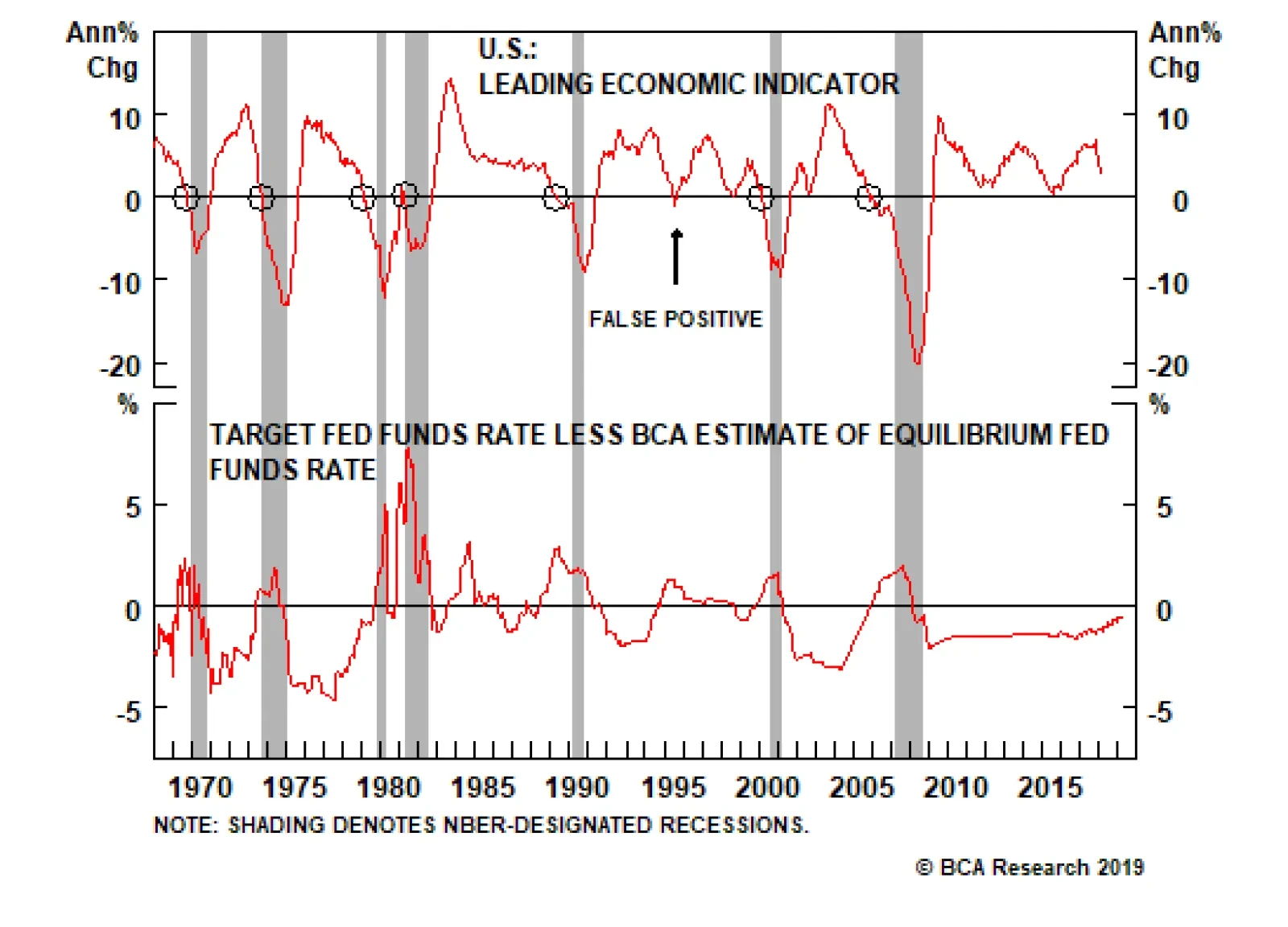

An inverted yield curve has called eight of the seven recessions that have occurred over the last 50 years, making it a dependable leading indicator. Year-over-year contraction in the Conference Board’s Leading Economic…

