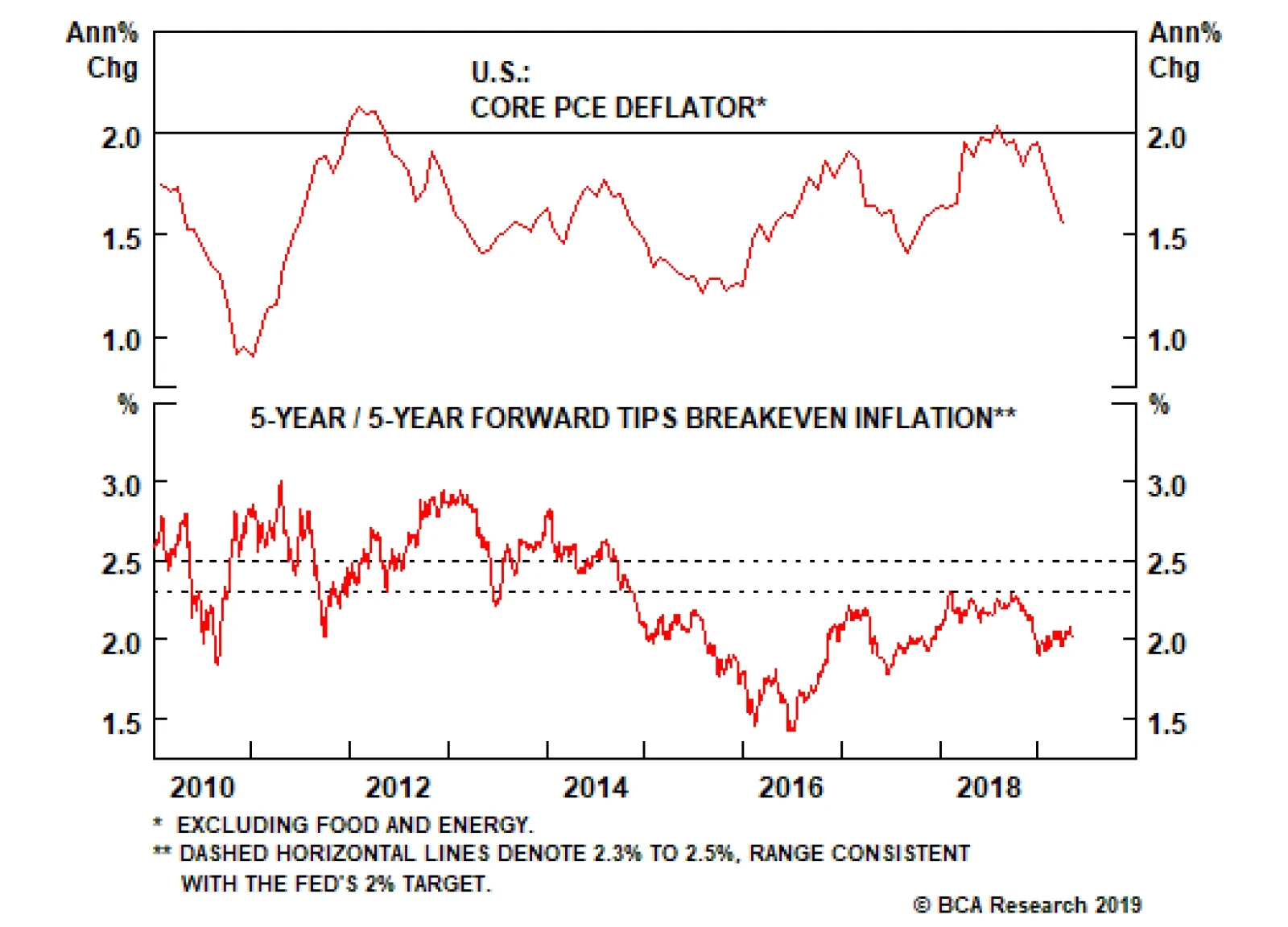

The official statement acknowledged that U.S. inflation was running below the 2% target, but Fed Chair Jerome Powell later described that inflation shortfall as “transitory” and expected to reverse. Powell standing…

