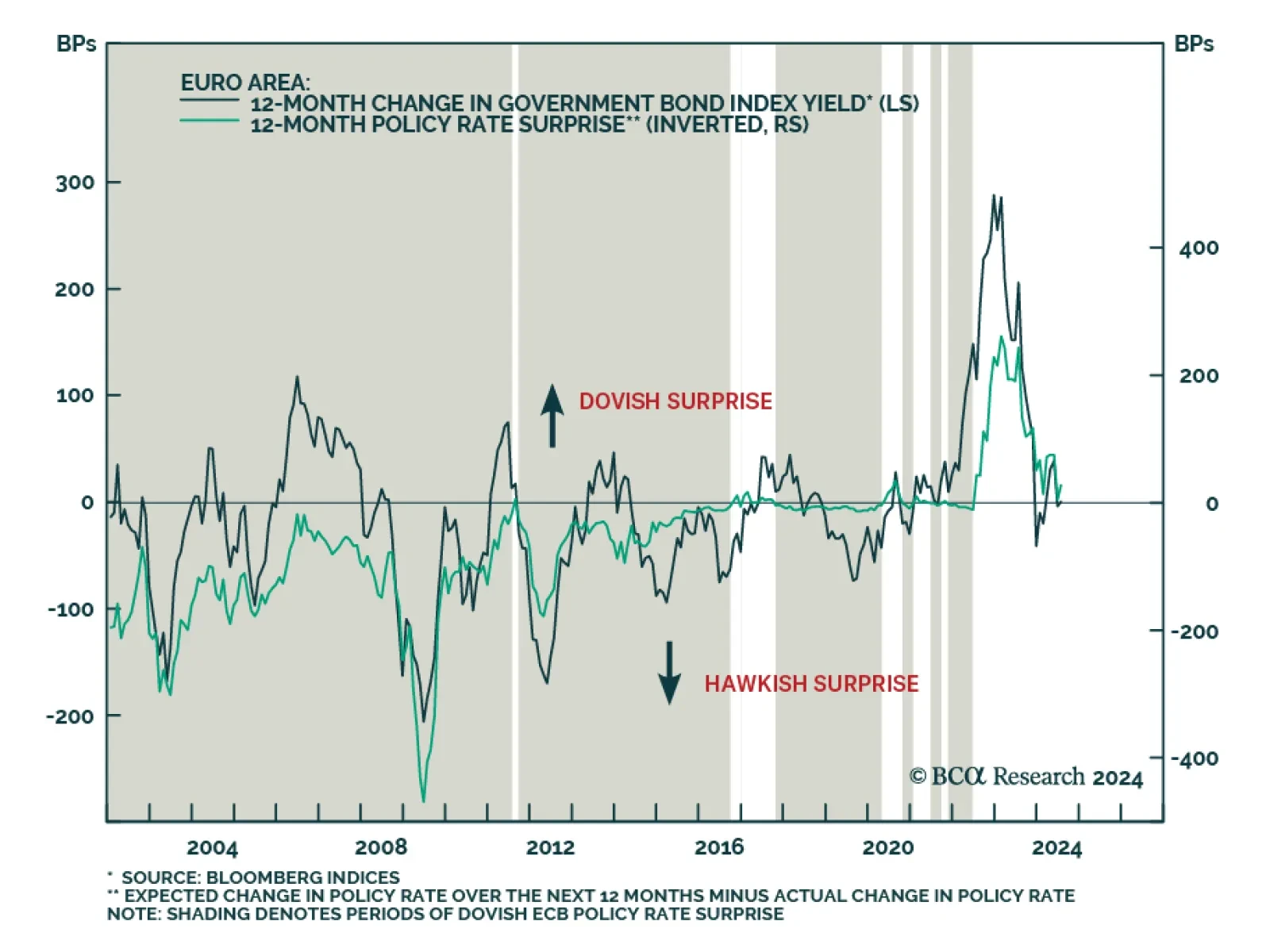

Eurozone headline inflation slowed from 2.6% y/y to 2.5% in June. Germany, its largest economy, saw price pressures ease from 2.4% to 2.2%, below expectations of 2.3% (or from 2.8% to 2.5% on an EU-Harmonized basis). However,…

