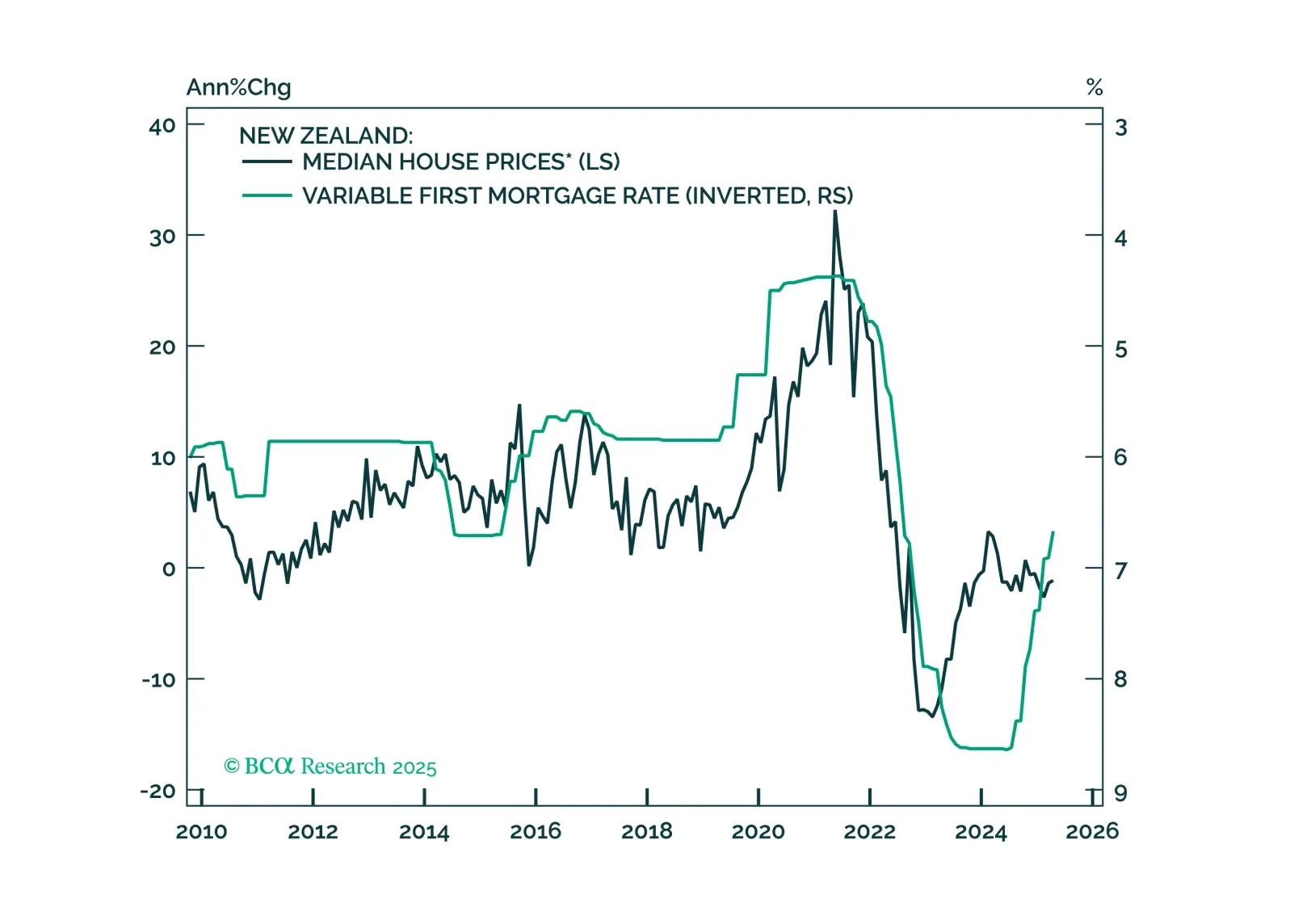

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

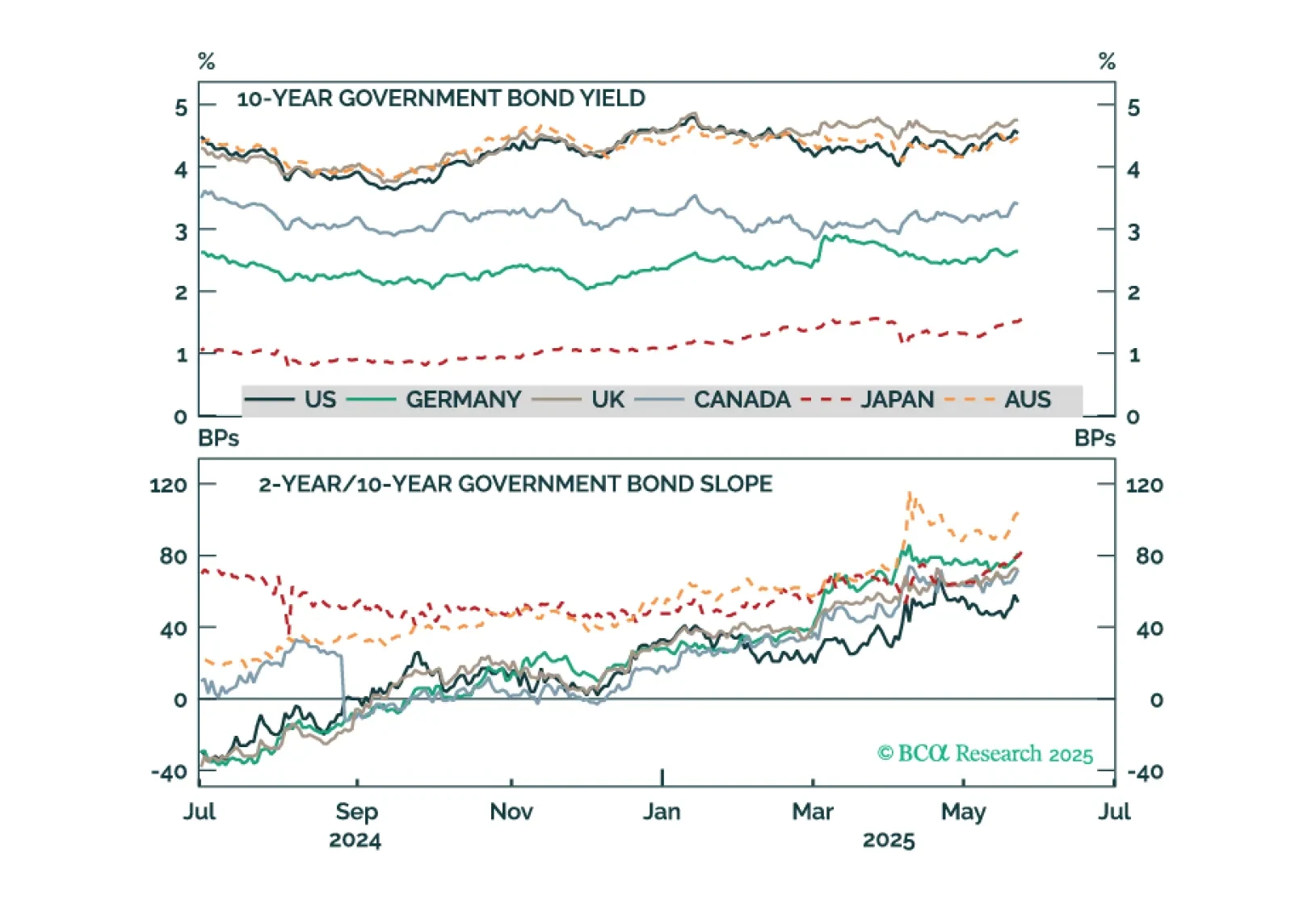

