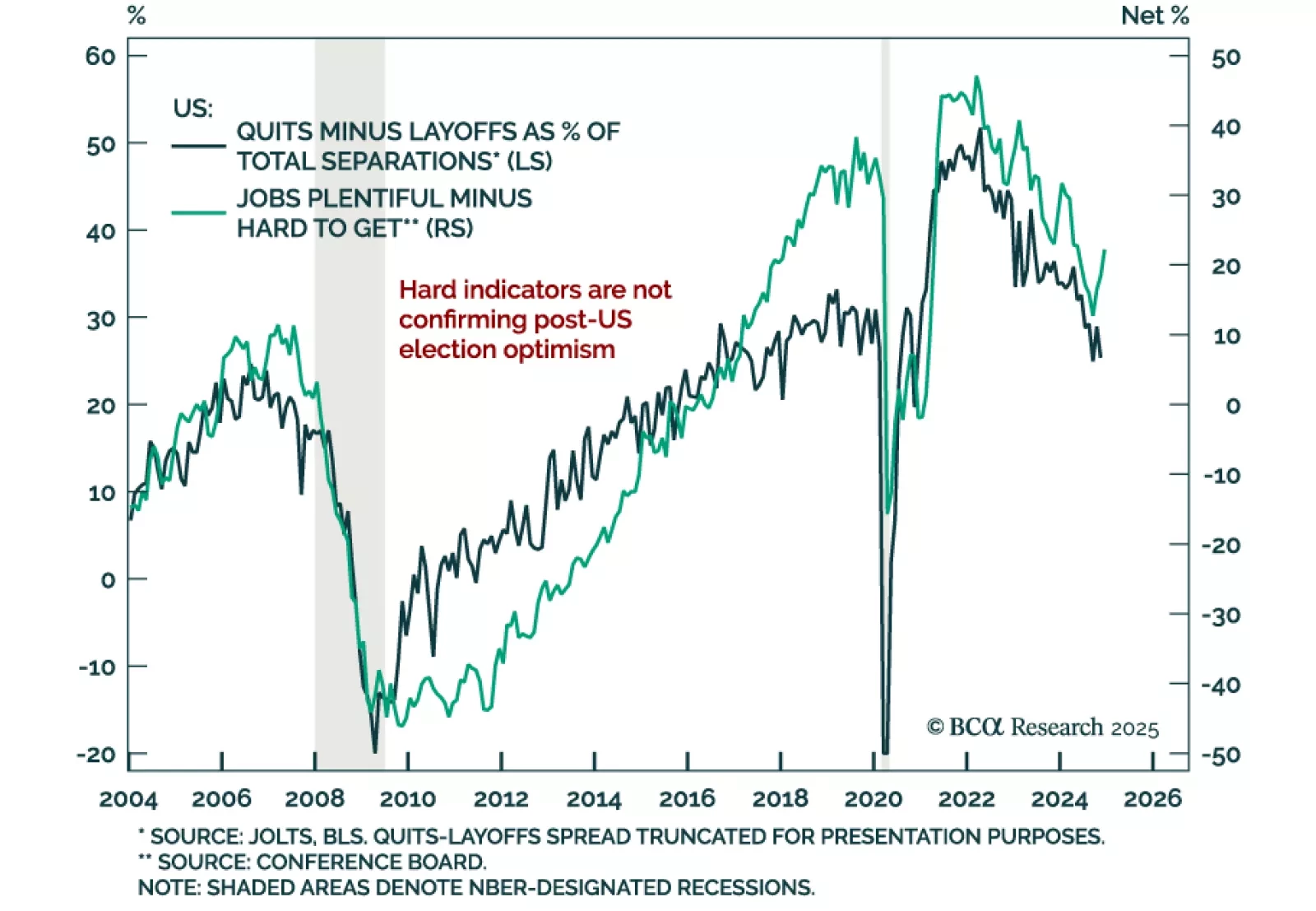

Job openings once again beat expectations in November, increasing to 8.1m from 7.8m in October. However, hires and quits decreased and layoffs increased. The gap between quits and layoffs, a leading indicator of labor market demand,…

