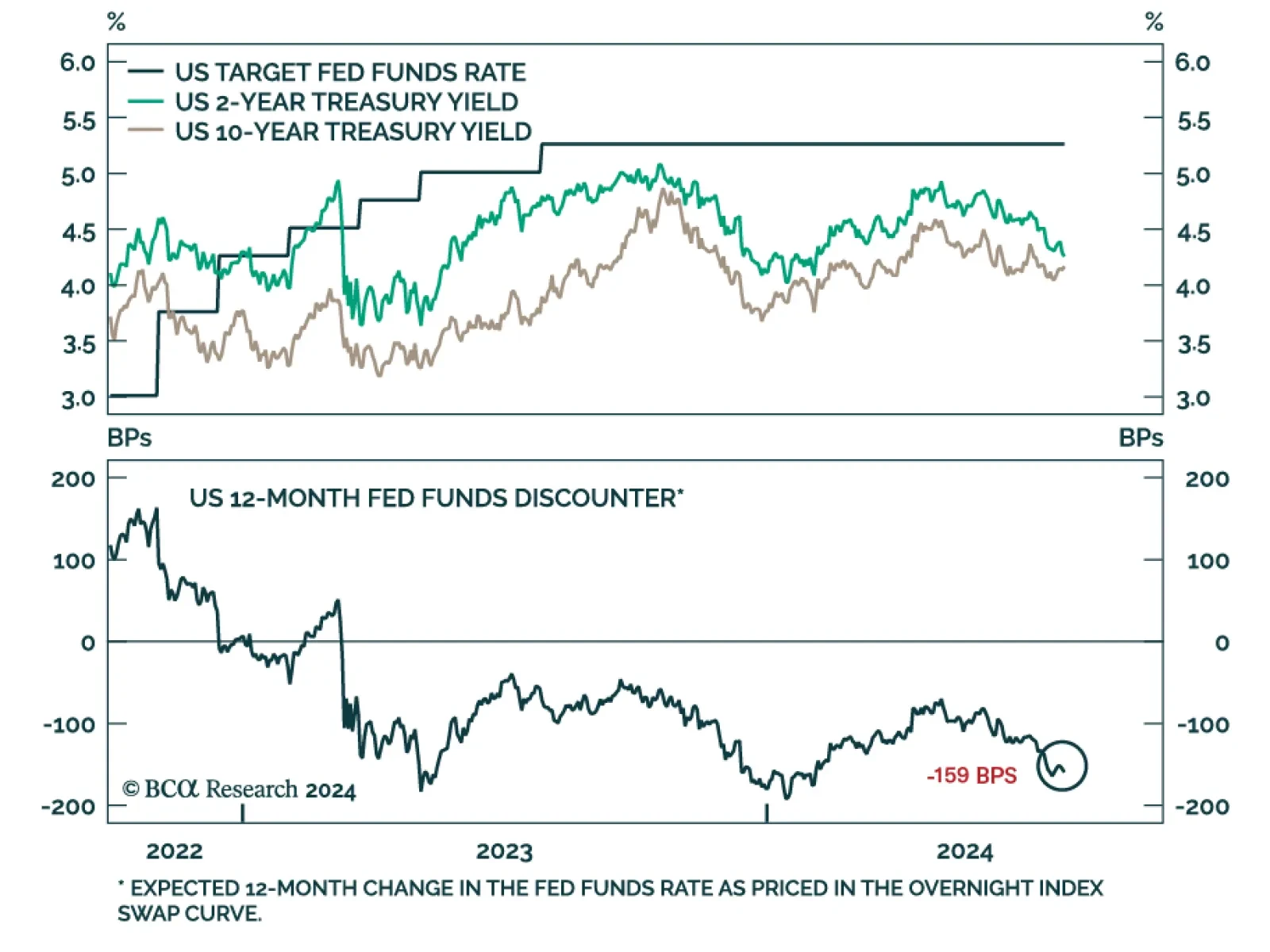

The Fed kept rates steady today, but teed up an initial rate cut in September while putting more emphasis on the employment side of its dual mandate.

