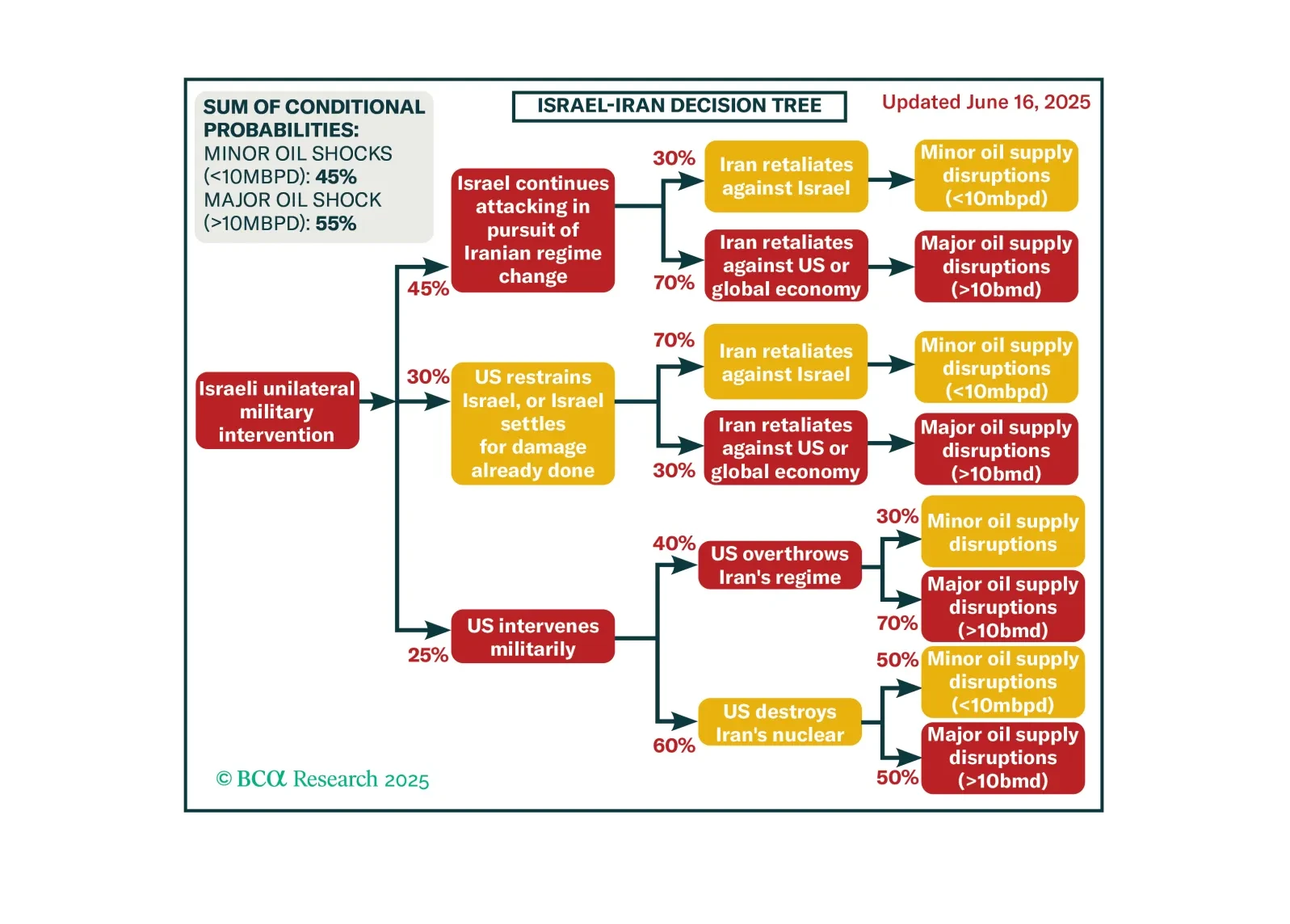

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

Investors should hold gold, build up some cash, tactically overweight US equities relative to global, and prepare for at least minor oil supply shocks – possibly major shocks – as the Israel-Iran war escalates.

