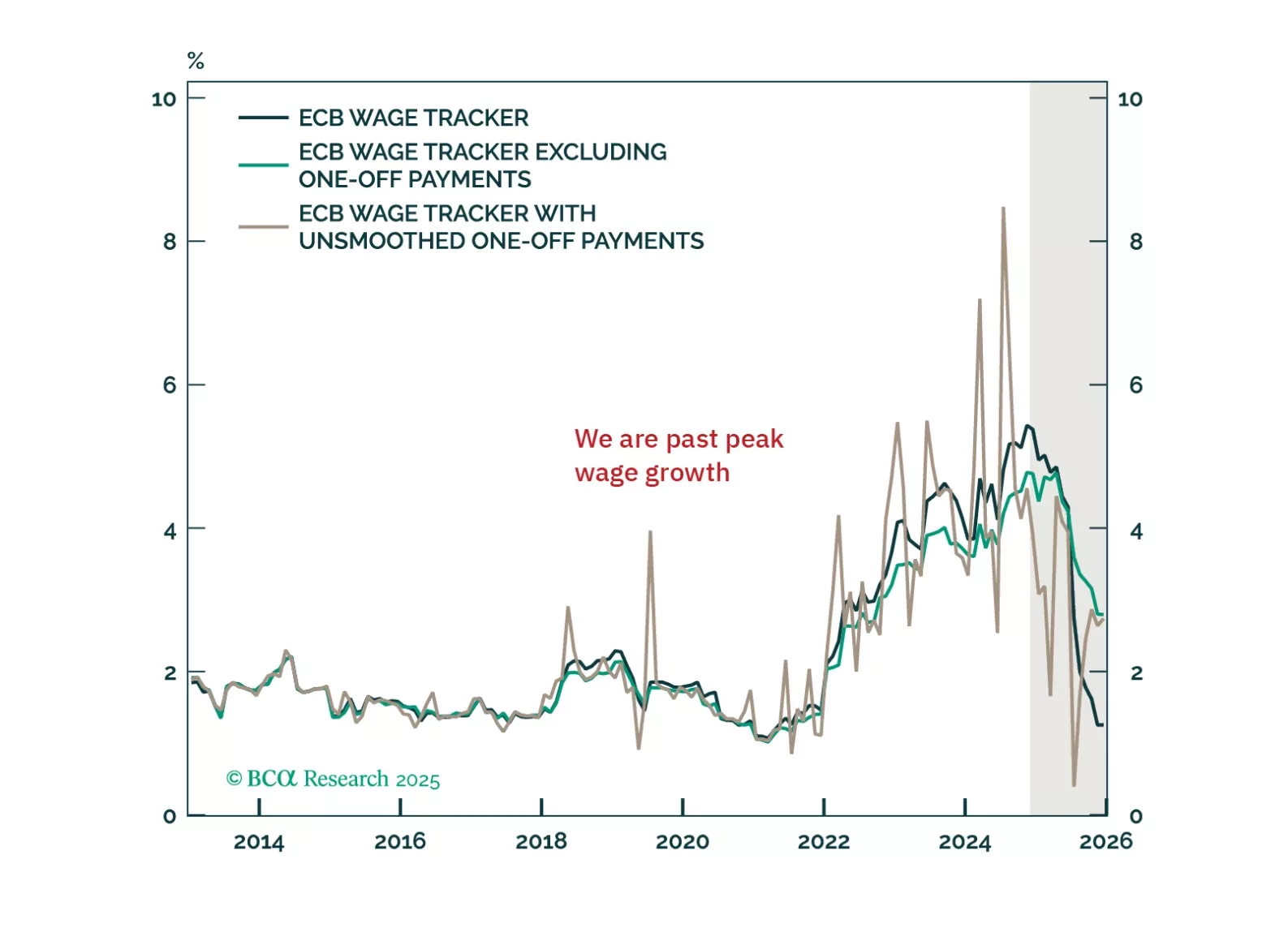

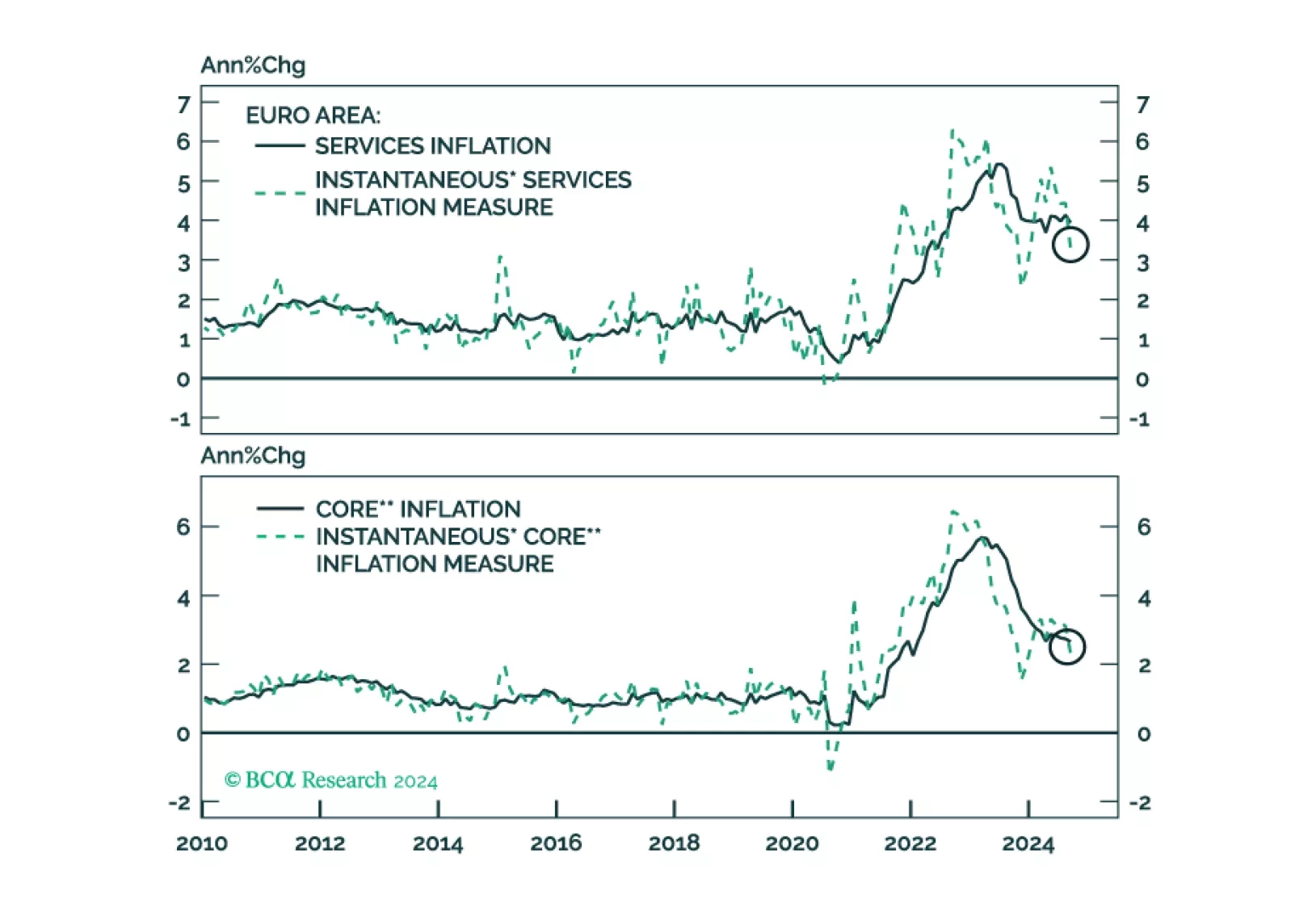