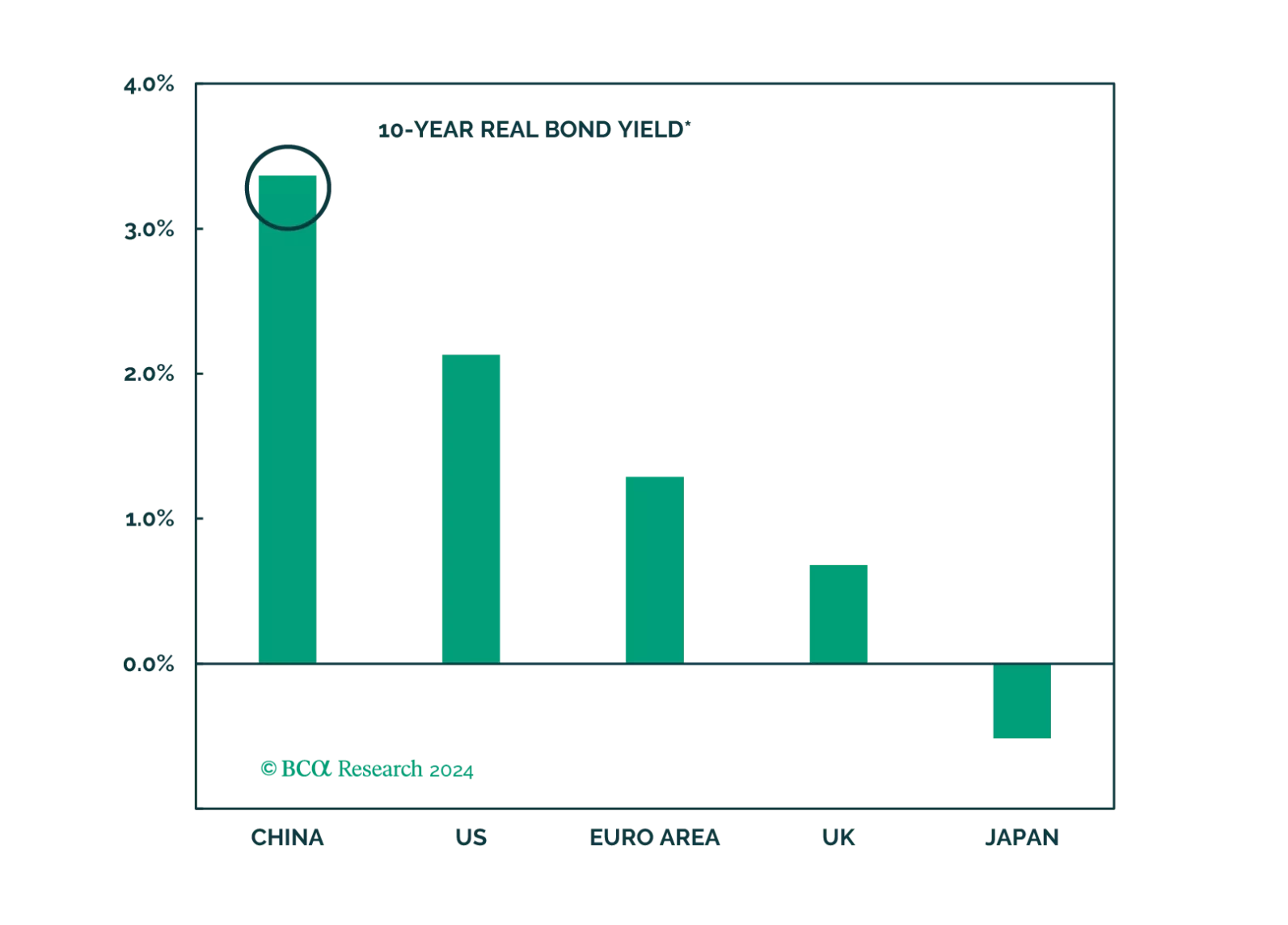

The PBoC appears increasingly uncomfortable with the rapid decline in the Chinese government bond yields. While the PBoC will succeed in temporarily curbing investors’ enthusiasm for bonds, the central bank will be unwilling to raise…

