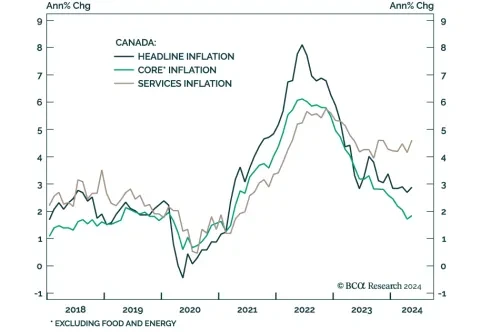

Canada’s headline inflation rate for May surprised to the upside on Tuesday. The 0.6% month-on-month print and 2.9% year-on-year increase came in above expectations of 0.3% m/m and 2.6% y/y, respectively. Both measures…

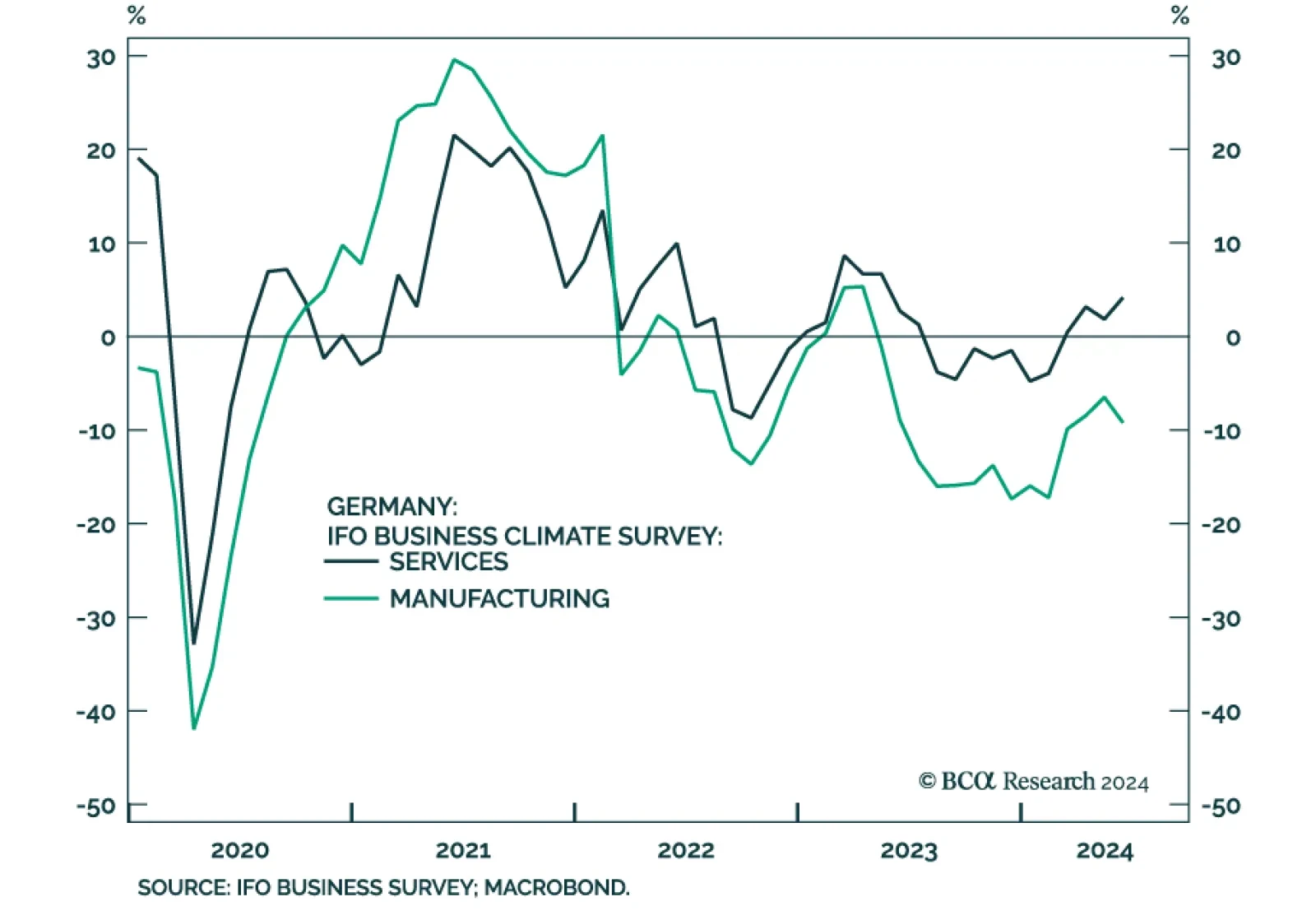

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

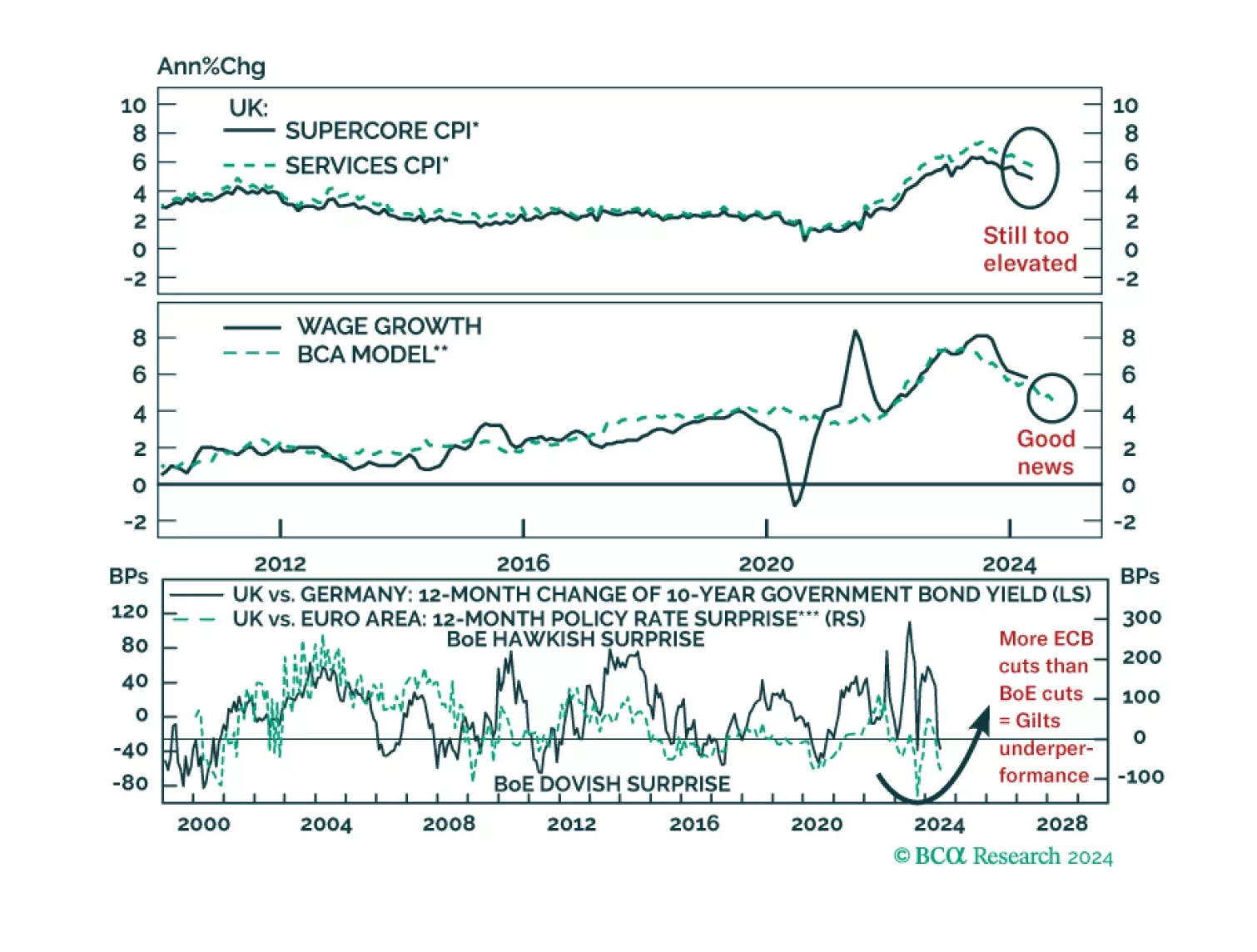

