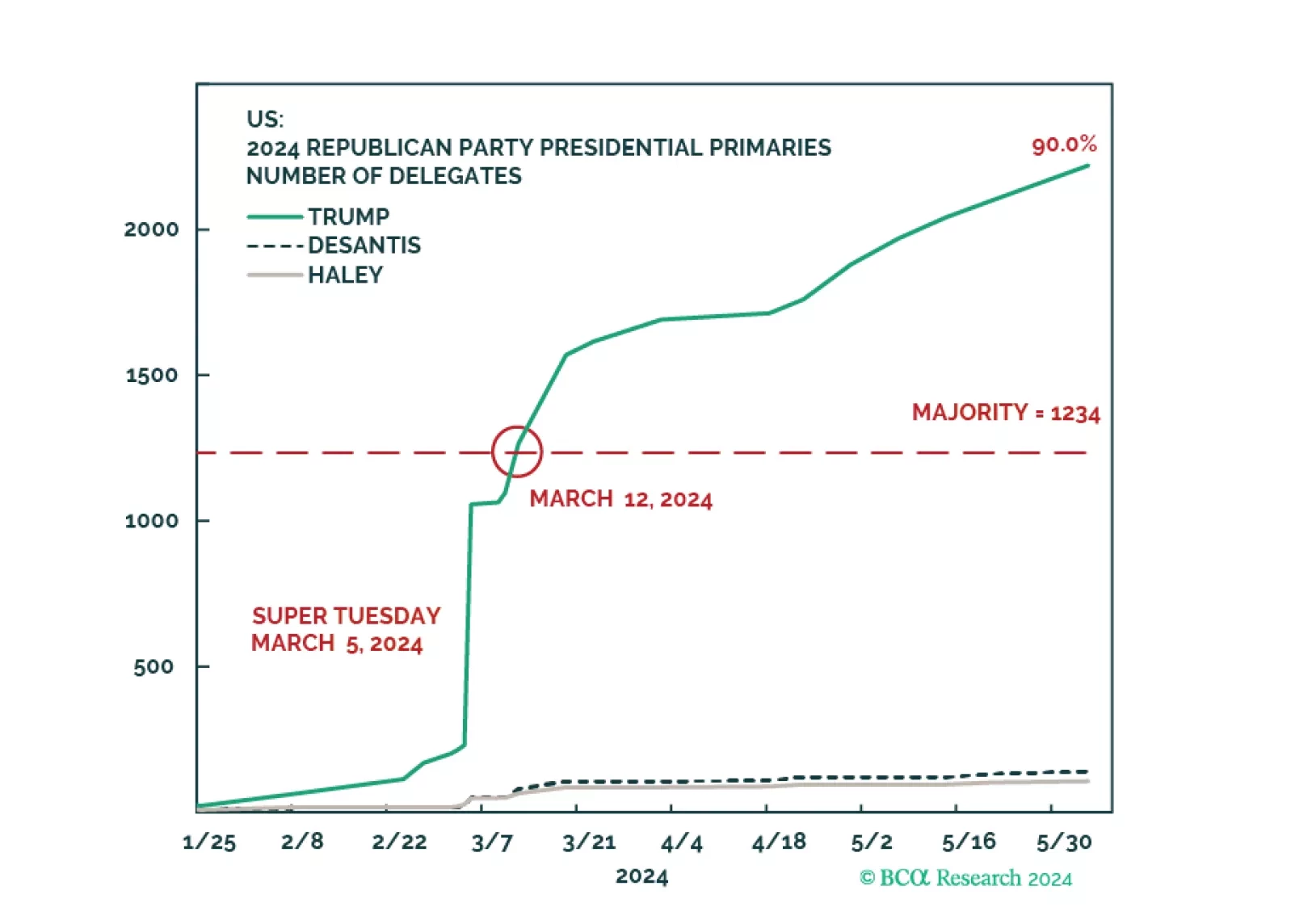

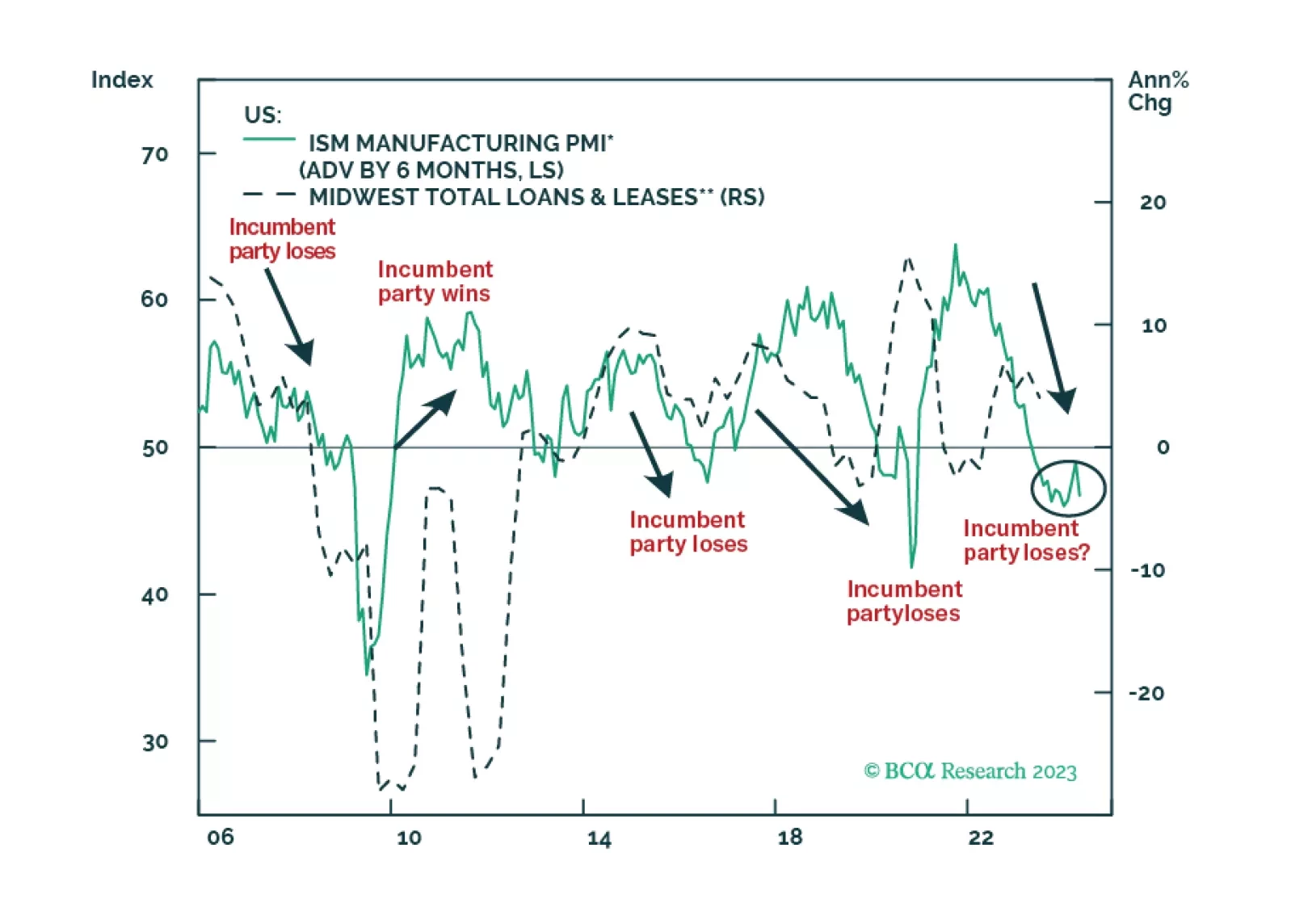

