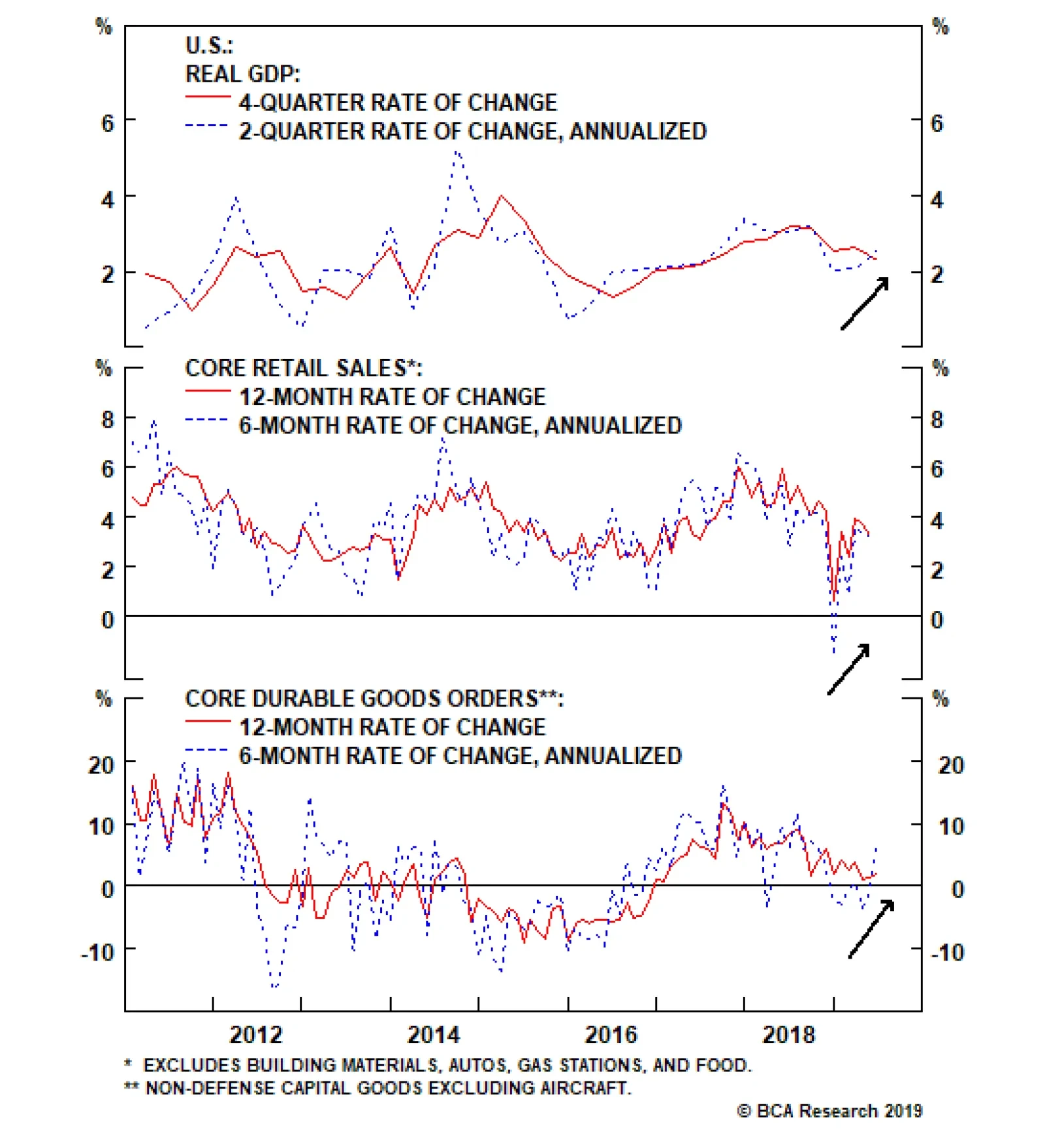

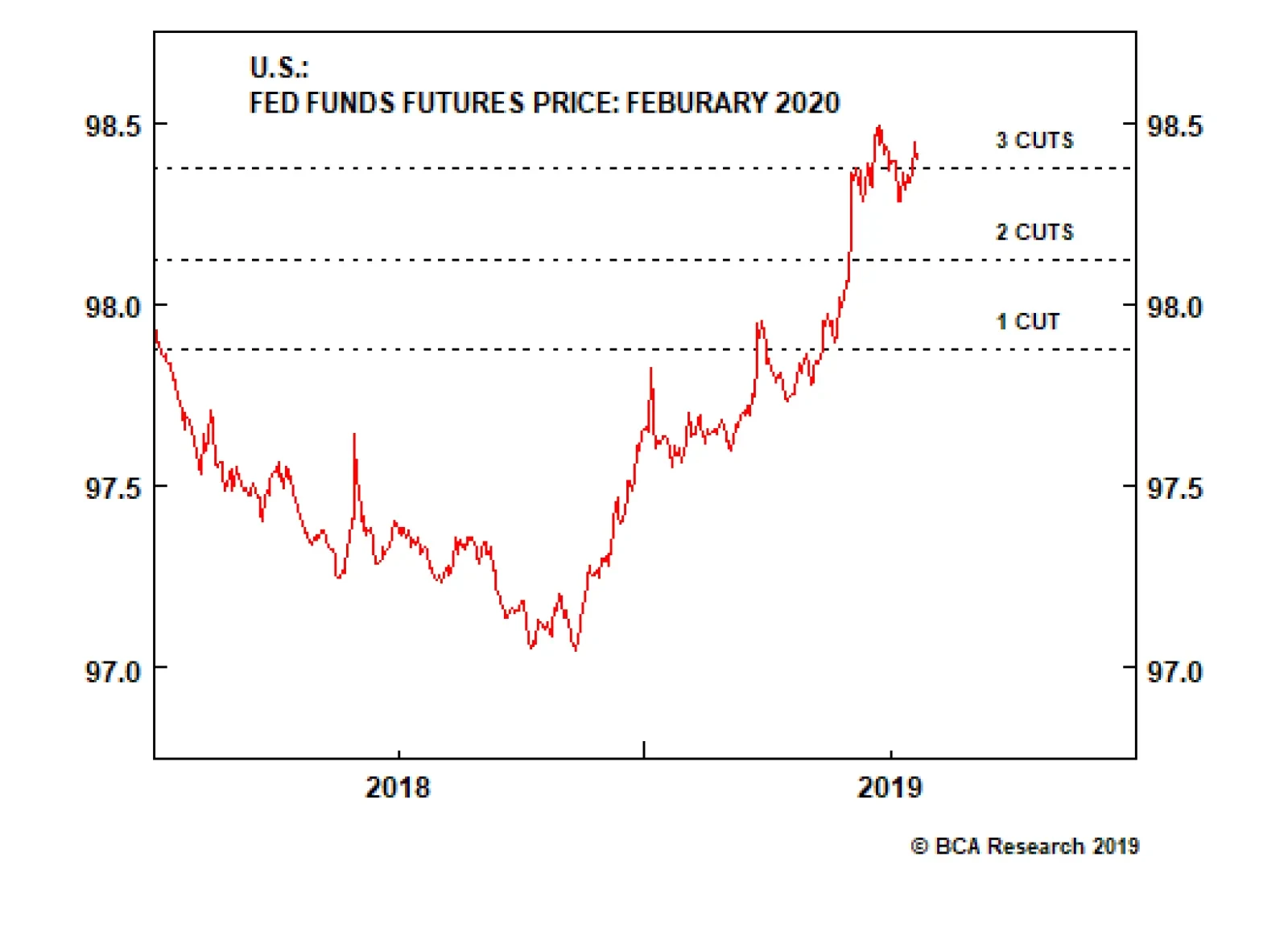

The latest batch of data from the U.S. suggests that today’s widely-expected Fed rate cut may be a one off. Expect a 25bp cut, with forward guidance open to another 25bps in September to protect against the adverse…

Highlights The global manufacturing cycle has averaged about three years in length (peak-to-peak). We are near the bottom of the current cycle, which should set the stage for a recovery phase lasting around 18 months. The global…

