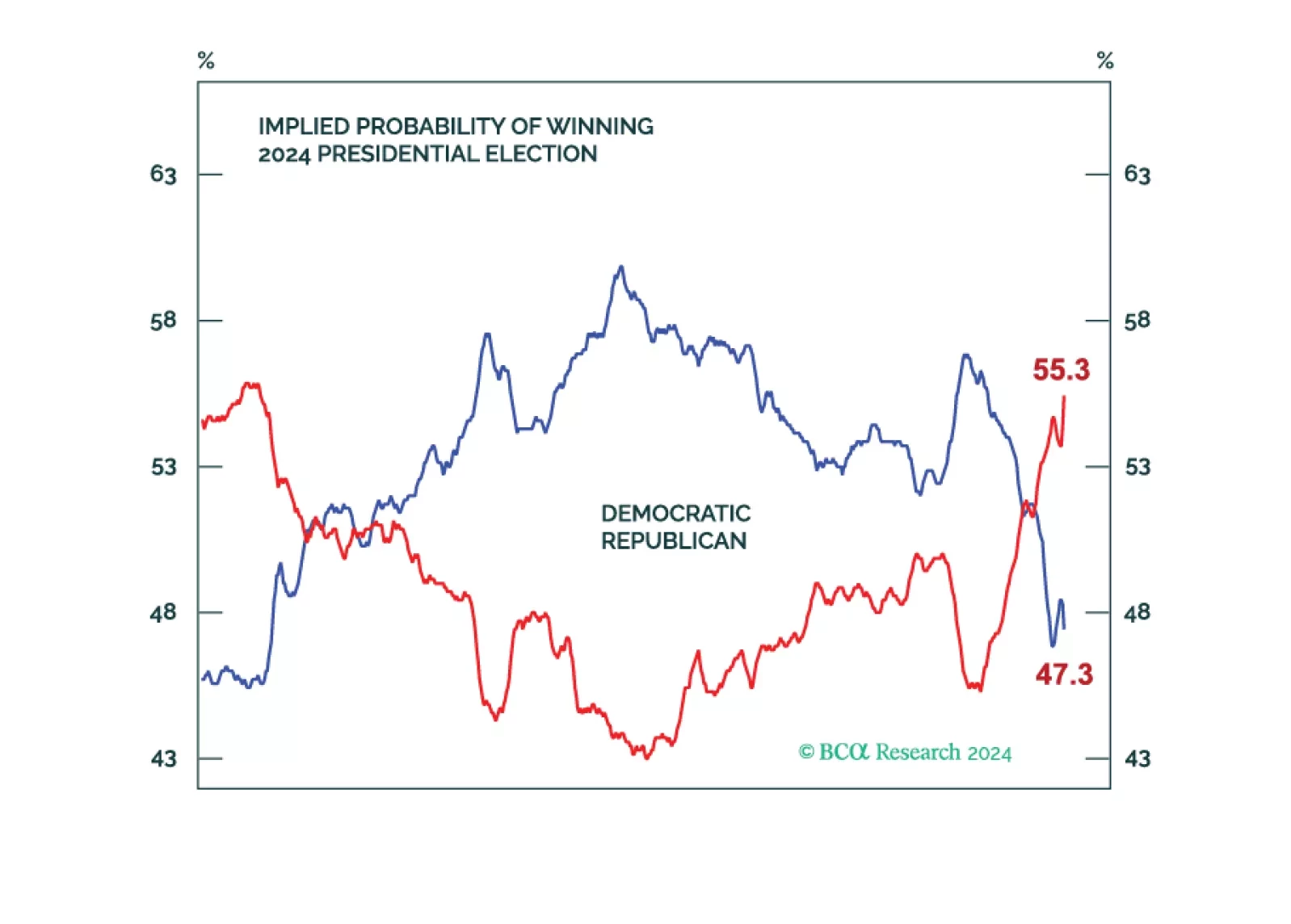

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

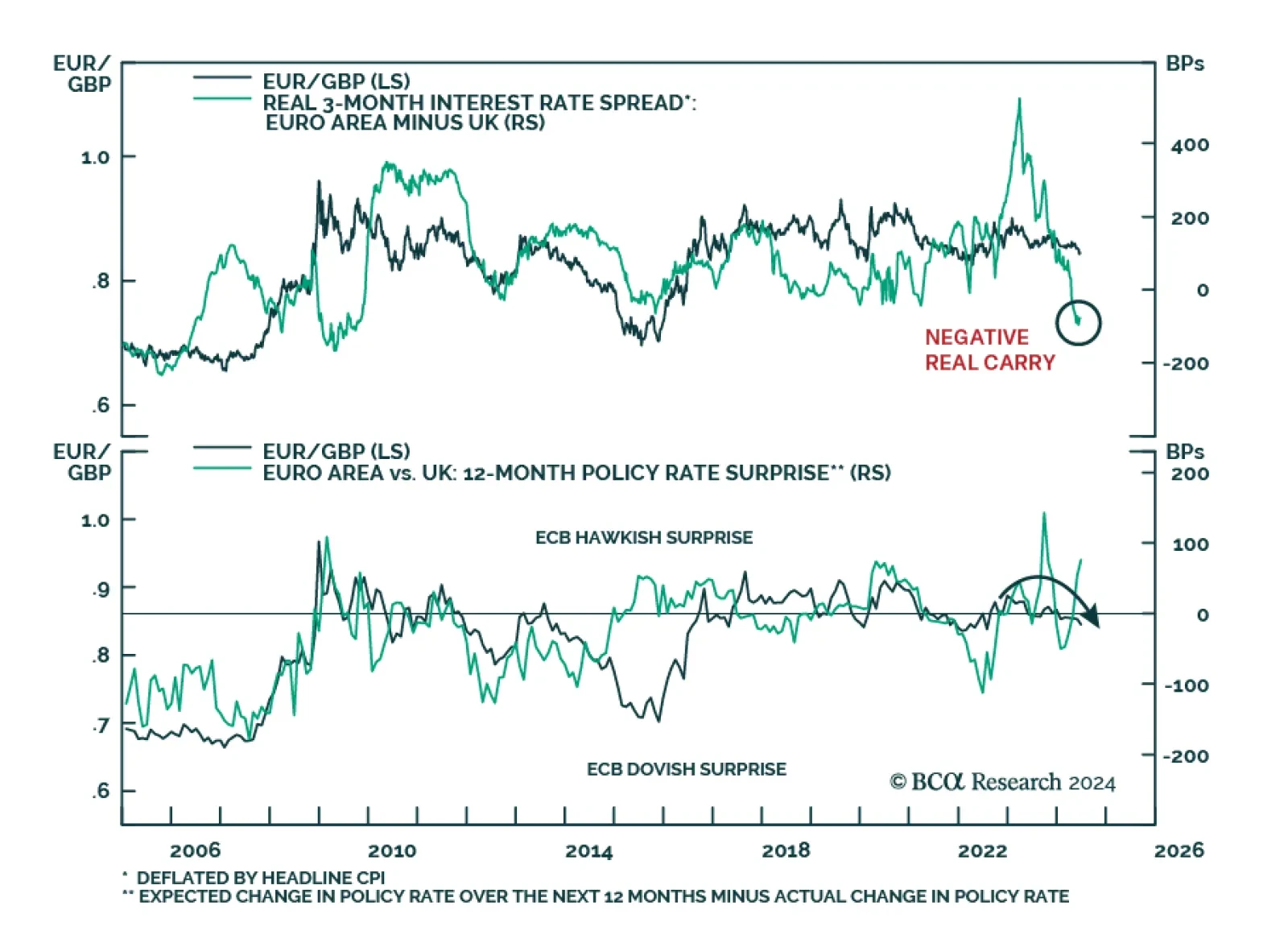

According to BCA Research’s European Investment Strategy service, the BoE will start cutting rates in September, but the pace of subsequent rate cuts will be modest until a recession engulfs Western economies in early 2025…