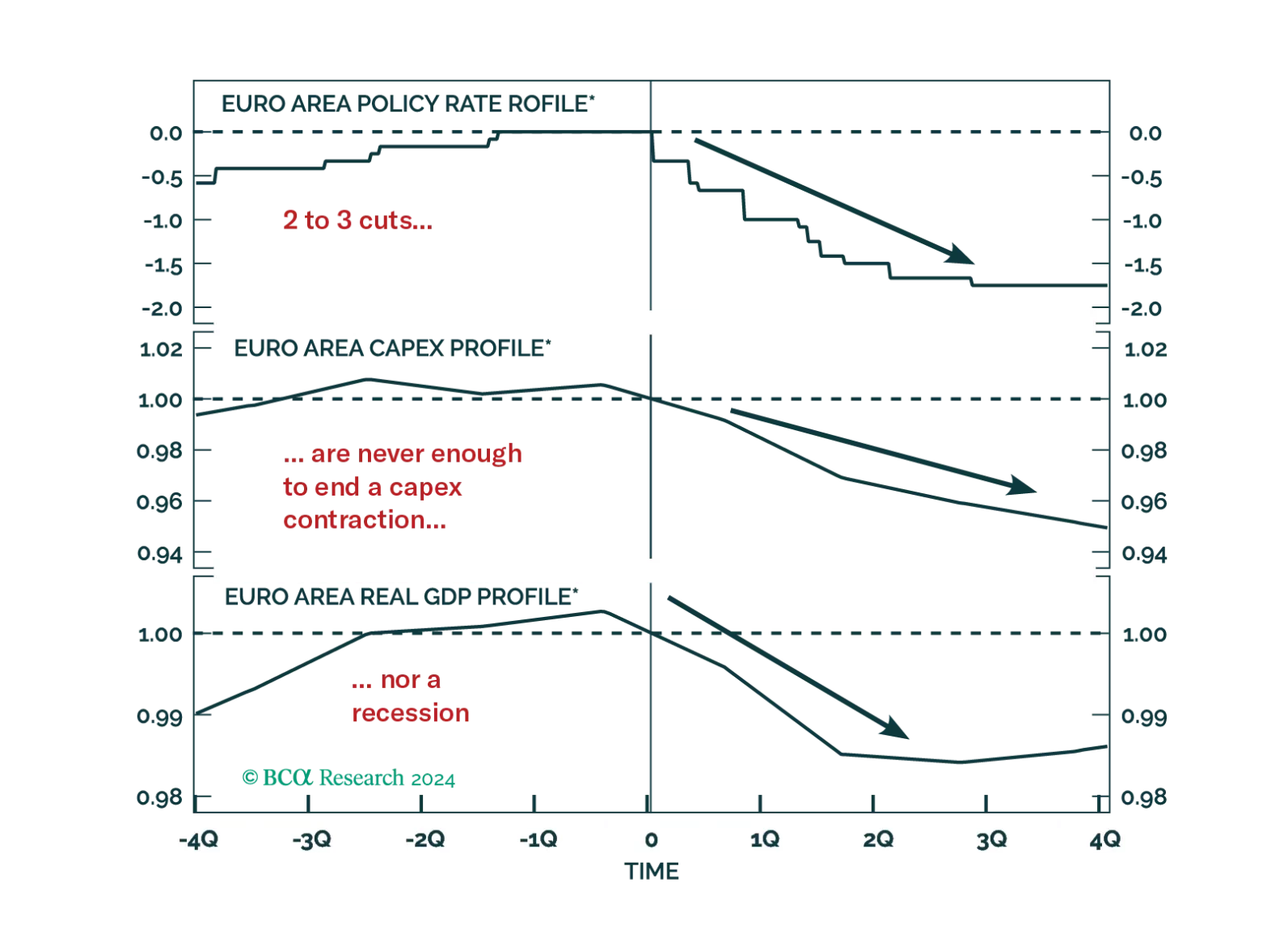

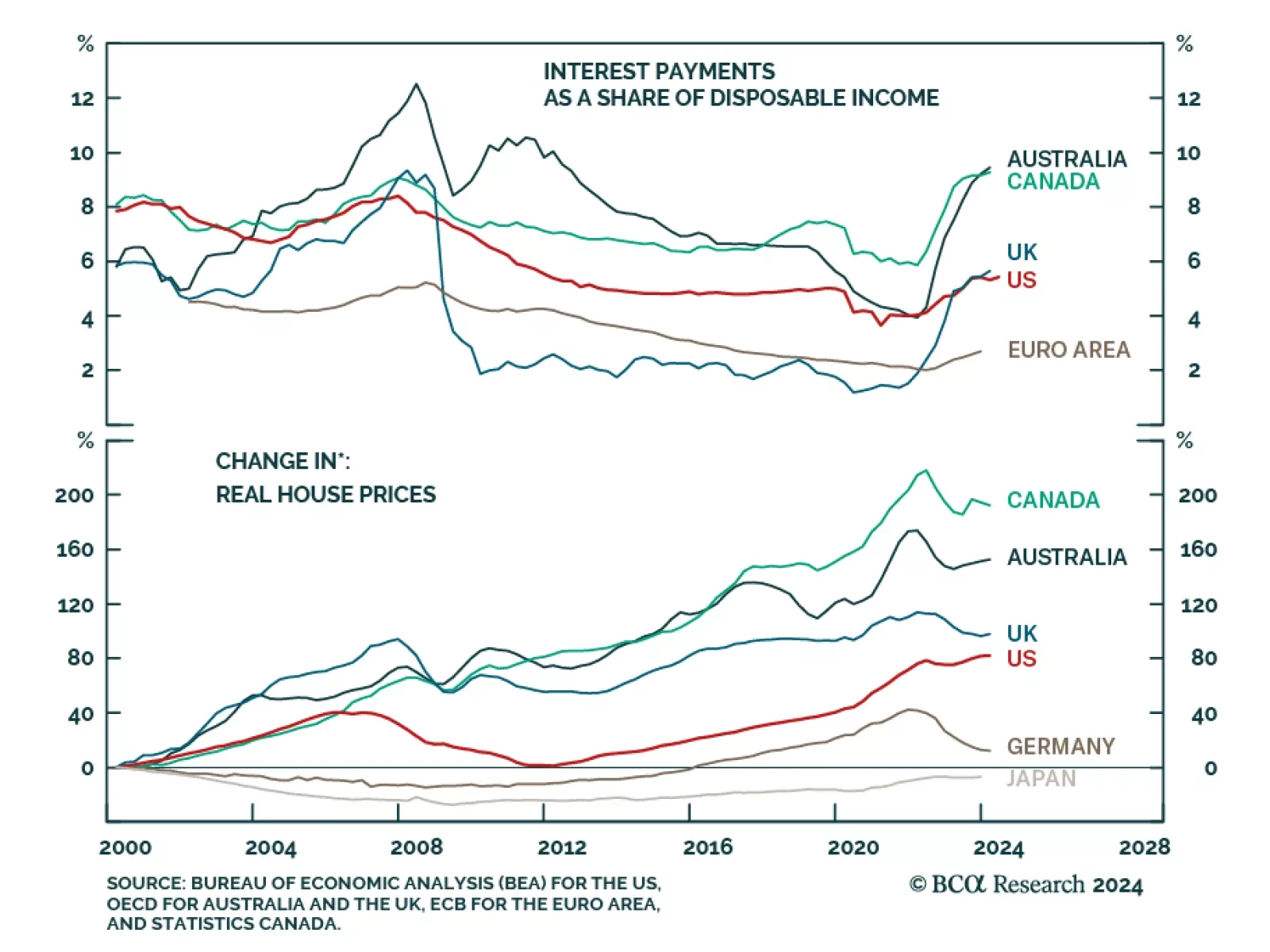

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?