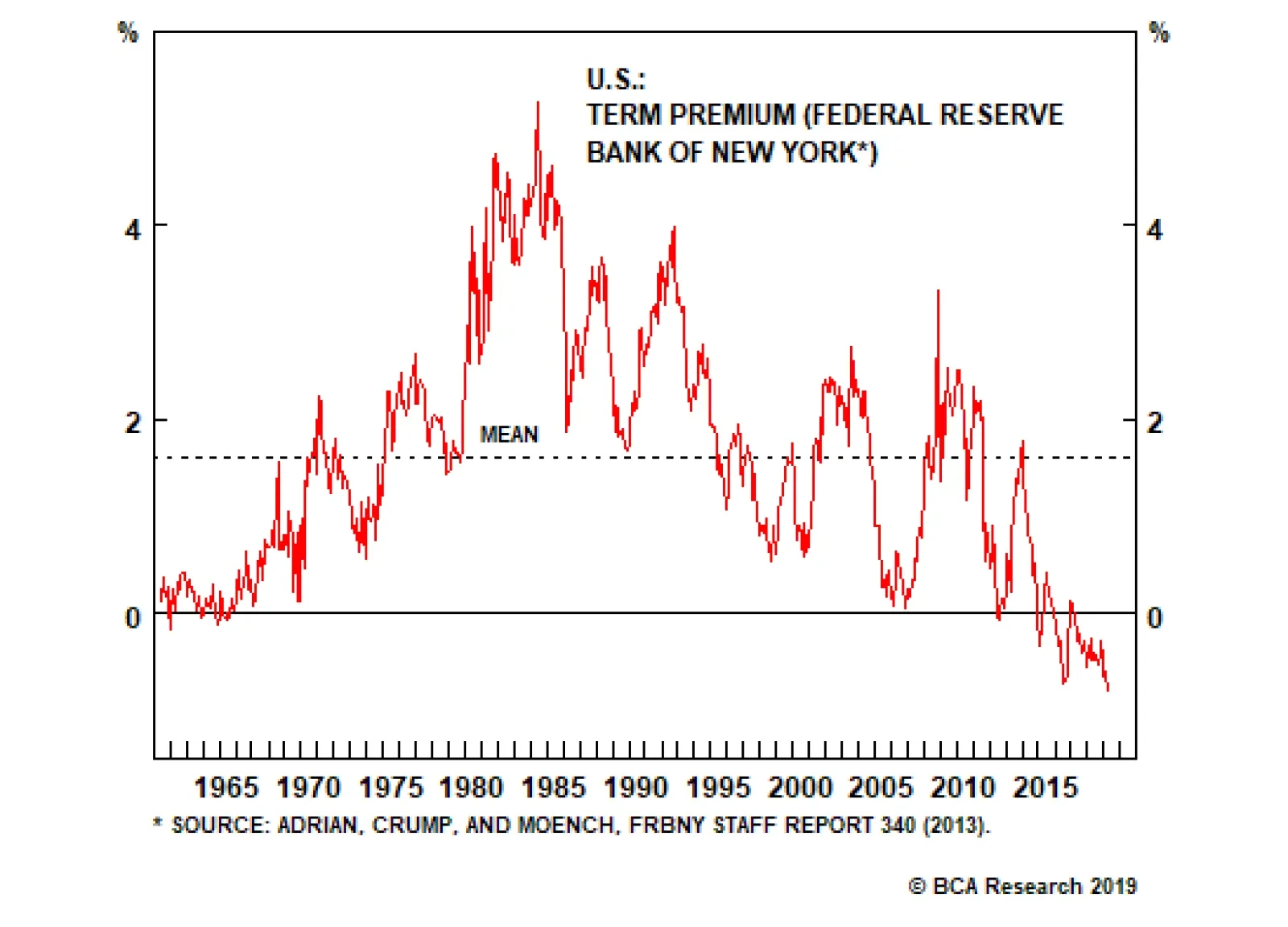

At its best, an inverted yield curve is a signal from the bond market that the Fed has tightened monetary policy too much, heralding future rate cuts and a sharp slowdown. Anything affecting yields at the long end, however, has…

