Highlights Our cyclical view is unchanged, … : Despite the evident risks from escalating trade tensions, soft global economic data, and widespread recession concerns, we expect the expansion and the bull markets in spread…

Highlights While a self-fulfilling crisis of confidence that plunges the global economy into recession cannot be excluded, it is far from our base case. Provided the trade war does not spiral out of control, it is highly likely that…

Highlights Four ghosts of 2016 are knocking at the door: Brexit, Trump, Brazil, Italy. President Trump and U.S. trade policy are keeping uncertainty high. Upgrade the odds of a no-deal Brexit to about 33%. Expect limited stimulus…

Highlights Economic data suggest the current business cycle in China has not yet reached a bottom. Stimulus measures have not been forceful enough to fully offset a slowing domestic economy and weakening global demand. With possibly…

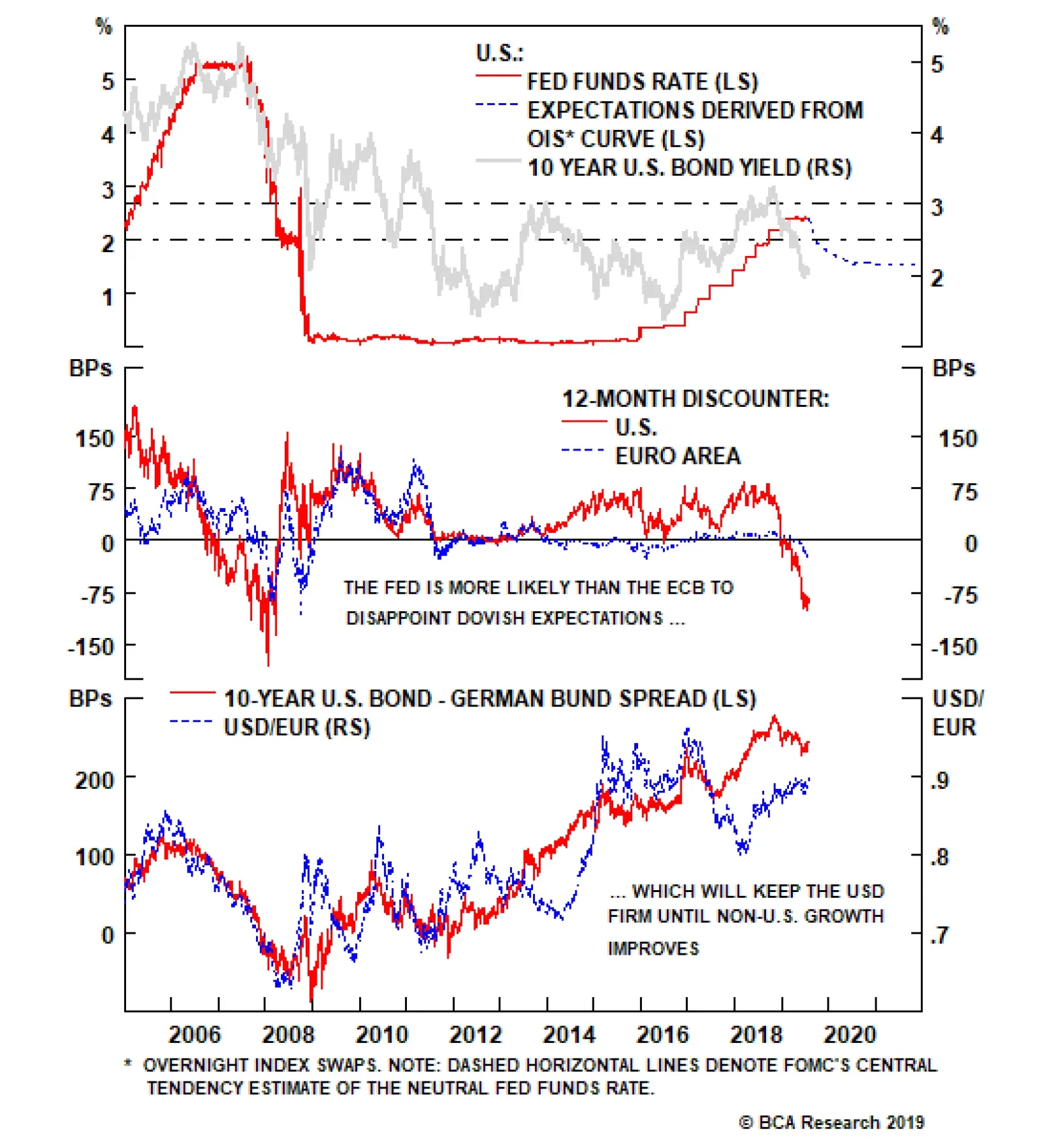

Since 1990, when the Fed has surprised dovishly (the fed funds rate has turned out to be lower than the money market implied twelve months earlier), Treasuries have almost always generated positive excess returns over cash.…

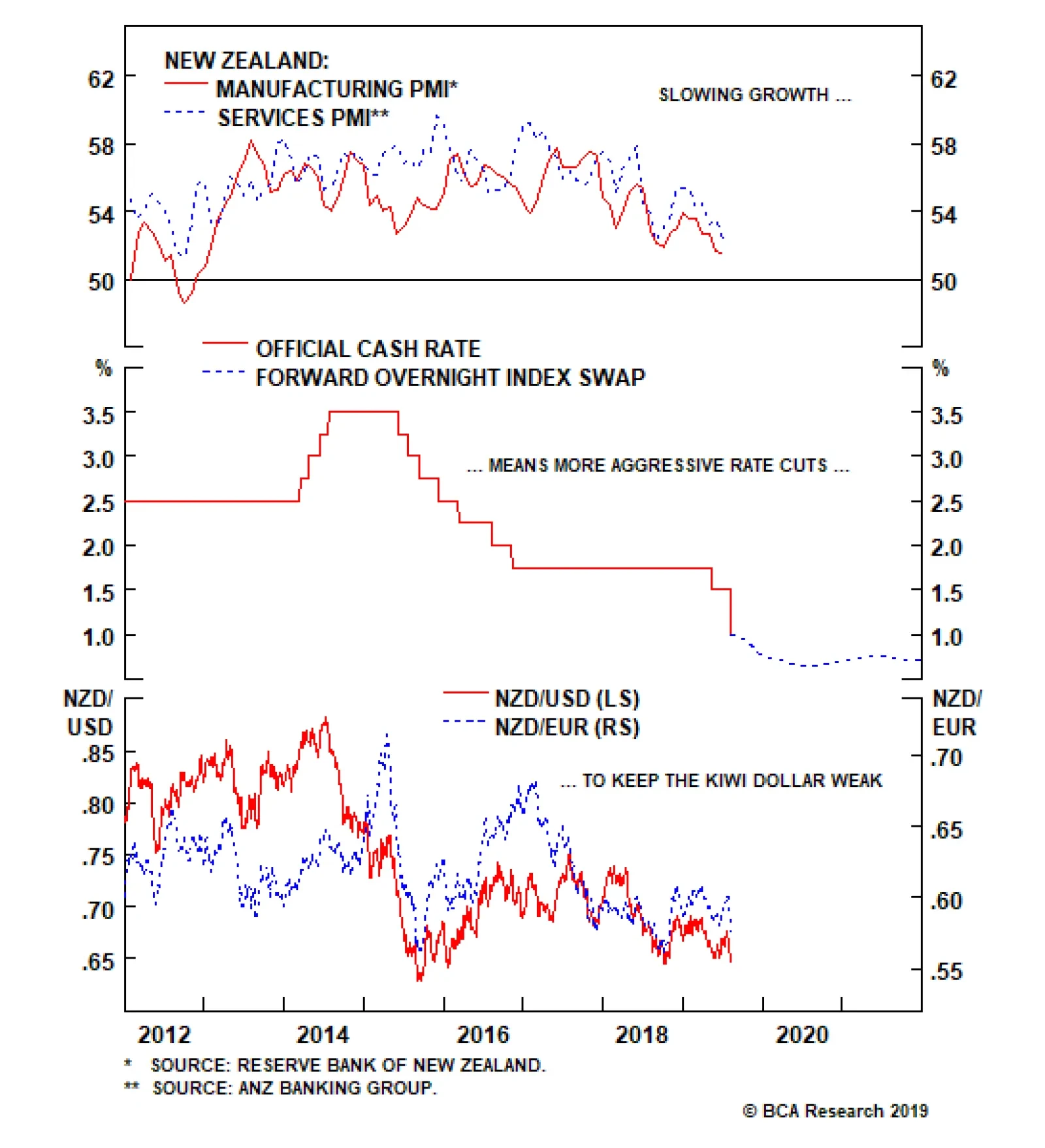

The Reserve Bank of New Zealand (RBNZ) cut rates by 50bps yesterday, stunning investors who expected only a 25bp cut. That took the Official Cash Rate to a record low of 1%, perilously close to the zero interest rate bound…