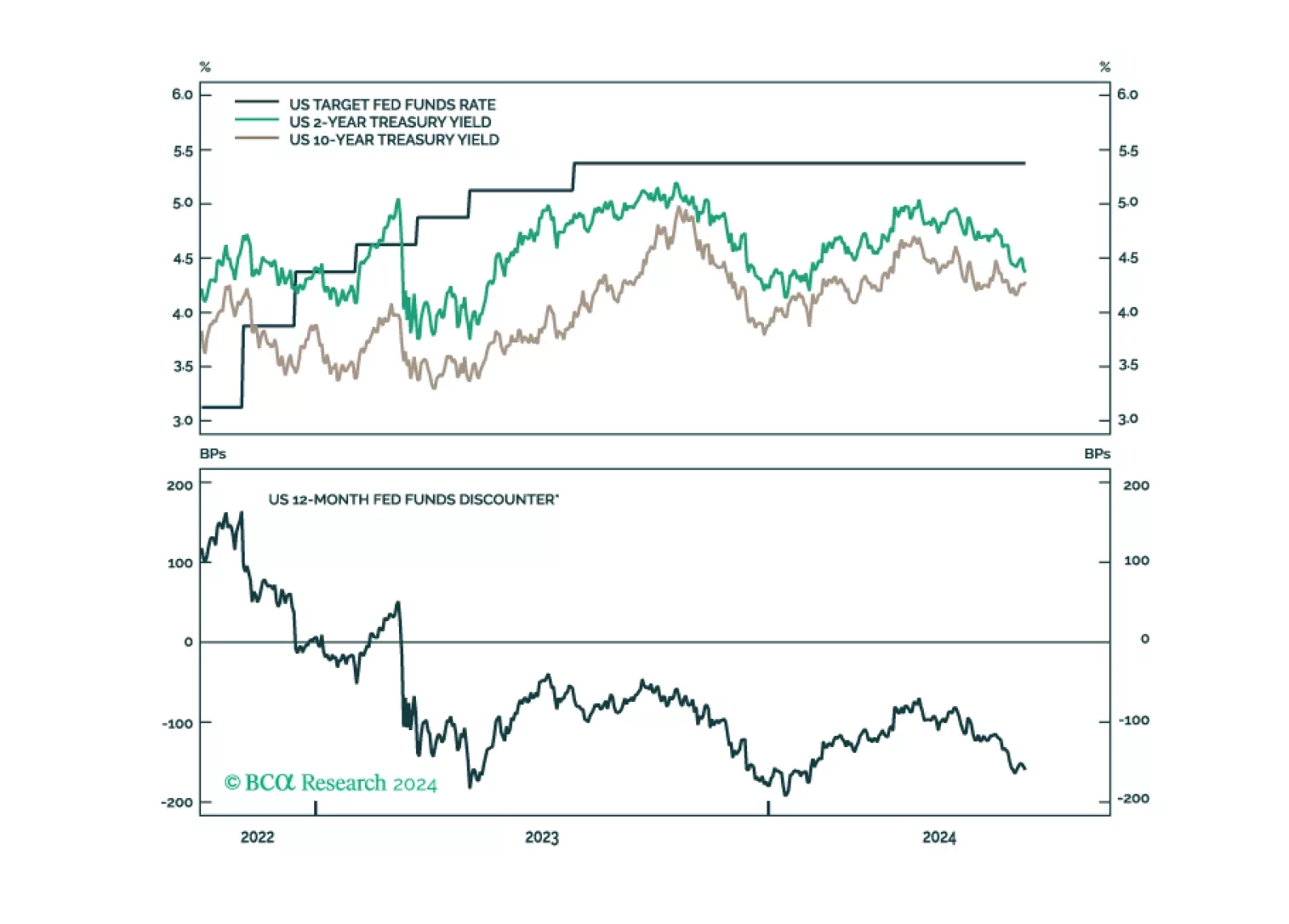

This report takes a look at bond and FX market technical indicators and calibrates the decision to increase portfolio duration and get long the US dollar.