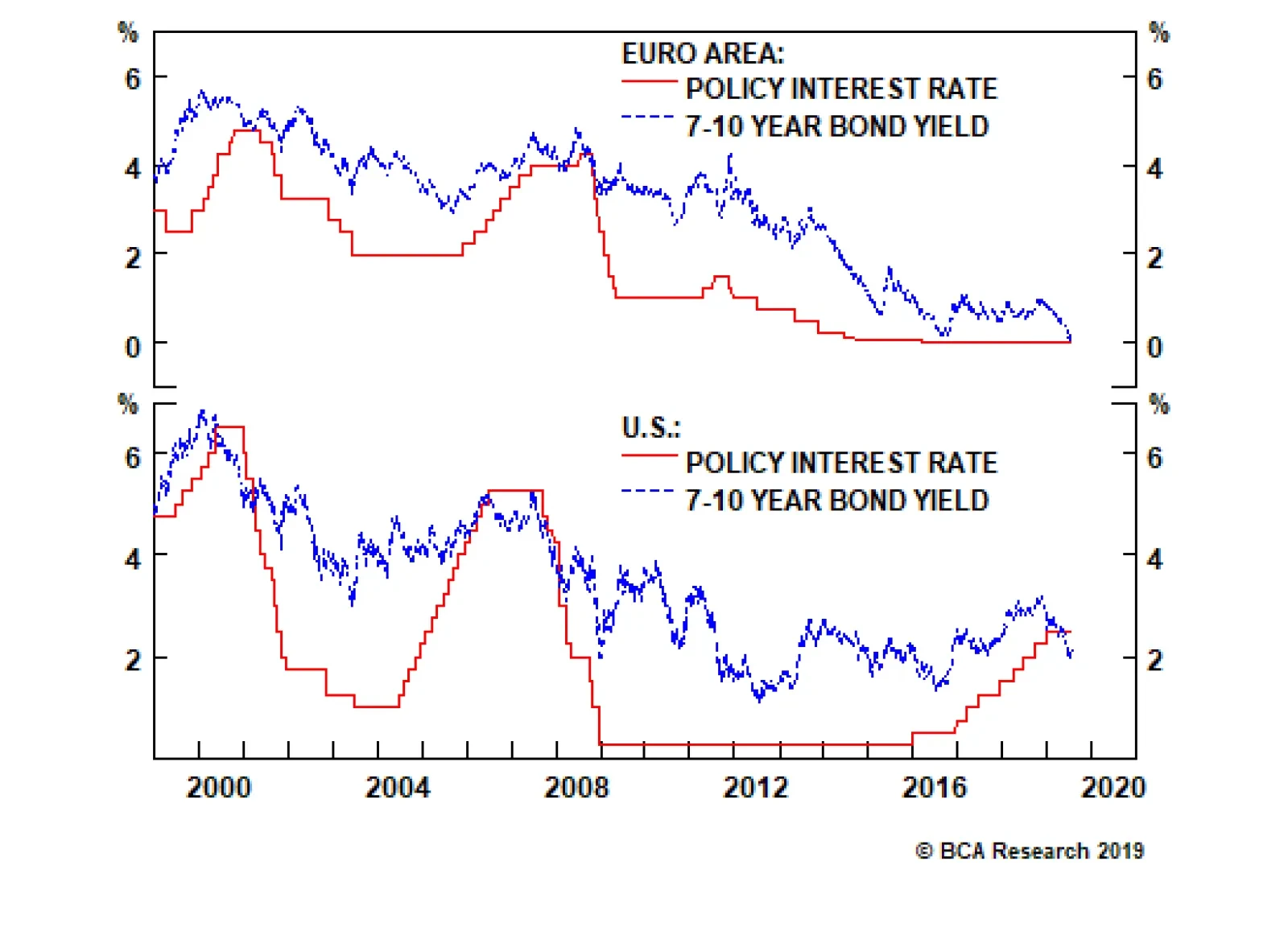

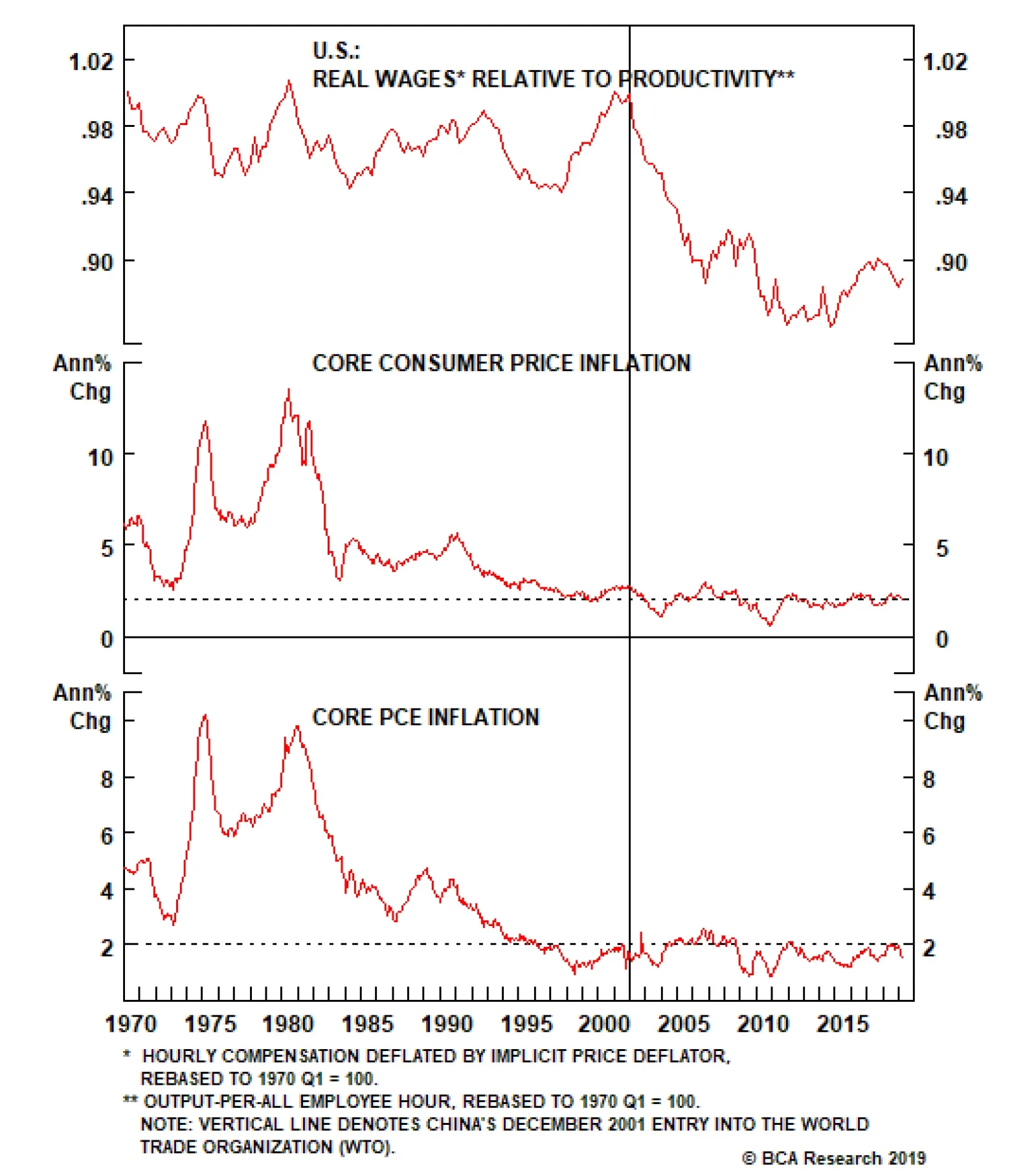

In a range of -1 to 2 percent, inflation expectations become insensitive to monetary policy. So in their obsession to achieve two point zero, central banks have pushed harder and harder on a piece of string. As a result, the…

The speech focused on how, when interest rates are close to the zero bound, the Fed should “act quickly to lower rates at the first sign of economic distress”. Investors interpreted this dovish speech as a signal…

Highlights Six months into a credit expansionary cycle, China’s economic recovery remains fragile. Lack of government support for the auto and property sectors is undermining a cyclical recovery. Accommodative monetary policy is…

Highlights So What? U.S. policy uncertainty adds to a slew of geopolitical reasons to remain tactically cautious on risk assets. Why? U.S. fiscal policy should ultimately bring market-positive developments – though the budget…

