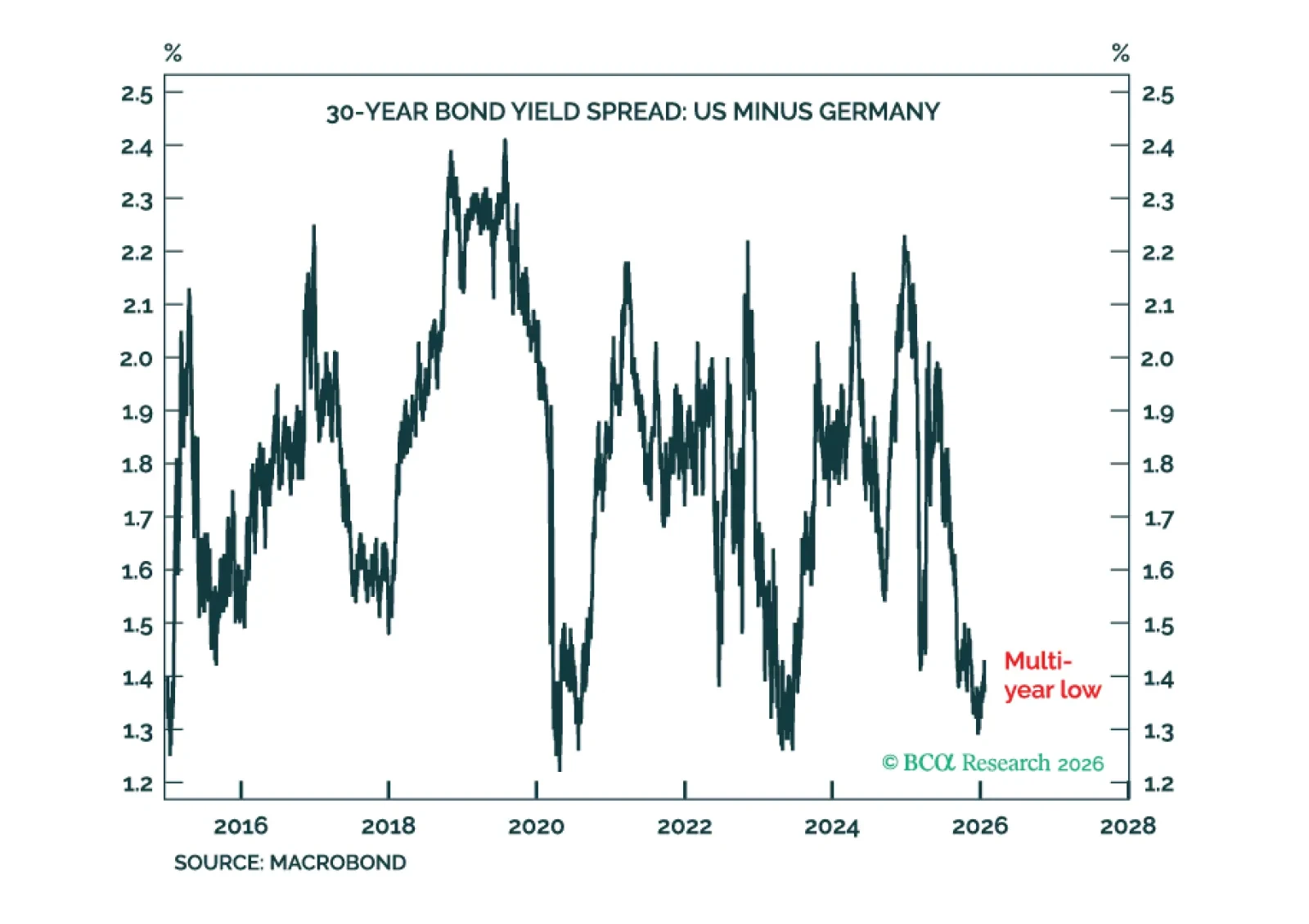

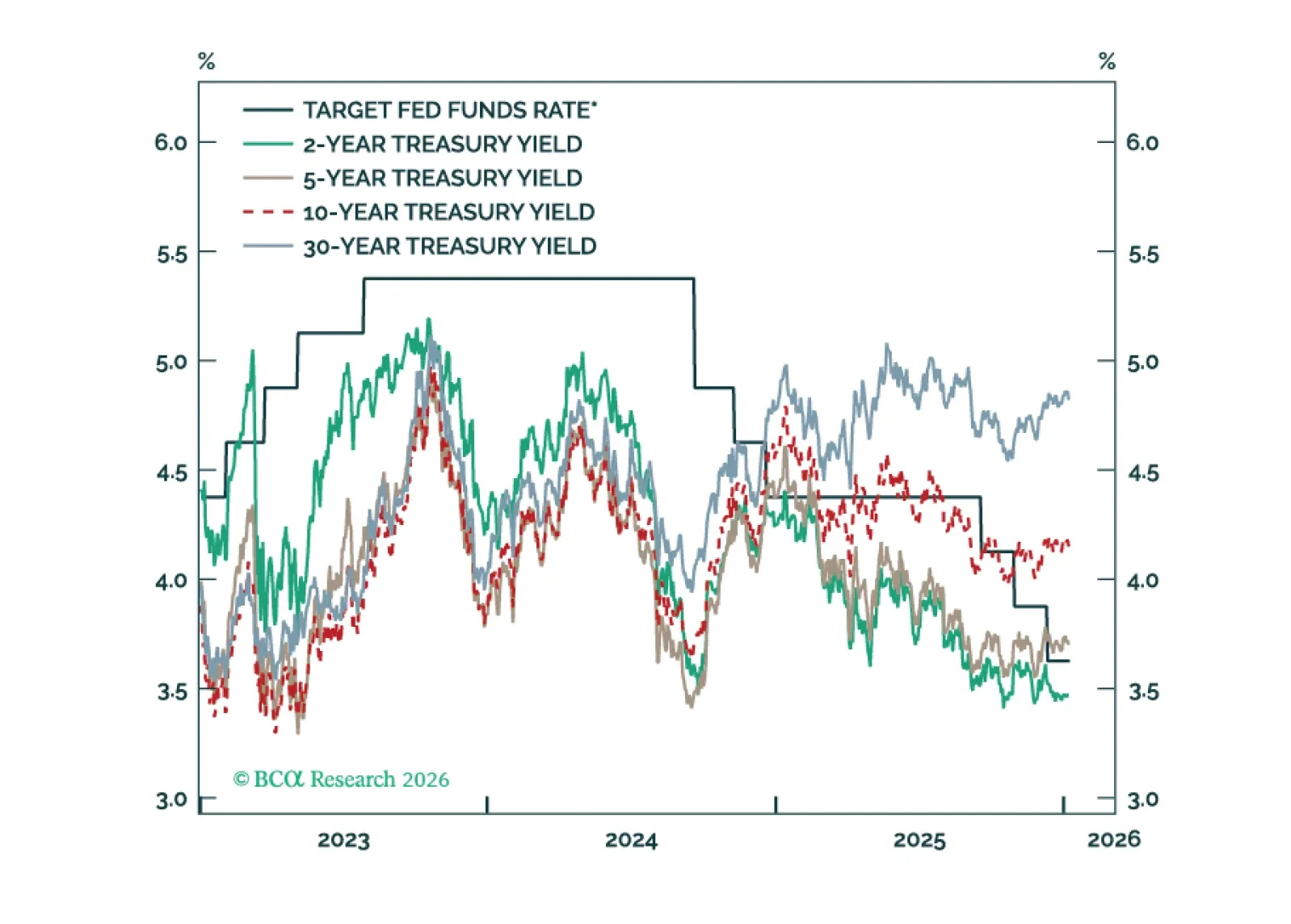

US Treasury yields require a higher premium for both geopolitical risk and inflation risk, but higher bond yields are not necessarily bad for stocks.

