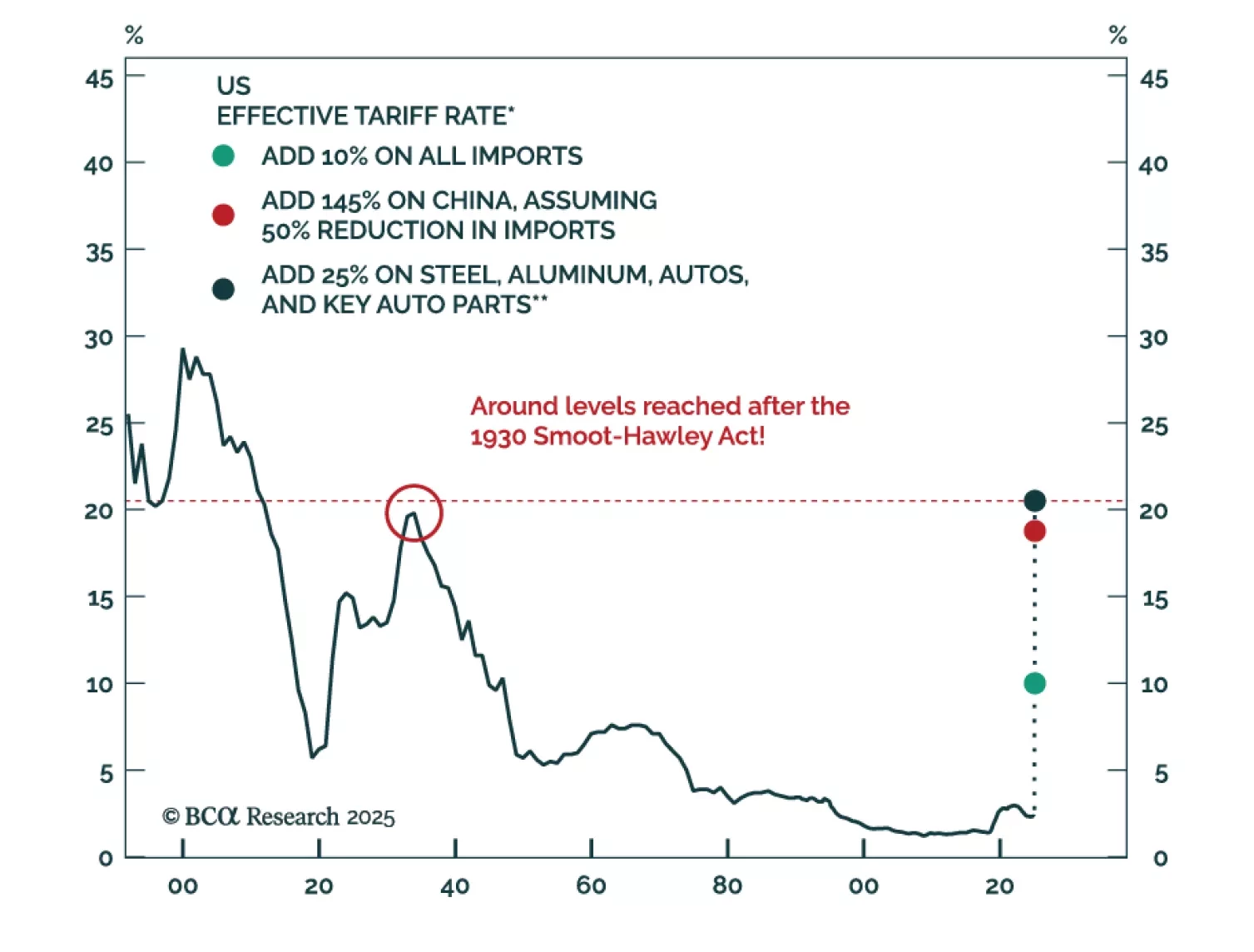

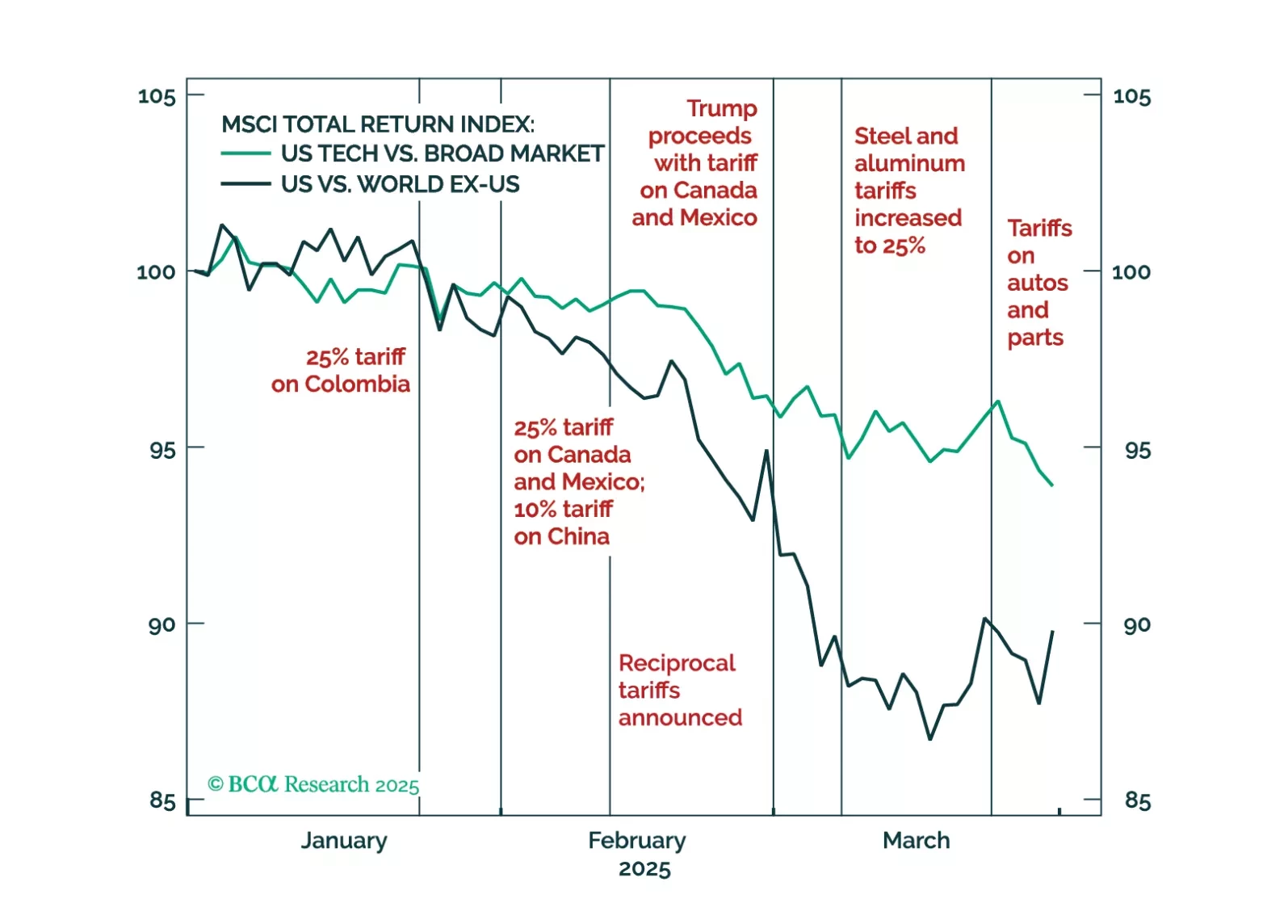

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