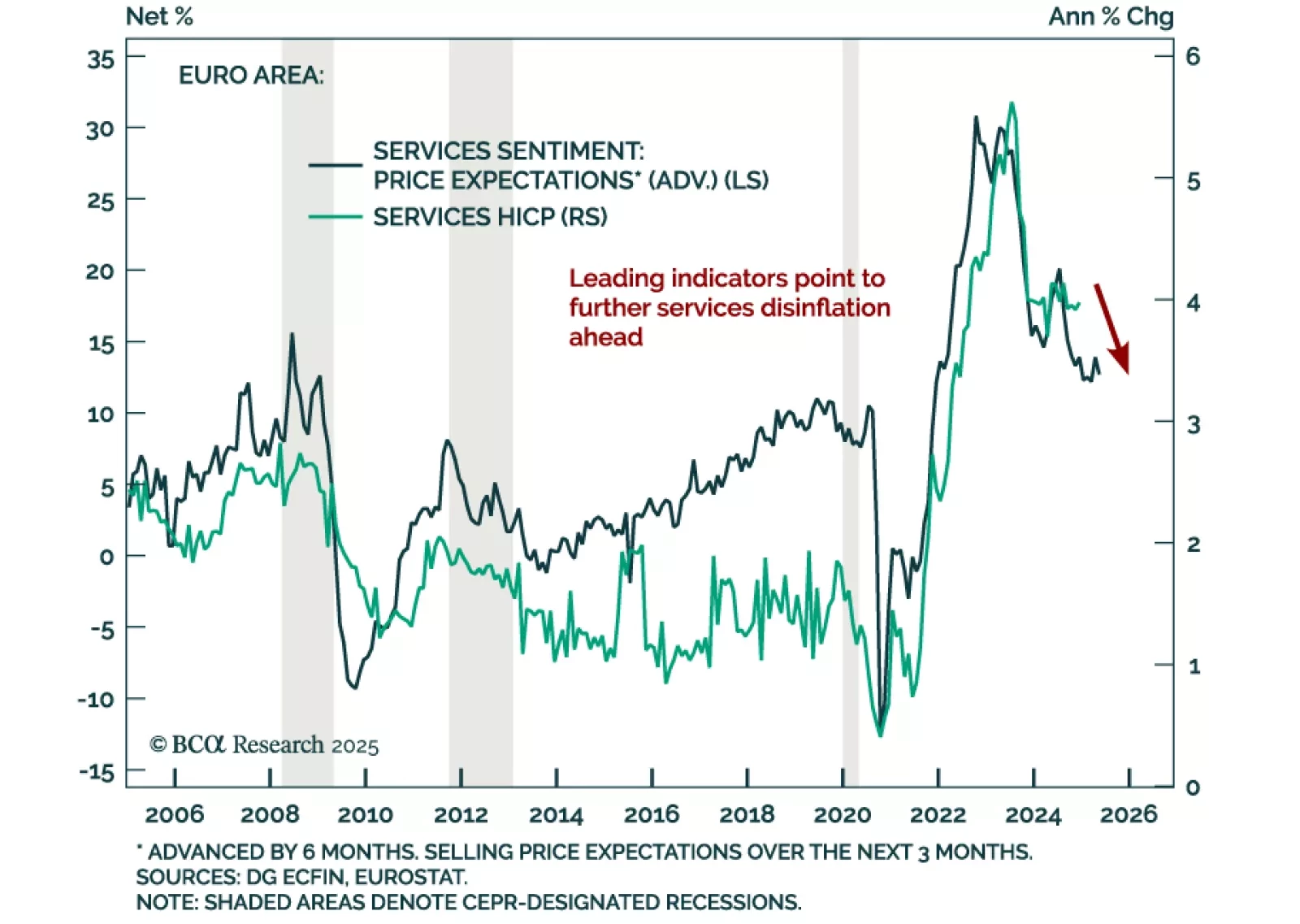

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…

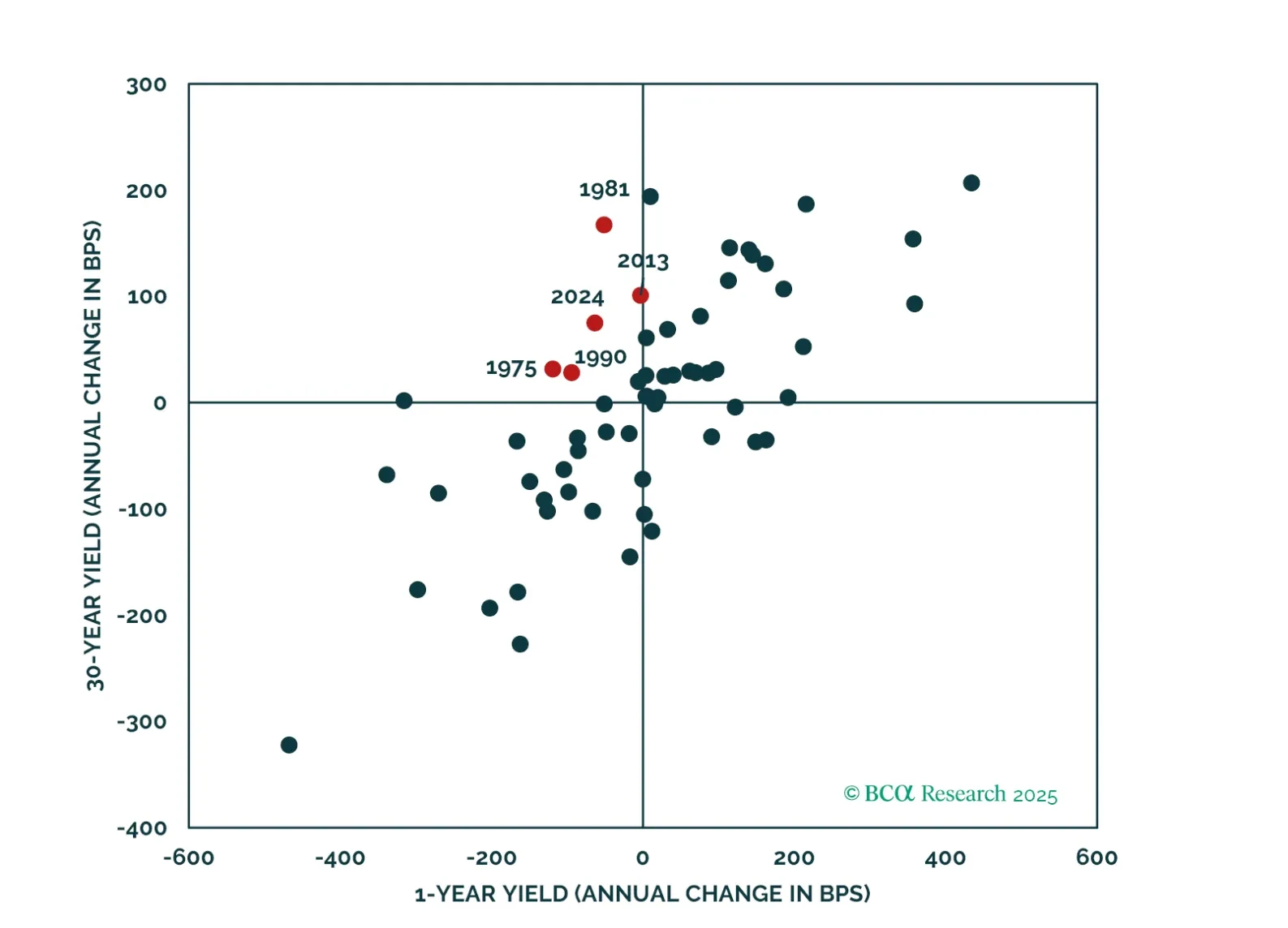