According to BCA Research’s US Bond Strategy service, it is time to increase portfolio duration from “at benchmark” to “above benchmark” on a 6-12 month horizon. Since February, our colleagues…

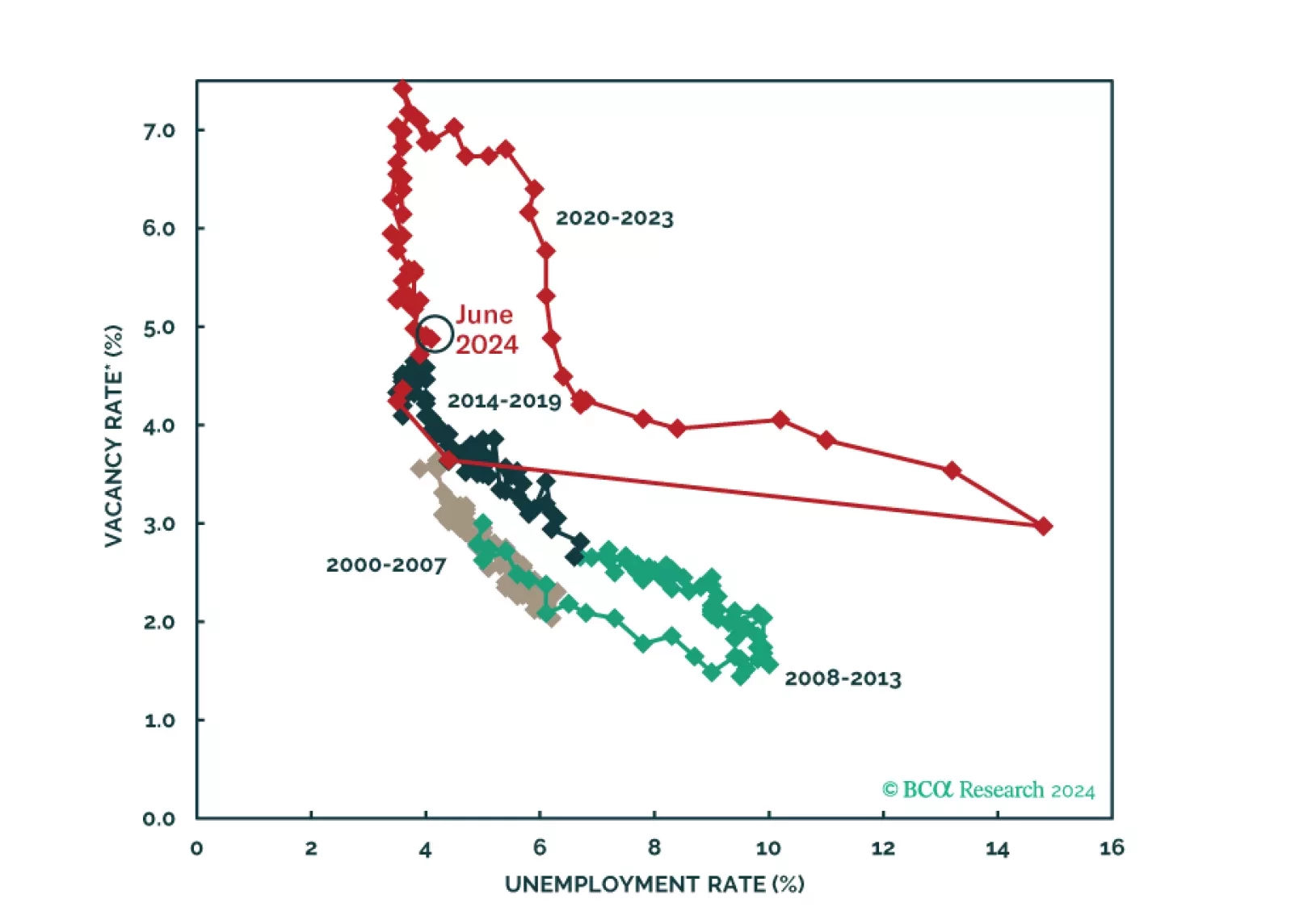

We have high conviction that continued labor market softening will tip the US economy into a recession by year-end or early next year. It will reverberate to the rest of the world given that the US has been the main driver of…

After this morning’s jobless claims number, we have now seen enough deterioration in our preferred labor market indicators to increase portfolio duration from “at benchmark” to “above benchmark”.