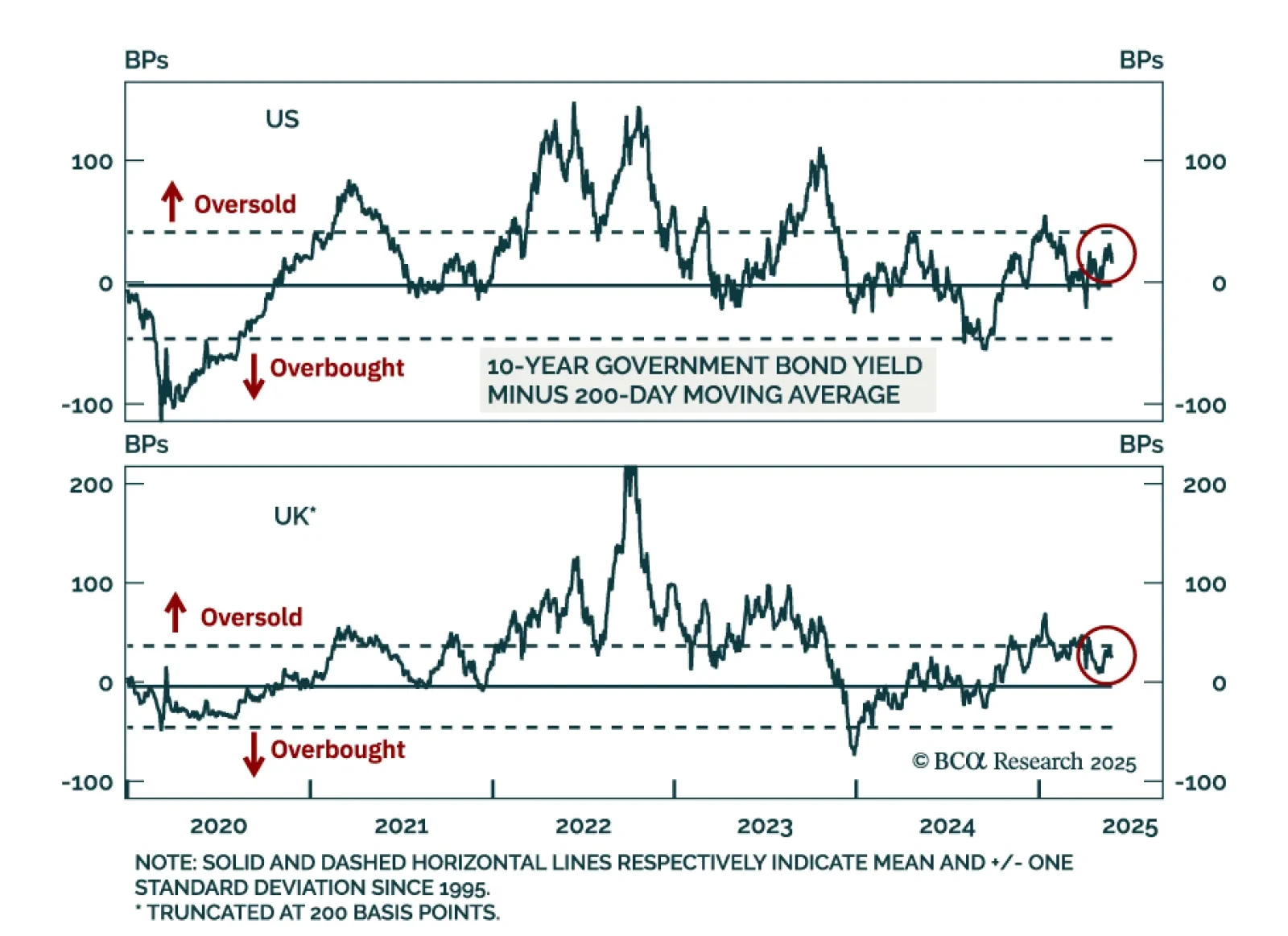

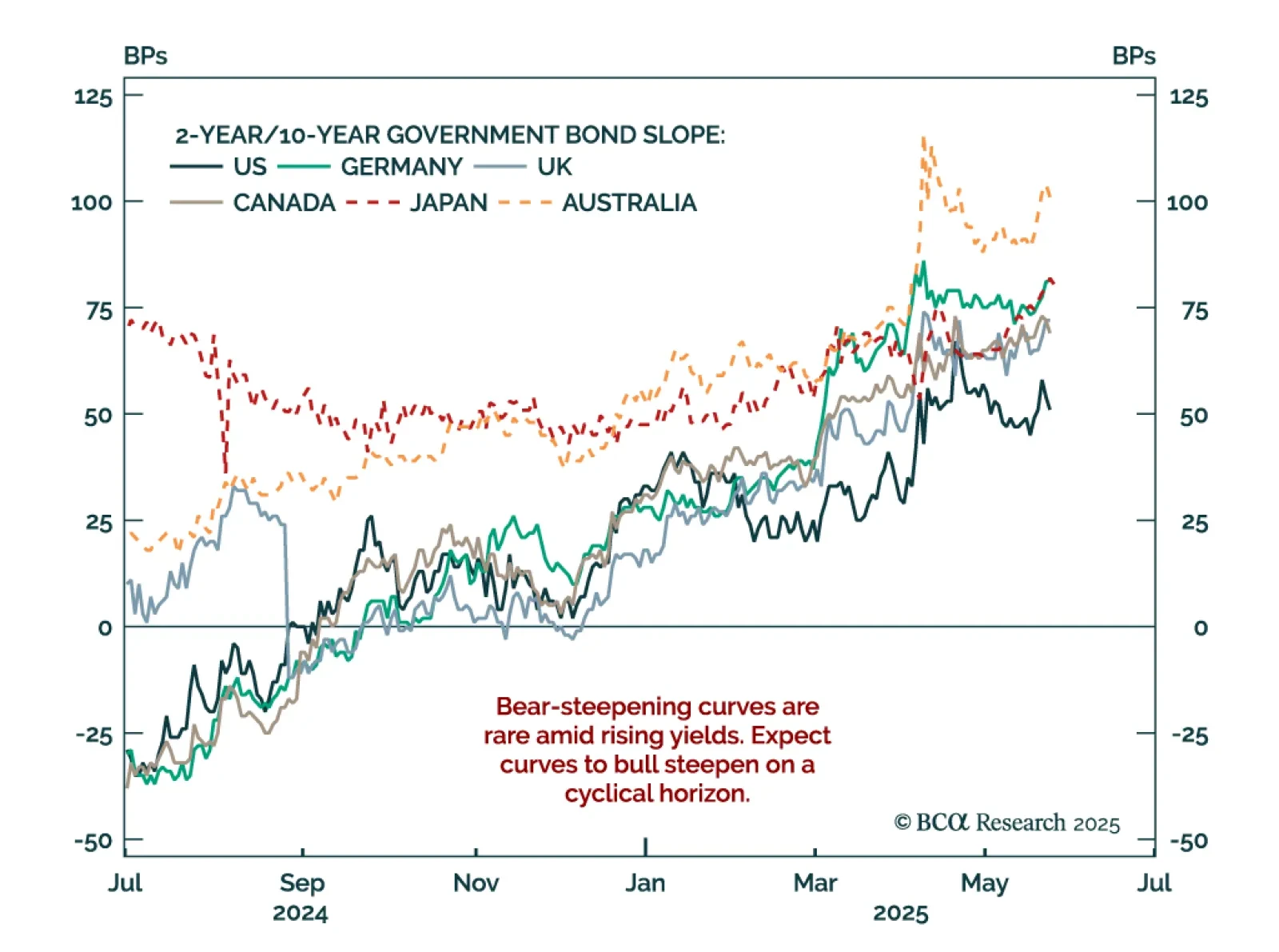

BCA’s latest technical analysis suggests that global bond markets are oversold, offering an attractive entry point to add long-duration bets in fixed-income portfolios. Our Global Fixed Income strategists analyzed a timing tool…