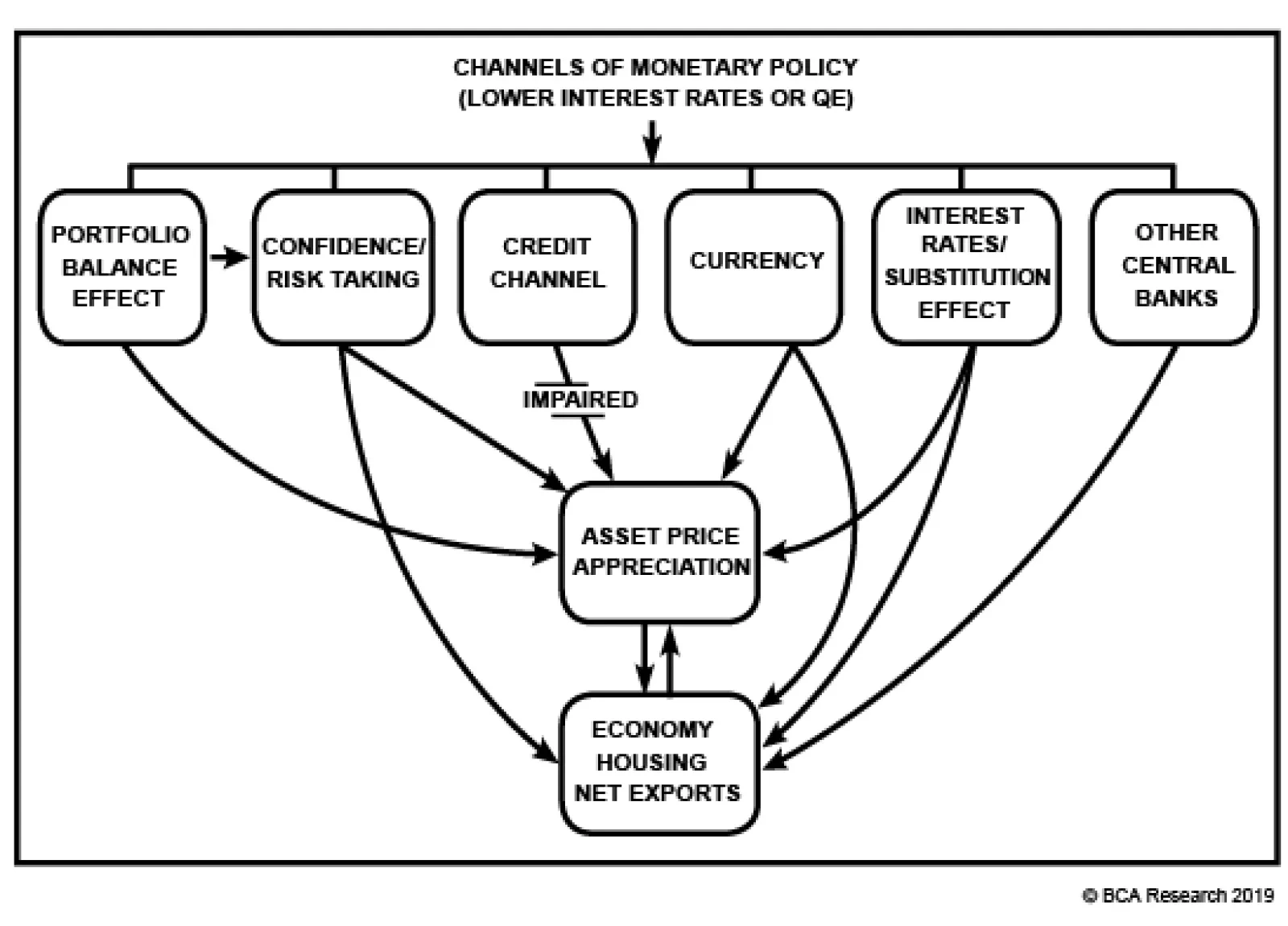

The textbook answer to the title question is that a lower Fed funds rate directly reduces the cost of financing big-ticket consumer purchases and corporate initiatives while indirectly nudging households and corporate managers to…