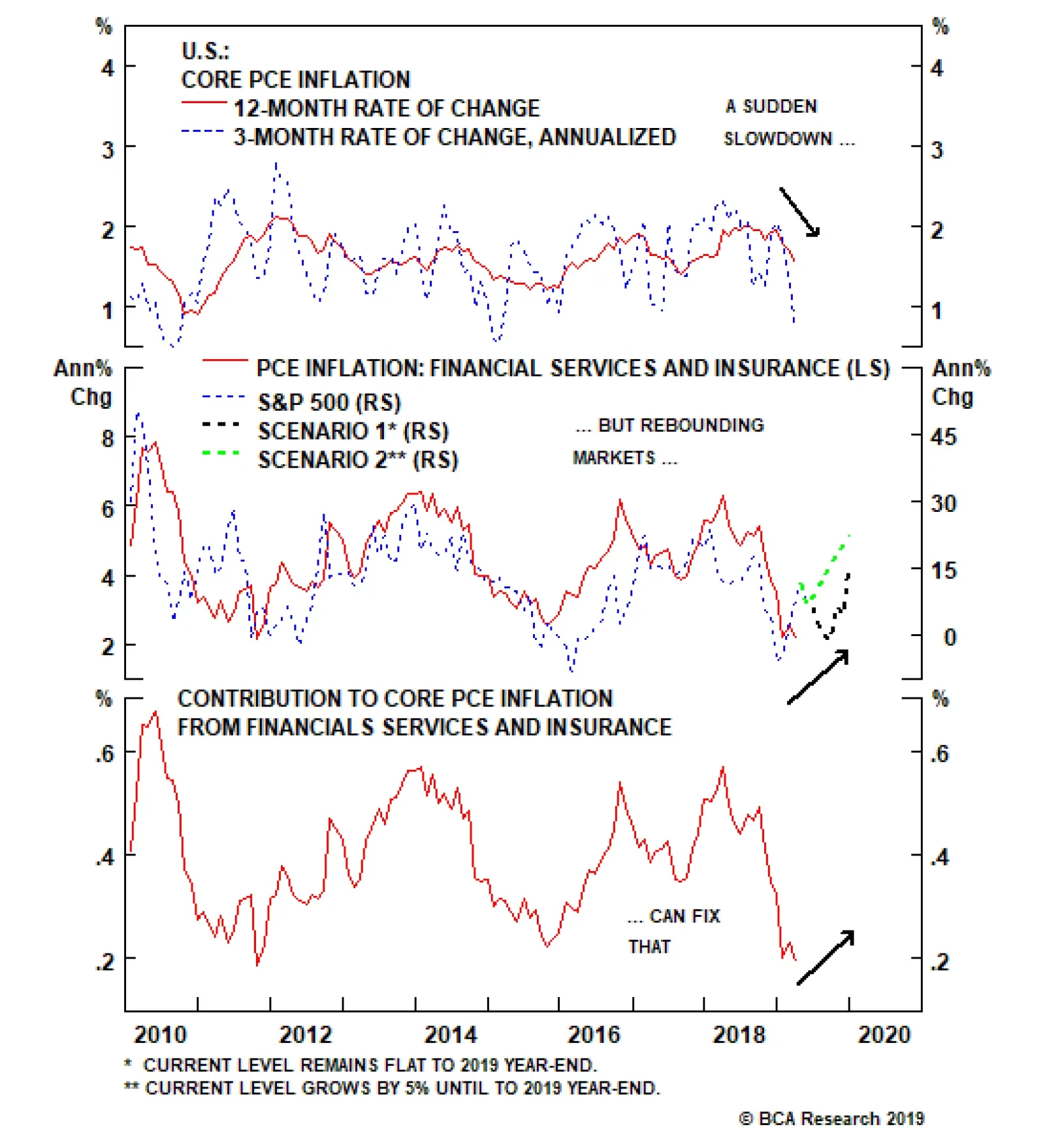

In 2018, prior to the year-end correction in U.S. equity markets, the contribution to core PCE inflation from the Financial Services category was a steady 0.5-0.6 percentage points. After the market rout, that contribution has…