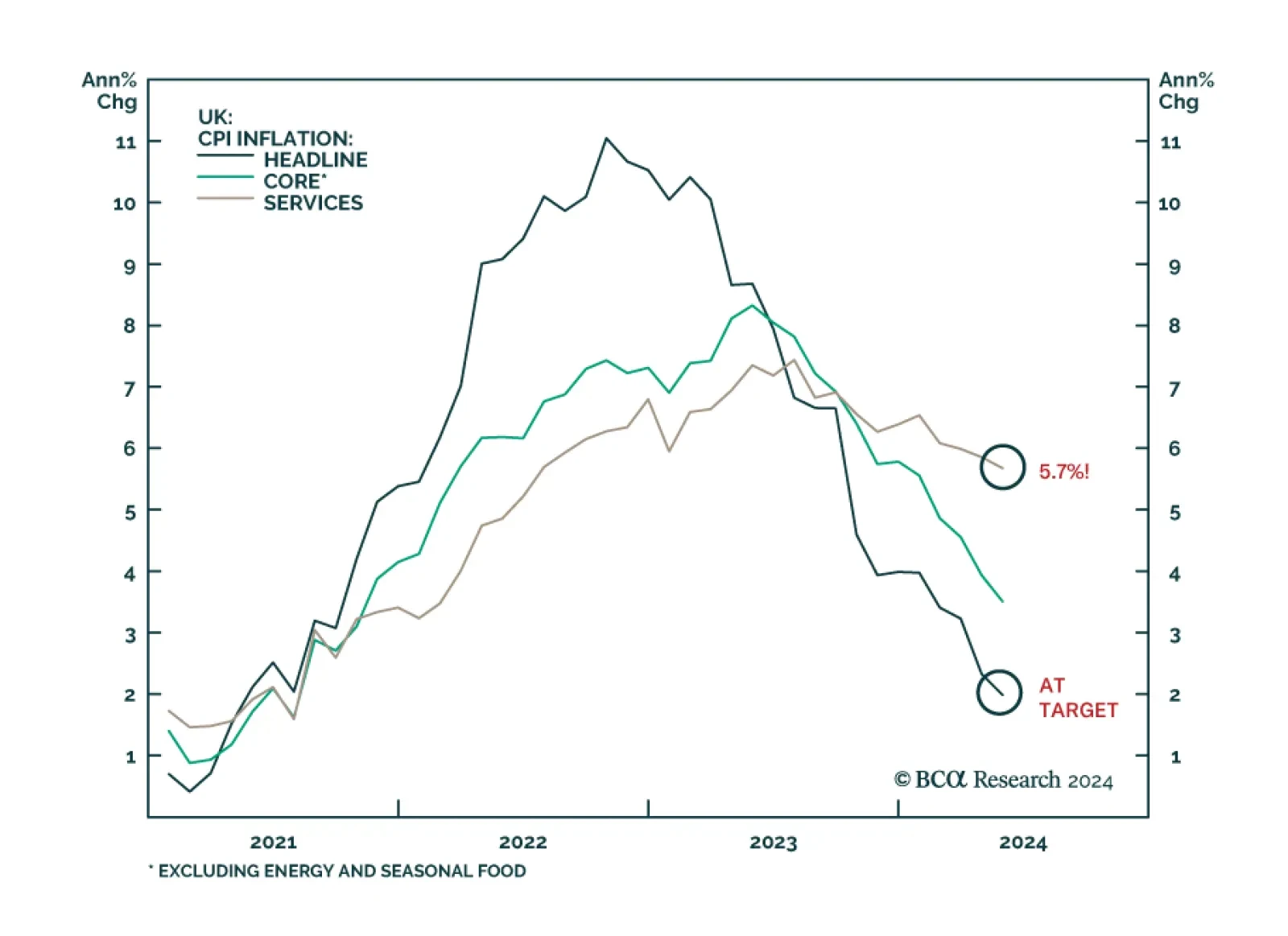

Is the BoE making a mistake moving toward rate cuts before the end of the summer? What would such a move mean for UK asset prices?

