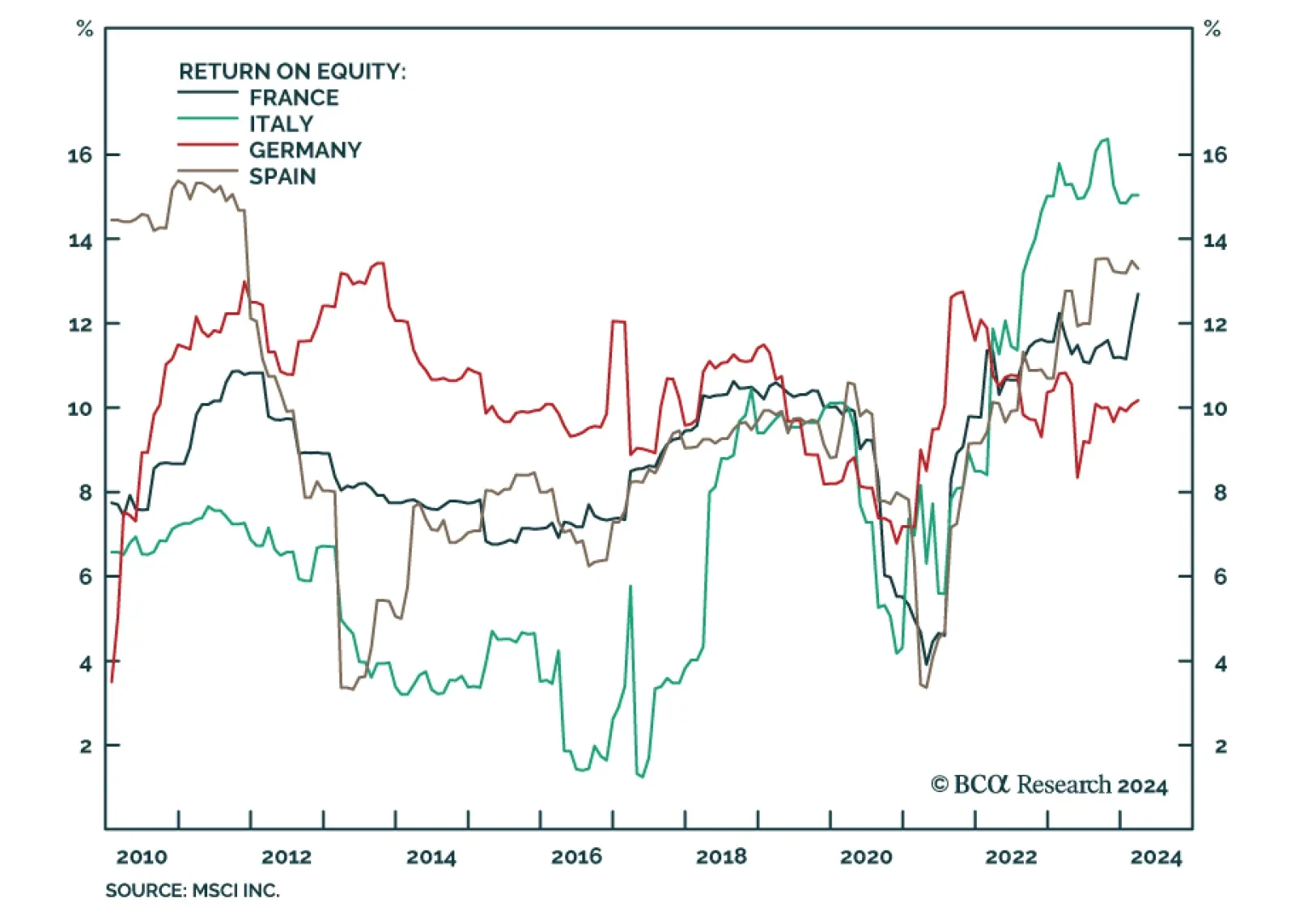

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

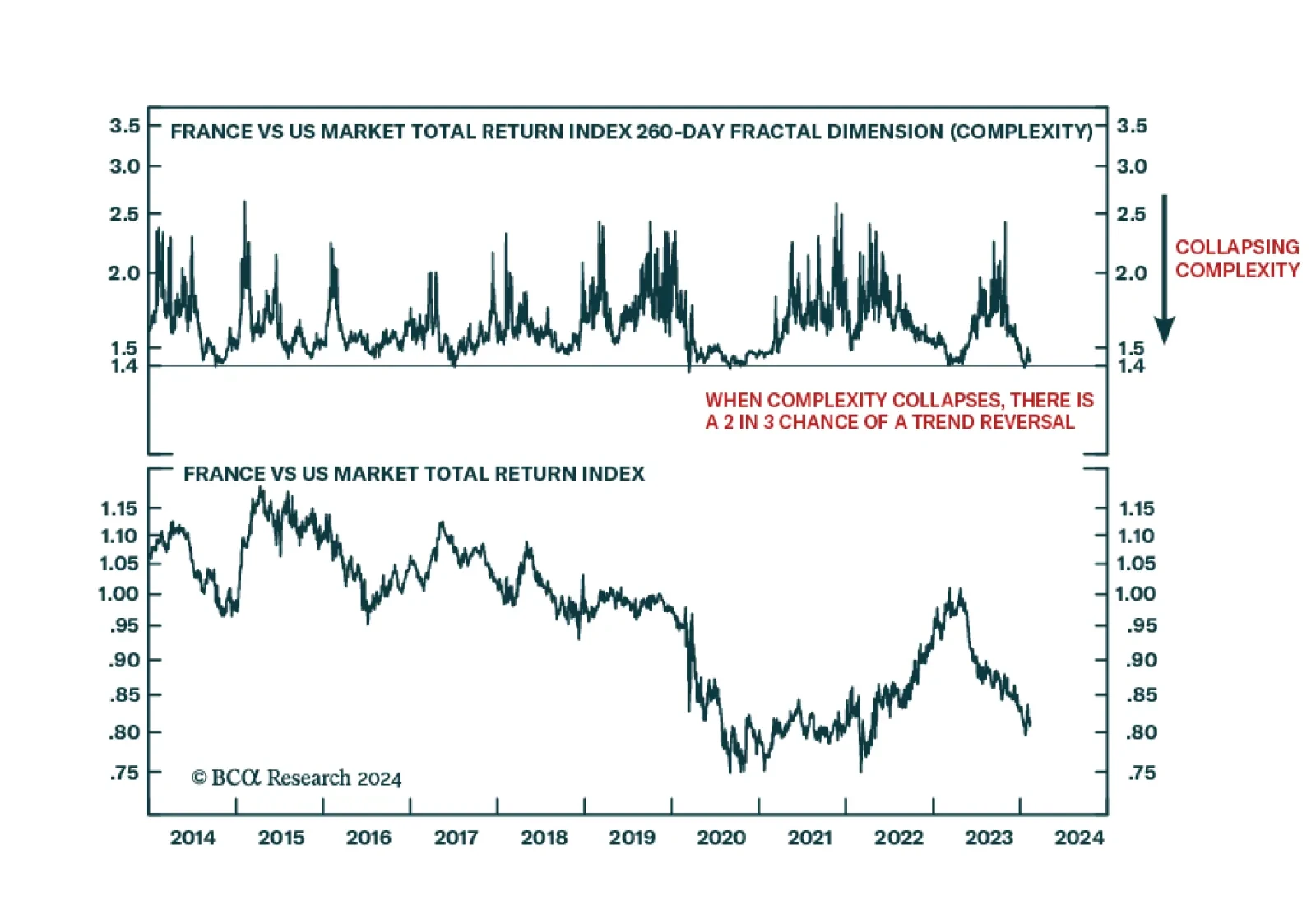

According to BCA Research’s Counterpoint service, European stocks will be the big winners of the 2020s. Every decade has a big loser and a big winner. Which stock market will be the winner through the remaining two-…

