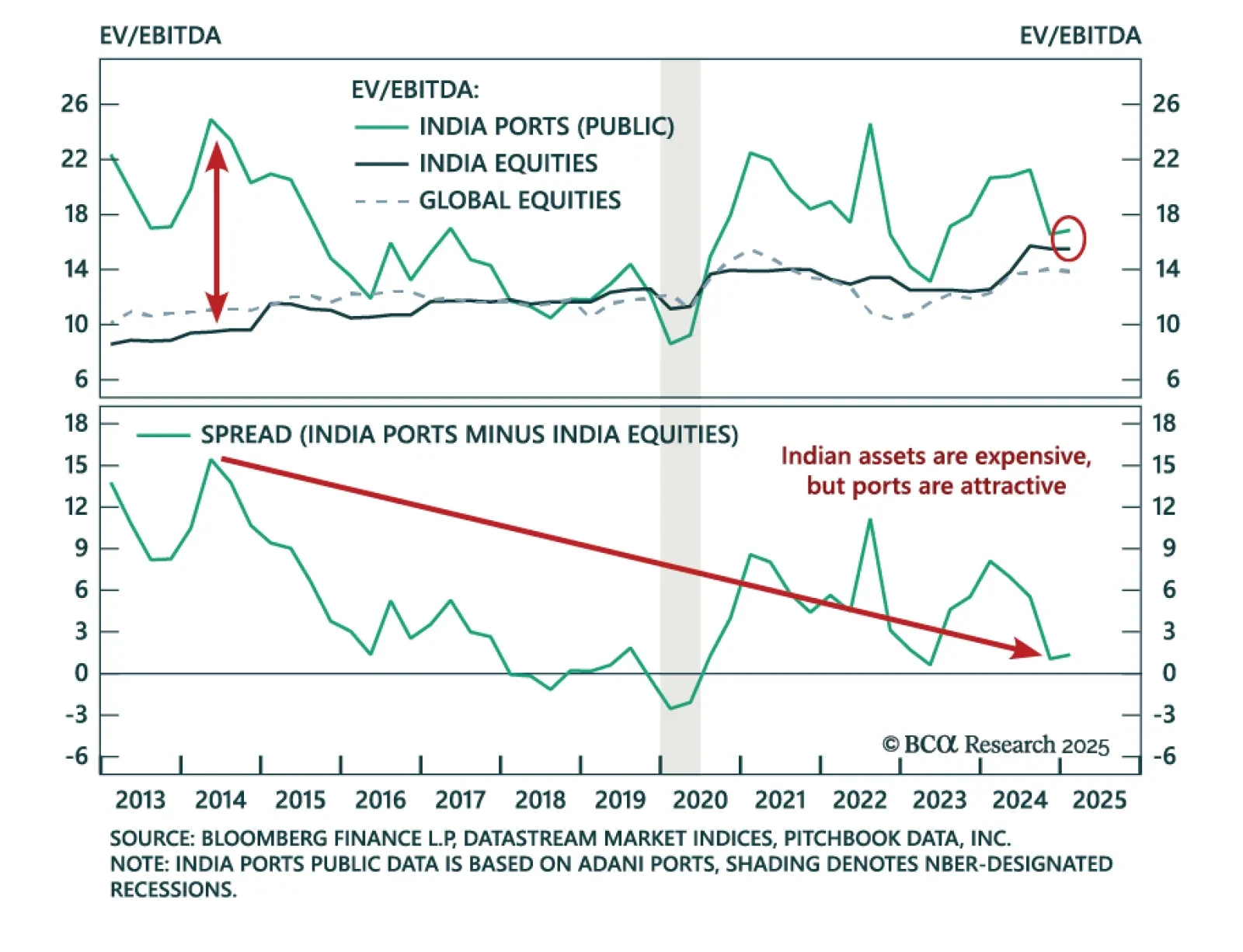

Our Private Markets & Alternatives strategists recommend shifting exposure within Port Infrastructure to India as re-globalization reshapes trade flows. The US will remain a trade leader, but tensions with China and the…