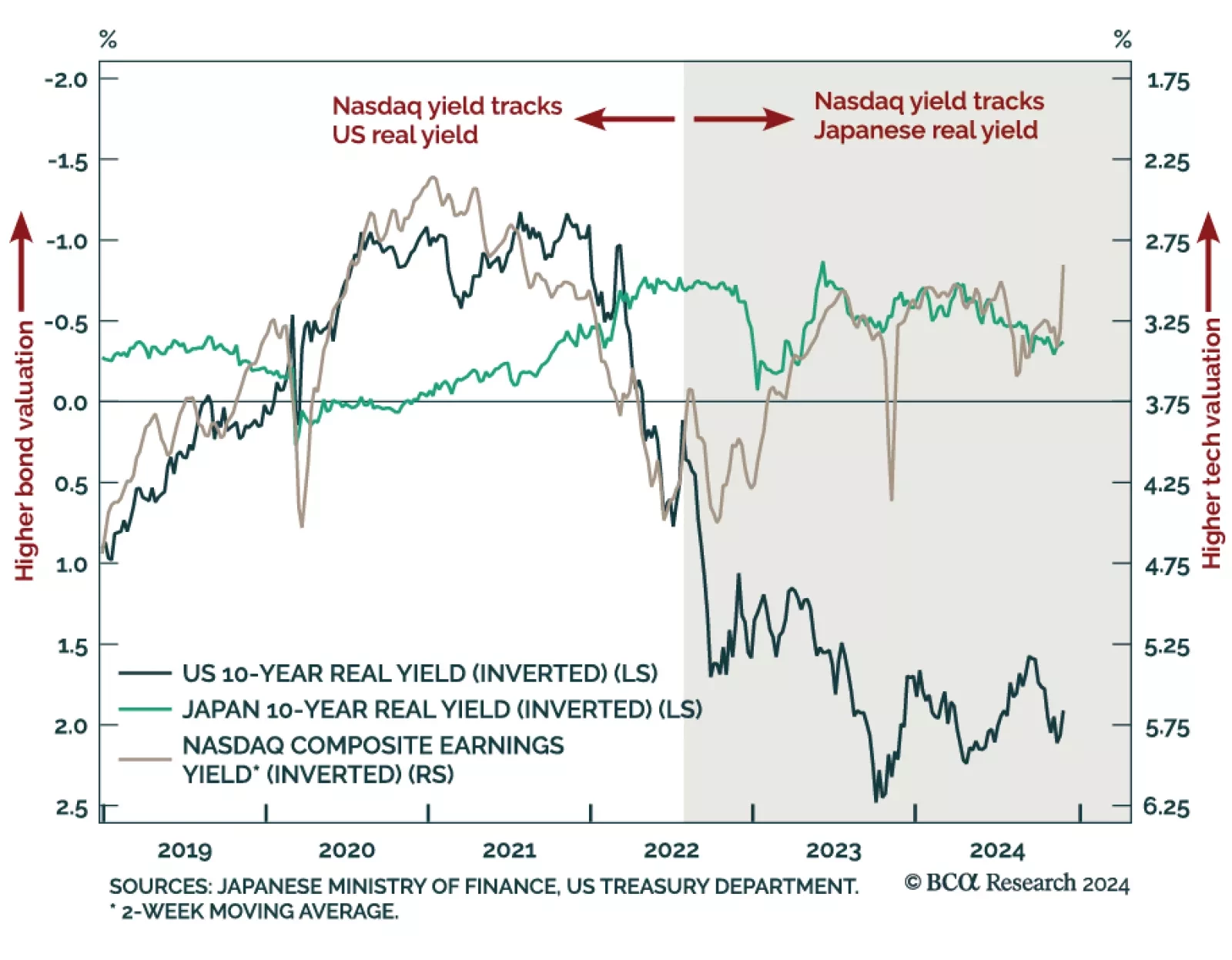

Our Counterpoint strategists published their 2025 outlook; they see major market movements for the year ahead hinging on Japan. Japan remains the cornerstone of global liquidity, with rising Japanese real yields posing a key…

