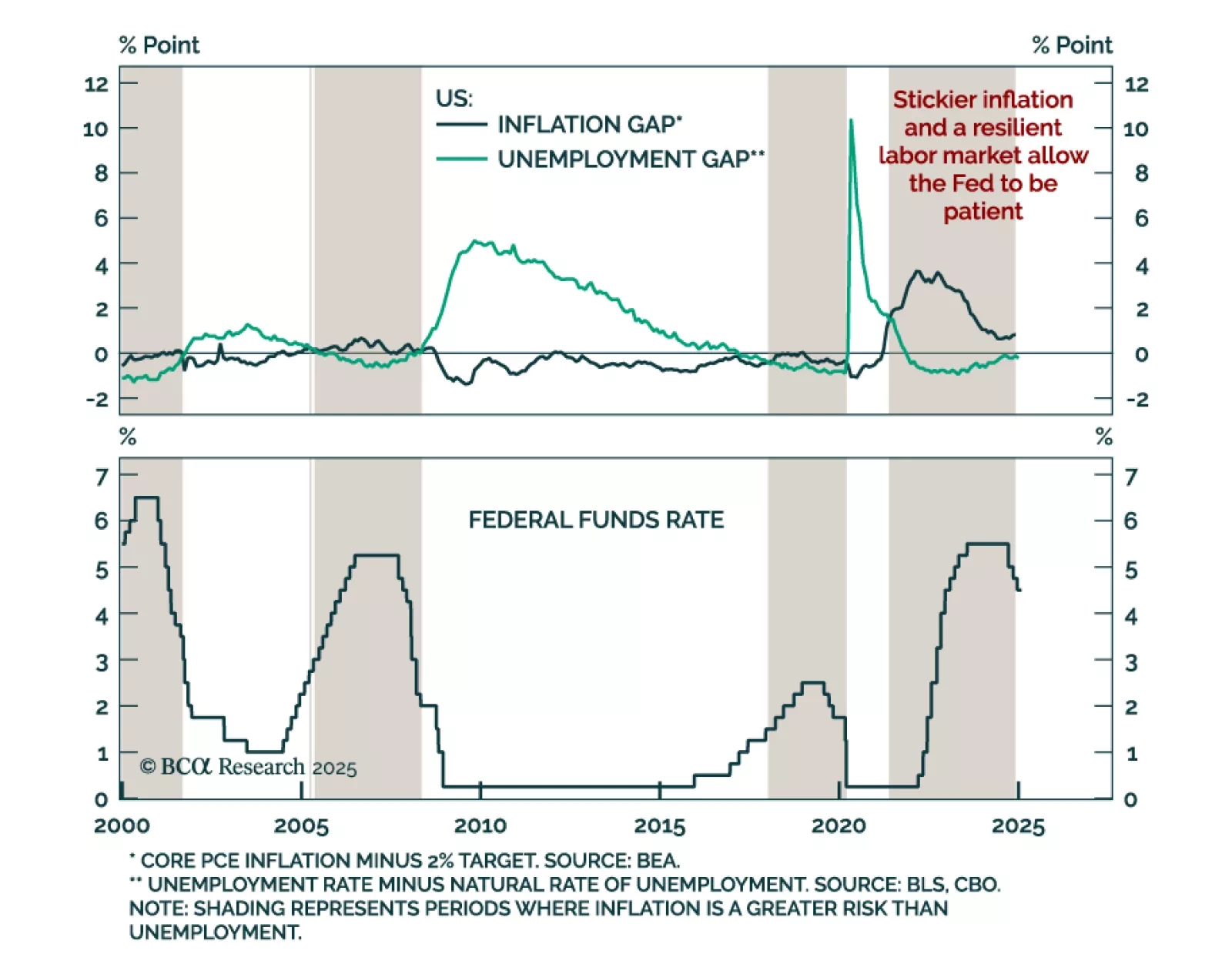

The Federal Reserve kept rates on hold in its 4.25%-to-4.5% range, as expected. The main change in the statement was the removal of the reference to progress towards the Fed’s 2% target, leaving instead a simple mention that…

Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

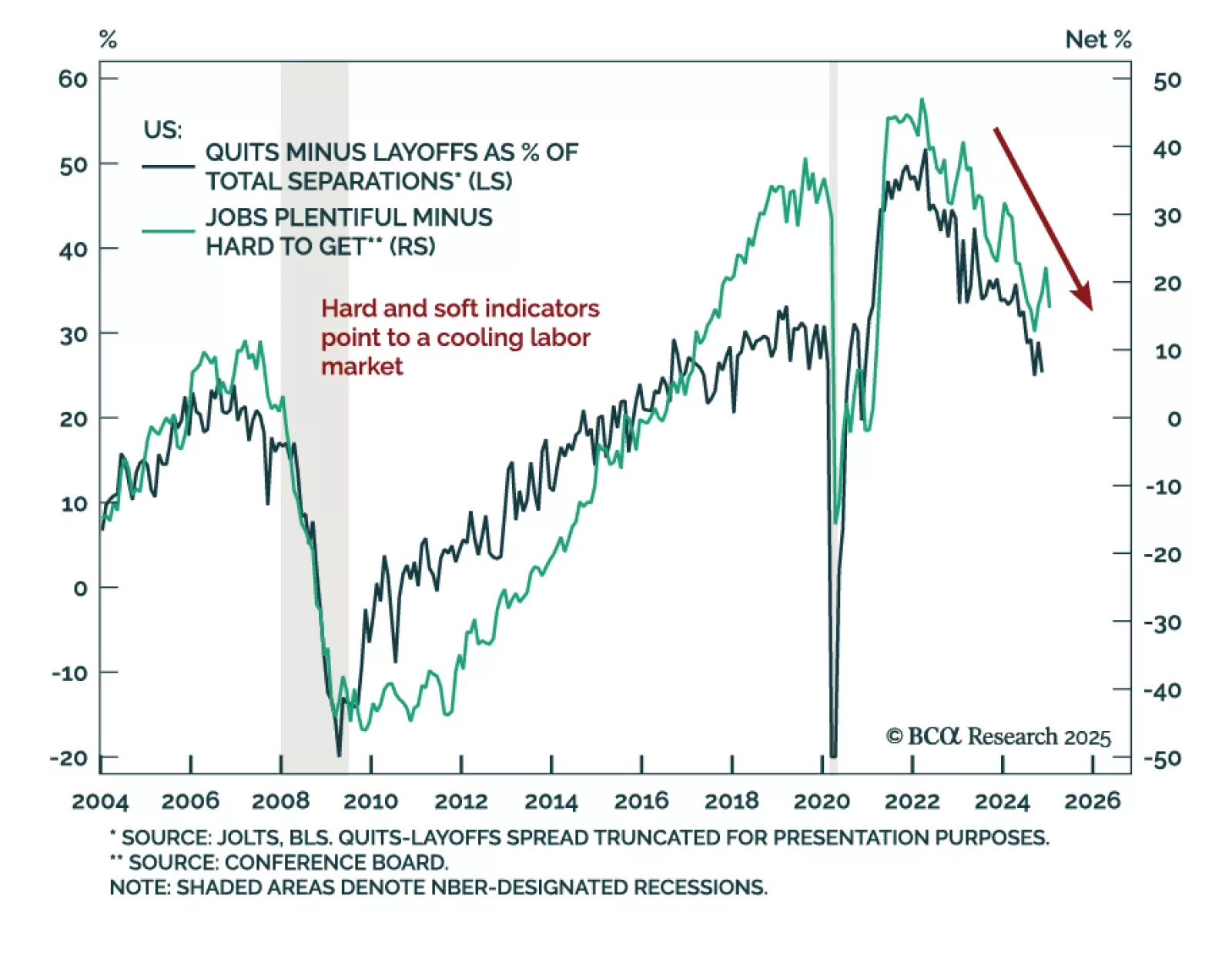

The January Conference Board Consumer Confidence index missed estimates, decreasing to 104.1 from an upwardly-revised 109.5 in December. The decrease was driven by both the present situation and expectations subcomponents. The…