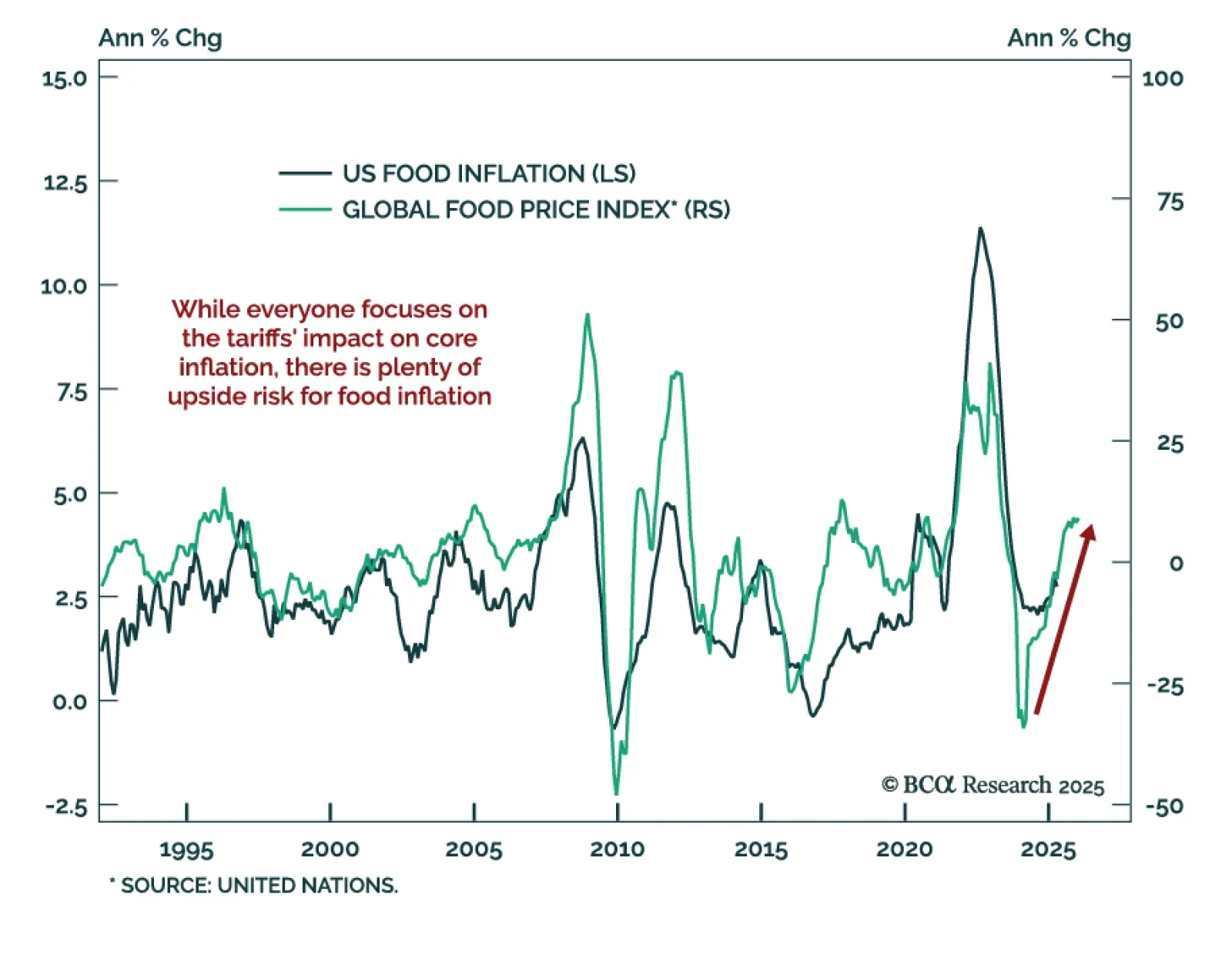

The upward trend in global food prices suggests that food inflation risks re-accelerating in the US. Historically, US food inflation lags the United Nations’ global food price index by about nine months. The annual growth in…