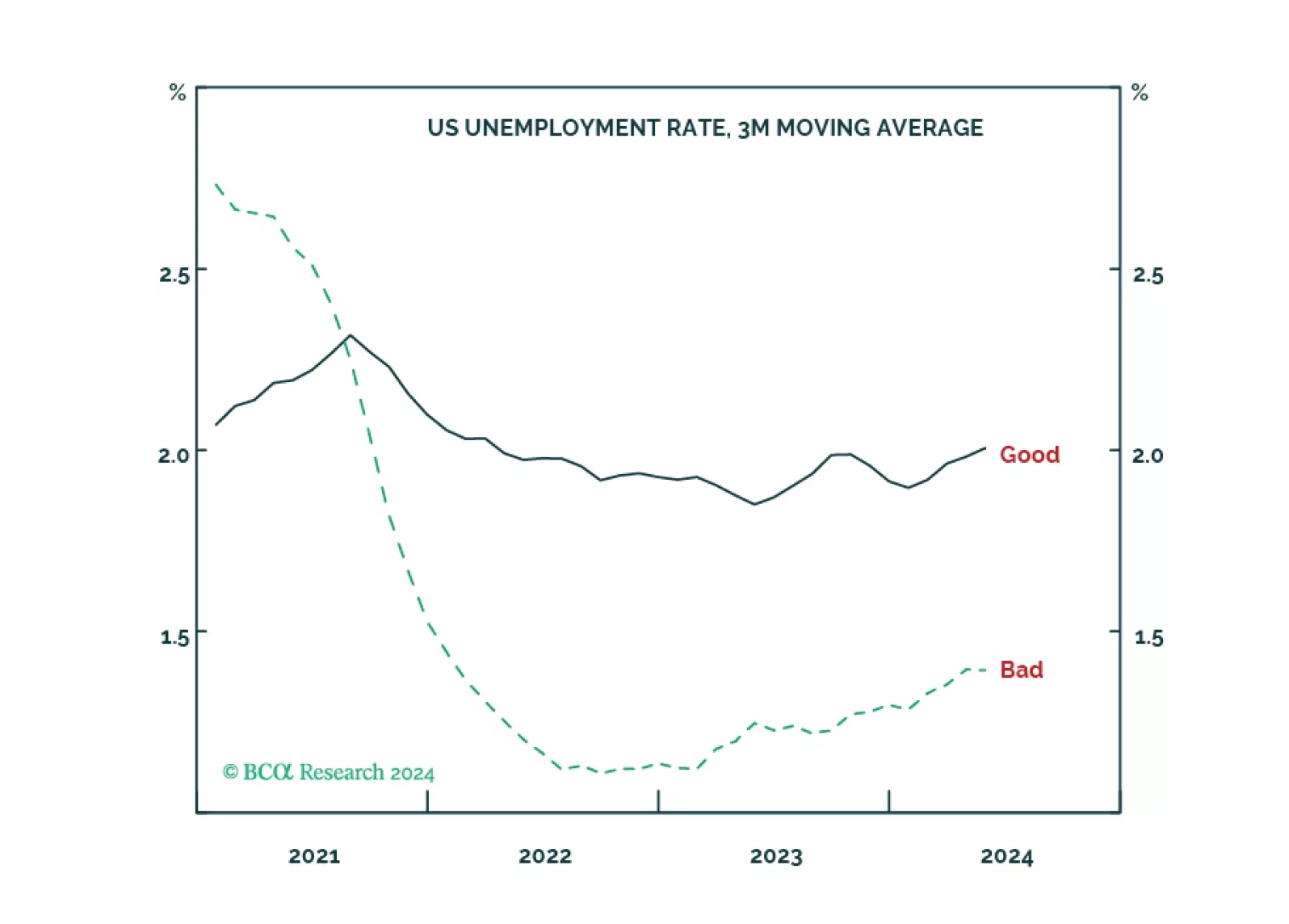

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

Our Portfolio Allocation Summary for July 2024.