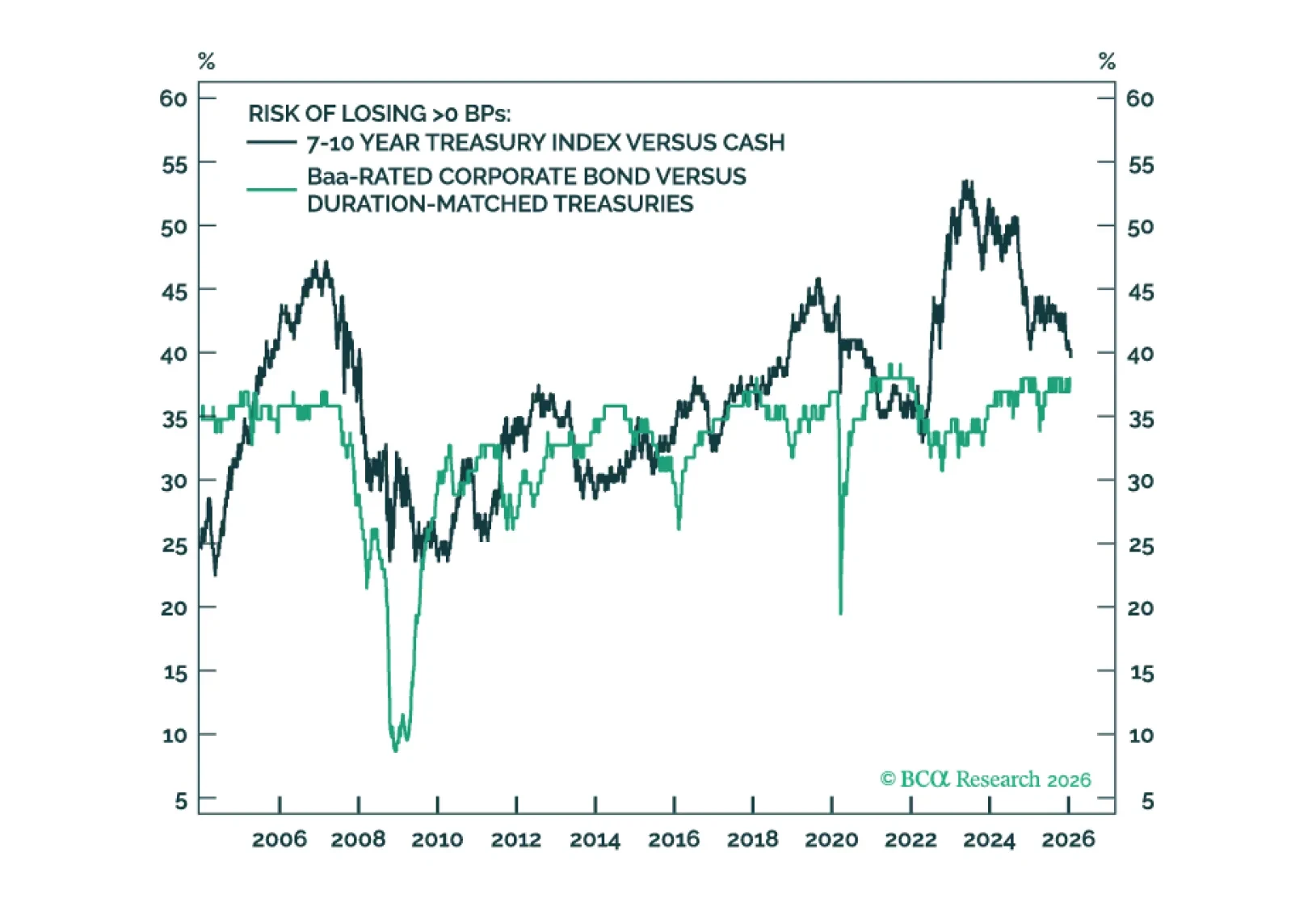

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.