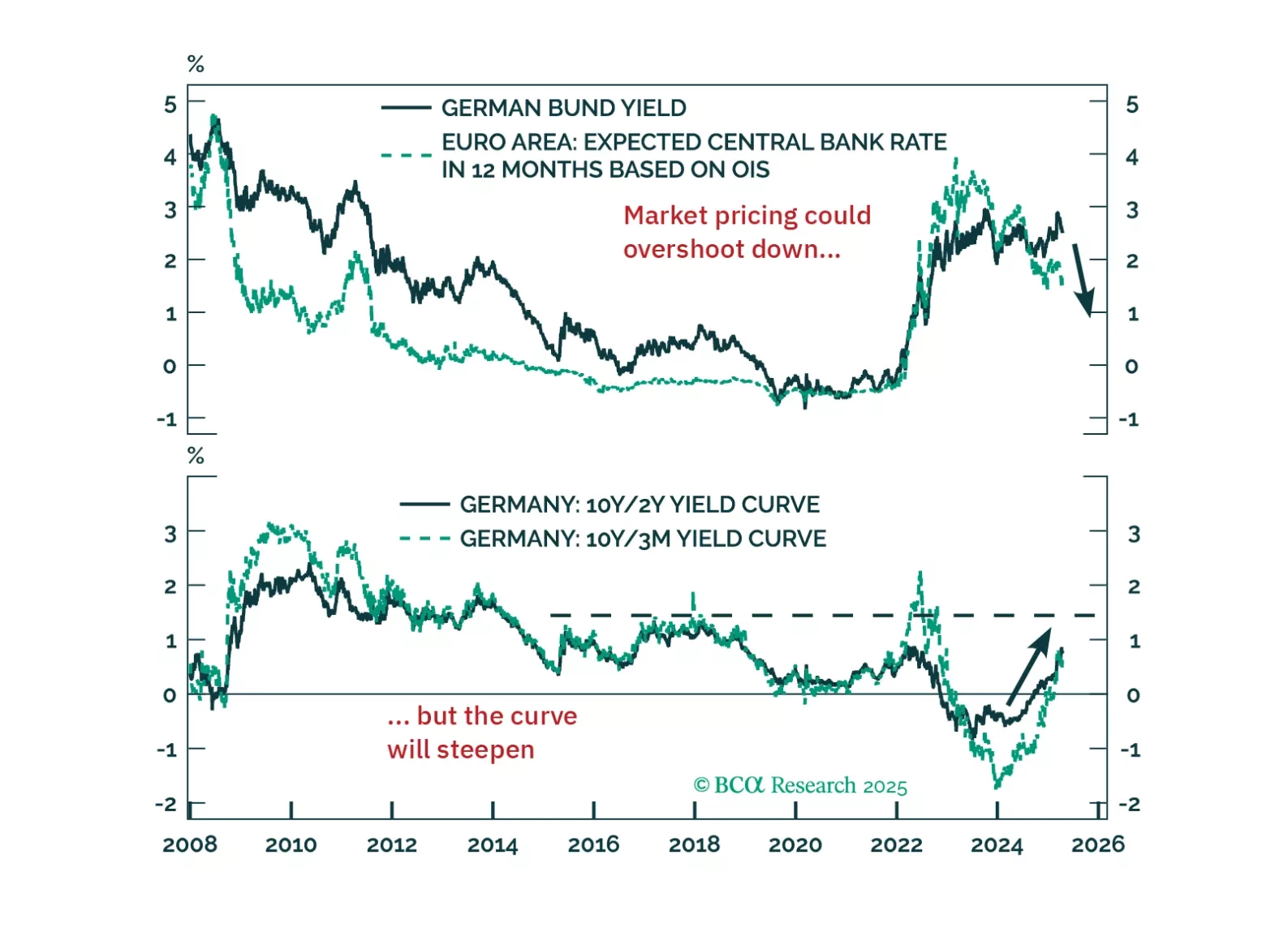

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