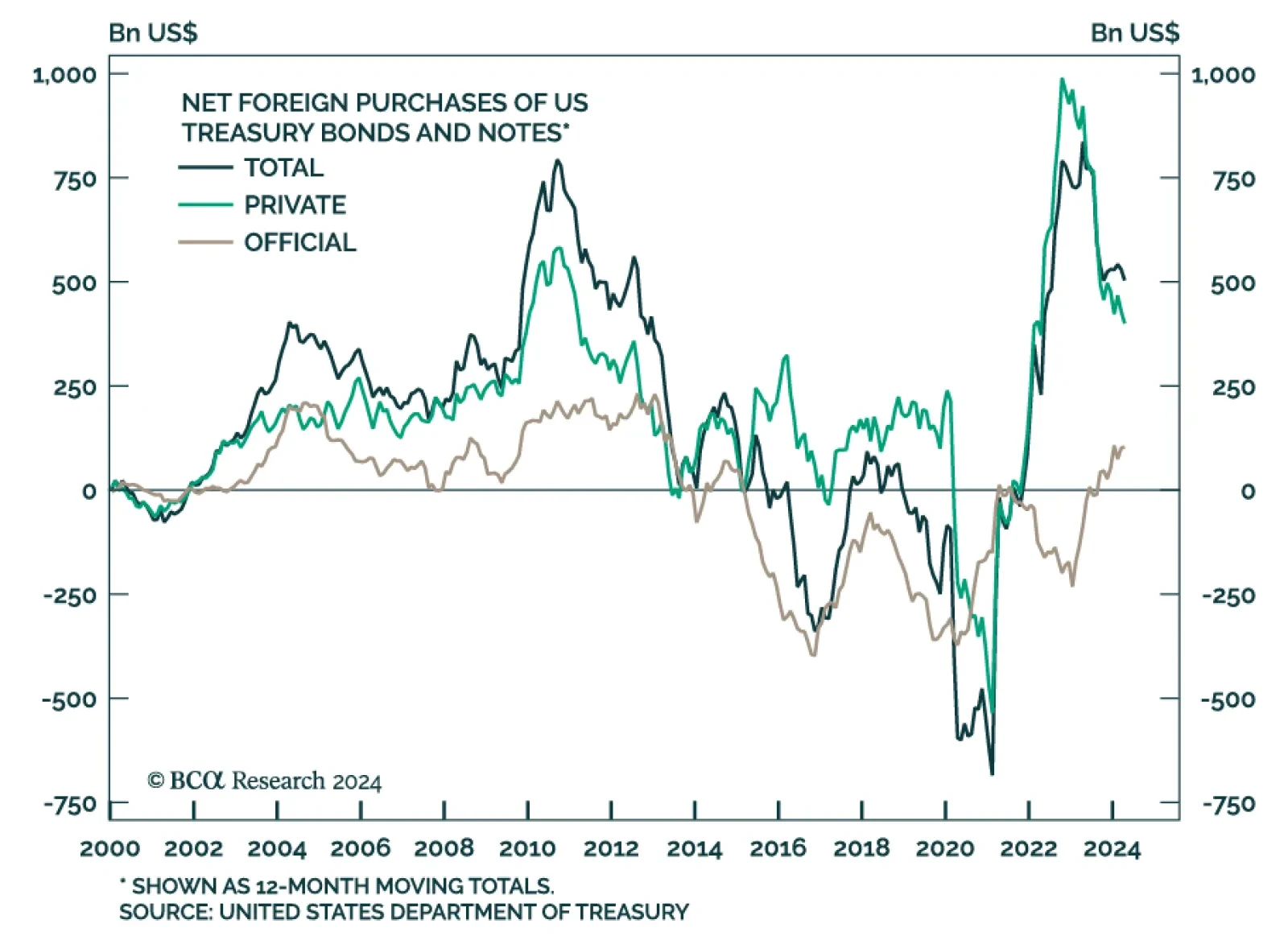

According to BCA Research’s Global Fixed Income Strategy service, while equity markets can drive US dollar crosses from time to time, bond market inflows matter a lot more. Part of the US exceptionalism story can be…