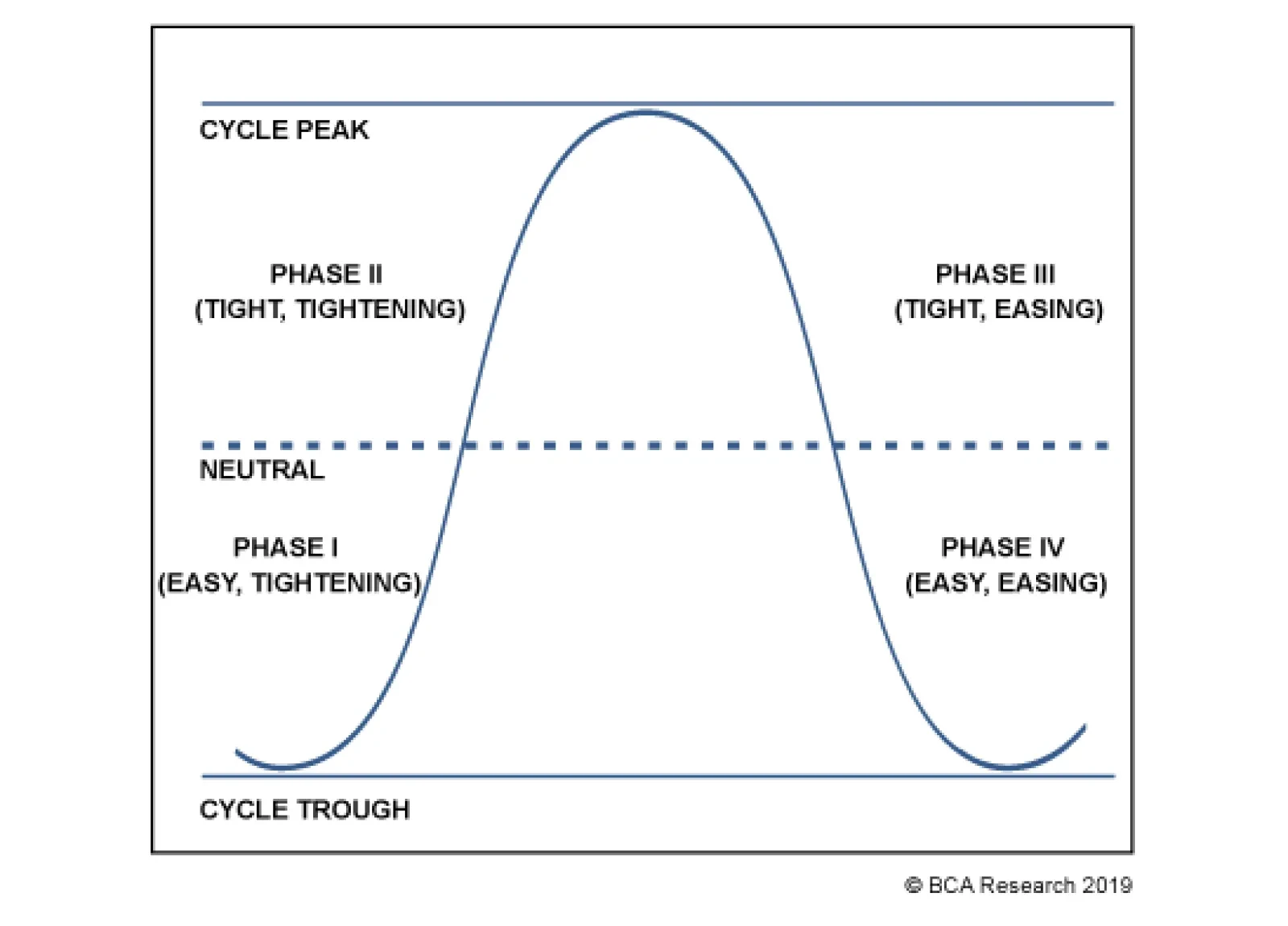

We decompose the fed funds rate cycle into four phases based on the interaction between the level of rates and their direction, as follows: Phase I represents the early stage of the withdrawal of monetary stimulus. This…