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…

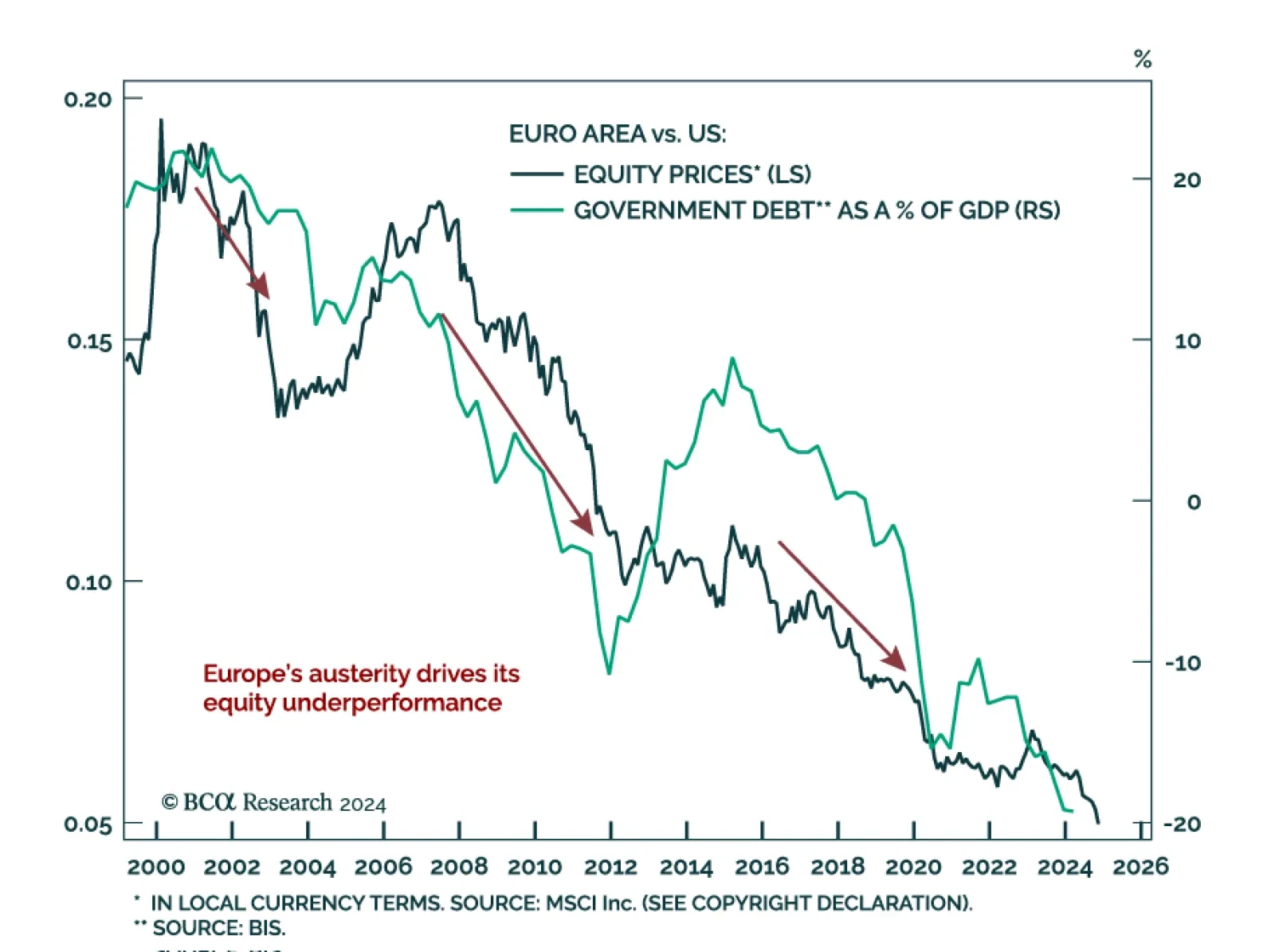

Our European Investment Strategy and GeoMacro Strategy teams published a joint report, digging into the structural challenges behind Europe’s economic underperformance, while pointing out to potential turnaround…