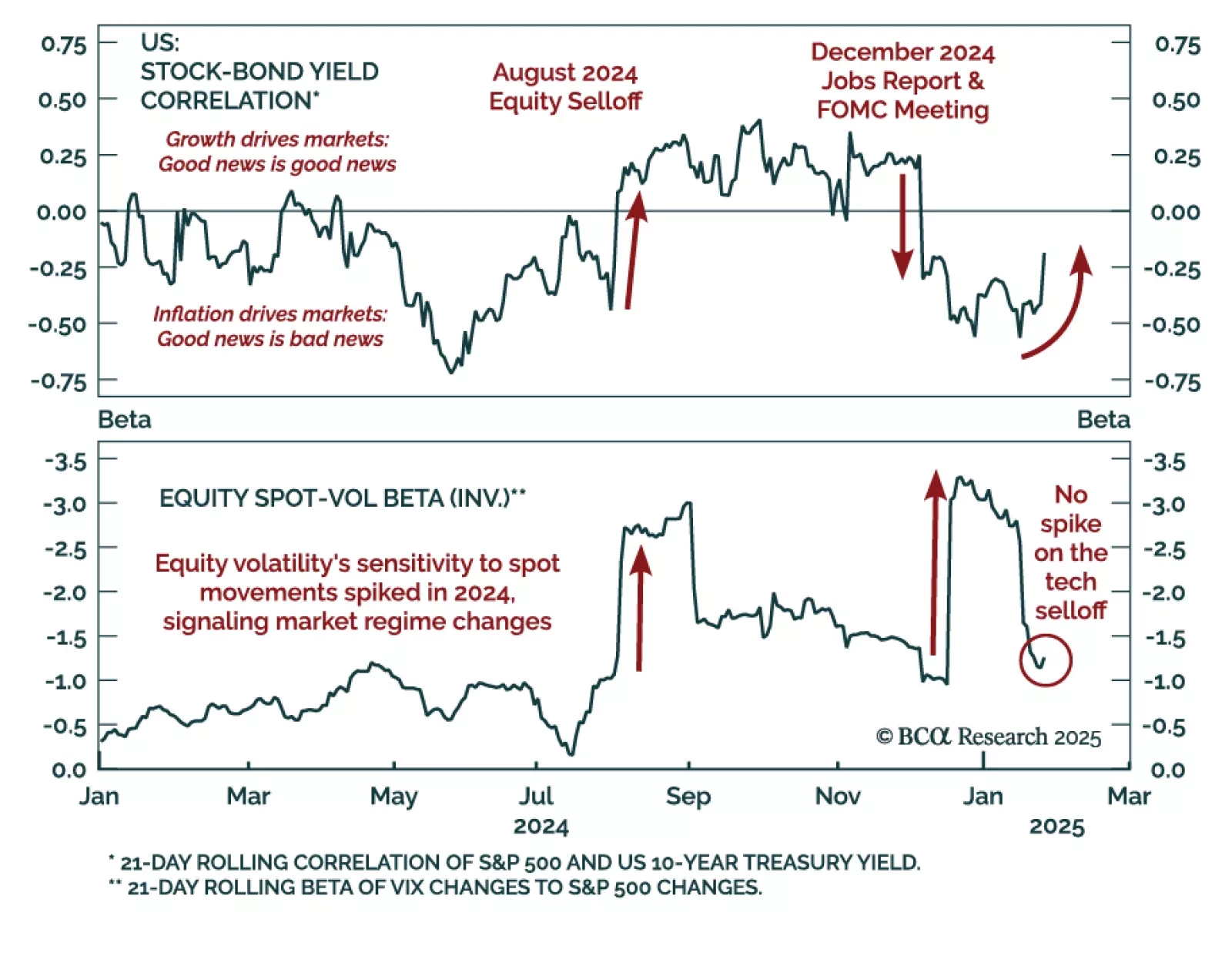

Monday’s selloff was orderly and concentrated in the tech sector. The price action was a classic risk-off response, where both stock prices and bond yields decreased. While the VIX increased, the equity spot-vol beta, volatility’s…

Despite the choppy price action of the last few weeks, equity sentiment remains elevated. Surveys of investor sentiment remain at the top end of the bullish spectrum, and the S&P 500 is trading over 22x forward earnings, levels…