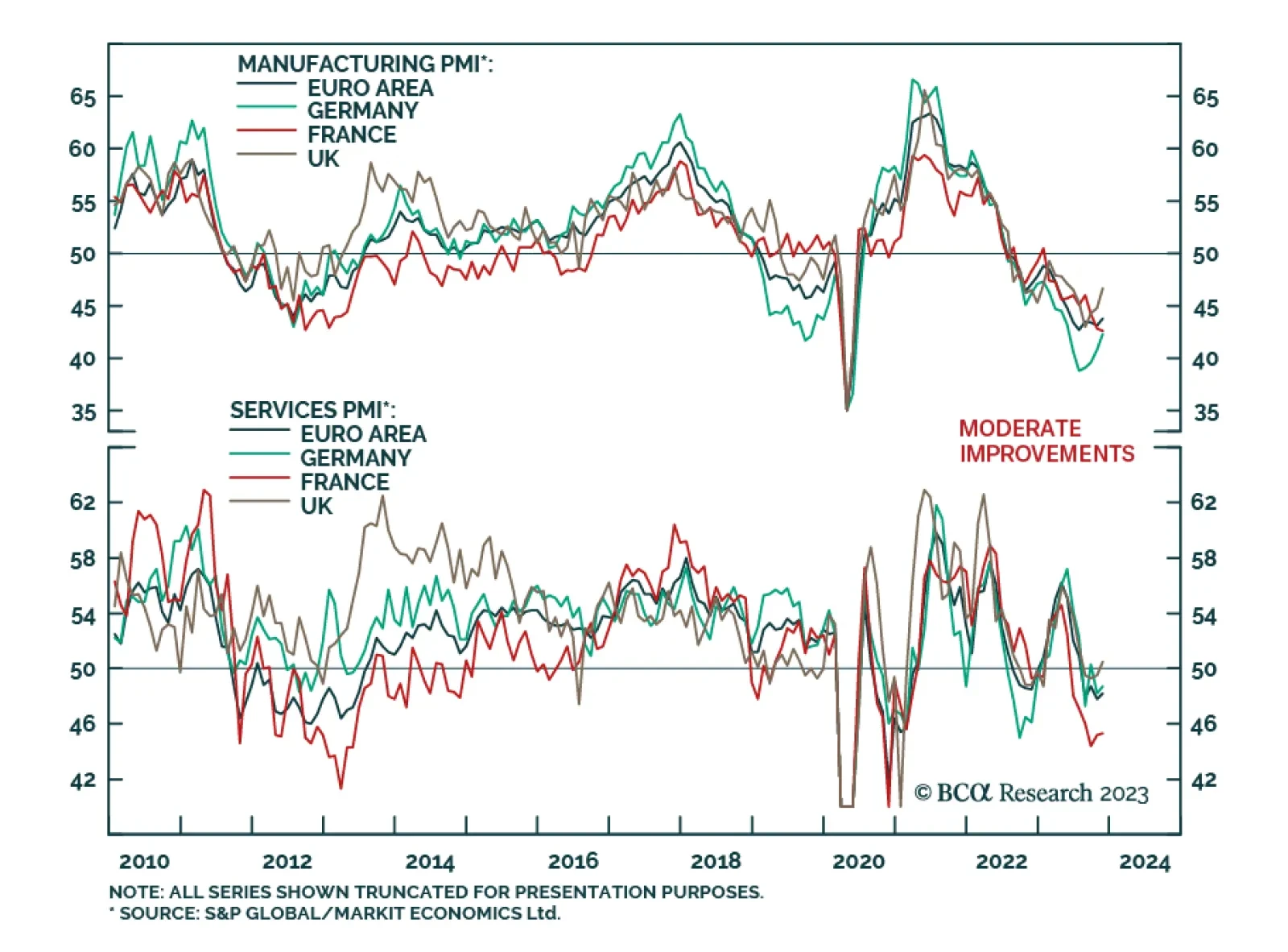

European flash PMI estimates for November sent a slightly less pessimistic signal on Thursday. The Eurozone composite PMI climbed by 0.6 points to 47.1, beating expectations of a more muted increase to 46.8. Notably, both the…