As a push for Russia-Ukraine peace talks emerges, energy prices are easing. Reduced geopolitical risk and the potential lifting of sanctions on Russia would be a headwind for oil and European natural gas prices. Should investors bet…

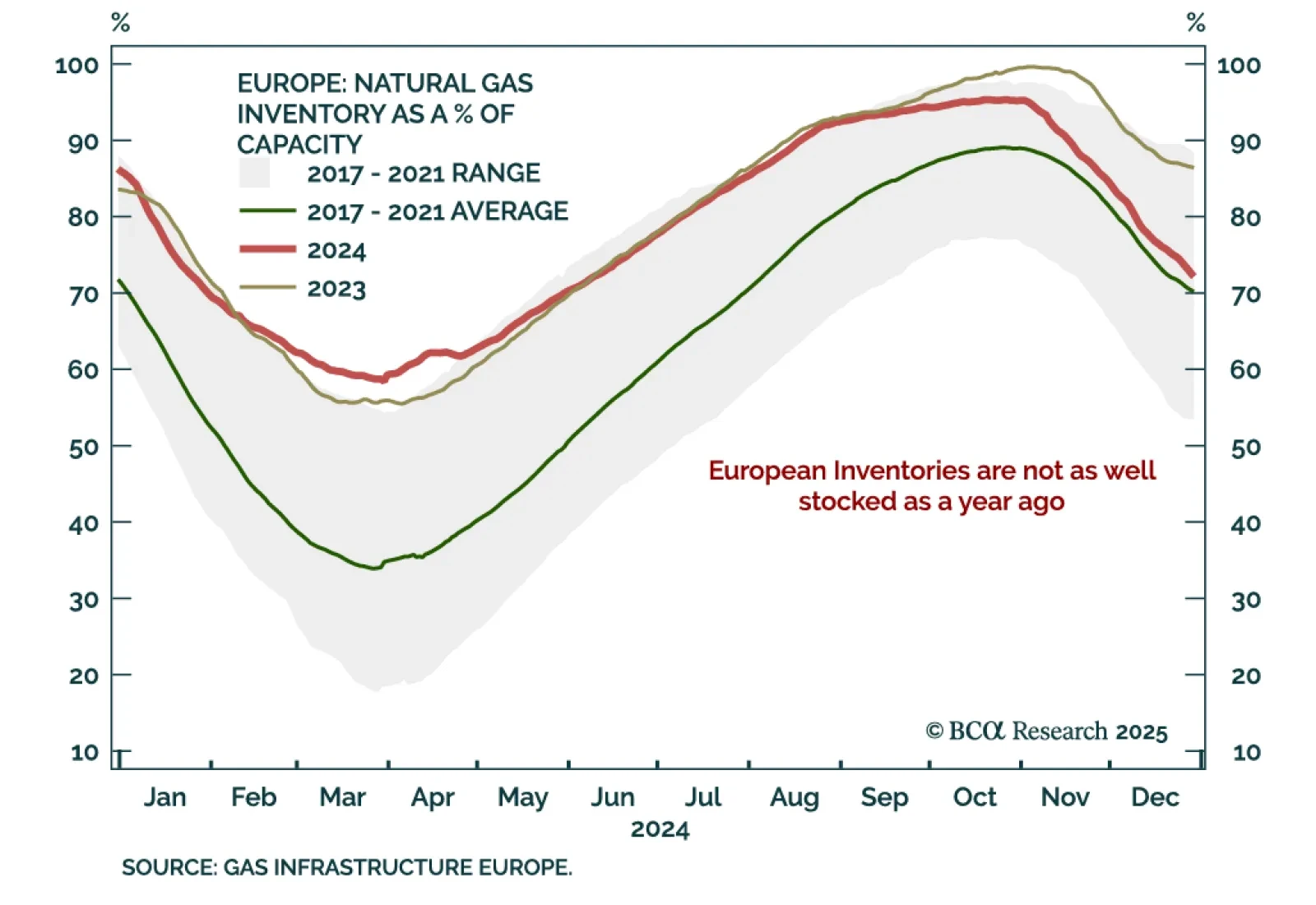

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

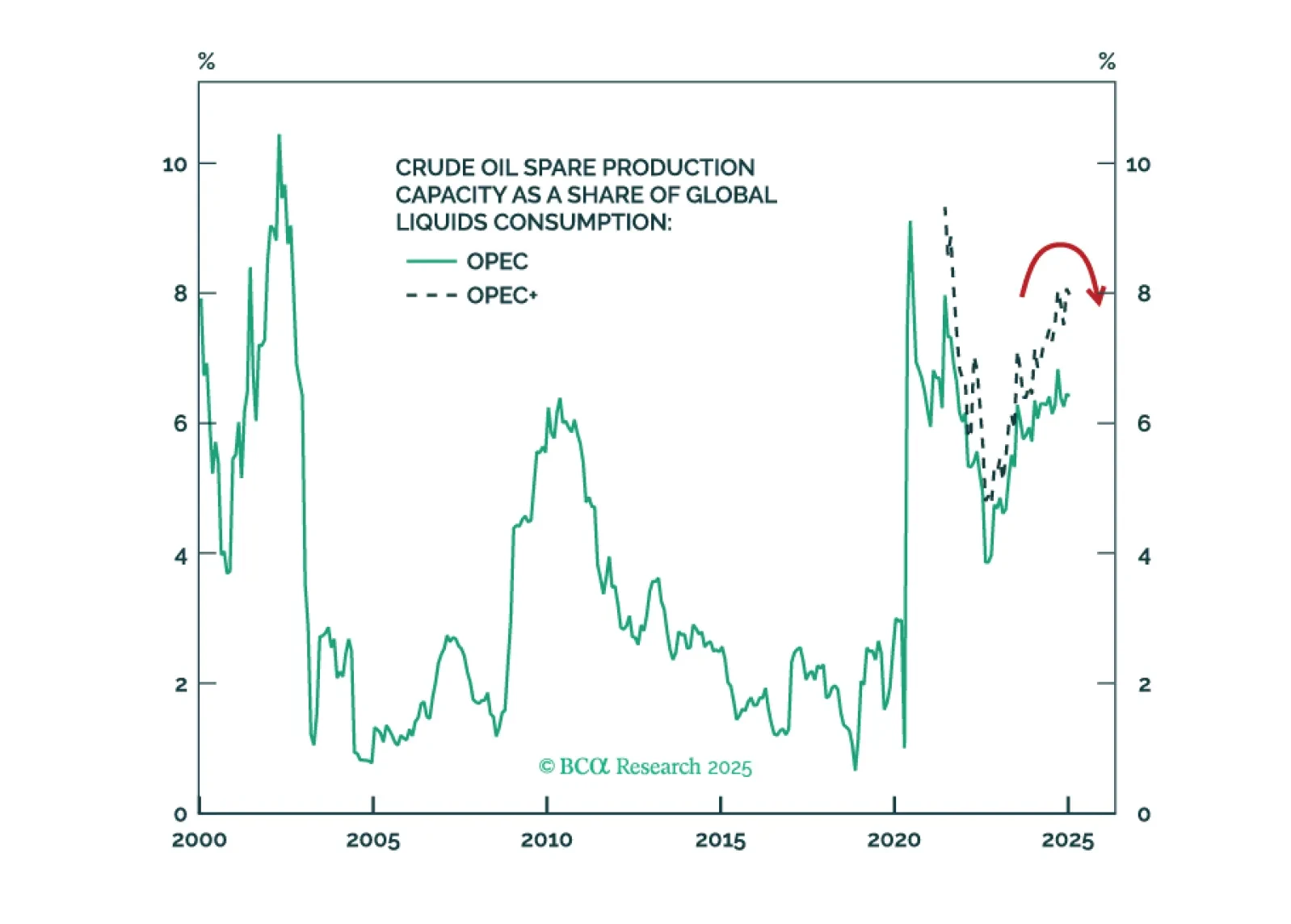