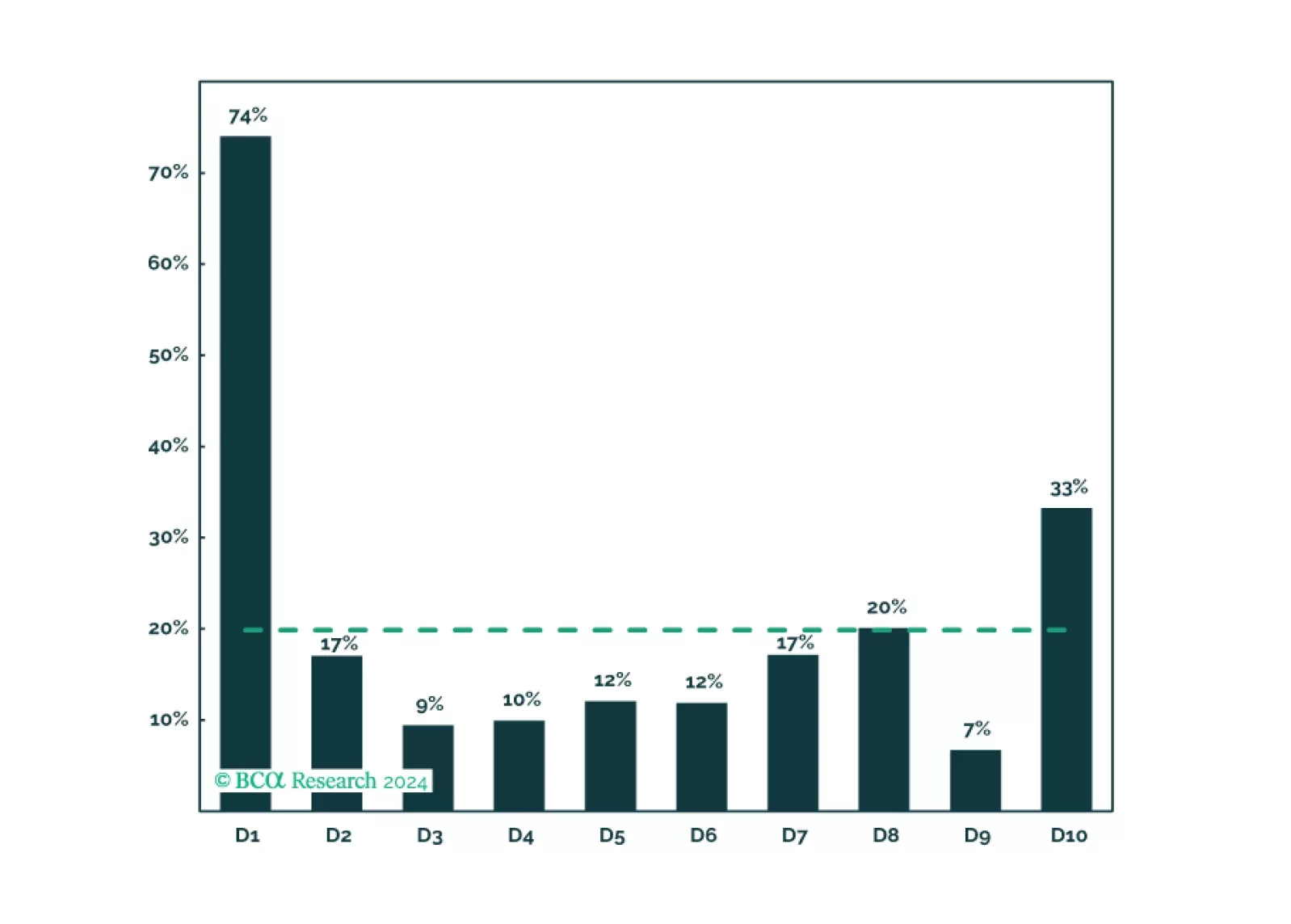

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

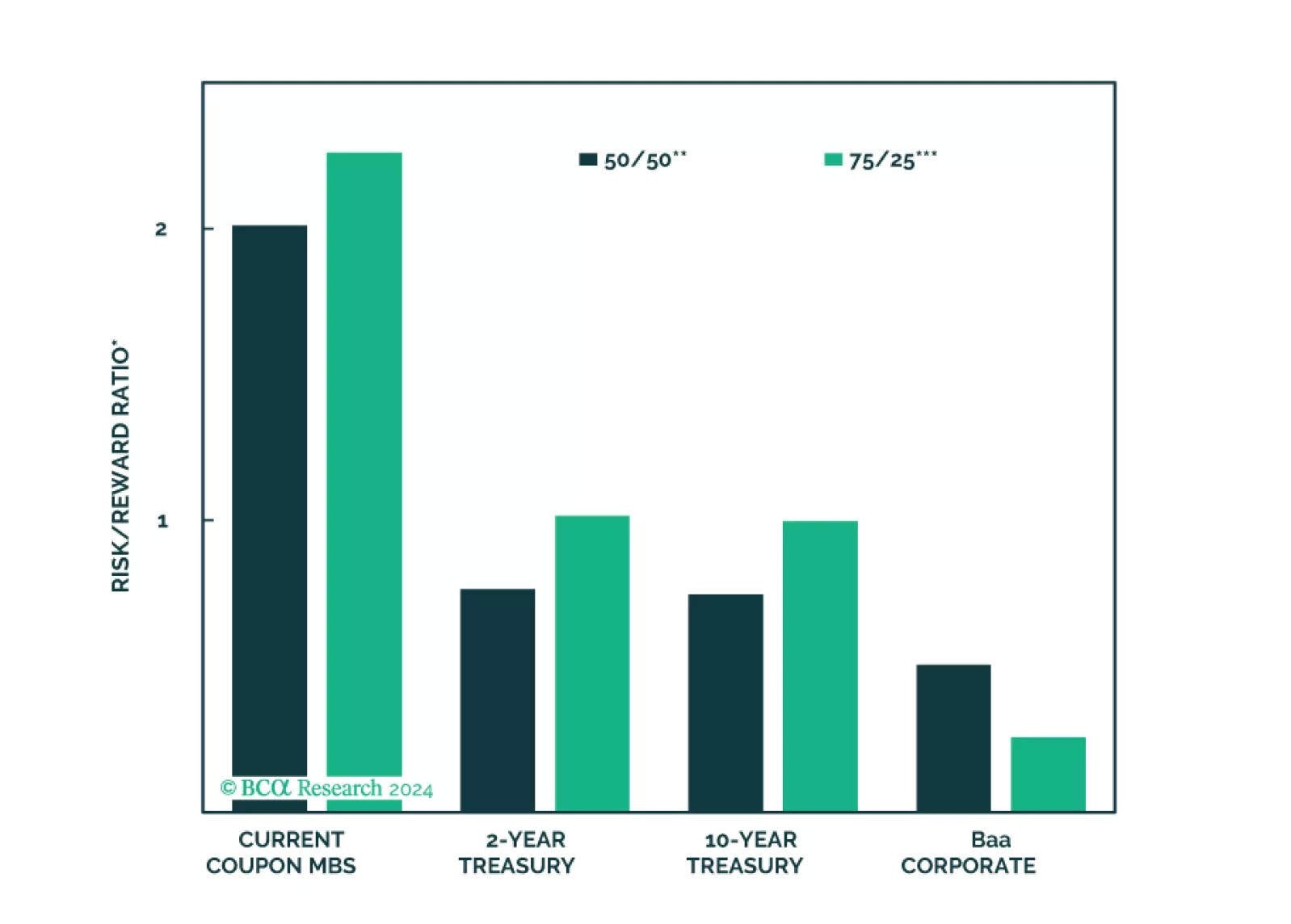

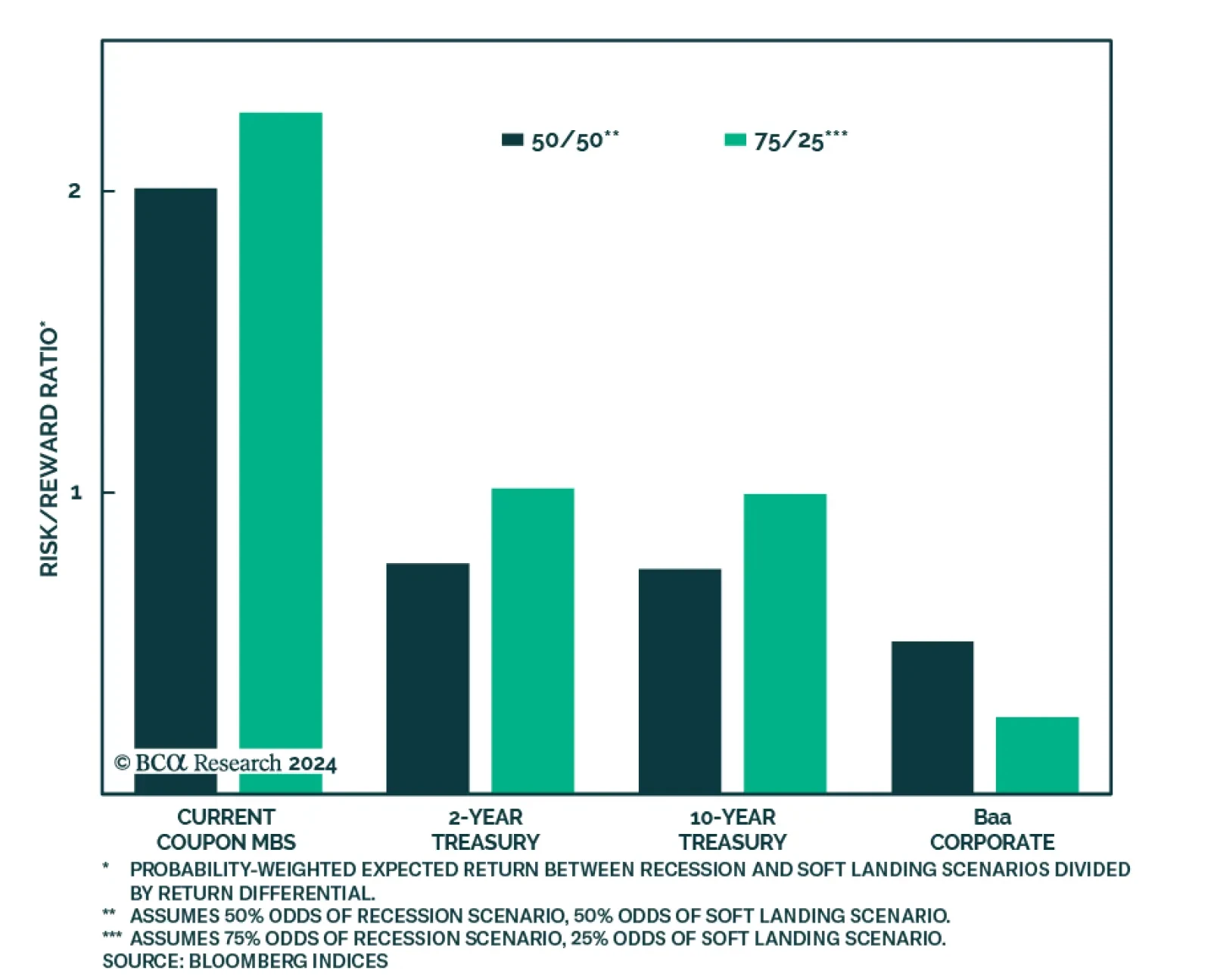

In its latest Special Report, BCA Research’s US Bond Strategy service considers the relative merits of four different fixed income investments in the current economic environment: 2-year Treasuries, 10-year Treasuries, Baa-…

