Highlights Globalization is recovering to its pre-pandemic trajectory. But it will fail to live up to potential, as the “hyper-globalization” trends of the 1990s are long gone. China was the biggest winner of hyper-…

Highlights The August 1 deadline for Congress to raise the debt ceiling will come and go but the looming debt showdown will not replay the 2011-13 crisis. It is not a major risk to the bull market. The Biden administration still…

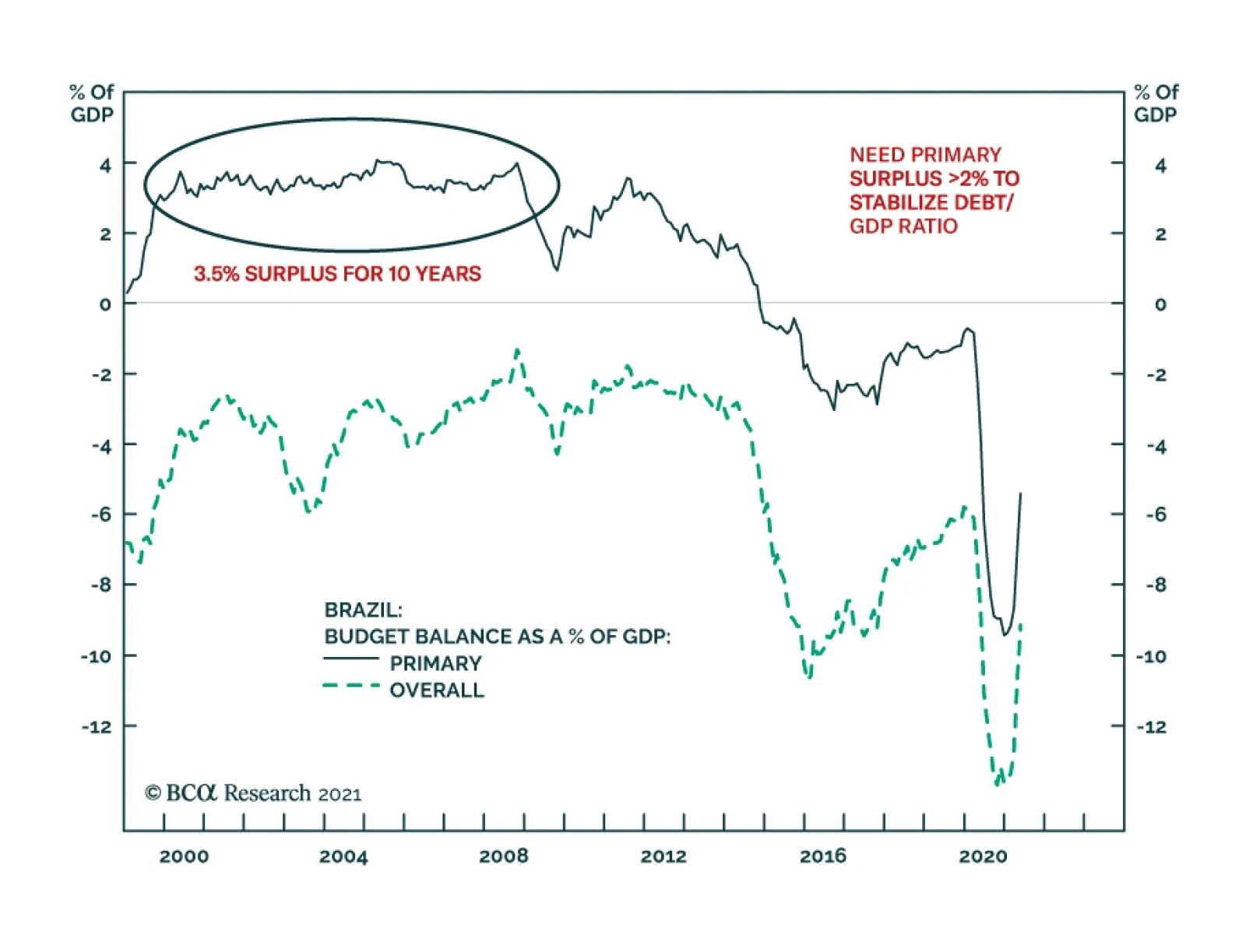

One of the structural challenges Brazil faces is its public debt overhang. The authorities have responded by periodically embarking on fiscal and monetary austerity. Yet, such austerity depresses nominal growth and has in fact…

Highlights Gold is – and always will be – exquisitely sensitive to Fed policy and forward guidance, as last month's "Dot Shock" showed (Chart of the Week). Its price will continue to twitch – sometimes…

Dear Client, China Investment Strategy will take a summer break next week. We will resume our publication on July 14th. Best regards and we wish you a happy and healthy summer. Jing Sima, China Strategist Highlights A USD…

Highlights The US is withdrawing from the Middle East and South Asia and making a strategic pivot to Asia Pacific. The third quarter will see risks flare around Iran and the US rejoin the 2015 Iranian nuclear deal. The result is…

Highlights The ongoing transition to a post-pandemic state and fiscal policy are either positive or net-neutral for risky asset prices. Fiscal thrust will turn to fiscal drag over the coming year, but the negative impact this will…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…