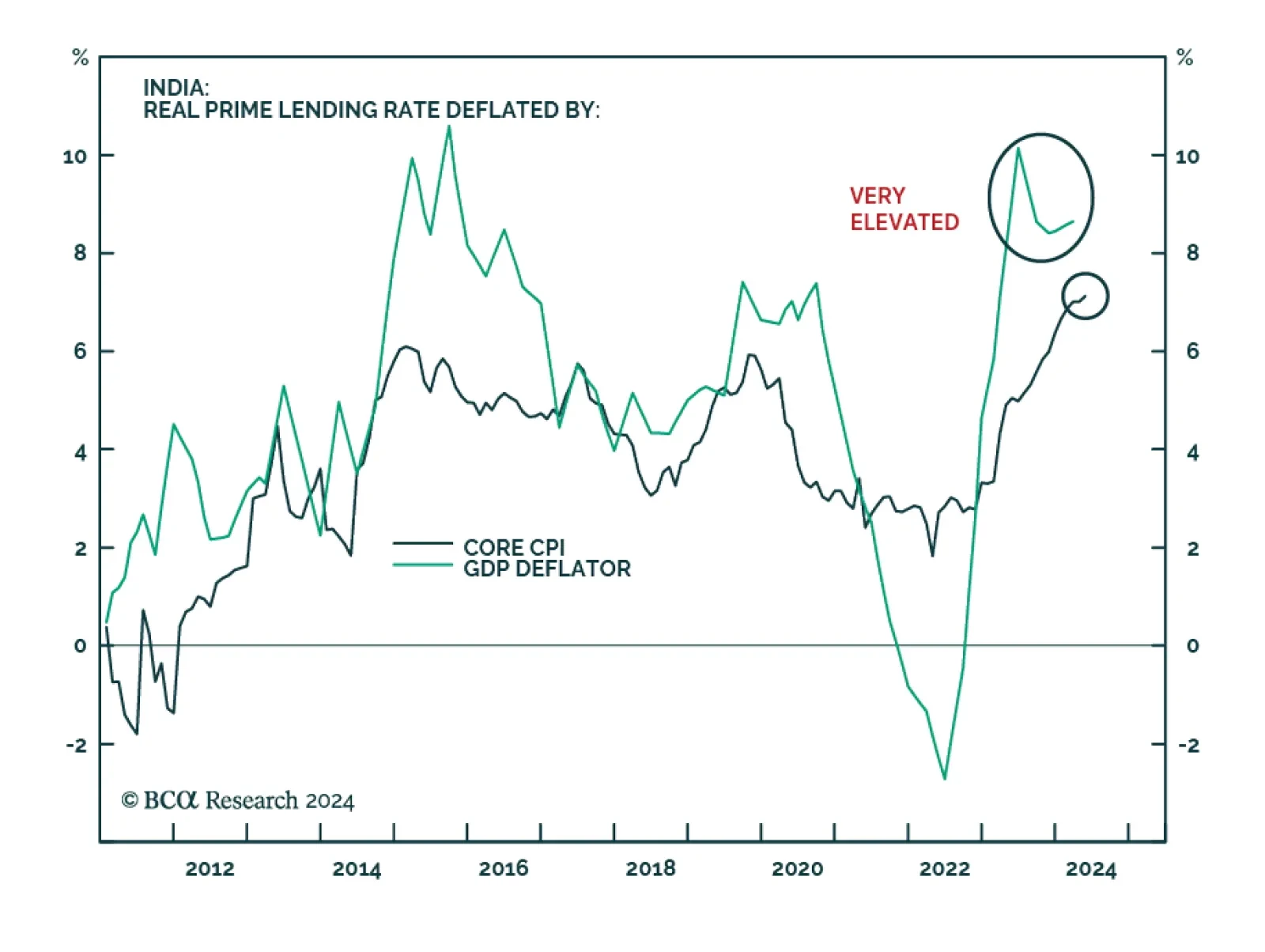

BCA Research’s Emerging Markets Strategy team posits that the BJP's loss of majority in India’s parliament could be a blessing in disguise for India. The new BJP-led coalition with the National Democratic…