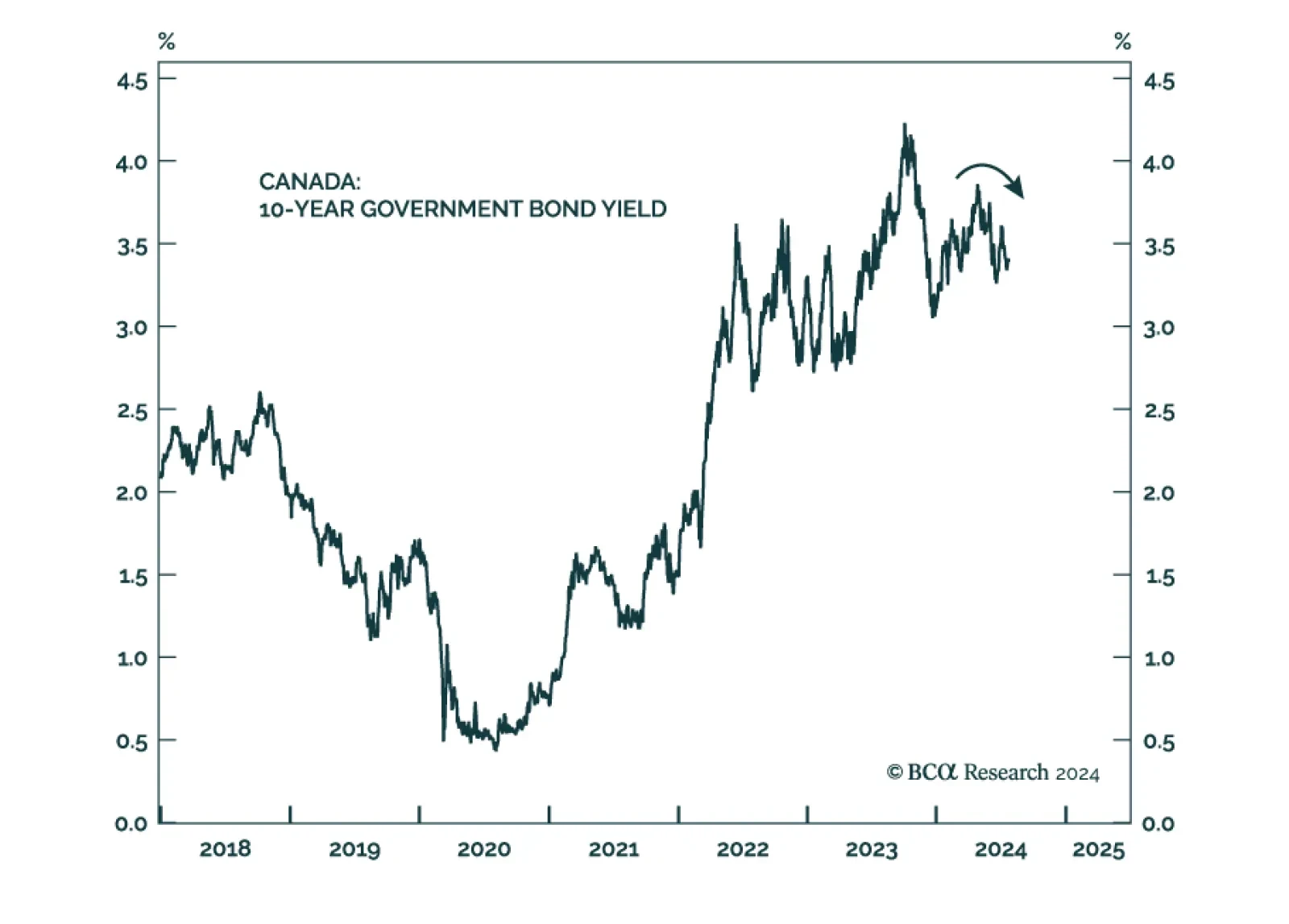

The Bank of Canada (BoC) reduced its policy rate by 25bps for the second meeting in a row on Wednesday. We highlighted in a recent Insight that the soft June inflation print and weakening labor market increased the odds of more…