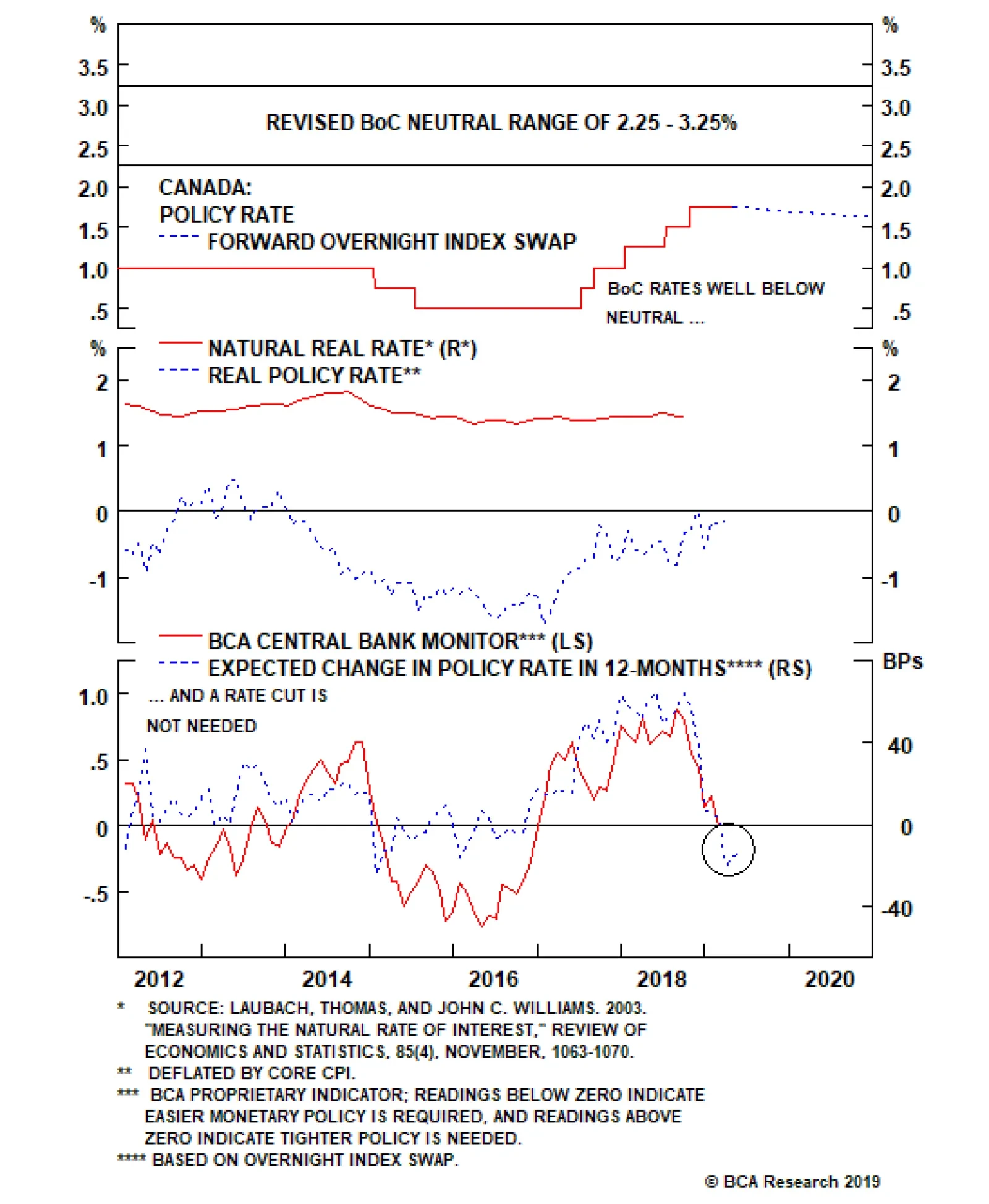

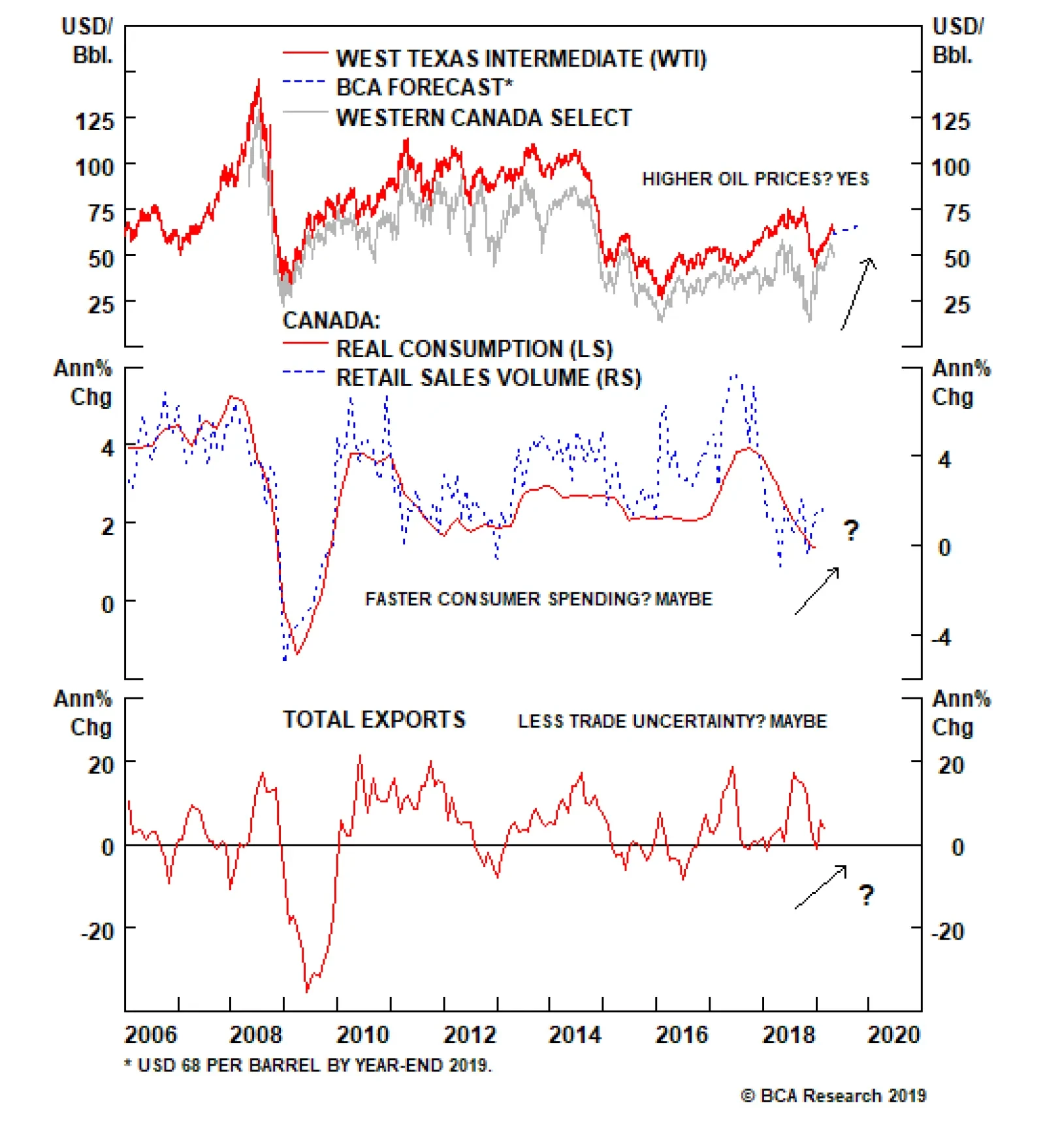

The problem for the BoC is that its policy rate of 1.75% remains well below its own estimated neutral range, which is now 2.25%-3.25%. A similar message comes when looking at the neutral real rate (“r-star”) estimate…

The BoC places a lot of weight on the Business Outlook Survey (BoS) in determining its economic forecasts, and in setting monetary policy. Thus, it is no surprise that in the official statement following the April 24…

The rationale is straightforward: If the neutral rate turns out to be higher than expected and inflation starts to accelerate, central banks can always tighten monetary policy. In contrast, if the neutral rate is very low, the…