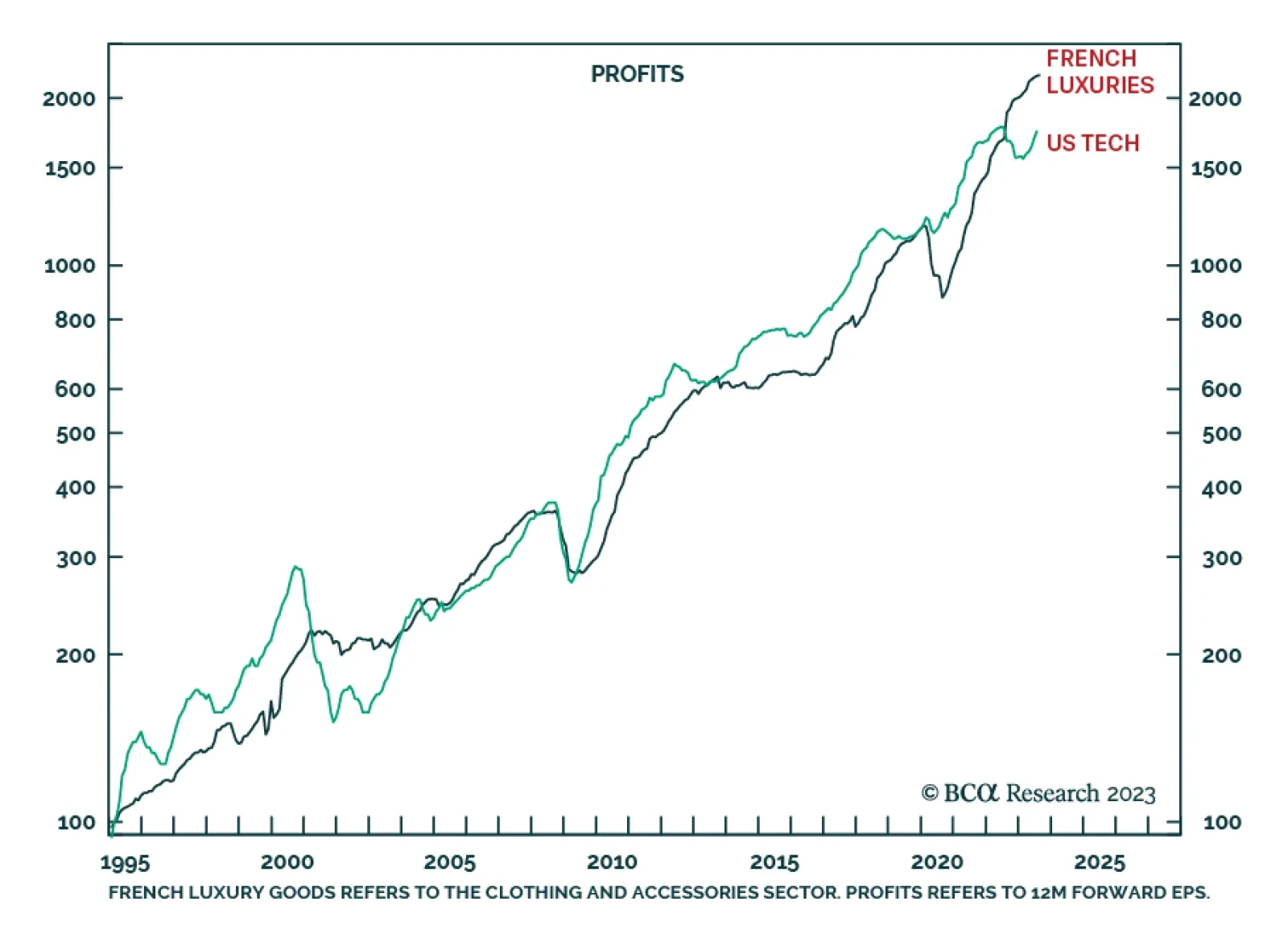

The stock market’s pre-eminent growth sector is not US technology, it is French luxury goods. On most time horizons over the past decades, French luxuries have trumped US technology on profit growth, price performance and…

The stock market’s pre-eminent growth sector is not US tech, it is French luxuries. No other sector can compare with French luxuries’ massive and sustained pricing power. The risk for French luxuries is not a China slowdown, the risk…