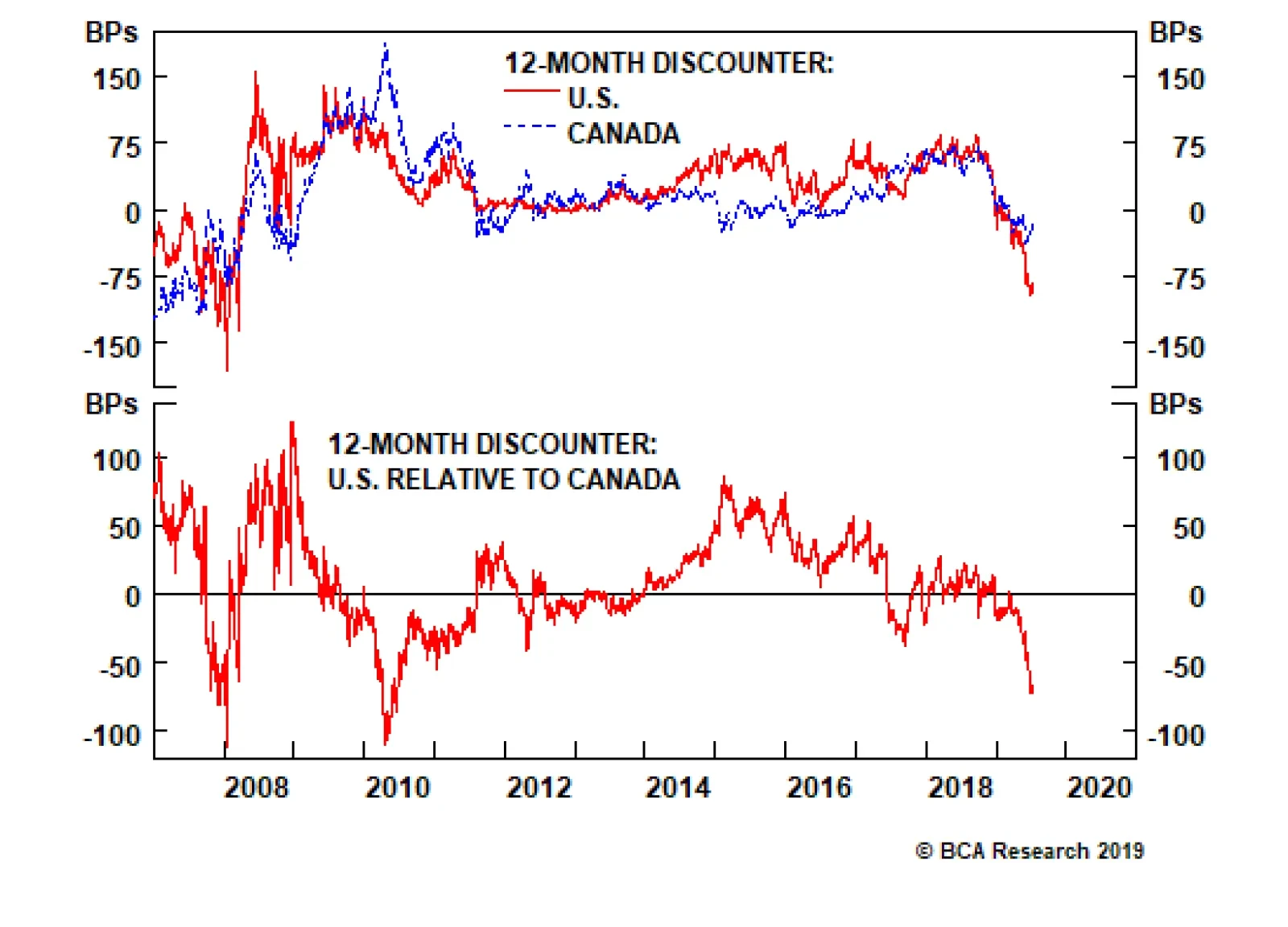

Canadian data has been firing on all cylinders of late, so it was no surprise that Governor Stephen Poloz decided to keep interest rates on hold today. That said, details in its monetary policy report were notably cautious…

Oil prices will remain volatile as markets work through the lingering effects of tighter financial conditions prevailing last year, which, along with extended angst over Sino-U.S. trade tensions, slowed commodity demand growth (Chart of…

Those three primary reasons are: countering the domestic threat posed by a potential worsening of trade tensions, making conventional recession-fighting measures more robust, and insulating the expansion from both market wiggles…