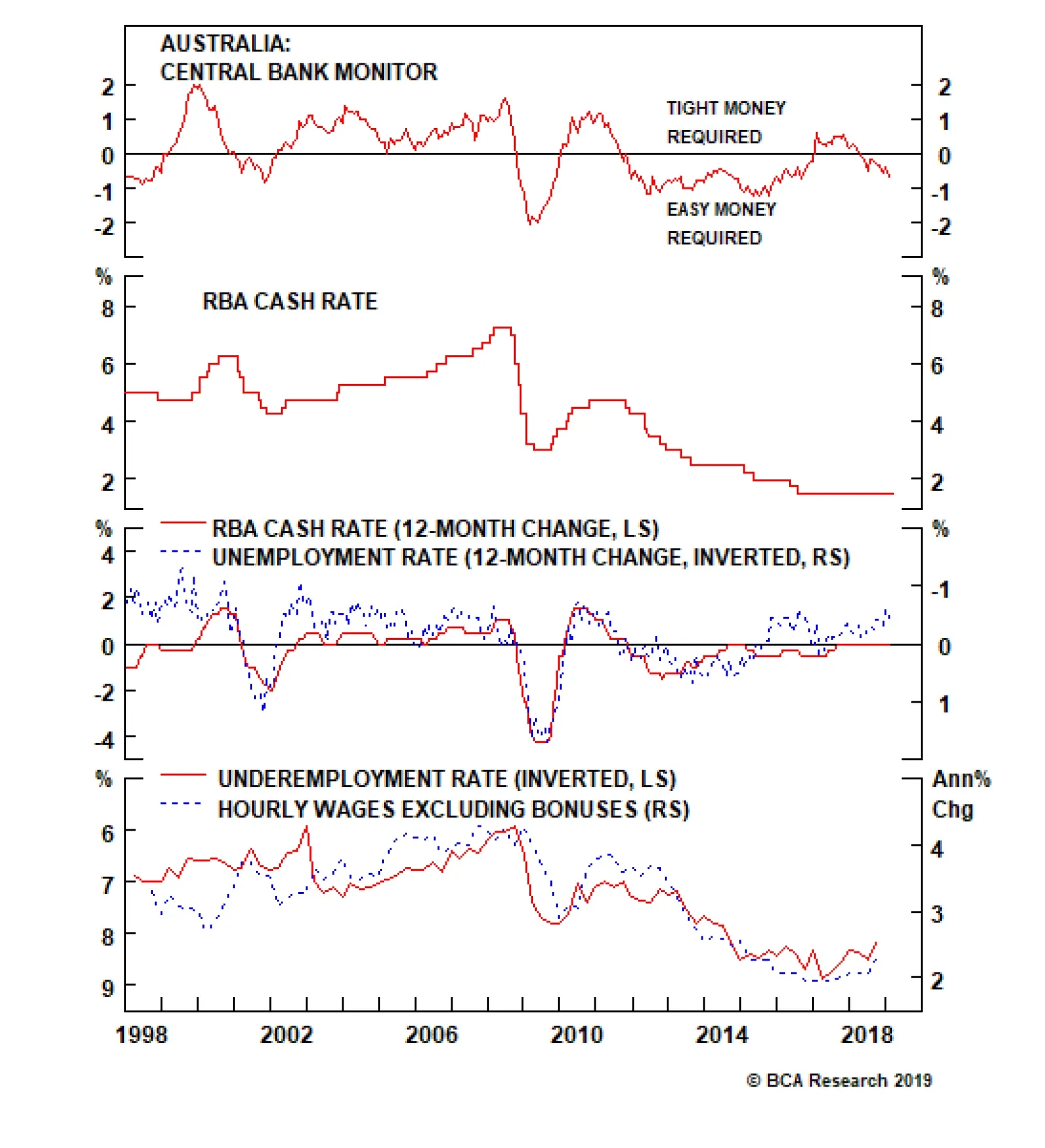

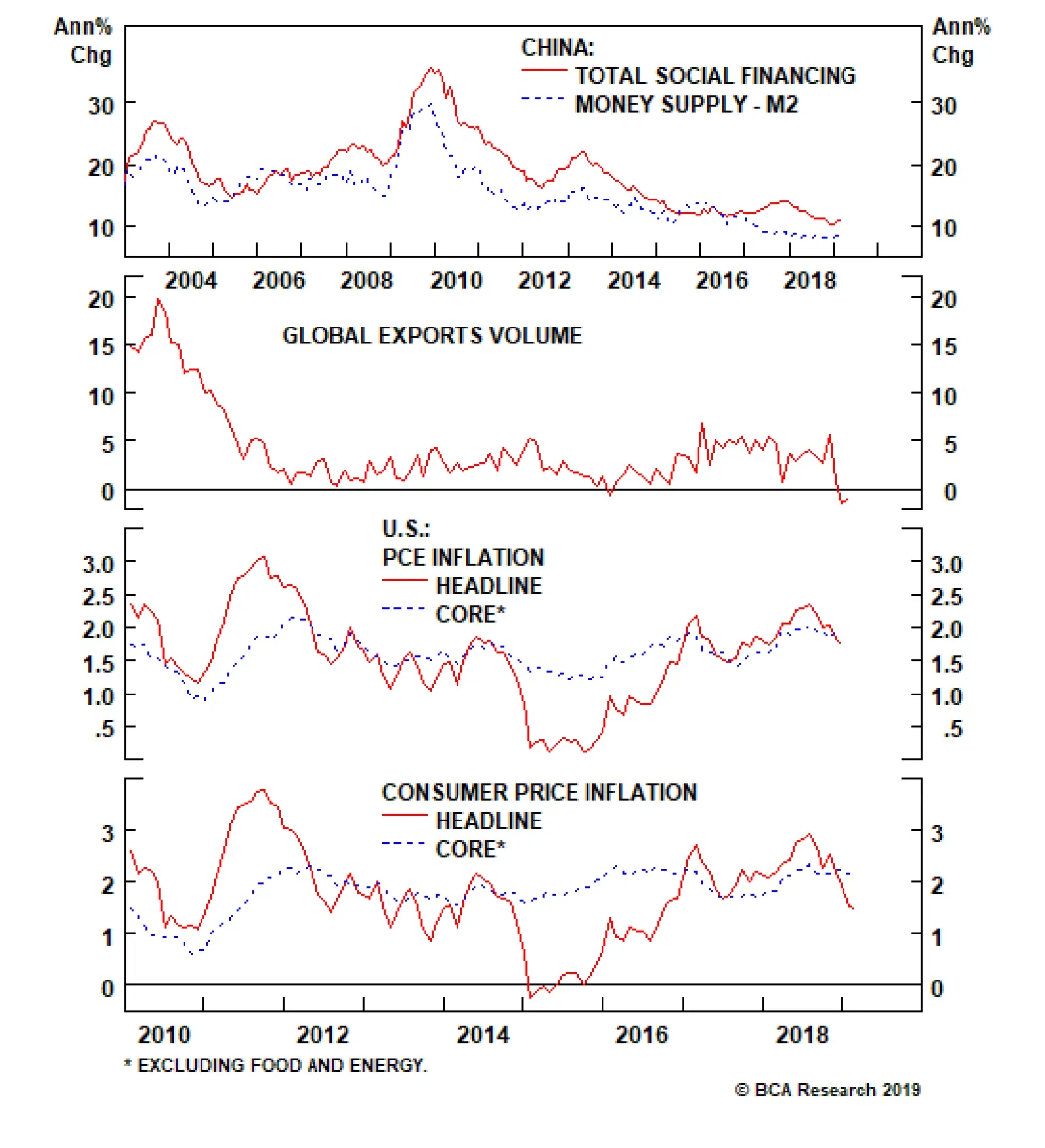

Governor Lowe refrained from cutting rates this month, but he acknowledged that the household sector continues to be hampered by dwindling real estate wealth and slowing income growth. Furthermore, he also highlighted that global…