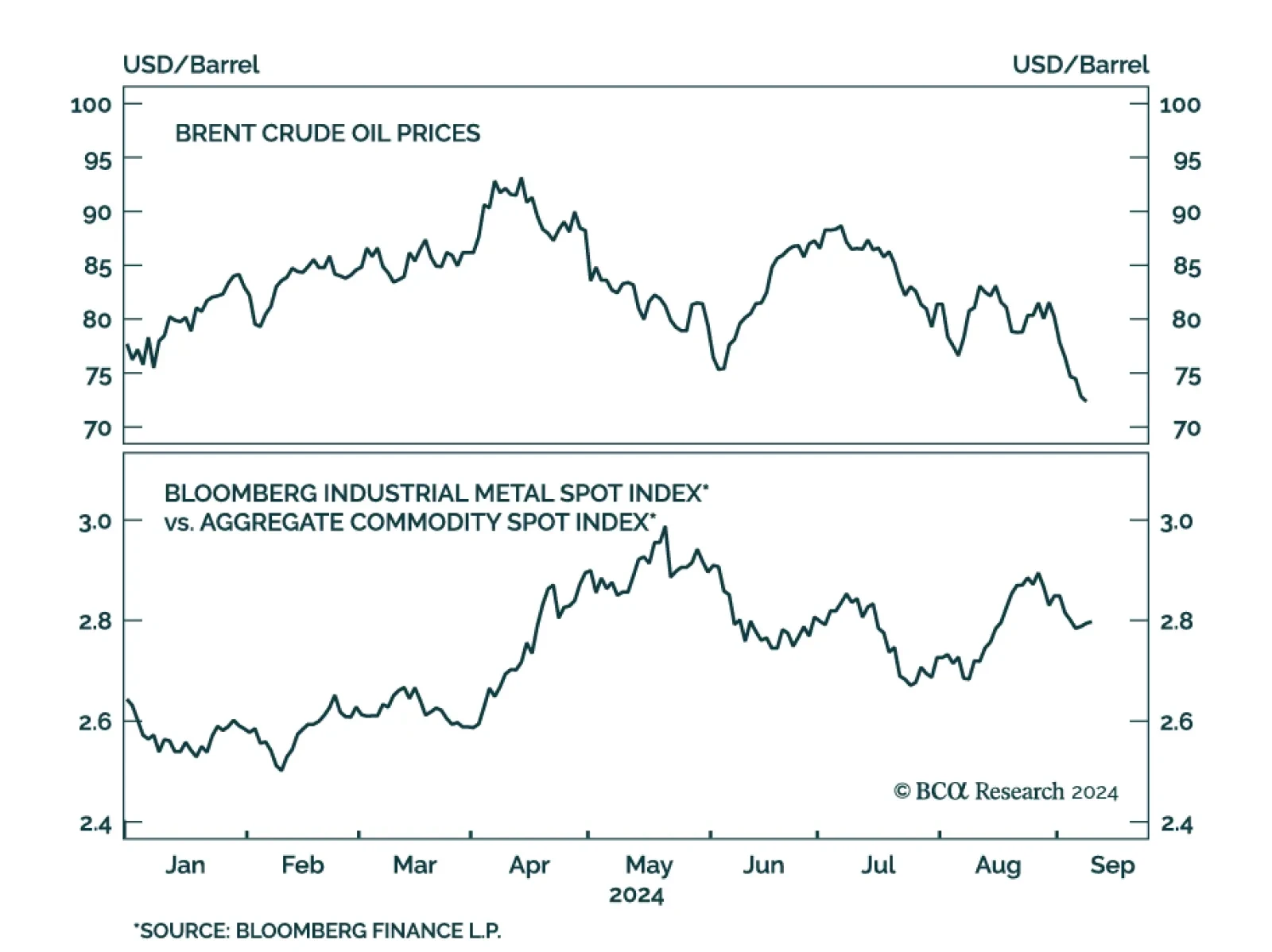

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