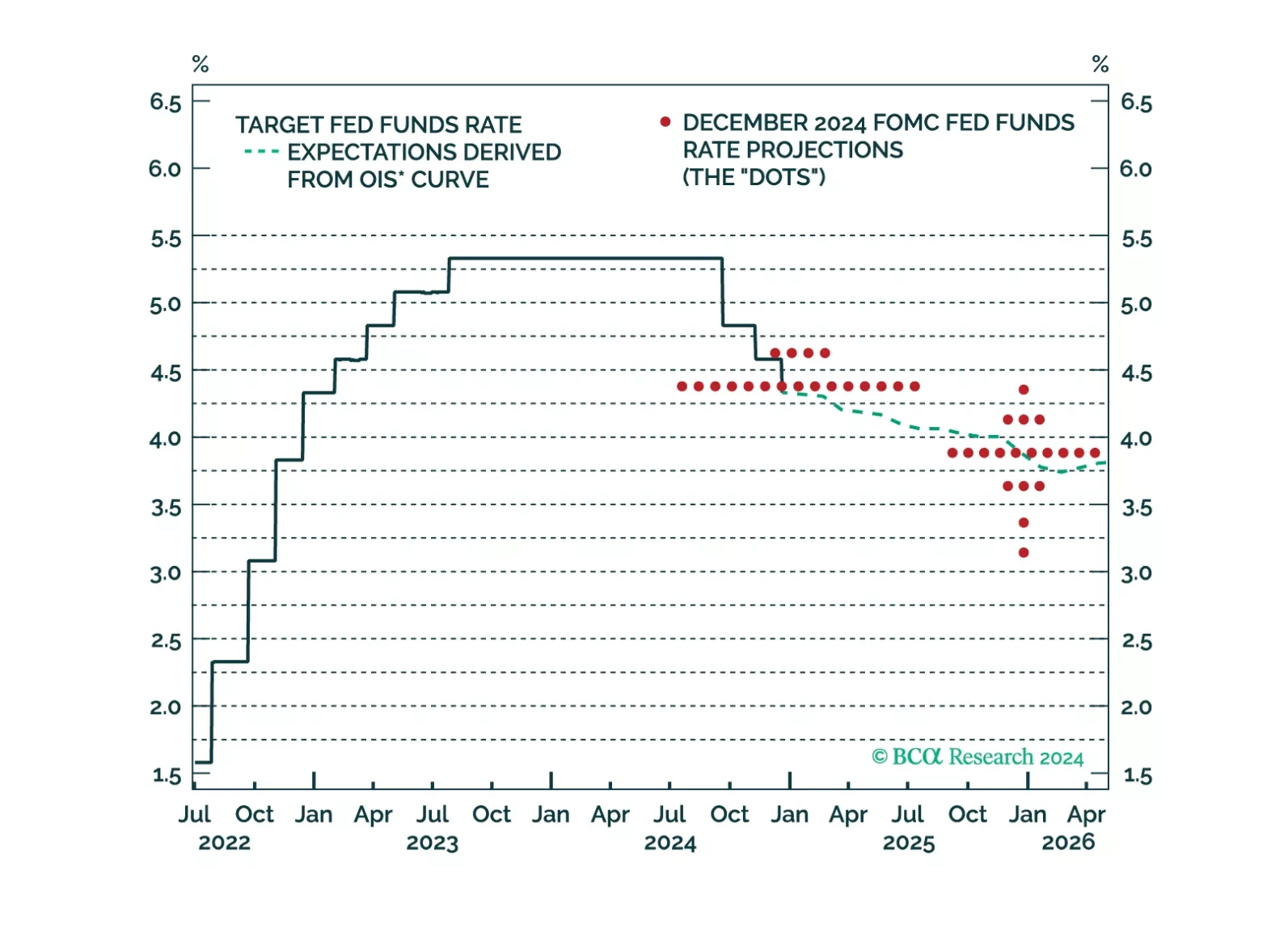

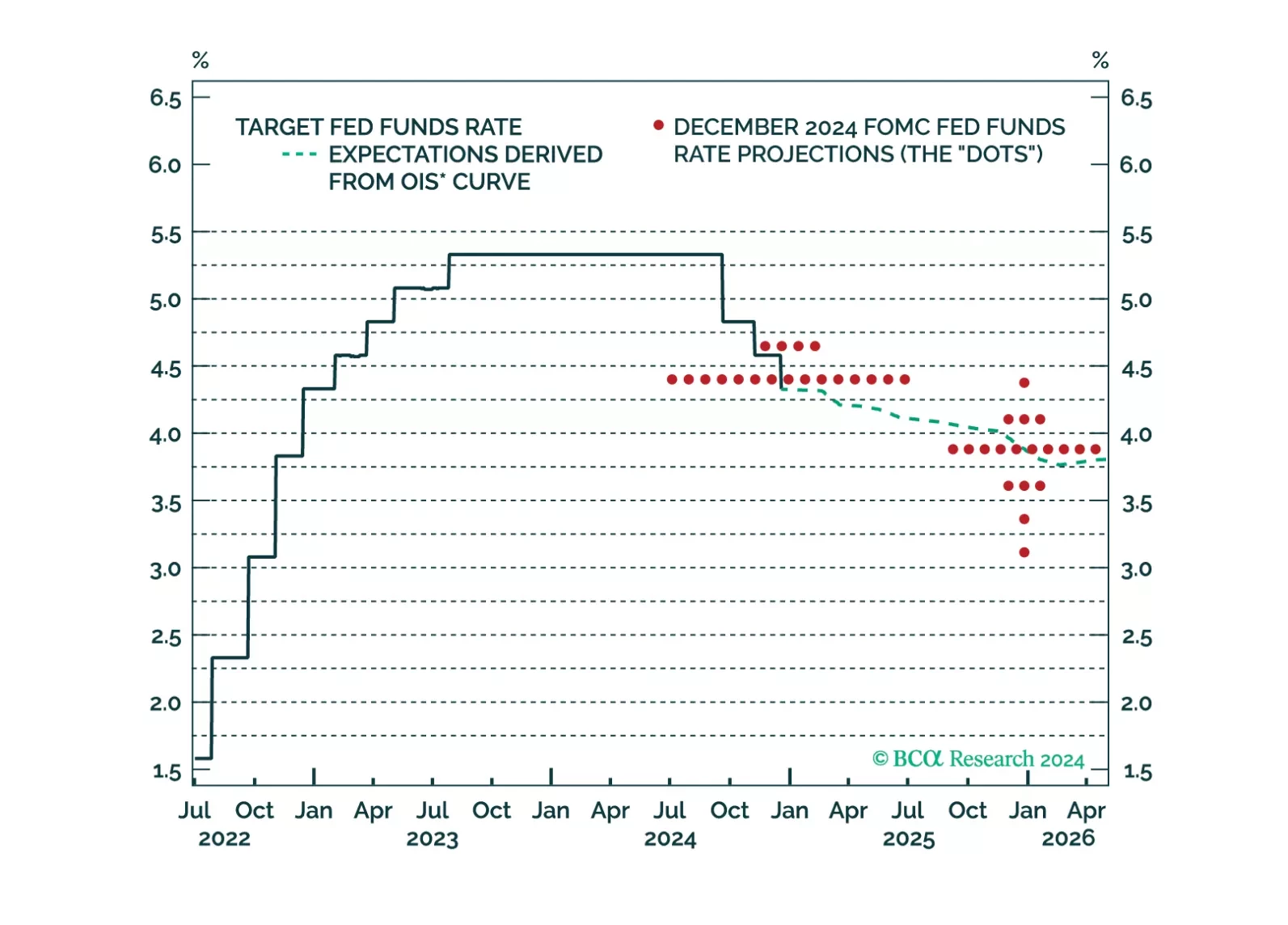

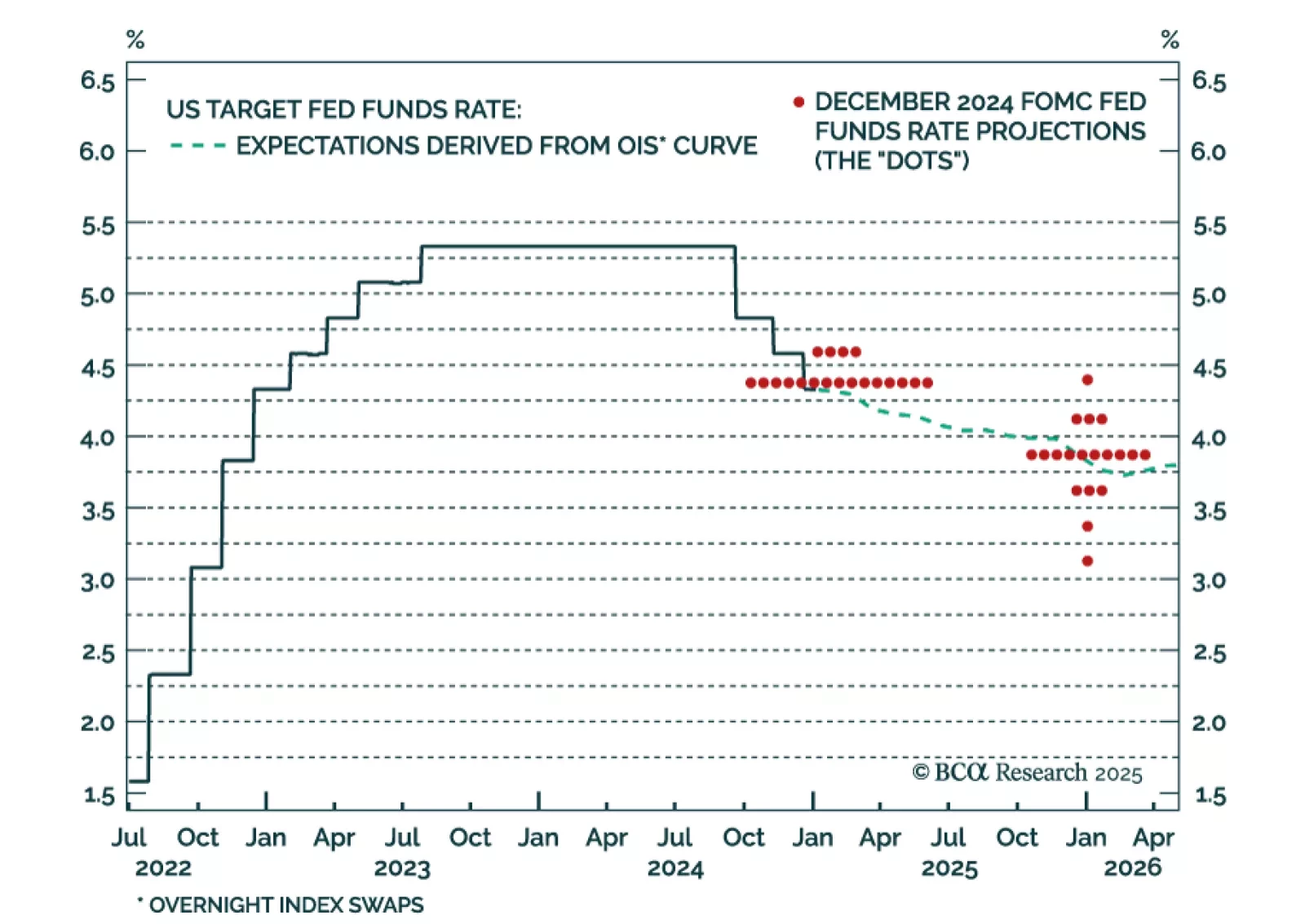

Our US Bond Strategy team published their outlook for the Fed in 2025. They expect more cuts than the 50 bps signaled by the Fed at its December meeting. Core PCE inflation is tracking well below the Fed’s 2.5% forecast, while…