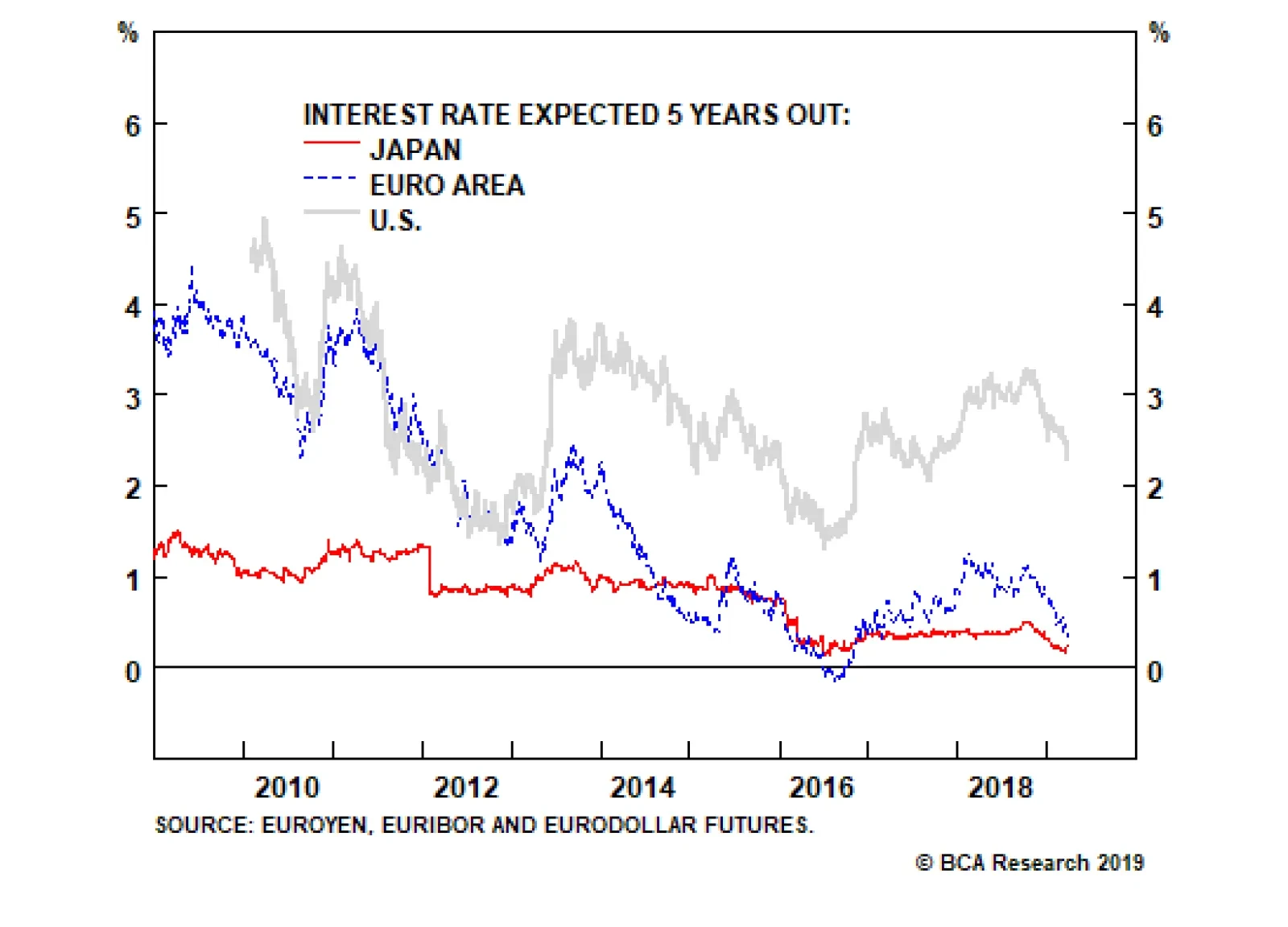

The twenty year life of the euro captures multiple manias and crises, some centered in Europe, some in the U.S. Through these twenty years, the euro area versus U.S. long bond yield spread has averaged -50 bps. Over this same…