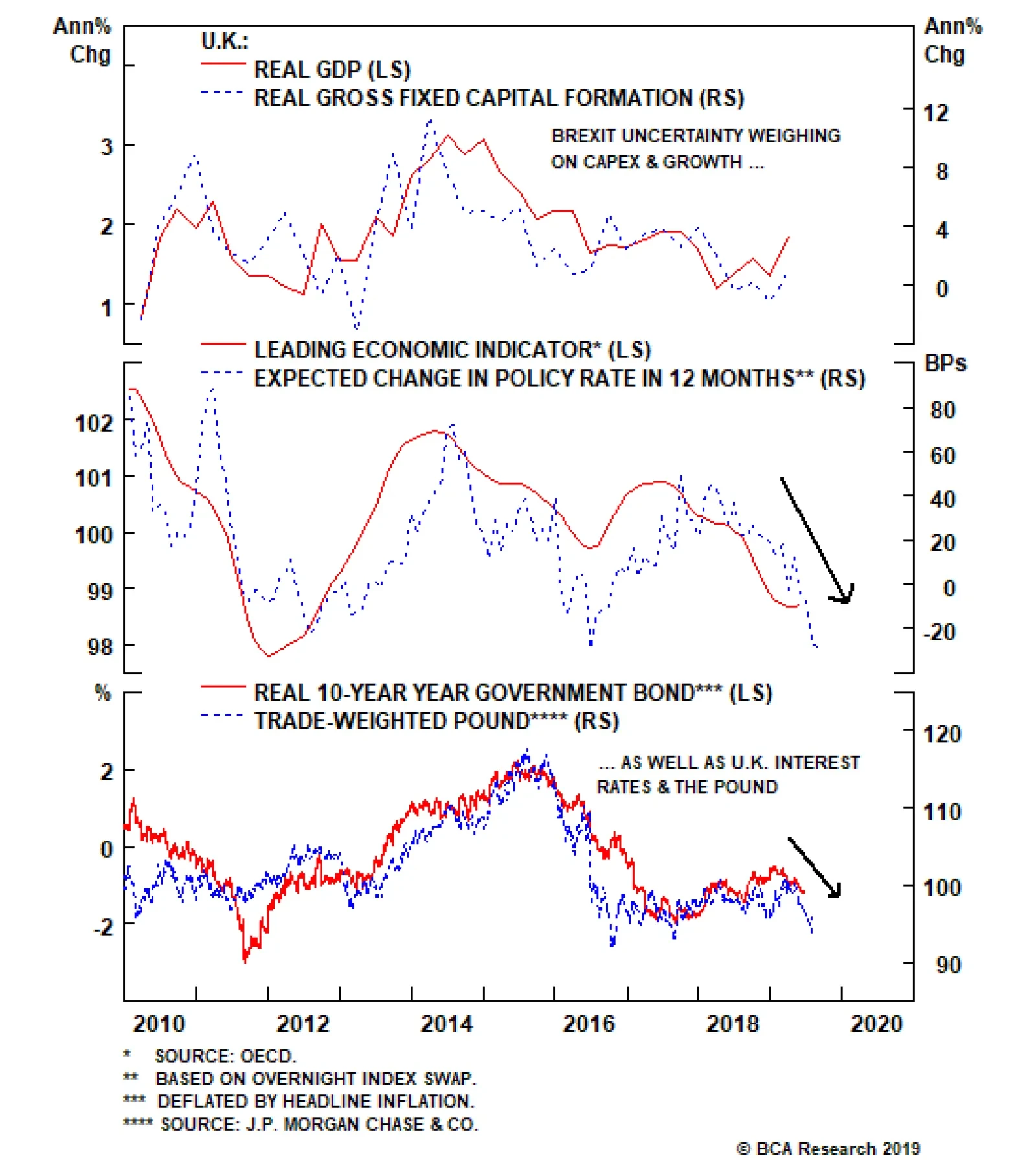

The Bank of England (BoE) held rates steady at last week’s Monetary Policy Committee (MPC) meeting, keeping the Bank Rate at 0.75%. The MPC modestly lowered its growth forecasts for 2019 and 2020 due to the dual…