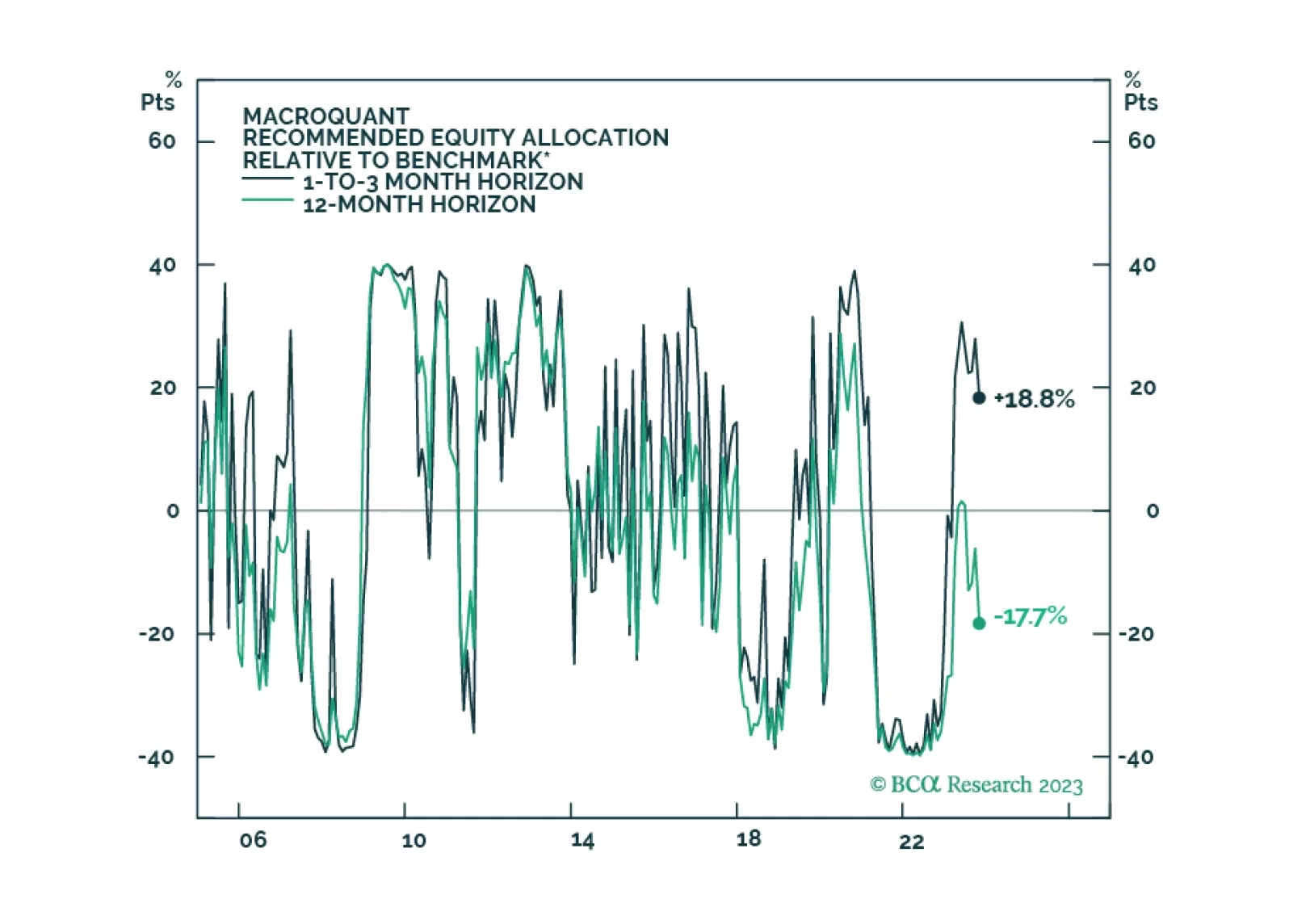

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