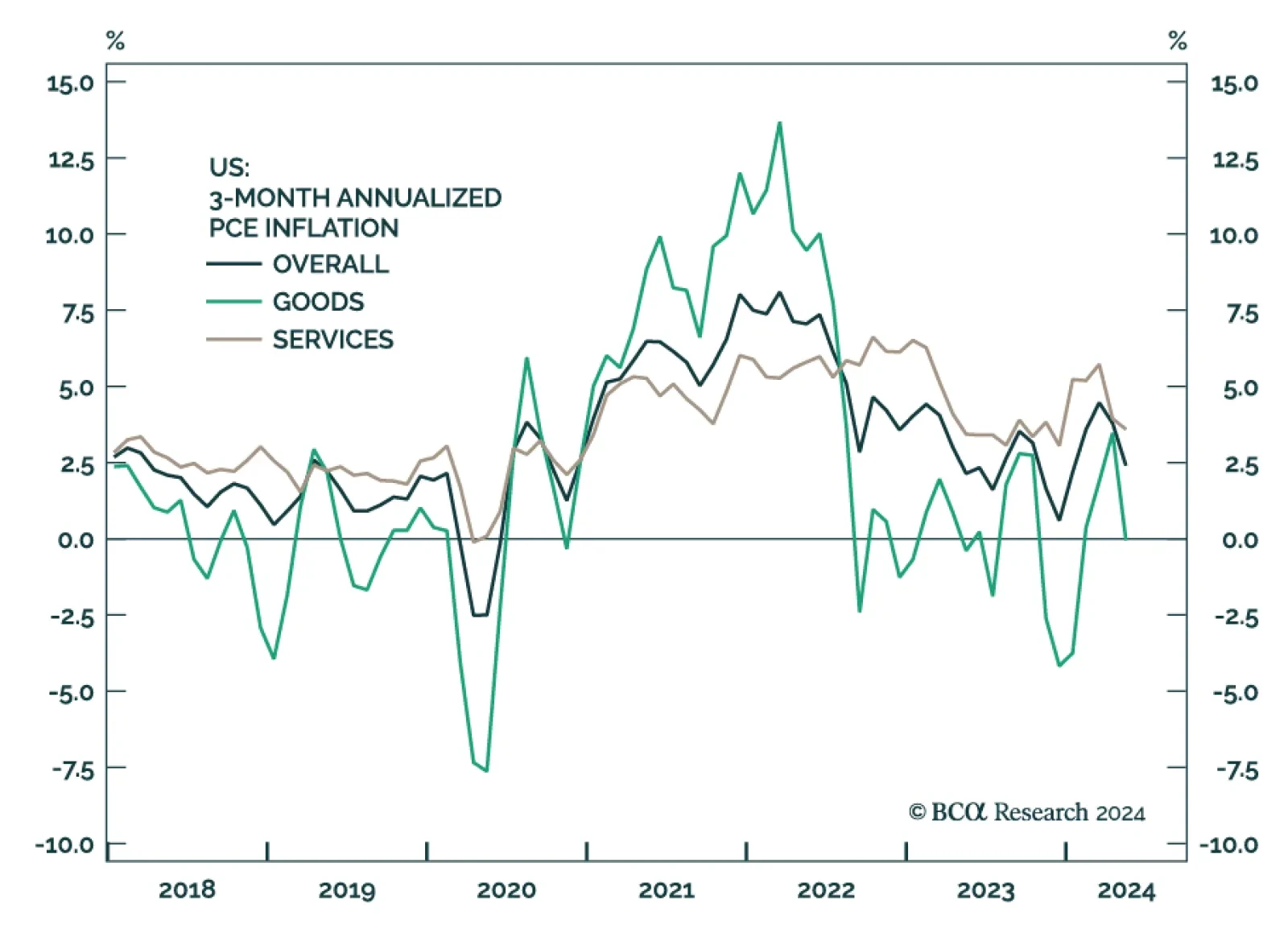

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

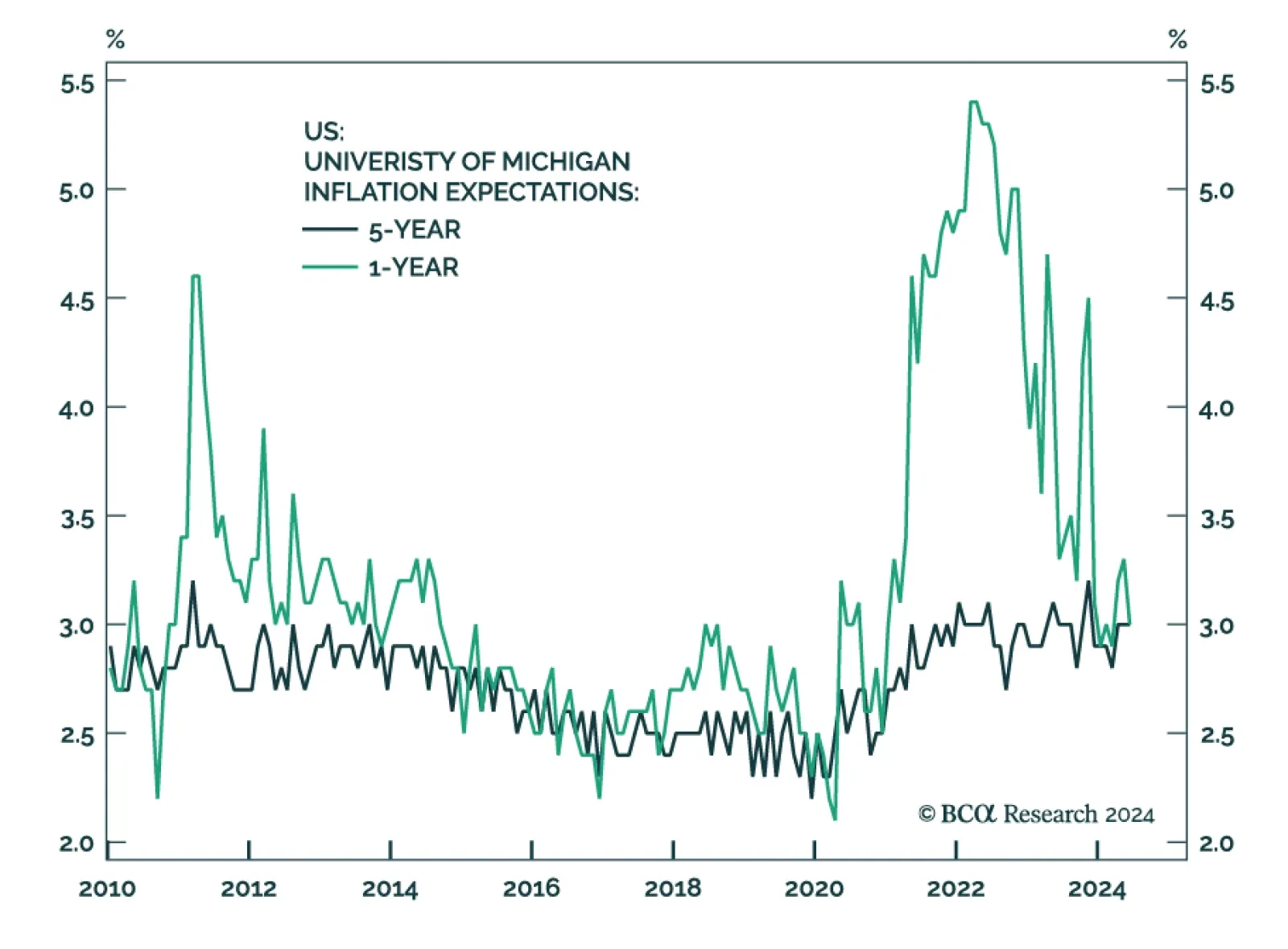

The University of Michigan survey of consumers was released on Friday. The sentiment measure increased from 65.6 to 68.2, beating consensus estimates of 66. Current conditions as well as expectations also increased, going from 62…