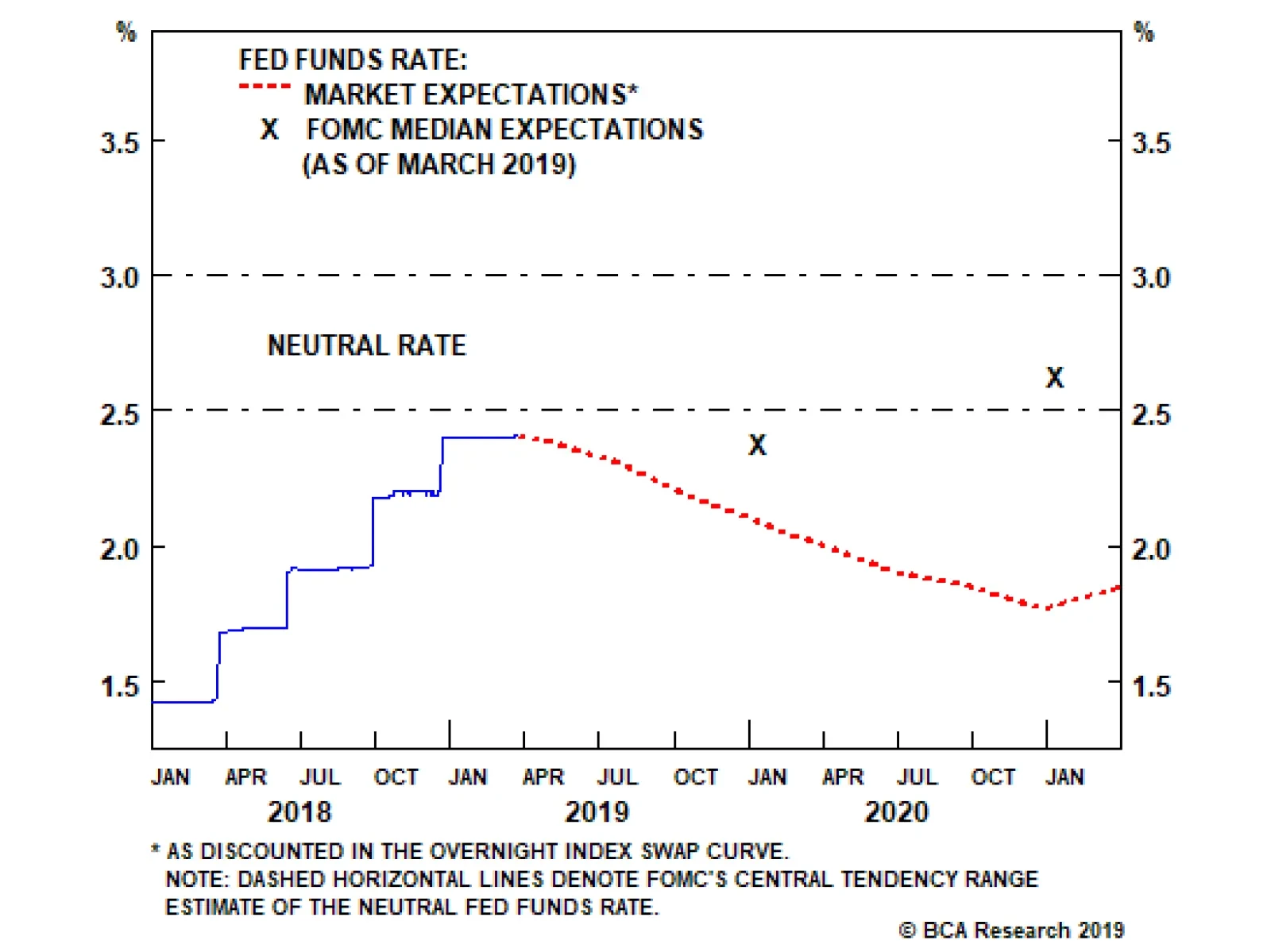

Our U.S. Investment Strategy team’s real-time view of the Fed’s turn to patience in early January was that it was a logical response to the sharp, sudden tightening of financial conditions imposed by the fourth-…

The delayed December retail sales release was lousy, and the uninspiring advance January figure led the Atlanta Fed to knock nearly 40 basis points off of its estimate of consumption’s contribution to first-quarter GDP, but…