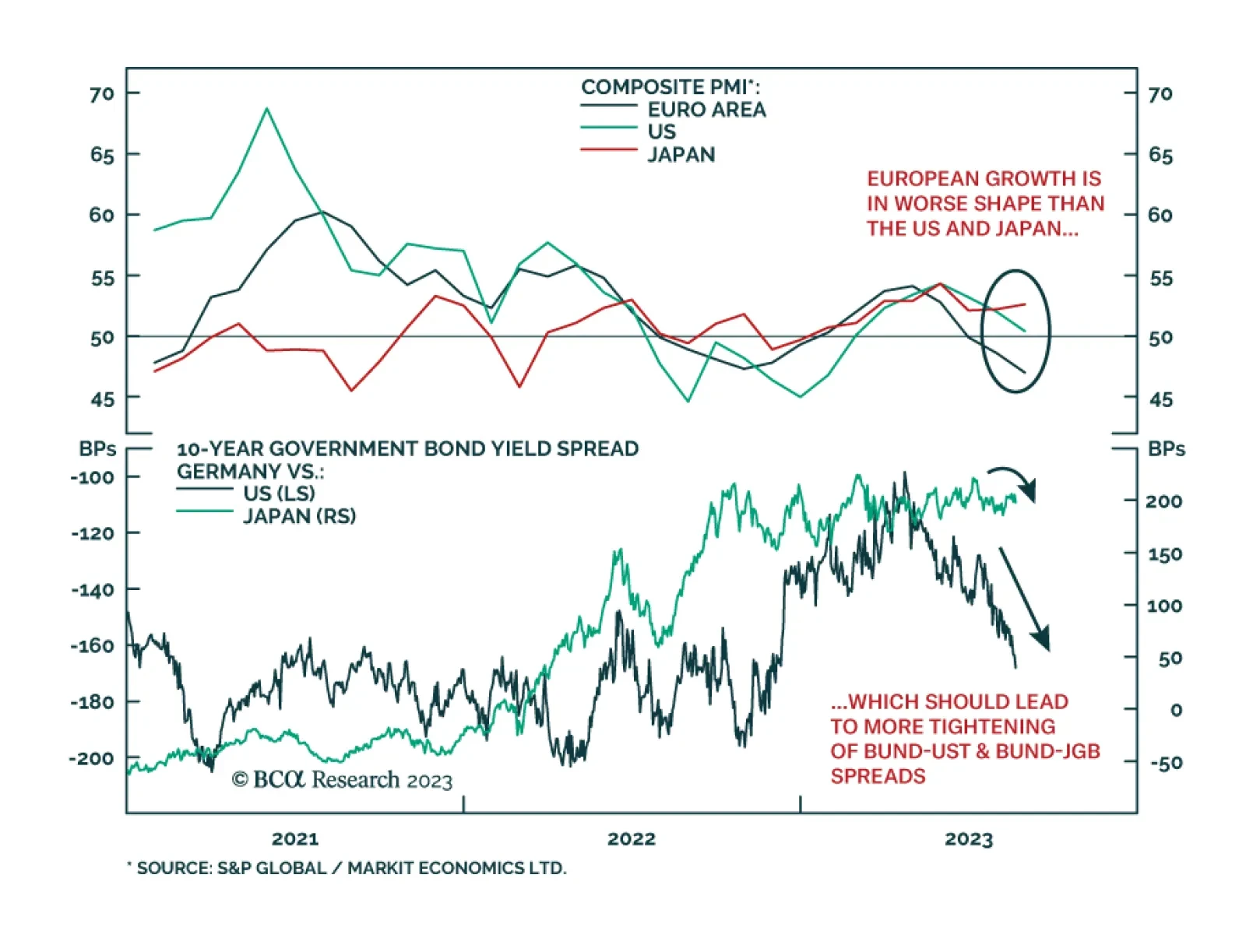

The flash August S&P Global PMI data released on Wednesday painted a picture of softer global growth, while also hinting that Europe is on the cusp of recession. The composite PMI for the euro area fell by 1.6 versus the…

