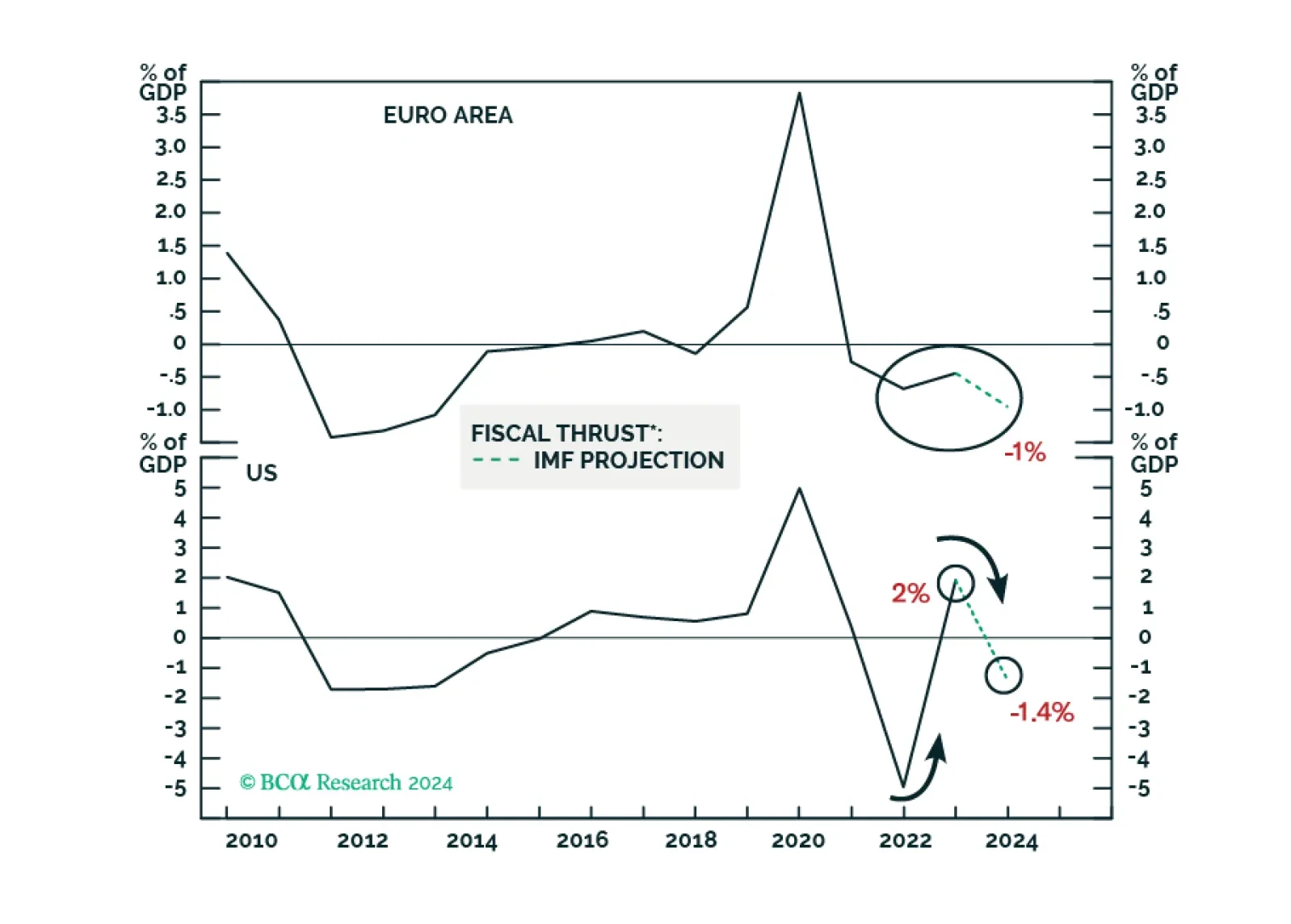

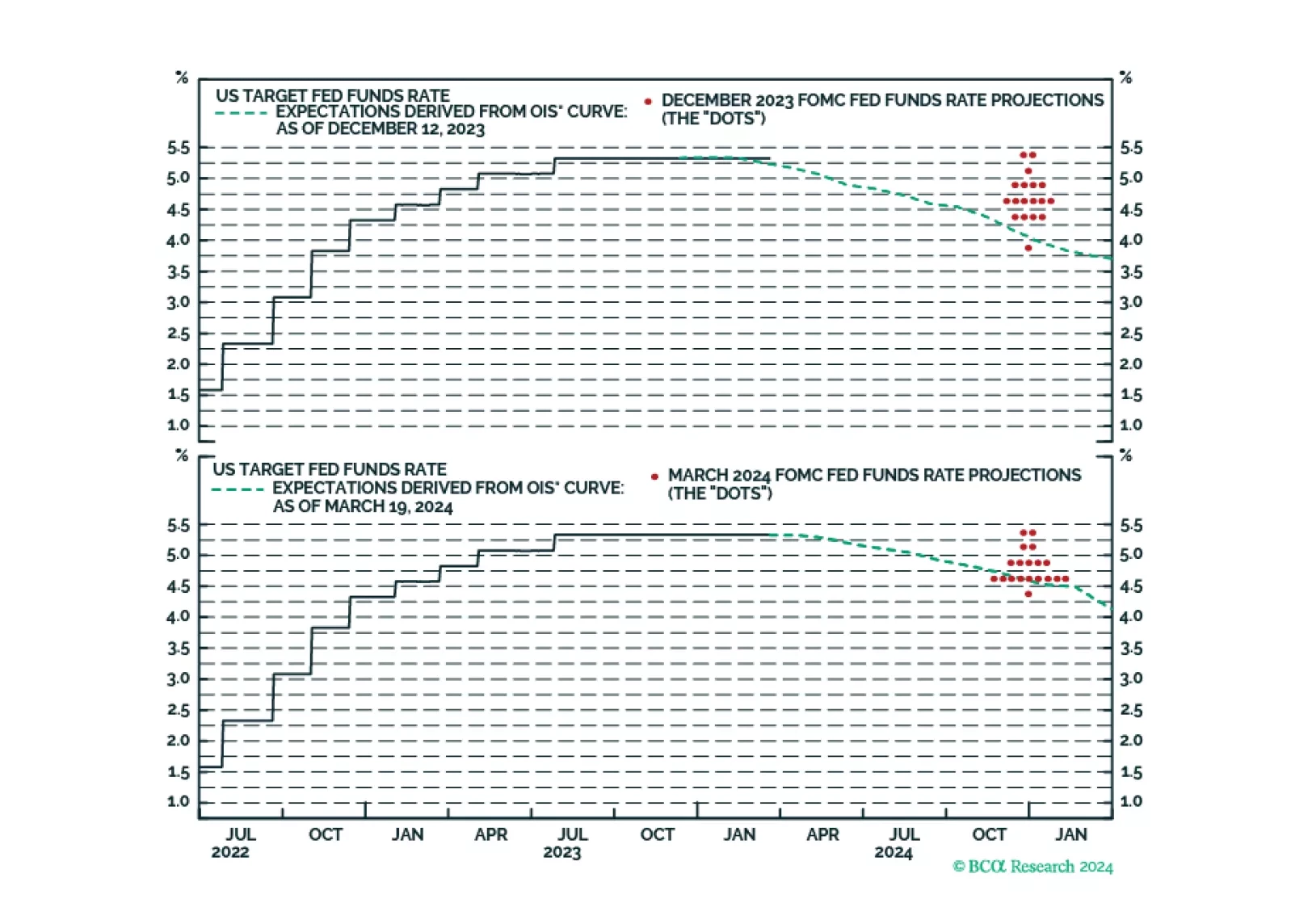

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

Our takeaways from this afternoon’s FOMC meeting.