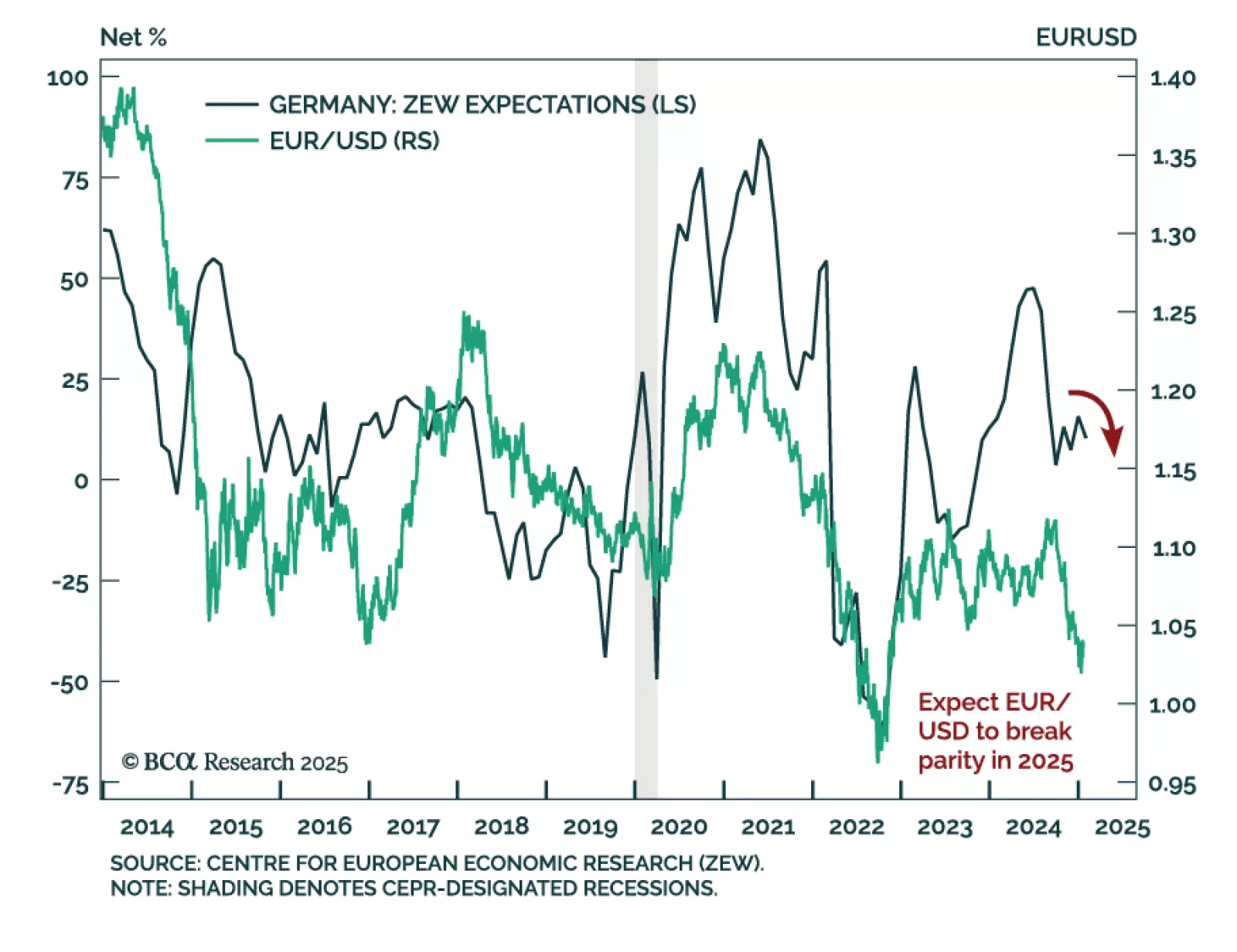

The January ZEW index for Germany missed estimates, with expectations falling to 10.3 from 15.7 in December. However, the euro area level index ticked up to 18 from 17 a month prior. Measures of current conditions also rose. The…