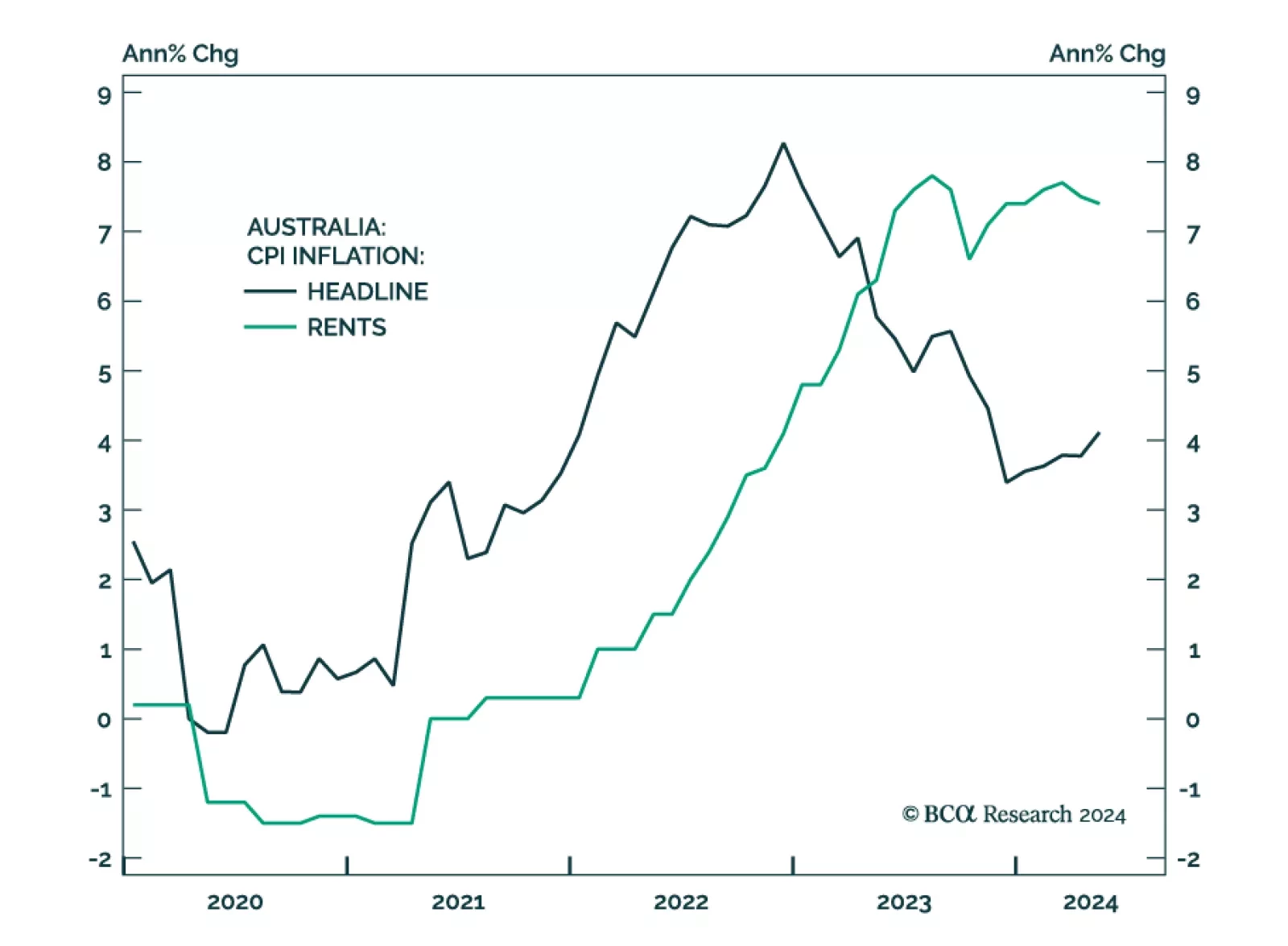

Australia’s inflation for May was released on Tuesday. Annual headline CPI increased from 3.6% in April to 4%, outpacing expectations of 3.8%. Trimmed-mean inflation also increased from 4.1% to 4.4%. Individual…