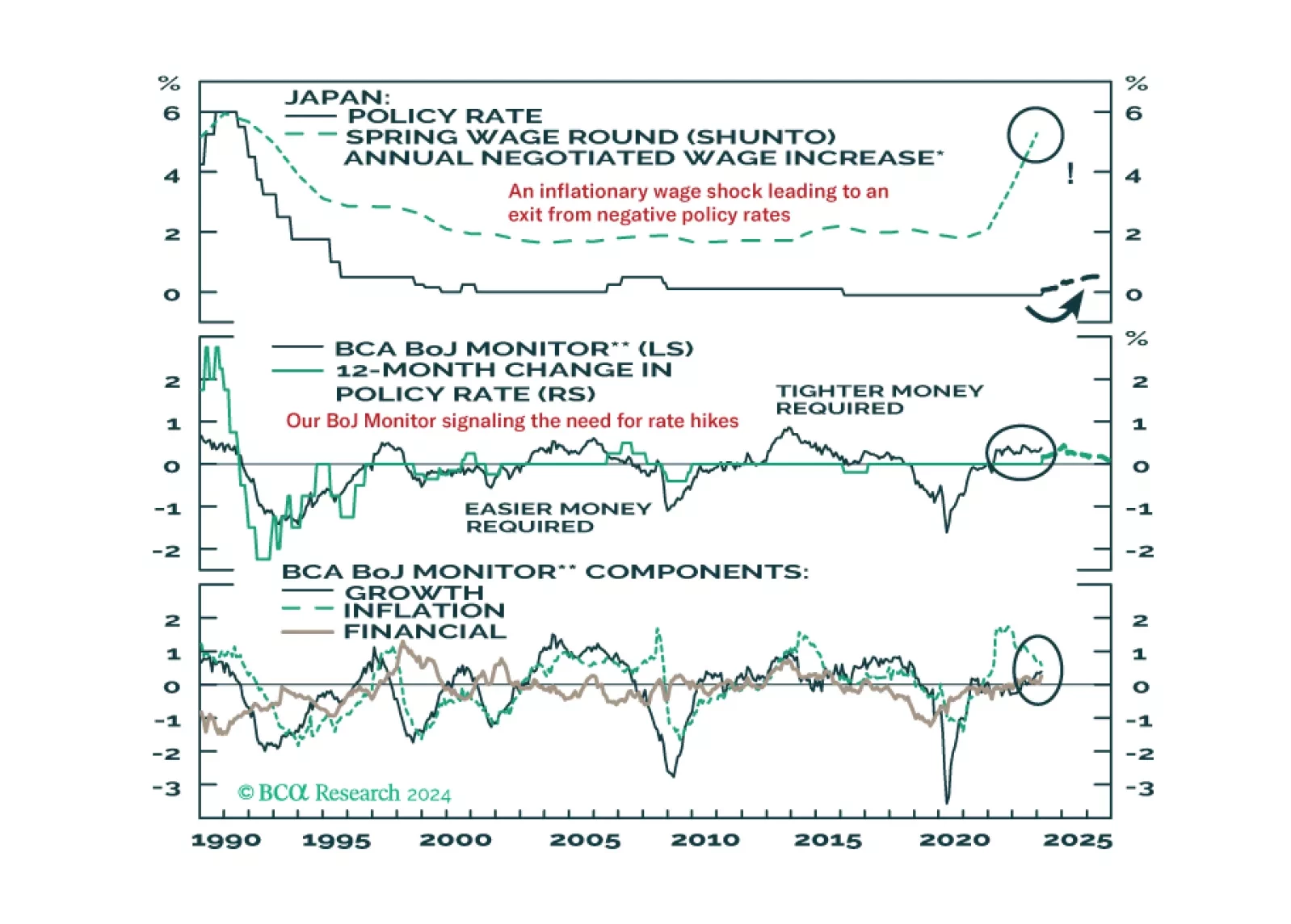

The Bank of Japan delivered a historic policy adjustment this week, ending both negative interest rates and Yield Curve Control. In this Insight, BCA’s global fixed income and currency strategists discuss the immediate implications…

