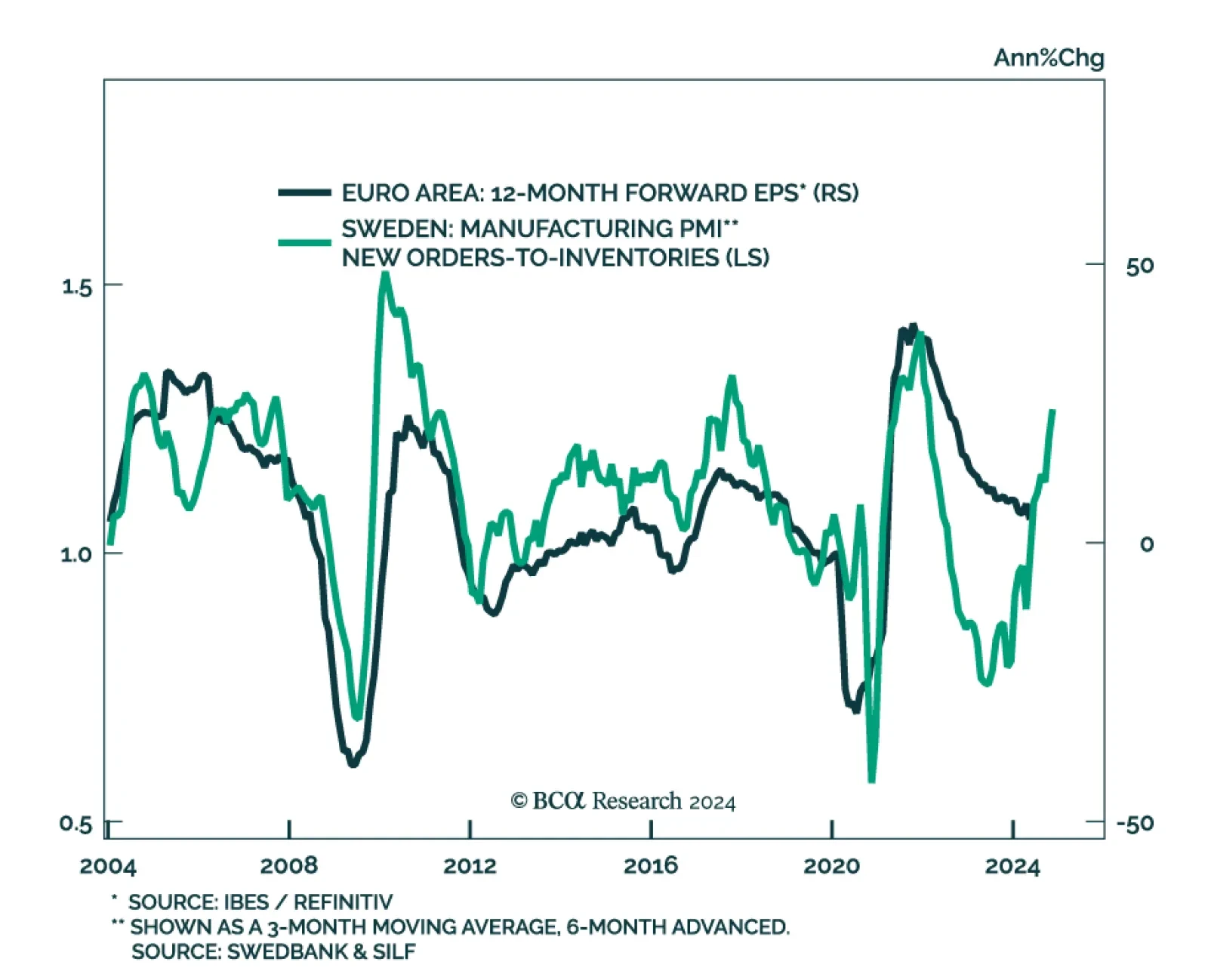

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

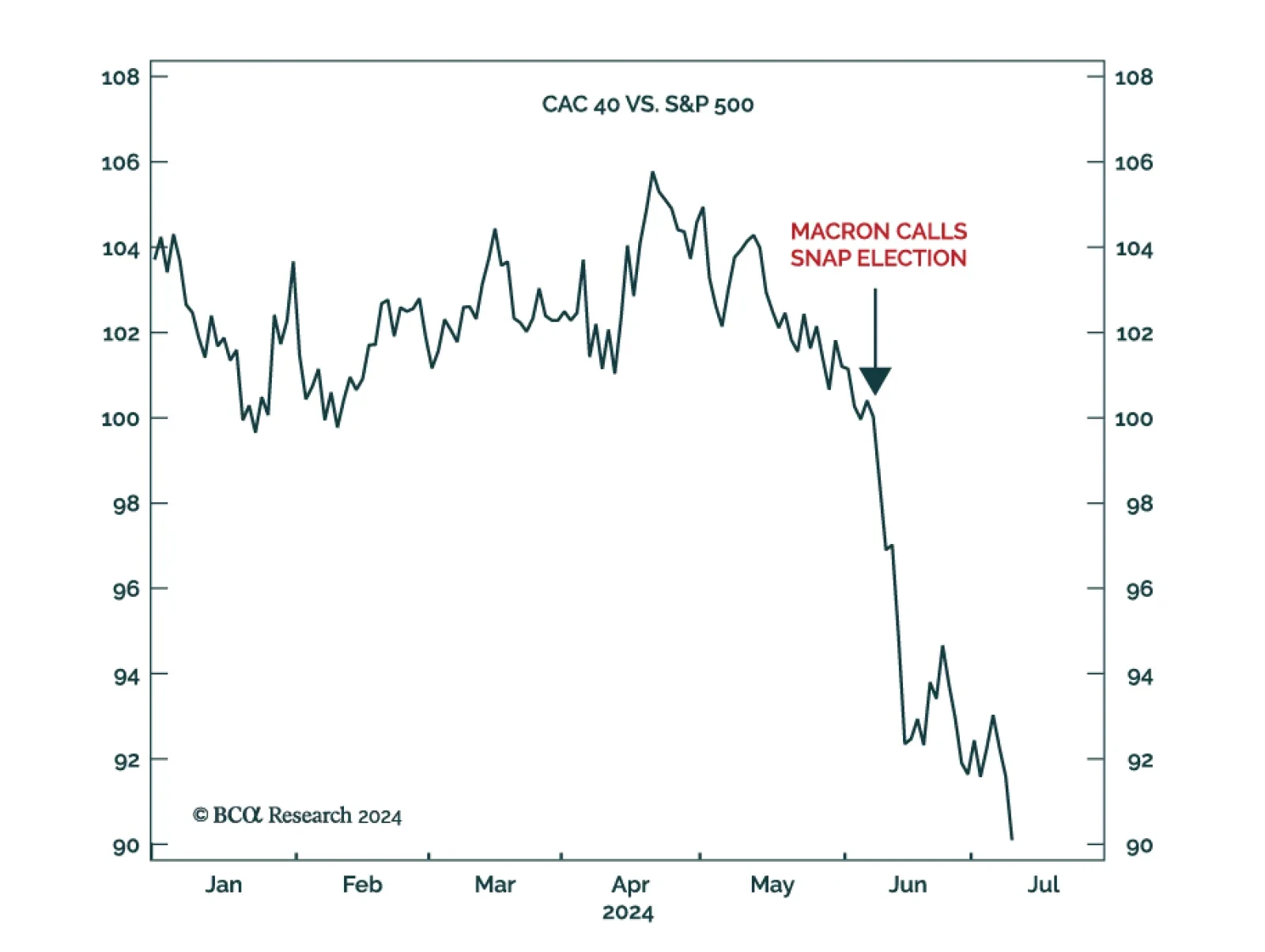