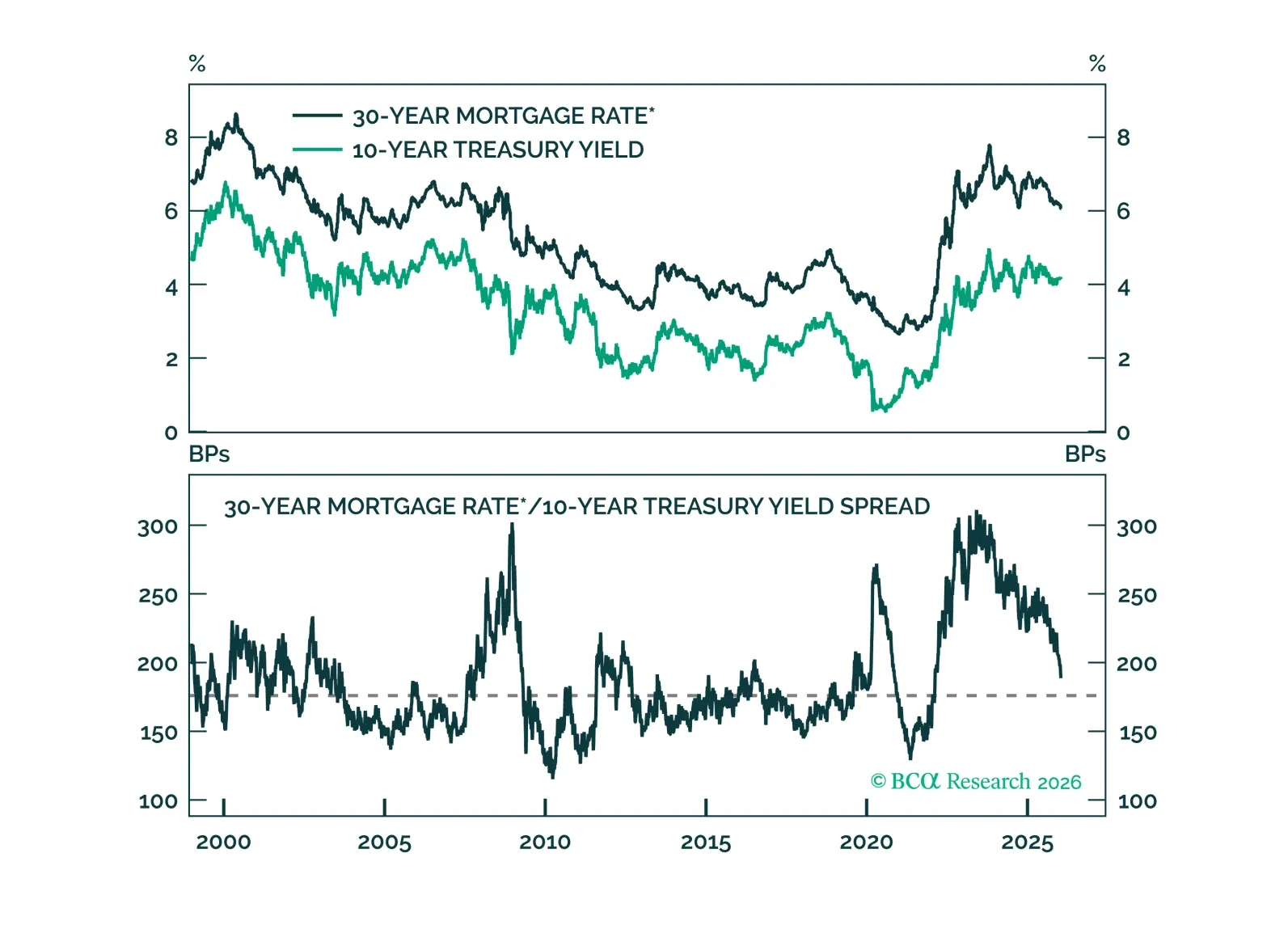

Mortgage spread tightening has run its course. Any further drop in mortgage rates will necessitate lower Treasury yields.