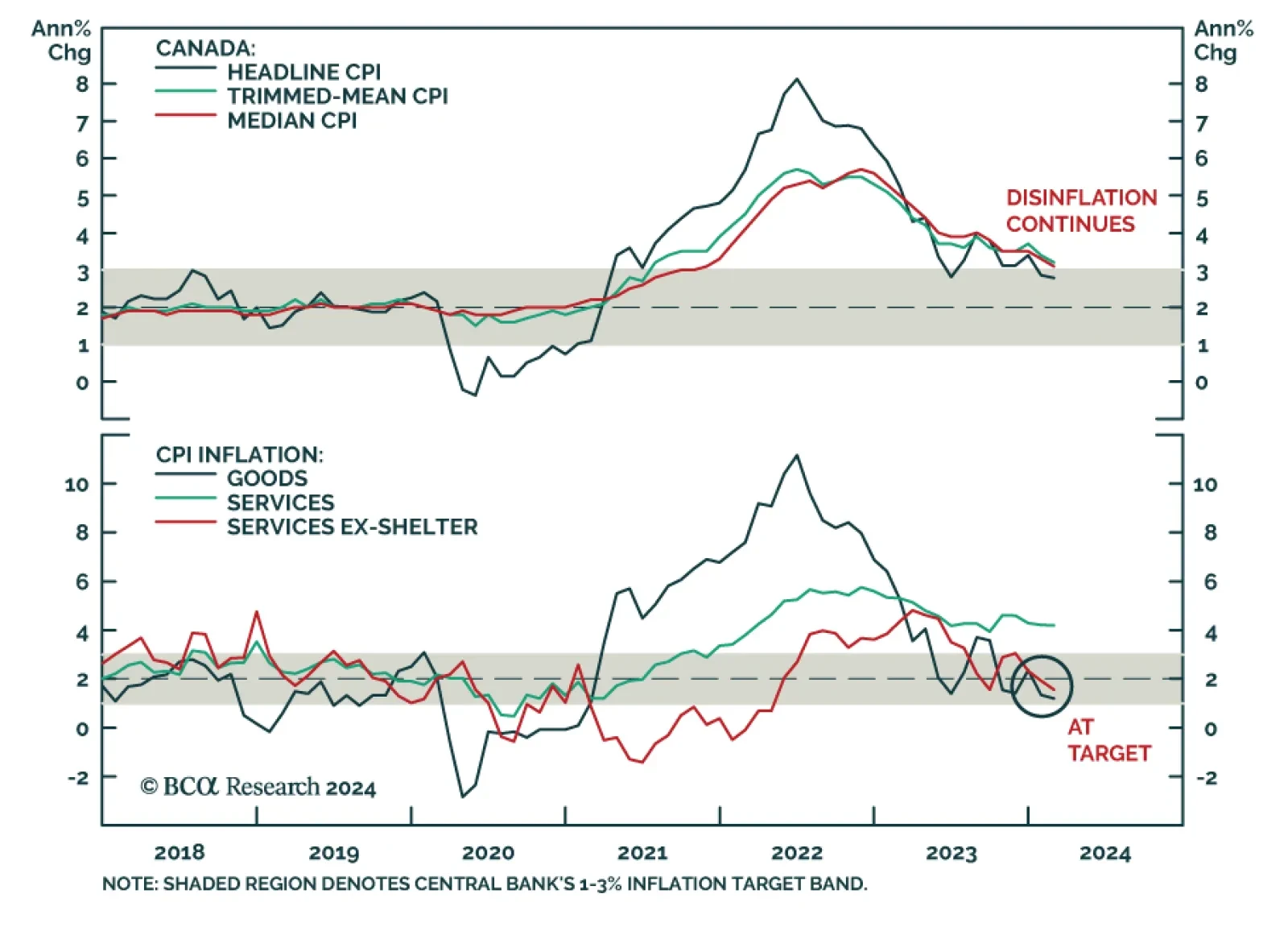

Canada’s CPI release for February shows price pressures continue to ebb with the various measures of inflation all falling below consensus estimates. In particular, headline inflation decelerated from 2.9% y/y to 2.8% y/y…