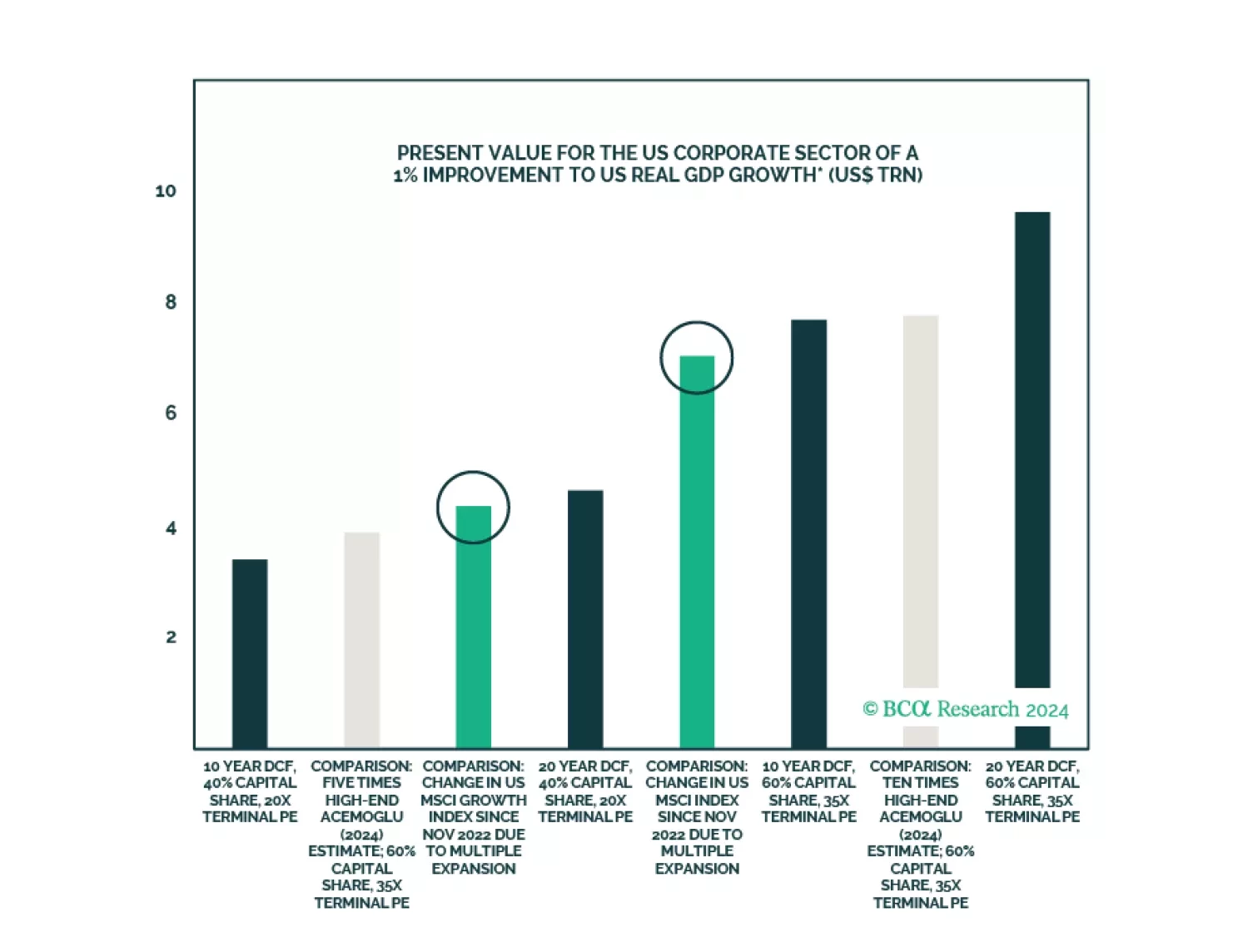

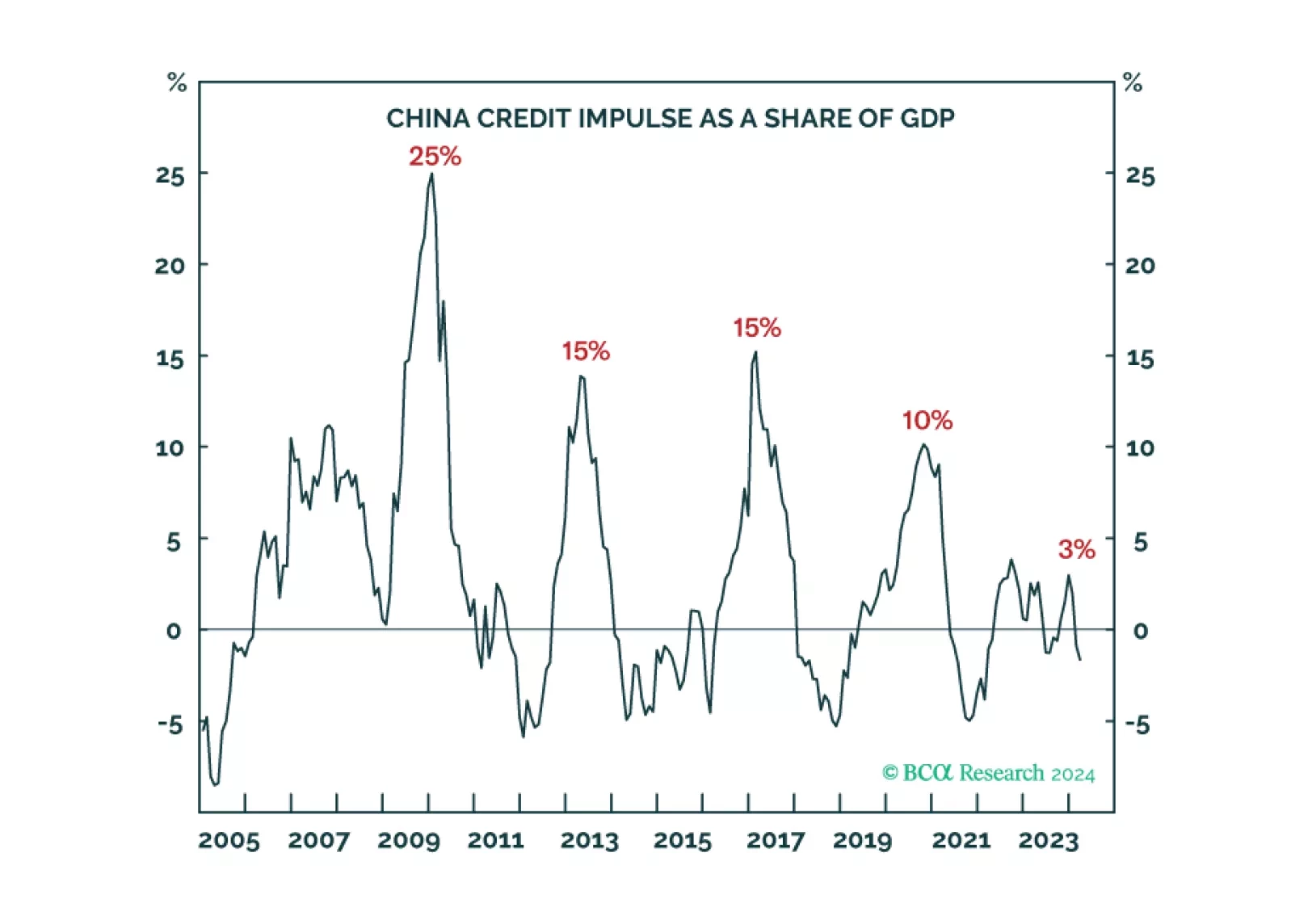

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

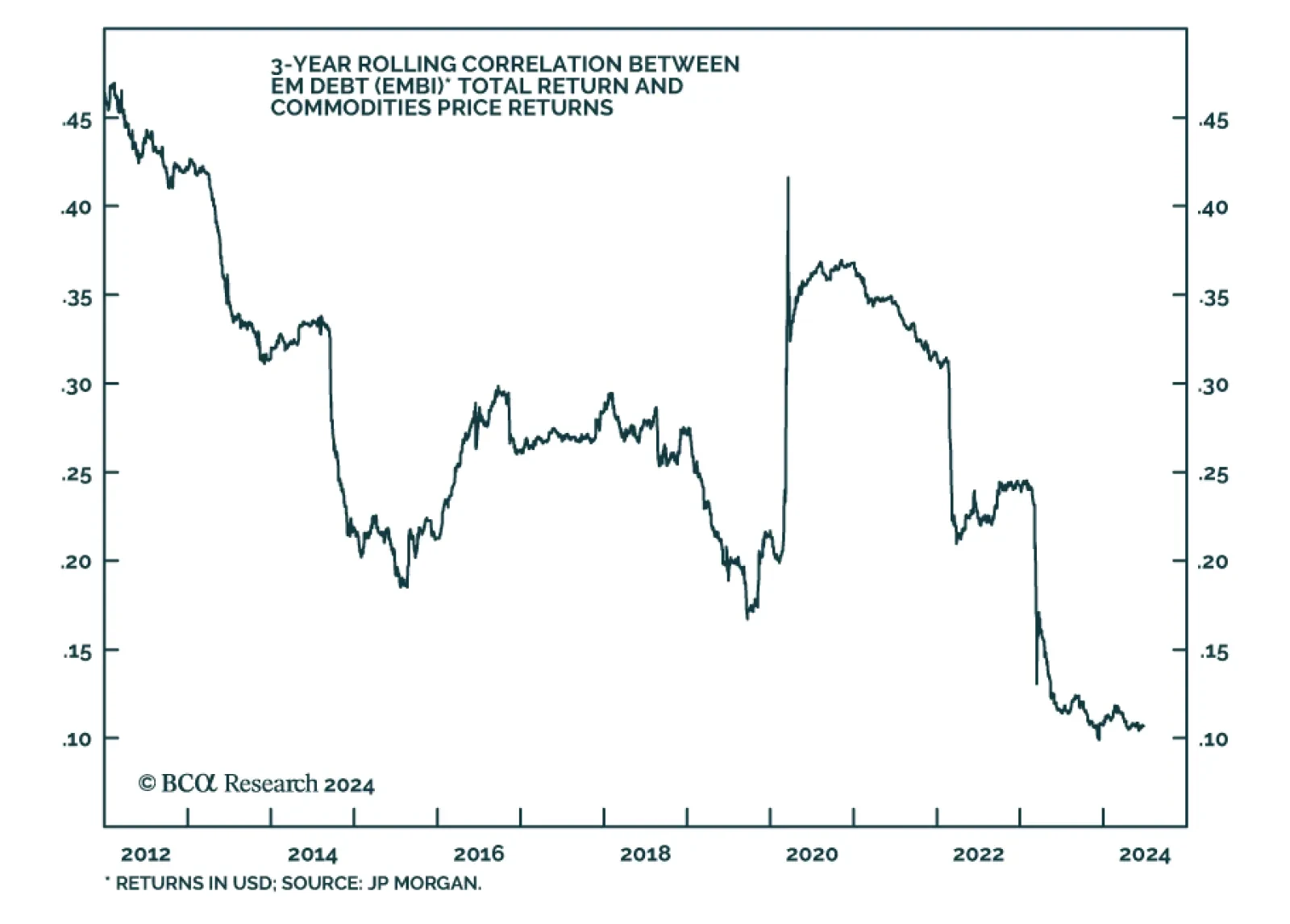

Emerging market debt is typically thought of as a cyclical asset. When risk assets sell off and the dollar rises, this asset class has historically suffered. However, there are some signs that the risk-on nature of EM debt has…

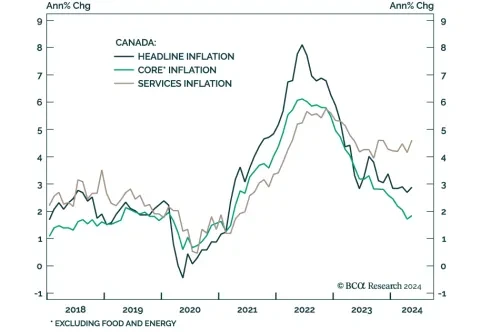

Canada’s headline inflation rate for May surprised to the upside on Tuesday. The 0.6% month-on-month print and 2.9% year-on-year increase came in above expectations of 0.3% m/m and 2.6% y/y, respectively. Both measures…