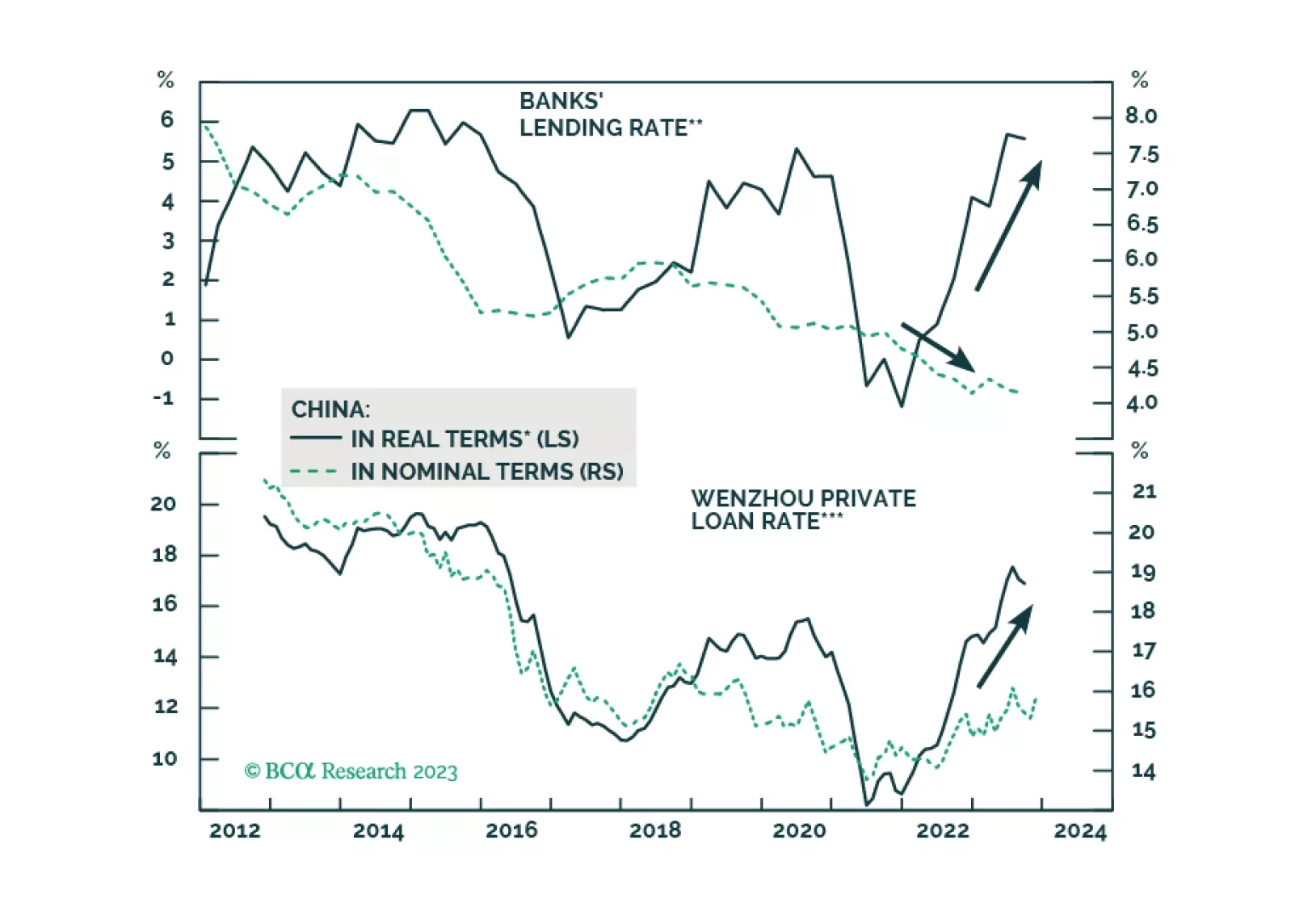

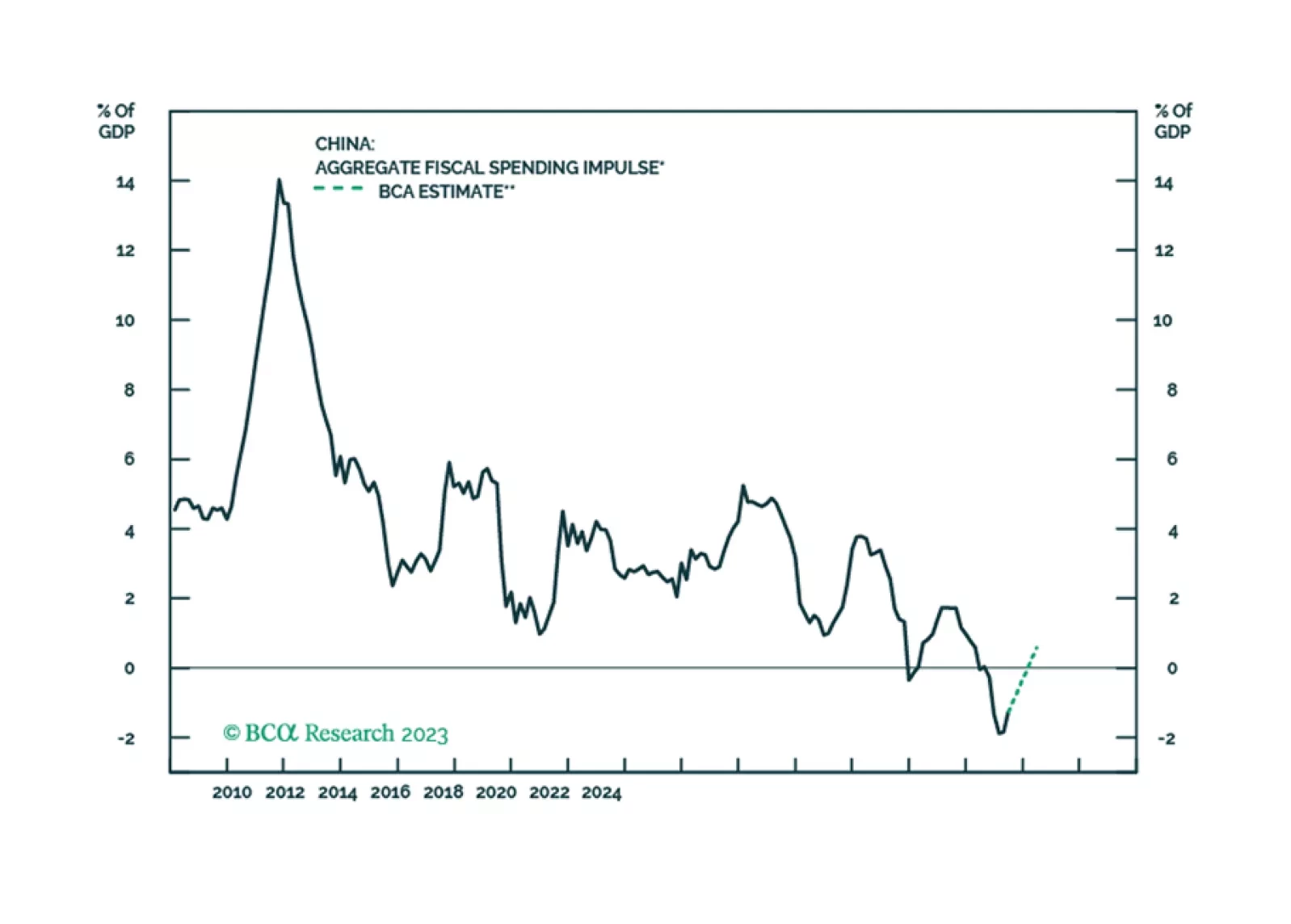