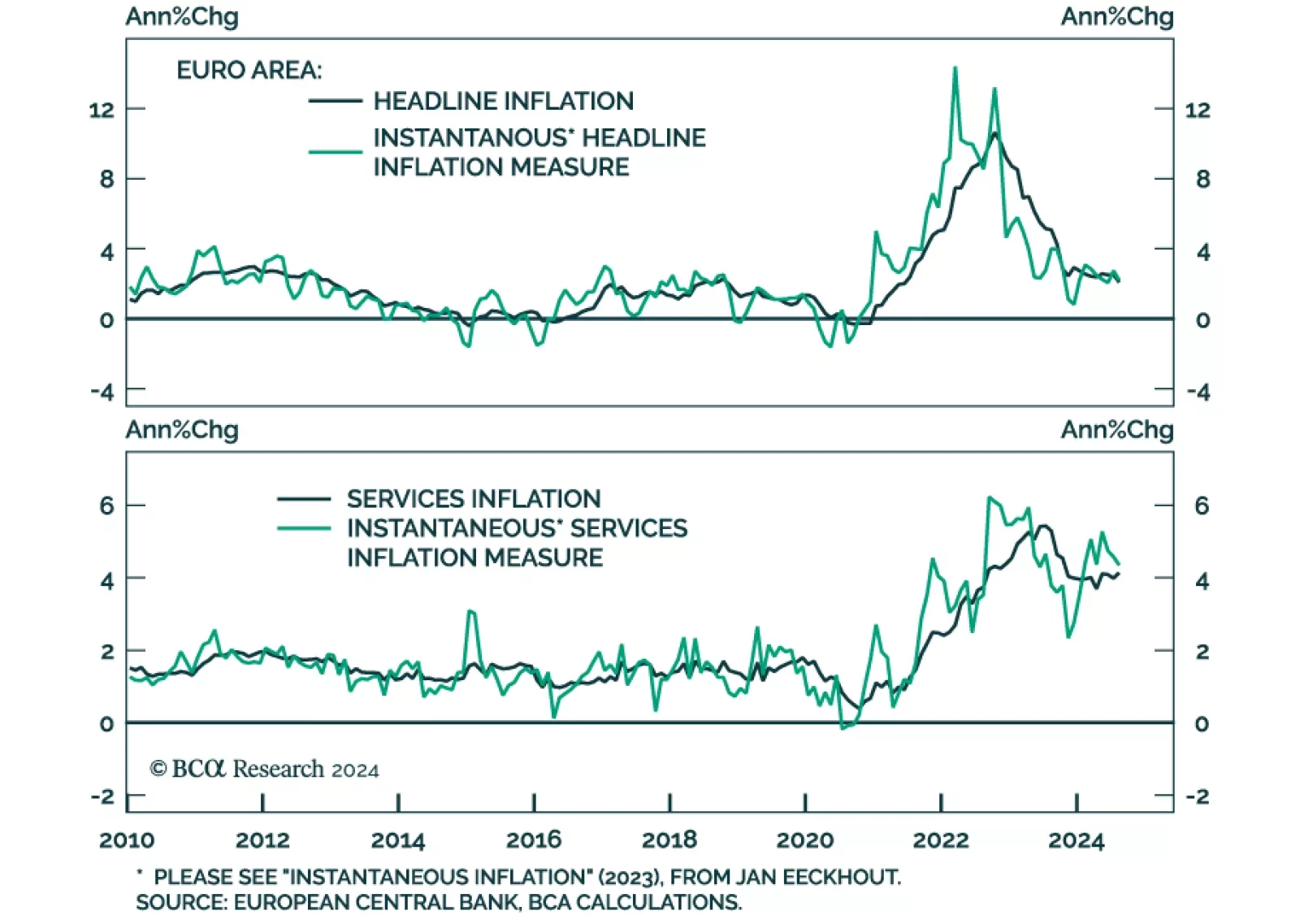

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