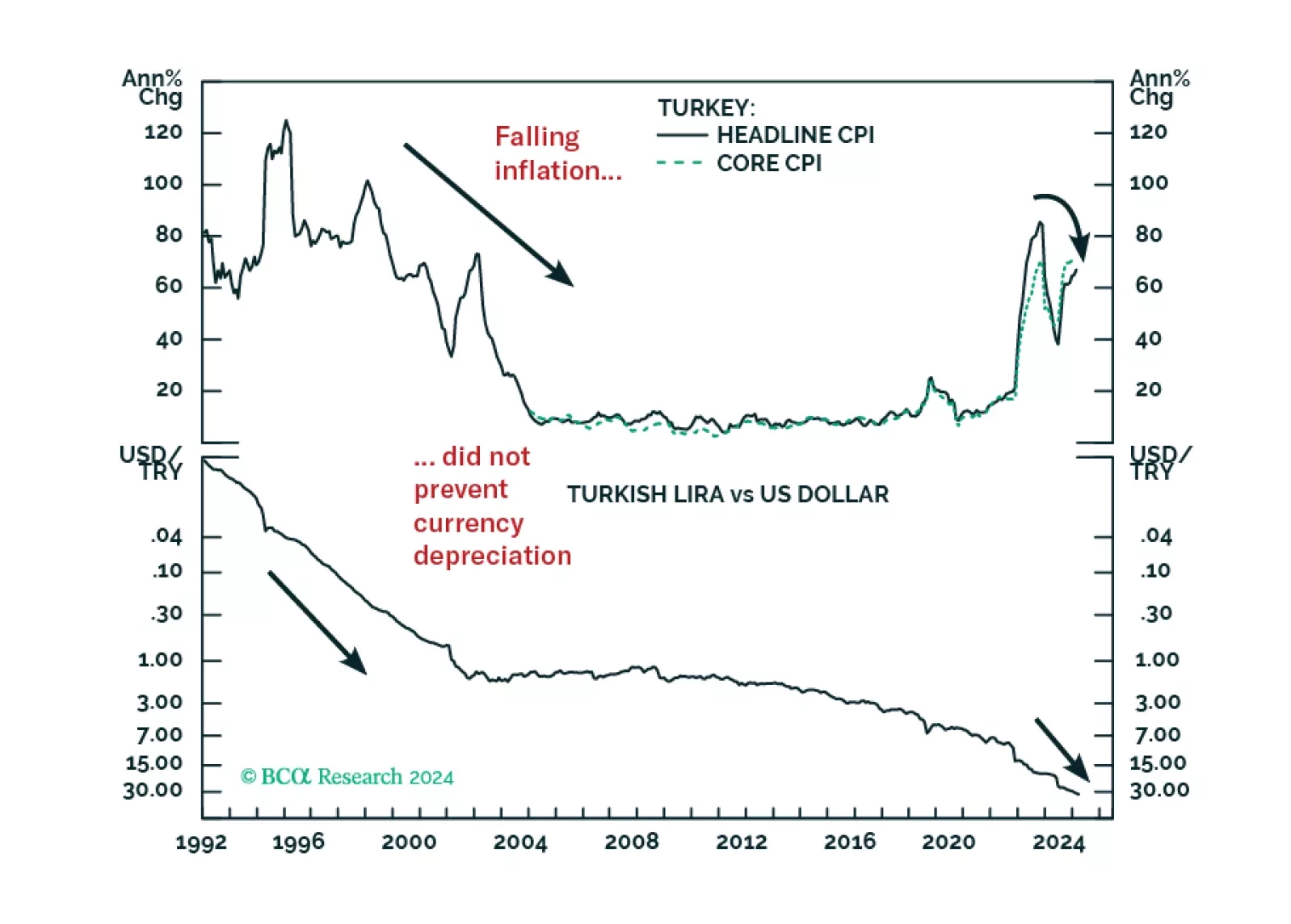

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

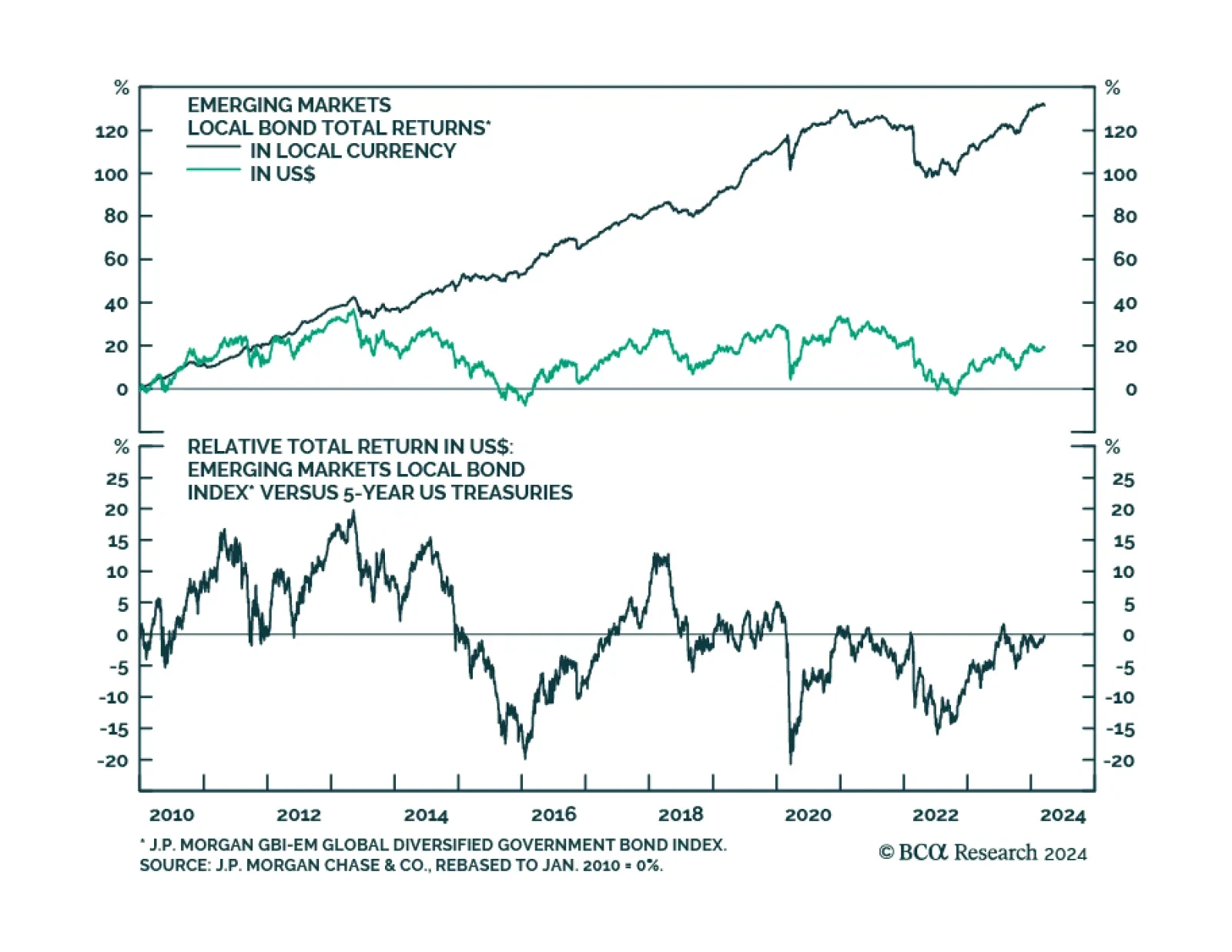

According to BCA Research’s Global Asset Allocation service, the impact of the global savings glut is among the four structural trends that will drive EM debt going forward. As an asset traditionally further out on the…