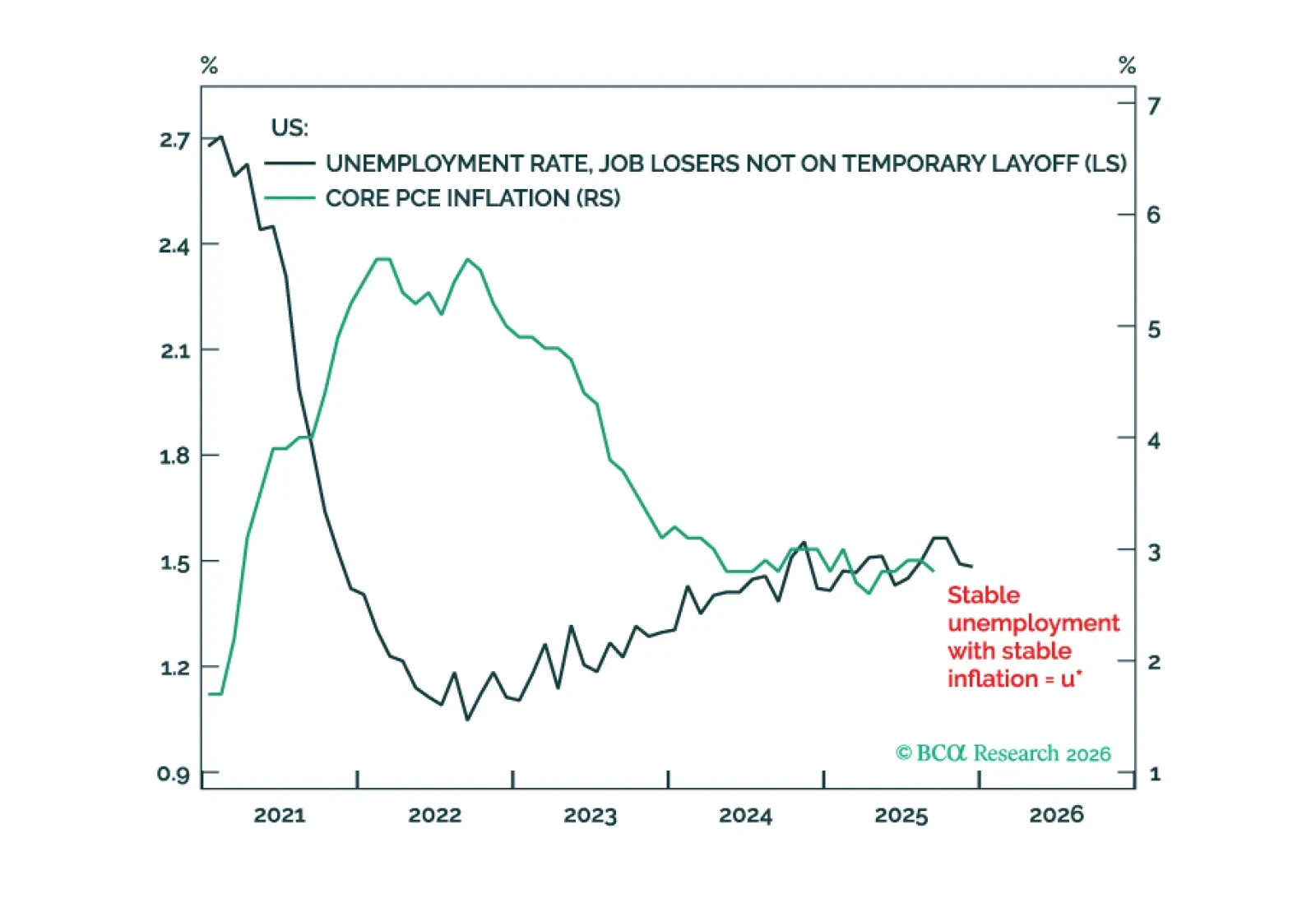

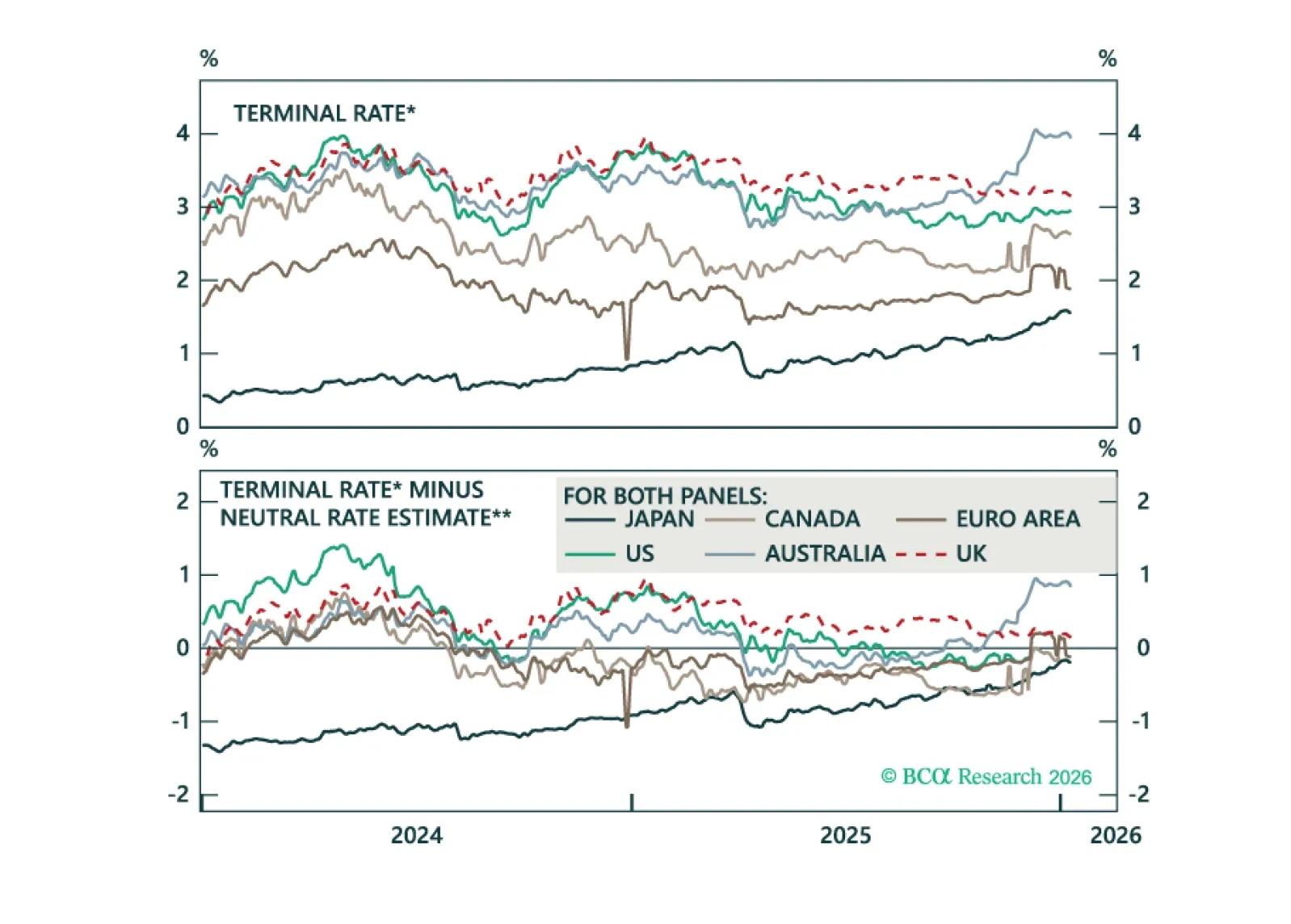

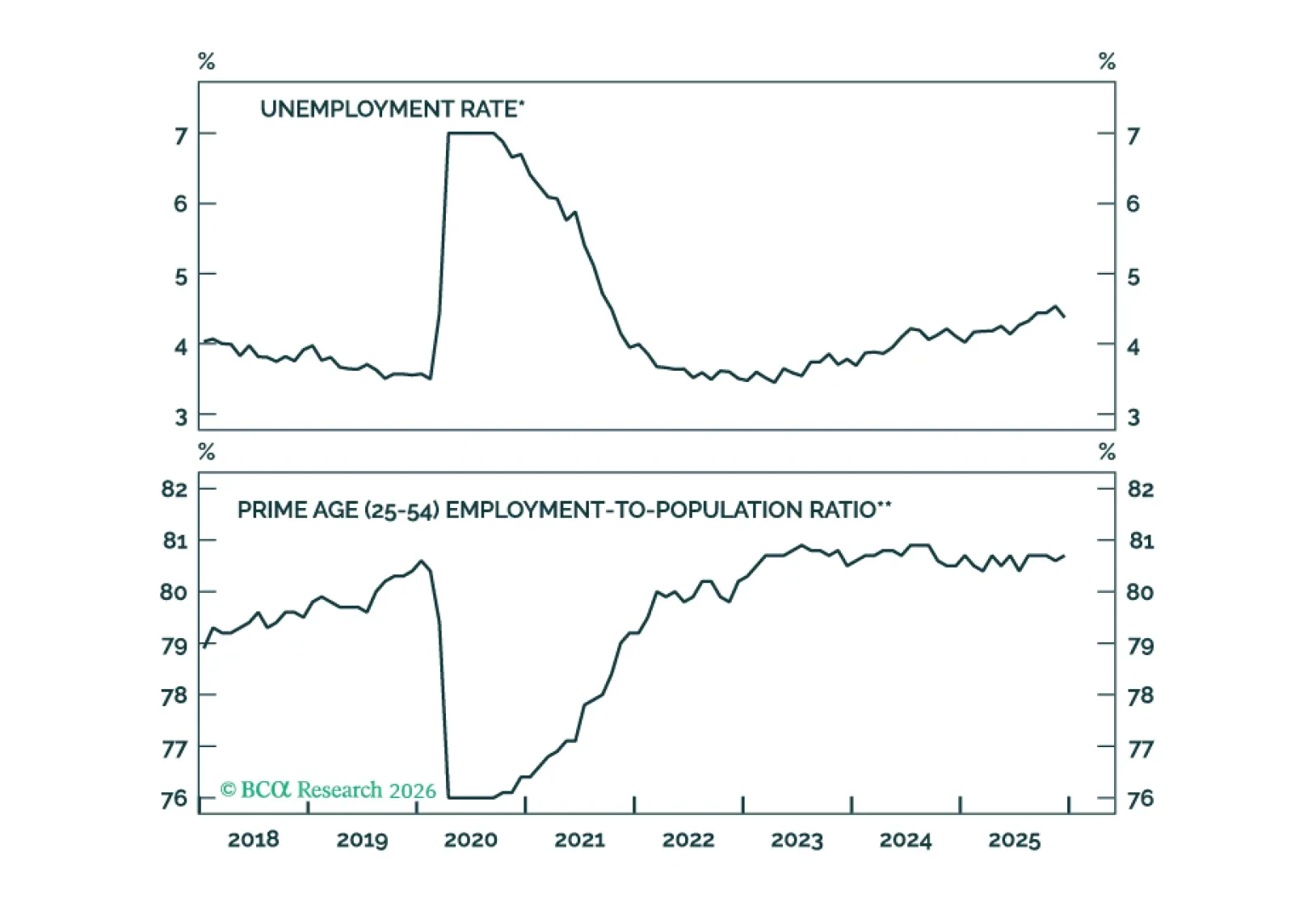