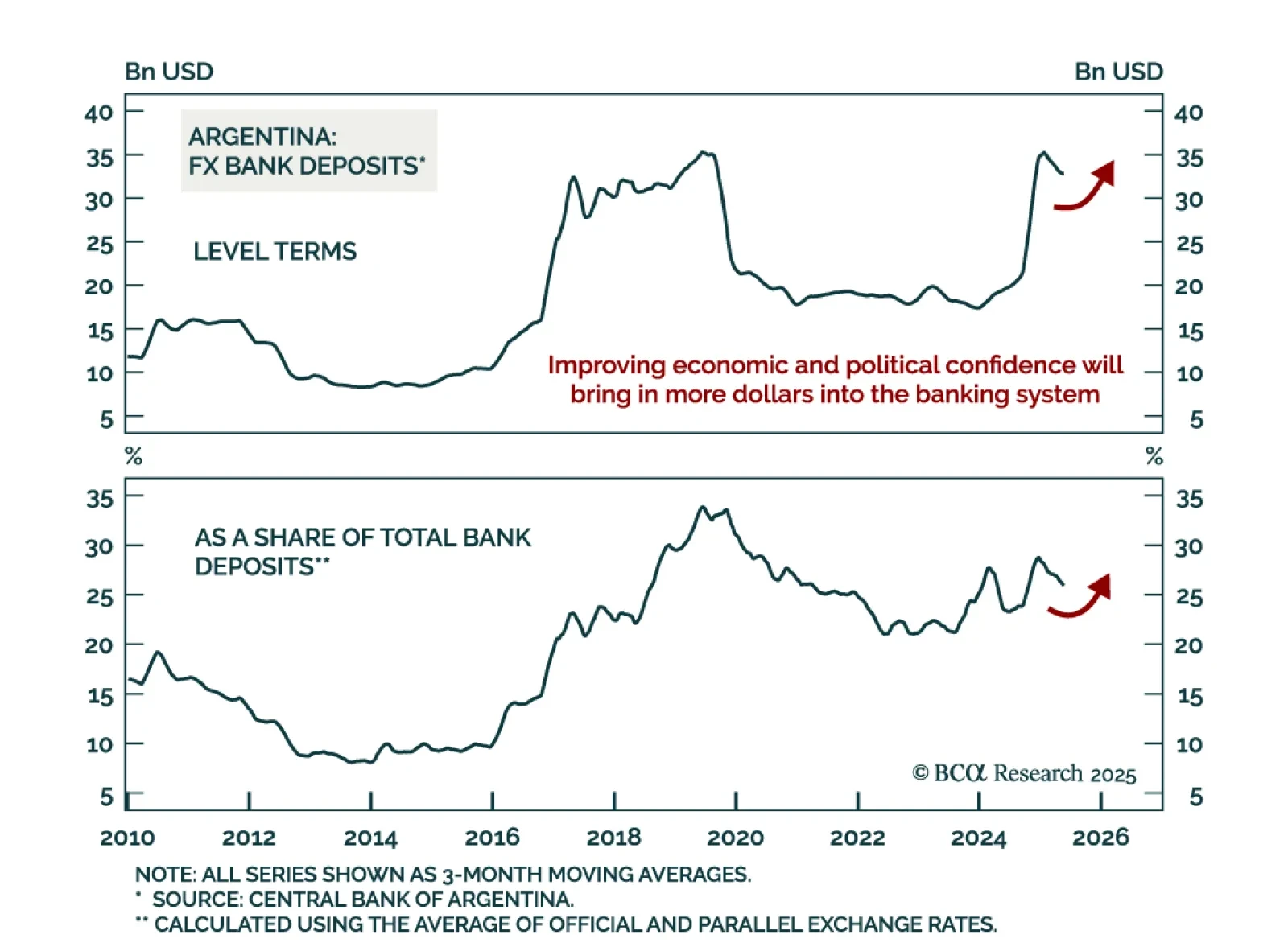

The latest political developments in Argentina increase the odds of further liberalizing reforms and solidify the economy’s structural upside. First, the libertarian governing party came out on top in Buenos Aires’ legislative…

