Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights This week, we present the second edition of the BCA Research Global Fixed Income Strategy (GFIS) Global Credit Conditions Chartbook—a review of central bank surveys of bank lending standards and loan demand. Feature…

Highlights With a vaccine already rolling out in the UK and soon in the US, investors have reason to be optimistic about next year. Government bond yields are rising, cyclical equities are outperforming defensives, international stocks…

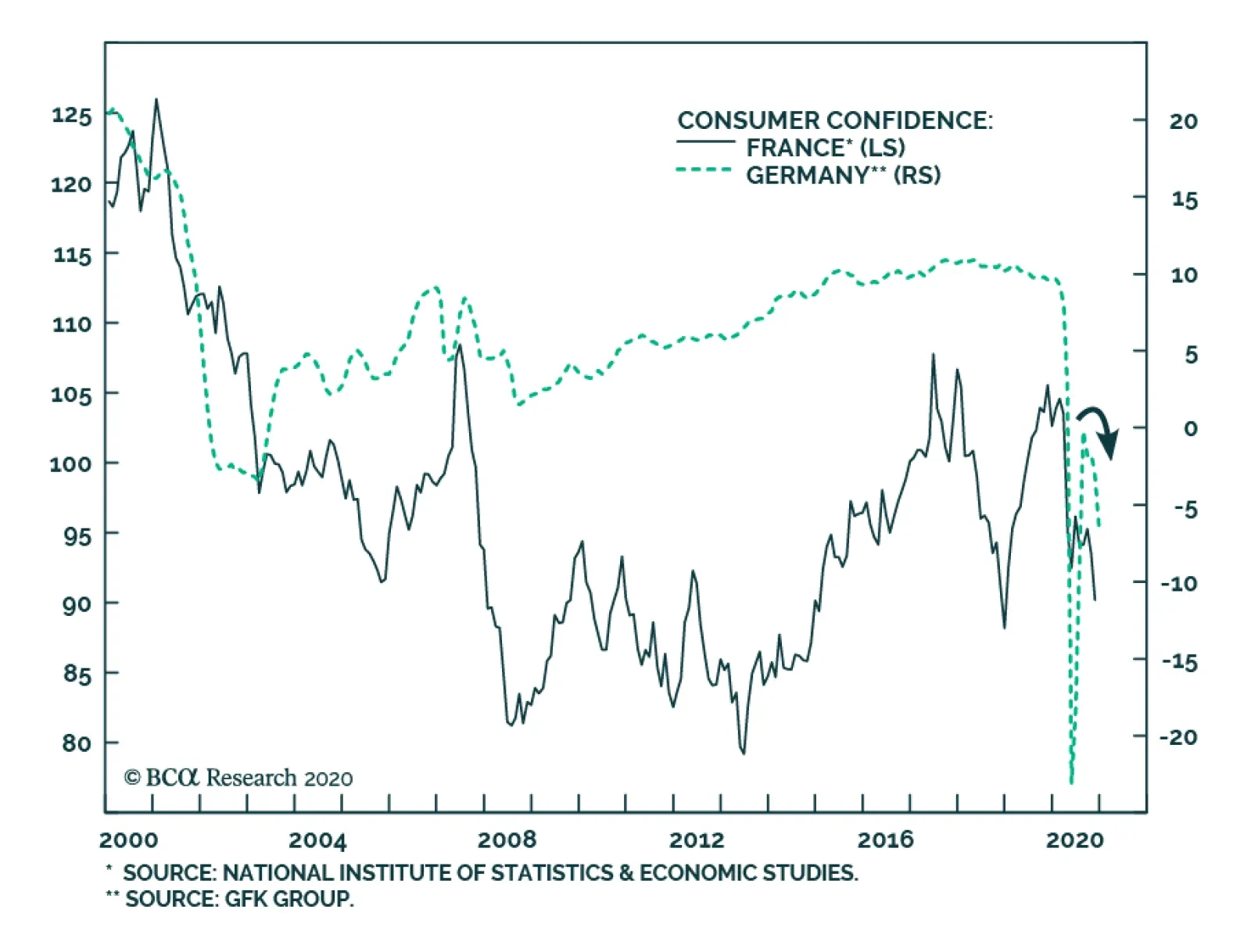

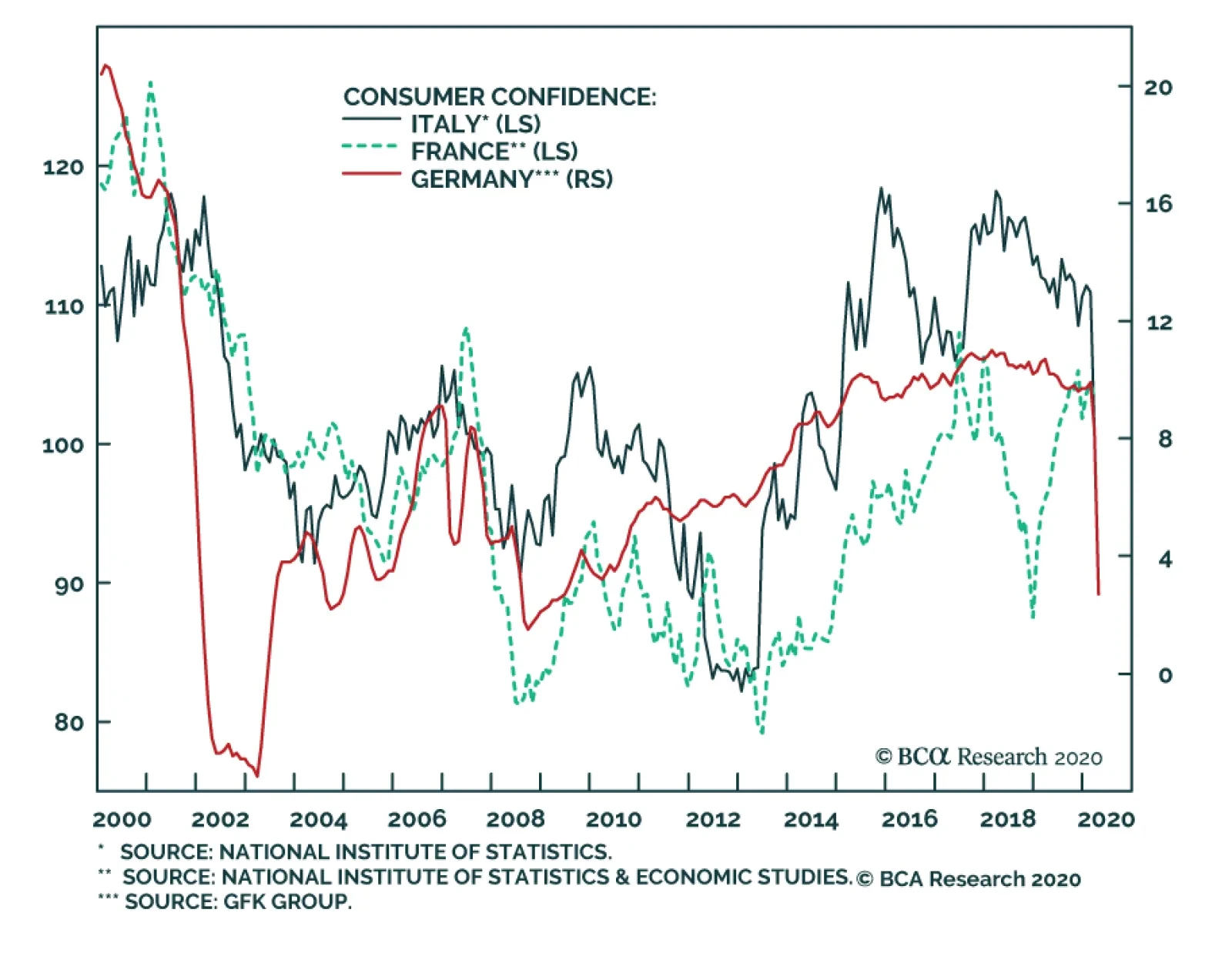

Consumer sentiment in the euro area’s two largest economies is souring amid the institution of renewed measures to control the pandemic. Germany’s GfK consumer confidence survey slipped to -6.7 from -3.2, missing…