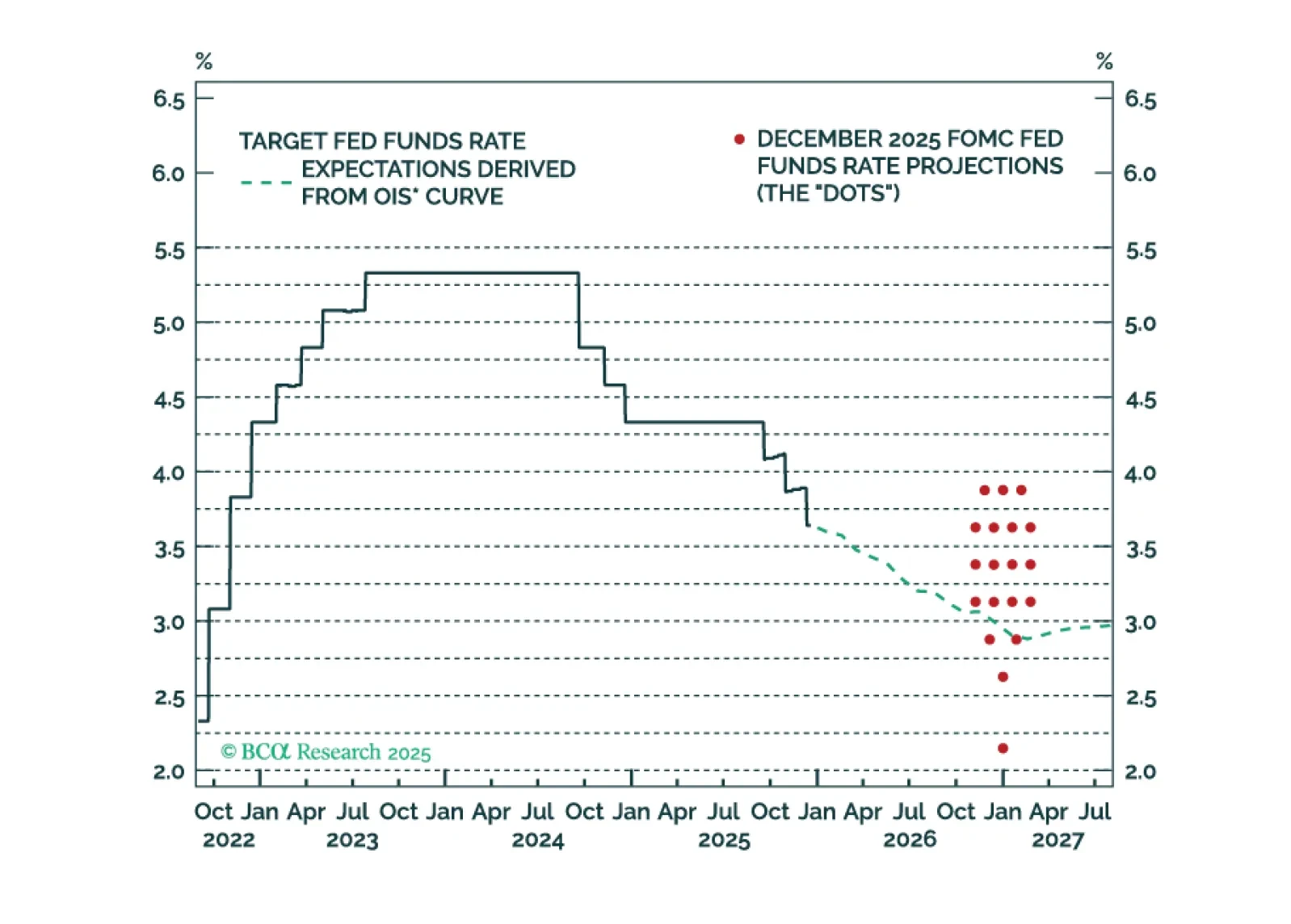

With the US unemployment rate and interest rate close to the ‘neutral’ u-star and r-star respectively, further Fed rate cuts risk pushing up inflation and long-term inflation expectations. This is bad for bonds but good for stocks.…