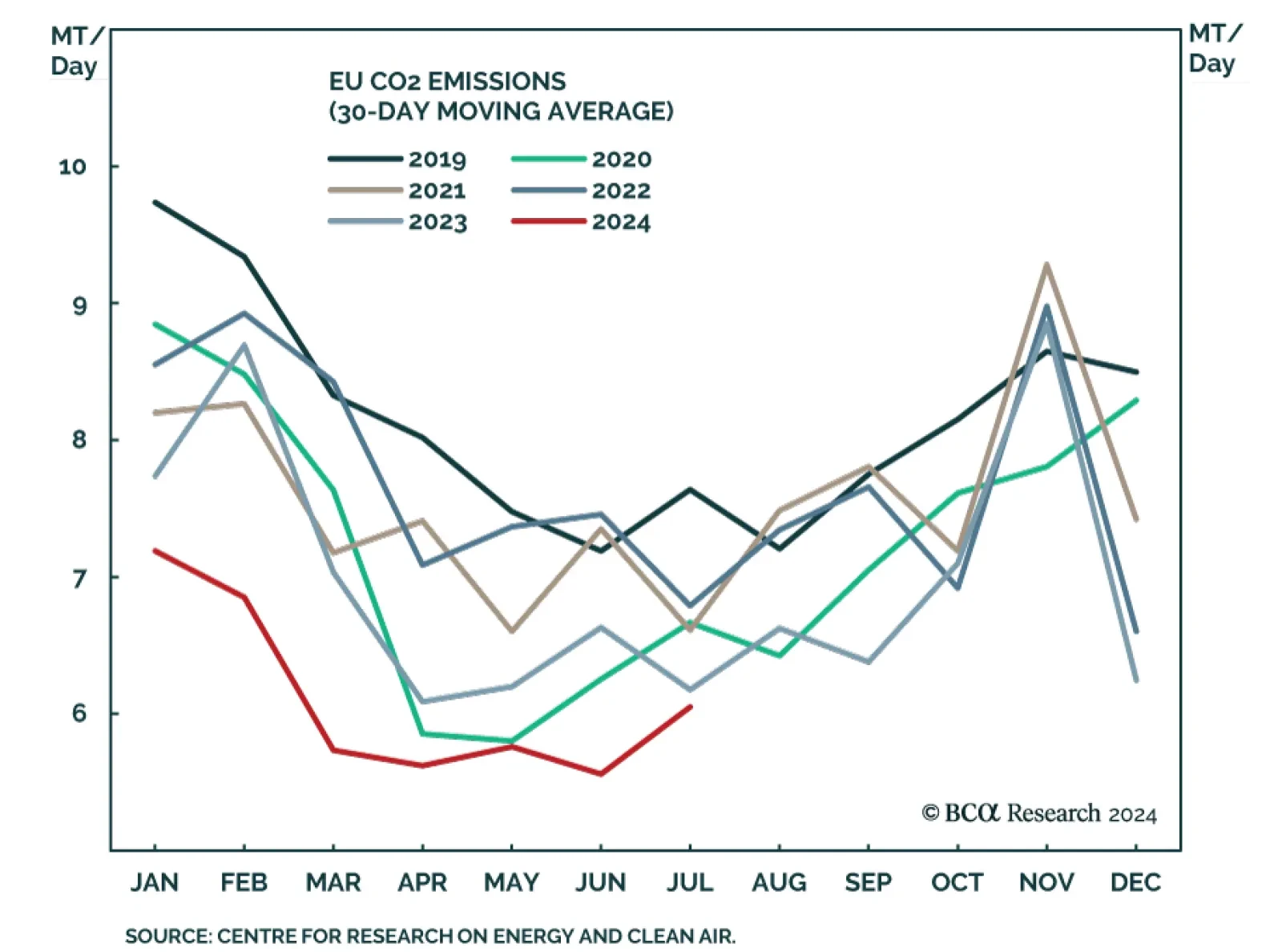

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