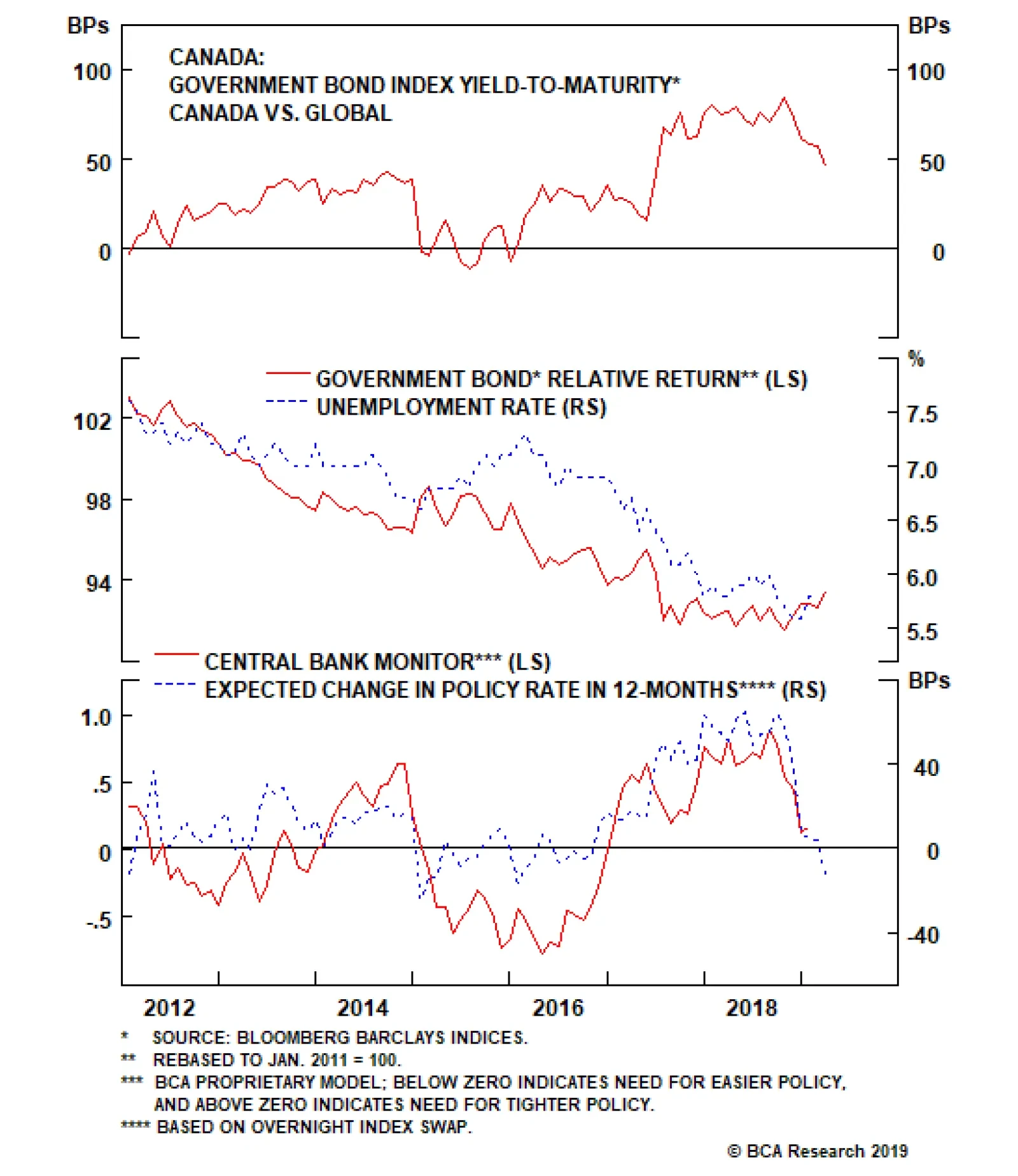

Canadian government bonds have been clawing back much of the relative underperformance that occurred in 2017 and 2018 when the Bank of Canada (BoC) was delivering multiple rate hikes. The spread between the yields on the…