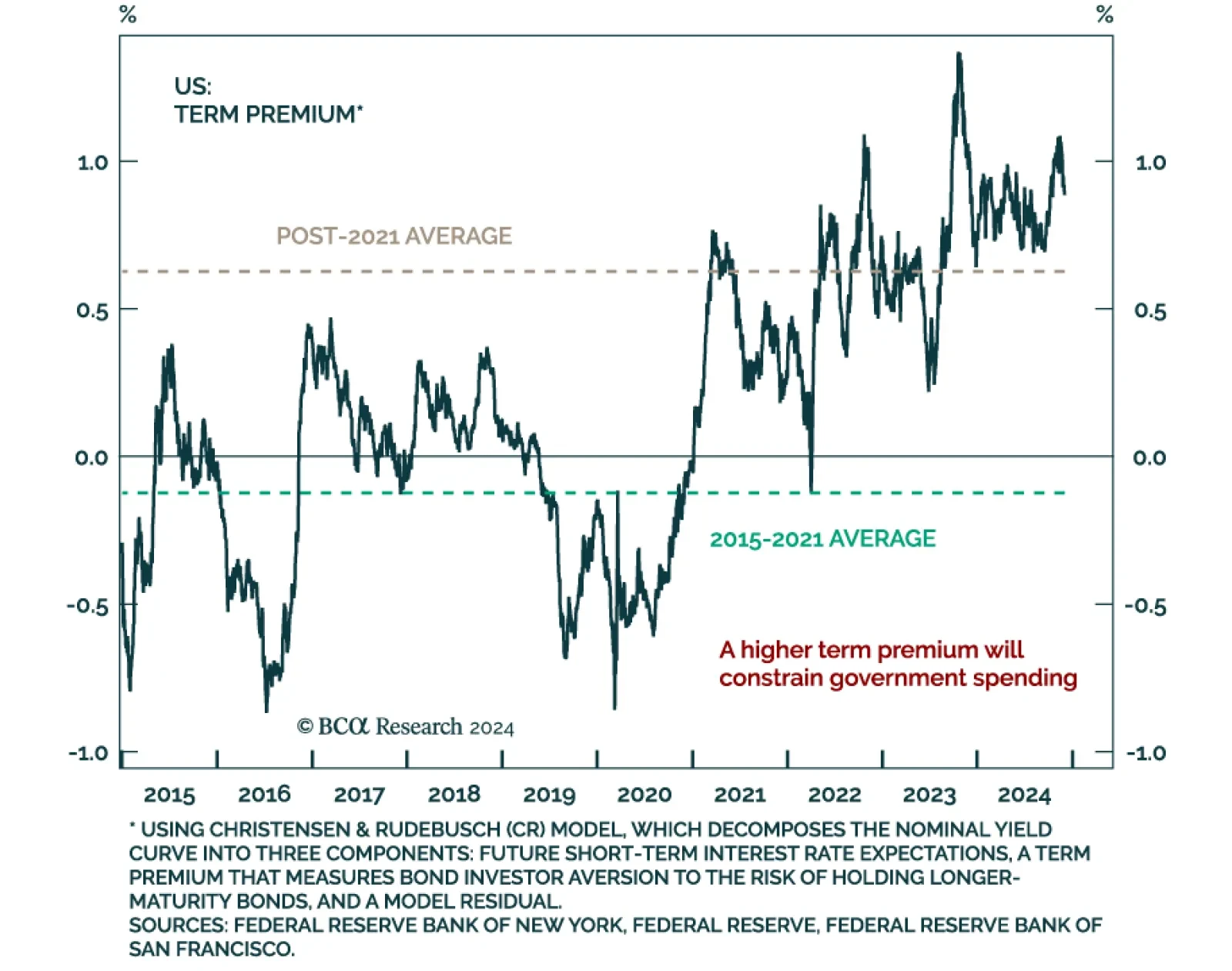

Our Global Asset Allocation strategists published their monthly tactical asset allocation report and foresee a change of trend for 2025. “Thin is back in” for government budgets, growth, and valuations. The post-…