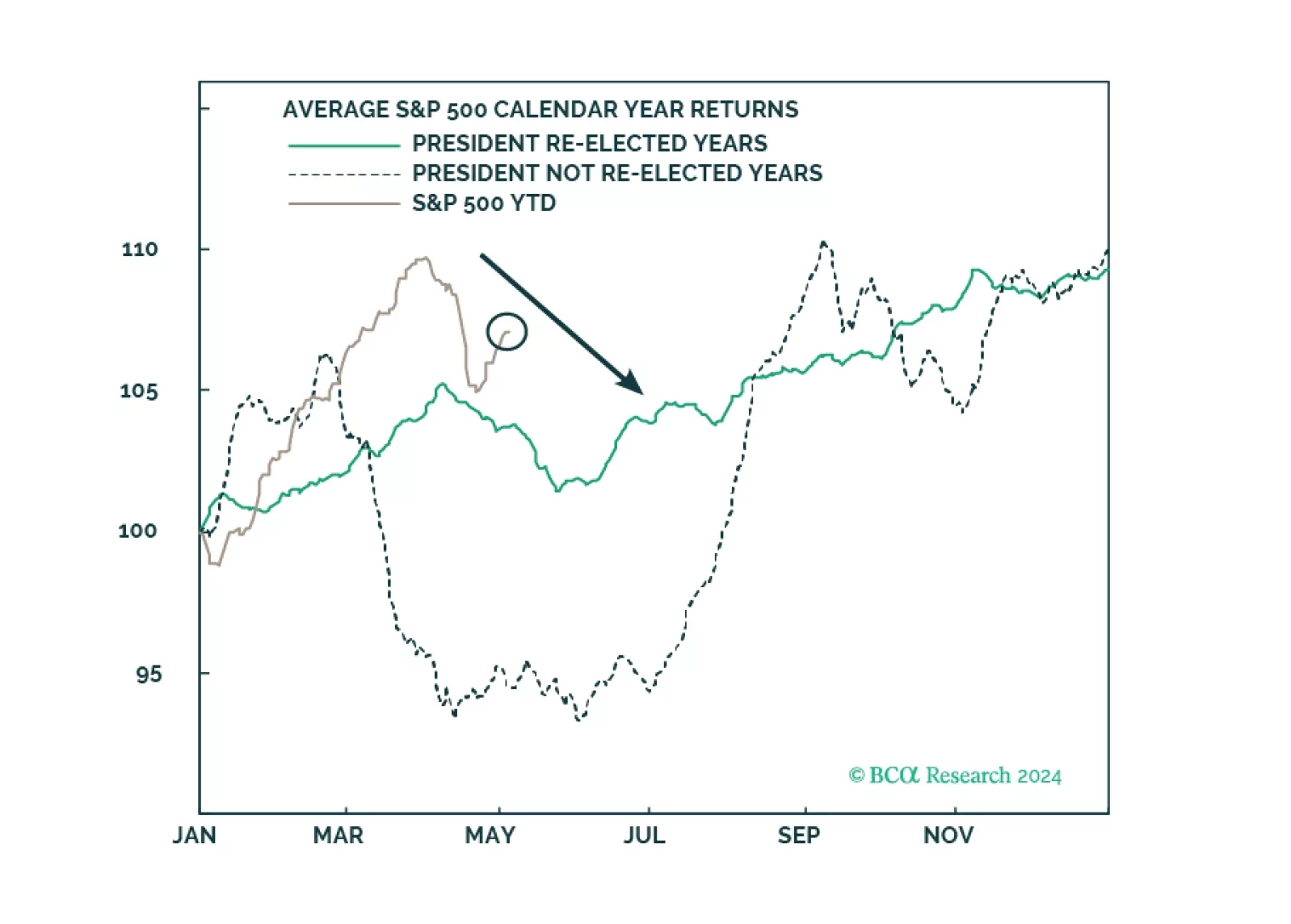

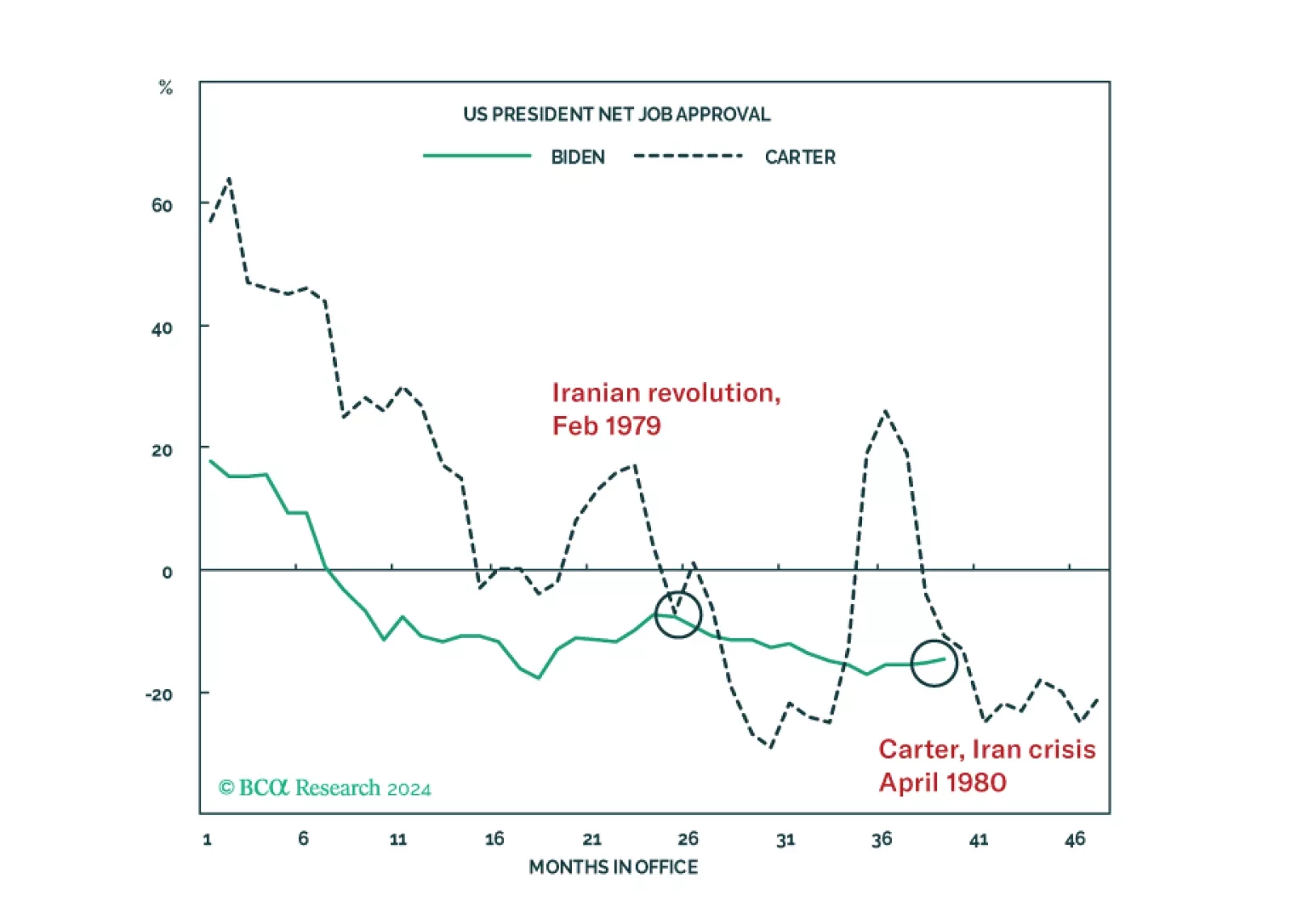

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…