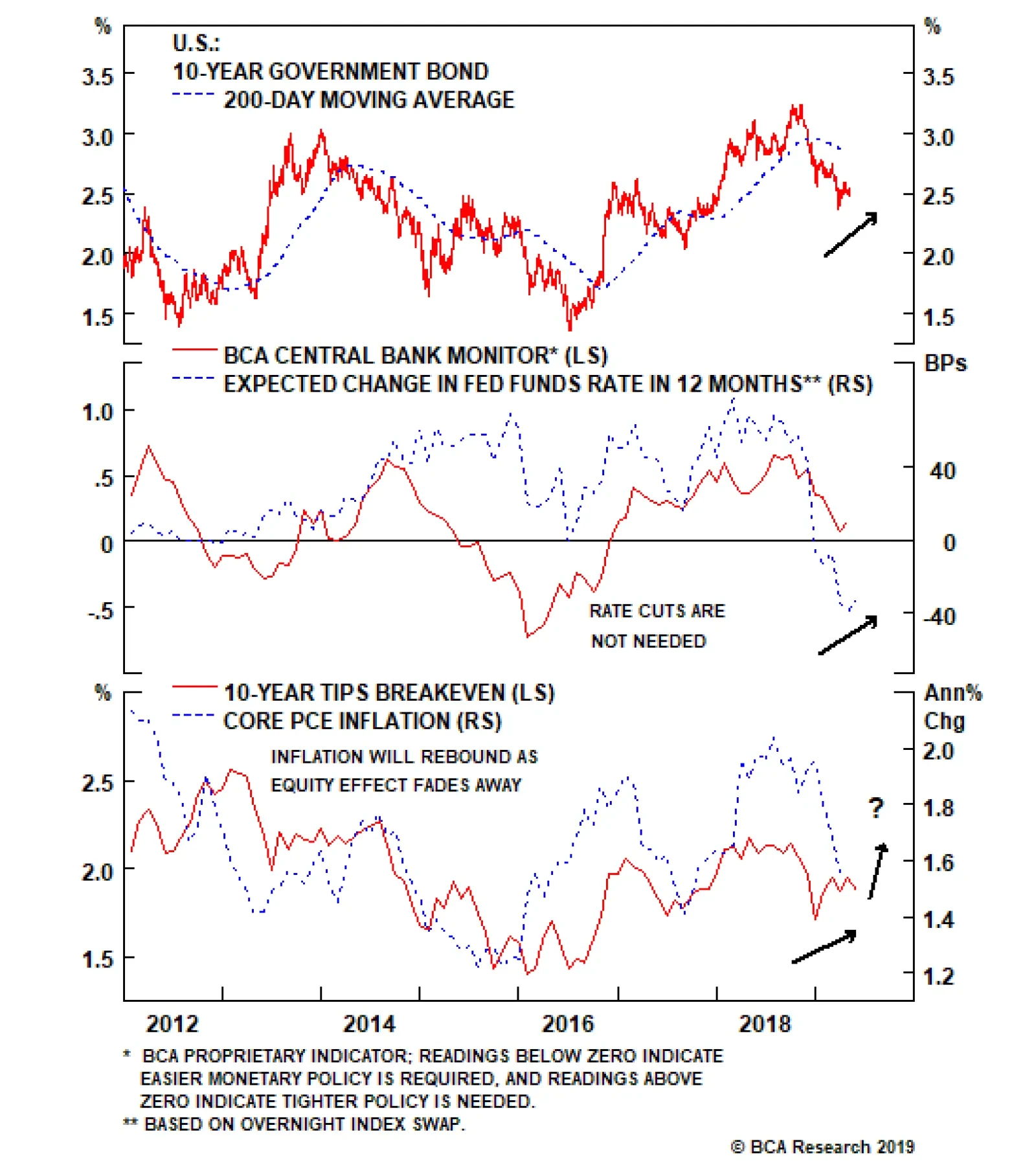

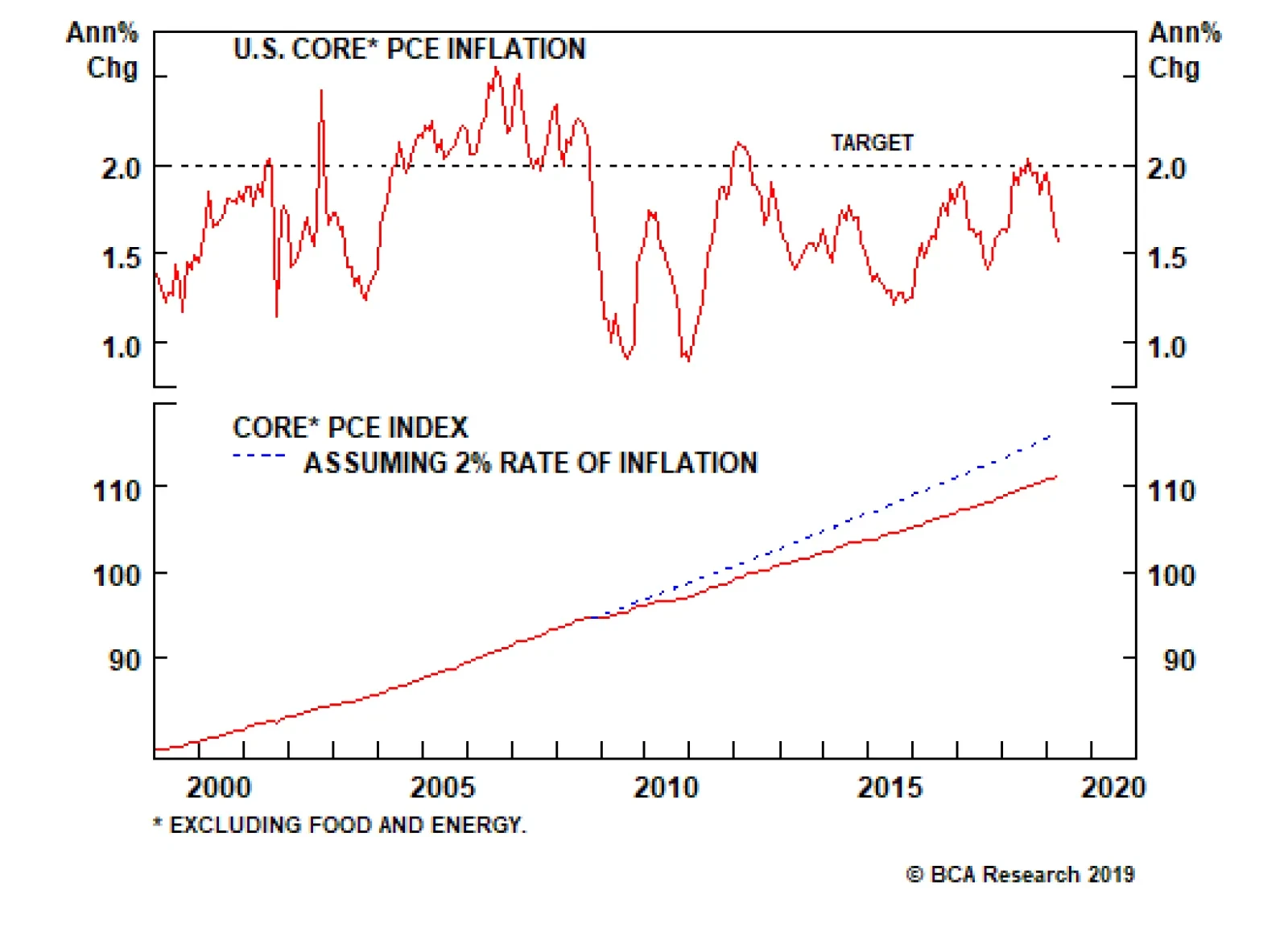

Under the Fed’s existing framework, its “symmetric” inflation target is not supposed to be backward-looking. Symmetry simply means that the Fed targets 2% inflation every year, allowing for an equal probability…

If inflation runs persistently above or below 2 percent, then the Fed would be forced to adjust its policy stance to nudge it back towards target. If inflation’s deviation from target is only transitory, it means that it…