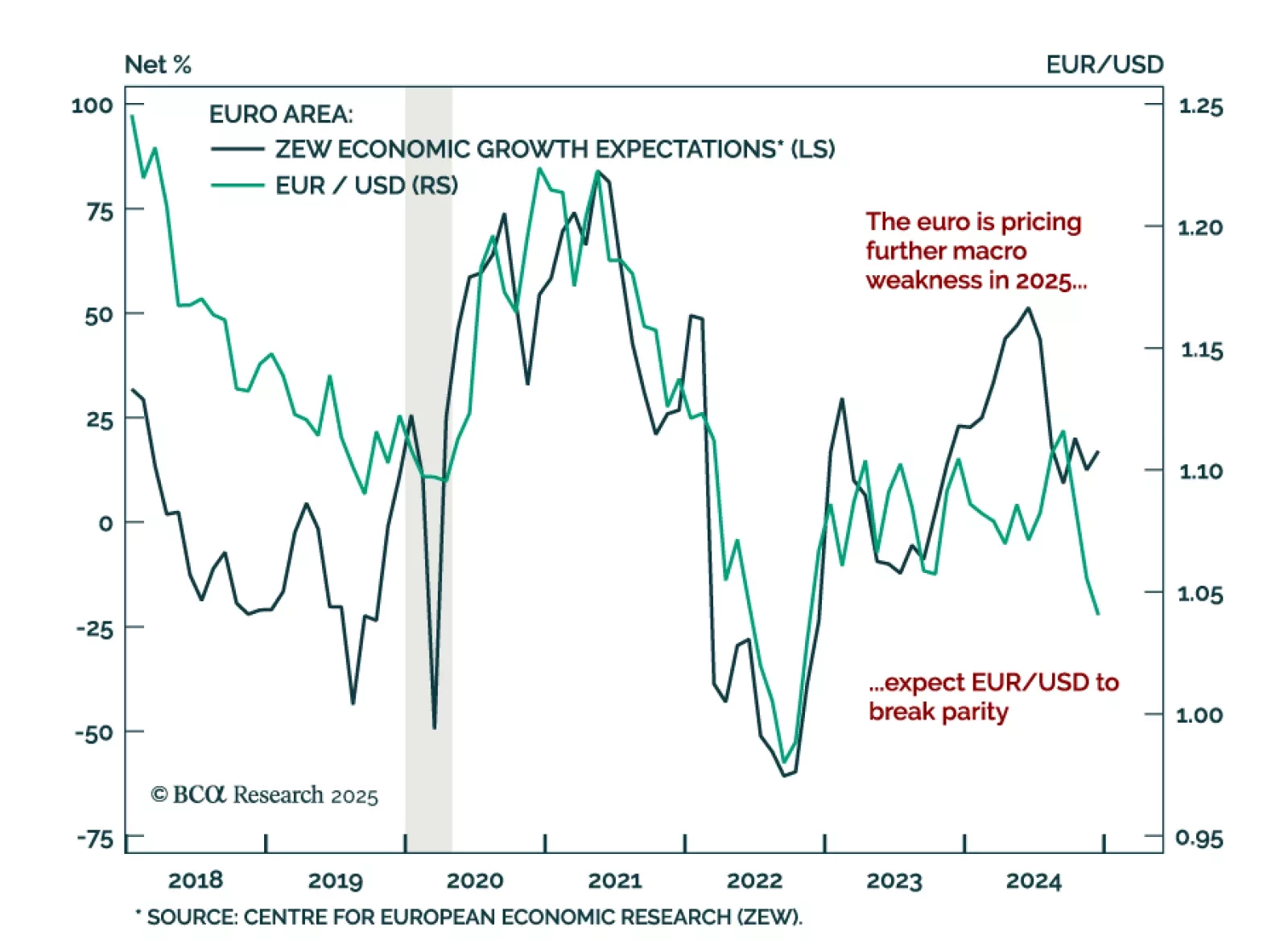

The euro broke the support level of its 2-year trading range against the USD, extending the strong dollar trend witnessed since September of last year. This trend will continue in Q1 2025. Despite global yields rallying in late…

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

Our Global Asset Allocation strategists upheld their yearly tradition of putting together reading or listening recommendations for the holiday period. This year, our strategists and research teams sent their best recommendations for…

Our thoughts on this afternoon’s Fed decision and the bond market reaction.