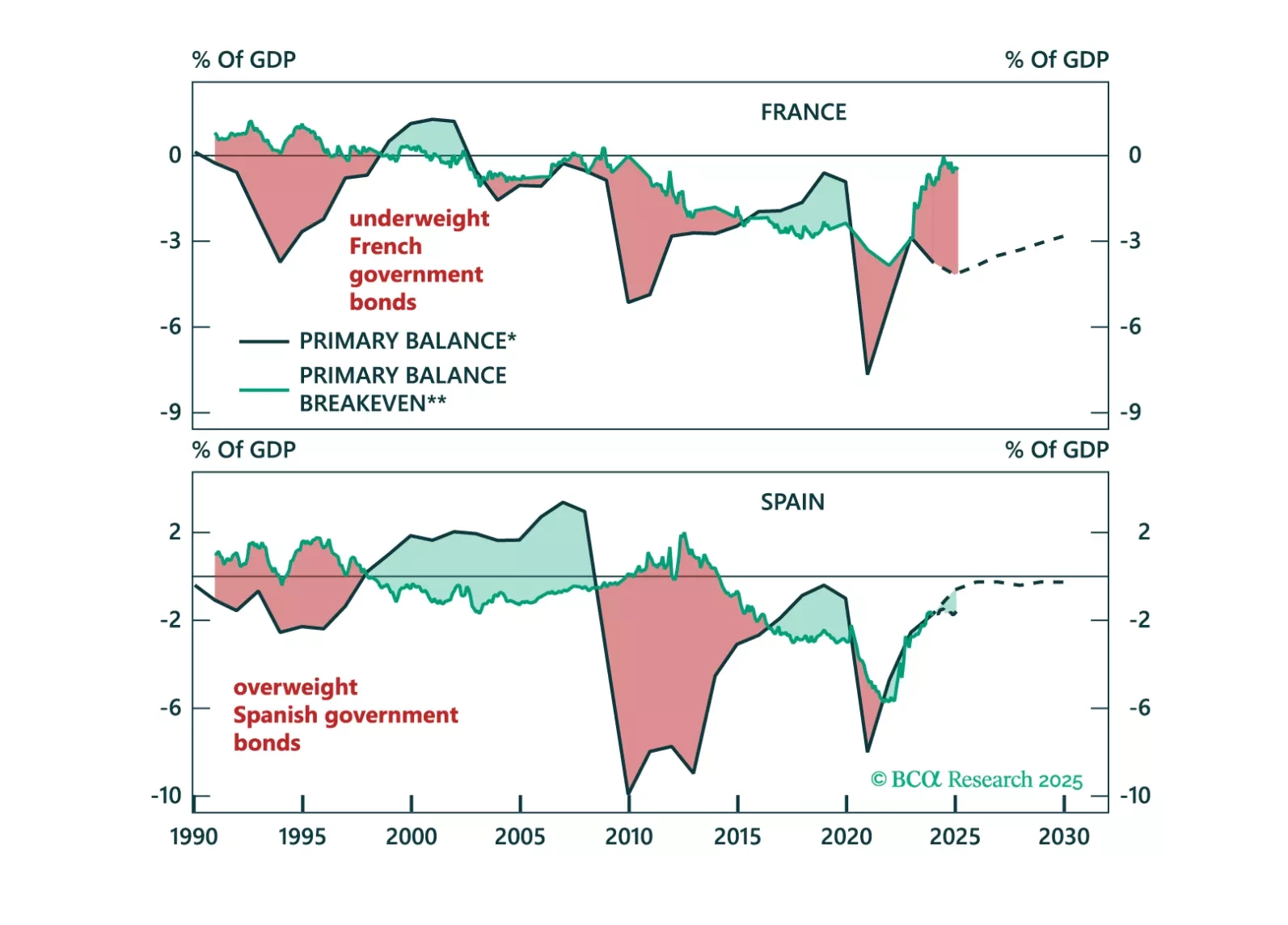

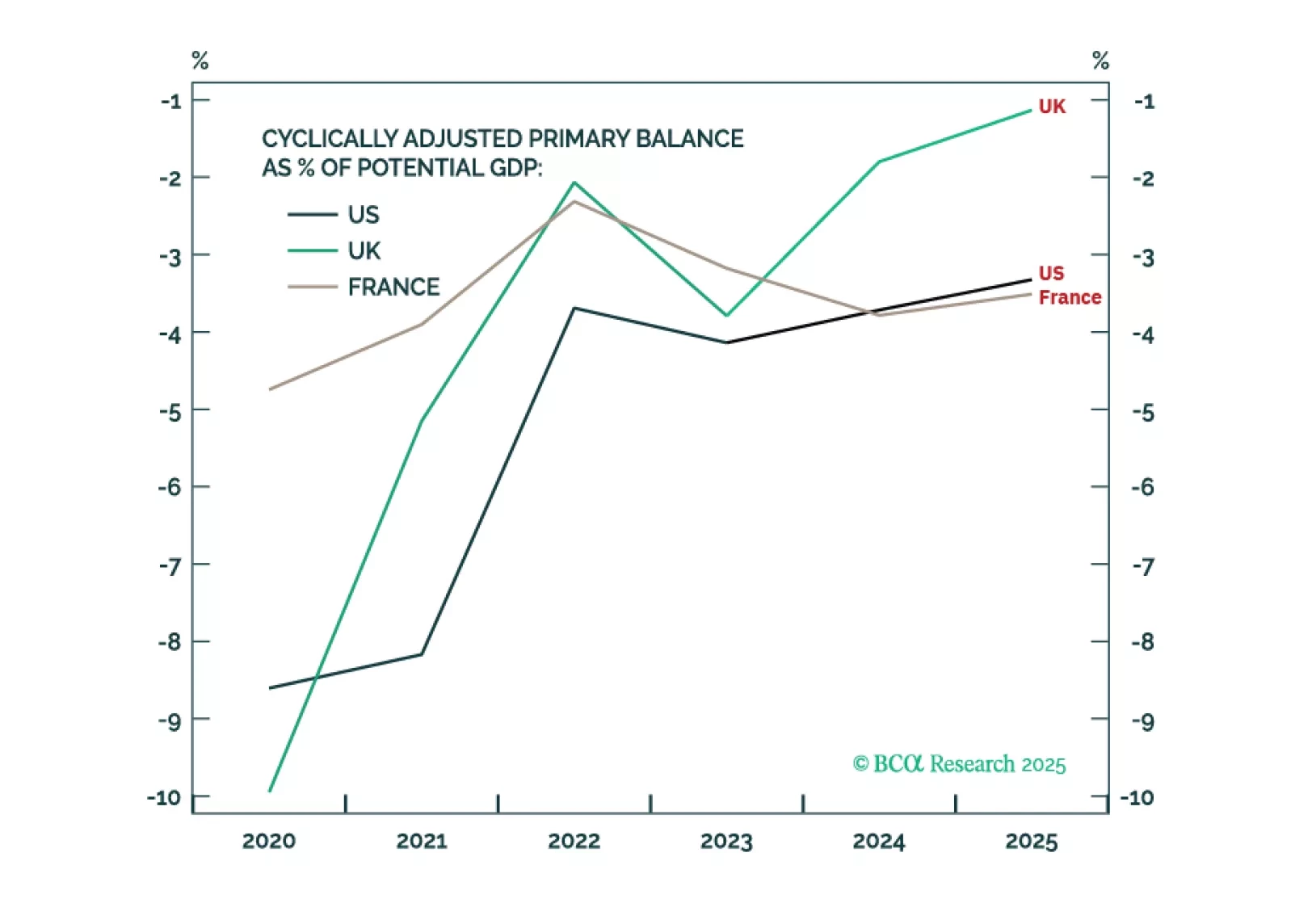