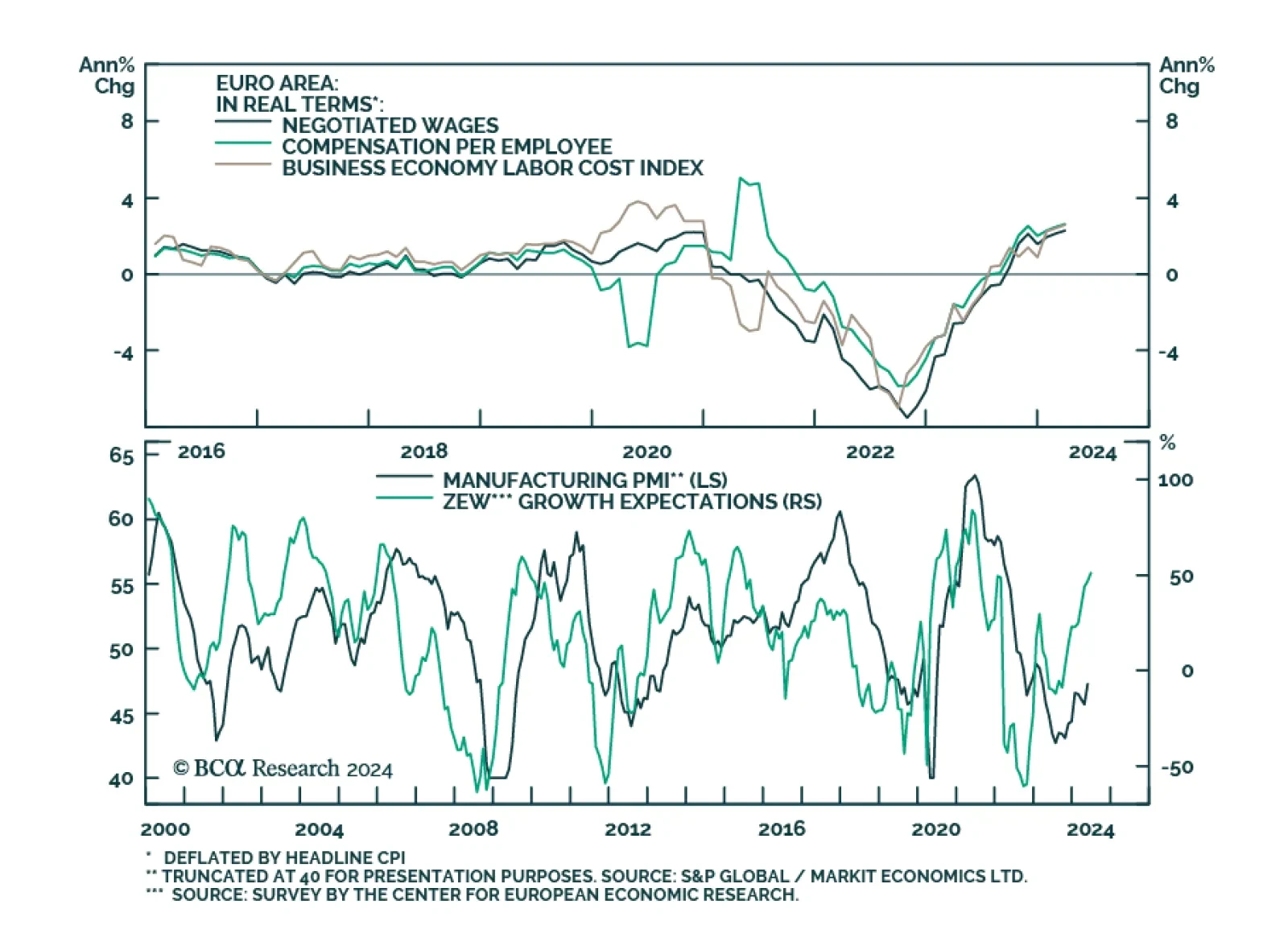

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…

On the surface, UK inflation appears to be on the right track. The May CPI release came in broadly within expectations. Headline inflation eased from 2.3%y/y to 2.0%y/y – directly on the BoE’s target for the first…