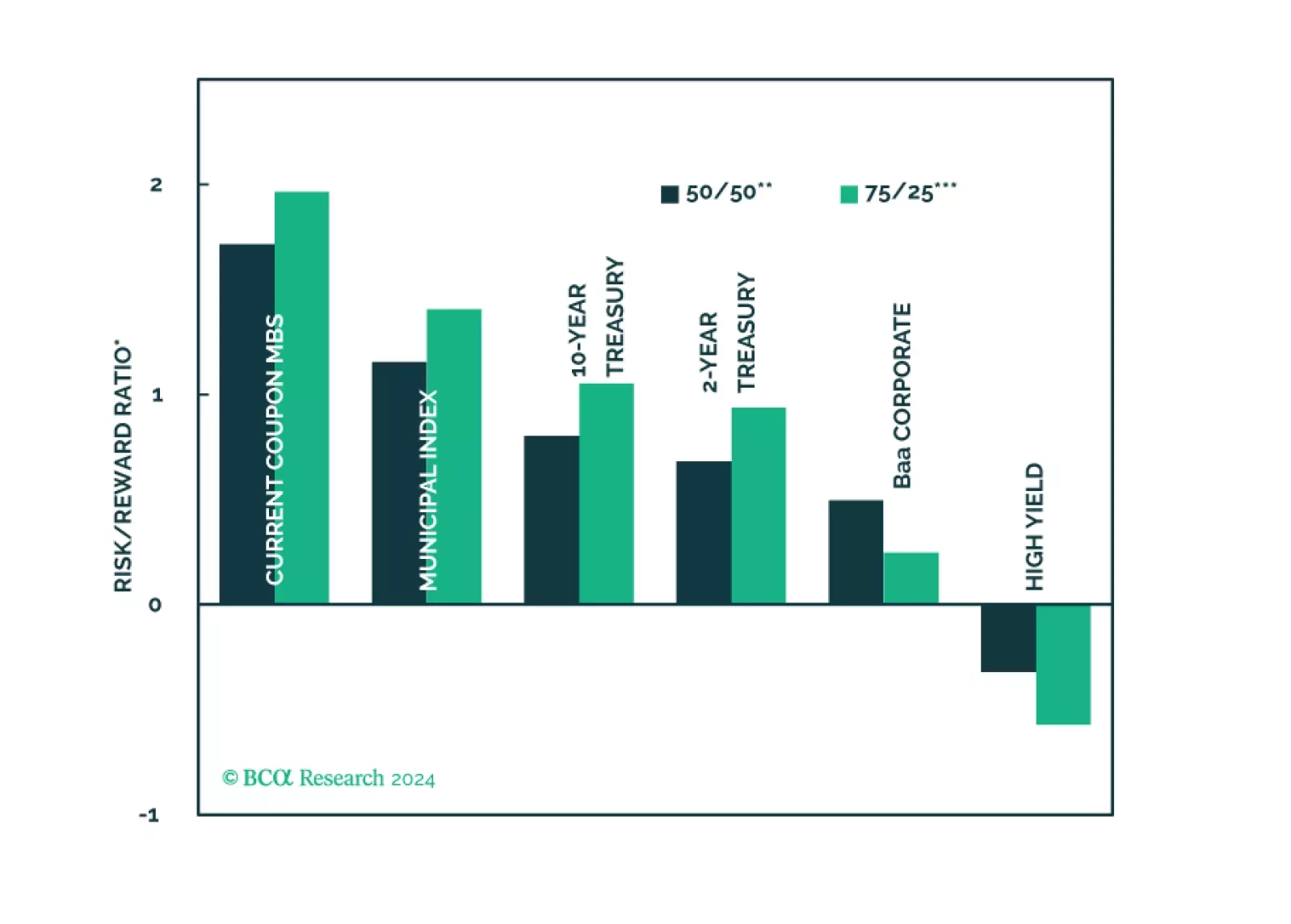

We calculate expected returns for several different US fixed income sectors with a focus on how municipal bonds stack up against the investment alternatives.