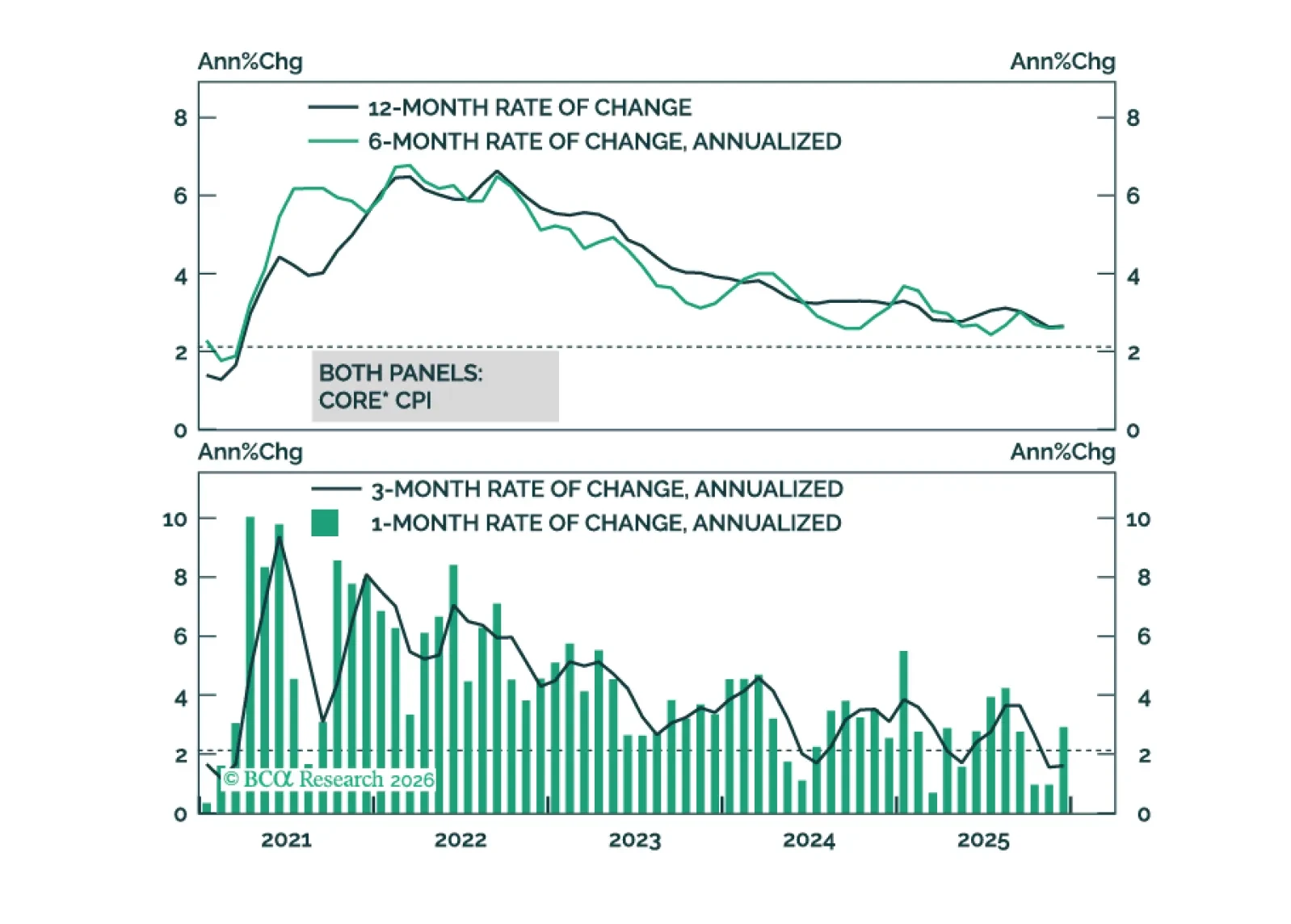

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

Our Q1 outlook maps global growth, curve dynamics, and policy surprises, which we then translate to our recommended global fixed income portfolio allocations and trades.