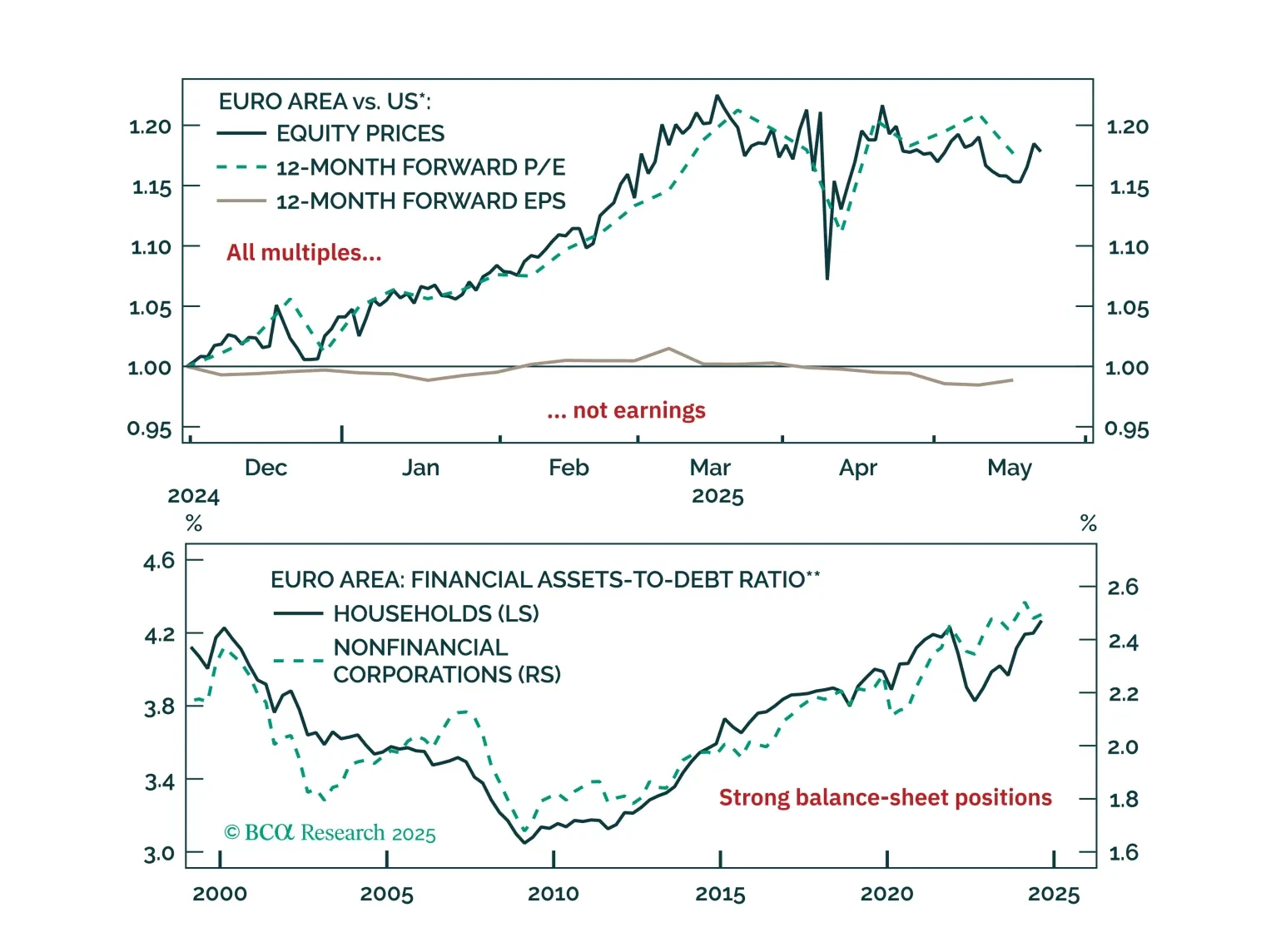

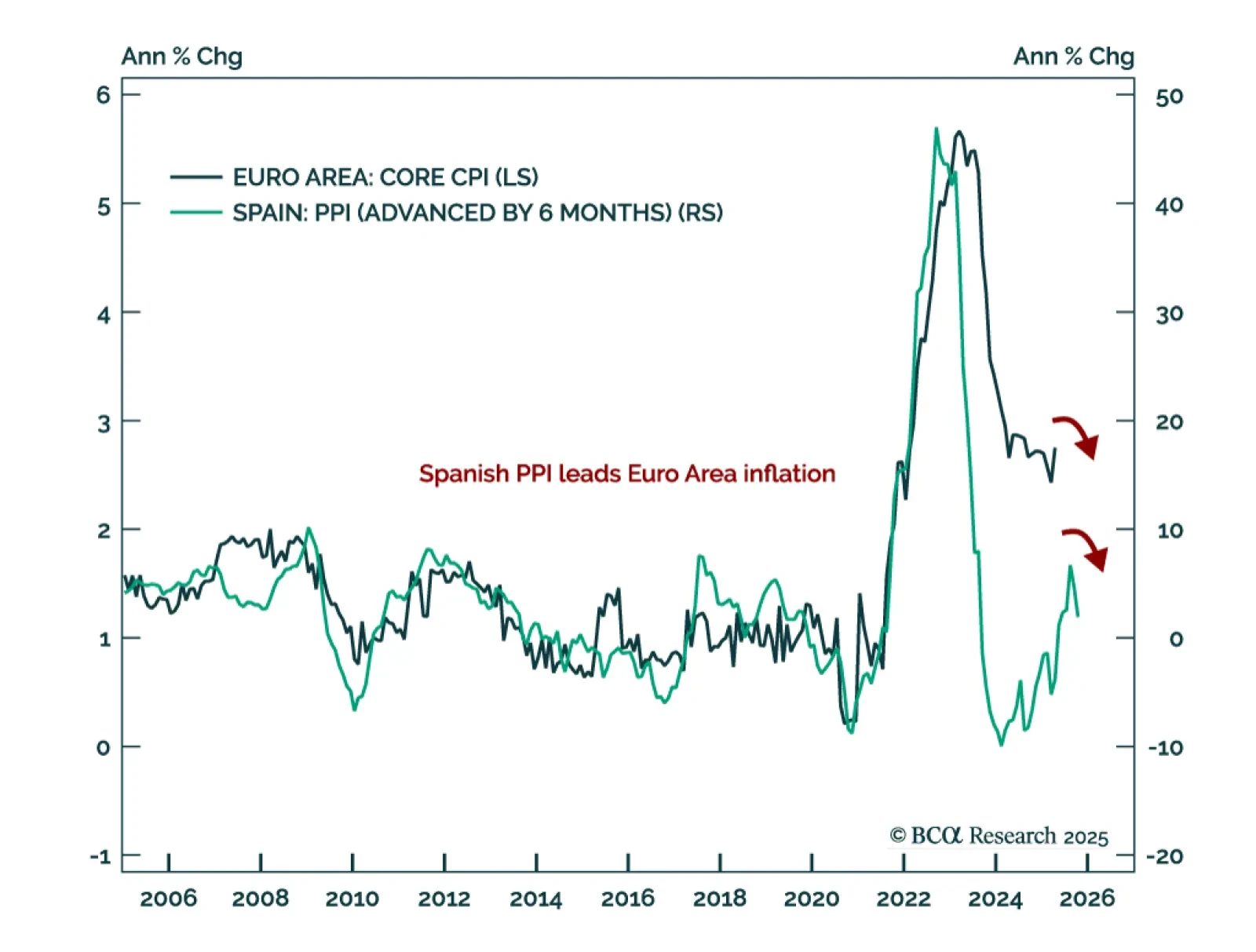

Producer prices in Spain surprised to the downside, foreshadowing a relapse in Euro Area inflation and cementing the ECB’s dovish stance. The Spanish PPI index fell to 1.9% in April, continuing the disinflation trend from the last…

According to our fixed income strategists, the main drivers of rising global yields have been widening bond/OIS spreads and term premiums. Wider government bond/OIS spreads reflect increasing government bond supply (net of…