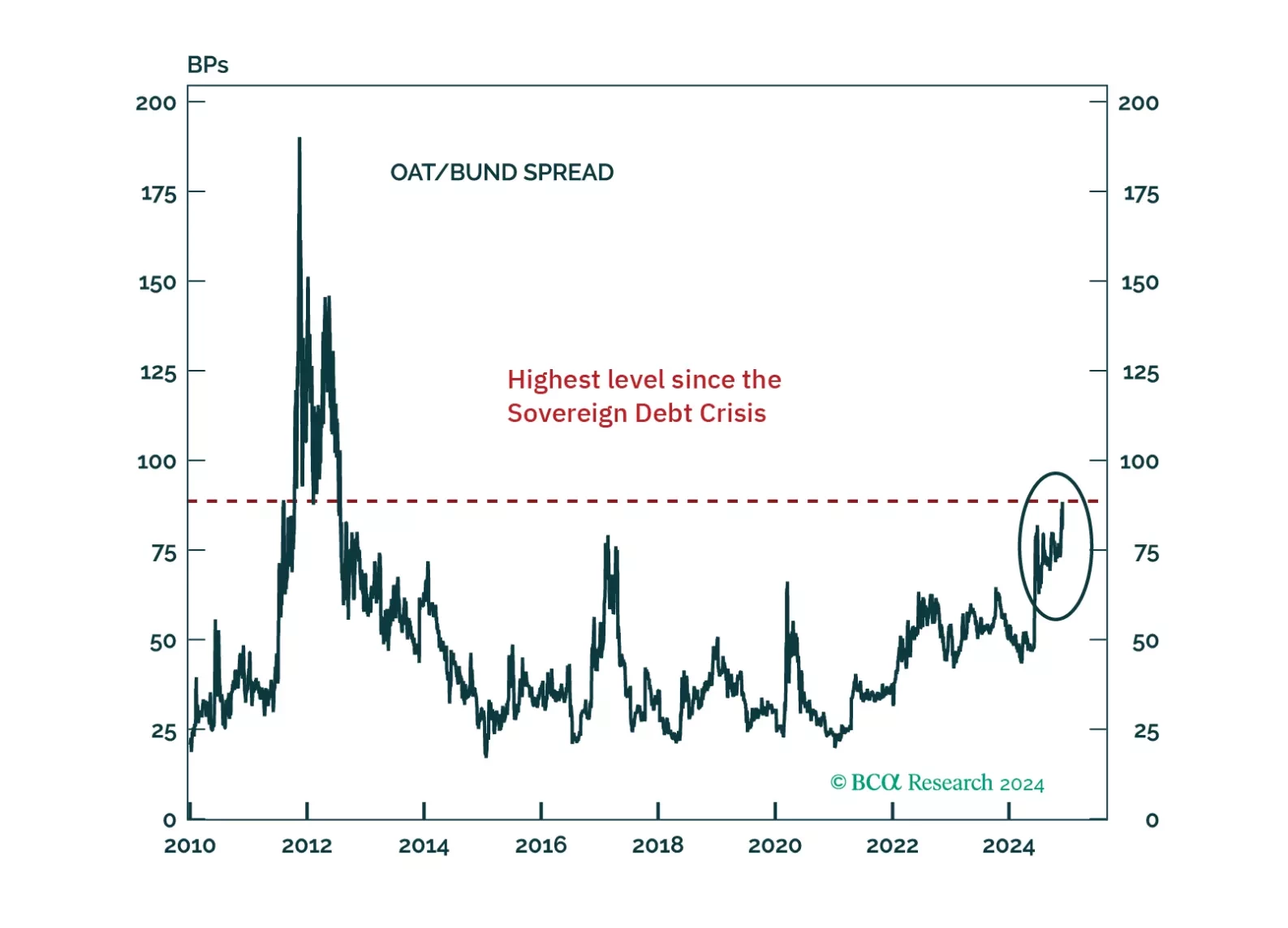

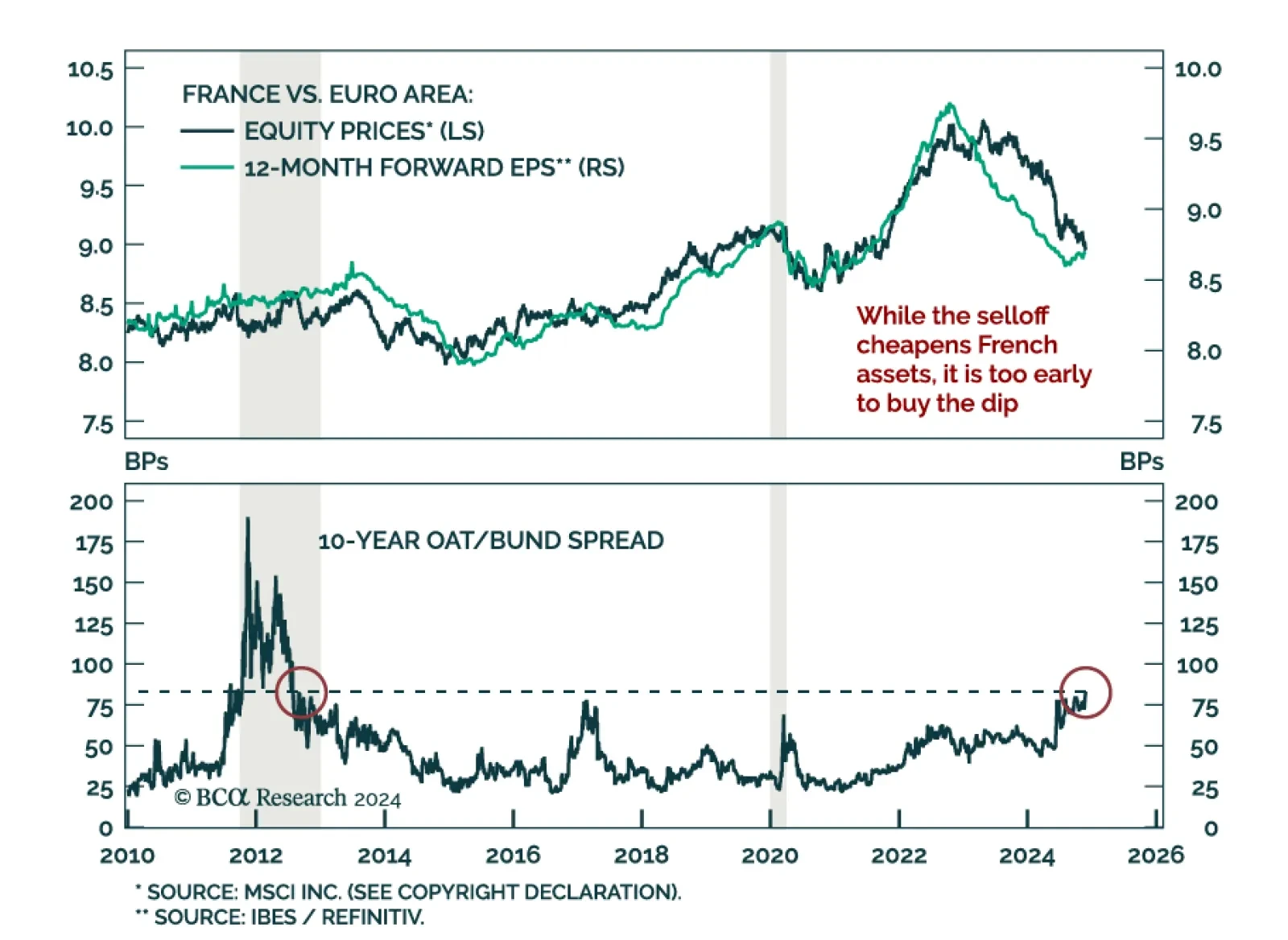

Political instability combined with the maths of debt sustainability is much more concerning in France than in either the UK or the US. Go long UK gilts versus French OATs and go tactically long GBP/USD.