According to BCA Research’s Counterpoint service, the sharp underperformance of the French stock market over political uncertainty is irrational, given the CAC 40’s limited exposure to French domestic economics and…

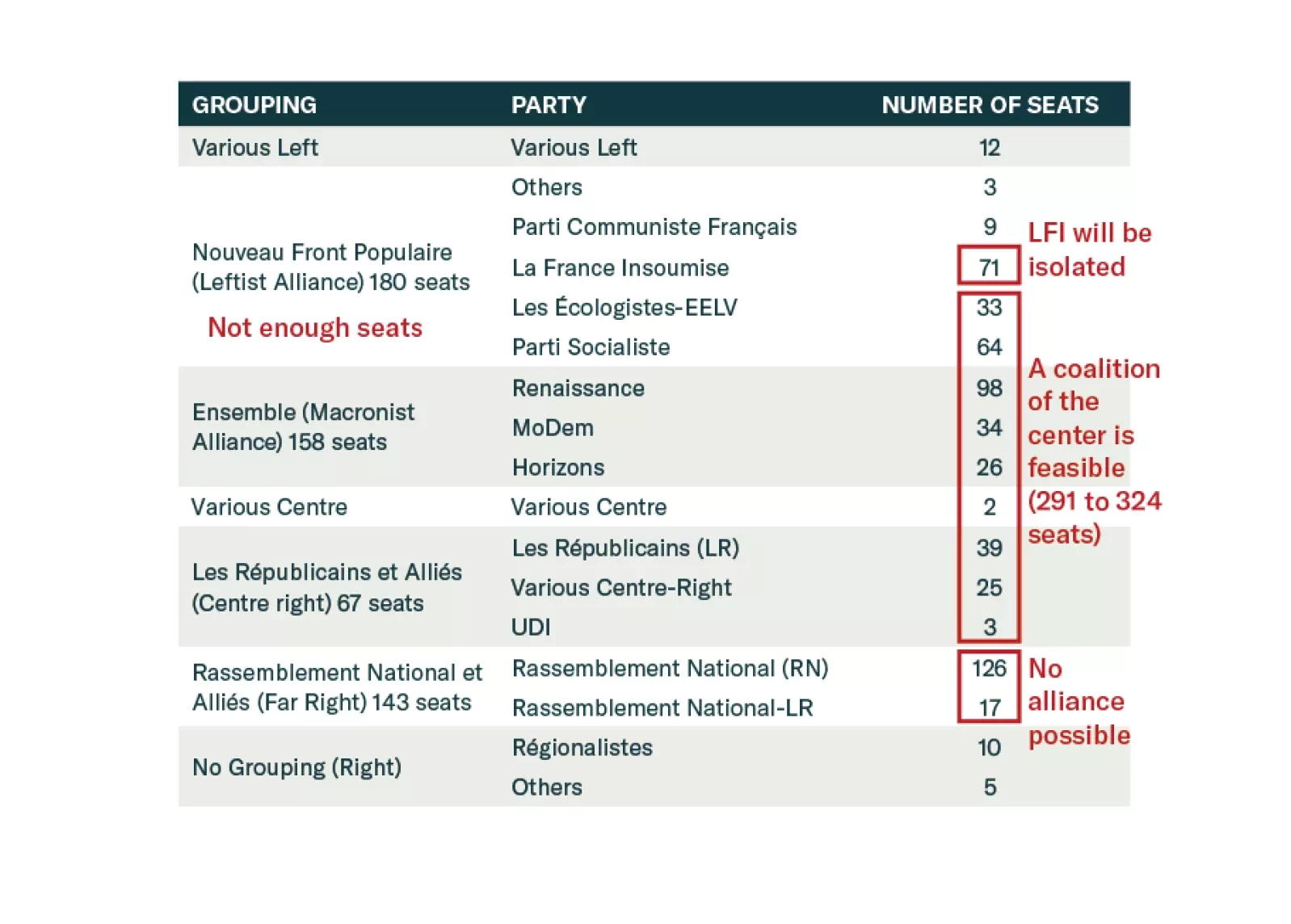

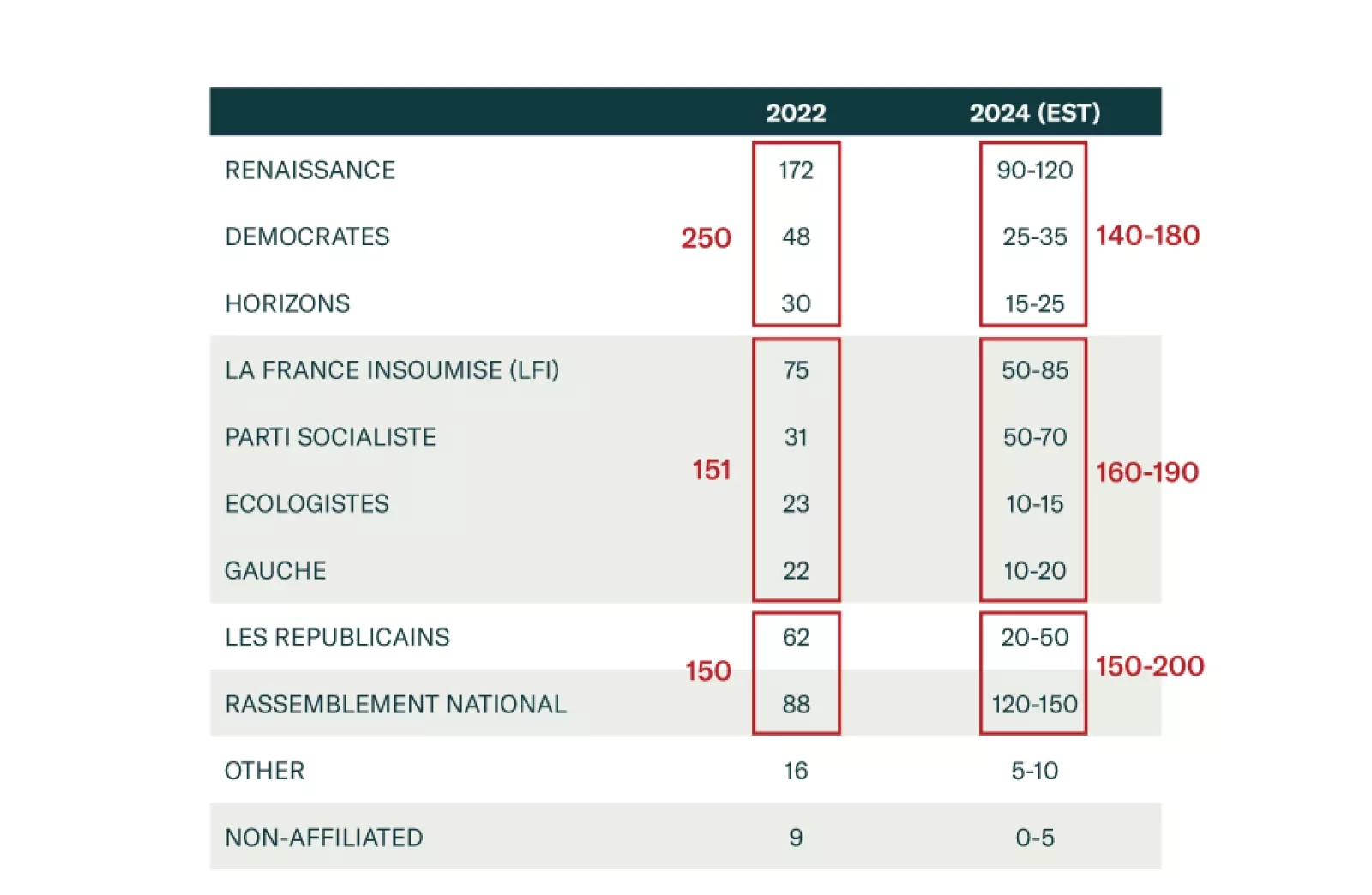