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

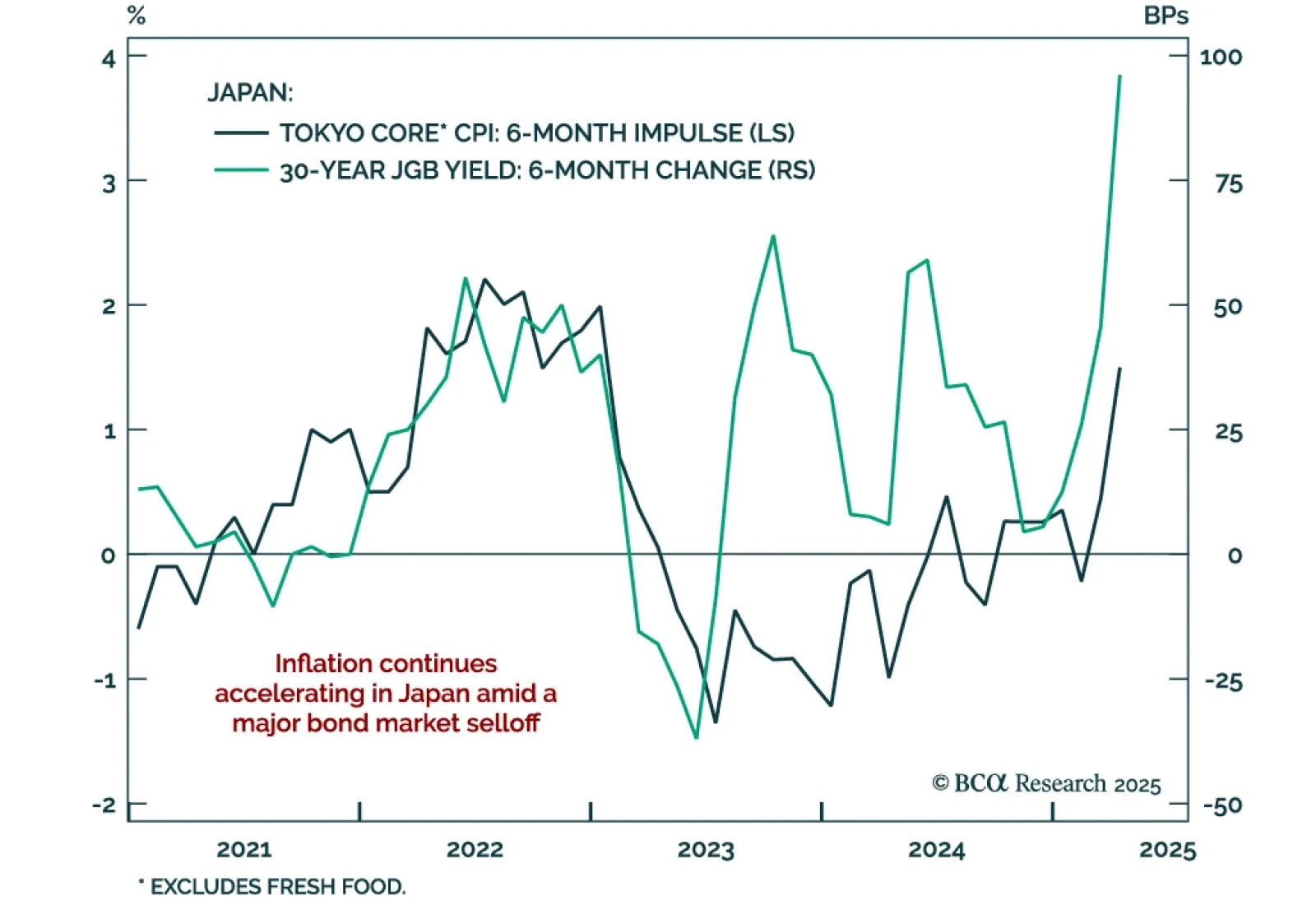

Tokyo CPI surprised to the upside in April, signaling that Japanese inflation shows no sign of deceleration and putting the Bank of Japan (BoJ) in a complicated position. Investors should remain maximum underweight in JGBs and…