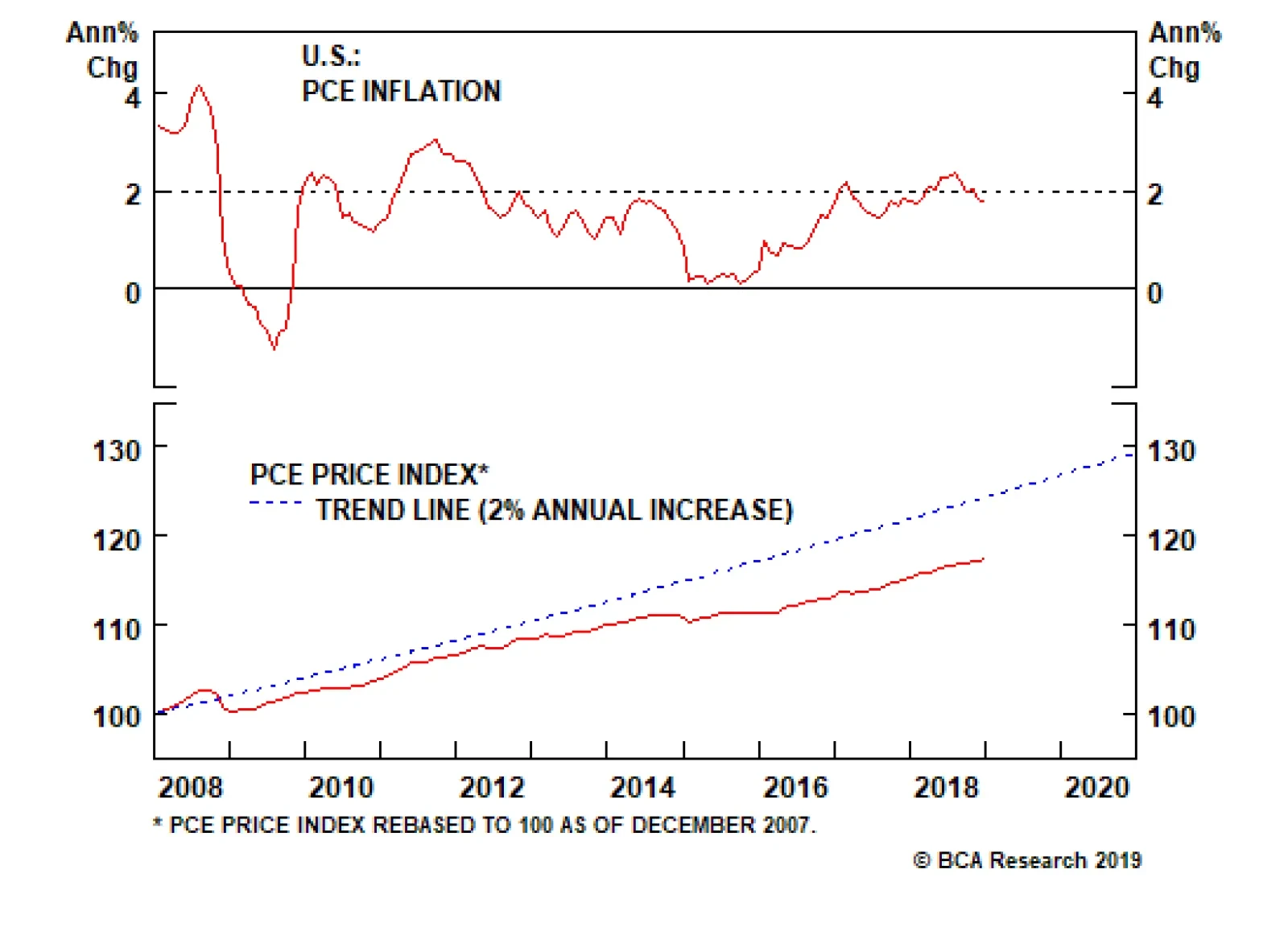

Strategies such as price-level targeting would represent a significant change from managing the 2% annual inflation target on a non-cumulative basis. The Fed has executed its price-stability mandate by aiming for 2% annual…

Highlights So What? The late-cycle rally still faces non-trivial political hurdles. Why? U.S.-China trade talks, the U.S. threat of tariffs on auto imports, and Brexit continue to pose risks. A shocking revelation from the…