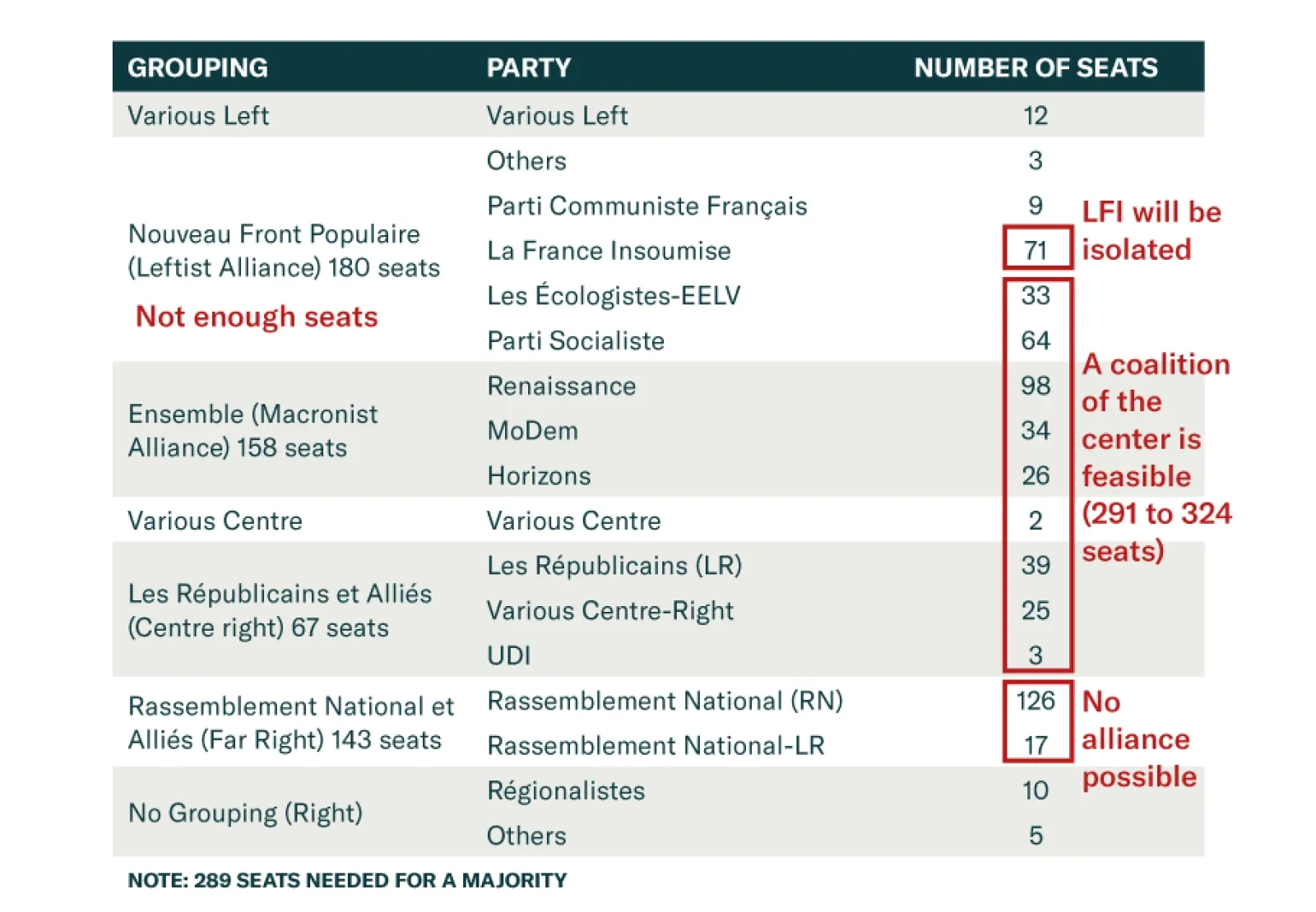

France’s snap election is over and, according to BCA Research’s European Investment Strategy service, President Emmanuel