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

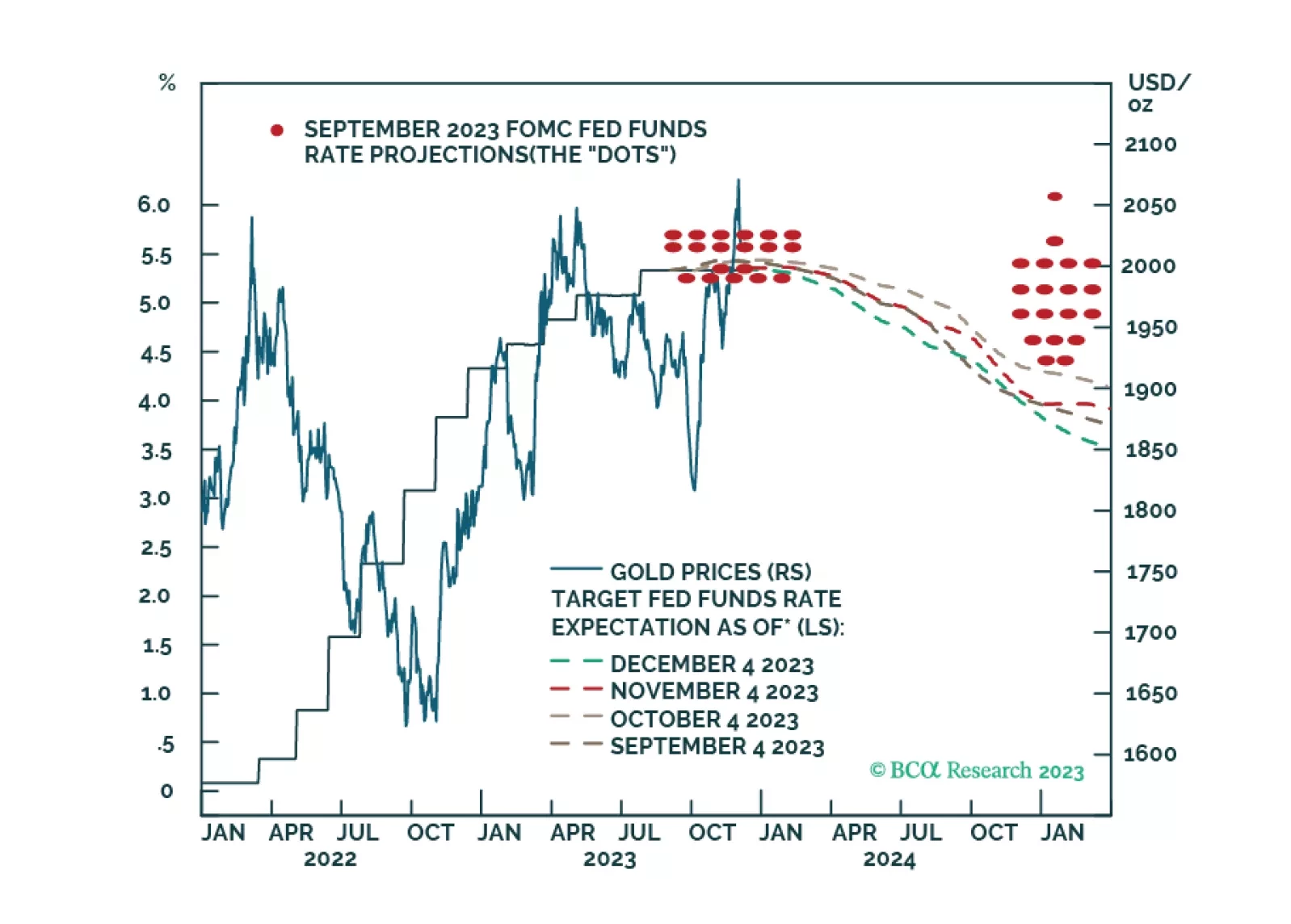