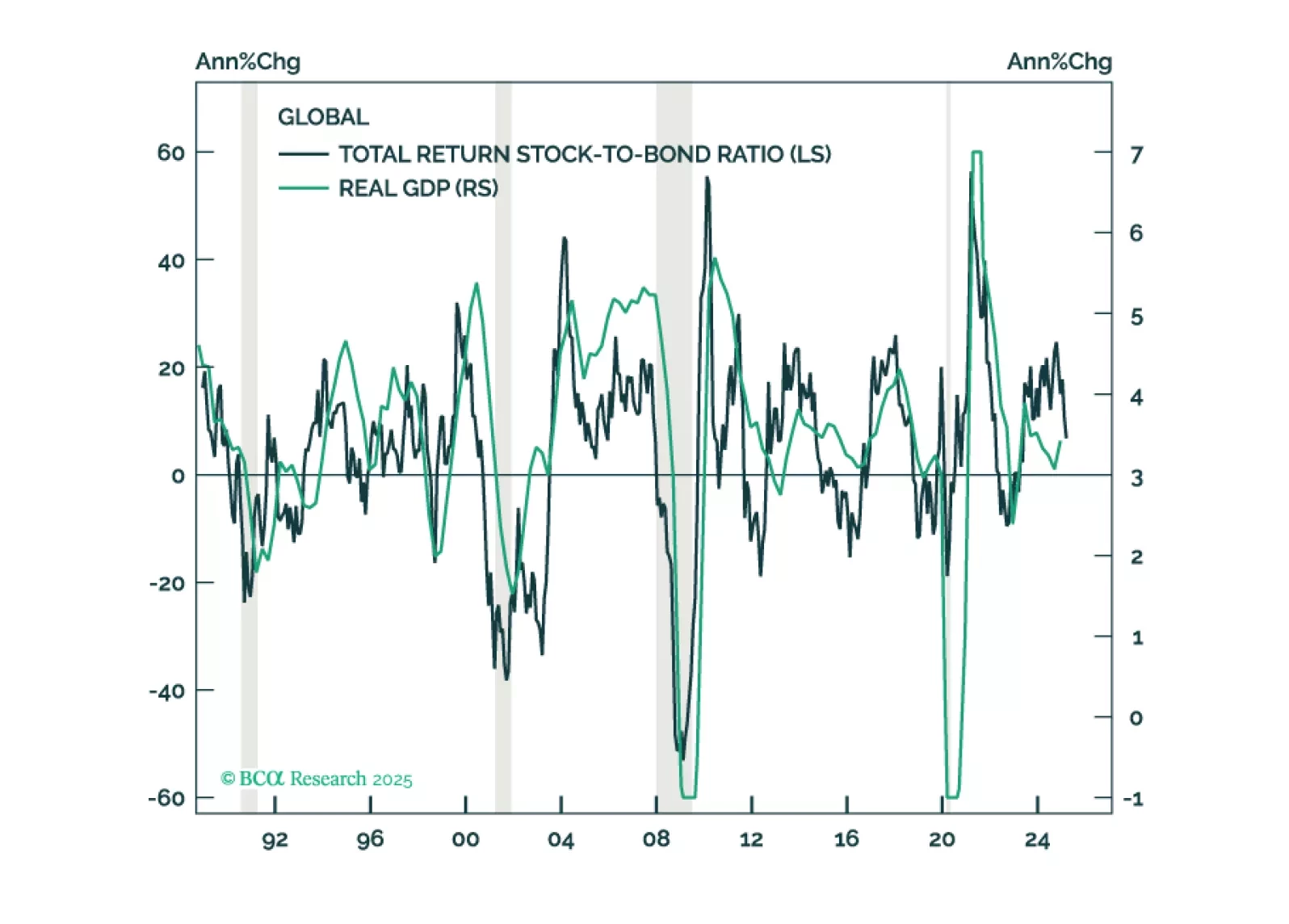

Barring a dramatic further de-escalation of the trade war, the US and much of the rest of the world will enter a recession over the next few months. Investors should remain defensively positioned for now.