Macron’s gamble paid off in some ways: neither the far right nor the far left can form a…

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

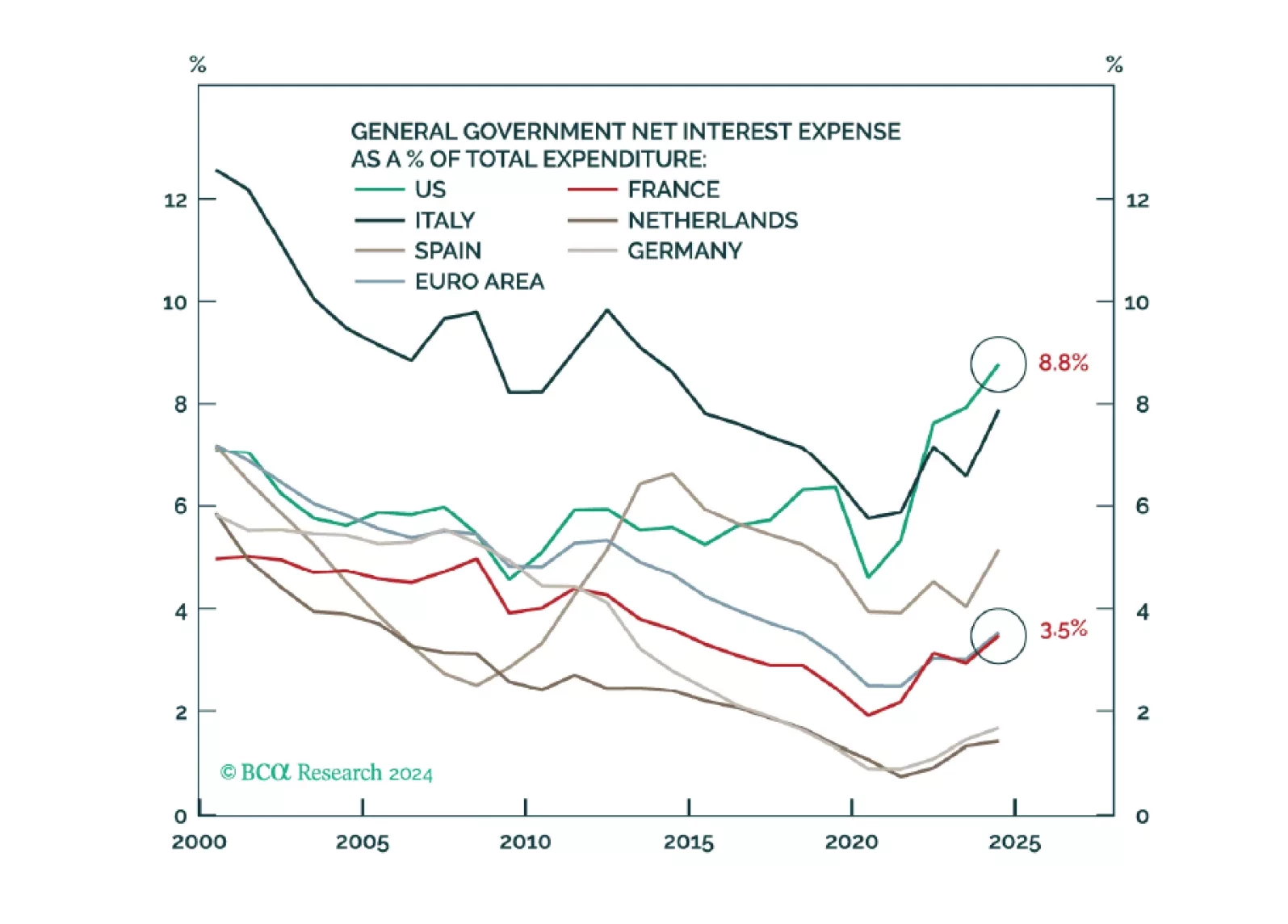

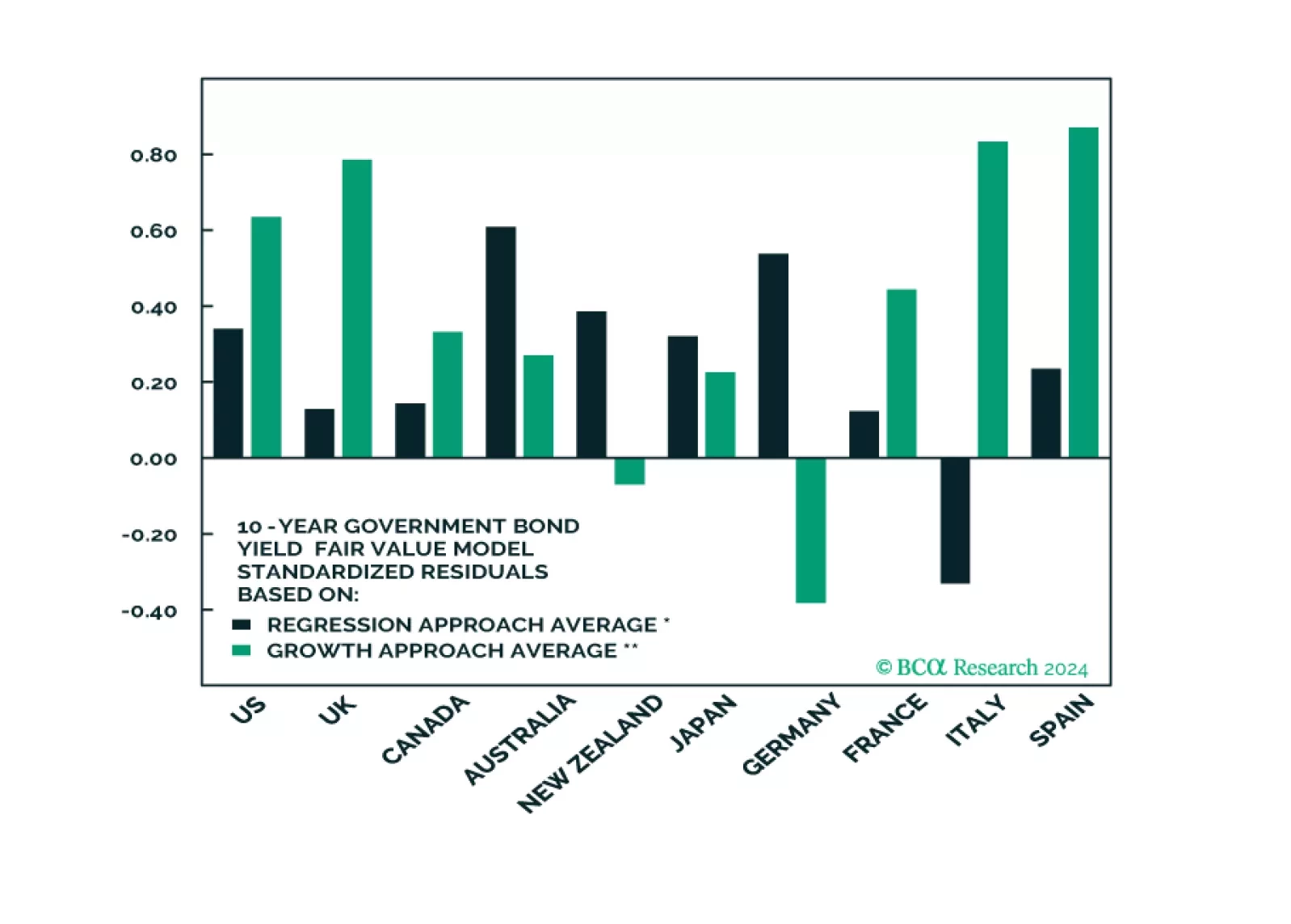

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…