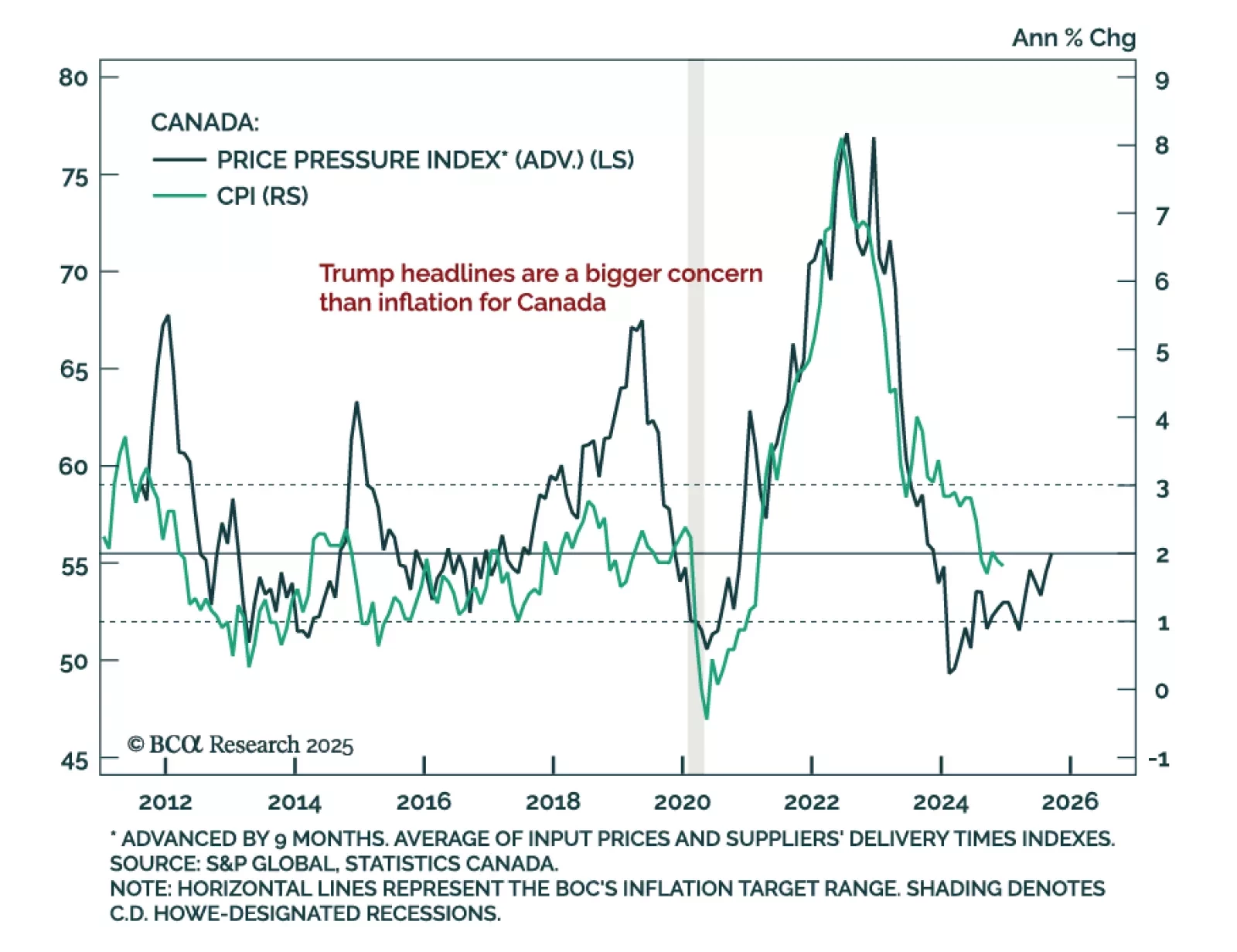

The December Canadian CPI was roughly in line with estimates, with headline inflation ticking down to 1.8% y/y from 1.9% in November. The BoC’s core inflation measures, median and trim, also decreased from 2.6% to 2.4% and 2.5%,…