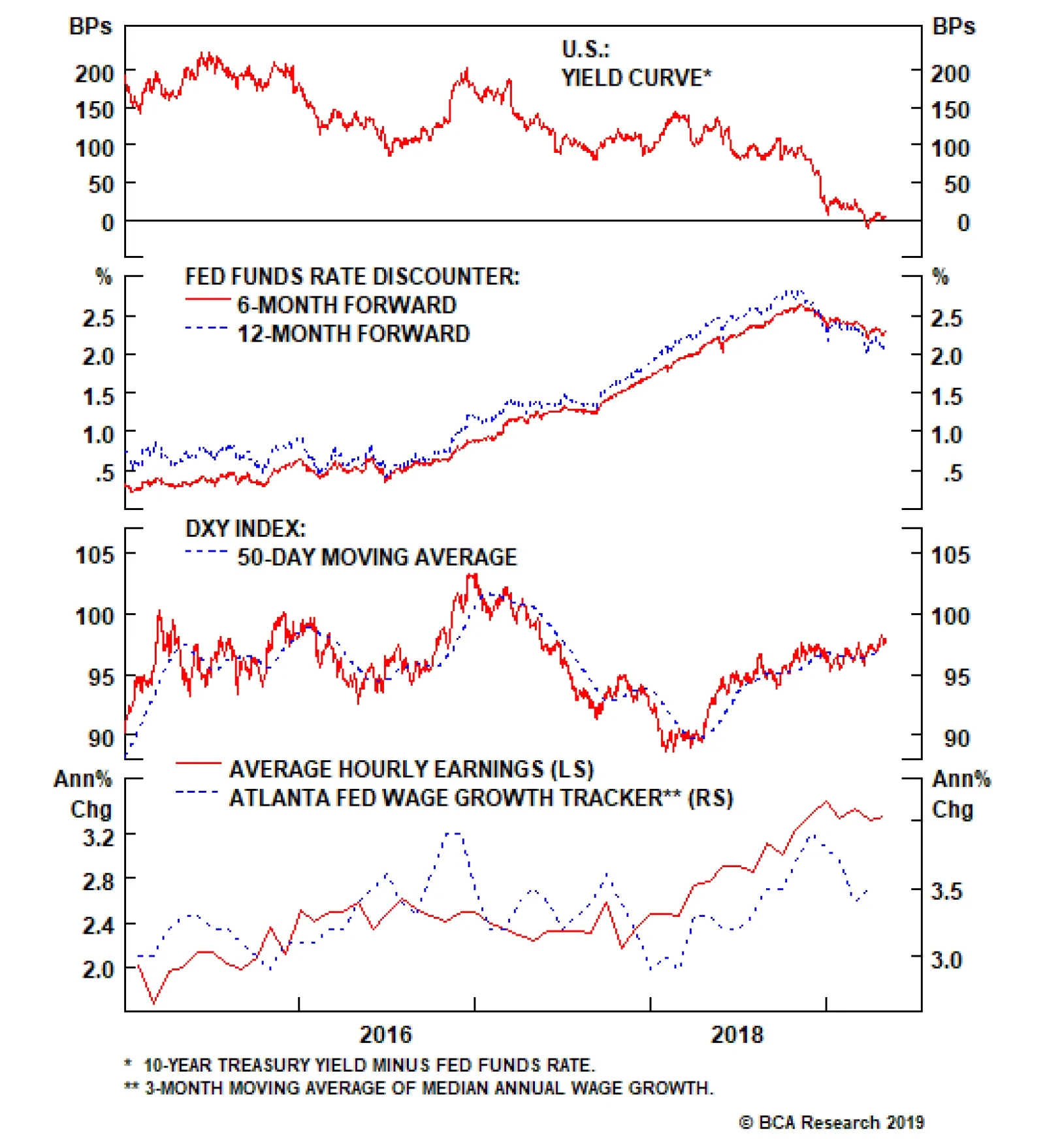

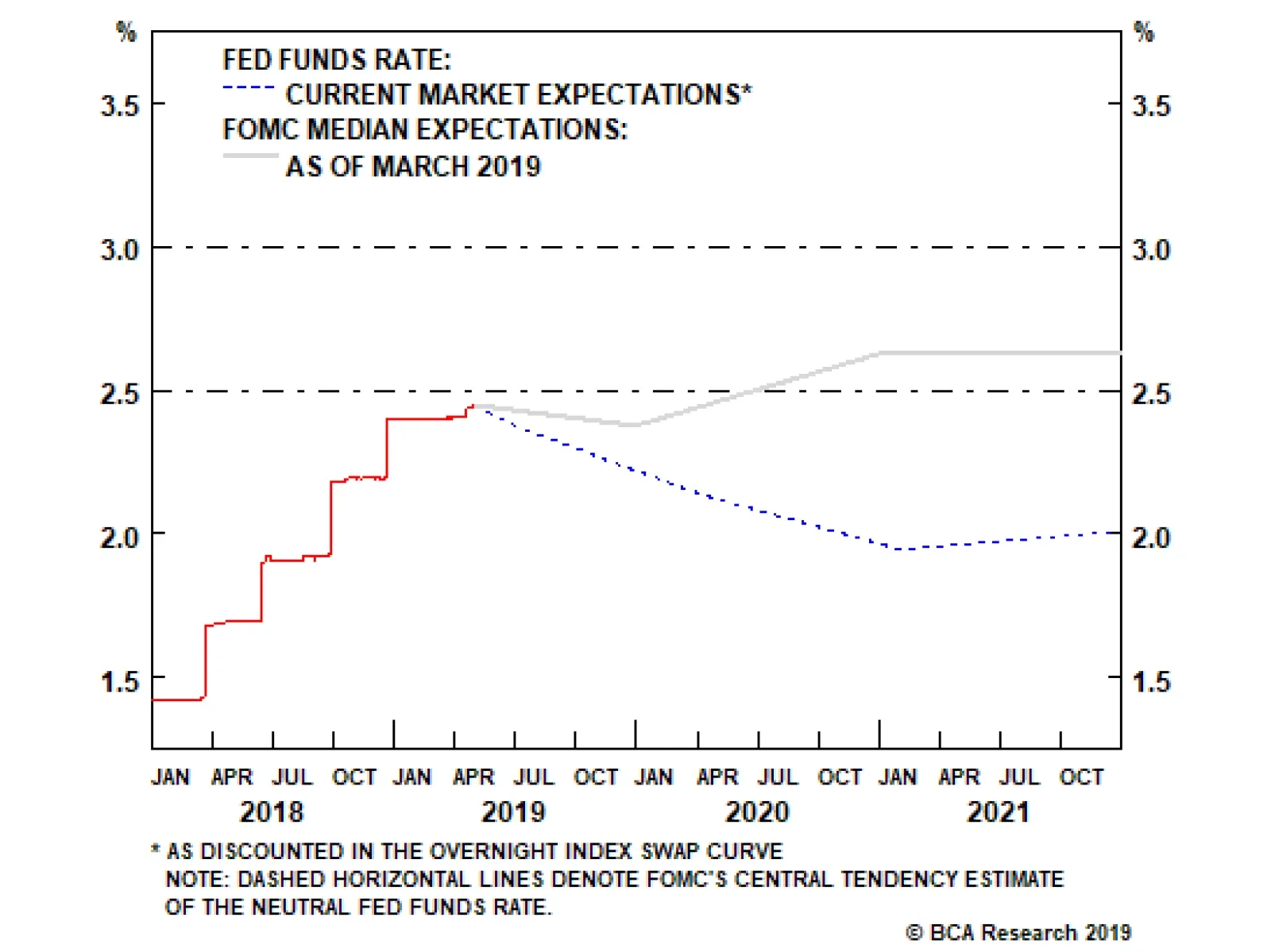

Our sector strategists recently examined the question of sector performance in an environment where the Fed is cutting rates. A Fed rate cut is not our base case view: leading indicators of inflation remain biased to the upside,…