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

Our Portfolio Allocation Summary for January 2026.

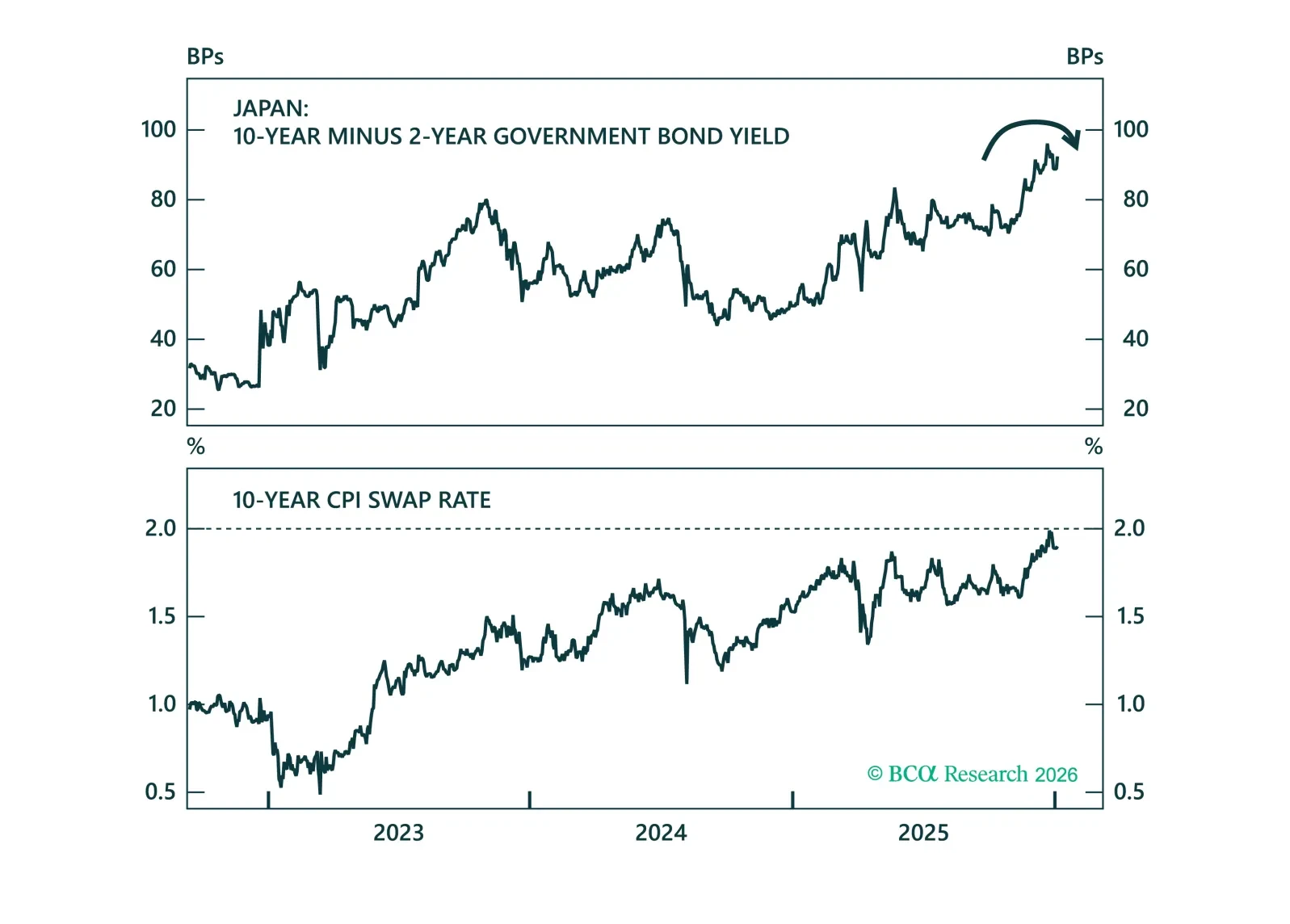

From steepening to flattening. As the BoJ continues to tighten in 2026, we show why curve flatteners are finally the right trade.