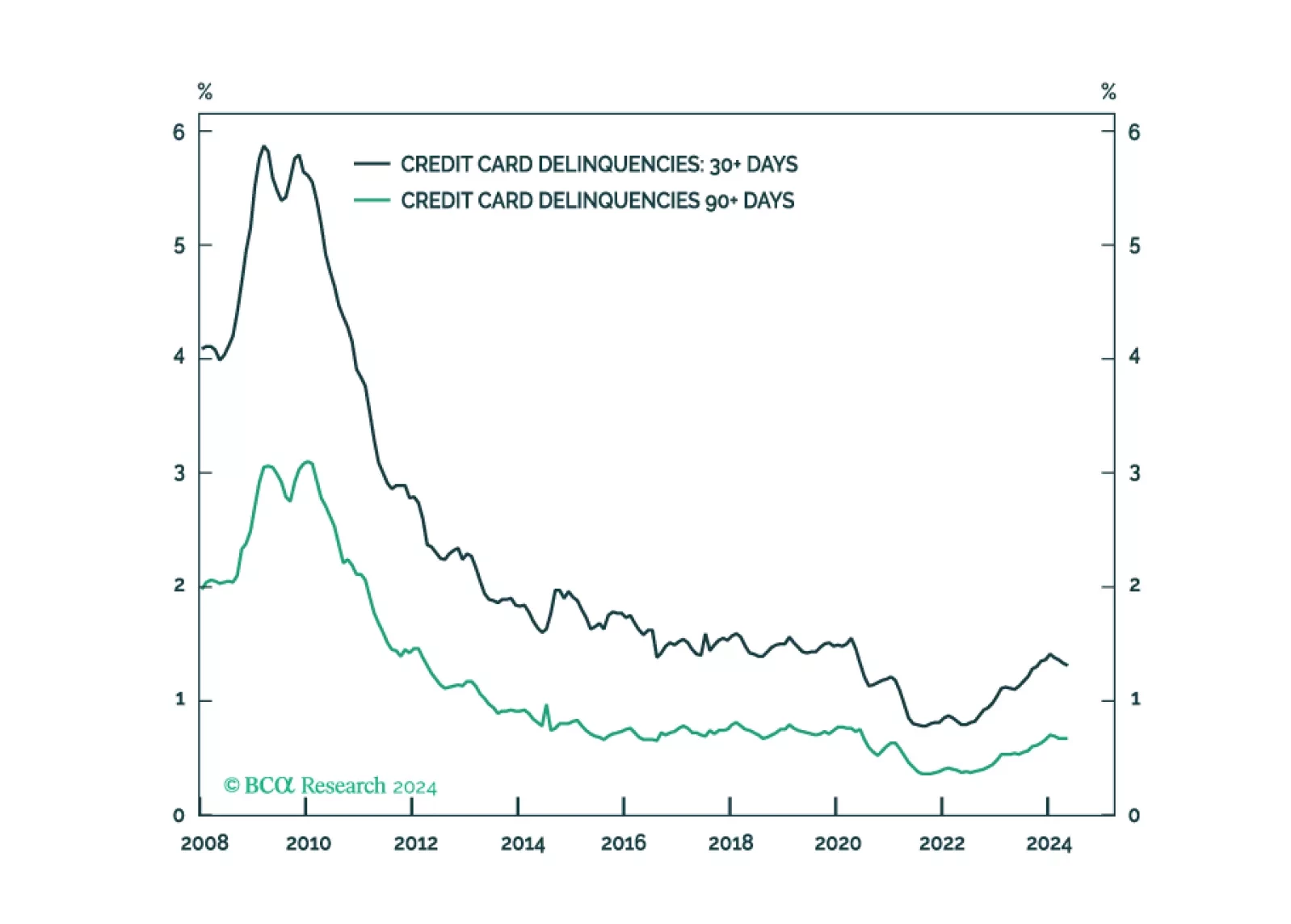

It’s status quo for the SIFI banks, as they don’t see consumer credit performance materially worsening from now-normalized levels and they are not meaningfully exposed to commercial real estate losses.