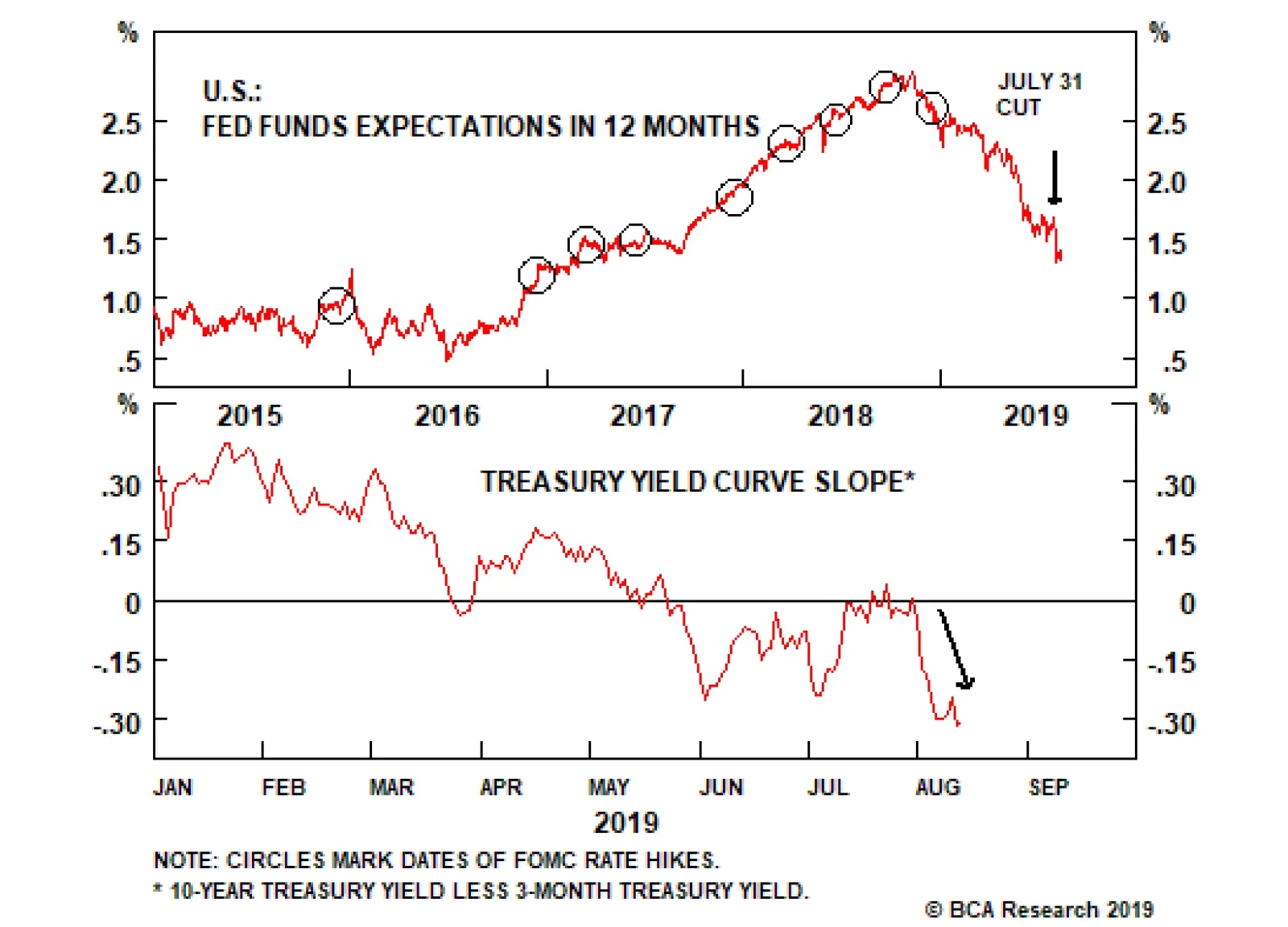

The Fed cut rates yesterday for the first time since the depths of the financial crisis in December 2008, lowering the target range for the funds rate by 25bps to 2-2.25%. The move was expected by markets, but the FOMC did…