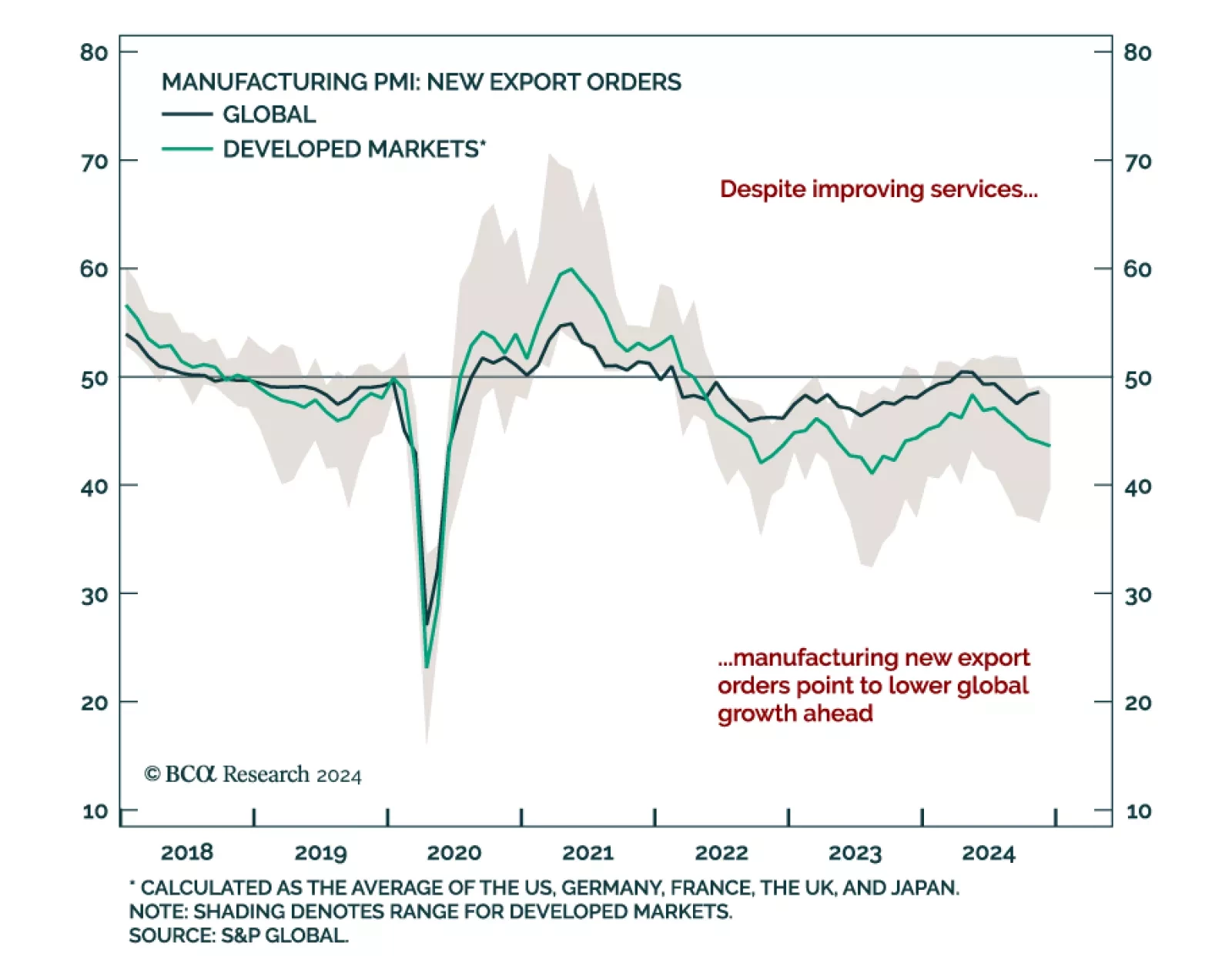

December flash PMIs for the core advanced economies showed service sector growth picking up. Manufacturing keeps contracting, and the US continues to outperform its DM peers. The US composite index beat expectations and…

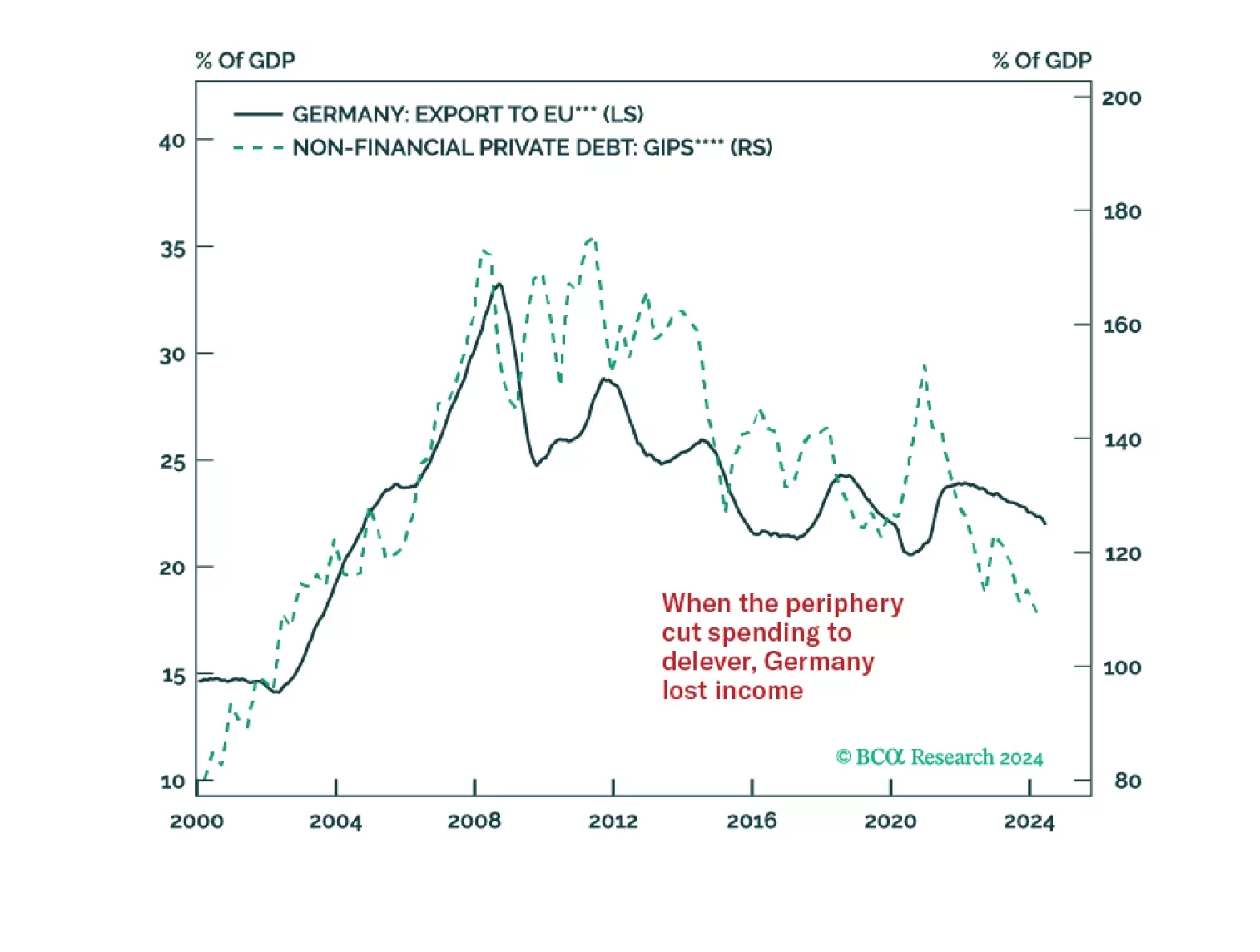

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Investors focused on the flurry of cabinet nominations in the aftermath of the US election, but the US does not have a monopoly on political drama. France is going through turmoil of its own. This summer’s snap election…

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…