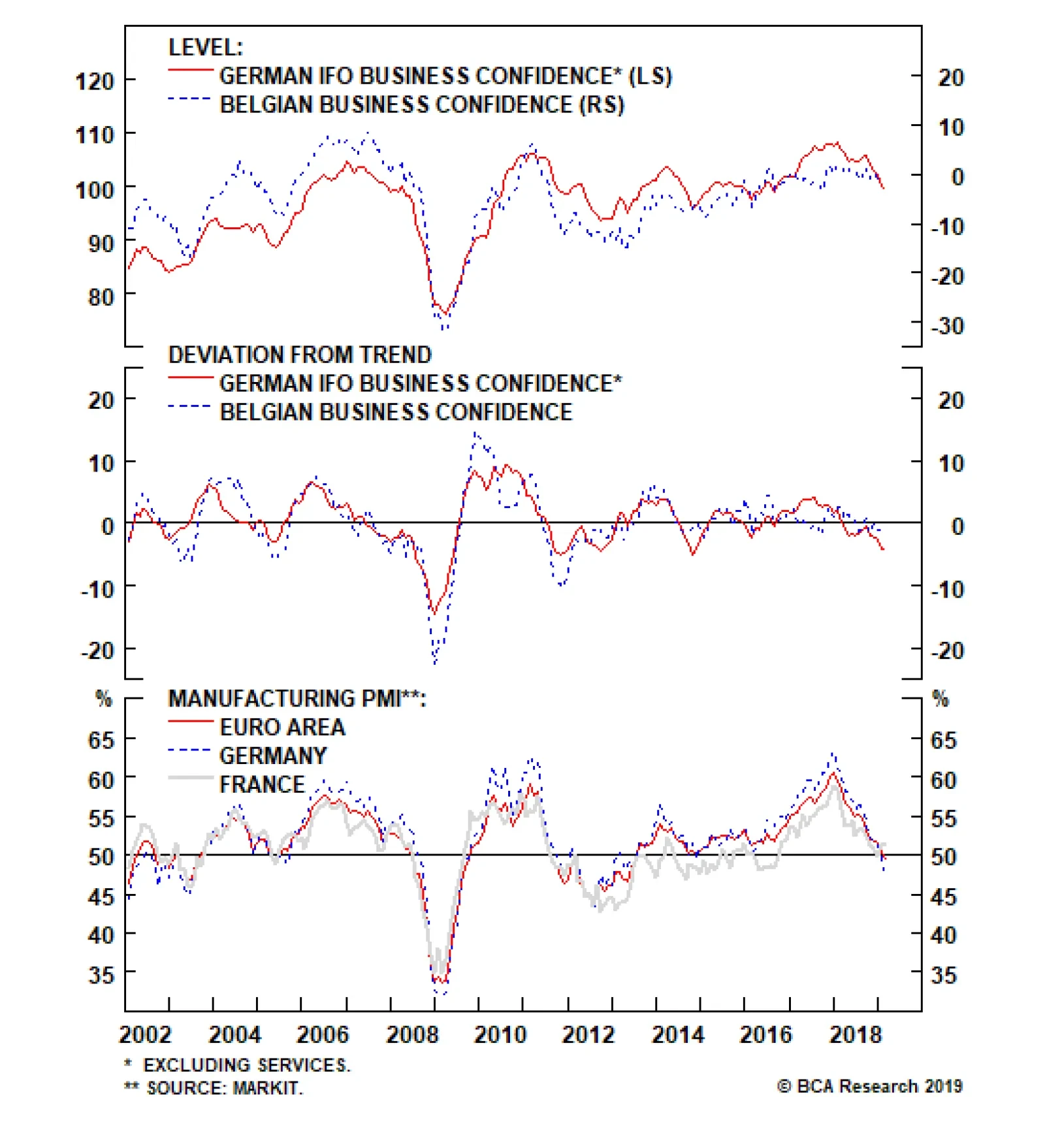

The European economic slowdown shows no sign of ending. This morning, both the German Ifo and the Belgian business confidence decelerated further, with the former falling to 98.5 from 99.3, and the latter weakening from -1.5 to -…

Highlights The global economic mini-cycle is set to weaken while the euro is set to grind higher. Upgrade Telecoms to overweight. Also overweight Healthcare and Airlines. Underweight Banks, Basic Materials and Energy. Overweight…

Highlights French labor reforms stack up well against German and Spanish predecessors; We remain bullish on French industrials versus German industrials; Populism is overrated in Germany - European integration may not accelerate, but…

Highlights Even isolated North Korean attacks are unlikely to lead to a full-scale war; The USD sell-off will start to reverse once Trump makes Gary Cohn his official pick for Fed chairman; Europe is not a risk for investors ... even…

Highlights Trade 1: An unwinding of the Trump reflation trade... has worked exactly as expected. Take profits and switch into Trade 5. Trade 2: Short pound/euro at €1.18 and simultaneously buy call options at €1.30... is up…

Highlights For the time being, our cyclical stance is to underweight the globally-sensitive Energy, Materials and Banks sectors versus Healthcare - in both the equity and credit asset-class. Combined with our expectation of a…

Highlights Macron has won in France; Economic reforms are forthcoming; Euroskeptic parties are moving to the center; Yet Italy remains a real risk; Stick to long French industrials versus German; stay long EUR/USD for now.…

Highlights The headwinds against commodity currencies are still brewing, the selloff is not over. Global liquidity conditions are deteriorating and EM growth will disappoint. The valuation cushion in commodity currencies and EM plays…

Highlights Chart 1European Policy Uncertainty Down Macron remains on target to win the French election, but Italy looms as a risk ahead; Fade any relief rally after South Korean elections; Russia is not a major source of…

Highlights ECB: The ECB is still on track to move to a less accommodative policy stance over the next year. Hints of this will be given at the June policy meeting, while a 2018 asset purchase taper announcement will be made at the…