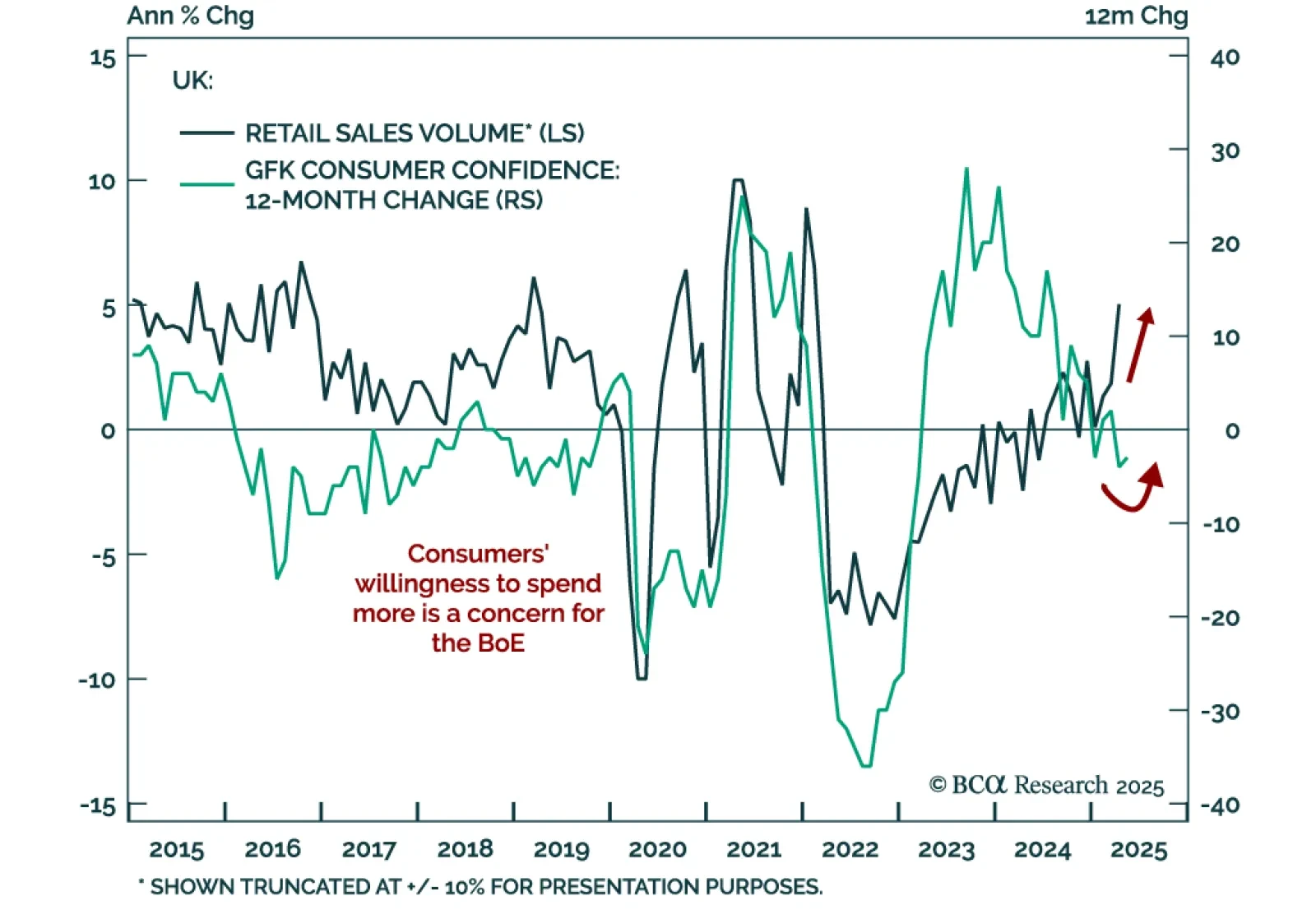

The rebound in UK retail sales and consumer confidence surprised to the upside, and suggests that the re-acceleration in inflation observed earlier this week may not be transitory. UK retail sales rose 1.2% m/m in April…