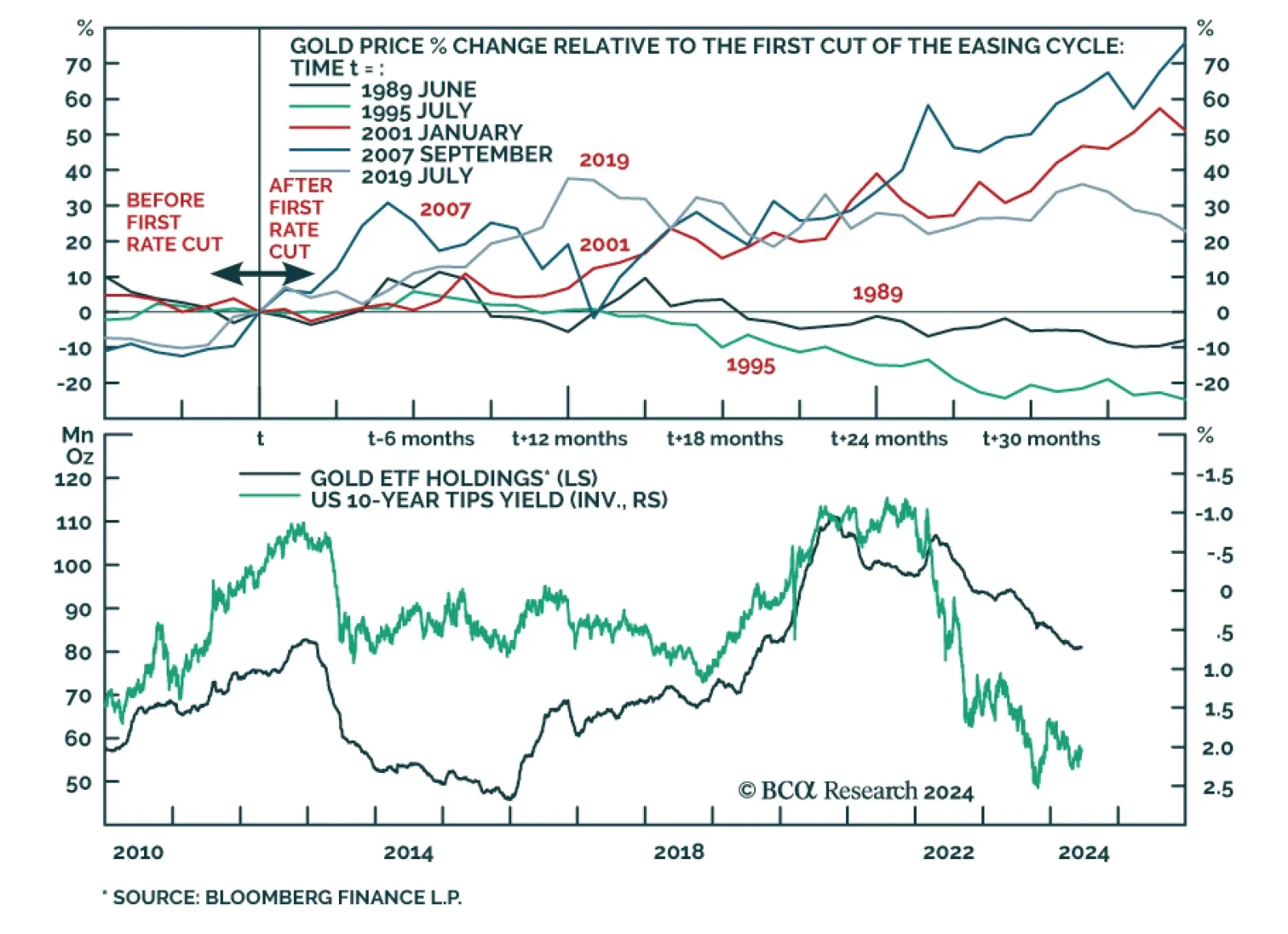

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…

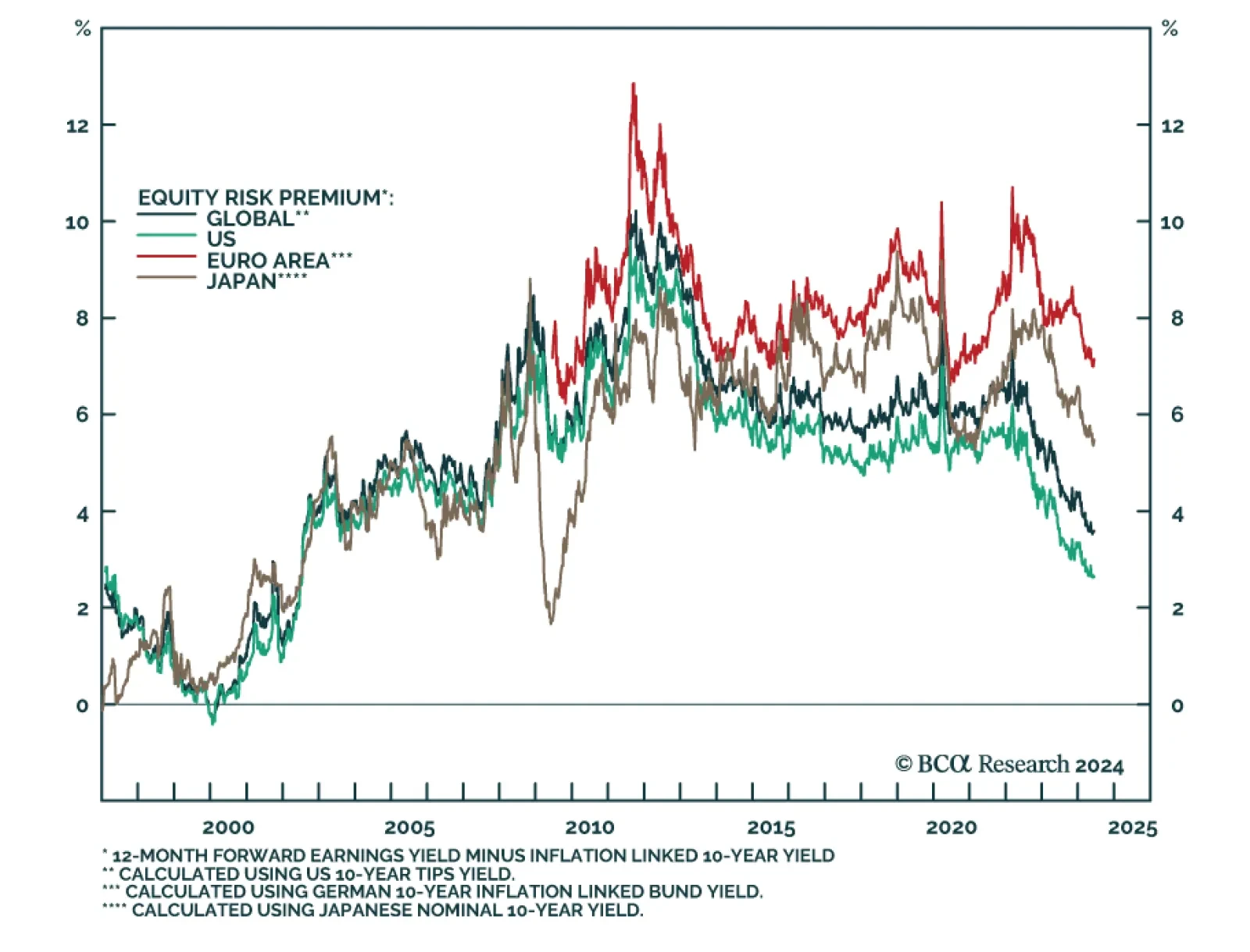

The equity risk premium (ERP) allows investors to assess the additional compensation they are offered as an enticement to assume equities’ incremental risk. The ERP measures equities’ excess return by deduct…