Falling core inflation in the US over the short run will boost real disposable household income, which will keep consumption – ~ 70% of US GDP – strong. Over the medium- to-longer term – 3 to 5 years out – inflation risks rise as…

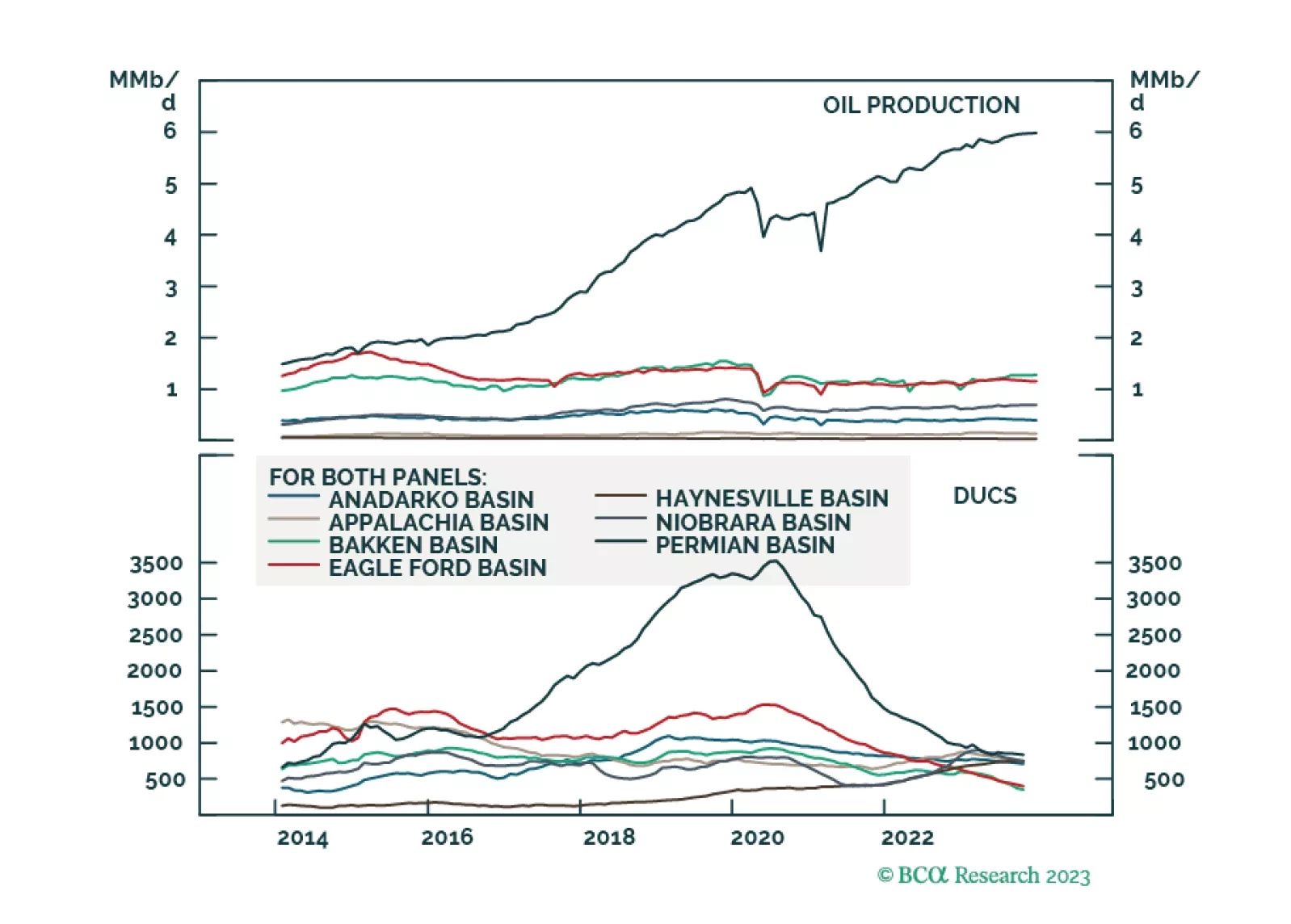