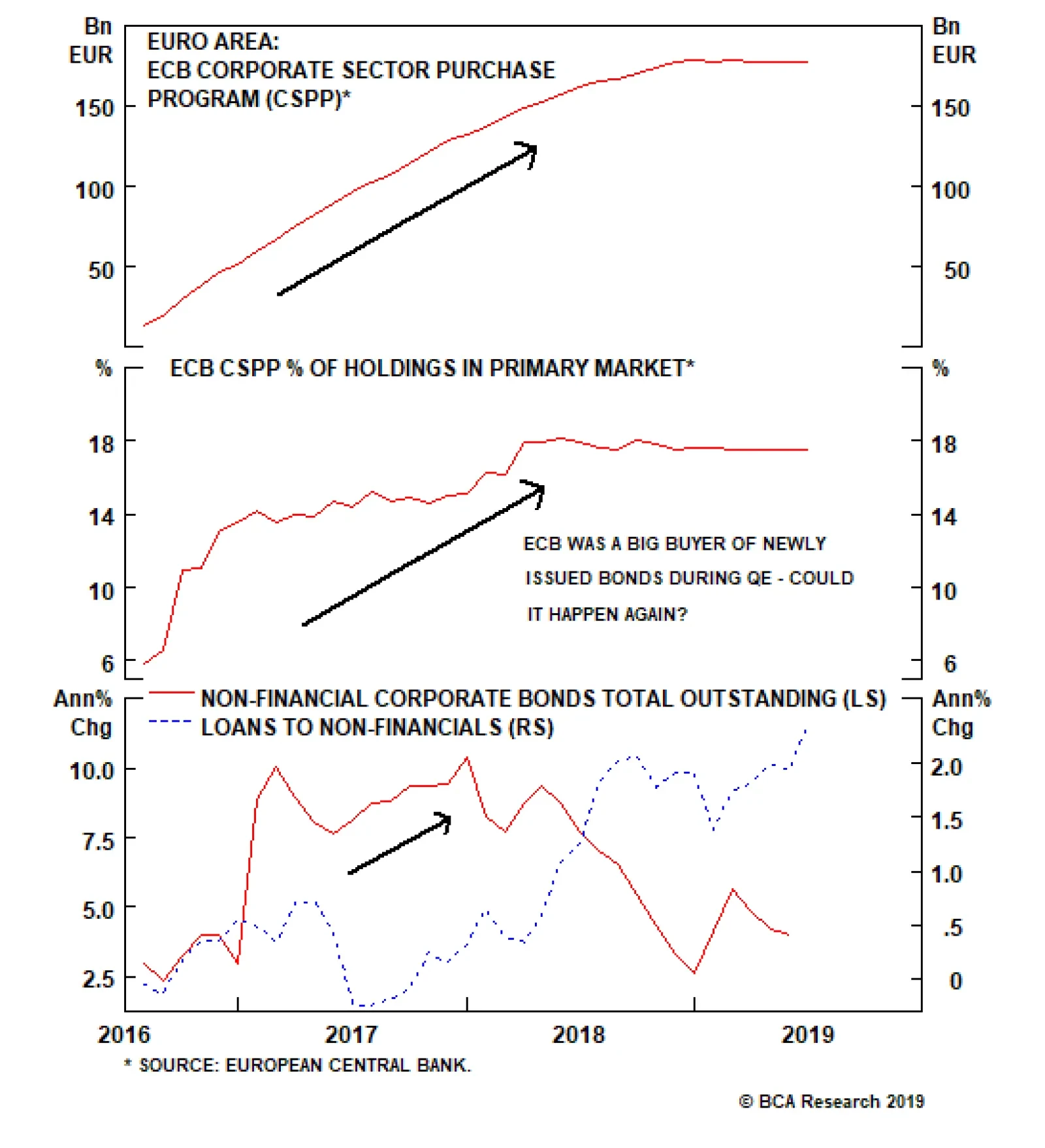

Given how loose monetary conditions already are, it makes sense for the ECB to restart the Asset Purchase Program (APP). This option is the most direct way for the ECB to directly lower the cost of borrowing for European…