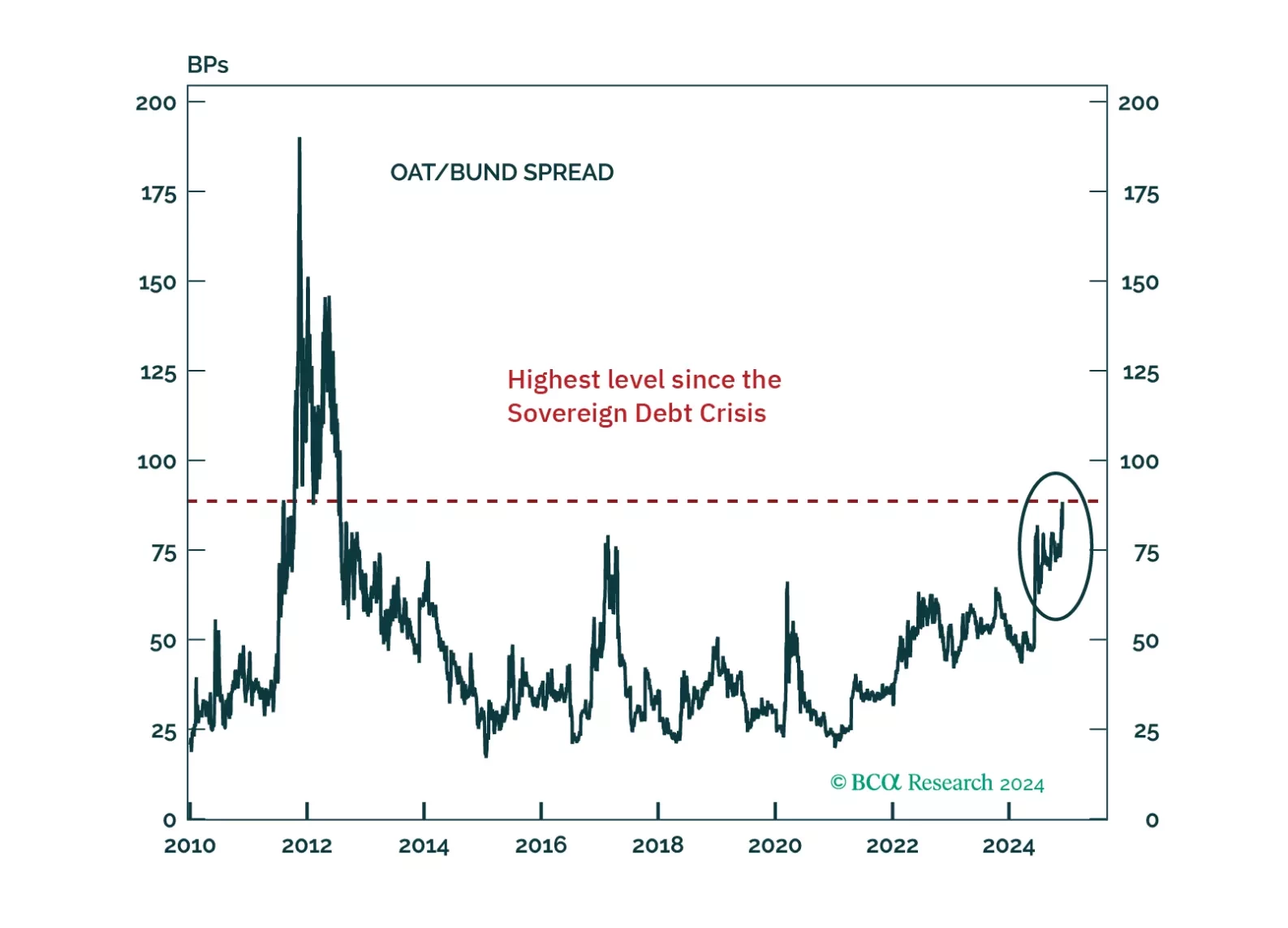

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

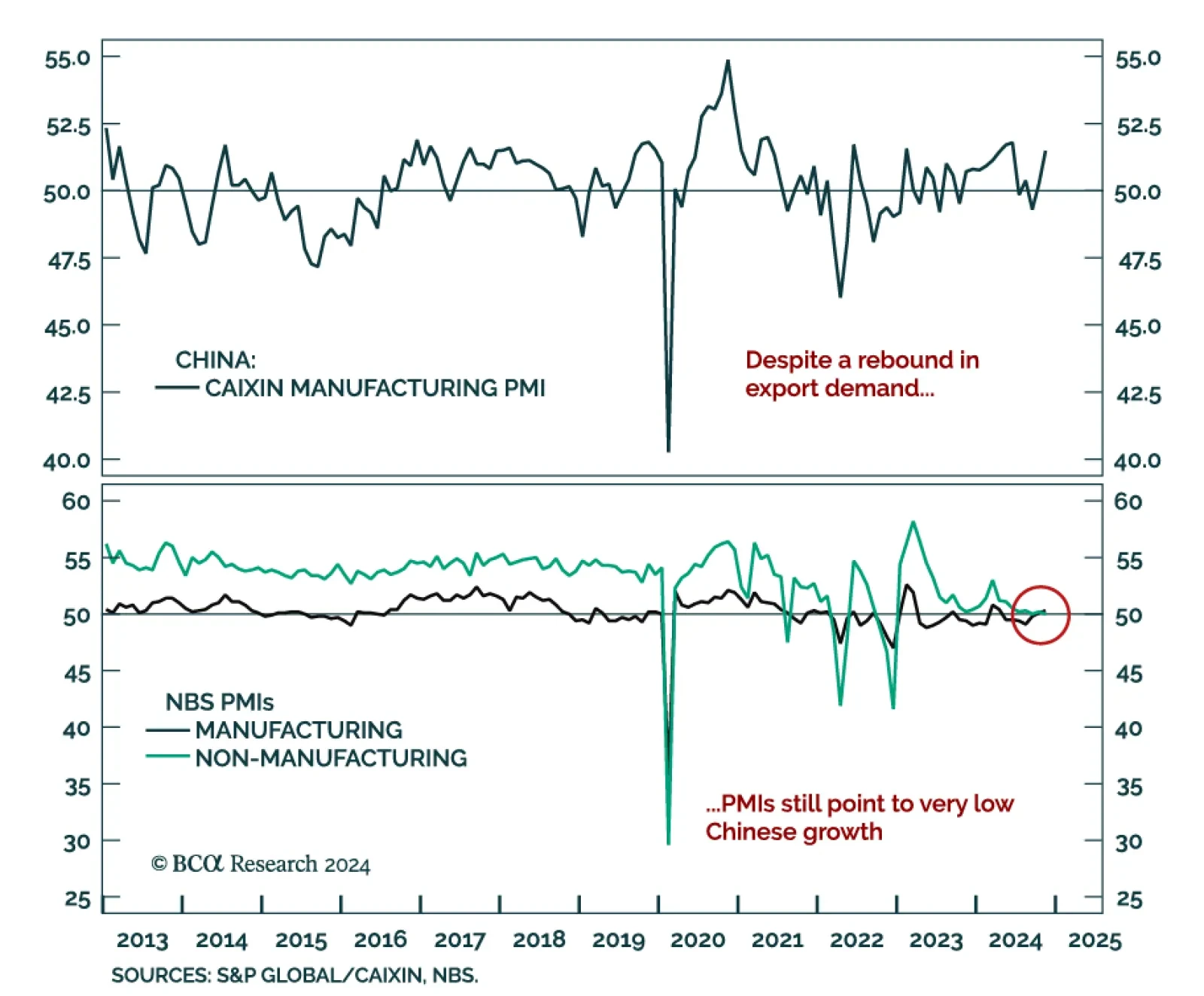

China’s November PMIs were mixed, and reflected very low growth. The official composite PMI was unchanged at 50.8, driven by a small uptick in manufacturing to 50.3 and a small downtick of services to 50. The Caixin…