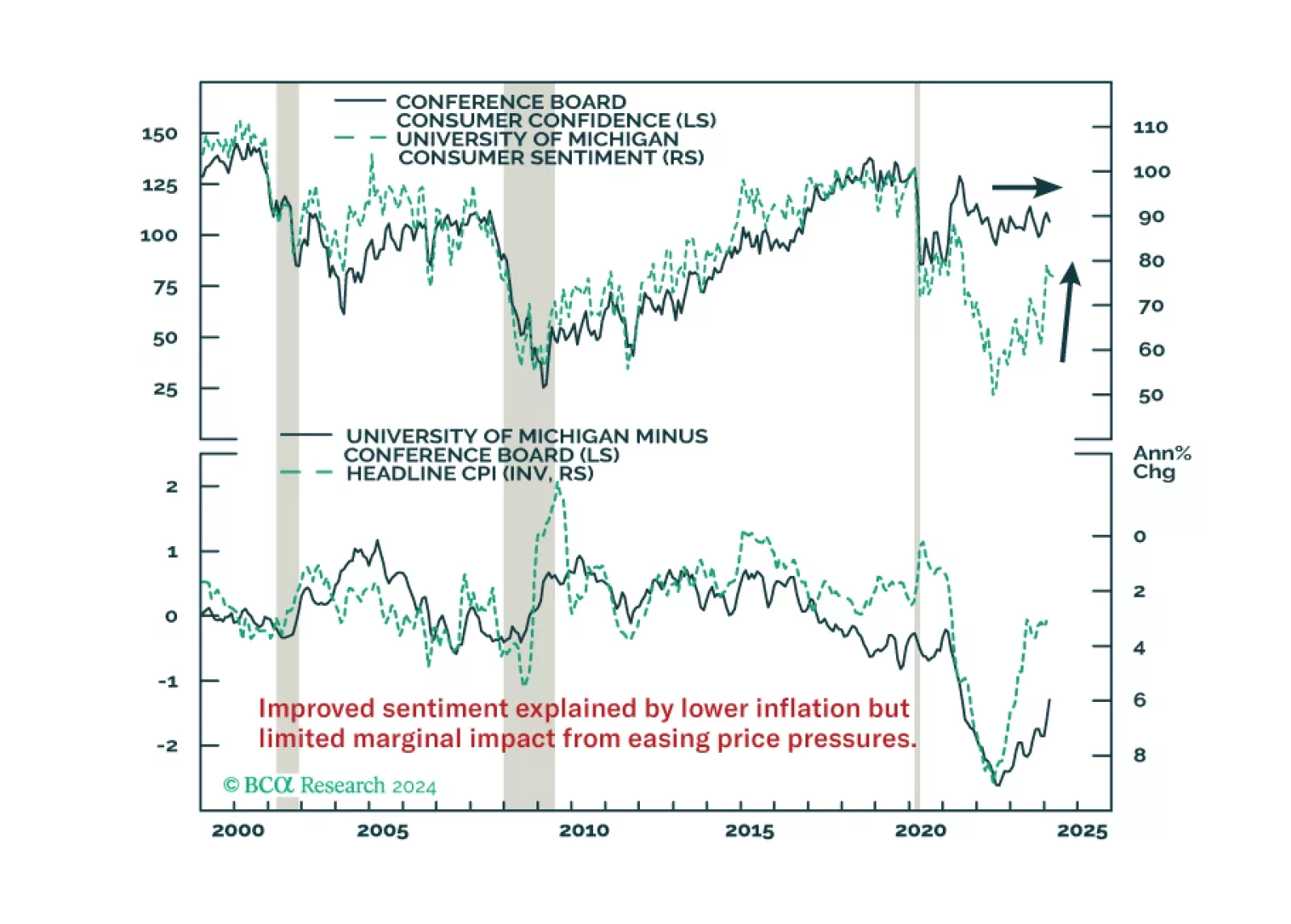

Improved consumer morale will not compensate for the fading tailwinds to consumption. Neither will the wealth effects from higher stocks and home prices.

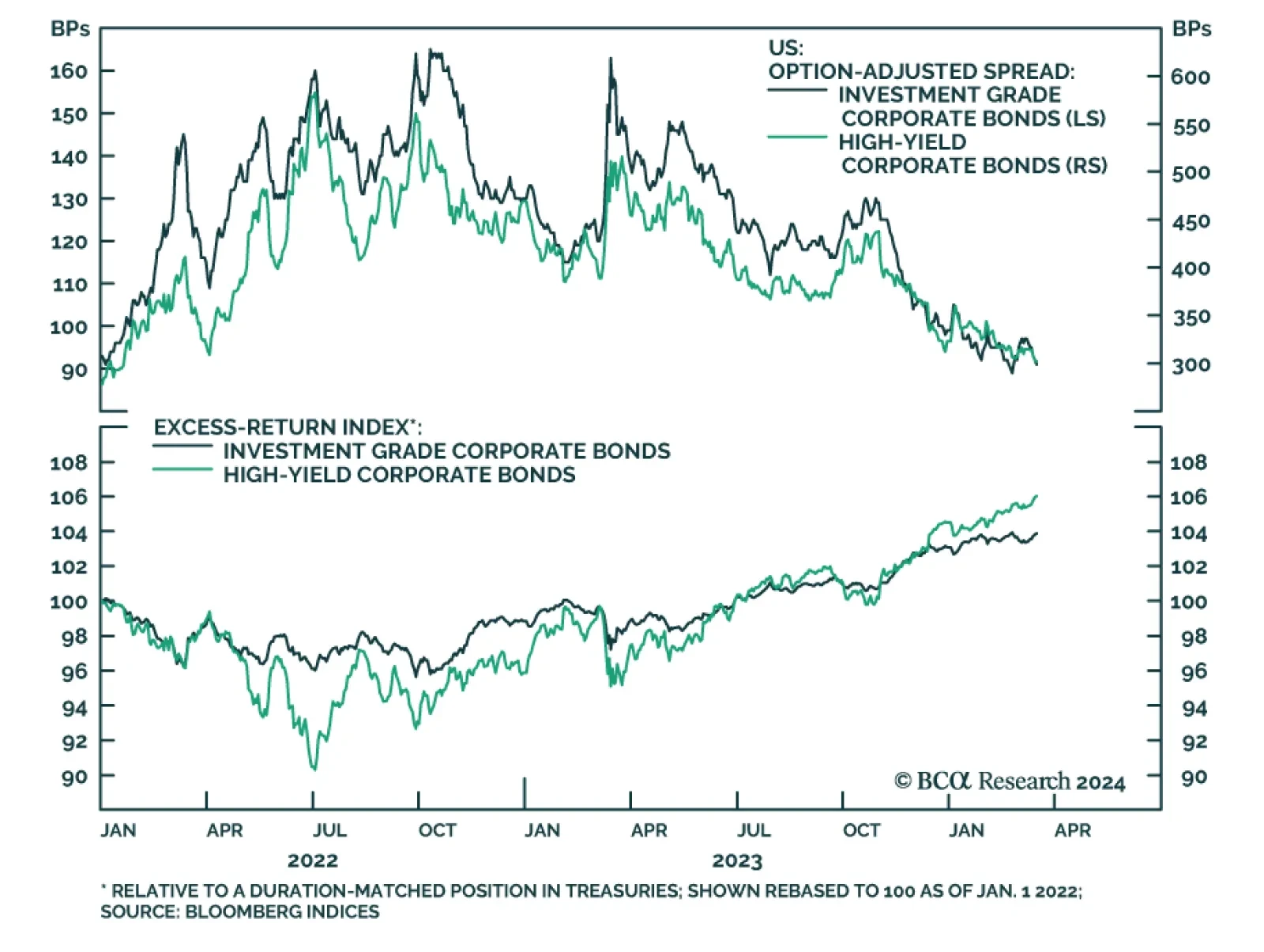

US Investment grade and high yield spreads have tightened 39 and 133 bps since their October 2023 highs, resulting in the outperformance of both fixed income sectors relative to equivalent-duration Treasuries. Still robust…