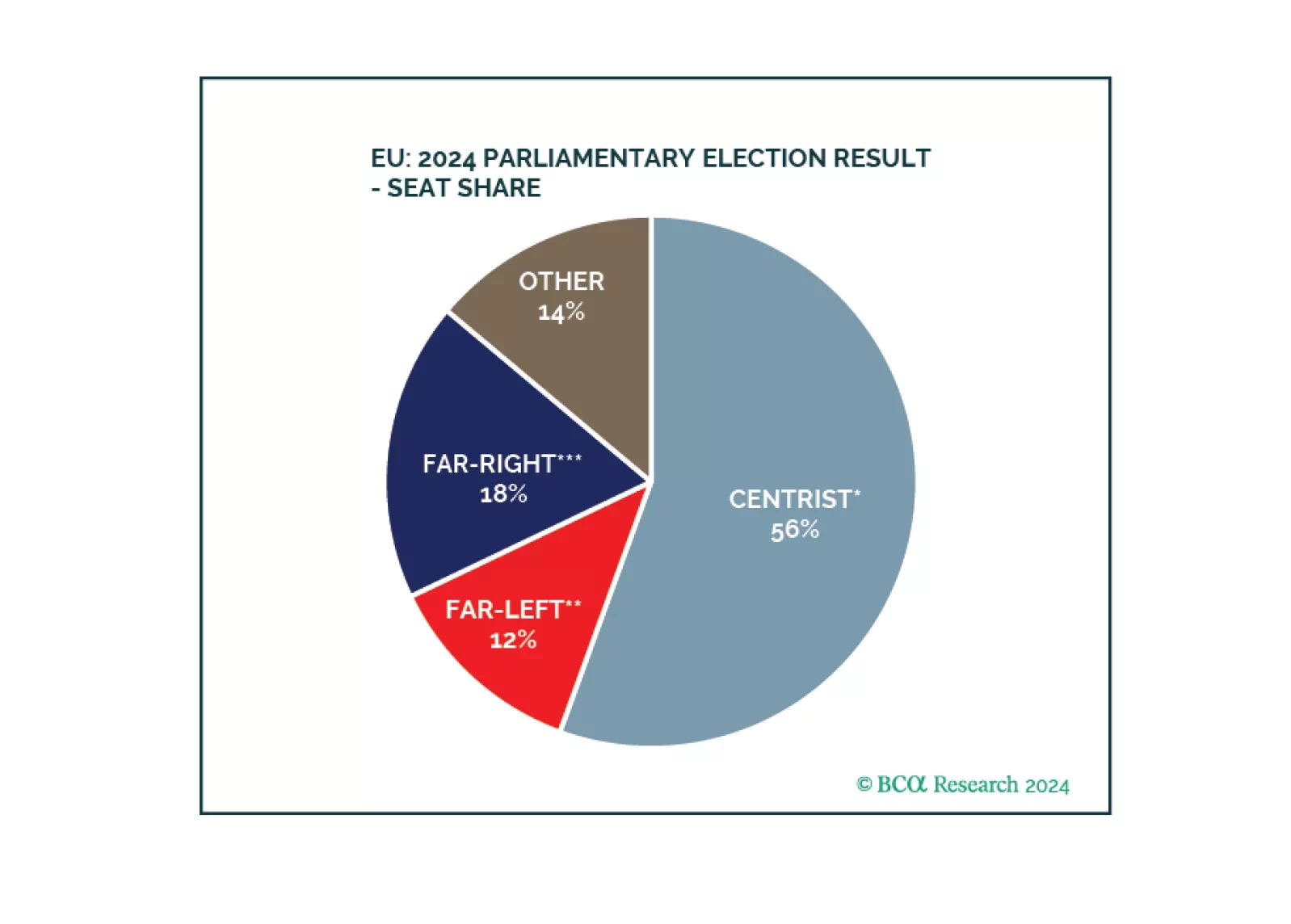

Eurozone equities sold off 7% from their June 6 highs, according to MSCI indices. The surprise French legislative elections and renewed fears of populism and European Union exits are spooking investors. Yet, our European…

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…