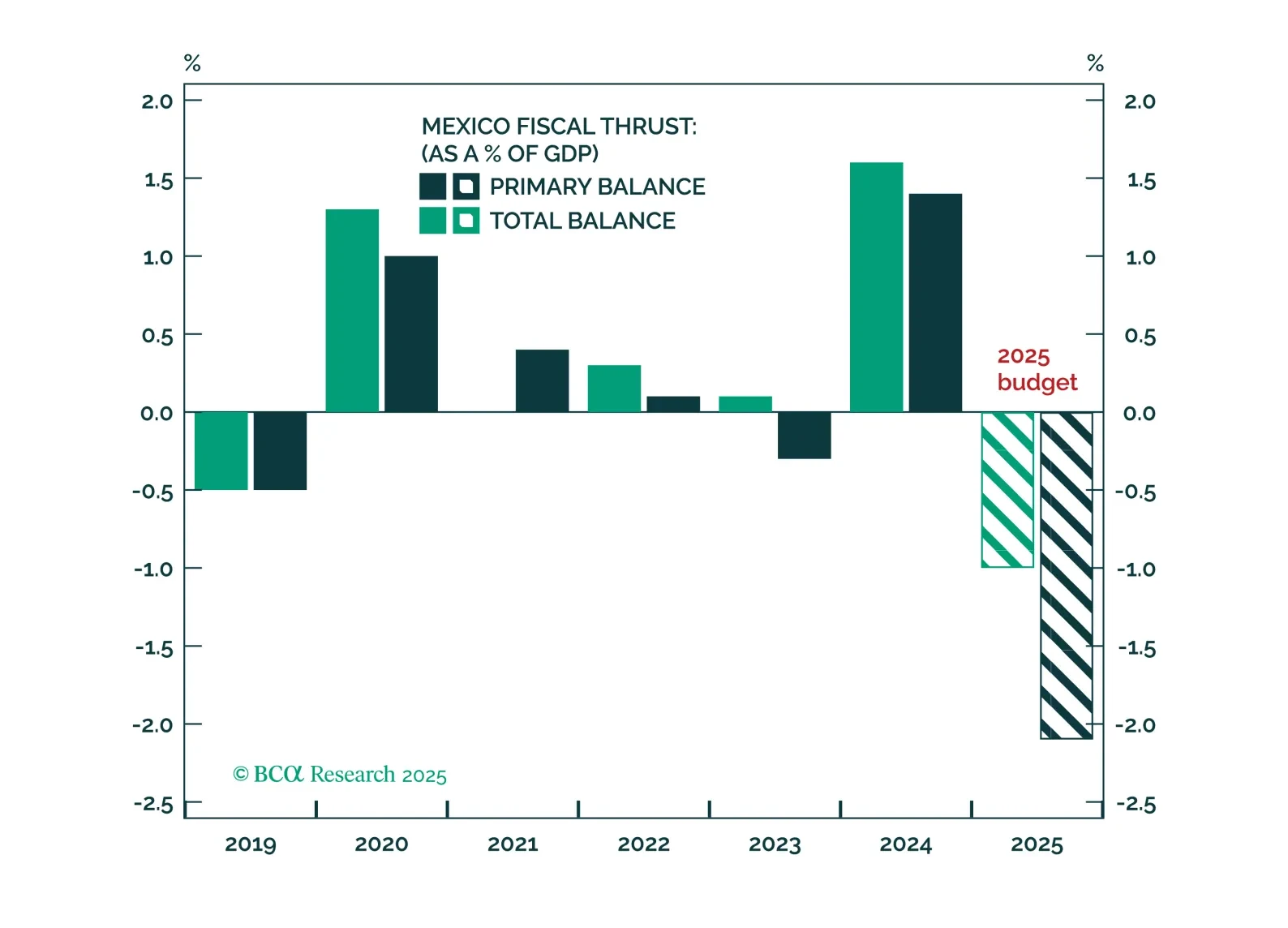

The trade war is on everyone’s mind with America’s “Liberation Day” upon us! However, the reality under the surface is that the main macro narrative