Our Emerging Markets strategists put together a hypothetical conversation between President Trump and Treasury Secretary nominee Scott Bessent on what economic policy would look like for the Trump 2.0 administration. …

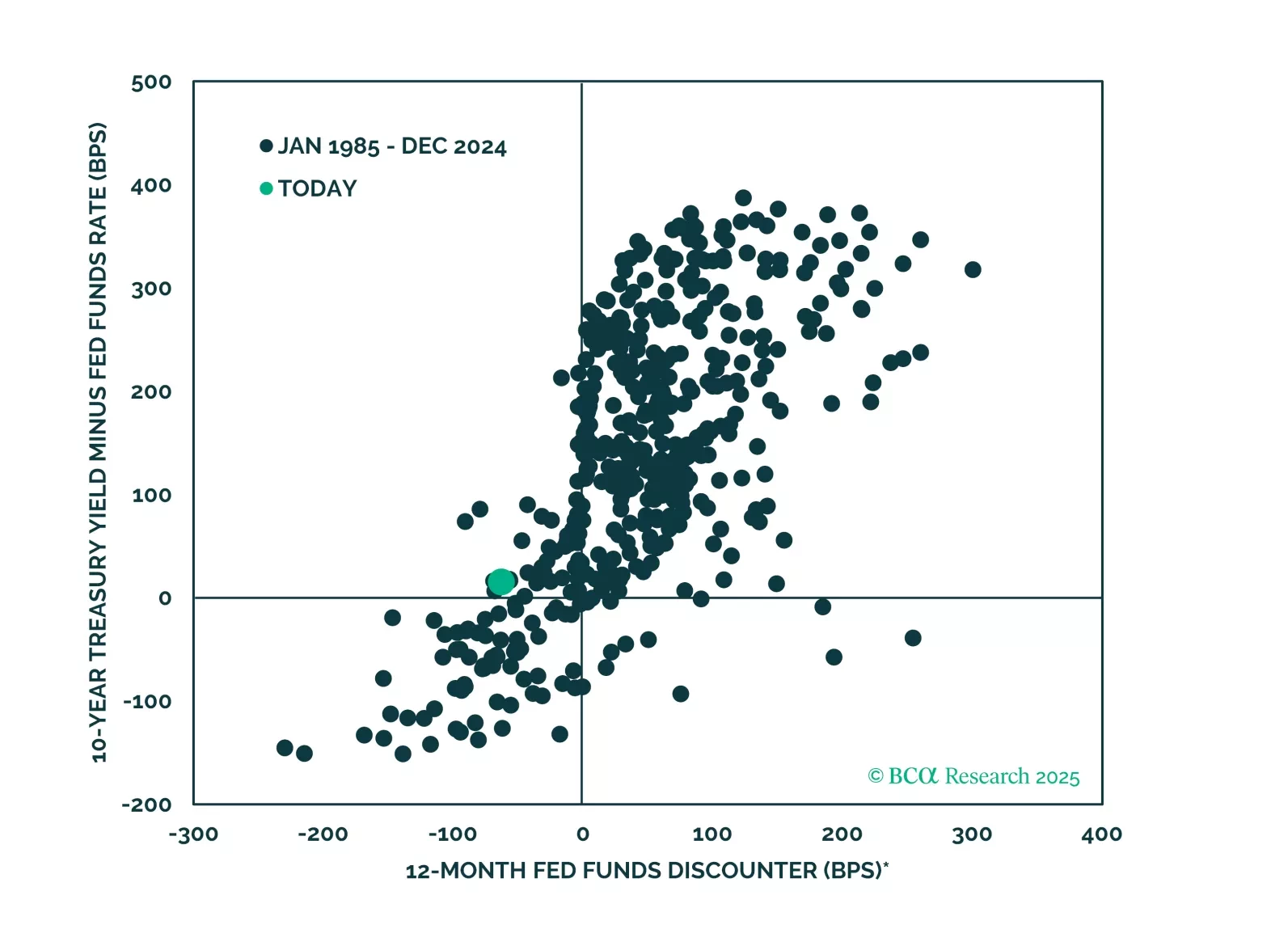