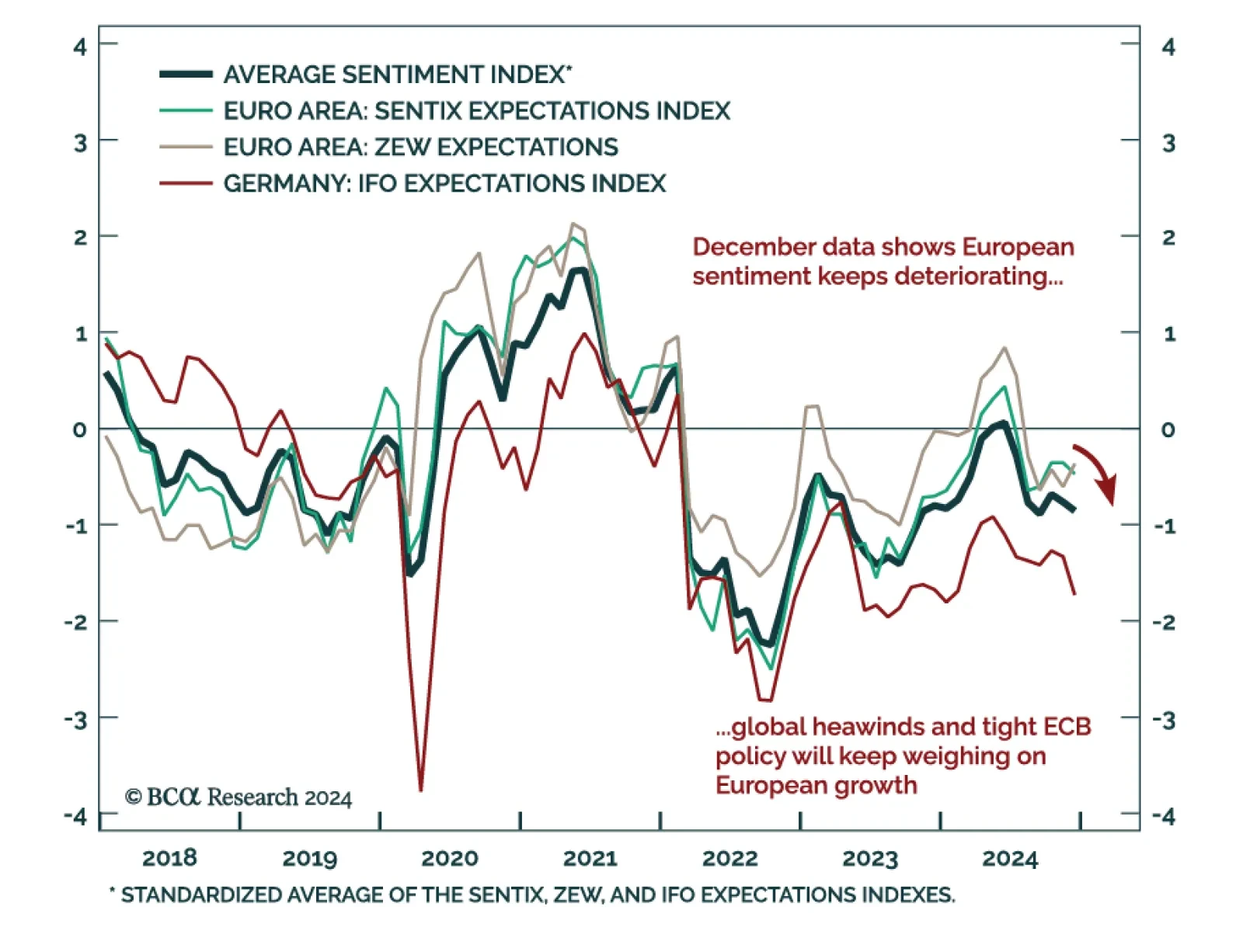

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

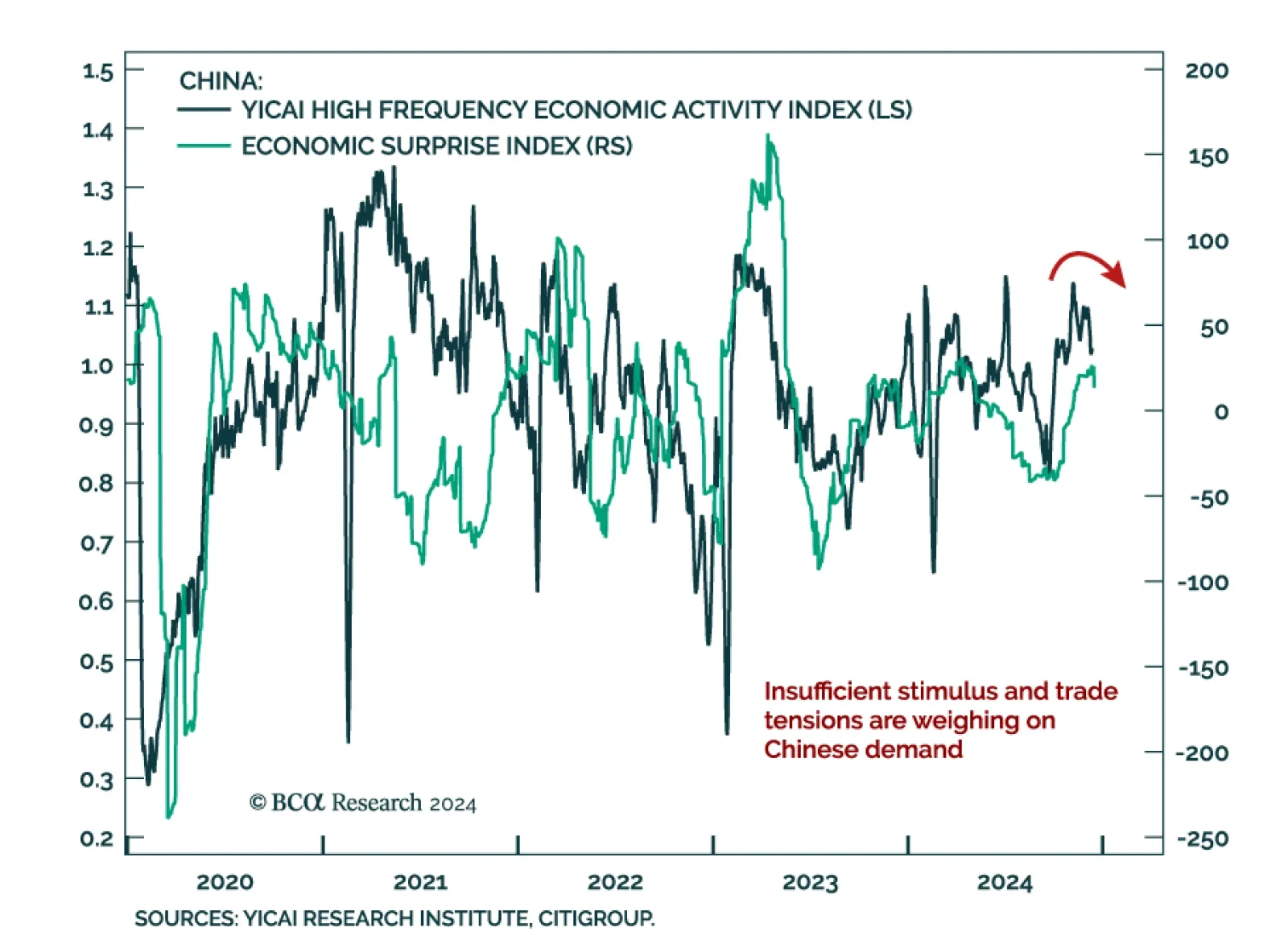

Chinese activity indicators were mixed in November, reflecting the dynamic of a resilient supply side coupled with weak demand. Industrial production growth was roughly flat at 5.4% y/y vs. 5.3% in October, while retail sales…