has been a rotation – nay… exodus – out of US assets into RoW. This was not supposed…

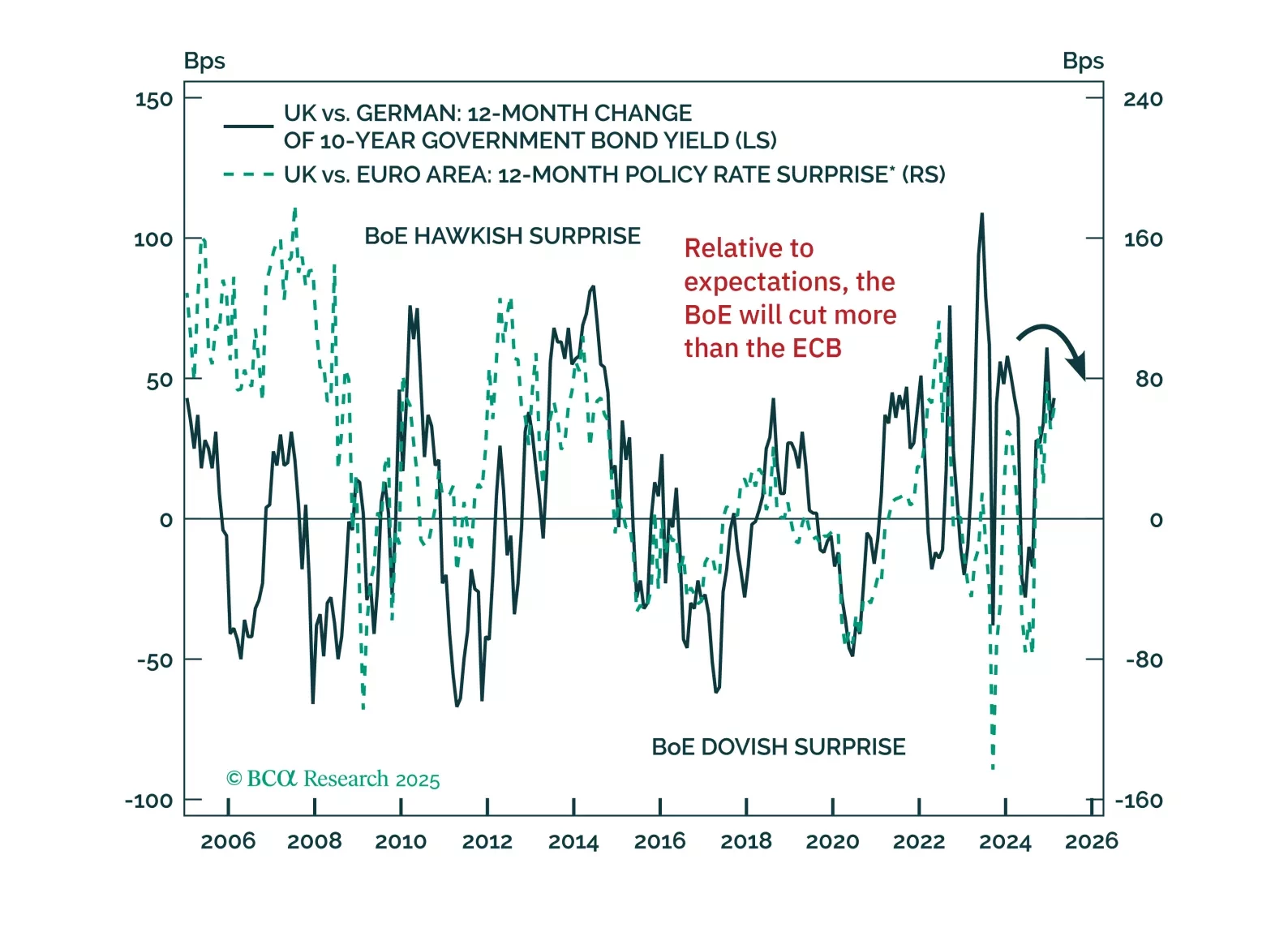

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.