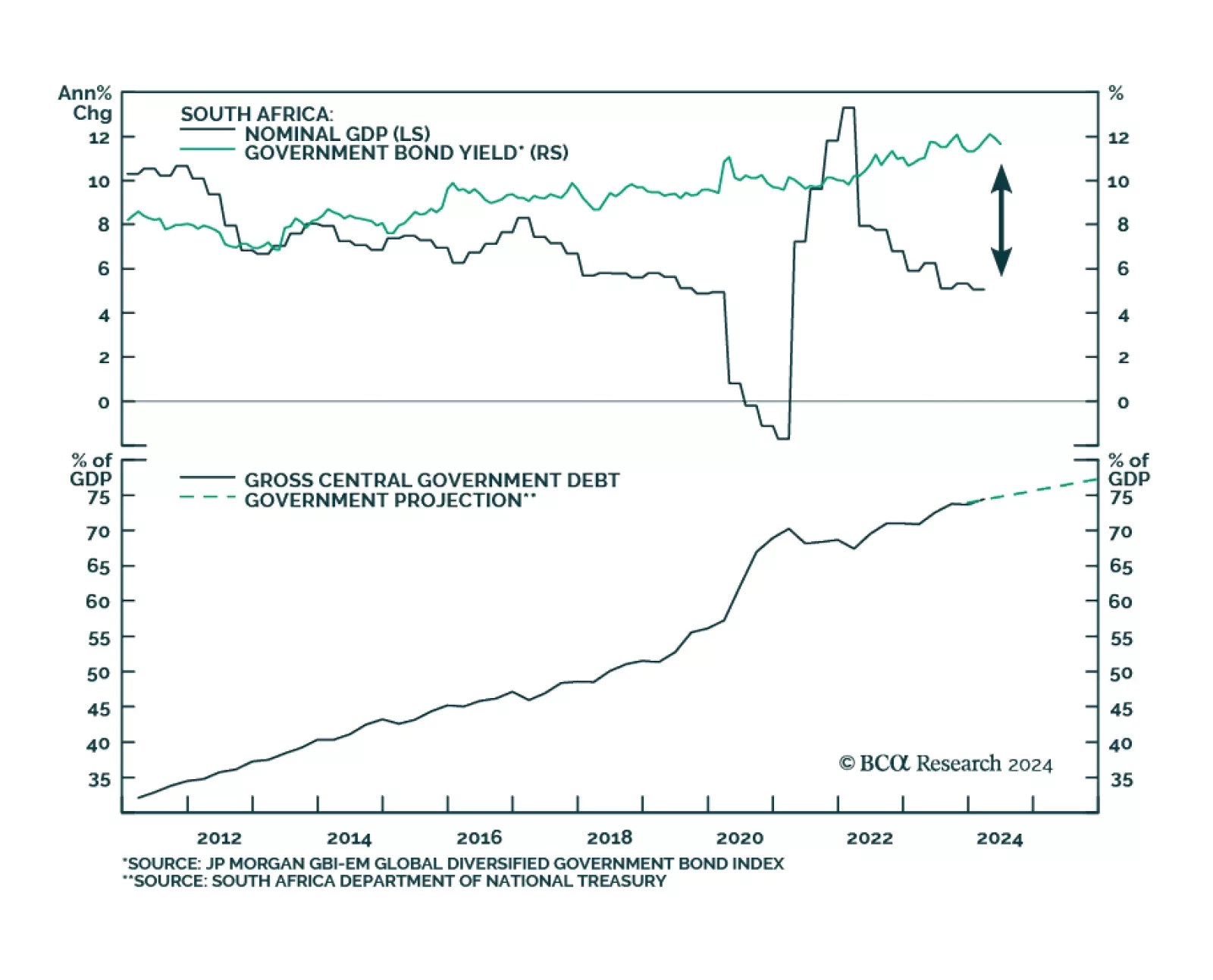

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

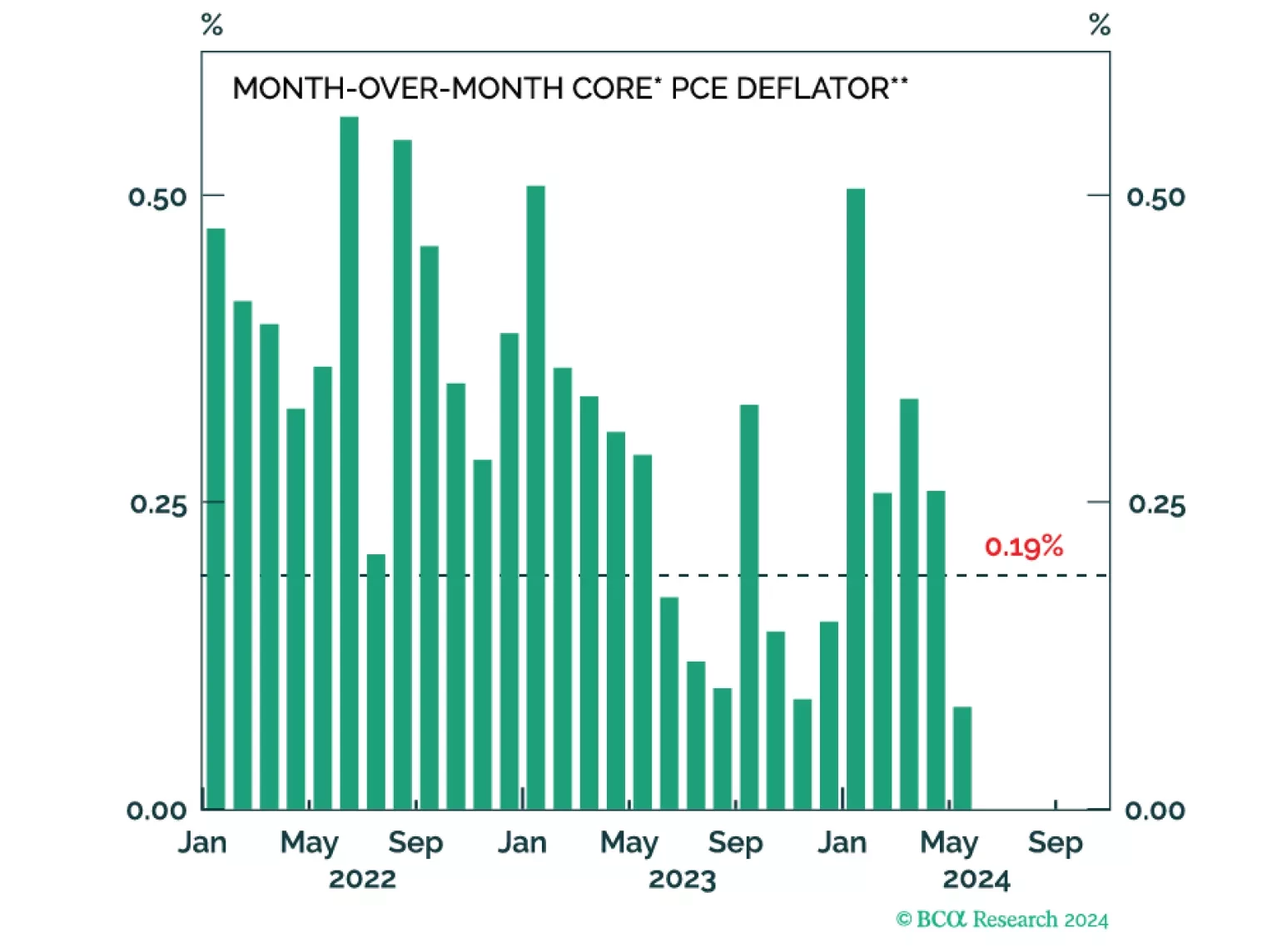

The US personal income and outlays report was released on Friday. Personal income grew by 0.5% versus 0.3% the previous month, beating consensus estimates. Real personal spending growth also increased, coming in at 0.3%…