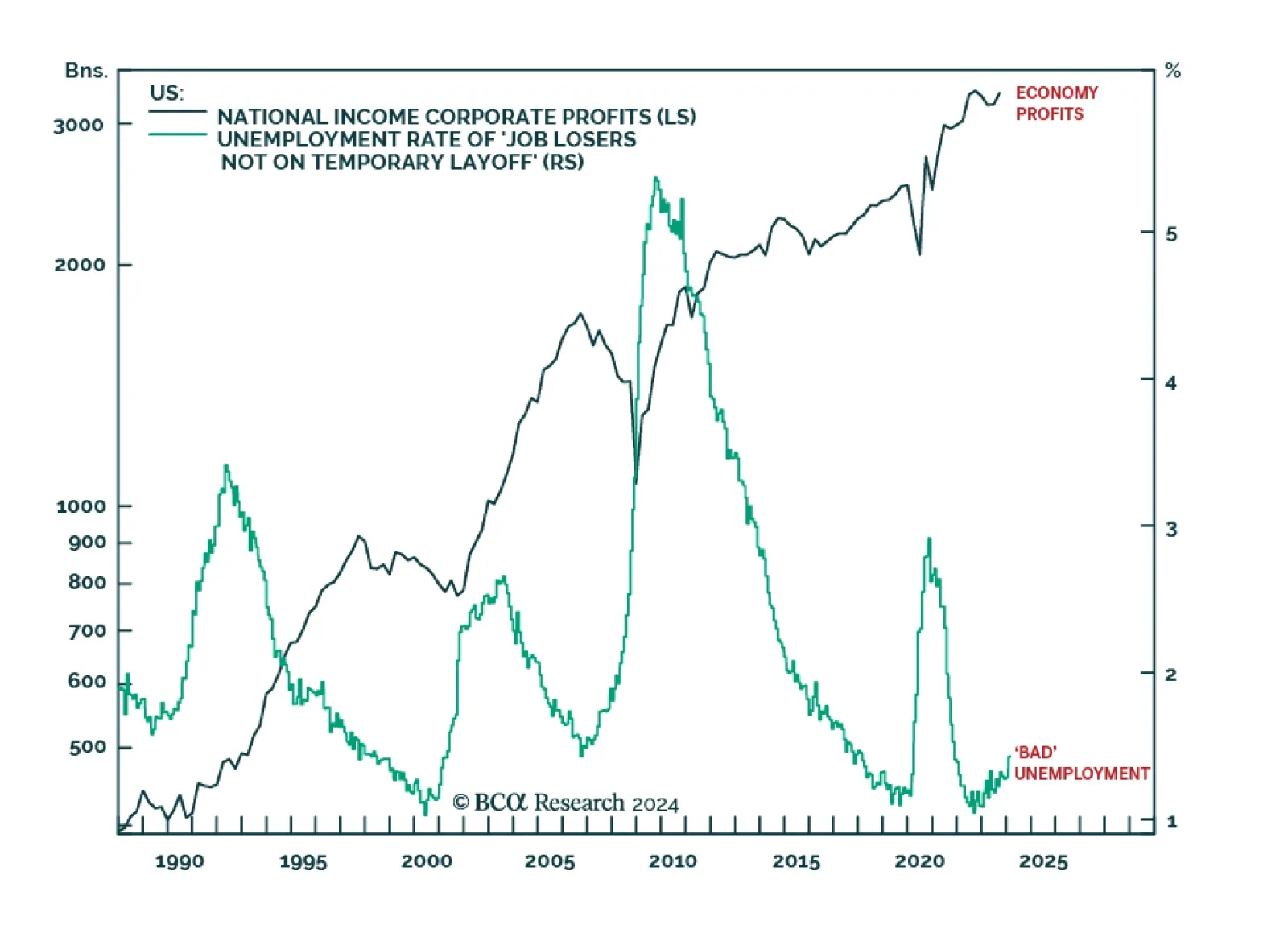

According to BCA Research’s Counterpoint service, ‘bad unemployment’ is on the rise in the US, despite resilient growth. There are two ways that you can become unemployed. Either by losing your job. Or by…