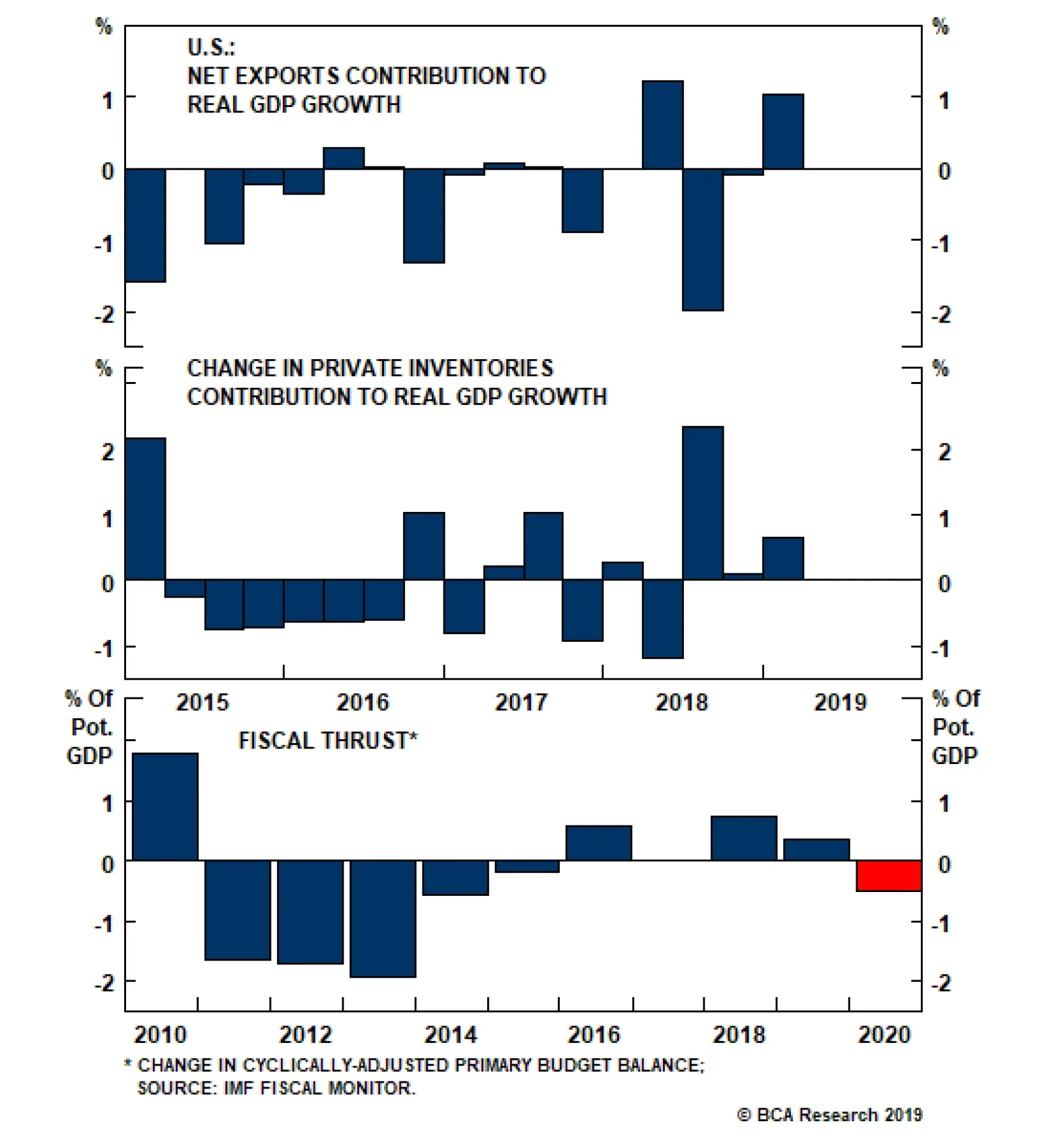

At first blush, the first quarter’s real 3.2% growth would seem to attack the notion that the Fed has already reined in the economy. However, there was much less to the GDP release than meets the eye, as it was propped up…