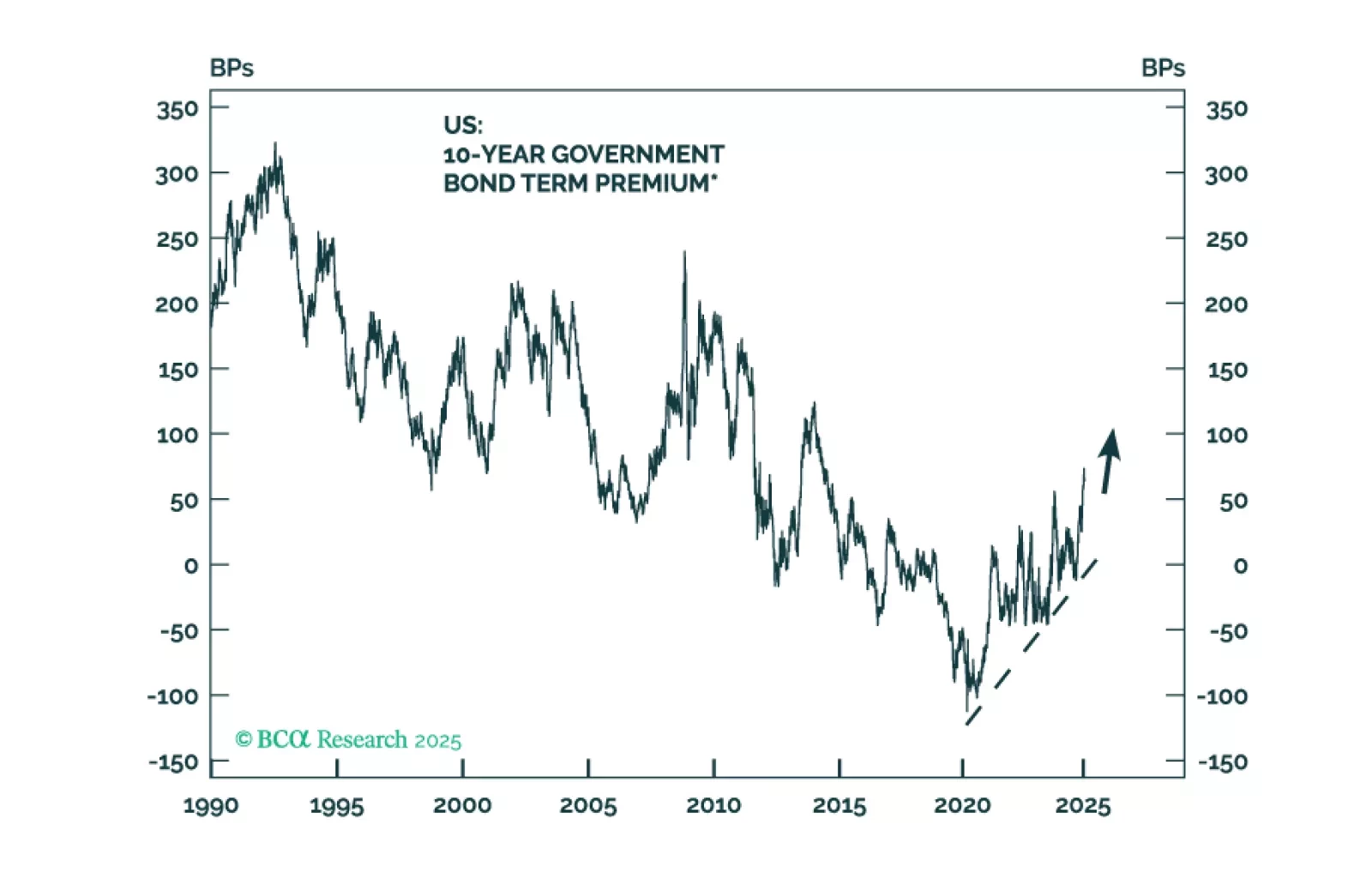

Our US Bond Strategy team put out a Strategy Insight outlining the value they see in the Treasury market. The recent rise in Treasury yields reflects increased inflation uncertainty and a higher term premium. Treasury…