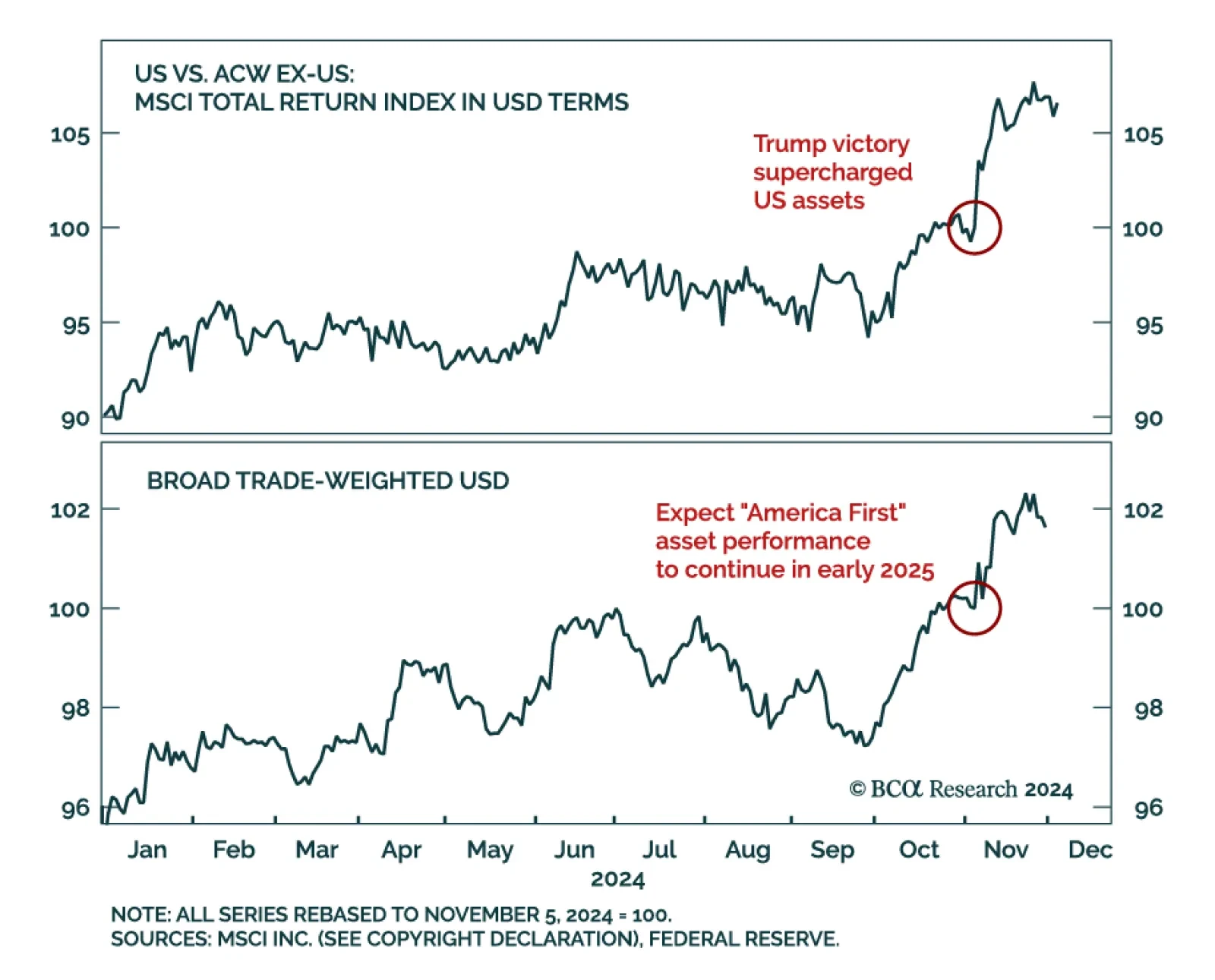

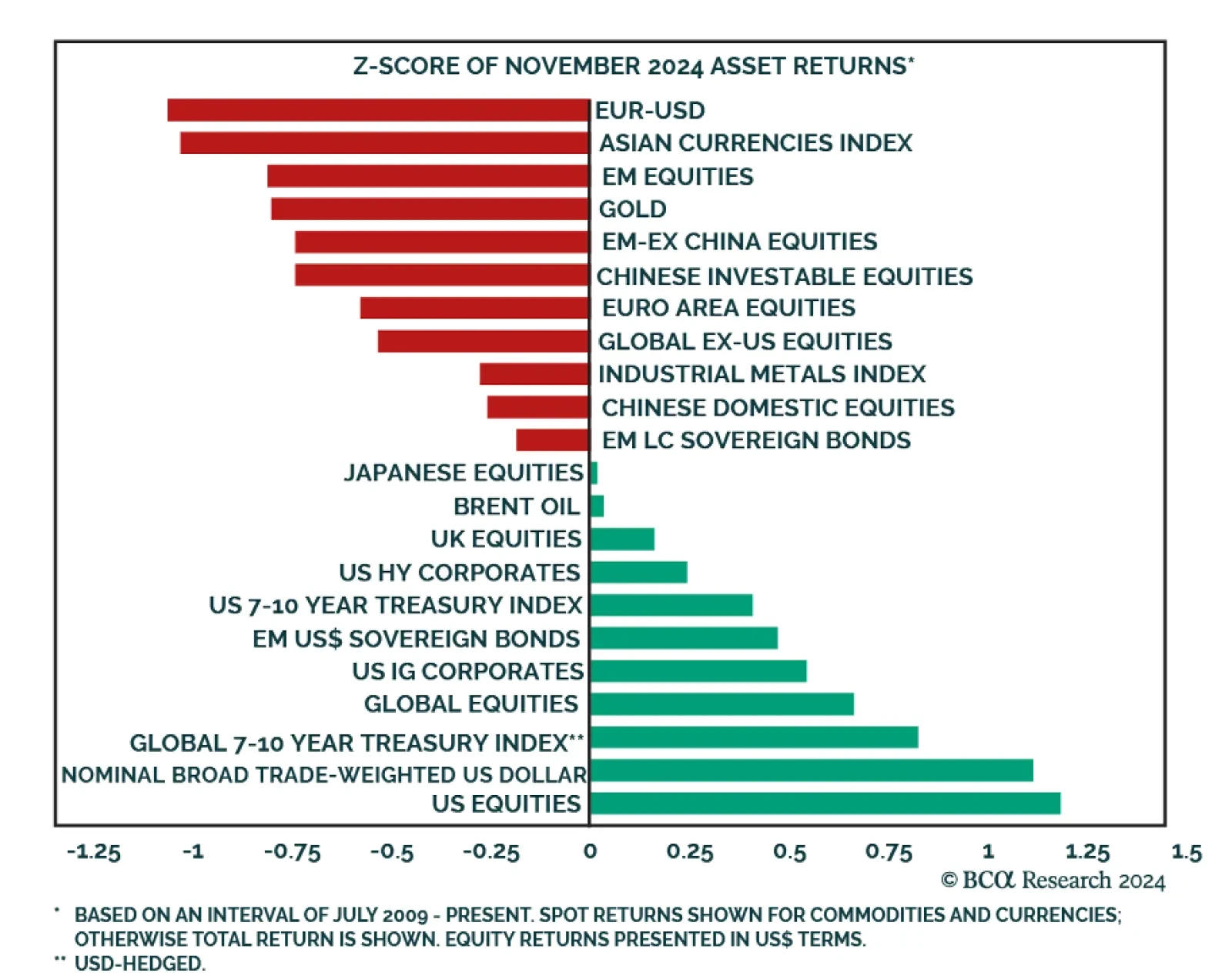

November trading was centered around the US election and its aftermath. US assets led the way, with US equities significantly outperforming their global counterparts. The US dollar strengthened considerably against both DM and EM…

The post-COVID recovery has been one of excesses. Government deficits have ballooned, tight labor markets have led to a windfall of consumer spending, and equity valuations have soared on the back of lofty growth expectations. But…