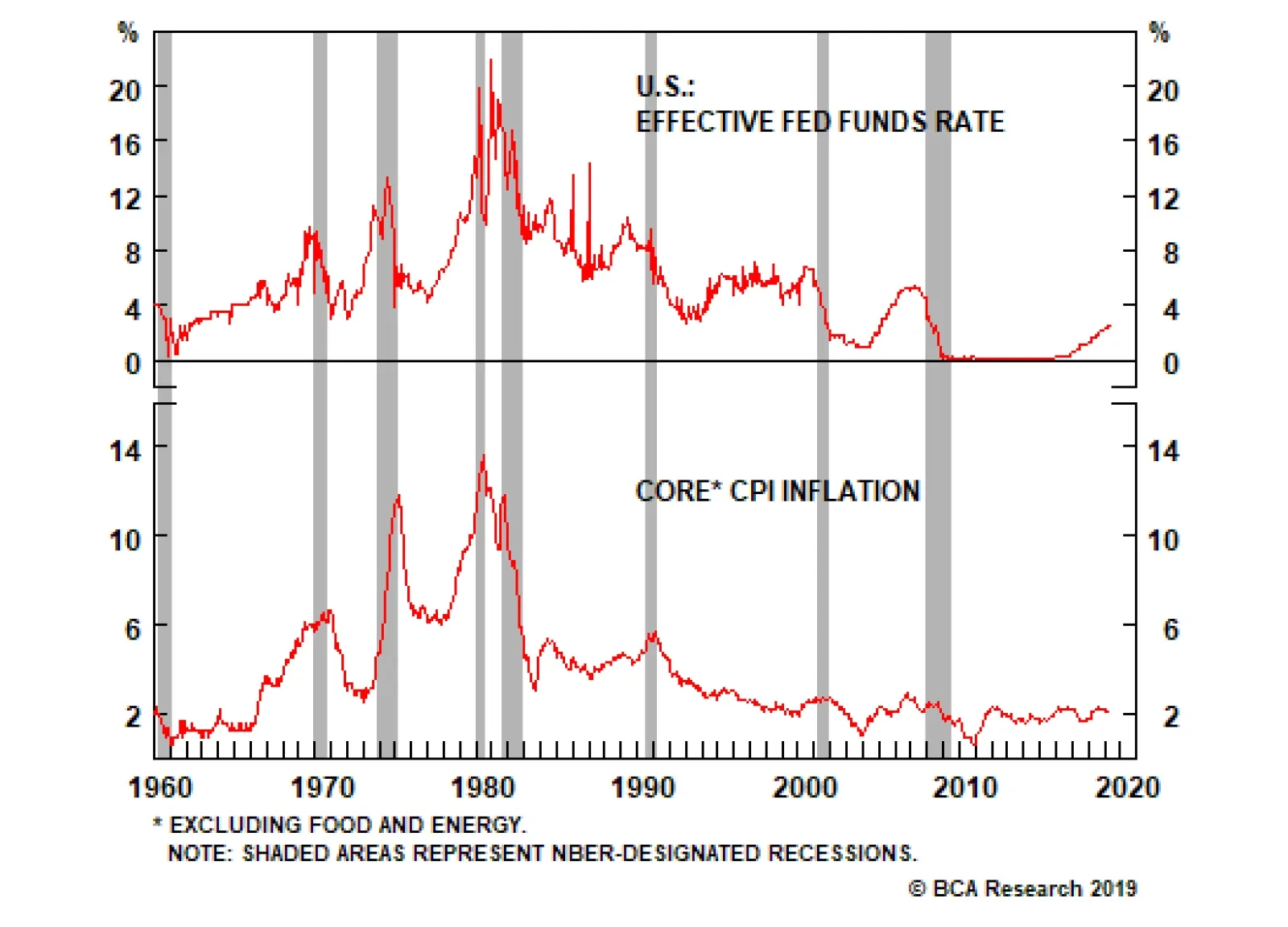

Yesterday, the Fed dashed the hopes of traders betting on an interest rate cut this year. The FOMC is on pause for now, and it will not respond to what it perceives as a transitory inflation slowdown. The Fed reaction function…