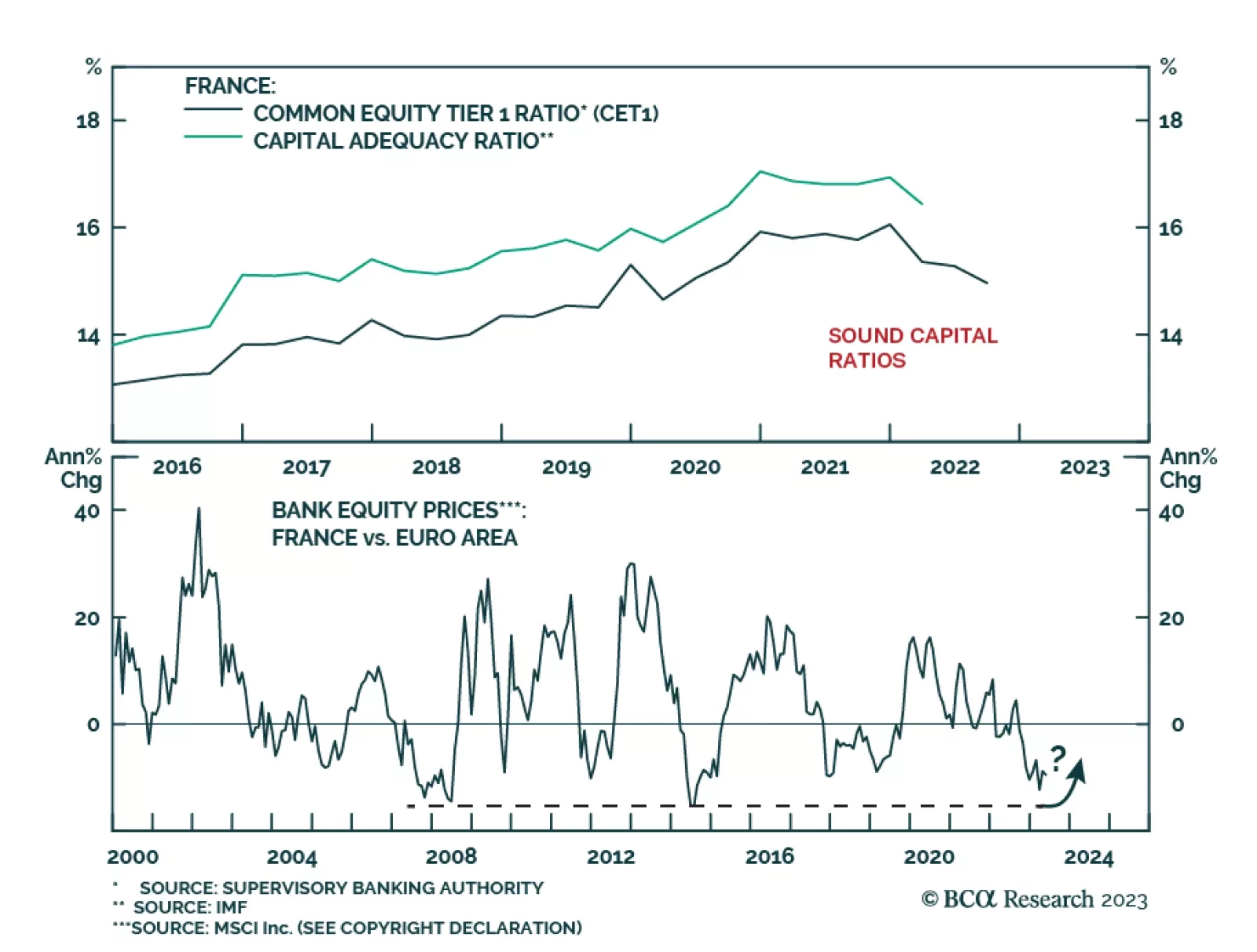

According to BCA Research’s European Investment Strategy service French banks are better positioned to weather current headwinds than their European peers. The team sees limited risks to the French banking sector from…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

Stay short Greater China assets. Stay long Japanese yen. Hold back on Brazil for now but look forward to opportunities in future.