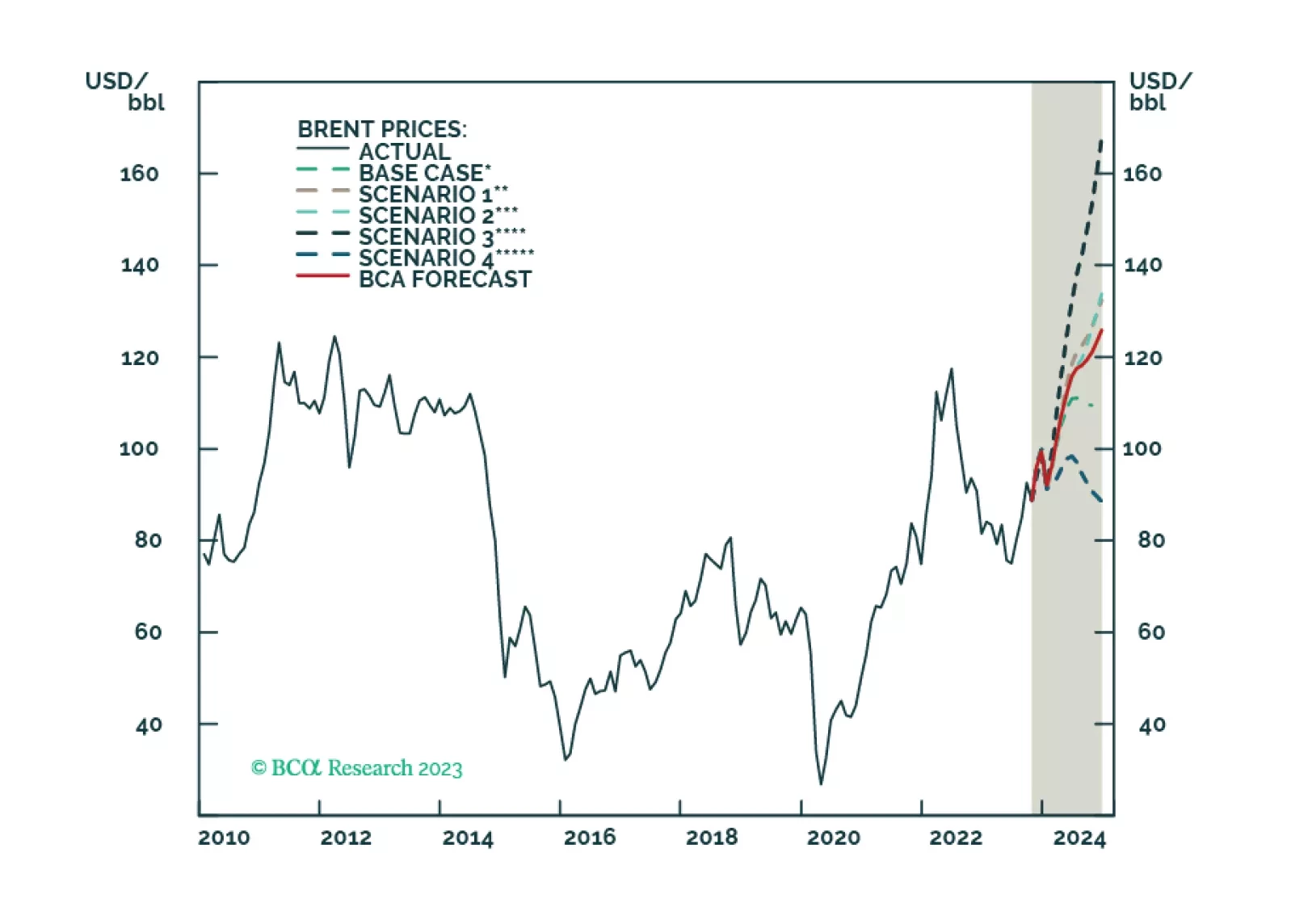

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…