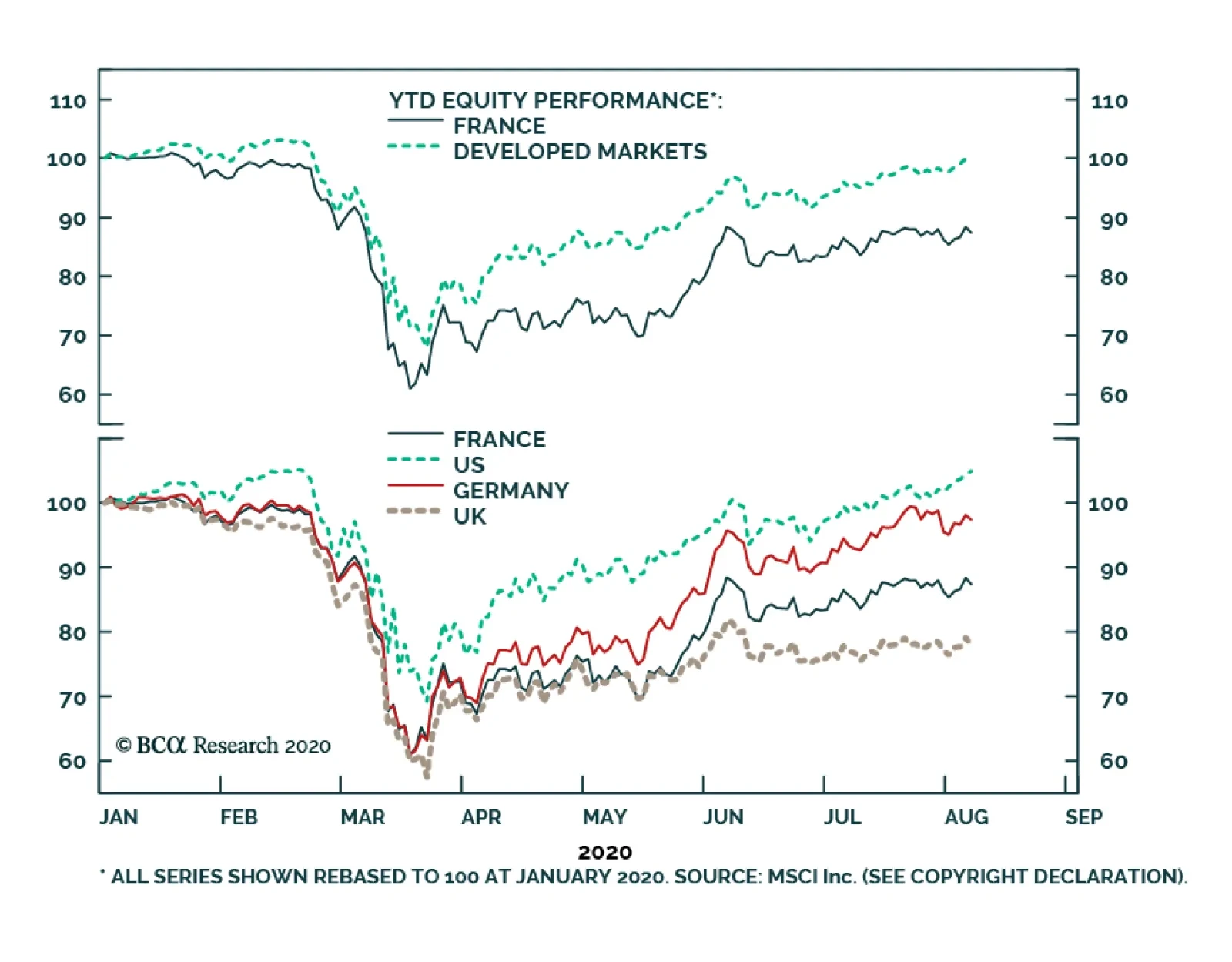

BCA Research's Geopolitical Strategy service recommends that long-term investors overweight French equities over other developed market bourses. French equities have underperformed developed market equities by 12% this…

Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

Unsurprisingly, European consumer confidence has declined sharply as a result of lockdown measures required to contain the spread of COVID-19. The GfK survey in Germany fell from 8.3 to 2.7, much worse than the consensus…

Highlights Uncertainty & Yields: Global bond yields, driven to all-time lows as investors seek safety amid rioting markets, now discount a multi-year period of very weak global growth and inflation. Bond Portfolio Strategy:…

Highlights It is too soon to bottom feed with fears of a global pandemic and “socialist” boom in the United States. China’s government will do “whatever it takes” to stimulate the economy – but…